Transcription

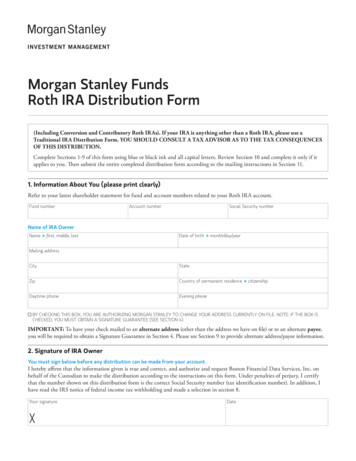

Morgan Stanley FundsRoth IRA Distribution Form(Including Conversion and Contributory Roth IRAs). If your IRA is anything other than a Roth IRA, please use aTraditional IRA Distribution Form. YOU SHOULD CONSULT A TAX ADVISOR AS TO THE TAX CONSEQUENCESOF THIS DISTRIBUTION.Complete Sections 1-9 of this form using blue or black ink and all capital letters. Review Section 10 and complete it only if itapplies to you. Then submit the entire completed distribution form according to the mailing instructions in Section 11.1. Information About You (please print clearly)Refer to your latest shareholder statement for fund and account numbers related to your Roth IRA account.Fund numberAccount numberSocial Security numberName of IRA OwnerNamefirst, middle, lastDate of birthmonth/day/yearMailing addressCityStateZipCountry of permanent residenceDaytime phoneEvening phonecitizenship Y CHECKING THIS BOX, YOU ARE AUTHORIZING MORGAN STANLEY TO CHANGE YOUR ADDRESS CURRENTLY ON FILE. NOTE: IF THE BOX ISBCHECKED, YOU MUST OBTAIN A SIGNATURE GUARANTEE (SEE SECTION 4).IMPORTANT: To have your check mailed to an alternate address (other than the address we have on file) or to an alternate payee,you will be required to obtain a Signature Guarantee in Section 4. Please see Section 9 to provide alternate address/payee information.2. Signature of IRA OwnerYou must sign below before any distribution can be made from your account.I hereby affirm that the information given is true and correct, and authorize and request Boston Financial Data Services, Inc. onbehalf of the Custodian to make the distribution according to the instructions on this form. Under penalties of perjury, I certifythat the number shown on this distribution form is the correct Social Security number (tax identification number). In addition, Ihave read the IRS notice of federal income tax withholding and made a selection in section 8.Your signaturexDate

3. Signature of Beneficiary (for death benefits only)Taxpayer Identification Number Certification (Substitute Form W-9)Citizenship of beneficial owner:U.S. CITIZEN RESIDENT ALIEN NONRESIDENT ALIEN*Country of permanent residencecitizenshipBy signing this application, I certify under penalties of perjury, that (1) my Social Security provided in this application is correct (orI am waiting for a number to be issued to me) and (2) I am not subject to backup withholding because (a) I am exempt from backupwithholding or (b) I have been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result ofa failure to report all interest or dividends or (c) the IRS has notified me that I am no longer subject to backup withholding and (3)I am a U.S. person (including a U.S. resident alien). (Please cross out item (2) above if it does not apply to you.)The Internal Revenue Service does not require your consent to any provision of this document other than the certificationsrequired to avoid backup withholding.Signature of beneficiaryDatexIn order to certify your status as a nonresident alien or foreign entity, you must complete and return the appropriate IRS Form W-8. If you have not obtaineda U.S. taxpayer identification number you must provide and attach one of the following: 1) passport number and county of issuance; 2) alien identificationcard number; or 3) number and county of issuance of any other government-issued document evidencing nationality or residence and bearing a photograph.*4. Signature GuaranteeA signature guarantee may be obtained by an officer of a bank or trust company; an authorized signer of a brokerage firm; an officerof a credit union; a national securities exchange; a registered securities association or clearing agency; a savings and loan association;or a federal savings bank. A signature guarantee may not be obtained through a notary public.Name of bank or firm providing signature guaranteeSignature of officer and titlexbe sure to affix a signature guarantee stampSTAMP HEREIMPORTANT: Signature guarantee is only required if any of the following applies: Amount to be distributed is over 100,000 if distribution is being sent to address of record. Amount to be distributed/transferred is for death benefits or due to divorce. The payee is other than the shareholder on the account. This distribution is to be sent to any address other than the address we have had on our records for the past 15 days. If your name has changed from the name we have on record, we must have a one-and-the-same name signature guarantee. A oneand-the same name signature guarantee must state “ Previous Name is one-and-the-same as New Name .” You must sign yourold and new name, and have your signature guaranteed. This distribution is being wired (i.e., direct deposit) according to instructions on this form and such information is notcurrently on file.2 MORGAN STANLEY INVESTMENT MANAGEMENT

