Transcription

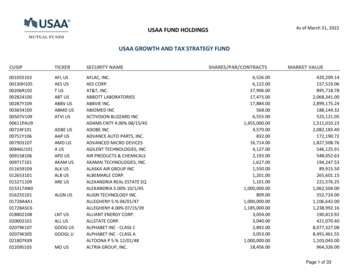

JULY 31, 2021Annual ReportUSAA Science & Technology FundVictory Capital means Victory Capital Management Inc., the investment adviser of the USAA Mutual Funds. USAAMutual Funds are distributed by Victory Capital Services, Inc., member of FINRA, an affiliate of Victory Capital. VictoryCapital and its affiliates are not affiliated with United Services Automobile Association or its affiliates. USAA and theUSAA logos are registered trademarks and the USAA Mutual Funds and USAA Investments logos are trademarks ofUnited Services Automobile Association and are being used by Victory Capital and its affiliates under license.

www.vcm.comNews, Information And Education 24 Hours A Day, 7 Days A WeekThe Victory Capital site gives fund shareholders, prospective shareholders, andinvestment professionals a convenient way to access fund information, get guidance,and track fund performance anywhere they can access the Internet. The site includes: Detailed performance recordsDaily share pricesThe latest fund newsInvestment resources to help you become a better investorA section dedicated to investment professionalsWhether you’re a potential investor searching for the fund that matches yourinvestment philosophy, a seasoned investor interested in planning tools, or aninvestment professional, www.vcm.com has what you seek. Visit us anytime. We’realways open.

TABLE OF CONTENTSShareholder Letter (Unaudited)2Managers’ Commentary (Unaudited)4Investment Overview (Unaudited)6Investment Objective & PortfolioHoldings (Unaudited)7Schedule of Portfolio Investments8Financial StatementsStatement of Assets and LiabilitiesStatement of OperationsStatements of Changes in Net AssetsFinancial Highlights18192022Notes to Financial Statements24Report of IndependentRegistered Public Accounting Firm35Supplemental Information (Unaudited)Trustees’ and Officers’ InformationProxy Voting and Portfolio Holdings InformationExpense ExamplesAdditional Federal Income Tax InformationLiquidity Risk Management ProgramPrivacy Policy (inside back cover)363642424344This report is for the information of the shareholders and others whohave received a copy of the currently effective prospectus of theFund, managed by Victory Capital Management Inc. It may be usedas sales literature only when preceded or accompanied by a currentprospectus, which provides further details about the Fund.IRA DISTRIBUTION WITHHOLDING DISCLOSUREWe generally must withhold federal income tax at a rate of 10% of thetaxable portion of your distribution and, if you live in a state thatrequires state income tax withholding, at your state’s tax rate.However, you may elect not to have withholding apply or to haveincome tax withheld at a higher rate. Any withholding election that youmake will apply to any subsequent distribution unless and until youchange or revoke the election. If you wish to make a withholdingelection, or change or revoke a prior withholding election, call(800) 235-8396, and form W-4P (OMB No. 1545-0074 withholdingcertificate for pension or annuity payments) will be electronically sent.If you do not have a withholding election in place by the date of adistribution, federal income tax will be withheld from the taxableportion of your distribution at a rate of 10%. If you must pay estimatedtaxes, you may be subject to estimated tax penalties if your estimatedtax payments are not sufficient and sufficient tax is not withheld fromyour distribution.For more specific information, please consult your tax adviser. NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE1USAA MutualFunds Trust

