Transcription

File revised 4/25/19 to include the USAA 2018 Report to Members(no changes to the documents originally submitted on 04/01/19)USAAUSAA9800 Fredericksburg RoadSan Antonio, TX 78288April 01, 2019Federal Reserve Bank of Dallas2200 N Pearl St.Dallas, TX 75201Re: FR Y-6 Submission for the period ending December 31, 2018Enclosed for filing is the combined Savings Association Holding Company Report (FR Y-6} for UnitedServices Automobile Association (USAA) RSSD ID 0001447376 and USAA Capital Corporation (CAPCO}RSSD ID 0001447385 for the period ending December 31, 2018.The following serves as an index to this submission:Item 1: Annual Report to Members USAA and CAPCO are privately held companies and we issue a consolidated annual reportto members that is published on usaa.com. Report is not yet available and will be sent underseparate cover at a later date.Item 2(a): Organizational Chart See Attachment A.Item 2(b): Domestic Branch Listing See Attachment B.Item 3: Securities Holders USAA is a diversified financial services company that is organized as a reciprocal interinsuranceexchange (owned by its policyholders who agree to insure each other through an attorney-in fact). See Attachment C. CAPCO is a holding company for certain noninsurance operations of USAA and is engaged inbanking, investment management and real estate investment operations. CAPCO is a wholly owned subsidiary of USAA. USAA owns 100% of CAPCO's common stock. See Attachment C.

Item 4: Insiders See Attachment D.Should you have any questions regarding this submission, please contact Danette Sampeck at 210-8573984 or Jennifer Flores at 210-414-3347.Sincerely,YJ(t1.///a/ Martha-L : f--USAASVP Corporate Controller

4/25/2019USAA 2018 Report to Members - USAA Community - 208052USAACOMMUNITYLOG ONUSAA News USAA USAA 2018 Report toCommunityExploreCenterNewsMembersUSAACommunity Manager75,832 Viewsa week agoA Message From the ChairmanDear Fellow Members,For five decades, I’ve been proud to be a USAA member.I’ve had the honor of serving you 14 years on the Board ofDirectors, six as Chairman. My role provides a unique frontrow view of innovations and activities that take care ofyour needs.For example, in 2018 we:Blocked approximately 13 million cyberattacks and prevented more than 11million in fraud losses every day.Launched an augmented-reality tool that empowers car shoppers with buyinginformation by simply pointing their mobile phone at a vehicle of interest.Provided world-class service through more than 1.4 billion member interactions bymobile, voice or our website.Your association continues to earn high praise. Temkin Trust Ratings gave USAA topbilling in banks, credit cards and insurance. Forrester’s Customer Experience Indexnamed us a “Best-in-Class” brand in four industry categories, including direct eprintpage/blog-id/usaa-news/article-id/33911/3

4/25/2019USAA 2018 Report to Members - USAA Community - 208052discount brokerages. The 2018 annual Bank Reputation Survey, presented byReputation Institute and American Banker, ranked USAA as the Most Reputable Bankamong customers and non-customers. Ethisphere again listed us among the World’sMost Ethical Companies.I deeply appreciate the member trust that lies behind these accolades and thank youfor your loyalty through the years. I will retire from the Board in 2019 following theAnnual Members’ Meeting in August. Our current Vice Chairman, Admiral Thomas FargoUSN Ret., will move into the Chairman’s seat.During my time serving as the Chairman of our Association, I had the opportunity everyyear to meet almost all of our 34,000 USAA employees, either in person or virtually. Icannot say how much I appreciated their dedication and passion to serve you, ourmembers.Sincerely,Lester L. LylesGeneral, USAF (Ret.)Chairman of the BoardView The 2017 FinancialsView The 2016 FinancialsThe Temkin Trust Ra ngs are based on consumer feedback on companies with which our survey respondents have recentlyinteracted. We asked consumers how much they trust those firms. For more informa on, see the Temkin Trust Ra ngsOverview.Forrester Research does not endorse any company included in any CX Index report and does not advise any person to selectthe products or services of any par cular company based on the ra ngs included in such reports. USAA received the highestCX Index score among Auto/home insurers, Banks (direct), Brokerages (direct), and Credit card issuers in /33912/3

