Transcription

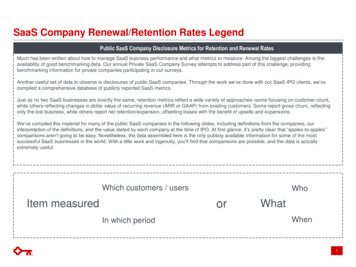

SaaS Company Renewal/Retention Rates LegendPublic SaaS Company Disclosure Metrics for Retention and Renewal RatesMuch has been written about how to manage SaaS business performance and what metrics to measure. Among the biggest challenges is theavailability of good benchmarking data. Our annual Private SaaS Company Survey attempts to address part of this challenge, providingbenchmarking information for private companies participating in our surveys.Another useful set of data to observe is disclosures of public SaaS companies. Through the work we’ve done with our SaaS IPO clients, we’vecompiled a comprehensive database of publicly reported SaaS metrics.Just as no two SaaS businesses are exactly the same, retention metrics reflect a wide variety of approaches–some focusing on customer count,while others reflecting changes in dollar value of recurring revenue (ARR or GAAP) from existing customers. Some report gross churn, reflectingonly the lost business, while others report net retention/expansion, offsetting losses with the benefit of upsells and expansions.We’ve compiled this material for many of the public SaaS companies in the following slides, including definitions from the companies, ourinterpretation of the definitions, and the value stated by each company at the time of IPO. At first glance, it’s pretty clear that “apples-to-apples”comparisons aren’t going to be easy. Nonetheless, the data assembled here is the only publicly available information for some of the mostsuccessful SaaS businesses in the world. With a little work and ingenuity, you’ll find that comparisons are possible, and the data is actuallyextremely useful.Which customers / usersWhoorItem measuredIn which periodWhatWhen1

SaaS Company Renewal/Retention Rates – DetailDEFINEDTERMCOMPANYMETRICFORMULARATE ATIPODEFINITIONDollar-based retention including the benefits of upsells, based on GAAP platformrevenuePlatformrevenueretention rateprograms t-2 end revenue t 144.4%programs t-2 endrevenue t-1“We measure our platform revenue retention rate for a particular period by firstidentifying the group of programs that our clients launched before the beginningof the prior year comparative period. We then calculate our platform revenueretention rate by comparing the revenue we recognized for this group ofprograms in the reporting period to the revenue we recognized for the samegroup of programs in the prior year comparative period, expressed as apercentage of the revenue we recognized for the group in the prior yearcomparative period.” (424B4 filed on 3/27/14, Page 53)Dollar-based retention including the benefit of upsells, based on annual �We calculate dollar-based net retention rate as (x) the annual recurringrevenues under contract at the end of a period for the base set of customers fromthe year prior to the calculation divided by (y) the annual recurring revenuesunder contract one year prior to the date of calculation for that same customerbase. We define annual recurring revenues under contract as the total amount ofsubscription revenues contractually committed to under each of our customeragreements over the term of the agreement, divided by the number of years inthe term of the agreement.” (S-1 filed on 6/1/18, Page 59)Dollar-based renewal excluding the benefit of upsells, based on SaaS andlicense revenueSaaS &licenserevenuerenewal rate1(Trailing 4Qtr. Avg.)customers q-4 entire sub. revenue qcustomers q-4 entire sub. revenue q-492%Workday announced the acquisition of Adaptive Insights for 1.6B on 6/11/2018“We measure our SaaS and license revenue renewal rate on a trailing 12-monthbasis by dividing (a) the total SaaS and license revenue recognized during thetrailing 12-month period from our subscribers who were subscribers on the firstday of the period, by (b) total SaaS and license revenue we would haverecognized during the period from those same subscribers assuming noterminations, or service level upgrades or downgrades.” (424B4 filed on 6/26/15,Page 60)2

