Transcription

AboutPrinting RequirementsResetShow Field al

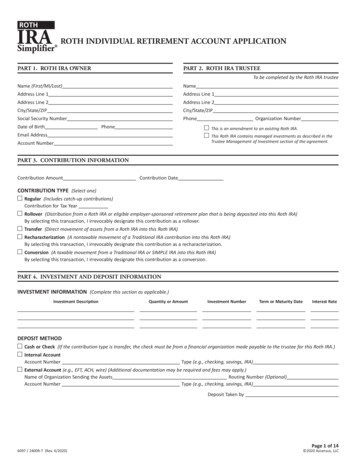

ADDITIONAL INFORMATIONPurpose. This Organizer contains the forms necessary to establish a Rothindividual retirement account (IRA). This Organizer should not be used toestablish an inherited Roth IRA.How to use this Roth IRA Organizer. The individual establishing thisRoth IRA must complete the Application page. The Roth IRA ownermust sign the document. An original signed copy of the Applicationshould be kept by the custodian for its records. The Roth IRA ownershould receive a copy of the Application and keep the remainingcontents of the Roth IRA Organizer. Community or marital propertystate laws may require spousal consent for nonspouse beneficiarydesignations.Roth IRA Organizer-Custodial2021 Wolters Kluwer Financial Services, Inc.All rights reserved.Additional Documents. Applicable law or policies of the Roth IRAcustodian may require additional documentation such as IRS Form W-9,Request for Taxpayer Identification Number and Certification.For Additional Guidance. It is in your best interest to seek the guidanceof a tax or legal professional before completing this document. For moreinformation, refer to Internal Revenue Service (IRS) Publication 590-A,Contributions to Individual Retirement Arrangements (IRAs), IRSPublication 590-B, Distributions from Individual Retirement Arrangements(IRAs), IRS Form 5498, IRA Contribution Information, instructions toyour federal income tax return, or the IRS's web site at www.irs.gov.IRACUSROTHLZ 11/1/2021(2111).00Page 1 of 14

Roth IRA ApplicationROTH IRA OWNER INFORMATION(Custodian's name, address, and phone number above)NAME, ADDRESS, CITY, STATE, AND ZIPROTH IRA ACCOUNT (PLAN) NUMBERSOCIAL SECURITY NUMBER (SSN)DAYTIME PHONE NUMBERE-MAIL (OPTIONAL)DATE OF BIRTHCONTRIBUTION INFORMATIONINVESTMENT NUMBERAMOUNTCONTRIBUTION DATETAX YEARTAX YEAR OF FIRST ROTH IRACONTRIBUTION/CONVERSION use this format 1,000.00CONTRIBUTION TYPE:l Regular (including Catch-Up)l Rolloverl Transferl Recharacterizationl Conversionl Rollover or Direct Rollover from an Eligible Retirement Planl Rollover or Direct Rollover from a Designated Roth Accountl Distribution Repayment*l Postponed Contribution/Late Rollover (including with self-certification)**Reason Code (if applicable)DESIGNATION OF BENEFICIARYAt the time of my death, the primary beneficiaries named below will receive my Roth IRA assets. If all of my primary beneficiaries die before me, thecontingent beneficiaries named below will receive my Roth IRA assets. In the event a beneficiary dies before me, such beneficiary's share will bereallocated on a pro-rata basis to the other beneficiaries that share the deceased beneficiary's classification as a primary or contingent beneficiary. Adesignation of a beneficiary's primary or contingent classification is generally made by entering a percentage in one of the two columns to the left of thename. In the event a beneficiary is named as both a primary and contingent beneficiary, or if a beneficiary is not assigned to a beneficiaryclassification, such beneficiary shall be a primary beneficiary. If no percentages are assigned to beneficiaries, or if the percentage total for anybeneficiary classification exceeds 100 percent, the beneficiaries in that beneficiary classification will share equally. If the percentage total for eachbeneficiary classification is less than 100 percent, any remaining percentage will be divided equally among the beneficiaries within such class. If all ofthe beneficiaries die before me, or if none are designated, my Roth IRA assets will be paid to my estate. This designation revokes and supercedes allearlier beneficiary designations which may apply to this Roth IRA.PRIMARYSHARECONTINGENTSHARE%%%%%%%%%%%%Total 100%NAME OF BENEFICIARYSSN OR TINRELATIONSHIP TOROTH IRA OWNERDATE OFBIRTHADDRESS, CITY, STATE, AND ZIPTotal 100%Roth IRA Organizer-Custodial2021 Wolters Kluwer Financial Services, Inc.All rights reserved.IRACUSROTHLZ 11/1/2021(2111).00Page 2 of 14

SPOUSAL CONSENTCommunity or marital property state laws may require spousal consent for a nonspouse beneficiary designation. The laws of the state in which thefinancial organization is domiciled, the Roth IRA owner resides, the trust is located, the spouse resides, or this transaction is consummated should bereviewed to determine if such a requirement exists. Spousal consent for the beneficiary designation may also be required by financial organizationpolicy.(Roth IRA Owner Initials)I Am Married. I understand that if I designate a primary beneficiary other than my spouse, my spouse must consent bysigning below.I Am Not Married. I understand that if I marry in the future, I must complete a new Designation of Beneficiary form, whichincludes the spousal consent documentation.I am the spouse of the Roth IRA owner. Because of the significant consequences associated with giving up my interest in the Roth IRA, the custodianhas not provided me with legal or tax advice, but has advised me to seek tax or legal advice. I acknowledge that I have received a fair and reasonabledisclosure of the Roth IRA owner's assets or property including any financial obligations for a community property state. In the event I have a legalinterest in the Roth IRA assets, I hereby give to the Roth IRA owner such interest in the assets held in this Roth IRA and consent to the beneficiarydesignation set forth in this Application.