Transcription

Global Equity ResearchIndustry NoteIndustry UpdateFINANCIALS RESEARCHPYPL – Why Instagram is a WatershedMarch 24, 2019RatingsIndustry View:KEY TAKEAWAYS“Putting a buy button at the moment of discovery is a game-changer . the key to this is theembedded payment function”. Aite Group, March 2019Instagram’s choice of PayPal to power “contextual” commerce, where buyers complete apurchase with in-app checkout rather than linking off to the seller’s site, is a watershed.It will catalyze PayPal’s franchise-extension from checkout provider to digital passport forconsumers and digital experience-channel for merchants. And it advances hybridization ofthe legacy PayPal and Braintree stacks which began last year with the launch of the “PayPalfor-Partners” solution targeted at marketplaces. Marketplaces are the future of online retail commerce given horizontal integrationof services such as customer acquisition and order fulfillment transforms the sellereconomics. By 2020, marketplaces will account for 40% of global online retail commerceand, at PayPal, the top-20 marketplaces (ex. eBay) generate 15% of payment volumeand are growing at 40% annually.Legacy PayPal supports marketplaces by enabling buyers and sellers to trust each other ina new context and providing brand-loyal customers and data-enabled experiences, suchas Smart Button and One Touch, to lift conversion rates. Braintree supports marketplacesby providing a single point of integration for digital payments acceptance including PayPalbranded and “unbranded” tender such as other wallets and raw credit/debit cards. Weestimate that 40% of PayPal’s total payment volume is unbranded (see Appendix), and thatBraintree processes half of Apple Pay volume in the US.Contextual commerce, or “shoppable“ ads, allow marketplaces to move buyers moreseamlessly from interest to purchase. The PayPal-for-Partners implementation, includingInstagram Checkout, combines elements from both the PayPal and Braintree stacks. Forexample, support for One Touch leverages the consumer data of legacy PayPal while supportfor unbranded payments leverages the full-stack processing of Braintree. Other processors,including Stripe, Adyen, and WorldPay, are hamstrung because PayPal Checkout is availableonly through legacy PayPal or Braintree.The vertical integration of Braintree with PayPal Checkout generates competitive advantagein processing, and underlines PayPal’s commitment to moving “beyond checkout”. Byrefusing to allow other processors to offer its checkout brand, PayPal promotes Braintreeeven if limiting distribution of the eponymous button. However, these processors areresponding in kind with WP announcing on Wednesday that it will be the first processor tooffer merchants the ability to enable Amazon Pay (outside the walled garden of Amazonproperties). For now, this means that a merchant can no longer accept all major tenders,including Amazon Pay, through a single integration with Braintree.Refer to page 8 for important disclosures and Analyst Certification. RenMac andits affiliated companies do not seek to do business with the companies covered inthis report. RenMac does not make a market in the security.Howard l

PYPL – A Watershed: Enabling In-App Checkoutwith InstagramInstagram’s entry into eCom through Checkout by Instagram whichuses PayPal, through its PayPal for Partners program, to enable“shoppable ads” is important for both companies. Launched lastyear, PayPal’s program supports “contextual” commerce where amarketplace offers sellers the ability to accept payments which areembedded so that, instead of linking off to the seller’s site, buyerscan complete a purchase right in context on the marketplace itself.As one industry commenter notes, “putting a buy button at themoment of discovery is a game-changer [and] the key to this is theembedded payment function that can move the customer frominterest to purchase with almost no friction”. Instagram adds thatembedded payments help it become “a place to experience thepleasure of shopping versus the chore of buying”.PayPal – From Checkout Button to Passport for DigitalExperienceCustomers of the PayPal for Partners program include Esty,BigCommerce, Intuit, and Shopify, but the extension to Facebookvia Instagram is a potential watershed as it builds its business inthe marketplace segment. Marketplaces are increasingly drivingdigital commerce, and are expected to account for 40% of theglobal online retail market in 2020. PayPal has disclosed that itstop-20 marketplace customers, excluding eBay, now account for 15% of its global payment volume and are growing at 40%annually. PayPal COO Bill Ready has highlighted the emergence ofmarketplaces as “one of the most important trends in e-Com adecade ago there were a couple of places where a smaller sellercould go to sell online now there is an explosion of new forumsthat they can go sell.”PayPal’s embedded payments capability addresses two importantchallenges in this objective: trust and experience. Let’s start withtrust. As Bill Ready notes that when you have a buyer and sellermeeting in a new context “both of them have the issue of how toestablish trust in that new context it is not just the consumerside of the equation [although] buyer protection matters a lot if you are a small business how do I know I’m not going to loseMarch 24, 20192

