Transcription

D.S. Assemat How to Invest in Penny Stocks for Beginners1

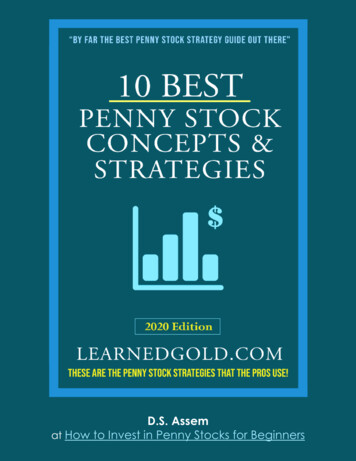

About the AuthorD.S AssemPenny Stock Trader, Researcher & Teacher - LearnedGold.ComD.S Assem is a professional Penny Stock trader and teacher with almost a decade ofknowledge and experience in making money with small cap stocks. Over the years, Ihave acquired the know-how, knowledge & tools that have allowed me to repeatedlyachieve success within the penny stock markets. I have traded penny stocks as both asolo trader and together with groups of other traders.There are many ways to make money with penny stocks, and I am here to share theabsolute best strategies with you.210 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Contentsi. IntroductionCopyright & Liability Notice4Preface. How to Use This “Best Penny Stock Strategies Guide”5Basics. Introduction to Basic Penny Stock Ideas & Concepts6ii. TOP 10 Best Penny Stock Strategies & ToolsStrategy #1. Best Penny Stock Screening Strategy For Massive Gains22Strategy #2. Best Strategy for Picking Great Quality Penny Stocks39Strategy #3. Best Brokers for Trading Penny Stocks51Strategy #4. Best Fundamental Analysis Strategy for Penny Stocks54Strategy #5. Best Technical Analysis Strategy for Penny Stocks58Strategy #6. Best Strategy for Trading Penny Stock Alerts68Strategy #7. Best Strategy for Trading The Penny Stock Pump & Dump76Strategy #8. Best Time to Buy or Sell a Penny Stock82Strategy #9. Best Strategy for Making Profits With .0001 Penny Stocks87Strategy #10. Best Penny Stock Exit Strategy for Maximum Risk Reduction91iii. ConclusionStart Winning. Time to Implement The Penny Stock Concepts & Strategies97310 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Copyright & Liability NoticeCopyrightCopyright 2020 by D.S. Assem.All rights reserved. No part of this book may be reproduced in any form on by anelectronic or mechanical means, including information storage and retrievalsystems, without permission in writing from the publisher, except by a reviewerwho may quote brief passages in a review.Disclaimer of Warranty / Limit of Liability10 Best Penny Stock Strategies & Concepts is the sole opinion and creation of theauthor. The author of this material used his best efforts in preparing this material,and makes no representation or warranties with respect to the accuracy,applicability, completeness or the contents of this e-book. The author disclaimsany warranties (expressed or implied) for any particular purpose, or anyconsequences arising from the use of this material. The author shall in no event beheld liable for any loss or damages, including but not limited to special,incidental, consequential, or other damages. Nothing in this strategies &concepts eBook may be construed as a guarantee of financial reward. Yourresults will be different. Use these strategies and ideas at your own risk. Just as witheverything in life, nothing is guaranteed. If you choose to move forward with thereading of this book and decide to utilize some of thesestrategies, be prepared to lose some or all of yourinvestment. With that said however, I personally have hadgreat success from these strategies, so do with this all asyou will.410 Best Penny Stock Concepts & StrategiesLearnedGold.Com

PrefaceLets face it, just about everyone out there has at least once or twice tried to make it big inthe stock markets. Almost like trying to win it big in Las Vegas. Well, the one thing thatthey (investors) probably didn’t take into consideration, is the fact that it is very hard to doso. It is especially hard if you don’t have the right teachers and mentors to show you theway. Well, this is where our book comes into play. It is filled with tactics and strategies thatwill give you a leg up on the competition in the Penny Stocks world. Although the book hasbeen written for the somewhat experienced trader, a novice trader can still greatly benefitfrom the tips and tricks that I will be teaching you.What the book will teach you, is the strategies about a very small part of the big bad StockMarket. I am of course talking about penny stocks. These penny stocks tend to have thebiggest risk to reward ratio. So if you really learn the material that we will be going overshortly, and apply yourself properly; you should be able to make a small fortune in themarkets. There is one small thing to keep in mind however. When you get to the end ofthis book, do not expect to just get rich overnight. You will still need to put in the work andtime to really be able to hone in the tactics and strategies that we are teaching you. Makesure to practice and test the strategies heavily before applying them in the real world.Paper trading is the way to go (more on this later).It has taken me much time and effort to learn the skills that I am about to share with you.So please do take your time in order to properly ingest all of the information.Without further adieu, lets get started.510 Best Penny Stock Concepts & StrategiesLearnedGold.Com

