Transcription

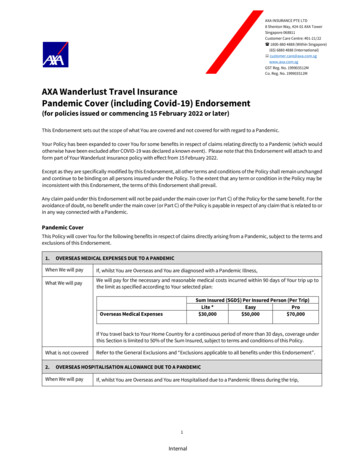

AXA INSURANCE PTE LTD8 Shenton Way, #24-01 AXA TowerSingapore 068811Customer Care Centre: #01-21/22 1800-880 4888 (Within Singapore)(65) 6880 4888 (International) customer.care@axa.com.sgwww.axa.com.sgGST Reg. No. 199903512MCo. Reg. No. 199903512MAXA Wanderlust Travel InsurancePandemic Cover (including Covid-19) Endorsement(for policies issued or commencing 15 February 2022 or later)This Endorsement sets out the scope of what You are covered and not covered for with regard to a Pandemic.Your Policy has been expanded to cover You for some benefits in respect of claims relating directly to a Pandemic (which wouldotherwise have been excluded after COVID-19 was declared a known event). Please note that this Endorsement will attach to andform part of Your Wanderlust insurance policy with effect from 15 February 2022.Except as they are specifically modified by this Endorsement, all other terms and conditions of the Policy shall remain unchangedand continue to be binding on all persons insured under the Policy. To the extent that any term or condition in the Policy may beinconsistent with this Endorsement, the terms of this Endorsement shall prevail.Any claim paid under this Endorsement will not be paid under the main cover (or Part C) of the Policy for the same benefit. For theavoidance of doubt, no benefit under the main cover (or Part C) of the Policy is payable in respect of any claim that is related to orin any way connected with a Pandemic.Pandemic CoverThis Policy will cover You for the following benefits in respect of claims directly arising from a Pandemic, subject to the terms andexclusions of this Endorsement.1.OVERSEAS MEDICAL EXPENSES DUE TO A PANDEMICWhen We will payIf, whilst You are Overseas and You are diagnosed with a Pandemic Illness,What We will payWe will pay for the necessary and reasonable medical costs incurred within 90 days of Your trip up tothe limit as specified according to Your selected plan:Sum Insured (SGD ) Per Insured Person (Per Trip)Lite *EasyPro 30,000 50,000 70,000Overseas Medical ExpensesIf You travel back to Your Home Country for a continuous period of more than 30 days, coverage underthis Section is limited to 50% of the Sum Insured, subject to terms and conditions of this Policy.What is not covered2.Refer to the General Exclusions and “Exclusions applicable to all benefits under this Endorsement”.OVERSEAS HOSPITALISATION ALLOWANCE DUE TO A PANDEMICWhen We will payIf, whilst You are Overseas and You are Hospitalised due to a Pandemic Illness during the trip,1Internal

