Transcription

Summer 2021Pennsylvania Association of Mutual Insurance CompaniesTHERE’S A LOT OFGOODPAIDHARRISBURG PAPERMIT NO. 533PRSRT STDU.S. POSTAGEIN GOODVILLE3 Research Backed Tipsto Attract and RetainMillennial Policyholders8 Reasons to Focus onVendor Management

PUTTING THE REIN RESPECTAt Grinnell Re, we respect how mutuals serve their communities. Andthat’s why it’s always been our mission to protect our mutual members.Our history is in backing mutuals. Our future is, too.Reinsurance done right.STRONG STABLE SECUREgrinnellmutual.com“Trust in Tomorrow.” and the “Grinnell Re” are registered trademarks of Grinnell Mutual Reinsurance Company. Grinnell Mutual Reinsurance Company, 2021.

CONTENTSA group of entrepreneurial church and community leadersenvisioned a modern “licensed” insurance company thatwould be formed to address these risks while maintainingaccountability to the values of love, justice, and integrity,shared by the faith community. On January 4th, 1926 theGoodville Mutual Casualty Company received its certificateof authority, named after Goodville, Pennsylvania, where itwas formed. The mutual insurance model allowed the newcompany to operate for the benefit of its members while alsomeeting its mission of carrying risk on their behalf.17TECHNOLOGY8Why Implementations Far Exceed Original Budgets12and Go Far Beyond Projected Timelines8 Reasons to Focus on Vendor Management15Recruiting the Next Generation of21Insurance ProfessionalsDo Your Systems Talk to Each Other?223 Research Backed Tips to Attractand Retain Millennial PolicyholdersThey Could.8IN EVERY ISSUEChairman’s MessagePresident’s Report574999 Louise Drive, Suite 304,Mechanicsburg, PA, 17055 (717) 303-0197pamic@pamic.org www.pamic.orgEditor-in-ChiefBrittany Bargo – bmlynek@pamic.orgPulse is a quarterly magazine that is published in printand electronically. Issues may feature editorial onPAMIC history, politics and legislation, legal information,technology, economic impact in Pennsylvania andother topics of interest to our membership.Designed and Published byFor Advertising Information: Joe Beahm, Account Manager(717) 238-5751 x126 joe.beahm@thinkgraphtech.com12SUMMER 2021 PAMIC.ORG 3

For 100 years, our Mission remains:Trust-Based Relationships.Our Independence. Your Advantage.FIRM HANDSHAKES AND FAMILIAR FACESare how Holborn has maintained itstrust-based relationships. Our unmatchedinnovative solutions and unique teamapproach has us well-positioned for thenext 100 years. 2021 Holborn Corporation. All Rights Reserved.4 PAMIC.ORG SUMMER 2021