SaaS Company Renewal/Retention Rates – Detail (cont’d)COMPANYDEFINEDTERMMETRICFORMULARATE ATIPODEFINITIONDollar-based net revenue retention rate, based on subscription revenueDollar-BasedNet RevenueRetentionRate(Trailing 4Qtr. Avg.)customers q-4 entire sub. revenue qcustomers q-4 entire sub. revenue q-4135%“Our dollar-based net revenue retention rate is a trailing four-quarter average of thesubscription revenue from a cohort of customers in a quarter as compared to the samequarter in the prior year. To calculate our dollar-based net revenue retention rate, we firstidentify a cohort of customers, or the Base Customers, in a particular quarter, or the BaseQuarter. A customer will not be considered a Base Customer unless such customer has anactive subscription for the entirety of the Base Quarter. We then divide the revenue in thesame quarter of the subsequent year attributable to the Base Customers, or theComparison Quarter, including Base Customers from which we no longer derive revenuein the Comparison Quarter, by the revenue attributable to that Base Customers in theBase Quarter. Our dollar-based net revenue retention rate in a particular quarter is thenobtained by averaging the result from that particular quarter by the corresponding resultfrom each of the prior three quarters. The dollar-based net revenue retention rate excludesrevenue from professional services from that cohort. (424B4 filed on 3/24/17, Page 62)Dollar-based retention including the benefit of upsells, based on GAAP subscriptionrevenueRecurringrevenueretention rateDollar-BasedNet ExpansionRate(Trailing 4Qtr. Avg.customers q-4 sub revenue q subcustomers q-4revenue q-4)102%123%“We calculate our recurring revenue retention rate by comparing, for a given quarter,subscription revenue for all customers in the corresponding quarter of the prior year to thesubscription revenue from those same customers in the given quarter. For the annual rate,we utilize the average of the four quarters for the stated year.” (424B4 filed on 3/20/14,Page 41)Dollar-based expansion rate including the benefit of upsells, based on annual recurringrevenue“Our dollar-based net expansion rate equals: the annual recurring revenue at the end of aperiod for a base set of customers from which we generated annual recurring revenue inthe year prior to the date of calculation, divided by the annual recurring revenue one yearprior to the date of the calculation for that same set of customers. Annual recurringrevenue is calculated as subscription revenue already booked and in backlog that will berecorded over the next 12 months, assuming any contract expiring in those 12 months isrenewed and continues on its existing terms and at its prevailing rate of utilization.” (424B4filed on 10/11/18, Page 67)3

SaaS Company Renewal/Retention Rates – Detail (cont’d)COMPANYDEFINEDTERMMETRICFORMULARATE ATIPODEFINITIONDollar-based expansion rate including the benefits of upsells, based on GAAP enueRetentionRateNetsubscriptiondollarretention ratecustomers Dec. t-2 Core & Value revenue t133%PropertyMgmtcustomers Dec. t-2 Core & Value revenue t-1100%Legal133%Dollar-based retention including the benefit of upsells, based on GAAP subscriptionrevenue“A key factor to our success is the renewal and expansion of subscription agreements withour existing customers. We calculate this metric over a set of customers who have beenwith us for at least one full year. To calculate our subscription revenue retention rate for aparticular trailing 12-month period, we first establish the recurring subscription revenue forthe previous trailing 12-month period. This effectively represents recurring dollars that weshould expect in the current trailing 12-month period from the cohort of customers from theprevious trailing 12-month period without any expansion or contraction. We subsequentlymeasure the recurring subscription revenue in the current trailing 12-month period from thecohort of customers from the previous trailing 12-month period. Subscription revenueretention rate is then calculated by dividing the aggregate recurring subscription revenue inthe current trailing 12-month period by the previous trailing 12-month period.” (424B4 filedon 5/26/17, Page 62) 100%Dollar-based retention rate including the benefit of upsells, based on annual contract value“We believe that our net subscription dollar retention rate provides insight into our ability toretain and increase revenue from our customers, as well as their potential long-term valueto us. Accordingly, we compare the aggregate annual contract value of our customer baseat the end of the prior year, which we refer to as the base annual contract value, to theaggregate annual contract value from the same group of customers at the end of thecurrent year, which we refer to as the retained annual contract value. We calculate our netsubscription dollar retention rate on an annual basis by dividing the retained annualcontract value by the base annual contract value.” (424B4 filed on 9/23/16, Page 58)customers LTM-1 sub. revenue LTM sub.customers LTM-1revenue LTM-1customers t-1 end Agg ACV t end Aggcustomers t-1 endACV t-1 end“Our ability to maintain and grow relationships with our existing customers can bemeasured by our annual dollar-based net expansion rate for a given fiscal year, whichcompares the revenue generated from the sale of our core solutions and Value servicesin that year and the preceding year (or base year) from our base customers. We establishour base customers by determining the customers from which we generated revenuesduring the month of December in the year preceding the base year. We then calculate ourannual dollar-based net expansion rate for a given fiscal year by dividing (i) revenuegenerated from the sale of our core solutions and Value services in the given fiscal yearfrom our base customers by (ii) revenue generated from the sale of our core solutions andValue services in the base year from our base customers. As of December 31, 2014, ourannual dollar-based net expansion rate was 133% for our property manager customersand 100% for our law firm customers.” (424B4 filed on 6/26/15, Page 55)4