(Roth IRA Owner Initials)Signature of SpouseDateSignature of Witness (if required)(Witness cannot be a beneficiary of this Roth IRA)DateSIGNATURESI certify that the information provided by me on this Application is accurate, and that I have received a copy of the Application, IRS Form 5305-RA,Roth Individual Retirement Custodial Account, a Disclosure Statement, and a Financial Disclosure. I agree to be bound by the terms and conditionsfound in the Agreement, Disclosure Agreement, Financial Disclosure, and amendments thereto. Except as otherwise provided by law, I assume soleresponsibility for all consequences relating to my actions concerning this Roth IRA. I understand that I may revoke this Roth IRA on or before seven(7) days after the date of establishment. My designation of the tax year for my contribution, and any election to treat a contribution as a rollover orrecharacterization, is irrevocable. I understand that the custodian cannot provide, and has not provided, me with tax or legal advice. I have beenadvised to seek the guidance of a tax or legal professional.Signature of Roth IRA OwnerRoth IRA Organizer-Custodial2021 Wolters Kluwer Financial Services, Inc.All rights reserved.DateSignature of CustodianDateIRACUSROTHLZ 11/1/2021(2111).00Page 3 of 14

ROTH INDIVIDUAL RETIREMENT CUSTODIAL ACCOUNT5305-RA(Under Section 408A of the Internal Revenue Code)Form(Rev. April 2017) Department of the Treasury Internal Revenue ServiceThe depositor and the custodian make the following agreement:Article I. Except in the case of a qualified rollover contribution describedin section 408A(e) or a recharacterized contribution described in section408A(d)(6), the custodian will accept only cash contributions up to 5,500per year for 2013 through 2017. For individuals who have reached theage of 50 by the end of the year, the contribution limit is increased to 6,500 per year for 2013 through 2017. For years after 2017, these limitswill be increased to reflect a cost-of-living adjustment, if any.Article II.1. The annual contribution limit described in Article I is graduallyreduced to 0 for higher income levels. For a depositor who is single ortreated as single, the annual contribution is phased out between adjustedgross income (AGI) of 118,000 and 133,000; for a married depositorfiling jointly, between AGI of 186,000 and 196,000; and for a marrieddepositor filing separately, between AGI of 0 and 10,000. Thesephase-out ranges are for 2017. For years after 2017, the phase-outranges, except for the 0 to 10,000 range, will be increased to reflect acost-of-living adjustment, if any. Adjusted gross income is defined insection 408A(c)(3).2. In the case of a joint return, the AGI limits in the precedingparagraph apply to the combined AGI of the depositor and his or herspouse.Article III. The depositor's interest in the balance in the custodial accountis nonforfeitable.Article IV.1. No part of the custodial account funds may be invested in lifeinsurance contracts, nor may the assets of the custodial account becommingled with other property except in a common trust fund orcommon investment fund (within the meaning of section 408(a)(5)).2. No part of the custodial account funds may be invested in collectibles(within the meaning of section 408(m)) except as otherwise permitted bysection 408(m)(3), which provides an exception for certain gold, silver,and platinum coins, coins issued under the laws of any state, and certainbullion.Article V.1. If the depositor dies before his or her entire interest is distributed tohim or her and the depositor's surviving spouse is not the designatedbeneficiary, the remaining interest will be distributed in accordance with(a) below or, if elected or there is no designated beneficiary, inaccordance with (b) below.(a) The remaining interest will be distributed, starting by the end ofthe calendar year following the year of the depositor's death,over the designated beneficiary's remaining life expectancy asdetermined in the year following the death of the depositor.