Transcription

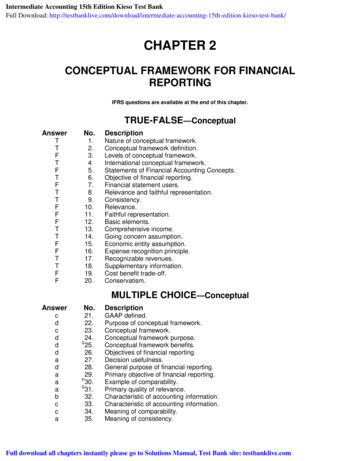

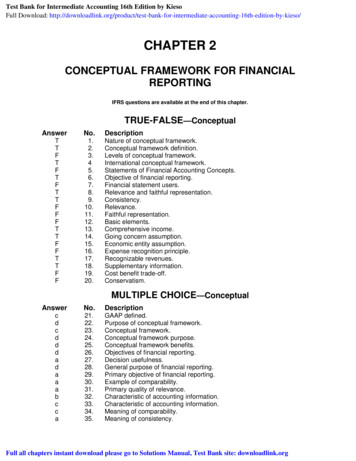

Test Bank for Intermediate Accounting 16th Edition by KiesoFull Download: rmediate-accounting-16th-edition-by-kieso/CHAPTER 2CONCEPTUAL FRAMEWORK FOR FINANCIALREPORTINGIFRS questions are available at the end of this 14.15.16.17.18.19.20.Nature of conceptual framework.Conceptual framework definition.Levels of conceptual framework.International conceptual framework.Statements of Financial Accounting Concepts.Objective of financial reporting.Financial statement users.Relevance and faithful representation.Consistency.Relevance.Faithful representation.Basic elements.Comprehensive income.Going concern assumption.Economic entity assumption.Expense recognition principle.Recognizable revenues.Supplementary information.Cost benefit trade-off.Conservatism.MULTIPLE AAP defined.Purpose of conceptual framework.Conceptual framework.Conceptual framework purpose.Conceptual framework benefits.Objectives of financial reporting.Decision usefulness.General purpose of financial reporting.Primary objective of financial reporting.Example of comparability.Primary quality of relevance.Characteristic of accounting information.Characteristic of accounting information.Meaning of comparability.Meaning of consistency.Full all chapters instant download please go to Solutions Manual, Test Bank site: downloadlink.org

Test Bank for Intermediate Accounting, Sixteenth Edition2-2MULTIPLE 74.75.76.77.78.79.80.81.82.83.84.Ingredient of relevance.Ingredient of reliability.Consistency characteristic.Primary quality of accounting information.Quality of relevance.Quality of reliability.Consistency quality.Decision-usefulness criterion.Primary qualities of accounting information.Definition of relevance.Definition of reliability.Relevance quality.Materiality characteristic.Completeness characteristic.Neutrality characteristic.Neutrality characteristic.Definition of verifiability.Quality of predictive value.Quality of free from error.Consistency.Consistency characteristic.Comparability and consistency.Comparability.Elements of financial statements.Distinction between revenues and gains.Definition of a loss.Definition of comprehensive income.Components of comprehensive income.Comprehensive income.Earnings vs. comprehensive income.Reporting financial statement elements.Basic element of financial statements.Basic element of financial statements.Basic element of financial statements.Definition of gains.Historical cost assumption.Periodicity assumption.Going concern assumption.Periodicity assumption.Monetary unit assumption.Periodicity assumption.Monetary unit assumption.Economic entity assumption.Economic entity assumption.Periodicity assumption.Going concern assumption.Going concern assumption.Implications of going concern assumption.Historical cost principle.(cont.)

Conceptual Framework Underlying Financial AccountingMULTIPLE .122.123.124.(cont.)DescriptionHistorical cost principle.Revenue recognition principle.Revenue recognition principle.Revenue recognition principle.Measurement principle.Expense recognition principle.Product costs.Expense recognition principle.Expense recognition principle.Expense recognition.Full-disclosure principle.Argument against historical cost.Recognition of revenue.Revenue recognition principle.Definition of performance obligation.Required components of financial statements.Recognition of expenses.Historical cost principle.Expense recognition principle example.Recording expenditure as asset.Historical cost principle violation.Full disclosure principle violation.Full disclosure principle.Historical cost principle violation.Industry practice constraint.Costs of providing financial information.Benefits of providing financial information.Use of materiality.Definition of prudence/conservation.Example of materiality constraint.Constraints to limit the cost of reporting.Cost-benefit relationship.Materiality characteristic.Materiality.Pervasive constraints.Prudence or conservatism.Conceptual framework second levelTrade-offs between characteristics of accounting information.Trade-offs between characteristics of accounting information.Prudence or conservatism.2-3

Test Bank for Intermediate Accounting, Sixteenth Edition2-4MULTIPLE CHOICE—CPA 31.132.133.DescriptionQuality of predictive value.Relevance and faithful representation.Classification of gains and losses.Comparability quality.Elements of financial statements.Components of comprehensive income.Faithful representation concept.Essential characteristic of an asset.Definition of recognition.BRIEF tative characteristics.Accounting concepts—identification.Accounting 8E2-139E2-140E2-141DescriptionAccounting concepts—matching.Accounting concepts—fill in the blanks.Basic assumptions.Historical cost principle.Expense recognition matching concept.CHAPTER LEARNING OBJECTIVES1. Describe the usefulness of a conceptual framework.2. Understand the objective of financial reporting.3. Identify the qualitative characteristics of accounting information.4. Define the basic elements of financial statements.5. Describe the basic assumptions of accounting.6. Explain the application of the basic principles of accounting.7. Describe the impact that the cost constraint has on reporting accounting information.*8. Compare the conceptual frameworks underlying GAAP and IFRS.