BasicsIntroduction to BasicPenny Stock Ideas &ConceptsThis section will go over some of the basic ideas andconcepts that comprise Penny Stocks.610 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Penny Stock BasicsI am sure that at some point, somebody told you to stay away from penny stocks. Theyeither said something like “penny stocks are super risky”, “penny stocks are too volatile”, “allpenny stocks are scams” or just a simple “penny stocks are a really bad investment”.Well, I am here to tell you that it is not the actual penny stocks that are bad. On the contrary,I believe that penny stocks are a great way of making money. If you ask me, it is the peoplethat know nothing about penny stocks who give penny stocks a bad name. I am talkingabout the everyday Bob’s of the world that end up losing all of their money with penny stocksbecause they don’t know enough about them. The knowledgeable penny stock traders onthe other hand end up profiting just about every single time they enter the markets. Just likeeverything else in life; if you know what you are doing and are good at something, thenchances are that you will do just fine. The lack of responsibility with some folks is justastounding.Alright, now that we got that out of the way, I will go aheadand make a few caveats regarding penny stocks.1.Penny Stocks Are Risky (just like any other stock)2.There are scams in penny stocks (it is true; however,even the bigger stock exchanges have their ownforms of scams that you need to watch out for. Theyare just not so easily seen by the public eyes).3.There isn’t as much regulation in penny stocks (this istrue, but once again the bigger stock companies alsotend to get away with some unethical stuff prettyregularly).710 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Penny Stock Basics Cont’dWhat are Penny Stocks & Where do They Trade?When a smaller company wants to go public, they can easily do so by becoming apenny stock company. Most penny stock companies typically tend to trade under 5 per share. These companies mainly trade on the OTC (Over the Counter)Markets, but some do trade on the larger exchanges like the NYSE (New York StockExchange).Most penny stock transactions take place on the OTC Markets via an electronictransaction process. Some of them can also be traded through Pink Sheets(privately owned stock listings). Unlike the NYSE, OTC Markets does not have atrading floor and the majority of the price quotations and transactions are doneelectronically. The OTC markets are typically not as regulated by the SEC whencompared to the bigger stock exchanges.How are They Different From the Larger Stocks?There is a lack of Available Public Information. One of the biggest differencesbetween penny stocks and the other larger stocks, is the fact that there isn’t asmuch company information that is available to the public. The larger and moreestablished companies tend to file regular reports with the SEC; whereas in thepenny stock companies, they are not required to do so (depending on the pennystock exchange).10 Best Penny Stock Concepts & Strategies8LearnedGold.Com