What We will payWe will pay for each full day of Hospitalisation up to the limit as specified according to Your selectedplan:Overseas Hospitalisation AllowanceSum Insured (SGD ) Per Insured Person (Per Trip)Lite *EasyPro 50 per day; 50 per day; 50 per day;Up to 1,000Up to 2,000Up to 3,000The period of Hospitalisation must be within the Period of Insurance and every day of Hospitalisationshall be counted towards the total number of days of Hospitalisation, notwithstanding that such daysmay not run consecutively.What is not covered3.Refer to the General Exclusions and “Exclusions applicable to all benefits under this Endorsement”.EMERGENCY MEDICAL EVACUATION & REPATRIATION DUE TO A PANDEMICWhen We will payWhat We will payIf, whilst You are Overseas and You are diagnosed with a Pandemic Illness and AAS certifies that it ismedically necessary to transfer You to another location for medical treatment or to repatriate You backto Singapore,We will arrange and pay for the costs of transportation including medical supplies, provided that:(a) Clearance for the evacuation and/or repatriation is approved by the relevant governmentauthority and medical facilities;(b) Any decision on the evacuation and/or repatriation will be exclusively and jointly made by the attendingDoctor and AAS;(c) Our maximum liability for repatriation to any country other than Singapore is the equivalent of thecost of repatriation to Singapore;In the case of death as a result of Pandemic Illness whilst Overseas, We will arrange and include the costof returning Your mortal remains to Singapore or to an alternative destination besides Singapore (atthe request of Your personal representative) or the cost of local burial in the country that You werevisiting.What is not coveredIn addition to the General Exclusions and the section “Exclusions applicable to all benefits under thisEndorsement”, We will not pay any claims under this benefit in respect of:(a)(b)(c)(d)(e)4.expenses incurred for services provided by another party for which You are not liable to pay, or anyexpenses already included in the costs of the trip;expenses for a service not approved and arranged by AAS or its authorized representative;treatment performed or ordered by a person who is not a Doctor;expenses incurred if treatment can be reasonably delayed until Your return to Singapore; andcosts related to religious ceremony or rites.TRIP CANCELLATION OR POSTPONEMENT DUE TO A PANDEMICWhen We will payWhen You have to unavoidably cancel or postpone Your trip due to any of these reasons occurringwithin 30 days prior to the commencement of the trip:You are diagnosed with a Pandemic Illness and are certified unfit to travel in the opinion of theDoctor;(b) You are suspected of being infected with a Pandemic Illness and are advised to self-isolate at homeby the Doctor or is served the Quarantined Order by the Singapore Government;(c) You are denied boarding the plane at the airport on the departure date of Your trip and are certifiedunfit to travel by the Doctor due to a Pandemic Illness;(d) Your Family Member is diagnosed (or is suspected of being infected) with a Pandemic Illness;(e) There is only one travelling companion going with You on the trip and he/she is diagnosed (or issuspected of being infected) with a Pandemic Illness;(a)2Internal

(f)What We will payA Family Member who is to host You at their place of residence during Your trip is diagnosed witha Pandemic illness;We will reimburse these expenses that You have incurred:1.2.the irrecoverable, pre-paid and unutilized charges of Your travel fare and hotel accommodation ifYour trip has to be cancelled; orthe resulting administrative charges to postpone the trip, for which You have paid and are legallyliable for the irrecoverable, pre-paid travel fare and hotel accommodation expenses.We will pay reimburse You up to the limit as specified according to Your selected plan:Sum Insured (SGD ) Per Insured Person (Per Trip)Lite *EasyPro 500 1,000 1,500 200 500 800Trip CancellationTrip PostponementThe Policy will only pay for a claim in respect of either Trip Cancellation or Trip Postponement for thesame event, but not both.Once an Insured Person makes a claim under this benefit, the coverage immediately terminates for thatInsured Person. However, the Policy continues to have force and effect with regards to other InsuredPersons in the same Policy who continue with the trip as scheduled.What is not coveredIn addition to the General Exclusions and “Exclusions applicable to all benefits under thisEndorsement”, We will not pay any claims in respect of:cancelling the trip after learning there are people infected with the Pandemic Illness at the planneddestination;(b) loss of vouchers, reward points or holiday points that You have used, in part or full, to pay forYour trip;(c) policies purchased less than three (3) days before the trip;(d) any airport taxes and administration fees included in the cost of your flights;(e) Your being unable to travel or choosing not to travel because the Singapore government and/orthe local government authority advises against travel due to a Pandemic.(a)5.TRIP CURTAILMENT OR REARRANGEMENT DUE TO A PANDEMICWhen We will payIf, whilst You are Overseas and You have to unavoidably Curtail any part of Your trip to return toSingapore earlier than planned or alter any part of Your trip itinerary due to any of these reasons:You are diagnosed with a Pandemic Illness and certified unfit to continue with Your trip by aDoctor;(b) Death or Hospitalisation of a Family Member due to a Pandemic Illness;(c) An outbreak of the Pandemic at the planned destination which prevents You from continuing withthe trip and You have to unavoidably incur additional accommodation costs to extend Your stay.(a)3Internal