(b) The remaining interest will be distributed by the end of thecalendar year containing the fifth anniversary of the depositor'sdeath.2. The minimum amount that must be distributed each year underparagraph 1(a) above is the account value at the close of business onDecember 31 of the preceding year divided by the life expectancy (in thesingle life table in Regulations section 1.401(a)(9)-9) of the designatedbeneficiary using the attained age of the beneficiary in the year followingthe year of the depositor's death and subtracting 1 from the divisor foreach subsequent year.3. If the depositor's surviving spouse is the designated beneficiary, suchspouse will then be treated as the depositor.Article VI.1. The depositor agrees to provide the custodian with all informationnecessary to prepare any reports required by sections 408(i) and408A(d)(3)(E), Regulations sections 1.408-5 and 1.408-6, or otherguidance published by the Internal Revenue Service (IRS).2. The custodian agrees to submit to the IRS and depositor the reportsprescribed by the IRS.Article VII. Notwithstanding any other articles which may be added orincorporated, the provisions of Articles I through IV and this sentence willbe controlling. Any additional articles inconsistent with section 408A, therelated regulations, and other published guidance will be invalid.Roth IRA Organizer-Custodial2021 Wolters Kluwer Financial Services, Inc.All rights reserved.Do Not File withInternal Revenue Servicel AmendmentArticle VIII. This agreement will be amended as necessary to complywith the provisions of the Code, the related regulations, and otherpublished guidance. Other amendments may be made with the consent ofthe persons whose signatures appear on the Application that accompaniesthis agreement.Article IX.9.01 Your Roth IRA Documents. This Internal Revenue Service (IRS)Forms 5305 series agreement for Roth IRAs, amendments,application, beneficiary designation, disclosure statement, and otherdocumentation, if any, set forth the terms and conditions governingyour Roth individual retirement account (IRA) and your or, afteryour death, your beneficiary's relationship with us. Articles Ithrough VIII of the IRS 5305 agreement have been reviewed andapproved by the IRS. The disclosure statement sets forth variousRoth IRA rules in simpler language. Unless it would be inconsistentto do so, words and phrases used in this document should beconstrued so the singular includes the plural and the plural includesthe singular.9.02 Definitions. This Agreement refers to you as the depositor, and usas the custodian. References to "you," "your," and "Roth IRAowner" will mean the depositor, and "we," "us," and "our" willmean the custodian. The terms "you" and "your" will apply to you.In the event you appoint a third party, or have a third partyappointed on your behalf, to handle certain transactions affectingyour Roth IRA, such third party will be your agent and will beconsidered "you" for purposes of this agreement. Additionally,references to "Roth IRA" will mean the custodial account.9.03 Additional Provisions. Additional provisions may be attached to,and made a part of, this agreement by either party. The provisionsmust be in writing, agreed to by us, and in a format acceptable to us.9.04 Our Fees and Expenses. We may charge reasonable fees and areentitled to reimbursement for any expenses we incur in establishingand maintaining your Roth IRA. We may change the fees at anytime by providing you with notice of such changes. We will provideyou with fee disclosures and policies. We may deduct fees directlyfrom your Roth IRA assets or bill you separately. The payment offees has no effect on your contributions. Additionally, we have theright to liquidate your Roth IRA assets to pay such fees andexpenses. If you do not direct us on the liquidation, we will liquidatethe assets of our choice and will not be responsible for any losses orclaims that may arise out of the liquidation.9.05 Amendments. We may amend your Roth IRA in any respect and atany time, including retroactively, to comply with applicable lawsgoverning retirement plans and the corresponding regulations. Anyother amendments shall require your consent, by action or noaction, and will be preceded by written notice to you. Unlessotherwise required, you are deemed to automatically consent to anamendment, which means that your written approval is not requiredfor the amendment to apply to the Roth IRA. In certain instances thegoverning law or our policies may require us to secure your writtenconsent before an amendment can be applied to the Roth IRA. Ifyou want to withhold your consent to an amendment, you mustprovide us with a written objection within 30 days of the receipt dateof the amendment.9.06 Notice and Delivery. Any notice mailed to you will be deemeddelivered and received by you, five days after the postmark date.This fifth day following the postmark is the receipt date. Noticeswill be mailed to the last address we have in our records. You areresponsible for ensuring that we have your proper mailing address.Upon your consent, we may provide you with notice in a deliveryformat other than by mail. Such formats may include variouselectronic deliveries. Any notice, including terminations, change inpersonal information, or contributions mailed to us will be deemeddelivered when actually received by us based on our ordinarybusiness practices. All notices must be in writing unless our policiesand procedures provide for oral notices.IRACUSROTHLZ 11/1/2021(2111).00Page 4 of 14