4/25/2019USAA 2018 Report to Members - USAA Community - 208052proprietary 2018 CX Index survey. The ranking was based on responses from 110,828 US individuals ages 18-88. Theproprietary survey results are based on consumers’ opinions of their experiences with the brands in the survey.The 2018 Annual Survey of Bank Reputa ons scores and rankings are based on more than ra ngs collected via an onlineques onnaire in the first quarter of 2018. They measure the general public’s percep on where the company stands on sevenkey ra onal dimensions of reputa on.World’s Most Ethical Companies” and “Ethisphere” names and marks are registered trademarks of Ethisphere LLC.261093-0419 22 LikesShareSTAY UPDATEDCopyright 2019 icleprintpage/blog-id/usaa-news/article-id/33913/3

The NumbersTo fulfill our mission and meet our commitments to memberstoday and well into the future, USAA must maintain deepfinancial strength. For example, USAA was able to helpthousands of members through recent catastrophes likeHurricanes Florence and Michael and the California fires. We alsorelied on our financial strength to invest in the technology, toolsand talent to better serve a growing number of military families.In 2018, we achieved solid earnings, grew our net worth andwere able to share our success by returning to members almost 1.8 billion in the form of distributions, dividends, bank rebatesand rewards. In addition, we achieved a property and casualtyoperating expense ratio that was better than the industry. Allthree key credit rating agencies reaffirmed USAA’s financialstrength ratings.USAA’S FINANCIAL STRENGTHALLOWED US TO PAY OUT ALMOST 16 BillionIN TOTAL CLAIMSWHILE STILL RETURNING ALMOSTAND STANDING STRONG AT OVERTO YOUIN DISTRIBUTIONS, DIVIDENDS,BANK REBATES AND REWARDSIN NET WORTH 1.8 Billion 31 BillionManagement’s Responsibility for Financial ReportingThe management of USAA is responsible for the integrity and objectivity of the financial information presentedin this annual report. Due to the volume of financial information contained in the audited consolidated financialstatements, including the accompanying footnotes, we have chosen not to include the full audited consolidatedfinancial statements in this Report to Members.The financial statements that appear in this document have beenselected from the audited consolidated financial statements,which were prepared in accordance with Generally AcceptedAccounting Principles (GAAP), to give basic and necessaryfinancial information about USAA. Certain prior-year amountswere reclassified to conform to the current-year presentation. Thekey statutory data was prepared in accordance with StatutoryAccounting Principles (SAP). Management believes the financialinformation contained in the audited consolidated financialstatements fairly presents USAA’s financial position, results ofoperations, and cash flows. A copy of the complete auditedconsolidated financial statements of USAA, including Ernst &Young LLP’s unqualified independent auditor’s report thereon, isavailable upon request to USAA headquarters in San Antonio.USAA’s internal controls are designed to reasonably ensurethat USAA’s assets are safeguarded from unauthorized use ordisposition and that USAA’s transactions are authorized, executedand recorded properly. In addition, USAA has a professional staffof internal auditors who monitor these controls on an independentbasis. The Finance and Audit Committee of USAA’s Board of1 2018 REPORT TO MEMBERSDirectors engaged Ernst & Young LLP as independent auditors toaudit USAA’s financial statements and express an opinion thereon.Ernst & Young LLP’s audit included consideration of USAA’sinternal controls over financial reporting as a basis for designingaudit procedures that support their financial statement auditopinion, but not for the purpose of expressing an opinion on theeffectiveness of USAA’s internal controls over financial reporting.The Finance and Audit Committee of USAA’s Board of Directorsconsists of members who are not officers or employees of USAA.This committee meets periodically with management, internalauditors and Ernst & Young LLP to ensure that management fulfillsits responsibility for accounting controls and preparation of theconsolidated financial statements and related data.Stuart ParkerLaura BishopChief Executive OfficerChief Financial Officer