Penny Stock Basics Cont’dWhen you turn on the CNN news and look at other professional financial reports onstocks, you will typically not find any information there about penny stocks. This is notbecause nobody wants to profile some of these companies. No, it is because thepenny stock companies themselves are not making their information publiclyavailable. This is one of the reasons why penny stocks can be prone to investmentfraud schemes and why most people tend to stay away from them.What are the Different Types of Penny StocksIf you were to take a look at the otcmarkets.comwebsite, you would see that there are actually 3different markets available on their site. These are;OTCQB, OTCQX & the OTCPink market. Everysingle security managed by otcmarkets.com isorganized within one of these markets (QB, QX &Pink). According to otcmarkets.com, they brokethings down this way in order to make their financial markets more efficient. Thesecurities themselves are organized based on the quality and quantity of informationthat the companies provide. Lastly, there are the NASDAQ & NYSE penny stocks aswell. These are the “safer” micro cap stocks (according to some) because they aremore heavily regulated when compared to their OTCMarkets.com counterparts. Thelast type of penny stocks are the Grey sheets. You typically won’t trade grey sheets asthey are for after hour or delisted stock trading only.Penny stocks can be broken down into 4 different tiers. Every serious penny stocktrader should have a complete understanding of the differences between these 4tiers. Let’s break it down below.Tier 1 Penny Stocks: These penny stocks are listed on the NYSE or Nasdaq910 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Penny Stock Basics Cont’dexchanges and are typically traded for under 5 per share. These particular pennystocks are still speculative, but they are a little less open to manipulation and scamsas the companies are required to keep their documentation and filings up to datewith the SEC. The companies that are part of the tier 1 stocks are held to higherstandards than the otcmarkets.com stocks.Tier 2 Penny Stocks: When it comes to the second tier type of penny stocks, theseparticular companies have their stock priced for trading between a penny and 99cents. Some of these penny stocks can still be found on the two major exchanges,Nasdaq & NYSE. However, in order for a company to be traded on these twoexchanges, the company needs to have the price of their shares stay at least at 1/share. If their shares fall bellow that price, the company will receive writtencommunication from the exchanges letting them know that they could be delisted iftheir stock share price doesn’t get back up past 1.Tier 3 Penny Stocks: The third tier type of penny stocks trade below one penny pershare. So, basically any penny stock that trades below .01/share belongs to this tier.10 Best Penny Stock Concepts & Strategies10LearnedGold.Com

Penny Stock Basics Cont’dThese particular companies will typically not be found on the NYSE or NASDAQexchanges. You can instead find them on the OTCQB, OTCQX & OTCPink markets.We call these stocks “Sub-Penny Stocks”. These particular companies are typicallynot going to be found on the largerand more popular NYSE or NASDAQexchanges. You can instead find themon the OTCQB, OTCQX & OTCPinkmarkets. They are called “Sub-Pennies”.Tier 4 Penny Stocks: Although Tier 4 penny stocks can technically be tiered underthe 3rd tier, the stocks that trade between .0001 & .0009 have their own tier. We callthese stocks “Triple Zero Stocks”. Most of the penny stock newsletters and alerts arefocused around triple zero stocks. These can be very lucrative if you find yourselfholding a good triple zero stock.Common Penny Stock Terminology & LingoIn order for you to be able to properly learn the rest of this book’s material, thereare some terms that we will now go over. These terms are used in the penny stockworld daily and you definitely should know their meaning. We will include some verybasic terms as well as the more advanced ones.Buy: To buy a company’s shares of stock. You buy it with the intent that the stockwill hopefully go up so that you can make money with it.Sell: Sell means to sell the shares of a stock that you currently own. If the stock’sshare prices went up from your initial “Buy” price, then you will want to execute asell order in order to make a profit on your investment. The other time you will wantto sell is to get out of a stock if it starts going down. You do this to get out of1110 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Penny Stock Basics Cont’dyour position in order to not lose money.Short Sell: This is a method that is used to sell a stock that you don’t own. I know,sounds confusing right? Well, it is really not. You take a loan out from your broker tobuy shares from them. Then you wait for the price of the stock to go down so thatyou can sell those same shares back to the broker for a lower price than where youbought them initially. This is called shorting the stock, where you make money withthe stock price going down.Level 2 Quotes: This is a set of real timetradinginformationthatincludesinformation on who the current marketmakers are, the stock’s Ask or Bid priceand order/transaction history.Market Maker: A market maker is anindividual market participant or anemployee of an exchange that buysand/or sells shares of a stock for its own account. You can see the market makerson L2 quotes.Bid Price: This is the price that buyers are willing to pay in order to buy a stock.Ask Price: The asking price is the price that a stock’s holder is willing to sell the stockfor.Bid / Ask Price Spread: This is the difference between a stock’s bid and ask prices.1210 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Penny Stock Basics Cont’dFor example, if you are looking at a Tier 4 penny stock, you might see a bid/askspread of .0001 and .0003.Where the bidding price is .0001 and the asking price is.0003. This is called the spread. Market makers will sometimes make trades betweenthe bid spread. So in this case, they might buy/sell this example stock at a price of.0002.Limit Order: This is when you place a limit order withyour broker for the exact price that you are willing topay for a stock’s shares. This way, you are not buyingthe stock’s shares at market price; you are insteadtrying to get the shares at your price.Market Order: If you don’t have time to put in alimit order, you may instead place a market order. This order type will give you thebest available market price at the time when your order reaches the market.Averaging Down: Averaging down means buying more shares of the same stock thatyou currently hold. As the price of the stock moves down, you can buy more sharesfor a lower price in order to average the total cost of your shares down. For example,if you own 100 shares of a penny stock’s at a price of .0004, and the price later goesdown to .0002 and you buy 100 more shares at the new price. You will now have 100shares at .0004 and 100 shares at .0002, this averages down to 200 shares at .0003.De-listing of a Penny Stock: When a stock is no longer traded on an exchange, it isconsidered to be delisted. To get re-listed, the company would need to clear up anyissues and get all of their paperwork in order to reapply for the exchange.1310 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Penny Stock Basics Cont’dAveraging Down: Averaging down means buying more shares of the same stockthat you currently hold. As the price of the stock moves down, you can buy moreshares for a lower price in order to average your total holding share prices down. forexample, if you own 100 of a penny stock’s shares a at .0004, and the price of thestock goes down to .0002 and you buy 100 more shares at the new price. You willnow have 100 shares at .0004 and 100 shares at .0002, this averages down to 200shares at .0003.De-listing of a Penny Stock: When a stock is no longer trader on an exchange, it isconsidered to be delisted. In order for a company to be re-listed, they would needto clear up any issues and get all of their paperwork completed in order to reapplyfor the exchange.Halts:When an exchange temporarily or even permanently stops a stock fromtrading on the markets. There are also times when a company can actually requestthat their stock be halted. There are many different reasons for halts, some of themare unethical, and others are ethical. For example, if big news comes out about acompany that can impact the company’s stock in a big way, the company mayrequest that their stock be temporarily halted in order to allow sufficient time for the10 Best Penny Stock Concepts & Strategies14LearnedGold.Com