(Unaudited)Dear Shareholder,It’s hard to believe that it was just last summer when we were still coming to gripswith a global pandemic, hoping for an effective vaccine, and wondering whether theU.S. Federal Reserve’s (the “Fed’s”) aggressive actions would continue to mollifyfinancial markets. As it turns out, a vaccine was rolled out (domestically) faster thanexpectations, and a recovery that began during the second quarter of 2020 continuedunabated.Fast forward to today and investors are still a bit uneasy, but with a different set ofworries. Financial assets have recovered, but the pandemic is still on the back ofeveryone’s mind, and we are all wondering how a recent surge in COVID-19 caseswill impact markets going forward. Today, CEOs are expressing concerns about laborshortages, disrupted supply chains, rising commodity prices, and the potential forlasting inflation. If anything, this merely exemplifies just how dynamic andunpredictable markets can be.Nevertheless, we consider ourselves relatively fortunate despite the myriad challengesof the past year. For starters, we are thankful how quickly the various forms ofmonetary and fiscal stimulus contributed to a rebound in gross domestic product(“GDP”). It wasn’t a straight line upward and there were bouts of elevated volatilityin both bond and stock markets. Late in 2020, for example, financial markets werealternately fueled and roiled by a contentious election season, growing optimism foran effective vaccine, and a fluid debate regarding the need for even more stimulus.Ultimately, stocks were propelled higher in the fourth quarter of 2020 as it becameclear Congress would provide another dose of stimulus in the form of direct payments,more unemployment insurance, and additional aid to businesses.As we moved into 2021, stocks continued their upward trajectory. Meanwhile, theyield on the 10-Year U.S. Treasury rallied sharply as many investors began to shifttheir focus. Deflation was out; inflation was in. More recently, the calculus has shiftedonce again. This summer a new variant of the virus emerged, and investors beganworrying about future economic growth. With those concerns volatility re-emergedand Treasury yields retreated. The ride continues.So how did markets actually fare during our most recent annual reporting period?Through all the volatility and surprises, the S&P 500 Index registered impressivegains of nearly 35% for this 12-month period ended July 31, 2021. Not coincidentally,this broad market index has been hovering near its all-time high. Over this sameannual period, the yield on the 10-Year U.S. Treasury jumped 69 basis points (a basispoint is 1/100th of one percent), reflecting a very low starting rate, substantial fiscalstimulus, and the Fed’s ongoing accommodative monetary policy. As the end of ourreporting period approached, however, the yield on the 10-Year U.S. Treasury begantrending lower, reflecting pandemic and growth concerns and finishing at 1.24% onJuly 31, 2021.Where to from here? Our investment professionals continually monitor theenvironment and work hard to position portfolios opportunistically. There will nodoubt be more challenges ahead, but we think it’s important to reflect on the positivesand remember our collective spirit and perseverance. Markets endured this past2

year and even surprised to the upside, and investors who remained calm in the faceof adversity and focused on their longer-term investment goals were likely rewarded.In our view, that always seems to be the best approach no matter what the marketsthrow at us.On the following pages, you will find information relating to your USAA Mutual Funds,brought to you by Victory Capital. If you have any questions regarding the currentmarket dynamics or your specific portfolio or investment plan, we encourage you tocontact our Member Service Representatives. Call (800) 235-8396 or visit our websiteat www.vcm.com.From all of us here at Victory Capital, thank you for letting us help you work towardyour investment goals.Christopher K. Dyer, CFAPresident,USAA Mutual Funds Trust3

USAA Mutual Funds TrustUSAA Science & Technology FundManagers’ Commentary(Unaudited) What were the market conditions during the reporting period?The global financial markets produced healthy returns during the second half of 2020,wrapping up a positive year for the major asset classes. Investors’ appetite for riskimproved considerably in early November, when the approval of vaccines for COVID-19raised expectations that the world economy could gradually return to normal in 2021.The conclusion of the U.S. elections, which removed a source of uncertainty that haddepressed performance in September and October, was an additional tailwind. Themarkets were also aided by continued indications that the U.S. Federal Reserve (the“Fed”) and other central banks would maintain their highly accommodative policiesindefinitely. Not least, an agreement on a new round of U.S. fiscal stimulus further cheeredinvestors in late December. Together, these developments outweighed negative headlinessurrounding renewed lockdowns and the persistence of the coronavirus.The first quarter of 2021 proved to be a continuation of the strong equity marketsinvestors experienced over the second half of 2020. Gains from global equity marketswere fueled by optimism surrounding the successful rollout of the COVID-19 vaccinescoupled with further monetary and fiscal stimulus proposals. Faster-than-expectedeconomic growth produced a meaningful increase in real interest rates, which led tonegative returns across most major fixed income asset classes. The 10-year U.S. Treasurybond yield finished at its highest level of the first quarter reporting period climbing fromunder 1% to 1.74%.In the second quarter of 2021, equity markets have been consolidating and interest ratesleveling off after large upswings. With strong first quarter GDP and corporate earningsgrowth in the rearview mirror, investors seem to be contemplating their next move. Equitymarkets rotated from value to growth leadership as Treasury bond yields retreated fromthe highs of March. Inflation has been increasing as the economy reopens more quicklythan expected. The Fed maintains that inflationary pressure is transitory but couldbecome more persistent. The inflationary environment will be a key metric moving intothe second half of the year.During the last month of the reporting period, markets appeared to focus on the latestCOVID-19 variant (delta) as rising infection numbers gave way to concerns around thereopening with mask mandates and other restrictions being reintroduced once again.During this time, large-cap growth names outperformed value and small-cap orientedsecurities. How did the USAA Science & Technology Fund (the “Fund”) perform during thereporting period?The Fund has two share classes: Fund Shares and Class A. For the reporting periodended July 31, 2021, the Fund Shares and Class A had total returns of 33.71% and33.31%, respectively. This compares to returns of 36.45% for the S&P 500 Index, 40.38%for the S&P North American Technology Index, 27.77% for the S&P Composite 1500 HealthCare Index, and 45.19% for the Lipper Science & Technology Funds Index.4