9.07 Applicable Laws. This agreement will be construed and interpretedin accordance with the laws of, and venued in, our state of domicile.9.08 Disqualifying Provisions. Any provision of this agreement thatwould disqualify the Roth IRA will be disregarded to the extentnecessary to maintain the account as a Roth IRA.9.09 Interpretation. If any question arises as to the meaning of anyprovision of this agreement, then we shall be authorized to interpretany such provision, and our interpretation will be binding upon allparties.9.10 Representations and Indemnity. You represent that anyinformation you or your agents provide to us is accurate andcomplete, and that your actions comply with this agreement andapplicable laws governing retirement plans. You understand that wewill rely on the information provided by you, and that we have noduty to inquire about or investigate such information. We are notresponsible for any losses or expenses that may result from yourinformation, direction, or actions, including your failure to act. Youagree to hold us harmless, to indemnify, and to defend us againstany and all actions or claims arising from, and liabilities and lossesincurred by reason of your information, direction, or actions.Additionally, you represent that it is your responsibility to seek theguidance of a tax or legal professional for your Roth IRA issues.We are not responsible for determining whether your contributionsor distributions comply with this agreement or the federal lawsgoverning retirement plans. We are not responsible for any taxes,judgments, penalties, or expenses incurred in connection with yourRoth IRA, or any losses that are a result of events beyond ourcontrol. We have no responsibility to process transactions until afterwe have received appropriate direction and documentation, and wehave had a reasonable opportunity to process the transactions. Weare not responsible for interpreting or directing beneficiarydesignations or divisions, including separate accounting, courtorders, penalty exception determinations, or other similar situations.9.11 Investment of Roth IRA Assets.(a) Deposit Investments Only. The deposit investments we offerare limited to savings, share and money market accounts, andcertificates of deposit (CDs), and will earn a reasonable rate.This Roth IRA is not, and cannot be, a self-directed Roth IRA.It does not permit you to invest your contributions or Roth IRAassets in nondeposit investments such as property, annuities,stocks, bonds, and government, municipal or United StatesTreasury securities.(b) Investment of Contributions. You may invest Roth IRAcontributions in any Roth IRA deposit investments we offer. Ifyou fail to provide us with investment direction for acontribution, we will return or hold all or part of suchcontribution based on our policies and procedures. We will notbe responsible for any loss of Roth IRA income associated withyour failure to provide appropriate investment direction.(c) Directing Investments. All investment directions must be in aformat or manner acceptable to us. You may invest in any RothIRA investments that you are qualified to purchase, and that weare authorized to offer and do offer at the time of the investmentselection, and that are acceptable under the applicable lawsgoverning retirement plans. Your Roth IRA investments will beregistered in our name for the benefit of your Roth IRA.Specific investment information may be provided at the time ofthe investment.Based on our policies, we may allow you to delegate theinvestment responsibility of your Roth IRA to an agent byproviding us with written notice of delegation in a formatacceptable to us. We will not review or guide your agent'sdecisions, and you are responsible for the agent's actions orfailure to act. We are not responsible for directing yourinvestments, or providing investment advice, including guidanceon the suitability or potential market value of variousinvestments.Roth IRA Organizer-Custodial2021 Wolters Kluwer Financial Services, Inc.All rights reserved.9.129.139.149.159.169.179.18(d) Investment Fees and Asset Liquidation. We have the right toliquidate your Roth IRA assets to pay fees and expenses, federaltax levies, or other assessments on your Roth IRA. If you do notdirect us on the liquidation, we will liquidate the assets of ourchoice and will not be responsible for any losses or claims thatmay arise out of the liquidation.Distributions. Withdrawal requests must be in a format acceptableto us, or on forms provided by us. We may require you, or yourbeneficiary after your death, to elect a distribution reason, providedocumentation, and provide a proper tax identification numberbefore we process a distribution. These withdrawals may be subjectto taxes, withholding, and penalties. Distributions will generally bein cash.Required minimum distributions for your beneficiaries will bebased on Treasury Regulations 1.408A-6, 1.401(a)(9) and 1.408-8in addition to our then current policies and procedures. The requiredminimum distribution regulations are described within