CHAIRMAN’S MESSAGEI am indeed pleased,that we will once again be ableto gather together for the114th Annual PAMIC Convention.”PAMIC BOARD OF DIRECTORSDavid GautscheGoodville Mutual Casualty CompanyChairmanJohn FosterPenn National InsuranceChair-ElectKevin TateThe Philadelphlia ContributorshipTreasurerArt MeadowsPanhandle Farmers Mutual InsuranceCompany of WVImmediate Past ChairmanTodd SalsmanTuscarora Wayne Insurance CompanyVice-ChairRon GallagherPAMIC(Acting Chair)Robert DoddsLititz Mutual Insurance Company(Government Affairs Chairman)Shawn KainUtica FirstKaren MashinskiHarford Mutual Insurance CompanyJonah MullMillers Mutual Insurance CompanyRobert PelletierFrederick Mutual Insurance CompanySTAFFRon GallagherPresidentAndrea StrobleDirector, Education & EventsBrittany BargoDirector, Communications & TechnologyLora SharpManager, Membership & AdministrationDesigned & Published byGraphtechFor Advertising InformationJoe Beahm, Account Manager(717) 238-5751 x126joe.beahm@thinkgraphtech.comDavid GautscheGoodville MutualInsurance GroupWhen I agreed to serve as PAMIC Chairman several years ago no one anticipated what wewere about to experience. Even as our companies shifted into remote work environments inMarch of 2020 many of us expected to work from home for a few weeks and then return tothe office. Much about the last fifteen months has been difficult and challenging, but yet wehave a lot to be thankful for. PAMIC and its member organizations successfully adapted to thesituation and have continued to serve their members resiliently in spite of the obstacles.I am indeed pleased that we will once again be able to gather together for the 114th AnnualPAMIC Convention August 1st through 3rd at the beautiful Hershey Hotel, in Hershey,Pennsylvania. This event will mark the first in person PAMIC event since late 2019 and I expectit to be a celebration. This opportunity to reconnect with old friends and reengage with theindustry will only be more special based on the isolation of the past year.The Convention Planning Committee, chaired by John Foster from Penn National, hasbuilt an exceptional agenda. Keynote addresses by Chuck Chamness, President & CEO ofNAMIC and the Insurance Information Institute’s President Sean Kevelighan, will provide anextraordinary opportunity to get a perspective on developments in the insurance industryat large. In addition, sessions have been added to provide Board of Directors valuableeducational opportunities on governance topics. I’m confident that each attendee will takeactionable ideas back to implement into their organization.While almost everything about this past year was different, PAMIC’s success continuedto rely on the generous commitment of time and resources by member companies andtheir committed staff. Volunteer committees continued to plan events which were adaptedto virtual delivery and worked to provide resources to member companies, as well asadvocating on our behalf with regulatory bodies. Please take time to read the committeereports provided in the annual report and to thank those who served this past year. Thesuccess of our trade association depends on member engagement and your willingness toshare your gifts!Lastly, I want to thank you for the honor of serving as PAMIC Chairman this past year.As a relative newcomer to the PAMIC family I was an unlikely candidate to serve in thisrole, but it was my privilege to serve. When I hand the gavel to John Foster as incomingChairman in August, my hope is that the coming year will be more predictable and filled withopportunities to gather and learn together.The mutual industry has a long and noble history of protecting and serving the interests ofmembers. Our success in continuing that tradition this past year is something we should allbe proud of and also serve as inspiration to ensure that we continue to deliver value to ourmembers for generations to come!Sincerely,David GautscheSUMMER 2021 PAMIC.ORG 5

Estim ate d oes note q u a l A d ju s tmentWe kno w the d i f ference.W e h i r e t h e d i f f e r e nc e yMap updated dailyF i n d y o ur n e a res t a d j uste r a t w w w .RV CS.com Homeowners LossesCommercial Property LossesCasualty InvestigationsSettlementMobile Home LossesInland Marine ClaimsAfter Hours Response Catastrophe Response TeamsAuto Physical Damage AppraisalsTractor/Trailer Damage AppraisalsTrial MonitoringMediationsSubrogationSend Assignments to: Claims@RVCS.comCall: 540.265.0502After Hours Emergency – 24/7/365540.523.10856 PAMIC.ORG SUMMER 2021

PRESIDENT’S REPORTThis year, we are delighted to announcethat the 2021 Convention is on and in person.”Ron GallagherPAMICWelcome to the Summer 2021 issue of the PAMIC Pulse! Thisissue of the Pulse typically follows the end of our fiscal year andthe anticipation of our Annual Convention at the Hotel Hersheyon August 1-3, 2021.and exhibitor registration. I am looking forward to seeingyou in person after almost 18 months of virtual educationalprogramming. Our last in-person event was the Annual SpringConference 2020 in State College, PA.This year, we are delighted to announce that the 2021Convention is on and in-person: a real celebration of “life gettingback to normal.” By the time this issue is published, you willhave received registration emails, sponsorship opportunities,This edition of the Pulse is also a great time to review the value andbenefits that PAMIC has developed over the last few years makingyour membership more important and useful in your businessoperations. Here is a rundown of those benefits:PAMIC Benefits & ave on Live Education Events Unlimited Access to the PAMICand Exhibitors with MemberMembership DatabaseRate PricingDiscounted Services through ISO Claimsearch ( 15000/yr Value)Lobbying on your behalfBiweekly 360newslettersPAMIC Institutes (DiscountedOnline Courses through “TheInstitutes”)Intelligent (internet-based)Marketing OpportunitiesSave with PAMIC New Insurer MemberThree Year DiscountRegultory Affairs with theDepartmentQuarterly PulseFinancial ManagementSeminarCommittee MembershipFree Access to the PAMIC Cyber Security Mutual Insurance DayCenter ( 3500/yr Value)Email Updates(as needed)Insurance Technology TrendsSeminarSpeak or Present at EducationalEvents or WebinarsFree Access to the PAMIC Law & HumanResources Center ( 2000/yr Value)Congressional Contact ProgramMonthly PAMICPostUnderwriting & LossPrevention WorkshopBecome an Author in the PAMICPulse and 360Free Registration to all PAMIC EducationalWebinars ( 600/yr Value)Online Legislative TrackingAnnual Spring ConferenceSponsor an Educational Event orWebinar10% Discount on Rate and Form FilingServicesState by State Compliance ListingsClaims SummitExhibit at varied EventsExclusive Subscription to All PAMICPublicationsCompliance AssistanceExecutive RoundtableAdvertising in the Pulse(hardcopy and digital versions)New Insurer Member 3-year DiscountLaws, Regulations, Notices OnlineAnnual ConventionSponsor events based on yourbudgetPAMIC Governance CenterSpring ConferenceNetworkingPAMIC Career PortalSpecial Educational EventsAnnual Small Company MeetingCE, CLE and CPE Credits forEducational EventsWhile this listing seems exhaustive, it is not static. YourAssociation continually looks for ways to bring added value toyour membership. If you are interested in finding out more aboutany of these programs listed in the table above, please contactthe PAMIC staff by phone or email.In closing, I want to thank you for your unwavering support ofPAMIC, especially in the last 18 months, and look forward toserving you in the future! See you in August at the Convention!Stay safe, and healthy,Ron GallagherSUMMER 2021 PAMIC.ORG 7

