Transcription

X9 TR-45–2016Retail Debit Balances Best Practicesand Procedures Technical ReportJanuary 2016A Technical Report prepared by:Accredited Standards Committee X9, IncorporatedFinancial Industry StandardsRegistered with American National Standards InstituteDate Registered: May 8, 2016American National Standards, Technical Reports and Guides developed through the AccreditedStandards Committee X9, Inc., are copyrighted. Copying these documents for personal or commercialuse outside X9 membership agreements is prohibited without express written permission of theAccredited Standards Committee X9, Inc. For additional information please contact Accredited StandardsCommittee X9, Inc., 275 West Street, Suite 107, Annapolis, Maryland 21401. ASC X9, Inc. 2016 – All rights reserved

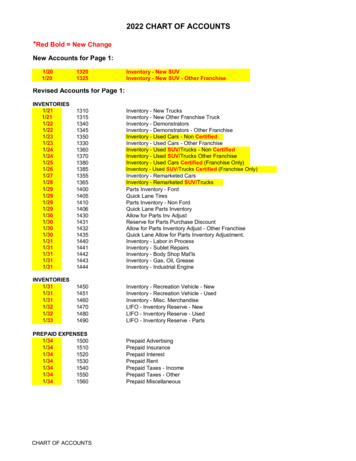

–201-2016X9 TR-45ContentsPageIntroduction . 11Reasons Why Debit Balances Occur . 12Best Practices and Procedures for Handling Debit Balances . 33Documentation Needed to Support Debit Balance Claims . 84Desirable Characteristics of Retailers’ Web Portals . 105Summary of Survey of Retail Practitioners . 136Definitions of Terms Used in this Technical Report . 22ExhibitsExhibit 1 — Agreed Upon Best Practices . 3Exhibit 2 — Supporting Documentation/Claim Information for Key Debit Balance Reasons . 9Exhibit 3 — Supplier Insights: “What information should be on portals?” . 10Exhibit 4 — Supplier Insights: “What features/functionality are important for portals?” . 11Exhibit 5 — Supplier Insights: “How long should information be maintained on portals?” . 12Exhibit 6 — Notification Methods Used by Retailers vs. Preferred by Suppliers . 14Exhibit 7 — Amounts for Which Debit Balance Notices Are Issued . 15Exhibit 8 — Who Retailers Contact at Suppliers Regarding Debit Balances . 16Exhibit 9 — Documentation Delivery Practices Used by Retailers vs. Preferred by Suppliers . 17Exhibit 10 — Amount of Time in Which Suppliers Should Review and Settle a Retail Debit Balance . 18Exhibit 11 — Information that Should be Included in a Retail Debit Balance Notification . 19Exhibit 12 — Top Reasons Why Retail Debit Balances Are Disputed . 20Exhibit 13 — Preferred Method of Settling Retail Debit Balances . 21 ASC X9, Inc. 2016 – All rights reservedi

–201-2016X9 TR-45Publication of this Technical Report that has been registered with ANSI has been approved by the AccreditedStandards Committee X9, Incorporated, 275 West Street, Suite 107, Annapolis, MD 21401. This document isregistered as a Technical Report according to the “Procedures for the Registration of Technical Reports withANSI.” This document is not an American National Standard and the material contained herein is not normative innature. Comments on the content of this document or suggestions for improvement or revision should be sent to:Attn: Executive Director, Accredited Standards Committee X9, Inc., 275 West Street, Suite 107, Annapolis, MD21401; telephone: 410-267-7707.Published byAccredited Standards Committee X9, IncorporatedFinancial Industry Standards275 West Street, Suite 107Annapolis, MD 21401 USAX9 Online http://www.x9.orgCopyright 2016 ASC X9, Inc.All rights reserved.No part of this publication may be reproduced in any form, in an electronic retrieval system or otherwise, withoutprior written permission of the publisher. Published in the United States of America.NOTEThe user's attention is called to the possibility that compliance with this technical report may require use of aninvention covered by patent rights.By publication of this technical report, no position is taken with respect to the validity of this claim or of any patent rights inconnection therewith. The patent holder has, however, filed a statement of willingness to grant a license under these rights onreasonable and nondiscriminatory terms and conditions to applicants desiring to obtain such a license. Details may beobtained from the standards developer.This Technical Report was processed and registered for submittal to ANSI by the Accredited StandardsCommittee on Financial Services, X9. Committee approval of the Technical Report does not necessarily implythat all the committee members voted for its approval.At the time this Technical Report was published, the X9 Subcommittee on Corporate Banking had the followingmembers:[[Chairperson Name]], ChairmanOrganization [Representative]][[Representative]] ASC X9, Inc. 2016 – All rights reserved

