Transcription

Tax Return notesTax year 6 April 2018 to 5 April 2019 (2018–19)Use these notes to helpyou fill in your tax returnThese notes will help you to fill in your paper taxreturn. Alternatively, why not complete it online?Because: it’s quick, easy and secure you’ll have an extra 3 months to send it to us you do not have to complete it all at once – youcan save your details and finish it later if you wantA For more information about Self Assessment Online,go to www.gov.uk/self-assessment-tax-returnsIf you have not completed a tax return onlinebefore, go to www.gov.uk/log-in-file-selfassessment-tax-return. When you’ve signed up,we’ll post you an Activation Code. This cantake 10 working days to arrive (or up to 21 daysif you’re setting up your account from abroad) soplease register in plenty of time.A If you do not think you need to complete atax return for this year, go towww.gov.uk/check-if-you-need-a-tax-returnA If you do not need to fill in a return, you must contactTax return deadlines and penaltiesIf you: want to fill in a paper tax return, you must sendit to us by 31 October 2019 (or 3 months afterthe date on your notice to complete a tax returnif that’s later) decide to fill in your tax return online or youmiss the paper deadline, you must send it onlineby 31 January 2020 (or 3 months after the dateon your notice to complete a tax return if that’slater) – if you want us to use your tax codeto collect any tax you owe through yourwages or pension, you must file online by30 December 2019The deadline for paying your tax bill, or anyClass 2 National Insurance, is 31 January 2020.If we do not receive your tax return by thedeadlines, you’ll have to pay a 100 penalty –even if you do not owe any tax. We’ll charge youfurther penalties if your return is more than3, 6 and 12 months late.A For more information about penalties, go us by 31 January 2020 to avoid paying penalties.Before you startContentsWhat makes up your tax returnStarting your tax returnIncomeTax reliefsStudent Loan repaymentsHigh Income Child Benefit ChargeMarriage AllowanceFinishing your tax returnSigning your form and sending it backA rough guide to your tax billSA150 Notes 2019TRG 2TRG 4TRG 5TRG 9TRG 12TRG 12TRG 12TRG 13TRG 14TRG 16You may need the following documents to helpyou fill in the tax return: your forms P60, ‘End of Year Certificate’,P11D, ‘Expenses or benefits’ or P45, ‘Details ofemployee leaving work’, payslips or your P2,‘PAYE Coding Notice’ if you work for yourself, your profit or lossaccount or your business records your bank statements, building societypassbooks, dividend counterfoils orinvestment brokers’ schedules personal pension contributions certificatesDo not send any receipts, accounts or otherpaperwork with your tax return, unless we askfor them. If you do, it will take longer to deal withyour tax return and will delay any repayment.Page TRG 1HMRC 12/18

How to fill in your tax returnIf you fill in a paper tax return please: read the ‘Most people file online’ sectionon the front of the form enter your figures carefully – if you make amistake, strike through the error and put thecorrect details next to the box, otherwise wemay ask you to pay too much taxIf you ask someone else to fill in your tax return,you’re still responsible for the information on it.And you must sign the form.What makes up your tax returnWe’ve sent you a tax return that we thinkmatches your personal circumstances. But youneed to make sure the booklet has all the relevantsupplementary pages.Please read the first 2 pages of your tax return(and read notes 1 to 9) before you fill in theform. If you put ‘X’ in any of the ‘Yes’ boxes onpage TR 2, you need to fill in and send us thesupplementary pages for that income or gaintoo. If you do not, we’ll treat your tax return asincomplete and send it back to you.A If you need any supplementary pages and notes tohelp you complete them, you can print them fromour website. Go to www.gov.uk/taxreturnforms1 EmploymentYou should fill in the ‘Employment’ page if you: were employed in full-time, part-time orcasual employment received income as a company director held an office, such as chairperson, secretary ortreasurer and received income for that work worked