my shirt selling on this unknown forum:. His point is that PayPal’sbuyer protection for consumers and and seller protection,including fraud risk-management tools, for merchants allows thefirm to “step in and solve those [trust] issues”. The consequencecan be dramatic with some sellers involved in eBay’s pilot move toits “managed” payments scheme with Adyen reporting up to a 50%decline in sales during the temporary period that they are unableto offer PayPal at checkout. The striking important of trust isillustrated by PayPal’s report that consumers are one-third morelikely to buy on a small merchant site if they see the PayPal logoeven if they do not use PayPal!Now let’s turn to experience, and again we address this from boththe consumer and merchant side. On the consumer side, removingpayments friction is important to conversion rates. Bill Ready tellsthe story of how Travis Kalanick, as CEO of Uber, would note thatthe biggest fall of point in Uber’s customer acquisition funnel waswhen people had to give payment credentials for the first time.This, of course, has always been the reason-for-being of the PayPalcheckout button on fixed internet, and motivated the addition ofOne Touch payment experience (which leverages PayPal’s riskcapabilities not only to reduce fraud but also to enabletransactions without user ID and password) for mobile internet.One study has found that over half of consumers reported makingmore online purchases because of PayPal One Touch. PayPal is nowgeneralizing the convenience value proposition of its consumerbrand to a “digital passport for the best new [online] experiences”including, in addition checkout at point-of-sale (POS), person-toperson (P2P) payments, and easy access and burn of reward pointswhether from a card-issuing bank, such as Chase, or a merchantsuch as Chipotle. The notion is that breadth and quality ofexperience drive brand-engagement.Braintree – From Checkout Provider to Distribution Rails forDigital ExperienceOne Touch for merchants has also been important as, late in 2018,PayPal began piloting One Touch seller sign-up with itsmarketplace clients, including Walmart, allowing them to connectmore seamlessly with sellers that have a proven history withPayPal. PayPal wants to help its 30mm active sellers connect to allof these places where they can meet buyers just as it wants to helpMarch 24, 20193

its 250mm active consumers connect to all of these places wherethey can meet sellers. This builds demand for sellers, with PayPalreporting that those who use PayPal to sell across multiplechannels growing at 3x the rate of those that sell only on onemarketplace, utility for consumers, and the pricing power of PayPalwith marketplaces who can get quickly to scale on both the sellerand buyer sides of their markets.Like One Touch for consumers, One Touch for merchants ispowered by Braintree which is the full-stack processor for digitalpayments acquired by PayPal in 2013. To understand theimportance of Braintree, it is worth remembering that in PayPal’searlier days most of its customers were established merchants inthe offline world looking to extend their franchises to fixedinternet. Given established offline activities, these early clients hadlong-standing relationships with a payments processor, and turnedto PayPal to provide top-of-stack services, including gateway andcheckout services, for online payments; PayPal would hand thetransactions off to the incumbent processor and therefore notprovide a full-stack of payments services.Braintree, like its main competitor Stripe, came from a differentlegacy. The core customer base were small-and-mediumbusinesses (SMBs) who grew up online and looked to extend theirfranchises from fixed- to mobile-internet. They looked for apayments processor that, like them, was a digital native creatingthe market for Braintree and Stripe. Braintree, then, is a full-stackprocessor and enables its SMB clients to accept payment insubstantially any form including through, but by no meansrestricted to, PayPal-branded checkout. Braintree has estimated,for example, that it likely processes over half of the volumes ofApple Pay in the US. Indeed, a key selling point for Braintree is thatmerchants can accept substantially all common forms of onlinepayment with a single integration.As with the consumer side where PayPal is stretching its brandfrom presentment of payment credentials as a checkout button toaccess to online experiences as a digital passport, so with themerchant side Braintree is extending its franchise from checkoutprovider enabling acceptance of a broad array of paymentcredentials in a single integration to a distribution channel foronline consumer experiences more generally. Bill Ready comments“we want our merchants to think about us as the very best way forMarch 24, 20194

