Transcription

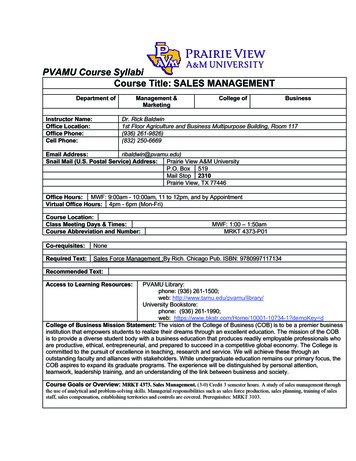

TennesseeSales and UseTax GuideSeptember 2019

SALES AND USE TAXDear Tennessee Taxpayer,This sales and use tax guide is intended as an informal reference for taxpayers who wish to gain abetter understanding of Tennessee sales and use tax requirements. It is not an all-inclusivedocument or a substitute for Tennessee sales or use tax statutes or rules and regulations. Theinformation in this guide is current as of the date of publication. Tax laws, their interpretation, andtheir application can change due to legislative action, reviews, and court decisions.Periodically, the Department of Revenue mails informational letters with updates on tax laws andpolicies to registered taxpayers. Be sure to read any letter you receive carefully; this informationmay save you time and money. Informational publications are also available for specific industries.Contact the Taxpayer Services Division to obtain these publications.If you have any questions, please visit www.TN.gov/Revenue. Click on “Revenue Help” to findhundreds of frequently asked questions and answers! You can also submit a question for emailresponse if you are unable to locate your answer or if the question involves a tax account matter.We also offer telephone assistance from 7:00am to 5:00pm, Central time, each business day. Ourmain office address and telephone numbers are as follows:Tennessee Department of RevenueTaxpayer Services DivisionAndrew Jackson Building500 Deaderick StreetNashville, TN 37242Toll-Free: (800) 342-1003Out-of-State: (615) 253-0600TDD: (615) 741-7398The locations and addresses of each of our regional offices are provided below. For yourconvenience, you may wish to call or send correspondence via email as described above since mostissues can be resolved by telephone or email.Regional OfficesKnoxville7175 Strawberry Plains PikeSuite 209Knoxville, TN 37914Chattanooga1301 Riverfront ParkwaySuite 203Chattanooga, TN 37402Johnson City204 High Point DriveJohnson City, TN 37601JacksonLowell Thomas State Office Building225 Dr. Martin L. King Jr. DriveSuite 340Jackson, TN 38301Memphis3150 Appling RoadBartlett, TN 381332

SALES AND USE TAXTable of Contents1010101113Sales or Use TaxSales or Use TaxSales PriceLocal Option Sales or Use TaxSales Tax Application to the Lease or Rental of Tangible PersonalPropertyWho Must Register for Sales or Use Tax?Who is Liable for Sales Tax?Who is Liable for Use Tax?How to RegisterTennessee RetailersOut-of-State RetailersRevocation of Certificate of RegistrationChanges in Ownership, Address, or BusinessAdditional References141515161616181818DefinitionsBusiness and Occasional and Isolated SalesComputer SoftwareCustomized and Prewritten Computer SoftwareComputer Software Maintenance ContractUtility Water, Electricity, Natural Gas, and Propane SalesSingle ArticleMotor VehiclesBoatsManufactured HomesState Tax on Purchases of Single ArticlesComputing Sales Tax Due on Single ArticlesSpecified Digital ProductsDigital Audio-Visual WorksDigital Audio WorksDigital BooksTangible Personal PropertyThird Party Drop ShipmentVideo Game Digital Products19191919202020212121212122222222222323Food and Food IngredientsWhat are “Food and Food Ingredients?”Examples of “Food and Food Ingredients”Meal SubstitutesItems Not Taxable at the 4.00% Food RateCandyDietary SupplementsPrepared Food24242424252525253