for one person through another companyor partnership, for example, agency work were resident in the UK and received an incomefrom any foreign employment had an outstanding balance on a disguisedremuneration loan from a third party in respectof your employer or ex-employer on 5 April 2019and have not entered into full and final settlementwith HMRCYou’ll need a separate ‘Employment’ page foreach job, directorship or office.2 Self-employmentFill in the ‘Self-employment’ pages if you: worked for yourself or you were a subcontractorworking in the construction industry, and thetotal turnover that would be taxed in the yearfrom all of your businesses was over 1,000 had, at 5 April 2019, an outstanding untaxedbalance on a disguised remuneration loan arisingfrom a current self-employment or one thatceased between 6 April 2018 and 5 April 2019If you have not already registered forself-employment and Class 2 National Insurancecontributions (NICs), you must do so now.For more information, go towww.gov.uk/working-for-yourselfTrading Income AllowanceIf your combined receipts from self-employment(excluding Rent-a-Room trades) and certainmiscellaneous income (read page TRG 8, Box 17Other taxable income) are no more than 1,000they are exempt from tax and do not need to bereported on a tax return unless the receipts are froma connected party. This new allowance applies toany receipts that would otherwise be included onyour tax return for the year ended 5 April 2019.If your income is no more than 1,000, you maychoose to complete the ‘Self-employment’ pages if: your allowable expenses are higher than yourturnover and you want to claim relief for theloss or carry forward a loss to be used againstfuture profits you expect your turnover to exceed 1,000 inthe next tax year you want to voluntarily pay Class 2 NationalInsurance Contributions to build entitlement tocontributory benefits like the State Pension you want to preserve your record ofself-employment, for example to support anapplication for Maternity Allowance you would like to claim Tax Free Childcarebased on your self-employment income you’re a subcontractor and want to claim backtax deducted under the Construction IndustryScheme (CIS)A For more information on the trading incomeallowance, go to -and-trading-incomeIf you worked with someone else in partnership,use the ‘Partnership’ pages.Page TRG 2

There are 2 types of ‘Self-employment’ pages.If your business is: straightforward and your annual turnover wasless than 85,000, and you do not have anoutstanding balance on a disguised remunerationloan, use the ‘Self-employment’ short pages more complex, your annual turnover was 85,000 or more, you need to adjust yourprofits or you have an outstanding balanceon a disguised remuneration loan, use the‘Self-employment’ full pagesYou’ll need separate ‘Self-employment’ pagesfor each business.3 PartnershipThere are 2 types of ‘Partnership’ pages – shortones and full ones. Each partner must fill in theirown ‘Partnership’ pages, and one partner will haveto complete the SA800, ‘Partnership Tax Return’.4 UK propertyFill in the ‘UK property’ pages if you receivedincome from: any UK property rental including rents fromland you own or lease out furnished holiday letting from properties inthe UK or European Economic Area (EEA) letting furnished rooms in your own home (but ifyou provided meals and other services, you’ll needto fill in the ‘Self-employment’ pages)of over 1,000 (including any income from a foreignproperty business reported in the ‘Foreign’ pages).Property Income AllowanceIf your total property income (excluding incomeeligible for Rent-a-Room relief) is not more than 1,000 it is exempt from tax and does not need tobe reported on a tax return unless the income isfrom a connected party.If your income is no more than 1,000, you maychoose to complete the ‘UK property’ pages if: your allowable expenses are higher than yourproperty income and you want to claim relieffor the loss or carry forward a loss to be usedagainst future profits you’re a non-resident landlord and you wantto claim back tax paid (in box 21), under thenon-resident landlord schemeIf you claim the Rent-a-Room relief, you cannotalso claim the property income allowance