SaaS Company Renewal/Retention Rates – Detail (cont’d)DEFINEDTERMCOMPANYMETRICFORMULARATE ATIPODEFINITIONDollar-based retention rate including the benefit of upsells, based on annual contract valuecustomers LTM – 1 end(1)Dollar-BasedNet RetentionRate implied recurring ACVLTM endcustomers LTM – 1 end127% implied recurring ACVLTM-1 endContractrenewal rateNet expansionrate1 implied impliedTrailing 4Qtr. Avg.(customers t-1 endACV t endcustomers t-1 endACV t-1 endcustomers q-4 revenue qcustomers q-4 revenue q-4)Cisco announced the acquisition of AppDynamics for 3.7B on 1/24/1797% 100%“Our dollar-based net retention rate compares the recurring contract value from the sameset of customers across comparable periods. Given the repeat buying pattern of ourcustomers and the average term of our contracts, we measure this metric over a set ofcustomers who have been with us for at least one full year. To calculate our dollar-basednet retention rate for a particular trailing 12-month period, we first establish the recurringcontract value for the previous trailing 12-month period. This effectively representsrecurring dollars that we should expect in the current trailing 12-month period from thecohort of customers from the previous trailing 12-month period without any expansion orcontraction. We subsequently measure the recurring contract value in the current trailing12-month period from the cohort of customers from the previous trailing 12-month period.Dollar-based net retention rate is then calculated by dividing the aggregate recurringcontract value in the current trailing 12-month period by the previous trailing 12-monthperiod. Recurring contracts are time-based arrangements for subscriptions and do notinclude perpetual license or professional services arrangements.” (S-1/A filed on 1/24/17,Page 14)Dollar-based renewal rate including the benefit of upsells, based on ACV“We have experienced a contract renewal rate of at least 97% in each of the last fiveyears.” (424B4 filed on 9/19/07, Page 1) “This rate reflects the implied annualized contractvalue of the customers at period end who were also customers at the end of the priorperiod, divided by the implied annualized contract value of the customers at the end of theprior period.” (athenahealth Investor Relations)Dollar-based expansion rate including the benefits of upsells, based on GAAP revenue“Such expansion is measured by our average quarterly net expansion rate, whichcalculates the year-over-year change in quarterly spending by customers that were payingcustomers during the same quarter in the prior year ("Prior Year Cohorts"), which is net oflost customers or reduced usage within a customer. Our average quarterly net expansionrate has been more than 100% for each quarter during fiscal 2014 and fiscal 2015.”(424B4 filed on 12/10/15, Page 63-64)5

SaaS Company Renewal/Retention Rates – Detail (cont’d)COMPANYDEFINEDTERMMETRICFORMULARATE ATIPODEFINITIONDollar-based retention including the benefit of upsells, based on total revenueNet RevenueRetentionRate107%*“We calculate our net revenue retention rate by dividing (a) total revenue in the currentquarter from any billing accounts that generated revenue during the corresponding quarterof the prior year by (b) total revenue in such corresponding quarter from those same billingaccounts. This calculation includes changes for these billing accounts, such as additionalsolutions purchased, changes in pricing and transaction volume, and terminations, butdoes not reflect revenue for new billing accounts added during the one year period.Currently, our net revenue retention rate calculation includes only customers with uniqueaccount identifiers in our primary U.S. billing systems and does not include customers whosubscribe to our solutions through our international subsidiaries or certain legacy billingsystems, primarily related to past acquisitions” (424B4 filed on 6/15/2018, Page 56)Dollar-based churn, based on total revenueRevenueChurn Rate 5%“We calculate our revenue churn rate by measuring the revenue contribution associatedwith billing accounts that cancel all of their product and service agreements with us overthe measurement year. This cancelled revenue contribution for each such billing account iscalculated as the revenue recognized for such billing accounts over the trailing fourquarters prior to the quarter in which such billing account cancelled its product and serviceagreements. We then divide this cancelled revenue contribution by our total annualrevenue recognized for the measurement year to calculate our revenue churn rate. Ourcalculation of revenue churn rate includes only customers with unique account identifiers inour primary U.S. billing systems and does not include customers who subscribe to oursolutions through our international subsidiaries or legacy billing systems, primarily relatedto past acquisitions.” (424B4 filed on 6/15/2018, Page 53)Dollar-based retention including the benefit of upsells, based on GAAP subscriptionrevenueDollar-basedNet RetentionRate(Trailing 4Qtr. Avg. CPaaScustomers q-4revenue qcustomers q-4 CPaaS revenue q-4)107%“Our dollar-based net retention rate compares the CPaaS revenue from customers in aquarter to the same quarter in the prior year. To calculate the dollar-based net retentionrate, we first identify the cohort of customers that generate CPaaS revenue and that werecustomers in the same quarter of the prior year. The dollar-based net retention rate isobtained by dividing the CPaaS revenue generated from that cohort in a quarter, by theCPaaS revenue generated from that same cohort in the corresponding quarter in the prioryear. When we calculate dollar-based net retention rate for periods longer than onequarter, we use the average of the quarterly dollar-based net retention rates for thequarters in such period.” (424B1 filed on 11/13/17, Page 17)6