SALES AND USE TAXTable of ContentsTax CreditsReturned MerchandiseRepossessionPollution ControlCertified Green Energy Production FacilityBad DebtFire Protection Sprinkler ContractorsSales or Use Tax Paid in Another StateFuel or Petroleum Products Sold to Air Common CarriersHeadquarters Facility Tax Credit28282828282929292930Taxable and Non-Taxable Property and ServicesTaxable Tangible Personal PropertyComputer SoftwareModifications to Computer SoftwareServices to Computer SoftwareRemotely Accessed Computer SoftwareVideo Game Digital ProductsApplication of Single Article Taxation to SoftwareWebsites and Computer SoftwareIn-House Computer SoftwareAffiliate Computer SoftwareComputer Software Maintenance ContractSupport Services to SoftwareSpecified Digital ProductsServicesTaxable ServicesTaxable AmusementsWarranty or Service ContractsNontaxable ptions Requiring CertificatesDocumenting ExemptionsBlanket Certificate of ResaleDirect Pay PermitsGovernment Certificate of ExemptionNonprofit Organizations and InstitutionsQualified Call Center ExemptionsDyed Diesel Tax Payments for Commercial CarriersCommon Carrier Permit to Pay Reduced Sales Tax RatesAgricultural Exemption Certificate41414343444545454546Exemptions Requiring DocumentationRemoval from Tennessee by BuyerExemption for Railroad Track Materials and Locomotive Radiators4747474

SALES AND USE TAXTable of ContentsExemption for Rural Electric Cooperatives, Community ServiceCooperatives, and Governmental Utility DistrictsExemption for Electric Generating and Distribution Systems,Resource Recovery Facilities, or Coal Gasification Plants4747Agricultural ExemptionsAgricultural Exemption CertificateAgricultural ExemptionsSales by Farmers and Nursery OperatorsPurchases of Livestock Drugs by VeterinariansCommunity Gardens4848505151Industrial Machinery Exemptions and Reduced RatesIndustrial MachineryPollution Control FacilitiesIndustrial Machinery AuthorizationIndustrial Energy Fuel and WaterIndustrial MaterialsQualified Data CenterWarehouse and Distribution FacilityCounty or Municipality Water Pollution Control and Sewage SystemsResearch and Development MachinerySpallation Neutron Source Facilities5252525353535454555555Exempt Products and ServicesAuthorized Large Aircraft Service FacilityAircraft Parts and SuppliesAmusementsAutomobilesDesign ProfessionalsDisplay PropertyEnergyExemptions for Tennessee Sales for Out-of-State Consumer UseFilmsFoodFuelLeased VehiclesMedical Equipment and SuppliesMiscellaneous Nonprofit SalesMotor Vehicles Used by Common CarriersNatural DisastersPackagingPollution ControlPreservation of Historic Property56565656575858585960606061616263636464645

SALES AND USE TAXTable of ContentsPublicationsPublic Safety & Public Works-Related GoodsRailroad Tank CarsSales in Interstate CommerceSales Tax HolidaySpecified Digital ProductsTelephone CooperativesTelecommunicationsTransactions between Parent Companies and Wholly OwnedSubsidiariesTime-Share AccommodationsUsed PropertyUtility PolesVending ItemsWarranty Parts and ServicesWaste RemovalWatershed Districts64656565656566666666666666666767Flea MarketsFlea Market RegistrationSales on Less than Permanent BasisSubmission of Flea Market ReturnsDealers Registering AnnuallyDealers Registering Quarterly or MonthlyPenalty for Late Filing67676767676868ContractorsContractors as ConsumersLiability for the Sales or Use TaxExemptionsTax on Fabricated MaterialsAsphalt FabricatorsInstallation of Industrial MachineryLump Sum or Unit Price Construction Contracts on Realty in Effecton July 15, 2002Property Owned by the United States GovernmentQualified Disaster Restoration69696969707071Returns and PaymentsReturns and PaymentsElectronic FilingOnline Filing through TNTAPOnline Filing through a Software VendorElectronic Funds Transfer (EFT)Filing Date747475757576766717272

SALES AND USE TAXTable of ContentsPenalty and InterestAudits and AssessmentsTaxpayer’s Right to an Informal ConferenceKeeping Records7677777778Tennessee Taxpayer Bill of Rights7