onRent-a-Room income.A For more information on the property incomeallowance, go to -and-trading-income5 ForeignUse the ‘Foreign’ pages if you received: interest (over 2,000) and income fromoverseas savings – if your only foreign incomewas untaxed foreign interest up to 2,000,you can put this amount in box 3 on pageTR 3 of your tax return instead of completingthe ‘Foreign page’ (see page TRG 5) dividends (over 300) from foreign companies distributions and excess ‘reported income’ fromreporting offshore funds – this is taxable incomeaccumulating in an offshore fund that youhave not yet received overseas pensions (including taxable lumpsums from overseas schemes treated as pensionincome), social security benefits and royalties income from land and property abroad(not furnished holiday lettings in the EuropeanEconomic Area, these go in the ‘UK property’pages) over 1,000 – if your total income fromUK and foreign property was 1,000 or less,this may be exempted by the Property IncomeAllowance, see ‘4 UK property’ above or goto -and-trading-income for moreinformation discretionary income from non-resident trusts income or benefits from a person abroad ora non-resident company or trust (includinga UK trust that has either been, or has received,income from, a non-resident trust) gains on foreign life insurance policies or ondisposals in offshore fundsYou should also fill in the ‘Foreign’ pages if youwant to claim Foreign Tax Credit Relief orSpecial Withholding Tax on income you reporton other pages.6 Trusts etcFill in the ‘Trusts etc’ pages if you were: a beneficiary of a trust (not a ‘bare’ trust) orsettlement the settlor of a trust or settlement whose incomeis deemed to be yoursIf you received income from the estate of a personwho has died, do not fill in the ‘Trusts etc’ pages if: you were entitled to a fixed sum of money ora specific asset your legacy was paid with interest (put theinterest in box 1 or box 2 on page TR 3 of yourtax return) that income came from a specific estate asset,for example, rents from an estate propertyPage TRG 3

Do not include in the ‘Trusts etc.’ pages, paymentsfrom a trust that were funded by a taxed lumpsum death benefit - these go in boxes 11 and 12on page TR 3.7 Capital gains summaryFill in the ‘Capital gains summary’ pages andattach your computations if: you sold or disposed of chargeable assets whichwere worth more than 46,800 your chargeable gains before taking off anylosses were more than 11,700 you want to claim an allowable capital loss ormake a capital gains claim or election for the year you were not domiciled in the UK and areclaiming to pay tax on your foreign gains onthe remittance basis you’re chargeable on the remittance basisand have remitted foreign chargeable gainsof an earlier year you sold or disposed of an interest in a UKresidential property and were not resident inthe UK or you were a UK resident and overseasduring the disposal you submitted a Real Time Transaction returnon the disposal of an asset and have not paid thefull amount of Capital Gains TaxYou should fill in the ‘Additional information’pages if you have any chargeable event gains. received income from a former employercovered by third-party arrangements or‘disguised remuneration’ rules an outstanding balance on a disguisedremuneration loan from– an employer that no longer exists or is basedoffshore– a self-employment or partnership that ceasedbefore 6 April 2018You should also fill in the ‘Additionalinformation’ pages if you: wish to claim– Married Couple’s Allowance– employment deductions– tax reliefs, for example, on maintenancepayments or certain investments– relief for losses from other income– relief now for the 2019 to 2020 tax yeartrading losses or certain capital losses are liable to pension savings tax charges, forexample, the annual allowance charge (includingoverseas pension schemes) need to tell us about a tax avoidance schemeA For more information about the tax charges onpension savings, go to www.gov.uk/tax-on-yourprivate-pensionA Your tax return should have all the relevant pages.8 Residence, remittance basis etcYou should fill in the ‘Residence, remittancebasis etc’ pages if you: are not a UK resident are eligible to overseas workday