USAA Mutual Funds TrustUSAA Science & Technology Fund (continued)Managers’ Commentary (continued)Victory Capital Management Inc. (“VCM”) is the Fund’s investment adviser. As theinvestment adviser, VCM employs dedicated resources to support the research, selection,and monitoring of the Fund’s subadviser. Wellington Management Company LLP is anexternal subadviser to the Fund, while RS Investments Growth is a VCM investmentfranchise that each manage portions of the Fund. Primary responsibility for the day-today discretionary management of the Fund lies with the subadviser and the investmentfranchises. What strategies did you employ during the reporting period?The Fund had strong positive returns for the reporting period ended July 31, 2021.Overall, stock selection in health care had the largest positive effect on relativeperformance, while individual stock selection in information technology detracted fromFund performance. On the other hand, the overall allocation in information technologyhad a positive effect on Fund performance.Thank you for allowing us to assist you with your investment needs.5

USAA Mutual Funds TrustUSAA Science & Technology FundInvestment Overview(Unaudited)Average Annual Total ReturnYear Ended July 31, 2021INCEPTION DATEFund SharesClass A8/1/978/2/10S&P 500 Index1S&P NorthAmericanTechnologyIndex2S&PComposite1500 HealthCare Index3LipperScience &TechnologyFunds Index445.19%Net Asset ValueNet Asset ValueMaximumOffering PriceOne Year33.71%33.31%25.64%36.45%40.38%27.77%Five Year24.13%23.79%22.34%17.35%29.80%14.43%27.24%Ten Year20.30%20.00%19.29%15.35%22.34%16.88%19.60%The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principalvalue will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performanceinformation current to the most recent month’s end, please visit www.vcm.com.The maximum offering price (“MOP”) figures reflect a maximum sales charge of 5.75% for Class A. Net Asset Value does not reflect sales charges. Totalreturn measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The totalreturns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. Generally Accepted Accounting Principles orthe deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, orredemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.USAA Science & Technology Fund — Growth of 10,000 80,000 75,09170,000 63,501 59,96560,00050,000 47,639 41,68940,00030,000USAA Science &Technology Fund Fund SharesS&P 500 Index1S&PNorth AmericanTechnologyIndex2S&P Composite1500 HealthCare Index320,000Lipper Science &TechnologyFunds /127/110The broad-based composite S&P 500 Index represents the weighted average performance of a group of 500 widely held, publicly traded stocks. This indexdoes not include the effect of sales charges, commissions, expenses, or taxes, is not representative of the Fund, and it is not possible to invest directly inan index.2The S&P North American Technology Index provides investors with a benchmark that represents U.S. securities classified under the Global IndustryClassification System (GICS ) technology sector and internet retail sub-industry. This index does not include the effect of sales charges, commissions,expenses, or taxes, is not representative of the Fund, and it is not possible to invest directly in an index.3The S&P Composite 1500 Health Care Index comprises U.S. traded stocks that are members of either the S&P Total Market Index (TMI) or the S&P/TSXComposite Index, and are classified within the health care sector of the GICS . This index does not include the effect of sales charges, commissions,expenses, or taxes, is not representative of the Fund, and it is not possible to invest directly in an index.4The Lipper Science & Technology Funds Index tracks the total return performance of funds within the Lipper Science & Technology Funds category. Thisindex does not include the effect of sales charges, commissions, expenses, or taxes, is not representative of the Fund, and it is not possible to invest directlyin an index.The graph reflects investment of growth of a hypothetical 10,000 investment in the Fund.The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.Past performance is not indicative of future results.6