them to connect with consumers and the digital world” adding thatBraintree has “made it such that we can automatically deploy newexperiences to users [such as One Touch, Google Pay, and Paywith-Rewards] without a merchant having to do a newintegration”.In short, Braintree owns distribution rails for digital experiences sothat, if a competitor comes up with an innovative idea to supportSMBs in engaging with their customers, Braintree has a first-tomarket advantage: “by the time they [the competitor] even makethe sales call to merchants, we deliver that experience a year prior [so that] it is already at scale and working”.The Hybrid PayPal/Braintree StackLegacy PayPal supports marketplaces by enabling buyers andsellers to trust each other when they first meet on a newcommerce platform and by providing brand loyalty and dataenabled experiences, such as Smart Buttons and One Touch, tofurther lift conversion rates. As a full-stack processor, Braintreesupports marketplaces by providing a single-point of integrationfor most common payment tenders including PayPal-branded and“unbranded” volumes such as other wallets and raw credit/debitcards. For example, Braintree processes over half of Apple Payvolumes.PayPal for Partners, the program used by so-called “contextual”commerce such as in-app Instagram Checkout, leverages elementsof both the PayPal and Braintree stacks. For example, support forOne Touch capability leverages consumer data of legacy PayPalwhile support for unbranded payments leverages the full-stackcapabilities of Braintree. No other full-stack processor can replicatethis hybrid stack because merchants can access the PayPalCheckout only through PayPal or Braintree.The vertical integration of Braintree with PayPal Checkouttherefore provides it with important competitive advantage, aswell as the opportunity to leverage the global reach of legacyPayPal, and underlines PayPal’s objective of moving “beyondcheckout”. By refusing to allow competing processors to offerPayPal Checkout, PayPal is advantaging Braintree as a full-stackprocessor even if limiting its ability to distribute the PayPal button.However, other acquirers are responding with WP announcing onWednesday that it will be the first acquirer to offer merchants theMarch 24, 20195

