Transcription

Transit Optimization PlanSeptember 2017

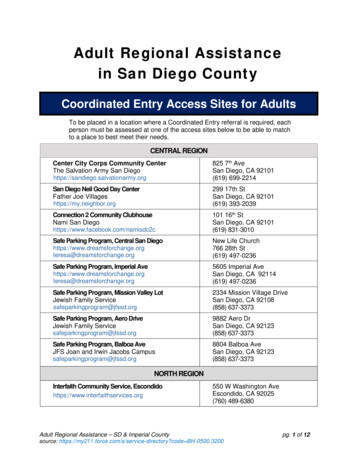

ContentsIntroduction.6Goals and Focus . 6Study Process . 7Report Contents . 8Existing Conditions .9Market Assessment . 9Population .9Employment .9Development Patterns .9Regional Growth . 10Growth in Senior Population .10Transit’s Role in Mobility . 10Service Evaluation . 11Service Tiers.11Service Design. 12Historical Ridership Trends.12Current Ridership . 16Service Productivity . 17Operating Speeds. 17Agency Partnerships . 17Framework and Guiding Principles .19Market Goals . 19Goal 1: Match Service to Current and Future Markets .19Goal 2: Coordinate Land Use, Housing, and Infrastructure. 19Service Goals . 20

Goal 1: Optimize Service . 20Goal 2: Increase Ridership . 20Goal 3: Strengthen the Network .21Transit Network Development Tradeoffs. 21Ridership versus Coverage .22Route Spacing: Access versus Frequency . 22Stop Spacing: Access versus Speed . 23Network Structure . 23All-Day, All-Week Service versus Peak Commuter Service. 26Route Evaluation Process . 29Density and Development Patterns . 29Stop Efficiency . 29Route Alignment . 30Service Duplication . 30Performance Indicators . 30Public Outreach .32Transit Optimization Plan .34Introduction. 34Trolley Service. 34Rapid Bus .35Recommendations. 35UCSD and Mira Mesa . 35163 Corridor.39I-15 Corridor .43Mid-City and Downtown . 46Beaches .52National City .55South County . 59PAGE 3 OF 89

East County – El Cajon. 64East County – La Mesa and Spring Valley. 69Rural . 73Customer Impacts & Benefits .75Frequency Investments . 75Travel Time Improvements . 77Financial and Operating Impacts .77Phasing .78Immediate-Term Changes (Summer 2017) . 79Near-Term Changes (Fall 2017) . 79Mid-Term Changes (Winter 2018) . 79Regional Coordination . 79List of TablesTable 1: MTS Service Roles . 12Table 2: Industry Ridership Trends.13Table 3: MTS Ridership Trends. 14Table 4: MTS Top 10 Routes Experiencing Ridership Declines by Route. 15Table 5: MTS Open House Events .32Table 6: UCSD/Mira Mesa Route Recommendations . 39Table 7: 163 Corridor Route Recommendations. 40Table 8: I-15 Corridor Route Recommendations . 44Table 9: Mid-City and Downtown Route Recommendations .48Table 10: Beaches Route Recommendations . 53Table 11: National City Route Recommendations . 57Table 12: South County Route Recommendations . 61Table 13: El Cajon Route Recommendations . 66PAGE 4 OF 89

Table 14: La Mesa and Spring Valley Route Recommendations . 71Table 15: Rural Route Recommendations . 74Table 16: Frequency Investments .76List of AppendicesAppendix A: MTS TOP Recommendations and Service Change Distinctions.81PAGE 5 OF 89