SaaS Company Renewal/Retention Rates – Detail (cont’d)COMPANYDEFINEDTERMMETRICFORMULARATE ATIPODEFINITIONCustomer count-based retention excluding the benefit of new customersActive clientretention rate# customers t entire89.7%# customers t beg“Active client retention rate is calculated based on the number of active clients atperiod end that were also active clients at the start of the period divided by thenumber of active clients at the start of the period.” (424B4 filed on 2/24/12, Page45)Dollar-based retention including the benefit of upsells, based on GAAPsubscription revenueSoftwareservicesrevenueretention rate sub subcustomers t-1revenuetcustomers t-1revenuet-1 implied monthlysubscription/support revenue implied monthlyDollar-basednet revenue subscription/support revenueretention rate 95%“We calculate this metric for a particular period by establishing the group of ourcustomers that had active contracts for a given period. We then calculate oursoftware services revenue retention rate by taking the amount of softwareservices revenue we recognized for this group in the subsequent comparableperiod (for which we are reporting the rate) and dividing it by the softwareservices revenue we recognized for the group in the prior period.” (424B4 filed on9/18/13 Page 53)Dollar-based net revenue retention rate including the benefit of upsells, based oncontracted MRRcustomers t-1tcustomers t-1t-1Note: Implied monthly subscription andsupport revenue is defined as the totalamount of minimum subscription and supportrevenue committed to agreements divided bythe number of months in the agreement119%“We calculate dollar-based net revenue retention rate as the implied monthlysubscription and support revenue at the end of a period for the base set ofcustomers from which we generated subscription revenue in the year prior to thecalculation, divided by the implied monthly subscription and support revenue oneyear prior to the date of calculation for that same customer base. (424B4 filed on10/28/16 Page 16)7

SaaS Company Renewal/Retention Rates – Detail (cont’d)COMPANYDEFINEDTERMMETRICFORMULARATE ATIPODEFINITIONDollar-based retention including the benefit of upsells, based on ACVcustomers t-1 endRetention rate(net dollarretention rate) implied ACVt endcustomers t-1 end implied ACVt-1 end130%Note: Includes only customers with 5k ACVand annual / multi-year contracts“We calculate our retention rate as of a period end by starting with the annual contractvalue (ACV) from customers with contract value of 5,000 or more as of 12 months prior tosuch period end (Prior Period ACV) and a subscription term of at least 12 months. We thencalculate ACV from these same customers as of the current period end (Current PeriodACV). Finally, we divide the aggregate Current Period ACV for the trailing 12 month periodby the aggregate Prior Period ACV for the trailing 12 month period to arrive at our retentionrate.” (424B4 filed on 1/23/15, Page 53 & 59)Dollar-based retention including the benefit of upsells, based on GAAP subscriptionrevenueRecurringdollar retentionrate renewed sub fees t expiring sub feest93%“We calculate the recurring dollar retention rate by dividing the retained recurring value ofsubscription revenue for a period by the previous recurring value of subscription revenuefor the same period. We define retained recurring value of subscription revenue as thecommitted subscription fees for all contracts that renew in a given period. We defineprevious recurring value of subscription revenue as the recurring value from committedsubscription fees for all contracts that expire in that same period. We typically calculate ourrecurring dollar retention rate on a monthly basis.” (424B4 filed on 2/17/12, Page 36)Dollar-based retention excluding the benefit of upsells, based on annual recurring revenueCustomerRetentionRate93%“We calculate retention rate by comparing the annual recurring subscription and supportrevenue from our customers at the beginning of a measurement period to the annualrecurring subscription and support revenue from those same customers at the end of ameasurement period. We divide the ending annual recurring revenue by the beginningannual recurring revenue to arrive at our retention rate metric. We exclude the impact ofany add-on purchases from these customers during the measurement period; accordingly,our retention rate cannot exceed 100%. In addition, the metric reflects the loss ofcustomers who elected not to renew contracts expiring during the measurement period.”(424B4 filed on 5/4/18, Page 23-24)8