SALES AND USE TAXChanges to the Sales and Use Tax Guide for 2019(1) Eliminates the 2.25% uniform statewide local option sales tax rate that is currently available todealers with no location in Tennessee that choose to pay state and local sales and use tax. Requiresout-of-state dealers to provide sufficient information indicating the municipality or county into whicha sale is shipped.(2) The Department of Revenue will begin to enforce Sales and Use Tax Rule 1320-05-01-129(2),which requires out-of-state dealers with no physical presence in Tennessee that make sales of 500,000 or greater to Tennessee customers to collect and remit sales and use tax. Effective July 1,2019 (Page 17)(3) The effective date of certain streamlined sales tax provisions is delayed until July 1, 2021. (Page17)(4) Increases, from 100,000 to 300,000, the maximum amount of annual sales that charitableentities whose primary purpose is fundraising in support of a city, county, or metropolitan librarysystem may make to be excluded from the definition of “business” for sales tax purposes. EffectiveMay 10, 2019 (Page 19)(5) The definition of tangible personal property does not include fiber-optic cable after it hasbecome attached to a utility pole, building, or other structure or installed underground. Such fiberoptic cable is deemed realty upon installation. Effective July 1, 2019 (Page 22)(6) Extends the sales tax exemption for trailers used to transport livestock to include trailers used totransport farm products, nursery stock, or equipment, supplies or products used in agriculture, orfor other agricultural purposes relating to the operation and maintenance of a farm. Effective July 1,2019 (Page 48)(7) Water furnished by a utility district and used exclusively in a farming operation is exempt fromsales and use tax. Effective July 1, 2019 (Page 49)(8) Admission, dues, fees, or other charges paid to any person principally engaged in offeringservices or facilities for the development or preservation of physical fitness through exercise orother active physical fitness conditioning are exempt from the amusement tax. This exemptionapplies to services and facilities such as gyms, fitness centers, fitness studios, high intensity intervaltraining, cross training, ballet barre, pilates, yoga, spin classes, aerobics classes, and othersubstantially similar services and facilities that principally provide for exercise or other activephysical fitness conditioning. Effective July 1, 2019 (Page 57)(9) Any services rendered by a car wash facility, coin-operated or otherwise, where the customerremains in custody of the vehicle and the preponderance of the vehicle’s wash is completed by thecustomer or automated equipment, is exempt from sales and use tax. Effective April 18, 2019, andapplies to assessments imposed or pending as of that date. (Page 58)8

SALES AND USE TAX(10) Expands the sales tax exemption for periodicals printed entirely on newsprint or bond paperand regularly distributed at least twice monthly, to apply to periodicals that are distributed no lessfrequently than monthly. Effective July 1, 2019 (Page 64)(11) A sales and use tax exemption is created for the sale of public safety and public works-relatedgoods to certain large nonprofit property owners associations. Effective July 1, 2019 (Page 65)(12) A sales and use tax exemption is created for the provision of dumpsters or other containers forwaste or debris removal for a fixed or indeterminate period of time, including the delivery andpickup of the dumpster, so long as the provider of the dumpster is exclusively responsible fordelivery and pickup of the dumpster. Effective July 1, 2019 (Page 67)9