relief arrived in the UK during the 2018 to 2019tax year and became a UK resident want to claim split-year treatment have a domicile outside the UK have foreign income or capital gains and wantto use the remittance basis for the 2018 to 2019tax year9 Additional informationFill in these pages if you have: interest from UK securities, peer-to-peer loans,deeply discounted securities and accruedincome profits gains from life insurance policies (chargeableevent gains) stock dividends, bonus issues of securities andredeemable shares business receipts taxed as income of anearlier year income from share schemes received lump sums or compensation from youremployer, or foreign earnings not taxable inthe UKIf it does not, you’ll need to get the supplementarypages and relevant notes to help you complete them.Go to www.gov.uk/taxreturnformsStarting your tax returnYour personal detailsBox 1 Your date of birthMake sure you tell us your date of birth. If youdo not, you may not get all the allowances you’reentitled to.Box 2 Your name and addressIf the details are different or missing, for example,because you moved address or printed the taxreturn from the internet, write the correct detailsin or under the ‘Issue address’ on the front of theform and put the date you changed address inbox 2. It’s important to keep your address detailsup to date, with HMRC, to make sure you’repaying the right rate of Income Tax. You’ll payScottish Income Tax if you live in Scotland formost of the tax year. We’ll confirm in your taxcalculation if you’re a Scottish taxpayer and willpay Scottish Income Tax.Page TRG 4

UK interestA Forinformation about Scottish Income Tax, go towww.gov.uk/scottish-rate-income-taxBox 4 Your National Insurance numberIf your National Insurance number is not at thetop of your tax return, it will be on: a payslip, P45 or your P60 for the year a P2, ‘PAYE Coding Notice’ any letter from us or the Department for Workand PensionsInclude in box 1 or 2 any interest from: bank and building society savings, includinginternet accounts UK authorised unit trusts, open-endedinvestment companies and investment trusts National Savings and Investments accounts andsavings bonds taxable interest received on compensationpayments, for example, payment protectioninsurance (PPI) certificates of tax deposit credit unions and friendly societiesDo not include interest from UK governmentsecurities (gilts), or interest from bonds, loan notesor securities issued by UK companies. These goin the ‘Additional information’ pages.Example of a National Insurance numberIncomeInterest and dividends from UK banksand building societiesThis includes: any interest you receive on bank, building societyand other savings accounts dividends and other qualifying distributions fromUK companies and UK authorised unit trusts oropen-ended investment companies income from purchased life annuities interest you receive in non-cash formDo not include any interest from IndividualSavings Account (ISAs), Ulster SavingsCertificates, Save As You Earn schemes or as partof an award by a UK court for damages.We usually treat income from investments heldin joint names as all receiving an equal share.However, if you hold unequal shares, you canelect to receive the income and pay tax on thoseproportions. Only put your share of any jointincome on the tax return.Box 1 Taxed UK interest – the net amount aftertax has been taken offCopy the net interest details from your statementsor electronic vouchers. If you have more than oneaccount, add up all your net interest and put thetotal in box 1.Include any net income (after tax has beentaken off) from a purchased life annuity.Use the details on your payment certificate andonly put the income part of the payment in box 1.Do not include the rest of the payment.If you received cash or shares following thetakeover or merger of building societies, you mayhave to pay tax on the income. If you do, includeit in box 1. If you’re not sure, put the amountin box 17 and give us details in ‘Any otherinformation’ on page TR 7.Box 2 Untaxed UK interest – amounts whichhave not had tax taken offIf a nominee receives investment income on yourbehalf, or if you’re a beneficiary of a bare trust,fill in