Penny Stock Basics Cont’dnews to disseminate through the different channels.Stock Screening: This is a way of looking for potential stocks to invest in via a toolcalled a stock screener. There are many different stock screeners out there, somegood and some bad. More on this later.Share Structure: A stock’s share structure includes information on; the market capamount, authorized share number, outstanding share number, the float and more.This is all very important information when researching penny stocks to buy.Common Stock:All of a stock’s shares that arecurrently available to the public for trading.Preferred Stock: Preferred stock is typically reservedfor private ownership. Penny stock companies caneven use preferred stock to pay for services. Forinstance, I have seen where a company will go outand pay somebody for a service by giving themstock shares as payment.Fundamental Analysis: This is a type of an analysisthat stock investors utilize to research a penny stock by looking at a company’s;financials, marketing material, filling status, industry conditions and more.Technical Analysis:Technical analysis is another method of performingresearch on a penny stock. Things like the share structure & chart history are alllooked at.1510 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Penny Stock Basics Cont’dCommon Penny Stock Scams to Watch Out ForAlthough there can be a variety of different scams in the penny stock world, the twothat we will describe below tend to be the most common ones.The Famous PUMP and DUMP Scam:Quite often, we come across variouspenny stock alerts either via email,website ads, text-messages or even aphone call telling us to “buy this pennystock quickly”, or “don’t get stuckholding a bag, sell now” or a similarsales pitch. Well, as it turns out; thesepeople that are alerting this stockare most likely just trying to make money off you. What usually happens, is that theperson alerting a stock has most likely been paid by the company to discuss theirstock, or they are themselves holding a large position in the company’s stock andare looking for someone to sell all of their shares to.They will hype and hype a stock until people start buying into the hype and bring involume. Once the volume comes in, the stock will spike upwards and fool moreinvestors into thinking that the stock is really becoming a rocket stock. This is wherethe promoter or the penny stock company both start selling shares into this volume.Once the promoter or company have made their money, they stop promoting thestock; this in turn results in the drying up of volume and the price of the stock tanking.The so called “Off-Shore” Scam: There is a small loophole in the OTC markets, wherea penny stock company can sell their stock outside the United States to foreign or1610 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Penny Stock Basics Cont’d“off-shore” entities without the legal need to register the “sold stock data” with theSEC. This sale of stock is usually sold to the “off-shore” investor at a huge discount.Once these scammers get their hands on that company’s stock, they can then sellthe stock back to the US investors at inflated prices. In the process, they create hugeprofits for themselves and the company that sold them the shares (as they usually splitthe profits up with the company). Since these crooks end up flooding the US marketswith all of their shares, the price of the penny stock will drop; leaving unsuspectinginvestors holding bags and completely losing their investment.Penny Stock Share Structure ExplainedWhen it comes to penny stocks, one of the most important technical analysis factorsto look for is the stock’s share structure. I will go ahead and break down what eachcomponent of the share structure represents and why its so important to know thisinformation. Market Cap: Market capitalization (also commonly knownas market cap), is the market value of a company’soutstanding shares (shares that are currently trading on themarket). If you were to multiply the outstanding shares bythe price of the stock, you would end up with the marketcap. Although this metric is usually important in stocktrading, it is not very important with most penny stock trading decisions. Reason being,is that the penny stock market is too volatile. Meaning, the stock price is too easilyable to manipulate and it tends to change quite easily. Authorized Shares: When it comes to a company’s stock, the company is onlyallowed to issue a certain amount of shares into the market. The number of sharesthat it is allowed to issue are called authorized shares. For instance,10 Best Penny Stock Concepts & Strategies17LearnedGold.Com