IntroductionThe San Diego Metropolitan Transit System (MTS) Transit Optimization Plan is a project thatsought to better utilize existing transit resources in the MTS service area. The study, conductedover a six-month period by Transportation Management and Design (TMD) Inc., follows the highlysuccessful Comprehensive Operations Analysis conducted between 2004 and 2006 whichincreased ridership and implemented a core frequent network. The Transit Optimization Plan(TOP) aimed to address ridership stagnation and decline through more effective and efficient useof operating resources. Additionally, this project aims to position the transit system in advance ofmajor regional projects, including the South Bay Rapid linking Otay Mesa to eastern Chula Vistaand downtown San Diego, and Mid-Coast Trolley which extends the Blue Line north to connect toUniversity City (UCSD/UTC).This study reviewed the broader network structure and route-specific performance to provideMTS with a comprehensive understanding of its market conditions and service performance. Thefindings led to the development of recommendations designed to build upon the network’sperformance strengths, maximize ridership, improve the overall rider experience, respond tomarket opportunities, and ensure the system’s financial sustainability. The recommendations arebased on analysis of existing and future market conditions, service performance data, andfeedback from MTS riders. The TOP is intended to help guide transit service development in theshort term.Goals and FocusThe primary goal of the TOP is to develop a plan that will grow MTS ridership while using vehicleand labor resources more efficiently. As population, employment, and demographics shift, it isimportant to reshape transit service to respond to new and changing public mobility demands. Itis also critical that MTS implement system improvements in a financially sustainable manner. Theoverall strategy is to enhance service on key network corridors to increase ridership and generatemore fare revenue, while maintaining mobility options in lower potential ridership areas. Therecommendations also respond to key issues identified by the community to create a system thatis more attractive to riders such as restoring Sunday services to more areas.The TOP addresses regional mobility issues of both existing and potential riders. To that end, theproject accomplishes the following:

Improves transit network design to increase ridership and improve public mobility Uses operating resources more effectively and efficiently Builds advocacy and ownership within the community Defines transit’s role in public mobility and economic developmentStudy ProcessDATA COLLECTION AND PUBLIC INVOLVEMENTThe study began in October 2016 with an extensive data assembly effort. Service and operatingdata from automated passenger counting and vehicle location systems was analyzed regardingrider activity, travel time, and on-time performance information on all fixed-route trips operatedby MTS.Prior to the start of the study, MTS conducted an extensive public outreach effort to gain feedbackfrom the public on improvements they would like to see in MTS transit services. MTS collected4,000 responses from an online survey and engaged riders and the general public at 15 meetingsthroughout the service area held at community centers, college campuses, neighborhoodgatherings, and major transfer hubs.SYSTEM ANALYSISUsing the collected regional market data and agency service data, a thorough analysis of theexisting conditions was conducted to evaluate the forces impacting current MTS service. Thisprocess consisted of three main documents: Review of Relevant Transportation and Land Use PlansMarket AnalysisService EvaluationAn overview of the Market Analysis and Service Evaluation documents is included in the “ExistingConditions” section of this report. This summary provides the key components that influence themarket for transit within San Diego County, as well as an overview of key service characteristics.These documents provide a comprehensive look at how MTS operates within the region and howthe agency’s ridership and productivity have changed over time. The documents also examinehow the region’s development patterns and demand for transit are expected to change in thecoming years.SERVICE ALTERNATIVESThe process for recommending service changes consisted of several iterations of analysis,discussion, and route modeling. Several metrics were examined to determine the relativestrengths and weaknesses of each subarea and its respective routes. A more thorough look at thePAGE 7 OF 89

recommendation process is included in the “Route Evaluation Process” section of this report. Thisprocess provided the opportunity to optimize each route’s operation individually as well as ensureroutes worked seamlessly together to create a cohesive network. The recommendation processresulted in service change proposals for more than 60 routes within the system.PUBLIC OUTREACHUpon completion of the system analysis and initial stages of the recommendation process, MTSconducted more than two dozen open house events to receive public comments. The agency alsohosted an online form for riders to provide their feedback on the proposed network. More than2,500 comments were collected in-person and online, providing valuable information on thetravel preferences of San Diego County residents. The TOP considered input from both this roundof public engagement as well as that undertaken prior to the project start.Report ContentsThe Transit Optimization Plan Final Report includes the following sections:§§§§§§§Existing Conditionso Provides key findings from the Market Assessment and Service Evaluation.o Summarizes trends in transit ridership within MTS as well as across the industry.Network Structureo Introduction to the ten subareas within the MTS network.o Overview of the proposed service tiers and their role in the MTS network.o Summary of critical agency partnerships.Framework and Guiding Principleso Outline of key service and market goals for MTS through the Transit Optimization Plan.o Discussion of guiding network development and design principles that provided aframework for the development of service recommendations.o In-depth look at the service change recommendation and decision-making processes.Public Outreach Activitieso Summarizes the public and stakeholder outreach activities and recurring themes thatemerged from the community engagement process.Transit Optimization Plano Summarizes the plan recommendations by geographic area.o Outlines the implementation plan and estimated resource requirements based onoperator and phase.Customer Impacts and Benefitso Provides an overview of the plan benefits as well as the ridership and ADA impacts ofthe plan.Implementation Plano Highlights the implementation phasing of the plan.PAGE 8 OF 89