boxes 1 to 5 on page TR 3 (not the ‘Trustsetc’ pages).If you have an account that pays you gross interest(for example, a bank or building society account),put the gross amount in box 2.If you make gifts to any of your children who areunder 18 that produces more than 100 income(before tax), you need to include the whole amountof the income in your tax return.Box 3 Untaxed foreign interest (up to 2,000)If your only foreign income was untaxed foreigninterest (of up to 2,000), put the amount (in UKpounds) in box 3 instead of filling in the‘Foreign’ pages.If your bank or building society pays you analternative finance return or profit share returninstead of interest, put the amount in box 1 if itis taxed, or box 2 if it is not.You must put the name of the country where theinterest arose in ‘Any other information’ onpage TR 7.If it was more than 2,000, you’ll need to fill inthe ‘Foreign’ pages.Page TRG 5

UK dividendsYou do not pay tax on the first 2,000 ofdividend income you receive (the dividendallowance). You pay tax on dividends above thedividend allowance at the following rates: 7.5% on dividend income within the basicrate band 32.5% on dividend income within the higherrate band 38.1% on dividend income within the additionalrate bandInclude all of your dividend income, even if it’sless than 2,000, as it will count towards yourbasic or higher rate bands and may affect the rateof tax that you pay on dividends received in excessof the 2,000 allowance.A For more information, go to www.gov.uk/tax-on-dividendsBox 4 Dividends from UK companies – theamount receivedYour dividend voucher will show your sharesin the company, the dividend rate and dividendpayable. Put the total dividend payments in box 4.Include any dividends from employee shareschemes. Do not include: Property Income Distributions from RealEstate Investment Trusts (REITs) or PropertyAuthorised Investment Funds (PAIFs) – these goin box 17, and the tax taken off in box 19 stock dividends or non-qualifying dividends –these go in the ‘Additional information’ pagesBox 5 Other dividends – the amounts receivedThis includes dividend distributions fromauthorised unit trusts, open-ended investmentcompanies, and investment trusts. Put the amounton your dividend voucher in box 5.Include in box 5 any dividend from accumulationunits or shares that are automatically reinvested.Do not include any ‘equalisation’ amounts.If you’re non-UK resident, enter the amountin box 4 instead, and in box 19 on page TR7,include details of the amount and type ofdividend.Box 6 Foreign dividends (up to 300)If your only foreign income was taxed dividendsup to 300, put the net amount (in UK pounds)in box 6 instead of on the ‘Foreign’ pages. Put theforeign tax taken off in box 7.UK pensions, annuities and otherstate benefits receivedNot all benefits are taxable. Do not includethe following in boxes 8 to 13: Attendance Allowance, lump sum BereavementSupport Payment or Personal IndependencePayments State Pension Credit, Working Tax Credit,Child Tax Credit or Universal Credit additions to State Pensions or benefits fordependent children income-related Employment and SupportAllowance, Jobfinder’s Grant or EmploymentZone payments Maternity Allowance War Widow’s Pension and some pensions paidto other forces dependants if the death in servicewas before 6 April 2005 pensions and other payments for disability,injury or illness due to military service some beneficiaries’ pensions where the memberdied before age 75 overseas pensions – these go on the ‘Foreign’ pagesA For more about what is and what is not taxable income,go to www.gov.uk/income-taxA For more about tax on pensions, go towww.gov.uk/tax-on-pension-death-benefitsand for war widow(er) pensions, go towww.gov.uk/war-widow-pensionBox 8 State PensionUse the letter ‘About the general increase inbenefits’ that the Pension Service sent you to findyour weekly State Pension amount.Add up the amount you were entitled to receivefrom 6 April 2018 to 5 April 2019 and put thetotal in box 8. Do not include any amount youreceived for Attendance Allowance.If your State Pension changed during the year oryou only received it for part of the year, multiplyeach amount by the number of weeks that youwere entitled to receive it. Add up youramounts carefully.If you do not have the letter from the PensionService, phone them on 0345 606 0265(textphone 0800 731 7339) and ask them forthe information.Page TRG 6