SALES AND USE TAX Sales or Use Tax[Tenn. Code Ann. §§ 67-6-102, 67-6-202] Sales or Use TaxThe sales or use tax is a combination of astate tax (7%) and a local option tax (whichvaries from 1.50% to 2.75%) imposed bycity and/or county governments. This taxis generally applied to the retail sales ofany business, organization, or personengaged in making retail sales, includingthe selling, leasing, or renting of tangiblepersonal property and the selling ofcertain taxable services, amusements, anddigital products specified in the law. Inaddition, there is a state single article taxrate of 2.75%, which is discussed later inthis text.The tax is imposed on the sales price ofsales, leases, and rentals of tangiblepersonal property and the sales price fortaxable services, amusements, and certaindigital products. It is the total amount ofconsideration for which products that aresubject to tax are sold. For example: Aconsumer buying four automobile tiressubject to the sales or use tax is charged afee for mounting the tires. The fee formounting the tires is also subject to thesales or use tax.Tangible personal property, taxableservices, amusements, and digitalproducts specifically intended for resaleare not subject to tax. Retail sales to thefederal government or its agencies andthe State of Tennessee or a county ormunicipality within Tennessee are notsubject to tax. In addition, there areexemptions for retail sales to certainentities that have qualified for taxexemption.The term “sales price” does not include: Sales PriceThe “sales price” of an item of tangiblepersonal property is the total amount ofconsideration (including cash, credit,property, and services) for which propertyor services are sold, including: Charges by the seller for servicesnecessary to complete the sale;Delivery charges made by the seller;Installation charges, andExempt property given to thepurchaser where taxable andnontaxable products are bundledand sold as a single product for oneprice. Cost of the property sold;Cost of materials, labor, or servicecost;Costs of transportation or deliveryto the seller;All taxes imposed on the seller;Expenses, interest, losses, andoverhead;10Dealer cash discounts allowed onproperty or services purchased.Manufacturer rebates are includedin the tax base.Interest charges on purchasesbought on an installment plan.Any tax legally imposed on theconsumer and separately stated onthe invoice, bill of sale, or similardocument given to the consumer.The value of items taken as “tradeins” on purchases of similar, new, orused items. The trade-in item mustbe listed by model and serialnumber, when applicable, on thecustomer’s invoice. [Tenn. CodeAnn. § 67-6-510]

SALES AND USE TAXSales or Use Tax (continued)There are some exceptions to the 7%general state sales or use tax rate: Sales of food and food ingredientsas defined in the law. These itemsare taxed at a state rate of 4.00%effective July 1, 2017. Whatconstitutes food and foodingredients is addressed later in thistext. [Tenn. Code Ann. § 67-6-228]Aviation fuel actually used in theoperation of aircraft motors is taxedat 4.5%. The 4.5% sales and use taximposed and remitted on any oneperson’s purchase, use,consumption, or storage of aviationfuel is limited to - 10,500,000 forany year occurring on or after July2018. [Tenn. Code Ann. § 67-6-217]Sales of property to commoncarriers for use outside Tennesseeare taxed at the rate of 3.75%.[Tenn. Code Ann. § 67-6-219]When sold to or used bymanufacturers, water is taxed at 1%,and gas, electricity, fuel oil, andother energy fuels are taxed at arate of 1.5%. [Tenn. Code Ann. § 676-206]Interstate or internationaltelecommunications services sold tobusinesses are taxed at a rate of7.5%. [Tenn. Code Ann. § 67-6-221]Gross receipts from the sale ofmanufactured homes, includingaccessories, furnishings, anddelivery or installation fees, aretaxed at half the current rate ofstate tax. [Tenn. Code Ann. § 67-6216]Property of a sole proprietorshipthat becomes property of acorporation as a result ofincorporation of the sole proprietorship is not subject to tax.[Tenn. Code Ann. § 67-6-223]Video programming servicesincluding cable television, wirelesscable television, and video servicesprovided through wireline facilitiesthat are offered for publicconsumption are taxed at a staterate of 8.25% on all charges of 15.01 - 27.50. Charges of 27.51and higher are taxed at the regularstate and local sales tax rates.Charges of 15 or less are exemptfrom tax. [Tenn. Code Ann. §§ 67-6103(f), 67-6-226]Sales of direct-to-home satellitetelevision programming or televisionservices are taxed at a state rate of8.25% only. [Tenn. Code Ann. § 67-6227]Electricity sold to or used by aqualified data center is taxed at astate rate of 1.5%. [Tenn. Code Ann.§ 67-6-206(c)]Tennessee vendors must indicate inspecific ways whether customers arepaying sales or use tax. If the purchaseprice of a product includes the tax, it mustbe indicated in writing on the invoice, on asign posted in the business, or in amanner that is assured to make thecustomer aware of that fact. [Tenn. CodeAnn. § 67-6-503]Local Option Sales or Use TaxAny county or incorporated city may levy atax on the same privileges that are subjectto the state’s sales or use tax; all countiesand some incorporated cities haveadopted a local option tax of up to 2.75%.11