theDisclosure Statement. In the event a beneficiary, after your death,fails to take a required minimum distribution we may do nothing,distribute the entire Roth IRA balance, or distribute the requiredminimum distribution based on our own calculation.Spouse Beneficiary. Notwithstanding Article V, a spousebeneficiary shall be permitted all the beneficiary options allowedunder law or applicable regulations. The default election for aspouse beneficiary is the life expectancy method. If your survivingspouse fails to take the required minimum distribution, he/she isdeemed to have treated your Roth IRA as his/her own. If yoursurviving spouse is your sole beneficiary, your spouse may treatyour Roth IRA as his/her own Roth IRA and would not be subject tothe required minimum distribution rules.Cash Contributions. We may accept transfers, rollovers,conversions, and other similar contributions in cash from otherIRAs, eligible retirement plans, and as allowed by law. Prior tocompleting such transactions we may require that you providecertain information in a format acceptable to us.Reports and Records. We will maintain the records necessary forIRS reporting on this Roth IRA. Required reports will be providedto you, or your beneficiary after your death, and the IRS. If youbelieve that your report is inaccurate or incomplete, you must notifyus in writing within 30 days following the receipt date. Yourinvestments may require additional state and federal reporting.Termination. You may terminate this agreement without ourconsent by providing us with a written notice of termination. Atermination and the resulting distribution or transfer will beprocessed and completed as soon as administratively feasiblefollowing the receipt of proper notice. At the time of termination wemay retain the sum necessary to cover any fees and expenses, taxes,or investment penalties.Our Resignation. We can resign at any time by providing you with30 days written notice prior to the resignation date, or within fivedays of our receipt of your written objection to an amendment. Inthe event you materially breach this agreement, we can terminatethis agreement by providing you with five days prior written notice.Upon our resignation, you must appoint a qualified successorcustodian or trustee. Your Roth IRA assets will be transferred to thesuccessor custodian or trustee once we have received appropriatedirection. Transfers will be completed within a reasonable timefollowing our resignation notice and the payment of your remainingRoth IRA fees or expenses. At the time of resignation we may retainthe sum necessary to cover any fees and expenses, taxes, orinvestment penalties. If you fail to provide us with acceptabletransfer direction within 30 days from the date of the notice we cantransfer the assets to a successor custodian or trustee of our choiceor distribute them to you in cash.Successor Organization. If we merge with, purchase, or areacquired by, another organization, such organization, if qualified,may automatically become the successor custodian or trustee of yourRoth IRA.IRACUSROTHLZ 11/1/2021(2111).00Page 5 of 14

IRS FORM 5305-RA INSTRUCTIONS (Rev. 4-2017)General InstructionsSection references are to the Internal RevenueCode unless otherwise noted.Purpose of FormForm 5305-RA is a model custodial accountagreement that meets the requirements of section408A. However, only Articles I through VIIIhave been reviewed by the IRS. A Rothindividual retirement account (Roth IRA) isestablished after the form is fully executed byboth the individual (depositor) and the custodian.This account must be created in the United Statesfor the exclusive benefit of the depositor and hisor her beneficiaries.Do not file Form 5305-RA with the IRS.Instead, keep it with your records.Unlike contributions to traditional individualretirement arrangements, contributions to a RothIRA are not deductible from the depositor'sgross income; and distributions after 5 years thatare made when the depositor is 59 1/2 years ofage or older or on account of death, disability, orthe purchase of a home by a first-time homebuyer(limited to 10,000), are not includible in grossRoth IRA Organizer-Custodial2021 Wolters Kluwer Financial Services, Inc.All rights reserved.income. For more information on Roth IRAs,including the required disclosures the custodianmust give the depositor, see Pub. 590-A,Contributions to Individual RetirementArrangements (IRAs), and Pub. 590-B,Distributions from Individual RetirementArrangements (IRAs).DefinitionsCustodian. The custodian must be a bank orsavings and loan association, as defined insection 408(n), or any person who has theapproval of the IRS to act as custodian.Depositor. The depositor is the person whoestablishes the custodial account.Specific InstructionsArticle I. The depositor may be subject to a 6%tax on excess contributions if (1) contributions toother individual retirement arrangements of thedepositor have been made for the same tax year,(2) the depositor's adjusted gross incomeexceeds the