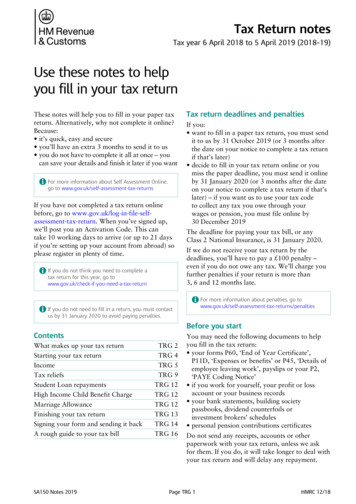

If you received a lump sum because you deferredyour State Pension from an earlier year, put theamount in box 9, not in box 8.Do not include State Pension Credit, the Christmasbonus, Winter Fuel Payment or any addition fora dependent child.date of death of the member who has died, fromyour R185 (Pension LSDB) certificate – put thegross amount and tax paid figures from yourcertificate in boxes 11 and 1210% deductionIf you receive a UK pension for former service toIncomean overseas government, only 90% of the basicBoxes 9 and 10 State Pension lump sumpensionis taxableInterestUKbanks, buildingsocietiesetc in the UK. Take 10% off theOnly andfill in dividendsbox 9 if you fromdeferredyourvalueofthepensionbefore you put the amount inState Pension for at least 12 months and chosebox5 10.Other dividends – the net amount, do not include the tax1 Taxed UK interest etc – the net amount after tax has beento receive it as a one-off lump sum in thetaken off - read the notes22018 to 2019 tax year. Put the gross amount 0 the(beforetax taken off) in box 9 and 0 tax takenoff in box 10. Do not include any lump sumUntaxed UK interest etc – amounts which have not hadamountin box 8.tax taken off - read the notes34Box 0 Pension), 11 Pensions (other than State0retirement annuities and taxable lump sumstreatedpensionsUntaxed asforeigninterest (up to 2,000) – amounts whichhave nothad tax payertaken off- readnotesYourpensionwillgivetheyoua P60, ‘End ofYear similar Certificate’ or0 0 statement. Add upyour total UK retirement annuities and pensionsDividendsfrom Pension),UK companiesthe netdo not(notthe Stateand–puttheamount,total grossincludethetaxcreditreadthenotesamount (before tax taken off) in box 11.credit - read the notesThe territoriesare: 0 0 any countryformingpart of Her Majesty’s dominionsdividends (upto 300)– the amountsterling6 Foreign anyCommonwealthcountry(excludingthe inUK)after foreign tax was taken off. Do not include this any territory under Her Majesty’s protectionamount in the ‘Foreign’ pages0 0 go toA For more about tax on pensions,www.gov.uk/tax-on-pension7Tax taken off foreign dividends – the sterling equivalent For help about payments from the Financial AssistanceSchemecovering several years, 0 0look under ‘keyinformation’ at www.pensionprotectionfund.org.uk/FASBox 12 Tax taken off box 11Use the P60 or certificate your pension payer includes taxable pensions: 0 0Thisgave you, and put the total amount of tax taken from your, or your deceased family member’soff receivedall your pensions in box 12.employer annuities and other state benefitsUK pensions, from personal pension plans and stakeholderPension– amount you were entitled to receive in the8 State12 Tax taken off box dthenotes paid as drawdown pensions from a registered 6 4 0 0 0pensionscheme 0 013 Taxable Incapacity Benefit and contribution-based from Additional Voluntary Contributions schemesExample of tax return, box ent and Support Allowance - read the notes9 for injuries at work or for work-related illnesseslumpsumreadthenotes from service in the Armed ForcesIf your P60 shows that you received0 0 a refund, fromretirementannuitycontractsortrustschemesit will have an ‘R’ next to it. Put a minus sign 0 0 from the Financial Assistance Schemetakenboxoff IncapacityBenefitin box 13in14theTaxshadedin front ofthe figure.Taxtakenoffagebox759 as a serious ill-health lump sum10 paidafter 0 0Box 13 Taxable IncapacityBenefit andor lump sum death benefit 0 0contribution-based Employment and15 Jobseeker’s AllowanceIt also includes the taxable part of any:Support Allowance (ESA)Pensions(otherthanStatePension),retirement11 lump sums you received instead of a small pension 0 0Not all Incapacity Benefit istaxable. It is notannuitiestaxable triviality– the gross(‘trivial andcommutationlump paymentssum’)amount. Tax taken off goes in box 12taxableinthefirst28weeksof incapacity or if ‘uncrystallised funds pension lump sum’ you16 Total of any other taxable State Pensions and benefitsyour