What We will payWe will reimburse these expenses that You have incurred:any irrecoverable, pre-paid and unutilized charges for Your travel fare and accommodation costs; orany additional travel costs (economy air ticket and accommodation expenses but excluding cost ofmeals, room service) that are necessarily incurred to alter Your itinerary to return to Singapore.1.2.We will reimburse You up to the limit as specified in the table according to Your selected plan:Trip Curtailment or RearrangementSum Insured (SGD ) Per Insured Person (Per Trip)Lite *EasyPro 500 1,000 1,500The Policy will only pay for a claim in respect of either Trip Curtailment or Trip Rearrangement for thesame event, but not both.What is not coveredIn addition to the General Exclusions and “Exclusions applicable to all benefits under thisEndorsement”, We will not pay any claims in respect of:Loss of vouchers, reward points or holiday points that You have used, in part or full, to pay forYour trip;(b) Cutting your trip short after learning there are people infected with the Pandemic Illness at theplanned destination.(c) Advisory from the Singapore government to Curtail Your trip and return to Singapore due to aPandemic;(d) Policies purchased less than three (3) days before the trip;(e) Any airport taxes and administration fees included in the cost of your flights.(a)* The Lite Plan is not applicable to the Annual Multi-Trip Policy.Exclusions applicable to all benefits under this Endorsement:In addition to the General Exclusions, We will also not pay any claim in respect of:1.2.3.4.5.6.7.8.9.10.11.12.13.You, Your Family Member, Your travelling companion or the family that You will be staying with during the trip, who isdiagnosed (or suspected of being infected) with a Pandemic Illness at the point of purchase of this Policy or trip, whicheveris earlier.Circumstances known to you before You purchased this Policy or trip which could reasonably have been expected to lead toa claim on the Policy.Any reason not listed in the 'When We will Pay' section of the benefits.Any unused or additional costs incurred by You which are recoverable from the airline, hotel, travel agent or any otherprovider of travel and/or accommodation, including but not limited to a refund, voucher, credit or re-booking of the trip ascompensationAny medical treatment or medical care that cannot be attributed to a Pandemic Illness.Your travel to a country, specific area or event when the Singapore government or regulatory authority in a country to/fromwhich you are travelling has advised against travelling.Loss caused directly or indirectly by government regulations or control including closure of borders of the country.Your failure to obtain any mandatory vaccines, inoculations or prescribed medications prior to Your trip.Costs of mandatory COVID-19 diagnostic tests that are required to take for the trip or cancellation/curtailment claims arisingfrom your failure to take these tests in a timely manner.Your disinclination to travel, change of mind or fear of travelling due to the Pandemic.Cruises are excluded from coverage under this Endorsement. By cruises, We mean travels on a cruise ship or cruise linerwhich lasts the period of time outlined in Your holiday package to visit multiple destinations.Any medical treatment or medical care that are paid for by the local government authority.One-way trips.4Internal

AXA Wanderlust Travel Insurance Policy Wordings(for policies issued or commencing 15 February 2022 or later)Thank you for choosing AXA to protect your travel plans.Having received and accepted Your first premium and any subsequent premiums, We will insure You based on the planstated on Your Policy Schedule.1.What Your Policy consistsYour Wanderlust Policy is a contract between You and AXA, and it consists of: this Policy Wordings; the Policy Schedule, which has details of all Insured Persons, the plan and the Period of Insurance; any Endorsements; and Your application, declaration and any other information given.If You have any questions after reading these documents, please contact AXA Customer Care.2.Check Your PolicyYou have 7 days from the issuance of this Policy or before Your trip starts (whichever is earlier) to check and inform Us if Youfind any of the Insured Persons' particulars and/or chosen plan(s) incorrect. Incorrect details can result in a claim beingdenied. If We do not hear from You at the end of the above-mentioned period, We will take it that the information iscomplete and correct.3.What You and all Insured Persons must doEvery Insured Person is individually and jointly responsible for the completeness and accuracy of the informationgiven to Us. For the cover under this Policy to be effective, You and all Insured Persons must follow all the conditionsof this Policy.Caring for YouWe want to ensure that You have a great experience every time You insure with Us. If in any way Our service falls below Yourexpectations, please let Us know so We can look into it.1.Your First ContactYou can email to Us at customer.care@axa.com.sg. It is important that You provide Us Your Policy number so that We canaddress Your case efficiently. Rest assured that We will look into Your concern promptly as soon as We receive Your email. Within 3 days: We will send You an acknowledgement email while We look into Your concern. Within 7 days: We will contact You if We need more information. Within 14 days: You can expect to get a full reply from Us on the matter.2.AppealIf You find that Our reply is not to Your satisfaction, You can email Us at axacares@axa.com.sg. We will respond to Your appealwithin 14 working days.3.Dispute ResolutionIf You are not satisfied with Our response, You can request for an independent dispute resolution organisation to assess andadvise You further. They can be contacted at:Financial Industry Disputes Resolution Centre Ltd (FIDREC)36 Robinson Road #15-01City House Singapore 068877Telephone: 6327 8878; Fax: 6327 1089Email: info@fidrec.com.sgWebsite: www.fidrec.com.sg5Internal