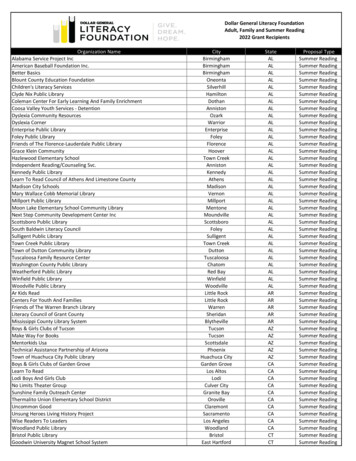

TECHNOLOGY3ResearchBacked Tipsto Attract and Retain MillennialPolicyholdersBy: Jeremy LeopoldInvoice CloudAs the largest generation in North America,Millennials are a critical demographic for insurancecarriers. Not only because this is a group withsignificant purchasing power, but also becausetheir expectations around customer service andcustomer experience are changing the way manycarriers operate.8 PAMIC.ORG SUMMER 2021Millennial policyholders expect exemplarycustomer experiences, and want digitalways to interact and pay bills. Manydigital native insurance carriers are takingadvantage of this, making it easier thanever to select and purchase a policy directlyfrom your mobile device. For carriers thathave been slower to innovate, gaining andretaining customers in this age group isbecoming a challenge. It’s important forinsurance carriers to realize, though, thattechnology can be an opportunity ratherthan a threat. Technology lets organizationspersonalize policyholder experiences,improve engagement levels, and elevate thecustomer experience.To help insurance organizations betterunderstand how to leverage Millennialpolicyholder preferences to their advantage,Invoice Cloud recently conducted an onlinesurvey asking this age group questionsabout the types of policies they own, howthey prefer to make payments, and more.You can download the full report here, buthere are three major takeaways from ourresearch.You can download the report by going th-millennial-policyholders

1. The needs of Millennialpolicyholders are evolvingHow many members of your household(including yourself) are coveredby your active insurance policies?In 2019, Millennials surpassed the Baby Boomer generation asthe largest living adult generation. This means Millennials nowmake up a major percentage of consumers, spending trillionsof dollars a year in goods and services – and insurance is noexception.Twopeople25%Oneperson27%According to the survey results, the most common policyamong Millennials is personal auto insurance (78%), followed byhealth insurance (76%).23%Which of the following insurance policiesdo you currently ople8%Life40%Fourpeople29%Homeowner’s ooking ahead, the buying power of Millennials in the insurancemarket only becomes more formidable. In total, 85% of surveyrespondents anticipate buying at least one new policy in thenext 5 years. This means that the money spent on insurance bythis already influential demographic will inevitably increase, andrapidly.As the data shows, the gap between single Millennials (whoseinsurance policies only cover themselves) and Millennials whoare starting families (whose insurance policies cover their partners and dependents) is gradually closing.When was the last time youswitched insurance carriers?Within thepast 6 monthsWithin thepast year17%Which of the following insurance policies do youanticipate needing in the next 5 years?24%(Please select only policies you do not currently own.)47%46%Health ��s BusinessOwner15%Other8%1%AutoOther(Commercial)The Millennial generation spans individuals in their mid-20sto late 30s (with the eldest in this group turning 40 in 2021).This represents a sizeable range when it comes to consumerneeds and life experiences. On the one hand, some Millennialsare starting at their first jobs, striking out in the renter’s market,and are no longer covered by their family’s insurance plans. Onthe other side of the age bracket, older Millennials are buyingproperty, starting families, and purchasing more policies as theirinsurance needs grow.I have notswitchedcarriers withinthe last 5 years24%26%9%Within thepast 3 yearsWithin thepast 5 yearsWhat this means for your organization: It’s clear that Millennialsare increasingly making up a large proportion of policyholders.They represent a group with a vast array of policy needs, and manyare going through transitional phases of life: moving from renter’sto homeowner’s insurance, or upgrading policies from coveringan individual to covering a family. It’s for these reasons that carriershave to take Millennial purchasing, payment, and interactionpreferences into consideration when deciding how to leveragetechnology and improve the overall customer experience.Continued on next pageSUMMER 2021 PAMIC.ORG 9