Penny Stock Basics Cont’da company has an authorized share structure of 100,000 shares. They are onlyable to issue 100,000 shares. If they would like to issue more shares than that,paperwork has to be filled along with an official filing that is available to thepublic. This is a very important factor when determining a stock’s worthiness. Youtypically never want to buy a stock that has lots of shares available as a part oftheir authorized shares. For example, a stock that has an authorized sharestructure of 20,000,000,000 (20 billion), is typically not as good of a buy as onethat only has 100,000,000 (100 million). Outstanding Shares: A stock’s outstandingshares are also a very important metricwhen researching penny stocks. Theseare the number of shares that are currentlyauthorized, issued and purchased by thevarious investors and are currently beingheld by them. For example, if a pennystock has 100 million shares authorized, and30 million of those shares are outstanding, that means that 30 million of them arecurrently being held by investors. The other 70 million are authorized, but still yetto be issued. The reason why this is also important data to us, is because you wantto target stocks that do not have too many authorized shares available andwhose outstanding shares are pretty close to the authorized number of shares.With a maxed out outstanding shares, that would mean that all of the shares areaccounted for and that the company could not dilute the stock any morewithout first sending out documentation to the SEC. Float: The last important piece of the share structure is the float. This is referringto the number of shares available for the public to trade. As mentioned earlier,the10 Best Penny Stock Concepts & Strategies18LearnedGold.Com

Penny Stock Basics Cont’doutstanding shares (OS) represent the total number of company shares currentlyavailable for trading. Now, there are also privately owned shares as part of theOutstanding Shares in a stock’s share structure. When you deduct the private sharesfrom the OS structure, you effectively end up with the float. The reason why this isimportant to us is that we want the float to be really small. The smaller the float, theeasier the stock can move.L2 Quotes ExplainedIf you are a serious and active trader (or want to become one), it is paramount thatyou learn all you can about L2 Quotes. L2 quotes can show you what is going onwith a stock at any moment; what trades are being made, how much volume iscoming in, where the support and resistance levels are, how much interest there is10 Best Penny Stock Concepts & Strategies19LearnedGold.Com