Existing ConditionsThe Market Assessment and Service Evaluation detail the existing conditions in the MTS servicearea. The findings from these documents helped inform and develop the guiding principles andframework for the final recommendations. Both of these documents provided the basis for theTOP’s recommendation process, further discussed in the Evaluation Process section of this report.Market AssessmentMTS provides bus and trolley services to residents within a 570-square mile area of San DiegoCounty. This includes ten cities and parts of unincorporated areas of the county and includes thecities of Chula Vista, Coronado, El Cajon, Imperial Beach, La Mesa, Lemon Grove, National City,Poway, Santee, and San Diego. The City of San Diego itself has over fifty different communitiesand is approximately 372 square miles in size.PopulationThe MTS service area includes over 2.3 million residents. The vast City of San Diego is home to 1.3million residents, followed by Chula Vista with a population of nearly 250,000, and El Cajon withroughly 100,000 people.EmploymentThere are about 1.1 million jobs within the service area. Major concentrations of employmentoutside of downtown San Diego span across University City, Sorrento Valley, Mira Mesa, andKearny Mesa. The largest employer in San Diego County is the University of California, San Diego(UCSD) and its associated medical and research facilities. UCSD facilities are primarily located inareas with high population densities which make it an area that can support high levels of transitinvestment. Downtown and surrounding communities also form an area with both highemployment and population concentrations.Development PatternsA significant part of the MTS service area is characterized by largely suburban developmentoutside of the urban core with pockets of denser development in key areas. Employment andpopulation are largely segregated, with overlap only in certain communities such as downtownSan Diego, University City, and Chula Vista. As a result, employees tend to commute out of thecommunity where they live to a neighboring community in which they work.PAGE 9 OF 89

Regional GrowthSan Diego County is expected to experience continued growth in the coming years, specifically inthe MTS service area. This growth will impact the type of rider who uses transit, as well as howpotential riders are able to access it. MTS service will need to reflect and react to changingdevelopment patterns.More specifically, SANDAG’s projections show that future growth in the region will trend towardsdenser, compact development and away from further suburban sprawl. The encouragement ofsmart growth concepts will allow for denser communities and more opportunities for transitoriented development. Specific areas that are expected to grow significantly include areas ofDowntown, Chula Vista, Mission Valley, and University City. Transit’s role in mobility will continueto grow with concentrated, mixed-use development.Growth in Senior PopulationSan Diego’s population is expected to age significantly in the next few decades, with the seniorpopulation accounting for 20 percent of total population by 2050. This segment of the populationwill likely age in place, a popular trend among current seniors, leading to a dispersed seniorpopulation that is difficult to serve. The TOP refinement of the current transit network and servicetiers should consider the senior customer experience in order to mainstream senior mobilitywhere cost-effective.Transit’s Role in MobilityFor the region to absorb growth in population and jobs without deterioration in San Diego’squality of life and further congestion, transit will need to play an increasing role in mobility asoutlined in SANDAG’s San Diego Forward: The Regional Plan. MTS should consider starting toimplement these strategies within its limited current funding as part of the TOP.PAGE 10 OF 89