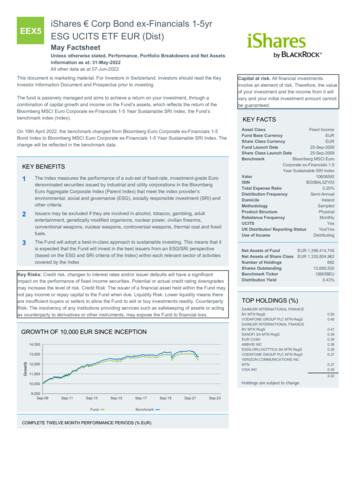

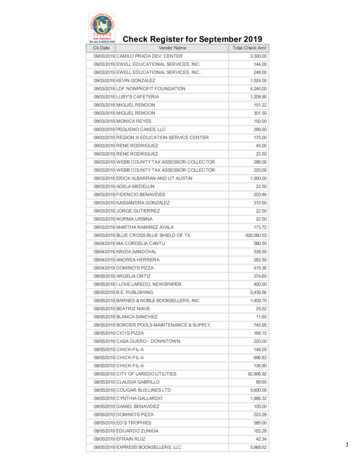

ability to integrate with Amazon Pay. For the time being, thismeans that if a merchant wants to enable checkout for both PayPaland Amazon Pay, it cannot do a single integration with Braintreebut must have a dual mandate with both Braintree and WorldPay.Appendix: How PayPal Checkout Lifts Braintree EconomicsBraintree is a processor for digital payments that, with a singleintegration, allows merchants to accept a broad variety of tendersincluding payment cards, either for registered customers or guestpurchases, and digital wallets. For example, Facebookpredominantly uses the Braintree platform for their paymentvehicles and more than half of Apple Pay volumes likely comethrough the Braintree platform. Of course, Braintree also supportsmerchant enablement of the PayPal-branded checkout button;indeed, Braintree is the only processor which supports the PayPalbranded checkout button and so has a product advantage overcompeting platforms such as those from Stripe, Adyen, andWorldPay.From Braintree’s perspective, then, processed payment volumefalls into two categories: “branded” when a consumer uses thePayPal-branded checkout button, and “unbranded” when aconsumer does not. For a merchant using Braintree as their singleprocessor for digital transactions, the fee (which, when expressedas a percentage of sales, is referred to as the “take rate) isindependent of whether the consumer uses the PayPal checkoutbutton.The lift to Braintree economics from branded volume arises notfrom the take rate but from the “funding cost” which representsthe fees, expressed as a percentage of payment volume, paid toother participants in the payments value-chain including, in thecase of Visa/Mastercard-branded payment cards, network fees of 5-10c per transaction and the “interchange” fee paid to the card“issuing” bank which is the lion’s share. PayPal discloses thatfunding costs were 0.96% of total payment volume (TPV) in 2018for a dollar amount of 5.6bn (Exhibit 1). We normalize this to1.27% of point-of-sale volume of 440bn because the fundingcost on person-to-person (P2P) volume is relatively insignificant.Figure 1Exhibit 1: Volume, Pricing, and Profit at PYPLMarch 24, 20196

Sourc e: C ompany Re por ts, RenMac AnalysisGiven this average funding cost for POS volume, and our estimatesfor the funding cost for each of the major tender forms including inparticular an assumed 1.7% for credit cards, we can back into the alikely mix of PayPal’s volumes between branded (whether throughlegacy PayPal or Braintree) and unbranded (i.e. Braintree volumesthat are not acquired via PayPal Checkout). We conclude that 40%of PayPal’s volumes are unbranded (Exhibit 2).Exhibit 2: Estimated Branded/Unbranded Mix of Volumes for PayPalSourc e: C ompany Re por ts, RenMac Es tim ate sMarch 24, 20197

ANALYST(S) CERTIFICATION(S): I, Howard Mason, herby certify that the views expressed in this research report accurately reflectmy personal views about the subject securities and issuers. I also certify that no part of my compensation was, is, or will be,directly or indirectly, related to the specific recommendations or views expressed in this research report.AFFILIATE DISCLOSURES: RenMac is the trade name and registered trademark under which research and services of RenaissanceMacro Holdings and its subsidiaries Renaissance Macro Securities, LLC and Renaissance Macro Research, LLC are marketed. Thisreport has been prepared by Renaissance Macro Securities, LLC. Renaissance Macro Securities, LLC is regulated by FINRA and theUnited States Securities and Exchange Commission. Disclosures in this section and in the Disclaimer section referencing RenMacinclude all subsidiaries unless otherwise specified.IMPORTANT DISCLOSURES: The analysts responsible for preparing this research report received compensation based on variousfactors, none of which is revenue generated by investment banking activities. RenMac is not engaged in any investmentbanking activities at this time. Analysts regularly conduct site and company visits to review the operations of the companyand discuss financial and strategic plans with management, but RenMac’s policies prohibit them from accepting payment orreimbursement for their travel expenses. RenMac produces many types of research including, but not limited to, fundamentalresearch, quantitative research, Washington Policy, Economics and Technical Research. Recommendation in one type of researchproduct may differ from recommendations contained in other types of research products whether as a result of differing timehorizons, methodologies, or otherwise.Companies Mentioned:Paypal (PYPL, 87.84). OverweightPrice target and Valuation Methodology: Each Analyst has a single price target in all of the stocks that they cover. The price targetrepresents that Analyst’s expectation of where the stock will trade in the next twelve months.We use a variety of valuation methodologies to arrive at our price targets including an enterprise value multiple of estimatedfuture EBITDA and a tangible book value multiple of estimated return on tangible common equity.Risk Disclosure(s):Key risks for banks and payment companies include changes in interest and currency rates among other market factors, thewillingness and ability of borrowers and derivative counterparties to make good on due amounts, legal risks related to conduct andcompliance with governmental requirements including those related to banking and money-transfer licenses such as know-yourcustomer and anti-money-laundering controls, structural shifts in competitive dynamics, and regulatory and other constraintson the ability to return capital to shareholders. We refer clients to the relevant SEC filings of covered companies, including inparticular the 10-K reports, for a more complete discussion.Guide to RenMac’s Fundamental Research Rating System: Our fundamental coverage Analysts use a relative ranking system torate stocks as Buy, Sell or Hold (see definitions below) relative to other companies covered by the Analyst or are deemed to bein the same industry (the Analysts Coverage Universe). In addition to the stock ratings each Analyst provides an Industry Ratingswhich provides the outlook for the industry coverage as Positive, Neutral or Negative (see definitions below). Investors shouldcarefully read the entire research report including the definitions of all ratings and not infer its content from ratings alone.Stock Ratings:Overweight – The stock is expected to outperform the un-weighted expected total return of the industry coverage universe overthe next 12 months.March 24, 20198