SALES AND USE TAXSales or Use Taxjurisdiction. [Tenn. Code Ann. § 67-6702(g)(2)](continued)The tax is imposed in the locality of theseller’s location in Tennessee from whichthe sale is made. If a sale is made from anout-of-state location by a seller withlocations in Tennessee, the local tax isimposed based on the purchaser’slocation of receipt. Effective October 1,2019, out-of-state dealers who collect andremit Tennessee sales and use tax mustreport their sales based on the shipped toor delivered to address of the customer.Out-of-state dealers will no longer be ableto use the uniform local rate option of2.25%. Instead, out-of-state dealers mustapply the specific local sales tax rate ineffect for the city or county jurisdictioninto which the sale was shipped ordelivered.Interstate or internationaltelecommunications services sold tobusinesses are subject to the state taxrate of 7.5% and exempt from local tax.[Tenn. Code Ann. § 67-6-702(g)(1)]Interstate and internationaltelecommunications services sold topersons other than businesses are subjectto a state tax rate of 7% and a flat 1.5%local tax rate regardless of the local taxrate levied by the local jurisdiction. [Tenn.Code Ann. § 67-6-702(g)(1)]Video programming services includingcable television, wireless cable television,and video services provided throughwireline facilities that are offered forpublic consumption are exempt from localtax up to an amount of 27.50. [Tenn.Code Ann. § 67-6-714]The sale of water services is subject to thelocal tax rate for the locality where waterservices are delivered to the consumer.[Tenn. Code Ann. §§ 67-6-702(a-f)]Vending machine sales of both food andnon-food items are taxed at a flat rate of2.25% local tax on all sales regardless ofthe local tax rate levied by the localjurisdiction. [Tenn. Code Ann. § 67-6702(h)]The law limits some local option tax rates:There is no local option tax on electricpower or energy, natural or artificial gas,coal, or fuel oil. [Tenn. Code Ann. § 67-6704]Specified digital products (digital audiovisual works, digital audio works, anddigital books) are subject to a standardlocal tax rate of 2.50% regardless of thelocal tax rate levied by the localjurisdiction. [Tenn. Code Ann. § 67-6702(g)(4)]The local tax rate for water sold tomanufacturers is 0.5%. [Tenn. Code Ann. §67-6-702(b)]The local tax rate for sales of tangibleproperty to common carriers for useoutside Tennessee is 1.5%. [Tenn. CodeAnn. § 67-6-702(e)]Sales Tax Application to the Lease orRental of Tangible Personal PropertyIntrastate telecommunications servicesare taxed at the state rate of 7% and aflat 2.5% local tax rate regardless of thelocal tax rate levied by the localFor leases under which the lessee willmake periodic (e.g., weekly or monthly)payments, sales tax is to be collected oneach lease payment at the time the12