5. What is the Type of Distribution? (check one)Contributions may be removed tax free. Any earnings withdrawn may be subject to a premature distribution penalty and incometax. Roth IRA ordering rules state that a distribution is deemed first to come from your Roth IRA Contributions, then fromany amounts converted from a Traditional IRA, and then from any earnings. See “Summary of Distribution Types” for moreinformation on the types of Roth IRA distributions. AGE 59½ OR OLDER.* UNDER AGE 59½. IVORCE—ATTACH A CERTIFIED COPY OF A DIVORCE DECREE. SEE SUMMARY OF DISTRIBUTION TYPES FOR DETAILS. SIGNATURE GUARANTEEDREQUIRED IN SECTION 4. REMOVAL OF ROTH IRA EXCESS CONTRIBUTION—ALSO COMPLETE SECTION 10. DEATH*—ATTACH A CERTIFIED COPY OF A DEATH CERTIFICATE AND COMPLETE THE BENEFICIARY INFORMATION BELOW. SIGNATUREGUARANTEE IS REQUIRED IN SECTION 4. IF A BENEFICIARY IS A TRUST, CONTACT MORGAN STANLEY FOR ADDITIONAL INSTRUCTIONS. DISABILITY*—BY CHECKING THIS BOX, I CERTIFY THAT THIS DISTRIBUTION MEETS ALL THE DISABILITY REQUIREMENTS OF THE INTERNALREVENUE CODE SECTION 72(M)(7). DATE OF INITIAL DETERMINATION OF �� YEAR QUALIFIED FIRST-TIME HOMEBUYER EXPENSES.* SEE SUMMARY OF DISTRIBUTION TYPES FOR LIMITATIONS. PERIODIC DISTRIBUTION—PART OF A SERIES OF SUBSTANTIALLY EQUAL PAYMENTS.Beneficiary Name**Namefirst, middle, lastDate of birthmonth/day/yearRelationship to IRA ownerSocial Security numberOr legal entityTax identification number, if beneficiary is a legal entityTrust, estate, corporation or tax-exempt organizationPermanent residence addressinclude street, apartment, suite or rural number. DO NOT USE P.O. Box addressesCityMailing addressStateZipStateZipif different from aboveCityPlease note that this distribution will not be coded as a qualified distribution unless Morgan Stanley has evidence that the participant meets the 5-yearaging period. Please see SUMMARY OF DISTRIBUTION TYPES for more information.*This must match the beneficiary information we currently have on record for you. If you would like to change your beneficiary, please complete a“DESIGNATION OF BENEFICIARY” form.**3 MORGAN STANLEY INVESTMENT MANAGEMENT

6. Method of DistributionDistribute the amount requested as follows: SINGLE CASH PAYMENT. PERIODIC DISTRIBUTIONS. (SEE A AND B BELOW.)A. FrequencyM ONTHLY QUARTERLYA NNUALLYBEGINNING THE MONTH OF AND DATE OF* .B. MethodE ACH PERIODIC PAYMENT EQUAL TO THE AMOUNTSPECIFIED IN SECTION 7.O VER THE LIFE EXPECTANCY OF THE BENEFICIARY NAMEDIN SECTION 5 (DEATH BENEFITS ONLY).O VER YEARS.O VER THE LIFE EXPECTANCY OF MY BENEFICIARY NAMED INSECTION 5 AND ME.O VER MY LIFE EXPECTANCY.If you do not select a date, the redemption will be made on or about the 18th of the month, provided that the distribution amount requested does notexceed the market value of your account(s).*7. Amount of Distribution (check one) I WANT ALL OF MY ACCOUNT. BANK DRAFT CONTRIBUTIONS WILL BE DISCONTINUED UNLESS YOU CHECK THIS BOX. I WANT A SPECIFIC DOLLAR AMOUNT, , FROM THE FUND/ACCOUNT LISTED ON THE FIRST PAGE,OR PLEASE ALLOCATE AS FOLLOWS:Fund/Account #AmountFund/Account # AmountFund/Account # Amount You will receive an amount equal to the amount requested LESS any withholding. If the amount indicated is greater than the totalaccount(s) value on the date your request is received, your account(s) will be closed. I WANT PERIODIC DISTRIBUTIONS CALCULATED AS SPECIFIED IN SECTION 6B. I WANT THE AMOUNT OF EXCESS CONTRIBUTION PLUS ANY EARNINGS REQUIRED TO BE DISTRIBUTED. ALSO COMPLETE SECTION 10.8. Income Tax Withholding Election (check one)IMPORTANT: We do not withhold for any applicable penalties. Please review the IRS notifications on withholding requirementsfor your distribution.Generally, Federal Income Tax withholding DOES NOT APPLY TO ROTH IRA DISTRIBUTIONS, except in the case of areturn of an excess contribution plus earnings, (see Section 10D).However, if you would like us to withhold Federal Income Tax,please specify below: I WANT FEDERAL INCOME TAX AT THE MINIMUM RATE OF 10% WITHHELD FROM MY DISTRIBUTION. I WANT FEDERAL INCOME TAX AT THE RATE OF % WITHHELD FROM MY DISTRIBUTION (PERCENTAGE MUST BEGREATER THAN 10%).4 MORGAN STANLEY INVESTMENT MANAGEMENT