Service EvaluationMTS provides trolley, fixed-route bus, and paratransit services to the greater San Diego area. Theagency currently serves over 90 million riders annually. The System and Service Evaluationprovided a comprehensive analysis of MTS services by examining the system at the network,service tier, and individual route level.Service TiersThe MTS service network embraces the following service tiers: Trolley: Light rail services including the Blue, Green, and Orange Trolley Lines. Fares are 2.50 per trip.Freeway Rapid/Express: Express, Rapid Express, and Rapid Routes 235 and 237. Theseservices are high-speed, limited stop services operating primarily on highways and majorarterials. Fares for these services are 2.50 for Express and Rapid routes and 5.00 forRapid Express routes.Arterial Rapid/Urban Frequent: Urban Frequent routes and Rapid Routes 201/202, 204,and 215. These services are high-frequency, high-turnover routes primarily operatingalong major arterials in the dense urban core. Fares are 2.25 per trip.Urban Standard: all Urban Standard routes operating within the MTS service area. Faresare 2.25 per trip.Circulator: Circulator routes operating within the MTS service area. Fares are 2.25 pertrip, excluding the SVCC Shuttles (Routes 972, 973, 978, 979), which are partiallysubsidized by NCTD and are free to the public.Rural: the four Rural routes operate primarily in the East and South regions of the MTSservice area. Zone boundaries for Rural routes are defined at Alpine, Tecate, and Ramona.Fares are 5.00 for trips within one zone and 10 for trips within two zones.Each service tier fills a unique role within the transit network. A discussion of each service tier’snetwork role and key transit markets follow. These distinctions helped to guide servicerecommendations by highlighting core network spines and major corridors that support highlevels of service while recognizing how other tiers help complete an integrated network of publicmobility options that match market needs and opportunities.

Table 1: MTS Service RolesMTS Service Tier RolesService TierNetwork RoleKey Rider MarketsTrolleyStructural network spine with fastregional service.All-day, all-week and peakperiod regional travelFreeway Rapid/ExpressStructural network spine with fastregional service.Peak period regional travelArterial Rapid/Urban FrequentStructural network spine with fastsubregional service.Peak period subregional travelUrban StandardCompletes core network with keycorridors outside of network spines.All-day, all-week community andsubregional travelCirculatorNetwork connections through localcirculation.Neighborhood circulationRuralNetwork connections from remotecounty destinations.Lifeline serviceService DesignMTS follows industry best practice and defines “frequent” services as those which operate every15 minutes or better during base periods. On weekdays, MTS currently operates 93 routes, 34 ofwhich are frequent. Of the 34 frequent weekday routes, 18 of them serve downtown San Diegowith 16 providing crosstown network connections. On Saturdays, MTS operates 66 routes withnine running frequently. On Sundays, MTS operates 53 routes, eight of which are frequent. Theroutes most likely to operate only on weekdays are commuter express and circulator services.Almost 90 percent of population and 91 percent of jobs within the MTS service area have accessto transit, while 72 percent of people and 81 percent of jobs have access to frequent networkservices – a key success story from the 2004 COA that helped drive ridership growth.Historical Ridership TrendsIndustryIn recent years, the transit industry as a whole has faced a decline in bus ridership coupled withan increase in light rail ridership. Between 2010 and 2016, bus ridership declined 5 percent andlight rail ridership increased by 17 percent, for a total ridership increase of 2 percent. TotalPAGE 12 OF 89

ridership was down 2 percent between 2015 and 2016, with a 4 percent decrease in bus ridershipand a 3 percent increase in light rail ridership.Light rail ridership is generally increasing, but bus ridership continues to decline. The recentridership decline is likely caused by low gas prices, increasing employment rates, an improvedeconomy which encourages more people to drive, and possibly new competition fromtransportation network companies (TNCs).Table 2: Industry Ridership TrendsIndustry Ridership ,1464,945,927-5%-4%464,978528,031546,126 17% 3%10,172,35210,626,93110,382,628 2%-2%ModeBusLight RailAll Modes% Change2010-2016% Change2015-2016Source: American Public Transportation Association Ridership ReportFigure 1: National Public Transit Ridership TrendsNational Public Transit Ridership Trends (Quarterly)3,000,000Ridership ,00002010201120122013Total Ridership (000s)201420152016Bus (000s)Source: American Public Transportation Association Ridership ReportPAGE 13 OF 89