USAA Mutual Funds TrustUSAA Science & Technology FundJuly 31, 2021(Unaudited)Investment Objective and Portfolio Holdings:The Fund seeks long-term capital appreciation.Top 10 Equity Holdings*:July 31, 2021(% of Net Assets)Microsoft Corp.Amazon.com, Inc.RingCentral, Inc. Class AFacebook, Inc. Class AWix.com Ltd.Alphabet, Inc. Class ATwilio, Inc. Class AMarvell Technology, Inc.Lam Research Corp.Visa, Inc. Class A5.9%4.2%3.1%2.5%2.3%2.2%2.1%2.1%1.9%1.6%Sector Allocation*July 31, 2021(% of Net Assets)Consumer ication Services9.8%InformationTechnology53.7%Health Care24.0%* Does not include futures contracts, money market instruments, and short-term investments purchased with cashcollateral from securities loaned.Percentages are of the net assets of the Fund and may not equal 100%.Refer to the Schedule of Portfolio Investments for a complete list of securities.7

Schedule of Portfolio InvestmentsUSAA Mutual Funds TrustUSAA Science & Technology FundJuly 31, 2021(Amounts in Thousands, Except for Shares)Security DescriptionSharesValueCommon Stocks (96.5%)Australia (0.1%):Health Care (0.1%):Opthea Ltd., ADR (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .332,567 2,188Belgium (0.0%): (b)Health Care (0.0%):UCB SA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2,680290Consumer Discretionary (0.3%):Arco Platform Ltd. Class A (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .196,9805,732Health Care (0.0%): (b)Hypera SA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Notre Dame Intermedica Participacoes SA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .35,30012,400242190Brazil (0.4%):432Information Technology (0.1%):StoneCo Ltd. Class A (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .36,9342,1748,338Canada (0.8%):Health Care (0.3%):Fusion Pharmaceuticals, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Zymeworks, Inc. (a) (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .486,52283,1243,9652,6686,633Information Technology (0.5%):Shopify, Inc. Class A (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6,79810,19616,829Cayman Islands (0.0%): (b)Health Care (0.0%):Theravance BioPharma, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4,17854Communication Services (0.1%):Tencent Holdings Ltd. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .49,3602,977Health Care (0.2%):Connect BioPharma Holdings Ltd., ADR (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Everest Medicines Ltd. (a) (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Gracell Biotechnologies, Inc., ADR (a) (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .InnoCare Pharma Ltd. (a) (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Shandong Weigao Group Medical Polymer Co. Ltd. Class H . . . . . . . . . . . . . . . . . .Venus MedTech Hangzhou, Inc. Class H (a) (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . .Wuxi AppTec Co. Ltd. Class H (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Zai Lab Ltd. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2131,86627112910725028China (0.3%):See notes to financial statements.8