9. How Should We Distribute Your Account?Your distribution will be mailed to the address of record, unless specified below: DEPOSIT INTO EXISTING MORGAN STANLEY FUND/ACCOUNT.Fund number(s)Account number(s)Assets must remain in the same share class DEPOSIT INTO NEW MORGAN STANLEY ACCOUNT. COMPLETED NEW ACCOUNT APPLICATION IS ATTACHED. DEPOSIT INTO A BENEFICIARY ACCOUNT. COMPLETE INFORMATION IN SECTION 5; ACCOUNT APPLICATION IS NOT NECESSARY. DEATHDISTRIBUTION ONLY. (IMPORTANT: SIGNATURE GUARANTEE REQUIRED IN SECTION 4.) TRANSFER TO A ROTH IRA FOR SPOUSE DUE TO DIVORCE OR DEATH. COMPLETED IRA APPLICATION FOR SPOUSE IS ATTACHED OR ACCOUNTIS ALREADY ESTABLISHED. (IMPORTANT: SIGNATURE GUARANTEE REQUIRED IN SECTION 4.)Fund number(s)Account number(s) DEPOSIT AS A ROTH IRA CONTRIBUTION FOR YEAR . AVAILABLE ONLY FOR RETURNS OF EXCESS CONTRIBUTIONS. (ANY EARNINGS ONEXCESS CONTRIBUTIONS WILL BE DISTRIBUTED TO YOU.) MAKE DISTRIBUTION CHECK PAYABLE TO ANOTHER PARTY. NOTE: ALL DISTRIBUTIONS WILL BE REPORTABLE UNDER THE ACCOUNT OWNER’SNAME AND SOCIAL SECURITY NUMBER. (IMPORTANT: SIGNATURE GUARANTEE REQUIRED IN SECTION 4.)Addressee/Payee MAIL DISTRIBUTION CHECK TO AN ADDRESS OTHER THAN MY ADDRESS OF RECORD. (IMPORTANT: SIGNATURE GUARANTEE REQUIRED INSECTION 4.)AddressCityStateZip DIRECT DEPOSIT* INTO AN ACCOUNT AT: (IMPORTANT: SIGNATURE GUARANTEE REQUIRED IN SECTION 4.)Name of institutionABA routing numberAccount numberBank account registrationW IRE** OR ACH***Attach a voided check or deposit slip from your bank account.You can choose to have your distribution sent via WIRE (generally requires one day processing) or ACH (Automated Clearing House, generally requirestwo-day processing). Check with your bank for any wire fees you may incur. Your distribution will be sent via ACH if a selection is not made.**5 MORGAN STANLEY INVESTMENT MANAGEMENT

10. Removal of Excess ContributionRemoval of excess contributions are complex in nature. The IRS allows several methods for correcting excess contributions. Pleaseconsult a financial or tax advisor concerning the tax treatment of a distribution and the effects to your individual situation.See “Descriptions of Distribution Types” in the back of this form.Please complete A, B, C and D below to remove an excess contribution from your account before tax filing deadline. For after taxfiling deadline, complete A, B and C.A. I am withdrawing my excess contribution: BEFORE THE TAX FILING DEADLINE (INCLUDING EXTENSIONS) FOR THE YEAR IN WHICH I DEPOSITED THE EXCESS CONTRIBUTION IN MYACCOUNT. AFTER THE TAX FILING DEADLINE (INCLUDING EXTENSIONS) FOR THE YEAR IN WHICH I DEPOSITED THE EXCESS CONTRIBUTION IN MY ACCOUNT.NOTE: THE FOLLOWING EXAMPLES MAY HELP YOU DETERMINE WHETHER YOU ARE CORRECTING YOUR EXCESS CONTRIBUTION BEFORE ORAFTER YOUR TAX FILING DEADLINE:EXAMPLE 1: IF YOU DEPOSIT A CURRENT YEAR CONTRIBUTION IN YOUR ACCOUNT IN NOVEMBER OF 2011, YOU WILL HAVE UNTIL APRIL 15OF 2012 (PLUS EXTENSIONS) TO CORRECT THE EXCESS BEFORE YOUR TAX FILING DEADLINE.EXAMPLE 2: IF YOU DEPOSIT A PRIOR YEAR CONTRIBUTION IN YOUR ACCOUNT IN MARCH OF 2012, YOU WILL HAVE UNTIL APRIL 15 OF 2012(PLUS EXTENSIONS) TO CORRECT THE EXCESS BEFORE YOUR TAX FILING DEADLINE.B. MOUNT OF EXCESS CONTRIBUTION WHICH WAS DEPOSITED IN YEAR AS A CONTRIBUTION FORATAX YEAR .C. Earnings on excess contribution (only for excess amounts withdrawn before your tax filing deadline):I AUTHORIZE BOSTON FINANCIAL DATA SERVICES, INC. TO CALCULATE THE EARNINGS ON THE EXCESS IN THE ACCOUNT IDENTIFIED INSECTION 1 AND I WILL ACCEPT THE CALCULATION ESTIMATE.I HAVE DETERMINED THE EARNINGS ATTRIBUTABLE TO THE EXCESS CONTRIBUTION. PLEASE DISTRIBUTE EARNINGS EQUAL TO .D. The earnings attributable to an excess contribution made to a Roth IRA are subject