2. Millennials will switch carriers fora better experience, and have ahistory of doing soWhen it comes to insurer loyalty, the survey results show thatMillennials will not hesitate to switch carriers if their currentinsurer isn’t providing a satisfactory customer experience. Fortyone percent of the Millennial policyholders surveyed haveswitched insurance carriers within the last six to 12 months.3. Digital experiences impact thepurchase decisionWhen asked how they purchased their latest insurance policy,41% of Millennial respondents said they bought the policyon their mobile device, directly from the insurer.Think about the last time you purchaseda new insurance policy. How did youmake the purchase?To better understand why 76% of these Millennial policyholdershave switched carriers in the last five years alone, we askedrespondents to pinpoint why they decided to leave their formerinsurance provider.What was the primary reason youswitched insurance carriers?*Throughan agentFrom theinsurerdirectly, onmy mobiledevice33%41%Coverage of policyoptions that moreclosely align withmy needs1%1%25%24%OtherThrough an From an insuranceemployer company’s websiteLowerpricing48%12%3%2%1%A bettercustomerexperience9%More digitalofferingsand paymentEmployermethodsLife changebased change(moving, Other (new job ormarital statusemployerchange, etc.)changed carrier)Purchasing policies and paying premiums aren’t where mobilepreferences stop, either. When asked about their communicationpreferences, 64% of respondents would rather communicatewith an insurance carrier through a digital or mobilechannel.How do you prefer to interact with yourinsurance carrier when you need to filea claim, ask a question, etc.?*Of the 76% of respondents who have switchedinsurance carriers within the past 5 yearsWhile 48% of respondents cited that price was a primary driverfor switching carriers, what’s more informative for insurers arethe 21% of Millennial respondents that switched carriers forbetter customer experiences or expanded digital offeringsand payment methods.What this means for your organization: Competitivepricing will always exist in the insurance space and no carriercan accommodate the changing needs of every insured – it’smuch more attainable for your organization to improve thepolicyholder experience and expand digital payment options.10 PAMIC.ORG SUMMER il14%Online chat

Even payment method preferences are evolving as Millennialstake up more of the insurance space. While credit cards and ACHare still common methods for making premium payments, 25%of Millennials who said online or mobile payment options were“very” or “somewhat important” would rather pay their premiumsvia PayPal/Venmo or Apple Pay/Google Pay. This is another hugeshift that’s unique to this rising demographic.Which of the following online payment optionswould you use to pay your insurancepremium, if available?ACH orbanknumber24%Creditcard50%14%Paypal orVenmo11%1%OtherApple Payor Google PayWhat this means for your organization: Insuranceorganizations can no longer afford to ignore mobile paymentchannels and methods. To cater to the new consumer mindset,insurers must provide mobile channels for purchasing policies,communicating with insurers, paying premiums, and more. Theymust also ensure that these mobile channels are fullyoptimized by offering digital wallet options, pay bytext functionality, and a well-designed mobile interface for anoutstanding user experience.Start leveraging this data todayClearly, Millennial policyholders are an important market forevery insurance organization, particularly as the needs of thisgeneration continue to grow and evolve.To learn more about important Millennial insurance preferences including how they choose insurance carriers, paymentpreferences and the most important factor when it comes to agreat customer experience, download your free copy of InvoiceCloud’s research report, Keeping up with Millennial Policyholders.Jeremy Leopold is an experienced representativein the Insurance and Consumer Finance space.He moved to Invoice Cloud just over two yearsago once he saw the Invoice Cloud Electronic BillPresentment and Payment platform, and the manygreat features it offers to drive online payments andimprove policyholder satisfaction and retention.Jeremy works with insurance companies alongthe East Coast to provide true SaaS solutions andundeniable results. You can reach Jeremy at: jleopold@invoicecloud.comor call him direct at 781-654-0167.SUMMER 2021 PAMIC.ORG 11