applicable limits in Article II for thetax year, or (3) the depositor's and spouse'scompensation is less than the amount contributedby or on behalf of them for the tax year.Article V. This article describes howdistributions will be made from the Roth IRAafter the depositor's death. Elections madepursuant to this article should be reviewedperiodically to ensure they correspond to thedepositor's intent. Under paragraph 3 of ArticleV, the depositor's spouse is treated as the ownerof the Roth IRA upon the death of the depositor,rather than as the beneficiary. If the spouse is tobe treated as the beneficiary, and not the owner,an overriding provision should be added toArticle IX.Article IX. Article IX and any that follow itmay incorporate additional provisions that areagreed to by the depositor and custodian tocomplete the agreement. They may include, forexample, definitions, investment powers, votingrights, exculpatory provisions, amendment andtermination, removal of the custodian,custodian's fees, state law requirements,beginning date of distributions, accepting onlycash, treatment of excess contributions,prohibited transactions with the depositor, etc.Attach additional pages if necessary.IRACUSROTHLZ 11/1/2021(2111).00Page 6 of 14

ROTH IRA DISCLOSURE STATEMENTRight to Revoke Your Roth IRA. With some exceptions, you have theright to revoke this Roth individual retirement account (IRA) within sevendays of receiving this Disclosure Statement. If you revoke your Roth IRA,we will return your entire Roth IRA contribution without any adjustmentfor items such as sales commissions, administrative expenses, orfluctuation in market value. Exceptions to your right of revocation includethat you may not revoke a Roth IRA established with a recharacterizedcontribution, nor do you have the right to revoke upon amendment of thisagreement.You may revoke your Roth IRA by providing us with written notice.The revocation notice may be mailed by first-class mail, or hand deliveredto us. If your notice is mailed by first-class, postage pre-paid mail, therevocation will be deemed mailed on the date of the postmark.If you have any questions or concerns regarding the revocation of yourRoth IRA, please call or write to us. Our telephone number, address, anda contact name to be used for communications can be found on theapplication that accompanies this Disclosure Statement and InternalRevenue Service (IRS) Forms 5305 series agreement.This Disclosure Statement. This Disclosure Statement provides you, oryour beneficiaries after your death, with a summary of the rules andregulations governing this Roth IRA.Definitions. The IRS Forms 5305 series agreement for Roth IRAscontains a definitions section. The definitions found in such section applyto this agreement. The IRS refers to you as the depositor, and us as thecustodian. References to "you," "your," and "Roth IRA owner" will meanthe depositor, and "we," "us," and "our" will mean the custodian. Theterms "you" and "your" will apply to you. In the event you appoint a thirdparty, or have a third party appointed on your behalf to handle certaintransactions affecting your Roth IRA, such third party will be consideredyour agent and, therefore, "you" for purposes of this agreement.Additionally, references to "Roth IRA" will mean the custodial account.For Additional Guidance. It is in your best interest to seek the guidanceof a tax or legal professional before completing any Roth IRAestablishment documents. For more information, you can also refer to IRSPublication 590-A, Contributions to Individual Retirement Arrangements(IRAs), IRS Publication 590-B, Distributions from Individual RetirementArrangements (IRAs), instructions to your federal income tax return, orthe IRS's web site at www.irs.gov.Roth IRA Restrictions and Approval.1. IRS Form 5305-R or 5305-RA Agreement. This DisclosureStatement and the IRS Forms 5305 series agreement, amendments,application, and additional provisions set forth the terms andconditions governing your Roth IRA. Such documents are theagreement.2. Individual/Beneficiary Benefit. This Roth IRA must be for theexclusive benefit of you and, upon your death, your beneficiaries.The Roth IRA must be established in your name and not in the nameof your beneficiary, living trust, or another party or entity.3. Beneficiary Designation. By completing the appropriate section onthe corresponding Roth IRA application you may designate anyperson(s) as your beneficiary to receive your Roth IRA assets uponyour death. You may also change or revoke an existing designation insuch manner and in accordance with such rules as we prescribe forthis purpose. If there is no beneficiary designation

disclosure of the Roth IRA owner's assets or property including any financial obligations for a community property state. In the event I have a legal interest in the Roth IRA assets, I hereby give to the Roth IRA owner such interest in the assets held in this Roth IRA and consent to the beneficiary designation set forth in this Application.