to Federal income tax withholding atthe rate of 10 percent, unless the recipient of the distribution checks the box below: I ELECT NOT TO HAVE FEDERAL INCOME TAX WITHHELD ON THE EARNINGS ATTRIBUTABLE TO AN EXCESS CONTRIBUTION.11. Mail Completed FormMail the completed six-page form to Boston Financial Data Services, Inc. (agent for the Custodian, UMB NA), at one of theaddresses below according to mailing type:Overnight Deliveries:Regular Mail: Morgan Stanley Fundsc/o Boston Financial Data Services, Inc.P.O. Box 219804 430Kansas City, MO 64121-98046 MORGAN STANLEY INVESTMENT MANAGEMENTMorgan Stanley FundsBoston Financial Data Services, Inc.West 7th StreetKansas City, MO 64105

Summary of Distribution TypesWhen you start withdrawing from your Roth IRA, you may take the distributions in regular payments, randomwithdrawals or in a single sum payment.Taxation of Distributions. “Qualified” distributions are neither subject to Federal income tax nor the 10 percent additional incometax for premature distributions. Nonqualified distributions are taxable to the extent such distribution is attributable to the incomeearned in the account.Qualified Distributions. A qualified distribution is one made: After the end of the 5-year period beginning with the first taxable year for which you made a regular contribution or conversion toa Roth IRA.AND on or after you attain age 59½ to a beneficiary after account owner’s death on account of you becoming disabled (as defined under section 72(m)(7) IRC)OR for qualified first-time homebuyer expenses.Nonqualified Distributions. Nonqualified distributions are treated as taken from the nontaxable portion first (the contributions) untilthe aggregate distributions exceed the aggregate contributions. When the aggregate distributions exceed the aggregate contributions,then the earnings will be treated as part of the distribution for taxation purposes. The portion of the nonqualified distributionthat represents earnings will be taxable and subject to the 10 percent additional income tax for premature distributions, unless anexception applies. You are required to complete, track and record contributions you make to your Roth IRA and to figure any taxable,nonqualified distributions from your Roth IRA by filing the IRS form 8606.Distributions Made Before the End of the 5-Year Period. Distributions taken before the end of the 5-year period are taxable (tothe extent you receive the earnings attributable) and are subject to the 10 percent additional income tax if the participant is not age59½. However, the 10 percent additional income tax is avoided if the distribution meets one of the exceptions under Section 72(t) (see“Exceptions” below.).Premature Distributions. If you are younger than 59½ and receive a “nonqualified” distribution from your Roth IRA, a 10 percentadditional income tax will apply to the taxable portion (generally the earnings portion) of the distribution unless the distributionis received due to death; disability; a qualifying rollover distribution; the timely withdrawal of the principal amount of an excess;substantially equal periodic payments; certain medical expenses; health insurance premiums paid by certain unemployed individuals;qualified higher education expenses; qualified first-time homebuyer expenses; or IRS levy.Exceptions for Early Distributions to Avoid the 10 Percent Penalty.Death Distributions. Upon death, the balance in your Roth IRA generally must be distributed no later than December 31st of theyear containing the 5th anniversary of your death. However, your beneficiary(ies) may elect to receive the balance in your accountover the non-recalculated single life expectancy of their lifetime if distributions begin no later than December 31st of the yearcontaining the one year anniversary of your death. If your spouse is your sole primary beneficiary, your spouse may assume yourRoth IRA as his or her own Roth IRA or may select any distribution option available to a non-spouse beneficiary as desired above.In addition, if the appropriate required death distributions are not made from your Roth IRA, an excise tax of 50 percent is assessedto your beneficiary based upon the difference between the amount that should have been distributed and the amount that wasactually