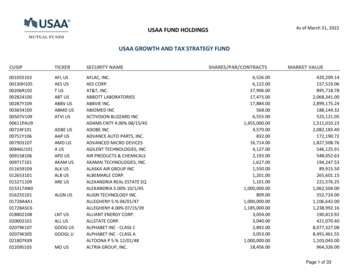

Consolidated Statements of Comprehensive IncomeIn 2018, USAA achieved almost 2.3 billion in net income, slightly lower than 2017. This is after another devastating catastrophe season in whichwe paid out more than 2 billion to thousands of members to help them recover from a series of natural disasters. Non-catastrophe lossesgrew as a result of an increase in the number of homeowner claims and rising costs for auto parts and repairs.Operating results from our lines of business – including property and casualty, banking, life insurance, and investment management operations– contributed to solid net income. Investment returns, although lower than last year due to a more volatile market, were also strong.This year, we invested in USAA’s technology, processes and talent in order to keep pace with our overall growth and near doubling in membersover the past decade. A key focus in 2018 was to strengthen our ability to meet regulatory expectations, over the long term enabling USAA toprovide consistent member experiences. Despite these outlays, our conservative approach to financial management enabled our property andcasualty company’s operating expense ratio to be approximately 16 percentage points better than the industry.In addition to paying higher member distributions in 2018, USAA is reinvesting the benefits of recent federal tax reform in ways that will benefitmembers and employees, including ensuring product competitiveness.Years ended Dec. 31 (dollars in millions)20182016201718,287 583,2248022,630339REVENUESInsurance premiums, netInvestment returns:Interest and dividends earned, netGains (losses) on investments, netTotal investment returnGains on sale of loans, netFees, sales and loan income, netReal estate operationsOther income (e.g., miscellaneous product services and fees) Total revenues 22,214LOSSES, BENEFITS AND EXPENSESNet losses, benefits and settlement expensesDeferred policy acquisition costsReal estate expensesInterest expenseDividends to policyholdersOther operating expenses (e.g., personnel, IT costs, loan losses, premium taxes)Total losses, benefits and expensesPre-tax incomeIncome tax expenseNET INCOME Other comprehensive income (loss), net of taxTOTAL COMPREHENSIVE INCOME2 2018 REPORT TO MEMBERS1,779 94 1,8732,422 (806)139 2,5612,291 1,485

Consolidated Balance SheetsPerhaps the best measure of USAA’s ability to keep its commitments to members is net worth. In 2018, net worth increased nearly 2 percent toover 31 billion, thanks in large part to our solid net income.Assets grew 2 percent to almost 159 billion. This increase was driven by cash inflows from member deposits, increase in investments andretained earnings.201620172018 12,45671,892 12,28879,512 13,72780,395Years ended Dec. 31 (dollars in millions)ASSETSCash and cash equivalentsInvestments47,66447,34246,795Premiums due from policyholdersProperty, equipment and software, net3,5041,8743,9991,9714,2582,110Securities lending collateralOther assets (e.g., accounts receivable, pension plans)2009,7006310,21612311,099 147,290 155,391 158,507 23,00119,07068,1302,470 25,05419,65870,8822,834 26,91219,36171,7412,8372005,579636,2921236,355 118,450 124,783 127,32928,84030,60831,178 147,290 155,391 158,507Loans, netTOTAL ASSETSLIABILITIESInsurance reservesLife insurance — funds on depositBank depositsBorrowingsSecurities lending payableOther liabilities (e.g., accounts payable, benefit plan obligations)TOTAL LIABILITIESNET WORTHTotal net worthTOTAL LIABILITIES AND NET WORTHMember DistributionsOne of the most important ways USAA shares its financial success is by returning a share of our profits to members. In 2018, USAA returnedalmost 1.8 billion to our members through distributions, dividends, bank rebates and rewards. This represented a nearly 16 percent increase over2017. For more than 20 years, we’ve returned no less than 20 percent of profits to members through distributions and policyholder dividends.Years ended Dec. 31 (dollars in millions)Subscriber's Account distributions2016 24620182017 299 404Senior Bonus distributions*277283287Subscriber's Account terminations197210225Automobile policyholder dividends72971297928891,045Total property and casualty distributionsLife insurance policyholder dividendsBank rebates and rewardsTOTAL DISTRIBUTIONS TO MEMBERS** 4645446026227101,440 1,556Past dividends or distributions are not a guarantee or promise of future dividends or distributions.*Senior Bonus distributions represent additional Subscriber's Account distributions for eligible members of the association with more than 40 years of membership.**Includes amounts returned to members, associates and other customers.3 2018 REPORT TO MEMBERS 1,799