SaaS Company Renewal/Retention Rates – Detail (cont’d)COMPANYDEFINEDTERMMETRICFORMULARATE ATIPODEFINITIONCustomer count-based renewal excluding the benefit of new customersRenewal rate# renewing customers t# expiring customers t82%“We define renewal rate for a period as the percentage of customers who renewannual or multi-year subscriptions that expire during the period presented.Renewal rate excludes customers under our discontinued third-party distributionagreements and prior SMB offering with subscriptions that remain active untilcancelled.” (424B4 filed on 8/11/11, Page 43)Customer count-based retention excluding the benefit of new customersAnnualretention rate#customers t-1 endcustomers t end#customers t-1 endcustomers t-1 end83%“We define annual retention rate as the percentage of customers on the last dayof the prior year who remain customers on the last day of the current year, or forquarterly presentations, the percentage of customers on the last day of thecomparable quarter in the prior year who remain customers on the last day of thecurrent quarter.” (424B4 filed on 8/11/11, Page 42-43)Dollar-based retention rate including the benefit of upsells, based on ACVAnnualnet dollarretention rate109%“We calculate annual net dollar retention rate for a given fiscal period as theaggregate annualized subscription contract value as of the last day of that fiscalyear from those customers that were also customers as of the last day of theprior fiscal year, divided by the aggregate annualized subscription contract valuefrom all customers as of the last day of the prior fiscal year. We calculateannualized subscription contract value for each customer as the expectedmonthly recurring revenue of our customers multiplied by 12.” (424B4 filed on3/14/14, Page 49)9

SaaS Company Renewal/Retention Rates – Detail (cont’d)COMPANYDEFINEDTERMMETRICFORMULARATE ATIPODEFINITIONDollar-based retention including the benefit of upsells, based on GAAPsubscription revenueSubscriptiondollarretention ratecustomers t-1 end sub revenue coret 100%core customers t-1 end sub revenue t-1“We calculate this metric for a particular period by establishing the cohort of corecustomers that had active contracts as of the end of the prior period. We thencalculate our subscription dollar retention rate by taking the amount of fixedsubscription revenue we recognized for the cohort in the period for which we arereporting the rate and dividing it by the fixed subscription revenue we recognizedfor the same cohort in the prior period. We do not include any revenue from thenon-core, legacy products described above, any variable subscription fees paidby our customers or any implementation fees.” (424B4 filed on 5/23/13, Page 4041)Dollar-based retention including the benefit of upsells, based on subscriptionrevenueNetexpansionrate(Trailing 4Qtr. Avg.customers q-4 sub. revenue qcustomers q-4 sub. revenue q-4Note: Excludes Intel (related party))142%“Our quarterly net subscription revenue expansion rate equals the subscriptionrevenue in a given quarter from end user customers that had subscriptionrevenue in the same quarter of the prior year, divided by the subscriptionrevenue attributable to that same group of customers in that prior quarter. Ournet expansion rate equals the simple arithmetic average of our quarterly netsubscription revenue expansion rate for the four quarters ending with the mostrecently completed fiscal quarter. We have excluded Intel from our calculation ofnet expansion rate, as it is a related party. (424B4 filed on 4/28/17, Page 44)10