–201-2016X9 TR-45Under ASC X9, Inc. procedures, a working group may be established to address specific segments of work underthe ASC X9 Committee or one of its subcommittees. A working group exists only to develop standard(s) ortechnical report(s) in a specific area and is then disbanded. The individual experts are listed with their affiliatedorganizations. However, this does not imply that the organization has approved the content of the standard ortechnical report. (Note: Per X9 policy, company names of non-member participants are listed only if, at the time ofpublication, the X9 Secretariat received an original signed release permitting such company names to appear inprint.)At the time this Technical Report was published, the X9C4 Retail Debit Balances Best Practices Work Group whichdeveloped this technical report had the following active members:First NameLast oZahorskyCeranskySchoonoverVan nMuellerNutterLylesAmerex GroupAttain Consulting GroupBest BuyBest BuyBurlingtonCIT Commercial Services Inc.Federal Reserve Bank of MinneapolisGenescoG-III Apparel Group, Ltd.H.H. BrownHaier AmericaJC PenneyJockeyKate Spade and CompanyKate Spade and CompanyKomar Distribution ServicesNordstromNordstromPerry EllisTargetTargetTargetThe Apparel Group, Ltd. ASC X9, Inc. 2016 – All rights reservediii

–201-2016X9 TR-45IntroductionThe need for a more standardized approach to debit balances in the retail sector was identifiedin a focus group sponsored by the Remittance Coalition at the fall 2013 Retail Value Chain FederationConference. Attendees brainstormed about common business practices and processes that could helpstreamline payments and remittance handling in the retail sector. Debit balance handling was identifiedas a major pain point. It was suggested that industry stakeholders could work together to proposeways to standardize retail debit balance handling and advocate a more consistent approach that wouldbenefit all parties.A group of 28 subject matter experts (the work group) conducted a broad-reaching survey toresearch and benchmark current practices in the retail industry. The survey’s goals were to understandpain points and inconsistencies and identify areas for improvement in the handling of retail debitbalances. There were a total of 436 survey respondents consisting of suppliers (77%), retailers (8%),and others (15%). “Others” classified themselves as manufacturers, both retailers and suppliers,brokers, distributors, factoring companies, and wholesalers. The work group catalogued, analyzed, anddiscussed each response. Survey findings were combined with the practical knowledge of the workgroup to develop this Technical Report.The deliverable of this work group is this Technical Report which offers best practices andprocedures for standardizing the handling of debit balances from both the supplier and retailerperspectives. The scope included but was not limited to account reconciliation, notification guidelines,timeframes, roles and responsibilities of each party, supporting documentation, and so on. This reportdoes not address import debit balances, as they were considered out of scope for this effort. Also, itdoes not cover retail debit balances related to the sale of a business, acquisitions, or bankruptcies.Best practices are methods proven to be successful in accomplishing tasks or goals whichshould be used or adapted by others in like situations. Not every trading partner will opt to implementall of the debit balance best practices outlined in this report. However, these practices have beenidentified by a diverse group of retail industry practitioners. As such, the work group encourages retailpractitioners to consider these best practices as they evaluate their own processes and adopt the onesthat are beneficial to their organizations.1. Reasons Why Debit Balances OccurAn accounts payable account typically has a credit balance which indicates the amount that aretailer owes a supplier for goods received. A debit balance means the account is in deficit status, thatis, the supplier owes the retailer. Furthermore, from the retailer’s perspective, debit balances occurwhen the payment activity on a supplier’s account at that retailer is less than the value of deductions(chargebacks) being posted against the account, resulting in a receivable balance rather than thetypical payable balance.The debit balance may be a temporary issue when there is ongoing activity on a supplier’s accountthat in the future will result in a subsequent payment of the net balance. The debit balance will not selfcorrect when there is no future payable activity on a supplier’s account.Temporary Causes and Potential Corrections:A debit balance could be cleared by new shipments and the resulting invoices, as long as thoseinvoices are in excess of the prior deductions. Failure to address temporary causes via preventative ASC X9, Inc. 2016 – All rights reserved1