distributed.You must file IRS Form 5329 with the Internal Revenue Service for any year an additional tax is due.Disability. You may receive a distribution due to disability if you meet the requirements of Internal Revenue Code Section 72(m)(7). An individual may be considered disabled if he is unable to engage in any substantial, gainful activity by reason of a medicallydeterminable physical or mental impairment that can be expected to result in death or to be of long-continued and indefiniteduration. Please be aware that such proof of the existence thereof may be required in a form and manner acceptable to theDepartment of the Treasury.Transfers (Divorce.) This is not a taxable distribution. If the former spouse desires a distribution to be made, a transfer into anew Roth IRA in the former spouse’s name must first be completed. Then we will distribute the proceeds to the former spouseonce we receive a Roth distribution form from the former spouse. We must have specific instructions contained in the decree or7 MORGAN STANLEY INVESTMENT MANAGEMENT

legal separation papers before we can transfer the account. If the account is being transferred to the former spouse, a Roth IRAapplication must be submitted if an account is not already established.Removal of Roth IRA Excess Contribution Before Tax Filing Deadline.A Roth IRA excess contribution may avoid the 6 percent excess tax if all of the following requirements are met:– The excess is withdrawn on or before the due date (including extensions) for filing your Federal income tax return for the year inwhich you deposited the excess contribution.– The earnings attributable to the excess contribution are also withdrawn.– No deduction will be taken for the excess contribution.The earnings are taxable in the year in which the excess contribution was deposited into your account and may be subject to theadditional tax on premature distributions. Morgan Stanley will calculate the earnings amount for you, if you so request. However,you are responsible for providing us with information regarding any other IRAs you maintained in the year in which the excesscontribution was made, or at any subsequent time. After Tax Filing Deadline.Roth IRA Excess Contributions, Where Aggregate Contributions Are Less Than the annual limit ( 5,000, or 6,000 for 50and older, for 2011-2012): If the aggregate contributions to your IRA(s) for the same taxable year are 5,000 ( 6,000 if age 50or over) or less, you may withdraw any excess contribution after the tax filing deadline and not include the amount withdrawn inyour gross income. This applies only to the part of the excess on which you did not take a deduction. No earnings are required to bewithdrawn, and the 6 percent tax on the excess amount must be paid until the excess is either withdrawn or used as a deduction in asubsequent tax year. Non-deductible contributions which do not exceed annual contribution limits set by the IRS are not eligible tobe withdrawn under these rules.IRA Excess Contributions, Where Aggregate Contributions Are Greater Than the annual limit ( 5,000, or 6,000 for 50and older, for 2011-2012): If the aggregate contributions to all IRAs for the same taxable year exceed 5,000 ( 6,000 if age 50 orover), you must pay the 6 percent tax on the excess contributions for each year that the excess remained in the IRA. You have twooptions for correcting the excess: If you are eligible to make an IRA contribution in a subsequent year, and have not yet contributed the full amount allowed inthat year, you may redesignate the excess contribution by leaving the money in the IRA and applying the excess contribution to asubsequent year. (However, your subsequent contributions, including redesignated amounts, are still subject to the annual limit ofthe lesser of 5,000 ( 6,000 if age 50 or over) or 100 percent of compensation.) No earnings on the excess amount are required to bewithdrawn. Another option involves withdrawing the excess amount from the account. You must include the excess contribution in income,and you may be subject to the additional tax on premature distributions. No earnings on the excess amount are required to bewithdrawn.Part of Series of Substantially Equal Periodic Payments. To avoid the additional premature distribution