ATTACHMENT AForm FR Y-6Report Item 2a: Organizational ChartUNITED SERVICES AUTOMOBILE ASSOCIATIONFiscal Year Ending December 31, 2018EntityUNITED SERVICES AUTOMOBILE ASSOCIATION1 RIVERWALK, LLC101 WEST END REIT, LLC106 RIDGE ST VENTURE LLC110 N. WACKER DEVELOPMENT, LLC110 NORTH WACKER TITLEHOLDER LLC110 RIDGE ST VENTURE LLC118 RIDGE ST VENTURE LLC1215 EAST 7TH MEZZ LLC1215 EAST 7TH OWNER LLC1255 22ND STREET LIMITED PARTNERSHIP1255 22ND STREET LIMITED PARTNERSHIP142 WEST 36TH STREET MEMBER LLC142 WEST 36TH STREET REIT INC.142 WEST 36TH STREET, LLC14675 DALLAS NORTH TOLLWAY, LLC160 EAST 48TH STREET OWNER II LLC2100 2ND ST SW LLC234 W 39TH STREET BORROWER LLC234 WEST 39TH STREET MEMBER LLC234 WEST 39TH STREET REIT INC.23RD STREET OWNER LLC2500 CITYWEST BLVD., LLC2500 CITYWEST JV, LLC2500 CITYWEST JV, LLC2500 CITYWEST JV, LLC2500 CITYWEST LAND, LLC2500 CITYWEST REIT, INC.2500 CITYWEST REIT, INC.2922 NORTHERN BOULEVARD JV LLC300 BARR HARBOR VENTURE, LLC300 BARR HARBOR, LLC300 CONVENT, LLC340 MADISON AVENUE JV LLC340 MADISON TRS LLC3657 BRIARPARK DRIVE, LLC3875 WEST CHESTER PIKE, LLC400 BARR HARBOR VENTURE, LLC400 BARR HARBOR, LLC410 7TH STREET OWNER LLC520 WEST 43RD STREET REIT, LLC520 WEST 43RD STREET REIT, LLC625 W. ADAMS, LLC649 SOUTH OLIVE HOLDINGS LLC649 SOUTH OLIVE JV LLC649 SOUTH OLIVE JV LLC649 SOUTH OLIVE LLC649 SOUTH OLIVE TENANT LLC6500 GRANDVIEW, LLC7101 WISCONSIN ASSOCIATES, LLC7101 WISCONSIN OWNER, LLC712 SOUTH OLIVE INVESTOR LLC712 SOUTH OLIVE INVESTOR LLC8TH STREET PRODUCE MEZZ LLC8TH STREET PRODUCE OWNER LLCACRE MANAGEMENT II, LLCACRE MANAGEMENT, LLCACREF HIE FORT WORTH LLCADAMS MORGAN HOTEL JV LLCADAMS MORGAN HOTEL JV LLCADAMS MORGAN HOTEL MEMBER LLCADAMS MORGAN HOTEL OWNER LLCADMIRAL CAPITAL REAL ESTATE FUND II, L.P.ADMIRAL CAPITAL REAL ESTATE FUND II, L.P.ADMIRAL CAPITAL REAL ESTATE FUND, L.P.ADMIRAL CAPITAL REAL ESTATE FUND, L.P.ADMIRAL CAPITAL REAL ESTATE GP II, LLCADMIRAL CAPITAL REAL ESTATE GP, LLCADMO HOTEL DEVELOPER MANAGER LLCAF/WP BROOKHAVEN, LLCALAMEDA SQUARE MEZZ LLCALAMEDA SQUARE MEZZ LLCALAMEDA SQUARE OWNER LLCALDEN CAPITAL PARTNERS TAX CREDIT FUND 20, LPALDEN CAPITAL PARTNERS TAX CREDIT FUND 20, LPALLIANT TAX CREDIT FUND 68, LTDLEI s TypeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeHead OfficeCitySan AntonioHoustonNew YorkNew