SaaS Company Renewal/Retention Rates – Detail (cont’d)COMPANYDEFINEDTERMMETRICFORMULARATE ATIPODEFINITIONDollar-based retention including the benefits of upsells, based on annualizedbillingsDollar-basednet retentionrate111.7%Annualized Billings: billings for eachcustomer in the final month of a periodmultiplied by 12“To calculate dollar-based net retention for a period, we compare the AnnualizedBillings from paid customers 12 months prior to the Annualized Billings from thesame set of customers in the last month of the current period. Our dollar-basednet retention includes any expansion and is net of contraction and attrition, butexcludes Annualized Billings from new customers in the current period. Ourdollar-based net retention excludes the benefit of free customers which upgradeto a paid subscription between the prior and current periods, even though this isan important source of incremental growth. We believe this provides a moremeaningful representation of our ability to add incremental business from existingpaid customers as they renew and expand their contracts.” (S-1/A filed 9/3/2019,page 86)Customer count-based retention excluding the benefit of new customersCustomerretention rate# customers t entireNA# customers t beg“One of the best measures we have for ourselves is our customers – their repeatbusiness. Founded in 1993, on the premise of helping drive costs out ofbusinesses through innovation, our services are now trusted by over 15,000clients around the globe with over 15 million users and a 95% retention rate.”(concur.com)Customer count-based retention excluding the benefit of new customersRetentionrateend# customers m-1m endend# customers m-1m-1 end97.8%“Our monthly retention rate of unique paying customers (# of customers in agiven month that continue to use the product in the following month– S-1, Page3) remains in our historical range of 97.8%, /- 0.5%.” (10-K filed on 2/28/13,Page 4)11

SaaS Company Renewal/Retention Rates – Detail (cont’d)COMPANYDEFINEDTERMMETRICFORMULARATE ATIPODEFINITIONDollar-based retention excluding the benefit of upsells, based on contracted MRRcustomers t-1 endAnnual dollarretention rate implied MRRt end95.8%customers t-1 end implied MRRt-1 end“We define annual dollar retention rate as the implied monthly recurring revenue underclient agreements at the end of a FY, divided by the implied monthly recurring rev., forthat same client base, at the end of the prior FY and excluding implied monthly recurringrevenue from clients of our CSB and Cornerstone for Salesforce solutions. This ratiodoes not reflect implied monthly recurring revenue for new clients added between theend of the prior FY and the end of the current FY. However, incremental sales up to andnot exceeding the original renewal amount to the existing client base as of Dec. 31,2012 are included in this ratio. We define implied monthly recurring revenue as the totalamount of minimum recurring revenue to which we have a contractual right under eachof our client agreements over the entire term of the agreement, but excluding nonrecurring support, consulting and maintenance fees, divided by the number of months inthe term of the agreement.” (424B3 filed on 3/17/11, Page 42-43)Dollar-based retention including the benefits of upsells, based on annualrecurring revenueDollar-basednet retentionrate147%“We calculate our dollar-based net retention rate as of a period end by startingwith the ARR from all subscription customers as of 12 months prior to suchperiod end, or Prior Period ARR. We then calculate the ARR from these samesubscription customers as of the current period end, or Current Period ARR.Current Period ARR includes any expansion and is net of contraction or churnover the trailing 12 months but excludes revenue from new subscriptioncustomers in the current period. We then divide the Current Period ARR by thePrior Period ARR.” (424B4 filed on 6/11/19, Page 21)12

SaaS Company Renewal/Retention Rates – Detail (cont’d)COMPANYDEFINEDTERMMETRICFORMULARATE ATIPODEFINITIONDollar-based retention excluding the benefit of upsells, based on annualrecurring revenueDollar-basedGrossRetentionRate98%“We calculate our dollar-based gross retention rate as of the period end bystarting with the ARR from all subscription customers as of 12 months prior tosuch period, or Prior Period ARR. We then deduct from the Prior Period ARRany ARR from subscriptions customers who are no longer customers as of thecurrent period end, or Current Period Remaining ARR. We then divide the totalCurrent Period Remaining ARR by the total Prior Period ARR to arrive at ourdollar-based gross retention rate, which is the percentage of ARR from allsubscription customers as of the year prior that is not lost to customer churn.Our dollar-based gross retention rate reflects only customer losses and doesnot reflect customer expansion or contraction.” (424B4 filed on 6/11/19, Page82)Dollar-based retention including the benefit of upsells, based on GAAPrecurring revenuecustomers t-1Recurringdollarretention rate recurring revenue tcustomers t-1 recurring revenue t-1“We calculate our recurring dollar retention rate by dividing (a) RetainedSubscription:Revenue by (b) Retention Base Revenue. We define Retention Base Revenue97%Marketing:115%as recurring revenue by product from all customers in the prior period; andRetained Revenue as recurring revenue by product from the same group ofcustomers in the current period, including any additional sales to thosecustomers during the current period. We do not include non-renewablerevenue such as overage fees for registrat

Base Quarter. Our dollar-based net revenue retention rate in a particular quarter is then obtained by averaging the result from that particular quarter by the corresponding result from each of the prior three quarters. The dollar-based net revenue retention rate excludes revenue from professional services from that cohort.