Schedule of Portfolio Investments — continuedUSAA Science & Technology FundJuly 31, 2021USAA Mutual Funds Trust(Amounts in Thousands, Except for Shares)Security DescriptionSharesZai Lab Ltd., ADR (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4,420Value 6393,7796,756Denmark (0.0%): (b)Health Care (0.0%):Ascendis Pharma A/S, ADR (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Genmab A/S (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Zealand Pharma A/S, ADR (a) (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1,7205841,49220326445512Germany (0.1%):Consumer Discretionary (0.1%):Auto1 Group Se (a) (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .41,0252,00926,0002,33446035985Hong Kong (0.0%): (b)Health Care (0.0%):CSPC Pharmaceutical Group Ltd. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Hutchison China Meditech Ltd., ADR (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Hutchmed China Ltd. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .138Israel (2.3%):Information Technology (2.3%):Wix.com Ltd. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ,60010,7303433683964,066114120245Italy (0.0%): (b)Health Care (0.0%):Stevanato Group SpA (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Japan (0.6%):Health Care (0.3%):Astellas Pharma, Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Daiichi Sankyo Co. Ltd. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Eisai Co. Ltd. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Hoya Corp. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Kyowa Kirin Co. Ltd. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Nippon Shinyaku Co. Ltd. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Ono Pharmaceutical Co. Ltd. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5,652Information Technology (0.3%):Sansan, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Taiyo Yuden Co. Ltd. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .26,40099,6002,1595,1127,27112,923Jersey (0.2%):Health Care (0.2%):Novocure Ltd. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .See notes to financial statements.924,5583,782

Schedule of Portfolio Investments — continuedUSAA Science & Technology FundJuly 31, 2021USAA Mutual Funds Trust(Amounts in Thousands, Except for Shares)Security DescriptionSharesValueKorea, Republic Of (0.4%):Information Technology (0.4%):Koh Young Technology, Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .SK Hynix, Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .153,63038,182 3,2683,7387,006Netherlands (1.7%):Health Care (0.2%):Argenx SE, ADR (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Koninklijke Philips NV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Merus NV (a) (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4447,065117,9241353262,0282,489Information Technology (1.5%):ASML Holding NV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .BE Semiconductor Industries NV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .STMicroelectronics NV, NYS (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . gapore (0.3%):Information Technology (0.3%):Flex Ltd. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .321,2235,7722,398309392222119226Switzerland (0.0%): (b)Health Care (0.0%):Novartis AG Registered Shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Roche Holding AG . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Tecan Group AG Class R . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .567Taiwan (0.3%):Information Technology (0.3%):Globalwafers Co. Ltd. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .197,8006,011150,149710,1817,5253,348United Kingdom (1.3%):Consumer Discretionary (0.5%):Farfetch Ltd. Class A (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Trainline PLC (a) (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10,873Health Care (0.8%):Abcam PLC (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .AstraZeneca PLC, ADR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Bicycle Therapeutics PLC, ADR (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Compass Pathways PLC, ADR (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .ConvaTec Group PLC (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Freeline Therapeutics Holdings PLC, ADR (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Genus PLC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Hikma Pharmaceuticals PLC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .See notes to financial ,1612,309251,1047,1215,9991554224285

USAA Mutual Funds TrustSchedule of Portfolio Investments — continuedUSAA Science & Technology FundJuly 31, 2021(Amounts in Thousands, Except for Shares)Security DescriptionSharesMyovant Sciences Ltd. (a) (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Smith & Nephew PLC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4,94712,710Value 10225915,13426,007United States (87.7%):Communication Services (9.7%):Alphabet, Inc. Class A (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Chicken Soup For The Soul Entertainment, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . .Electronic Arts, Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Facebook, Inc. Class A (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .IAC/InterActiveCorp. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Match Group, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Snap, Inc. Class A (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Take-Two Interactive Software, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Twitter, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Vimeo, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24813,64228,4894,064196,739Consumer Discretionary (6.9%):Airbnb, Inc. Class A (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Amazon.com, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Booking Holdings, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Chegg, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Duolingo, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Etsy, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Roku, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Shutterstock, Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ancials (1.0%):DA32 Life Science Tech Acquisition Corp. Class A (a) . . . . . . . . . . . . . . . . . . . . . . .MedTech Acquisition Corp. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Omega Alpha SPAC Class A (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Orion Acquisition Corp. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Oscar Health, Inc. Class A (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Panacea Acquisition Corp. II (a) (e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81007,07119,855Health Care (21.9%):10X Genomics, Inc. Class A (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .89bio, Inc. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Abbott Laboratories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Absci Corp. (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Aclaris Therapeutic

Toppan Merrill - Victory USAA Mutual Funds Trust Science _ Technology Fund Annual Report [Funds] 811-07852 Fund 232 akiesli 27-Sep-21 12:28 21-24755-7.ba Sequence: 3 CHKSUM Content: 37746 Layout: 40072 Graphics: 61001 CLEAN