CONTENTS(A) SUMMARY OF BENEFITS . 8(B) ELIGIBILITY & SCOPE OF COVER. 9(C) DESCRIPTION OF BENEFITS . 11MEDICAL EXPENSES . 11SECTION 1 – OVERSEAS MEDICAL EXPENSES . 11SECTION 2 – HOSPITAL VISIT BENEFIT. 11SECTION 3 – CHILD CARE BENEFIT . 11SECTION 4 – OVERSEAS HOSPITALISATION ALLOWANCE . 12SECTION 5 – POST-TRIP MEDICAL EXPENSES . 12PERSONAL ACCIDENT . 12SECTION 6 – DOUBLE PUBLIC TRANSPORT COVERAGE . 12SECTION 7 – ACCIDENTAL DEATH & PERMANENT DISABLEMENT . 13SECTION 8 – COMPASSIONATE VISIT BENEFIT . 13SECTION 9 – SPECIAL GRANT . 14SECTION 10 – CHILD EDUCATION GRANT . 14EMERGENCY TRAVEL-RELATED ASSISTANCE . 14SECTION 11 – EMERGENCY MEDICAL EVACUATION & REPATRIATION . 14SECTION 12 – REPATRIATION OF MORTAL REMAINS BACK TO SINGAPORE . 15SECTION 13 – EMERGENCY PERSONAL MOBILE PHONE CHARGES . 15TRAVEL INCONVENIENCES . 16SECTION 14 – TRIP CANCELLATION . 16SECTION 15 – TRIP POSTPONEMENT . 16SECTION 16 – REPLACEMENT OF TRAVELLER. 16SECTION 17 – FINANCIAL COLLAPSE OF TRAVEL AGENCY . 17SECTION 18 – TRIP CURTAILMENT. 17SECTION 19 – NATURAL DISASTER BENEFIT . 18SECTION 20 – TRAVEL DELAY/ALTERNATIVE TRAVEL ARRANGEMENT . 18SECTION 21 – TRAVEL DIVERSION. 19SECTION 22 – OVERBOOKED FLIGHT. 20SECTION 23 – TRAVEL MISCONNECTION . 20SECTION 24 – BAGGAGE DELAY . 20SECTION 25 – LOSS/DAMAGE TO BAGGAGE & PERSONAL BELONGINGS . 20SECTION 26 – PURCHASE OF ESSENTIAL ITEMS . 22SECTION 27 – FRADULENT USE OF LOST CREDIT CARD . 22SECTION 28 – PERSONAL LIABILITY . 236Internal

SECTION 29 – HIJACKING AND/OR KIDNAPPING. 23ADVENTURE COVER AND OTHERS . 24SECTION 30 – FULL TERRORISM COVER . 24SECTION 31 – ADVENTURE COVER . 24SECTION 32 – SPORTS EQUIPMENT. 25SECTION 33 – RENTAL VEHICLE EXCESS . 25SECTION 34 – OVERSEAS WEDDING PHOTOSHOOT . 26(D) 24-HOUR EMERGENCY ASSISTANCE . 26(E) DEFINITIONS . 28(F) GENERAL EXCLUSIONS . 32(G) GENERAL CONDITIONS . 34(H) CLAIMS PROCEDURE. 377Internal