YorkChicagoDallasNew YorkNew YorkNew YorkNew YorkNew YorkNew YorkNew YorkNew YorkNew YorkDallasNew YorkNew YorkNew YorkNew YorkNew YorkNew YorkHoustonSan AntonioSan AntonioSan AntonioSan AntonioSan AntonioSan AntonioNew YorkNewton SquareNewton SquareHoustonUniondaleUniondaleHoustonNewton SquareNewton SquareNewton SquareNew YorkNew YorkNew YorkSan AntonioNew YorkNew YorkNew YorkNew YorkNew YorkAtlantaBethesdaBethesdaNew YorkNew YorkNew YorkNew YorkSan AntonioSan AntonioLa JollaNew YorkNew YorkNew YorkNew YorkSan AntonioSan AntonioSan AntonioSan AntonioSan AntonioSan AntonioNew YorkAtlantaNew YorkNew YorkNew YorkLos AngelesLos AngelesPalm BeachState/CountryTexasTexasNew YorkNew YorkIllinoisTexasNew YorkNew YorkNew YorkNew YorkNew YorkNew YorkNew YorkNew YorkNew YorkTexasNew YorkNew YorkNew YorkNew YorkNew YorkNew YorkTexasTexasTexasTexasTexasTexasTexasNew YorkPennsylvaniaPennsylvaniaTexasNew YorkNew YorkTexasPennsylvaniaPennsylvaniaPennsylvaniaNew YorkNew YorkNew YorkTexasNew YorkNew YorkNew YorkNew YorkNew YorkGeorgiaMarylandMarylandNew YorkNew YorkNew YorkNew YorkTexasTexasCaliforniaNew YorkNew YorkNew YorkNew YorkTexasTexasTexasTexasTexasTexasNew YorkGeorgiaNew YorkNew YorkNew eDelawareDelawareDistrict of ColumbiaDistrict of ColumbiaDelawareNew ew reDelawareDelawareFloridaFR Y-10 p Type/Percentage Parent Interest HeldCGL RELP SA JV, LLCDERMOT ACQUISITION VENTURE HOLDCO I, LLCFW ACRE RIDGE LLCUSEF RELP 110 NORTH WACKER LLC110 N. WACKER DEVELOPMENT, LLCFW ACRE RIDGE LLCFW ACRE RIDGE LLCDTLA PARENT JV LLC1215 EAST 7TH MEZZ LLCLEGACY WEST END GENERAL PARTNER, LLCLEGACY WEST END LIMITED PARTNER, LLC142 WEST 36TH STREET REIT INC.WEST THIRTIES REALTY LLC142 WEST 36TH STREET MEMBER LLCUSODP TOLLWAY INVESTOR, LPUSEF MADISON BUCHANAN LLCRBW CGHQ LLC234 WEST 39TH STREET MEMBER LLC234 WEST 39TH STREET REIT INC.WEST THIRTIES REALTY LLCRPA 23RD STREET LLC2500 CITYWEST JV, LLCUSAA EQUITY ADVISORS, LLCCREF 2500 CITYWEST BLVD., LLC2500 CITYWEST REIT, INC.2500 CITYWEST JV, LLCCREF 2500 CITYWEST BLVD., LLCUS REAL ESTATE LIMITED PARTNERSHIPSQUARE MILE 2922 NORTHERN BOULEVARD PREFERRED LLCUSAA EAGLE REAL ESTATE MULTI-SECTOR OPERATING PARTNERSHIP, LP300 BARR HARBOR VENTURE, LLCCGL RELP SA JV, LLCUSRC-340 MADISON REIT IIUSRC-340 MADISON REIT IIUSODP LOCKTON PLACE INVESTOR, LPUSEF EQUUS 3875 