–201-2016X9 TR-45measures can result in these causes becoming permanent. Temporary causes of retail debit balancesmay include: Suppliers may fail to submit accurate invoices; may send invoices where shipment of producthas not been received; and/or fail to present invoices. In these instances, the resolution of theissue is, respectively, to correct inaccurate invoices, ship the product, and process the missinginvoices, thus clearing the debit balance. Preventative measures include accuracy in ordertaking and entry; verification of purchase order (PO) details before shipping; shipping andbilling in strict compliance with POs; delivery of accurate, proper shipments; and resolvingdiscrepancies prior to order acceptance or shipment. Inaccurate or incomplete documentation may result in an unauthorized deduction against asupplier’s account that is ultimately reversed, thus clearing the debit balance. Allowances andreturns are often major reasons why retail debit balances occur. Communication within eachorganization of the terms of all agreements can help minimize debit balances and alsofacilitate resolution. It is imperative to engage the sales staff with account receivables andengage buyers with account payables to ensure all deductions are authorized. All appropriateassociates should have access to the agreements made between a buyer and salesperson.Terms of the agreements must be clear and concise so that deductions are accurate. Deduction(s) with immediate terms where supplier invoices have due dates that occur in thefuture is another temporary cause. The deductions will be offset against the invoices whenthey become due for payment and the debit balance will be cleared. A temporary debit balance where deductions are posted to the account after payment hasbeen made (e.g., supplier provides product related to a season, such as air conditioners, or anannual product like calendars or holiday goods) can occur when a supplier sends products inbulk or at infrequent intervals. That is, the supplier’s product is provided in advance of theapplicable season and the invoices have terms that result in payment due prior to the end ofthat season. Deductions are posted against the account for marketing promotions,advertising, returns, post audit, and so on, subsequent to payment of the inbound productinvoices, resulting in a debit balance. The debit balance may be cleared by the nextinvoice/shipment cycle. The supplier should be prepared to remit payment if the shipment andresulting invoices don’t occur according a specified period of time.Permanent Causes:Accounts with no future activity will remain in a debit balance until cleared by receipt of paymentfrom the supplier, deductions are disputed and reversed, or the debit balance is written off to bad debt.Permanent causes of retail debit balances include: Supplier is being exited from the retailer’s assortment. No additional invoices/shipments will bepresented to offset the remaining deductions; a large volume of product is returned to the supplierafter the inbound invoices have been disbursed; or post audit deductions occur. Retailer was required to prepay supplier for inventory. This would result in no accounts payablebalance to offset subsequent deductions. Product recalls. All of the supplier’s product in assortment is being returned for regulatory reasonsand will not be replaced.2 ASC X9, Inc. 2016 – All rights reserved

–201-2016X9 TR-452. Best Practices and Procedures for Handling Debit BalancesExhibit 1Agreed Upon Best PracticesDisclaimer: This technical report does not attempt to cover every possible situation.Inparticular, it does not cover retail debit balances related to the sale of a business, acquisitions,or bankruptcies, nor does it cover imports.AREANotification –TimingNotification –MethodContacts &ResourcesRETAILER BEST PRACTICESUPPLIER BEST PRACTICE Initial Notification: Retailer should actively notify the supplieras soon as possible that a debitbalance exists Subsequent Notification:Retailer should actively notify thesupplier that they remain in adebit balance position on atimetable that is consistent withtheir normal payment frequency Retailer should communicate tosupplier that they are in a debitbalance position— Email communication ofinitial debit balance positionis preferred Retailer should maintain debitbalance information on their webportal which has 24/7 access During customer setup/onboarding, retailer shouldrequest supplier to providecontact information for person tobe notified in the event of debitbalance position Retailer should clearlycommunicate (in initialnotification email, on portal) andprovide contact information forperson(s) supplier shouldcontact to discuss debit balancesituation ASC X9, Inc. 2016 – All rights reservedSupplier should routinely monitoraccount balance and retailervendor web portal forsigns/indication of retail debitbalance position Supplier should acknowledge thecommunication Supplier should have point personresponsible for managing retaildebit balances and shouldcommunicate current contactinformation to retailers Job functions of specific individualswill vary by supplier, but typically itshould be the person most familiarwith the account The supplier’s point person mayneed to reach out to others withinthe supplier’s organization withspecific knowledge to research,validate and resolve retail debitbalance situations3