TECHNOLOGYWhy ImplementationsFar ExceedOriginal Budgets and Go FarBeyond Projected TimelinesBy: Barbara Schwarz, SimpleSolve, IncPicture this. You finally decide on an insurance system and are excited to transform yourcompany’s processes with it. You’ve got your budget approved and set a clear project timeline. Thetwin benefits of digitization and automation are right around the corner! But, before you realize it,scope creep has set all those careful plans to naught. Now your ‘go-live’ date is months or yearsbeyond the original project management timeline.While this may sound like a worst-case scenario, the harsh reality is thatinsurance system implementation can often take between 12 to 18 monthsand cost more money than anticipated. However, this does not have tobe the case. Quick implementation of insurance systems boils downto one thing: clear up-front scope definition.12 PAMIC.ORG SUMMER 2021

Starting out with a well-defined roadmap will help you narrowdown what your requirements are and what features are actuallyneeded. If you start the project without this vision, you canoften be tempted by extraneous services that you don’t actuallyneed. Oftentimes ‘one additional feature’ might be added on tothe initial project scope. But if such ‘small’ inclusions start to addup, you begin to realize you have exceeded your budget. Thatis ‘scope creep’ which is one of the most common reasons forproject failure.2. Not identifying a strong ProjectChampionImplementation of a new insurance system requires a completeoverhaul of the current processes. Depending upon thetechnological maturity of the organization, it might even requirenew infrastructure to be set up and old ones to be retired. Thiscoupled with the costs associated with implementation canmake insurance companies averse to change.Why Project Timelines aren’t metThis scenario is more common than you would expect.A strong project champion can look past these short-term challengesand understand the long-term benefits of investing in theright insurance system. They are critical for getting approval of theimplementation, finalizing the budget, and securing the resourcesnecessary to make the project a success. The project advocate alsodefines the end-goals and objectives of the implementation, whichwill help guide all decisions that need to be made.3. Not including all parties affected by theimplementationA fully-integrated insurance software will typically includefeatures for various departments, and can be from your agents,to your accounts team and ultimately, your leadership team. Butunless each of these teams are involved right from the beginningin the actual implementation, errors can occur.Reasons for project failure costing you millions1. Not defining your requirements, leadingto scope creepBefore you even begin the process of implementation with yourchosen insurance software provider, you need to set aside clearobjectives and goals. What do you plan to achieve by the implementation? What are the pain points in your current system and youroperations that you want the new system to fix?When implementation is done without consulting all the teamswho will be using it, multiple critical features can get missed out.These will have to be added on in later stages, often at a highercost. Ultimately this will extend your overall project managementtimeline. To avoid this, it’s essential that you have all your teamsand their needs unified under a central project managementstructure to help finalize the list of features that the insurancesystem needs to have.4. Not consulting Subject Matter Experts onthe designA SME is a person with expert knowledge about what it takesto do a particular job. This can be more than one persondepending on the specializations required to design thesolution. The subject matter expert might be an internalemployee who has specialized insight or it can be an externalconsultant contracted to advise the company on a technicalpractice. Business users and programmers usually don’t speakContinued on next pageSUMMER 2021 SPRINGPAMIC.ORG2021 13