SALES AND USE TAXtangible personal property in this stateare subject to sales and use tax.Sales or Use Tax (continued)payment is due. For leases under whichthe lessee will make a lump sum paymentup front, tax is due with that payment.The state general sales tax rate of 7% iscollected for the entire length of the leasecontract. Tenn. Code Ann. § 67-6-702defines a “single article” for purpose of thelocal option tax. Generally, the localoption tax is required only on the first 1,600 of the cost of statutorily definedsingle articles of tangible personalproperty.A lease does not include financeagreements for the transfer of possessionor control of property. A contract thatrequires the transfer of title uponcompletion of allpayments and payment of an option pricethat does not exceed the greater of 100or 1% of the total payments under thecontract is a financing contract and not alease. Sales tax is due at the time of sale,and the periodic payments, includinginterest and financing charges madeunder the agreement, are not subject totax.The state single article tax rate of 2.75% islevied on the sales price of single articlesof tangible personal property beginning at 1,600.01 and continuing up to, andincluding, 3,200. On a lease or rental, thismeans the local tax applies to the first 1,600 of lease or rental income on eachsingle article, then the state tax rate of2.75% begins and continues up to, andincluding, 3,200 on the single articlelease price. Tenn. Code Ann. § 67-6204(b)(3) allows for a lump sum paymentof the local option tax due on the costprice to the lessee; this can be remitted tothe Department on the sales tax returnfor the tax period in which the tax for thefirst periodic lease payment is due. [Tenn.Code Ann. § 67-6-204 and Sales and UseTax Rule 1320-05-01-.32]Sales tax applies to the “sales price” of thelease or rental. Generally, the totalamount received from the customerbecomes the base for state sales tax.However, charges that are optional to thepurchaser and separately stated are notpart of the sales price that is subject to taxfor the lease of the property. Interestcharges associated with the lease orrental are included in the sales price uponwhich sales tax is to be collected.When leased property is relocated toTennessee from another state during thelease period, Tennessee use tax applies toeach lease payment for periods duringwhich the property is located inTennessee. The lessor is required toregister with the Department to collectand remit the use tax. If the lessor doesnot collect the tax, the lessee must remitthe tax directly to the Department. If thelessor properly collects and remits salestax to another state with respect to thelease payments, such sales tax will be aFor sales and use tax purposes, insurancepolicies such as accident, collision, andgap on motor vehicles and charges forfuel used in motor vehicles are notincluded in the sales price of a lease orrental when the charges are separatelystated on the invoice and the purchaserhas the option of leasing the propertywithout purchasing the insurance policyor fuel from the lessor.Extended warranties or repair andmaintenance agreements covering13

SALES AND USE TAXor permanent, must also hold a Certificateof Registration. A business having morethan one location must hold a certificatefor each business location. For example: Aclothing business with locations in twomalls must hold a certificate for eachlocation.Sales or Use Tax (continued)credit against the Tennessee use taxliability.Who Must Register for Sales or Use Tax[Tenn. Code Ann. §§ 67-6-102, 67-6-201,67-6-210, and 67-6-602]Dealers having average monthly grosssales of 400 of tangible personalproperty or less and taxable services of 100 or less, may, at the discretion of theCommissioner, be required to pay tax totheir suppliers on purchases in lieu ofregistering for sales or use tax purposes.Any entity wishing to manufacture,distribute, sell, rent, or lease tangiblepersonal property, or provide taxableservices, in this state must hold aCertificate of Registration to conductbusiness in Tennessee. Business may beconducted by: Who is Liable for Sales Tax?[Tenn. Code Ann. §§ 67-6-501, 67-6-502]Selling, renting, or leasing, even by atransient vendor, any type oftangible personal propertySelling any type of taxable service inthe stateFurnishing property or services thatare subject to the sales taxCharging admission, dues, or feesthat are subject to the sales taxUsing tangible personal property,computer software, specified digitalproducts, or warranty ormaintenance contracts notpreviously taxed.Selling any item from a vendingmachine or device in whichmerchandise is provided upondeposit of money, other than certainvending machines operated for thebenefit of tax-exempt organizations,is taxable under the sales or use taxlaw.In Tennessee, the responsibility for salestax rests on the dealer that provides thetaxable product or service. The lawrequires that the dealer pass the tax tothe customer; failure to do so does notrelieve the dealer of the responsibility totimely remit the tax to the state. In thecase of a property management companyhired to manage vacation lodging for anindividual property owner, the sales taxwill be imposed on the gross charge forrental and will be remitted by the propertymanagement company.Tax will be reported and paid each monthbased on the gross sales, or purchases,from all taxable sales and purchasesduring the preceding month. The tax willbe paid on the return for the month inwhich the taxable event occurs, even if thetax is not collected from the customerduring that month. For example: A chargesale is made during the month of June.The dealer must pay the tax on the Junereturn even though the customer may notpay the account until July.This requirement applies whether yourbusiness is a sole proprietorship,partnership, LLC, corporation, or anyother type of organization including thosethat are not for profit. Retailers fromother states that maintain a physicallocation in Tennessee, whether temporary14