–201-2016X9 TR-45AREARETAILER BEST PRACTICESupporting hod4Provide the supplier withsupporting documentation ondeductions that result in debitbalance situations Supporting documentationshould be provided on theretailer’s vendor portal with 24/7access Exhibit 2 SupportingDocumentation/ClaimInformation for Key DebitBalance Reasons outlines themost common causescontributing to retail debitbalances and lists the supportingdata elements that should beprovided Signed agreements should belocated on the retailer’s vendorportal or be available uponrequest Retailer should respond tosupplier inquiries regardingadditional information/supportingdocumentation within 30calendar days of receivingrequest Retailer should respond tosupplier disputes within 30calendar days of receiving all ofthe information from the suppliernecessary to make a decision Retailer should reverse aninvalid deduction within 60calendar days Settlement method will vary Settlement should be negotiatedand agreed to by both partiesduring the 60 calendar dayperiod betweenvalidation/approval of debitbalance and settlementSUPPLIER BEST PRACTICE A supplier who is disputing aretailer’s debit balance is typicallydisputing one or more of theunderlying deductions that causedthe debit balance— Supplier should providesupporting documentation tothe retailer when disputingdeductions Within 60 calendar days ofvalidating/approval of the debitbalance, the supplier should remitpayment for the outstandingbalance ASC X9, Inc. 2016 – All rights reserved

–201-2016X9 TR-45AREAMeasures toPrevent RetailDebit BalancesRETAILER BEST PRACTICE Retailer should providesupporting documentation ontimely basis Retailer should allow 24/7access to supplier portal andprovide up-to-date informationon the portal (See section 4.Desirable Characteristics ofRetailers' Web Portals) SUPPLIER BEST PRACTICE — Supplier should ship andinvoice according to thepurchase order and otherretailer requirements— Supplier should work closelywith their logistics team toeliminate shipping andcompliance problemsThe retailer should clearlypublish and/or communicatename and contact information ofknowledgeable resource(s)The retailer should providesupplier training on vendorportals regarding:— Supplier should adhere to alltrading partner agreements — Onboarding for new vendors— Ongoing training for commonissues The supplier should discuss andagree upon any policies andprocedures which may differ fromretailer’s and document them inthe signed written agreement— Changes and updates topolicies should becommunicated promptlyThe retailer should considerholding a reserve to coversignificant deductionsThe retailer should ensure thereare clear communicationchannels both internally and withthe supplierThe supplier should comply withthe retailer’s requirementsincluding but not limited to:— Supplier’s policies regardingdebit balances should beexplained to the retailer The supplier should utilize theretailer’s web portal to monitoraccount status The supplier should review debitbalance communications, follow upwith retailer, request deductiondocumentation if needed, andresolve the debit balance withinthe recommended 60 calendar dayperiod The supplier should ensure thereare clear communication channelsboth internally and with the retailer— The supplier shouldcommunicate effectively withthe retailer’s buying office— The supplier should share ASC X9, Inc. 2016 – All rights reserved5