MTSMTS bus and rail system ridership is up 12 percent from 2010, yet MTS has experienced a smalldecline in both bus and rail ridership in the past years. Between fiscal years 2015 and 2016, busridership declined 6 percent while combined Trolley and bus ridership declined 4 percent.Table 3: MTS Ridership TrendsMTS Ridership Trends2010Mode2015% Change2010-20162016% al82,349,01696,093,39892,075,42812%-4%Figure 2: MTS System Ridership TrendsMTS System Ridership (Fiscal Year)100Annual Boardings (Millions)908070605040302010201020112012System Total120132014BusTrolley20152016Ridership recording systems on trolleys were updated to an automated system in 2014. Thus, Trolleyridership may have been undercounted prior to 2014.PAGE 14 OF 89

In a recent comparison of ridership numbers over a five-month period (July-November) of fiscalyears 2016 and 2017, there was still a 4 percent decline in weekday ridership. The table belowfeatures 10 routes with the largest percentage decrease in weekday ridership.Among the top ten routes with the most significant declines in ridership are nine Urban Frequentroutes. These routes carry a significant number of riders along central corridors within the servicearea. A main concern within the TOP includes efforts to reverse ridership decline within thisservice tier and along these critical routes by reinvesting in frequency. Efforts to improve traveltime and limit the time spent waiting for bus transfers will help ensure that transit is a competitivemobility option within San Diego.Table 4: MTS Top 10 Routes Experiencing Ridership Declines by RouteMTS Top 10 Routes Experiencing Ridership Declines – 5 Month ComparisonRouteService TypeTotal RidershipDecline FY16-FY17% Ridership DeclineFY16-FY172 – Downtown San Diego – 30th & AdamsUrban Frequent-108,57330 – Downtown San Diego – UTC viaPacific BeachUrban Frequent-98,352905 – Iris Trolley to Otay Mesa BorderUrban Standard-98,020-28%13 – Kaiser Hospital – 24th St. TrolleyUrban Frequent-77,461-9%7 – Downtown San Diego – La MesaUrban Frequent-77,022-6%11 – SDSU – Skyline HillsUrban Frequent-76,024-8%8 – Old Town - Mission Beach/PacificBeachUrban Frequent-69,9703 – UCSD Hospital – Euclid TrolleyUrban Frequent-66,409-9%929 – Iris Trolley – Downtown San DiegoUrban Frequent-59,920-6%955 – National City - SDSUUrban Frequent-52,966-8%Source: FY16 vs FY17 July – November Ridership by RoutePAGE 15 OF 89-21%-13%-24%

Current RidershipRidership by Time of DayRidership peaks during the morning between 6 AM and 7 AM with 23,200 boardings, while theafternoon rush hour has its highest ridership of 27,100 boardings between 3 PM and 4 PM.Midday ridership is robust, averaging between 17,000 and 21,000 boardings per hour. The strongmidday ridership is the result of the frequent all-day all-week network that allows for a live-workplay mobility lifestyle.Ridership by GeographyRidership throughout the MTS service area is highest along Trolley lines, with heavy south to northmovement in the South County along the Blue Line and significant east to west movementbetween downtown and El Cajon along the Orange and Green Lines. Bus ridership is also notablyhigh in North Park, Mid-City, South Bay urban west, and El Cajon; and around UC San Diego andthe U.S./Mexico Border Ports of Entry.Areas such as the U.S. Border, downtown, and UC San Diego have high ridership because they arekey destination points which generate demand, parking is expensive and/or scarce, and triplengths, origins, and destinations are conducive to transit.Ridership by Service TypeDaily ridership on the Blue, Orange, and Green trolley lines accounts for 39 percent of total MTSweekday ridership with approximat

o Summarizes the plan recommendations by geographic area. o Outlines the implementation plan and es timated resource requirements based on operator and phase. § Customer Impacts and Benefits o Provides an overview of the plan benefits as well as the ridership and ADA impacts of the plan. § Implementation Plan