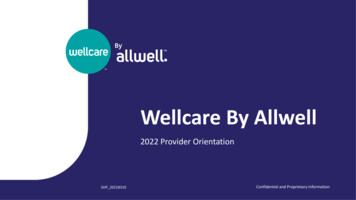

Equal Weight – The stock is expected to perform in line with the un-weighted expected total return of the industry coverageuniverse over the next 12 months.Underweight – The stock is expected to underperform the un-weighted expected total return of the industry coverage universeover the next 12 months.Ratings Suspended - The ratings and price target have been suspended temporarily due to market events that make coverageimpracticable or to comply with applicable regulations and /or firm policy.Distribution of Ratings:RenMac has 33 companies under coverage.48% have been assigned an Overweight Rating. 39% have been assigned an Equalweight Rating. 12% have been assigned anUnderweight Rating. None of the companies under coverage are Invetment Banking clients.Industry Rating:Positive – Industry coverage universe has improving fundamentals and valuations.Neutral – Industry coverage universe has neutral fundamentals and valuations.Negative – Industry coverage universe has deteriorating fundamentals and valuations.Paypal Rating History as of 10/31/2018Powered by: 007/31/2017Jul 16Oct 201811010090807060504030Apr 16Jan 17Apr 17Jul 17Closing PriceOct 17Jan 18Apr 18Jul 18Oct 18Jan 19Price TargetOverweight (O); Equalweight (E); Underweight (U); Ratings Suspended (S)DISCLAIMER: This document has been prepared by Renaissance Macro Securities LLC, a subsidiary of Renaissance Macro Holdings,LLC. This document is for distribution only as may be permitted by law. It is published solely for information purposes; it is not anadvertisement nor is it a solicitation or an offer to buy or sell any financial instruments or to participate in any particular tradingstrategy. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness orreliability of the information contained in this document. The information is not intended to be a complete statement or summaryof the markets, economy or other developments referred to in the document. Any opinions expressed in this document maychange without notice. Any statements contained in this report attributed to a third party represent RenMac’s interpretation ofthe data, information and/or opinions provided by that third party either publicly or through a subscription service, and suchMarch 24, 20199

use and interpretation have not been reviewed by the third party. Nothing in this document constitutes a representation thatany investment strategy or recommendation is suitable or appropriate to an investor’s individual circumstances or otherwiseconstitutes a personal recommendation. Investments involve risks, and investors should exercise prudence and their ownjudgment in making their investment decisions. The value of any investment may decline due to factors affecting the securitiesmarkets generally or particular industries. Past performance is not indicative of future results. Neither RenMac nor any of itsdirectors, employees or agents accept any liability for any loss (including investment loss) or damage arising out of the use ofall or any of the information. Any information stated in this document is for information purposes only and does not representvaluations for individual securities or other financial instruments. Different assumptions by RenMac or any other source may yieldsubstantially different results. The analysis contained in this document is based on numerous assumptions and are not all inclusive.Copyright RenMac 2019. All rights reserved. All material presented in this document, unless specifically indicated otherwise,is under copyright to RenMac. None of the material, nor its content, nor any copy of it, may be altered in any way, or transmittedto or distributed to any other party, without the prior express written permission of RenMac.March 24, 201910

purchase with in-app checkout rather than linking off to the seller's site, is a watershed. . including Stripe, Adyen, and WorldPay, are hamstrung because PayPal Checkout is available . franchises from fixed- to mobile-internet. They looked for a payments processor that, like them, was a digital native creating .