incapacity began before 13 April 1995 and 0 0 withdrew under pension flexibility been getting it for the0 same0you haveillnessDo not include non-taxable pension death benefitsever since.you’reentitledto from6 Aprilon2015.OtherUK firstincomenotincludedsupplementary pagesAll contribution-based Employment and Supportgiveus thedetailsinbe‘Anyotheron supplementary pages. Share schemes, gilts, stock dividends,Do notPleaseuse thissectionforfollowingincome thatshouldreturnedAllowance and ESA Time Limited Supplementaryinformation’on page7: kinds of income go on the ‘Additional information’ pages.life insurancegains andcertainTRotherPayment (paid Northern Ireland only) is taxable. details of your pension or annuity payer andUseP60(IB),P60(U)P45(U)thatincome– before expenses and taxBenefitfromP45(IB),pre-ownedassets -orreadthe notes17 Other20 theyourtaxablereferencenumbertaken offtheDepartmentforWorkandPensions(DWP) your PAYE reference 0 0 gaveyou.Putthetotaltaxableamountof your thepaymentbeforetaxandtheamountoftax 0 comeinboxes17and20 –takenif there21taken notenoughspaceherepleasegivedetailsinthe18 offyourpaymentsinbox14.if you received a taxable lump sum death benefit ‘Any other information’ box, box 19, on page TR 7 of through a trust, the name, date0 birth0 and19Any tax taken off box 17 0 0Page TRG 7

Box 15 Jobseeker’s AllowanceUse the P60(IB), P45(IB), P60(U) or P45(U) thatDWP gave you and put the total amount ofJobseeker’s Allowance in box 15.If you stopped claiming before 5 April 2019,you’ll find the total amount on your P45(U).Box 16 Total of any other taxable State Pensionsand benefitsIf you had any of the following, add up yourpayments and put the total in box 16. Bereavement Allowance or Widow’s Pension Widowed Parent’s Allowance or WidowedMother’s Allowance Industrial Death Benefit Carer’s Allowance or Carer’s AllowanceSupplementary Payment (where received toreplace Carer’s Allowance - paid NorthernIreland only) Carer’s Allowance Supplement (where receivedas an extra payment for people in Scotland whoget Carer’s Allowance) Statutory Sick Pay or Statutory Maternity,Paternity or Adoption Pay and Shared ParentalPay but only if paid by HM Revenue andCustoms (not your employer)Do not include the Christmas Bonus and WinterFuel Payment, or any Cold Weather Payments.From 6 April 2017, receipts from self-employment(read page TRG 2 of these notes) and certainmiscellaneous income of 1,000 or less are exemptfrom tax and do not need to be reported on a taxreturn. If the total receipts from both are morethan 1,000, the ‘Self-employment’ pages must becompleted to report the self-employment incomeand the miscellaneous income must be reported inBox 17.Do not include any income from your employment,self-employment or capital gains, or anymiscellaneous income exempted by the tradingincome allowance. If you’ve already claimed partor all of your 1,000 trading income allowanceagainst self-employment income, then it’s theunused amount, if any, that is exempt here andyou should still show any miscellaneous incomeexceeding that amount in Box 17.ExampleTony has self-employed income of 500 andmiscellaneous income of 800.As this income is over 1,000 it has to be reported in histax return.Tony puts 500 in box 9 (Turnover) and 500 in box10.1 (Trading income allowance) of his Self-employment(short) pages.Amount of allowance remaining 500Tony puts 300 in box 17 ( 800 minus 500 (remainingamount of trading income allowance)).Other UK income not included onsupplementary pagesBox 17 Other taxable incomeThis includes: miscellaneous income from casual earnings,commission or freelance income (not exemptedby the trading income allowance) business receipts where your business has ceased Property Income Distributions (PIDs) fromReal Estate Investment Trusts (REITs) andProperty Authorised Investment Funds (PAIFs) payments from a personal insurance policyfor sickness or disability benefits inc

your forms P60, 'End of Year Certificate', P11D, 'Expenses or benefits' or P45, 'Details of employee leaving work', payslips or your P2, 'PAYE Coding Notice' if you work for yourself, your profit or loss account or your business records your bank statements, building society passbooks, dividend counterfoils or