2-5Conceptual Framework Underlying Financial AccountingSUMMARY OF QUESTIONS BY LEARNING OBJECTIVES AND BLOOM’S 6666666666666666677775, 34444446KCCCCCKKKCCCKKKKKKKKKAN141.6CTRUE-FALSE 12.3334CKKC13.14.15.16.MULTIPLE CHOICE 104.105.106.107.108.109.110.111.112.BRIEF EXERCISES134.1, 2C135. 3, 5,6, 7C136. 3, 6,7CEXERCISES137.3, 6K138. 3, 5,6K139.5K140.

2-6Test Bank for Intermediate Accounting, Sixteenth EditionTRUE-FALSE—Conceptual1. A soundly developed conceptual framework enables the FASB to issue more useful andconsistent pronouncements over time.Ans: T, LO: 1, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA, IFRS:None2. A conceptual framework is a coherent system of concepts that flow from an objective.Ans: T, LO: 1, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA, IFRS:None3. The first level of the conceptual framework identifies the recognition, measurement, anddisclosure concepts used in establishing accounting standards.Ans: F, LO: 1, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA, IFRS:None4. The second level of the conceptual framework provides the qualitative characteristics thatmake accounting information useful and the elements of financial statements.Ans: T, LO: 1, Bloom: K, Difficulty: Moderate, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA,IFRS: None5. Although the FASB has developed a conceptual framework, no Statements of FinancialAccounting Concepts have been issued to date.Ans: F, LO: 1, Bloom: K, Difficulty: Moderate, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA,IFRS: None6. The objective of financial reporting is the foundation of the conceptual framework.Ans: T, LO: 2, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA, IFRS:None7. Users of financial statements are assumed to need no knowledge of business and financialaccounting matters to understand information contained in financial statements.Ans: F, LO: 2, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA, IFRS:None8. Relevance and faithful representation are the two fundamental qualities that makeaccounting information useful for decision making.Ans: T, LO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA, IFRS:None9. The idea of consistency does not mean that companies cannot switch from one accountingmethod to another.Ans: T, LO: 3, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA,IFRS: None10. Timeliness and neutrality are two ingredients of relevance.Ans: F, LO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA, IFRS:None11. Verifiability and predictive value are two ingredients of faithful representation.Ans: F, LO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA, IFRS:None12. Revenues, gains, and distributions to owners all increase equity.Ans: F, LO: 4, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Measurement, AICPA PC: Communication, IMA: FSA,IFRS: None

Conceptual Framework Underlying Financial Accounting2-713. Comprehensive income includes all changes in equity during a period except thoseresulting from investments by owners and distributions to owners.Ans: T, LO: 4, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Measurement, AICPA PC: Communication, IMA: FSA,IFRS: None14. The historical cost principle would be of limited usefulness if not for the going concernassumption.Ans: T, LO: 5, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA,IFRS: None15. The economic entity assumption means that economic activity can be identified with aparticular legal entity.Ans: F, LO: 5, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA, IFRS:None16. The expense recognition principle states that debits must equal credits in each transaction.Ans: F, LO: 6, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Measurement, AICPA PC: Communication, IMA: FSA,IFRS: None17. Revenues are recognized in the accounting period in which the performance obligation issatisfied.Ans: T, LO: 6, Bloom: K, Difficulty: Moderate, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Measurement, AICPA PC: Communication, IMA: FSA,IFRS: None18. Supplementary information may include details or amounts that present a differentperspective from that adopted in the financial statements.Ans: T, LO: 6, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA, IFRS:None19. In order to justify requiring a particular measurement or disclosure, the benefits to bederived from it must equal the costs associated with it.Ans: F, LO: 7, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA,IFRS: None20. In cost-benefit analysis, costs are generally more difficult to quantify than are benefits.Ans: F, LO: 7, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA,IFRS: NoneTrue False 6.17.18.19.20.Ans.FTTFF

2-8Test Bank for Intermediate Accounting, Sixteenth EditionMULTIPLE CHOICE—Conceptual21.Generally accepted accounting principlesa. are fundamental truths or axioms that can be derived from laws of nature.b. derive their authority from legal court proceedings.c. derive their credibility and authority from general recognition and acceptance by theaccounting profession.d. have been specified in detail in the FASB conceptual framework.Ans: c, LO: 1, Bloom: C, Difficulty: Easy, Min: 2, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA, IFRS:None22.A soundly developed conceptual framework of concepts and objectives shoulda. increase financial statement users' understanding of and confidence in financialreporting.b. enhance comparability among companies' financial statements.c. allow new and emerging practical problems to be more quickly solved.d. All of these answer choices are correct.Ans: d, LO: 1, Bloom: C, Difficulty: Easy, Min: 2, AACSB: None, AICPA BB: None, AICPA FC: Reporting, AICPA PC: Communication, IMA: FSA, IFRS:None23.Which of the following is not true concerning a conceptual framework in accounting?a. It should be a basis for standard-setting.b. It should allow practical problems to be solved more quickly by reference to it.c. It should be based on fundamental truths that are derived from the laws of nature.d.

Test Bank for Intermediate Accounting, Sixteenth Edition 2 - 4 MULTIPLE CHOICE—CPA Adapted Answer No. Description a 125. Quality of predictive value. b 126. Relevance and faithful representation. b 127. Classification of gains and losses. b 128. Comparability quality. a 129. Elements of financial statements. b 130. Components of comprehensive .