(A) SUMMARY OF BENEFITSThe following provides an overview of all the plans, their benefits and the respective Sum Insured of each benefit. Fordetails on how each benefit pays, refer to (C) Description of Benefits.Legend:Pre-TripRefers to the period before You depart Singapore for Your trip.OverseasRefers to the period You are travelling Overseas during the trip.Post-TripRefers to the period after You have returned to Singapore from Your trip.Add-on benefitSum Insured Per Insured Person (Per Trip)BENEFITSLite *EasyPreTripMEDICAL EXPENSES1Overseas Medical ExpensesAdult up to 70 years oldAdult above 70 years oldChildSub-limit for TCM treatment 30,000 30,000 30,000 100 250,000 50,000 150,000 250 300,000 70,000 250,000 5002Hospital Visit Benefit 1,000 5,000 5,0003Child Care Benefit 1,000 2,000 5,0004Overseas Hospitalisation AllowancePays for each day of HospitalisationPays for each day of Hospitalisation in ICU 2,000 200 400 10,000 200 400 20,000 200 4005Post-Trip Medical ExpensesAdult up to 70 years oldAdult above 70 years oldChild 10,000 1,000 5,000 10,000 1,000 5,000NANA 500,000 200,000 200,000 50,000 25,000 25,000 150,000 100,000 75,000 250,000 100,000 100,000 5,000N.A.PERSONAL ACCIDENT67Double Public Transport CoverageAdult up to 70 years oldAdult above 70 years oldChildAccidental Death & PermanentDisablementAdult up to 70 years oldAdult above 70 years oldChild8Compassionate Visit Benefit 1,500 5,0009Special Grant 1,000 2,000 4,000Child Education Grant 4,000 1,000 8,000 2,000 16,000 4,00010When the benefit paysProPays per ChildEMERGENCY TRAVEL-RELATED ASSISTANCE11Emergency Medical Evacuation &Repatriation 100,000 500,000Covered12Repatriation of Mortal Remains Back toSingapore 100,000 500,000Covered13Emergency Personal Mobile Phone Charges 150 150 1508InternalOverseasPostTrip

Sub-limit per day 50 50 50 1,000 5,000 6,000 200 500 800NANA 500TRAVEL INCONVENIENCES14Trip Cancellation15Trip Postponement16Replacement of Traveller17Financial Collapse of Travel Agency 1,000 2,000 3,00018Trip Curtailment 1,000 5,000 10,00019Natural Disaster Benefit 1,500 7,500 15,00020Travel Delay/ Alternative TravelArrangementPays for every 6 hours of delay (Overseas) 500 100 1,000 100 1,000 100NANA21Travel DiversionPays for every 6 hours of delay (Overseas) 1,000 10022Overbooked FlightNA 100 20023Travel MisconnectionNA 100 10024Baggage DelayPays for every 6 hours of delay (Overseas) 500 100 1,000 100 1,000 150 2,000 3,000 5,000 200 500 500 500 300 500 500 500 300 500 500 50025Loss/Damage to Baggage & PersonalBelongingsSub-limit per articleSub-limit for all ValuablesSub-limit for Mobile DevicesSub-limit for loss of passport26Purchase of Essential ItemsSub-limit per articleNANA 250 5027Fraudulent Use of Lost Credit CardNANA 1,50028Personal Liability 500,000 500,000 500,00029Hijacking and/or KidnappingPays for every 6 hours of detention 1,500 300 3,000 300 10,000 500ADVENTURE COVER AND OTHERS30Full Terrorism CoverCoveredCoveredCovered31Adventure CoverCoveredCoveredCovered 2,000 500 2,000 500 2,000 50032Sports EquipmentSub-limit per article33Rental Vehicle Excess 1,000 1,000 1,00034Overseas Wedding Photoshoot 2,500 2,500 2,500* The Lite Plan is not applicable to the Annual Multi-Trip Policy.9Internal