WEST CHESTER PIKE VENTURE, LLCUSEF RELP 400 BARR LLC400 BARR HARBOR VENTURE, LLCOLIVE STREET HOLDINGS LLCDERMOT VENTURE REIT MANAGER I, LLCDERMOT ACQUISITION VENTURE HOLDCO I, LLCUSODP 625 W. ADAMS JV, LLC649 SOUTH OLIVE JV LLCSQUARE MILE DTLA HOTEL COMMON LLCSQUARE MILE DTLA HOTEL PREFERRED LLC649 SOUTH OLIVE HOLDINGS LLC649 SOUTH OLIVE HOLDINGS LLCLOADSTAR, LLCUSAA EAGLE REAL ESTATE MULTI-SECTOR OPERATING PARTNERSHIP, LP7101 WISCONSIN ASSOCIATES, LLCATLAS SOUTH OLIVE MEMBER LLCSQUARE MILE SOUTH OLIVE MEMBER LLCDTLA PARENT JV LLC8TH STREET PRODUCE MEZZ LLCUSAA EQUITY ADVISORS, LLCUSAA EQUITY ADVISORS, LLCADMIRAL CAPITAL REAL ESTATE FUND, L.P.SQUARE MILE ADAMS MORGAN HOTEL COMMON LLCSQUARE MILE ADAMS MORGAN HOTEL PREFERRED LLCADAMS MORGAN HOTEL JV LLCADAMS MORGAN HOTEL MEMBER LLCADMIRAL CAPITAL REAL ESTATE GP II, LLCUS REAL ESTATE LIMITED PARTNERSHIPADMIRAL CAPITAL REAL ESTATE GP, LLCUS REAL ESTATE LIMITED PARTNERSHIPUSAA EQUITY ADVISORS, LLCUSAA EQUITY ADVISORS, LLCSYDELL GROUP LLCADMIRAL CAPITAL REAL ESTATE FUND, L.P.MMP VENTURES, LLCDTLA PARENT JV LLCALAMEDA SQUARE MEZZ LLCUSAA FEDERAL SAVINGS BANKGARRISON PROPERTY AND CASUALTY INSURANCE COMPANYUSAA CASUALTY INSURANCE COMPANYGENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERLIMITED PARTNER/NON-MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERLIMITED PARTNER/NON-MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBER100GENERAL PARTNER/MANAGING MEMBERLIMITED PARTNER/NON-MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBER100GENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERLIMITED PARTNER/NON-MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBER252GENERAL PARTNER/MANAGING MEMBERLIMITED PARTNER/NON-MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERLIMITED PARTNER/NON-MANAGING MEMBERLIMITED PARTNER/NON-MANAGING MEMBERLIMITED PARTNER/NON-MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERLIMITED PARTNER/NON-MANAGING MEMBERGENERAL PARTNER/MANAGING MEMBERGENERAL PART

USAA USAA 9800 Fredericksburg Road San Antonio, TX 78288 Enclosed for filing is the combined Savings Association Holding Company Report (FR Y-6} for United Services Automobile Association (USAA) RSSD ID 0001447376 and USAA Capital Corporation (CAPCO} RSSD ID 0001447385 for the period ending December 31, 2018.