tax, your distributionmust be made as part of a series of substantially equal periodic payments (at least annually) over your single life expectancy, jointlife expectancy of you and your beneficiary or over the Uniform Lifetime Method. If this type of distribution is selected, one of thelife expectancy choices in Section 6 must be completed. Any additional distribution or change in the periodic payments made priorto the later of age 59½ or five years (other than by reason of death, disability or as allowed by Revenue Ruling 2002-6) will subjectamounts prior to age 59½ to the additional premature distribution tax.Additional ExceptionsAs required by law, Morgan Stanley will report the distribution as a premature distribution to the IRS on Form 1099-R. To claimthe following exceptions you must file Form 5329 along with your personal tax return to the IRS. Please contact a tax advisor todetermine your eligibility for these exceptions.Medical Expenses. Your distribution is not subject to the additional early distribution penalty tax if it is for medical expenses inexcess of 7.5 percent of your adjusted gross income as defined in Internal Revenue Code Section 213.Health Insurance Premiums for Unemployed Individuals. 12 consecutive weeks under federal or state law and thedistributions must have been made during any tax year in which the unemployment compensation is paid or during the next taxyear. This exception does not apply to distributions made after you are re-employed if you are employed for at least 60 days afterthe initial separation from service. See IRS Publication 590 for additional information.8 MORGAN STANLEY INVESTMENT MANAGEMENT

Education Expenses. Penalty-free withdrawals are allowed for money used to pay qualified higher education expenses of theRoth IRA owner, the owner’s spouse or a child or grandchild of the owner or owner’s spouse. Qualified expenses, as definedby code Section 529(e), include: tuition, fees, books, supplies, required equipment, and room and board must be at an eligibleeducation institution. Some limitations do apply. Please consult your tax advisor to determine your eligibility for this exception.First-Time Home Buyers. A distribution used towards qualified acquisition costs of a first-time homebuyer who is the IRAowner, or any relative of the owner or the owner’s spouse, is not subject to the early distribution penalty tax. This distributionmust be used before the close of the 120th day after the day the distribution was received. The lifetime limit on a first-timehomebuyer exception is 10,000.00. “Qualified Acquisition Cost” as defined by the Internal Revenue Code Section 303 meansthe cost of acquiring, constructing or reconstructing a residence. A first-time homebuyer, as defined by the Code, means anyindividual if “such individual had no present ownership interest in a principal residence during the 2-year period ending on thedate of acquisition.”Involuntary Distribution Due to an IRS Levy. Beginning January 1, 2000 distributions made on an account due to an IRS levywill not be subject to the additional early withdrawal tax of 10 percent if distribution prior to the participant’s age 59½.Basis Recovery Rules for Distribution from Different IRA Plans. The taxation of distributions from a Roth IRA shall be treatedseparately from the taxation of a distribution from other IRA plans. In other words, nondeductible contributions made to yourTraditional IRA will continue to be recovered tax-free on a ratable basis.Ordering Rules. Roth IRA distributions are subject to the following ordering rules; first, from regular contributions made to yourRoth IRA; second, from converted amounts (taxable amount first, non-taxable amount second); and third, from any earnings inyour Roth IRA. Please refer to the Morgan Stanley Roth IRA Disclosure Statement regarding the treatment or ordering rules inconnection with a beneficiary inherited Roth IRA and multiple beneficiaries.Required Distributions. Unlike a Traditional IRA, you are not required to begin distributions when you attain age 70½.Prohibited Transactions with a Roth IRA. If you or your beneficiary engage in a prohibited transaction (as defined under Section4975 of the Internal Revenue Code) with your Roth IRA, it will lose its tax exemption