Penny Stock Basics Cont’dwith the stock etc. We will go ahead and go through the different components ofthe most important features that encompass the L2 quotes. If you look at the imageon the previous page, you will see a screenshot of a popular L2 quote service. Thisparticular one is provided by Investorshub. Let’s go ahead and break this imagedown a bit for a better understanding. At the top area of the image, you will see aplace where you can search for the stock symbol. The image has information on thestock “ELCR” is pulled up. Directly under this stock symbol search box, you will find (inyellow) the total number of shares so far traded for the day. In the case of theimage, there are over 114 million shares that have traded so far.Total Volume Traded for the Day:Current BID Price:Current ASK Price:All Market Makers Currently On the Stock – The screenshot below shows all of thedifferent market makers that want to buy and sell the stock. On the left side you willfind the market markers that are sitting on the bid and wanting to buy the stock. Andon the right side, you will find the market makers that want to sell the stock. Thescreenshot also shows how much stock the market makers are willing to buy or sell (inthis case 50 shares It can actually be in the millions – sometimes the market makerswill hide the true number of shares as well).All Streaming Orders As They Happen Live – If you look at the image on the nextpage, you will see all of the past orders and trades that have happened. The redones usually mean that they are being sold into the BID. The green ones typically2010 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Penny Stock Basics Cont’dmean that the shares are being bought bysomebody directly buying from the ASK (orcurrent market price). Knowing if most of thevolume that is coming in is buyer volume is veryimportant. If most of the volume is from buyers,and they are repeatedly hitting the ASK price,that usually means that all of the shares on the ASK are being bought up and thestock might end up going up instead of down. Green typically means good buyerinterest. For example, if a company releases some amazing news, then there willbe more buyers “when compared to sellers” that are trying to get in. If on the otherhand the company releases some bad news, then you will see nothing but red sellorders on the L2 quotes as the investors try to exit the stock.2110 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Strategy #1Best Penny StockScreening StrategyFor Massive GainsHere, I will show you how to find the best penny stocksto trade via the OTCMarkets.com stock screener.2210 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Penny Stock Screener BasicsAlright, now that we got some of the penny stock basics out of the way, we can getinto the good stuff. First up, I will share with you the absolute best strategy for utilizinga stock screener to find potential penny stock rockets. There is certain criteria thateach one of the penny stocks will need to have in order for us to consider buyingthem. As mentioned in the basic concepts section (under basic penny stock termsand lingo), stock screeners can be used to search for penny stocks by utilizing manydifferent categories and data points to find he exact companies that we aresearching for. Some stock screeners are better than others. Having the most up todate and current information out there is one of the utmost important things to whensearching out good quality penny stocks. I will go ahead and breakdown thedifferent sections of one of the stock screeners that I use for almost all of myscreening needs. Once we go through the stock screener basics, we will move on tothe Best Penny Stock Screening Strategy.The OTCMarkets.Com Stock ScreenerWhen it comes to penny stocks, one of the beststock screeners out there is OTCMarkets.com’spenny stock screener.Since this particularscreener is offered by the actual provider of themarkets where most penny stocks trade, youcan rest assured that they will probably havethe most up to date information on the pennystocks. Now, one thing to keep in mind, is thefactthatthestockscreenerofferedbyOTCMarkets.com will typically not include anyresults from the NASDAQ and/or NYSE stocks.10 Best Penny Stock Concepts & Strategies23LearnedGold.Com

Best Penny Stock Screening Strategy For Massive Gains Cont’dLets go over some of the most helpful features that you can find on this stockscreener.OTCMarkets.com Penny Stock Screener Features1.Growth – This sections of the otcmarkets.com stock screen screener is super usefulas it allows you to search for penny stock companies that are in a particular pricerange as well as a specific volume of trading. Here is a breakdown of the growthsection. Price – The price boxes should be utilized to pinpoint the exact price rangeof a stock’s share price that you are looking for. If you remember, pennystocks have 4 different tiers that we could focus on. With the price rangeboxes, you can look for penny stocks within a specific tier. For instance, ifyou want to look for a stock that is trading with a price around .002/share,then you could type in a minimum price of .0016 and a maximum price of .0024. This way you would find all of the stocks within the .0016 & .0024price per share range. Price Change – Here is where you would put in a percentage of a stock’sprice change. For example, if you want to find all of the penny stocks thathave had a drop or gain in a 30% range, then you would place 30% in2410 Best Penny Stock Concepts & StrategiesLearnedGold.Com

Best Penny Stock Screening Strategy For Massive Gains Cont’dthe “price change” box, this would show you all of th

Best Strategy for Trading Penny Stock Alerts 68 Strategy #7. Best Strategy for Trading The Penny Stock Pump & Dump 76 Strategy #8. Best Time to Buy or Sell a Penny Stock 82 Strategy #9. Best Strategy for Making Profits With .0001 Penny Stocks 87 Strategy #10. Best Penny Stock Exit Strategy for Maximum Risk Reduction 91 i. Introduction ii.