.the harsh reality is that insurance system implementationcan often take between 12 to 18 months and cost more money than anticipated.”the same language. The SME therefore, becomes an importantbridge between them to translate business requirements intoeffective solutions.5. Lack of proper communicationCommunication is the bridge that brings together thevarious teams working on implementation. Without propercommunication, there will not be visibility into the status of theimplementation, pending action items or any decisions thatneed to be taken. This will lead to unnecessary delays which willaccumulate and lead to the implementation missing the fixedproject timeline. Guidelines should be established for all projectcommunication.important to have clear frameworks and parameters for decisionmaking within your team task management plan. Leadersat each level need to have a complete understanding of theobjectives, budgets and project timelines so that they can aligntheir decisions around these goals.7. Not equipping your team with therequired skill setsThe initial software implementation is completed and it lookslike you’re ready to go! But before you can start reaping thebenefits of higher productivity and efficiency, there’s one criticalissue: your employees do not know how to use the softwareor change business processes to take advantage of thenew system. Using a new system requires your employees tolearn what the new workflows are that relate to their businessprocesses. Proper training ensures that your team actually usesthe new system effectively, so you can get a measurable returnon your investment in the new system.The high costs and long implementation time of insurancesoftware can be a deterrent for companies looking to makethe investment. This is why it is critical to clearly establishthe business objectives and the scope of the project with theInsurance System provider and get a commitment on thetimeline and a fixed cost for the implementation.6. Lack of identified decision-makingprocessHaving a centralized project management structure is only oneside of effective communication. The other part of team taskmanagement is determining who has ownership over whataspect of the implementation.While there will be a project manager spearheading the project,at the execution level, there needs to be one decision-makerfor every stage of the process to avoid delays. It’s also14 PAMIC.ORG SUMMER 2021Barbara Schwarz joined SimpleSolve in Novemberof 2018 as a New Business Development manager.Barbara’s background includes 40 years in insurancetechnology including IT programmer, middle levelmanager, front line manager positions. Additionally,Barbara worked as a consultant specializing inprocess improvement analysis and strategicenterprise level system selection. Barbara has beeninvolved with numerous large system developmentprojects and as well as having production support responsibility. Shehas a broad knowledge of Property and Casualty lines of business andis proficient in her knowledge of technical solutions available in theindustry.

8Reasons to Focuson Vendor ManagementBy: Steve Mazefsky, Intrepid Risk AssociatesYour service partners are critical to your success in the market and impactyour profits, client acquisition, and retention. They’re also at the heart ofmany of your organization’s processes. However, you might not consider howimportant it is to effectively manage your relationships with them. In the past,procurement was simply the act that brought goods and services to the table.But now, procurement should be considered as a part of your overall business strategy. To get the bestvalue for your money, you should be taking a strategic approach to efficiently selecting, then managingyour service partners. Doing so will have a myriad of beneficial effects for your organization.Unfortunately, vendormanagement isn’t widely implementedin the middle market of the insuranceindustry. Most mid-sized carriers lackthe time and resources to get themost out of their service providers.The bigger insurance carriers and third-party administrators in our industryunderstand the importance of vendormanagement and make a significantinvestment in internal staffing tomanage their Managed Care, LitigationSupport, and Investigative spend. Inmost instances, multiple full-timemanagement level staff review andmanage this spend for these industryleaders. To help you understand itsimportance, we’ve outlined eightreasons why vendor managementshould be a top priority in business.1.Mitigate Risks To effectivelyreduce service provider risk,whether in terms of operations,unforeseen cost implications, orregulatory compliance, you needincreased visibility with these providers.Vendor management can track yoursuppliers and provide the data you needto identify supplier risks so you can takethe necessary steps to mitigate themor choose an alternative vendor. Youcan easily verify supplier information,such as qualifications and certifications,licensure, proper insurance coverage,track performance, and even look intothe supplier’s financials to get a broaderpicture of their risk level in order toprotect your organization.2.Optimize PerformanceOnce you have a serviceprovider active in your vendormanagement system, you can trackand measure performance against thecontract to ensure that the companyis meeting your needs and complyingwith your requirements. You candevelop Standard Operating Proceduresso that all parties understand theexpectations, and you can achieveconsistency in service delivery. You canalso measure outcomes versus industrynorms, or internal goals, as well as setyear-to-year improvement objectives incosts, results, or both. If you are usingmultiple suppliers, you can evaluatethem comparatively for service, costs,and results. This will enable you toContinued on next pageSUMMER 2021 PAMIC.ORG 15

ensure optimal performance. The datayou receive from tracking performancecan signal challenges before theybecome problems and identify areasthat may need improvements fromyour vendor, or even from the mannerin which your internal staff engagesthe vendor. Vendor relationships are atwo-way street, and you should elicitfeedback from your vendor partnerson a regular basis as to how your teamcan be more effective in assignmentselection, data provided, and follow-up.You know the old axiom, garbage in,garbage out!3.Reduce Costs When youhave increased visibility, youcan see service costs that youcan bet

Recruiting the Next Generation of 21 Insurance Professionals Do Your Systems Talk to Each Other? 22 They Could. . Panhandle Farmers Mutual Insurance Company of WV Immediate Past Chairman Todd Salsman Tuscarora Wayne Insurance Company . ever to select and purchase a policy directly from your mobile device. For carriers that have been slower .