(B) ELIGIBILITY & SCOPE OF COVERWho can be covered:1.You are eligible for cover under this Policy if You hold a valid Singapore identification document, such as Singapore NRIC,Birth Certificate (for Child), Employment Pass, Work Permit, Long Term Visit Pass, Dependent Pass or Student Pass.2.For Adult Cover, You have to be at least 18 years old at the start of the Period of Insurance of the Policy.3.For Child Cover, the benefit limits under ‘Child Cover’ will apply.If a Child satisfies the eligibility requirements at the start of the Period of Insurance and becomes ineligible during the Periodof Insurance, this Policy shall extend to cover him/her under Child benefits till the end of that Period of Insurance.Scope of coverage:1.The original point of departure of Your trip must be from Singapore.2.You must purchase the Policy and must have fully paid Your premium before Your trip.3.Single-Trip Plan:(a) Maximum 9 adults and 5 Children who are travelling together on the same dates and to the same destination under onePolicy.(b) The adults and Children need not be related to one another.(c) Children must be covered together with at least one adult.(d) The maximum duration per trip allowed is 182 days.4.Annual Multi-Trip Plan:(a) Maximum 2 adult Family Members and 5 Children under one Policy.(b) Each Child must be related to at least one insured adult.(c) The adults can travel separately. However, the Children must travel with at least one of the insured adults.(d) Unlimited trips can be made to the selected region as long as each trip does not exceed 92 days.5.The premium will depend on Your selected Travel Region, as follows:(a) REGIONALAustralia, Brunei, Cambodia, China, Hong Kong, India, Indonesia, Japan, Korea, Laos, Macau, Malaysia, Mongolia,Myanmar, New Zealand, Sri Lanka, Taiwan, The Philippines, Thailand, Timor-Leste and Vietnam.(b) GLOBALWorldwide, excluding Afghanistan, Belarus, Crimea including Sevastopol, Cuba, Democratic Republic of Congo, Iran,Iraq, Liberia, North Korea, Russia, Somalia, Sudan, Syria, Ukraine, Venezuela and Zimbabwe.6.Under specific circumstances, Your insurance cover will automatically be extended beyond the Period of Insurance withoutadditional premium:(a) Up to 30 days, if You are Hospitalised whilst Overseas upon the written advice of a Doctor; or(b) Up to 72 hours, if You are unable to return to Singapore as planned due to the delay of the Public Transport that You arescheduled to travel in, which is not due to Your fault.10Internal

(C) DESCRIPTION OF BENEFITSImportant Notes:The benefits provided herein will not (under any sections) pay for claims of any kind directly or indirectly arising from, relating to orin any way connected with a Pandemic (including Covid-19). For the benefits that You will be covered for, please refer to Yourselected plan.MEDICAL EXPENSESPre-TripSECTION 1 – OVERSEAS MEDICAL EXPENSESOverseasPost-TripNote: For Lite plan, this benefit only applies for expenses incurred for HospitalisationWhen We will payIf, whilst You are Overseas on a trip, you suffer Injury or Illness and seek medical and/or dental treatmentOverseas.What We will payWe will reimburse the Medical Expenses (including expenses incurred for TCM) and Dental Expenses thatYou incurred within 90 days from the date of Injury or Illness, up to the Sum Insured under this Section.For a One-Way Trip Policy, coverage under this Section will cease 24 hours after You have clearedimmigration at Your intended destination.If You travel back to Your Home Country for a continuous period of more than 30 days, coverage underthis Section is limited to 50% of the Sum Insured.‘Home Country’ shall mean the country, other than Singapore, which You are granted rights ofcitizenship or permanent residence by the respective government.What is not coveredRefer to General Exclusions.Pre-TripOverseasPost-TripSECTION 2 – HOSPITAL VISIT BENEFITWhen We will payIf, whilst You are Overseas on a trip, You suffer Injury or Illness resulting in Hospitalisation for more than5 consecutive days and:(a) the attending Doctor has advised that You are not fit to travel back to Singapore; and(b) there is no adult who is at least 18 years old with You.What We will payWe will reimburse the following costs incurred, up to the Sum Insured under this Section, for one adultrelative or friend to visit and stay with You until the attending Doctor has advised that You are fit tocontinue with Your trip or to return to Singapore:(a) direct economy air, rail or sea travel fare, excluding domestic travel fares such as taxi, bus or intraci

Any unused or additional costs incurred by You which are recoverable from the airline, hotel, travel agent or any other provider of travel and/or accommodation, including but not limited to a refund, voucher, credit or re-booking of the trip as compensation 5. Any medical treatment or medical care that cannot be attributed to a Pandemic Illness. 6.