and you must include the taxable portionof your account in your gross income for that taxable year. If you pledge any portion of your Roth IRA as collateral for a loan, theamount pledged will be treated as a distribution and the taxable portion will be included in your gross income for that taxable year.You may also be subject to the 10 percent penalty.Income Tax Withholding. Federal income tax withholding does not apply to Roth IRA distributions, except in the case of returnof an excess contribution plus earnings. The earnings will be taxable, even if the recipient otherwise meets the definition of aqualified distribution. The earnings attributable to an excess contribution made to a Roth IRA are subject to Federal Income Taxwithholding at the rate of 10 percent, unless the recipient of the distribution checks the box in Section 10-D of this form. However,if processing a distribution other than the removal of an excess contribution, you may still elect to withhold federal income tax inSection 8.Federal Estate and Gift Taxes. In the event of your death, the value of your Roth IRA will be includible in your gross estate forfederal estate tax purposes. However, if your surviving spouse is the beneficiary of your Roth IRA, the value of your Roth IRA mayqualify for the marital deduction available under Section 2056 of the Internal Revenue Code. A transfer of property for Federal gifttax purposes does not include an amount which a beneficiary receives from a Roth IRA plan.Rollover. You may avoid current taxation of a distribution if you roll over the assets as to another Roth IRA within 60 days, as arollover contribution. Please refer to the Morgan Stanley Roth IRA Custodial Agreement and Disclosure Statement for more detailsregarding rollovers. You should consult your tax advisor if you have any questions regarding rollovers.Transfers. A direct transfer of all or a portion of your funds is permitted from this Roth IRA to another Roth IRA or vice versa.Transfers do not constitute a distribution since you are never in receipt of the funds. The monies are transferred directly to the newtrustee or custodian. Transfers are neither subject to the 12-month restriction nor the 60-day rollover period usually associated withrollovers.9 MORGAN STANLEY INVESTMENT MANAGEMENT

Morgan Stanley Individual Retirement AccountsImportant Information To Recipients of Distribution(Retain this information for your records.)Notice of Federal Income Tax Withholding. Under the Internal Revenue Code 3405, most Roth IRA distributions are exemptfrom Federal Income Tax Withholding per the Consolidated Appropriations Act of 2000. The exception is the removal of an excesscontribution. In this instance, Morgan Stanley is required to withhold for Federal Income Tax unless the recipient elects not to havewithholding apply. You may elect out of Federal Income Tax withholding by checking the appropriate box in Section 10-D. If noelection is made in 10-D, Morgan Stanley must withhold taxes at the required rate. According to the IRS Regulations, you may incurpenalties under the estimated tax rules if your withholding and/or estimated tax payments are not sufficient. Even if you elect not tohave the income tax withheld, you are liable for payment of income tax on the taxable portions of your distribution.Taxability. IRAs and distributions from such accounts are subject to complex rules on taxability including, in addition to any ordinaryincome tax on taxable distributions, a 10 percent additional tax on certain distributions prior to attaining age 59½, and a 6 percentexcise tax on excess contributions. The information on this form is only a brief statement of the applicable requirements and/or taxtreatment thereof.Tax Advisor. You should consult your own tax advisor concerning the tax treatment of a distribution before taking it.Additional Information. Additional information concerning the minimum distribution r

(Including Conversion and Contributory Roth IRAs). If your IRA is anything other than a Roth IRA, please use a Traditional IRA Distribution Form. YOU SHOULD CONSULT A TAX ADVISOR AS TO THE TAX CONSEQUENCES OF THIS DISTRIBUTION. Complete Sections 1-9 of this form using blue or black ink and all capital letters. Review Section 10 and complete it .