SALES AND USE TAXSales or Use Tax (continued)Who is Liable for Use Tax?[Tenn. Code Ann. §§ 67-6-203, 67-6-210,67-6-208, 67-6-231] When a user of tangible personalproperty, computer software, computersoftware maintenance contracts, warrantyor maintenance contracts coveringtangible personal property located in thisstate, and specified digital property doesnot pay sales tax to a dealer, the userbecomes personally liable for the tax. Thisgenerally occurs when a user purchasesarticles from an out-of-state dealer notregistered in Tennessee. It also occurswhen a dealer withdraws inventory itemspurchased on a resale certificate forbusiness or personal use. For example: Aclothing store owner purchases clothingon a resale certificate and then takesitems from inventory for personal use.Use tax is then due on that clothing. How to Register[Tenn. Code Ann. §§ 67-6-601, 67-6-602]Tennessee RetailersYou may apply for the Certificate ofRegistration online. Select the link to“Register a New Business” in theAdditional Services section of our TNTAPwebsite https://tntap.tn.gov/eservices/ /.The use tax rate is equal to the sales taxrate on both the state and local level. Usetax is due even when a resident importstangible personal property into Tennesseefor use.You may also visit one of the Departmentof Revenue offices listed on the insidefront cover of this publication. Trainedpersonnel are available to explainTennessee’s tax system and answer any ofyour questions.For example: A business relocating toTennessee brings property purchased in astate with no sales or use tax. The dealerwould be liable for use tax on thisproperty. [Tenn. Code Ann. § 67-6-210]When registering, you will need thefollowing information to complete yourapplication:Use tax is normally incurred when: paying no sales or use tax [Tenn.Code Ann. § 67-6-210]Purchasing a product from atransient business that does notcollect sales or use tax [Tenn. CodeAnn. § 67-6-210]Consuming or using a product thatwas purchased without paying salesor use tax [Tenn. Code Ann. § 67-6203]Consuming, as a service provider,tangible products in theperformance of a service [Tenn.Code Ann. § 67-6-102(75)] Purchasing a product in anotherstate without paying sales or use taxand bringing it into Tennessee foruse in the state [Tenn. Code Ann. §67-6-210]Purchasing a product from a mailorder catalog or on the internet and 15The name, address, and phonenumber of the business, all owners,officers, or partners, and the personmaking the applicationThe Social Security Number(s) of theowner(s), partners, or officers

SALES AND USE TAX Sales or Use Tax (continued) The Federal Employer IdentificationNumber (FEIN) issued by the U.S.Internal Revenue Service if you haveone.A description of the business, thetype of ownership, a briefexplanation of the nature of thebusiness, and, if the business is acorporation, the date ofincorporationIf you have purchased yourbusiness, the name and address ofthe previous ownerThe signature, on the paperapplication, of the sole proprietor, apartner, or an officer of acorporation This requirement applies even though thesale of the product or its delivery is ininterstate commerce. For example: Anout-of-state computer company sellscomputer systems to Tennesseebusinesses through a salesperson thattravels in this state. This business isrequired to obtain a Certificate ofRegistration and collect sales or use taxon the price of the system.Out-of-State RetailersOut-of-state retailers must register withthe Department of Revenue and obtain acertificate of registration for payment ofthe sales or use tax if they have “nexus”with Tennessee. Nexus is essentiallyhaving enough contact with Tennessee sothat the state can place tax requirementson the business. Retailers are consideredto have nexus if they: Have company personnelparticipate in promotional activity inTennessee, including trade shows.Use company-owned trucks or usecarriers acting as an agent to deliversales in Tennessee.Provide telecommunications tosubscribers located in Tennessee.Have a subsidiary with physicalpresence in Tennessee act as anagent to conduct in-state activitieson behalf of the out-of-state retailer.Have any other physical presence inTennessee.A business having a physical presence inTennessee must collect and remit sales oruse tax on all sales whether orders aretaken in person, by phone, or by mail.Effective July 1, 2015, sales or use tax lawcreates a rebuttable presumption thatout-of-state dealers have nexus and mustcollect Tennessee sales and use tax fromTennessee customers if the dealer paysan in-

This sales and use tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee sales and use tax requirements. It is not an all-inclusive document or a substitute for Tennessee sales or use tax statutes or rules and regulations. The information in this guide is current as of the date of .