–201-2016X9 TR-45AREARETAILER BEST PRACTICESUPPLIER BEST PRACTICEagreements and othercommitments with thesupplier’s internal staff (sales,accounts receivable, etc.)— The supplier should assignspecific individual(s) in theaccounting area to theretailer’s account and informthe retailer who should becontacted in the event of adebit balancePost AuditsFactors6 The retailer should make postaudit claims within two years The retailer should supply a copyof agreement/contract that wasused to determine post audit claim Supporting documentationprovided by the retailer for a postaudit claim should clearlydemonstrate that the post auditclaim is valid and meets thesame requirements assupporting documentation for theunderlying deduction reason(See Exhibit 2 SupportingDocumentation/ClaimInformation for Key DebitBalance Reasons) A retail debit balance for afactored supplier should not bededucted from a retailer’spayment to the factor if thepayment includes other suppliersnot related to the debit balance The supplier should acknowledgea post-audit claim in 30 calendardays even if it is to requestadditional time to researchThe supplier should providedocumentation supporting a postaudit disputeIt is the supplier’s responsibility toresolve a retail debit balancedirectly with the retailer if theaccount is factored ASC X9, Inc. 2016 – All rights reserved

–201-2016X9 TR-45SUMMARYTo a retailer, the “best” supplier:Characteristicsof “Best”TradingPartnerTo a supplier, the “best” retailer:— Applies payments correctlyand keeps the accountcurrent— Monitors and manages thesupplier’s account so it nevergoes into debit balance— Reaches out to retailer withquestions for timelyresolution— Notifies supplier of retail debitbalance position as soon as ithappens and provides specificdetails— Shares agreements andother commitmentsinternally within the supplierorganization— Complies with requirementsso has minimal shipping andcompliance issues— Ships and invoicesaccurately— Uses retailer web portalregularly to monitor accountstatus— Conducts timely follow-upand reconciliation— Resolves debit balancespromptly— Honors promises to pay andcontractual obligations— Is open to partnering withretailer to resolve recurringissues proactively ASC X9, Inc. 2016 – All rights reserved— Makes knowledgeable staffaccessible to the supplier toanswer questions— Promptly provides supportingdocumentation needed (viaweb portal or upon request) toresearch and validate claimsleading to retail debit balance— Provides supplier onboardingand ongoing training— Offers a well-executed webportal— Accepts the burden of proof forpost-audit claims— Honors promises to pay andcontractual obligations— Is open to partnering withsupplier to resolve recurringissues proactively7

–201-2016X9 TR-453. Documentation Needed to Support Debit Balance ClaimsExhibit 2 Supporting Documentation/Claim Information for Key Debit Balance Reasons on the nextpage identifies the documentation a retailer should make available to a supplier to explain the debitbalance claim. The exhibit identifies the key deductions (chargebacks) that contribute most frequentlyto debit balances, but it does not include all deduction reasons. For each deduction, the exhibitindicates which back-up documentation should accompany the debit balance notice, be available uponthe supplier’s request, and/or be posted on the web portal. Required supporting documentation dataelements for deduction reasons not listed below should be agreed upon between trading partners.8 ASC X9, Inc. 2016 – All rights reserved

–201-2016X9 TR-45Exhibit 2Supporting Documentation/Claim Information for Key Debit Balance ReasonsSUPPORTING DOCUMENTATION - DATA ELEMENTSUnderlyingDeductionReason for DebitBalanceReasonDebitMemo# orClaimDoc #AccommodationReturnXXXPhysicalDefective ReturnXXXDefectiveAllowanceXXTrade Promotion(advertising,fixtures,allowances,rebates, volumerebates)XXMarkdown (priceprotection, end oflife product)Post Audit1XXInvoice#RA#2X2X21PO#CreditMemo#Promo 2XX22XX2XDeduction XXX2X2X2X2XSee underlying deduction reason above for specific data elements required.A copy of the signed underlying agreement should be included with all post audit claims.2RA# Return authorization or return merchandise authorization. X If information is available/applicable ASC X9, Inc. 2016 – All rights reservedProof ofPerformance9XX2X2XFreight&HandlingOther /CommentsCopy of emailor underlyingagreement2XIf deduction istaken onperiodic basis(e.g., monthly,quarterly),include list ofinvoicesincluded indeductionand/orreconciliationXXInventorylevels shouldbe included inItem / Quantityinformation asrequired

–201-2016X9 TR-454. Desirable Characteristics of Retailers' Web PortalsThe next three exhibits summarize insights obtained from a survey of suppliers by Attain ConsultingGroup called Vendor Portals – The Supplier Perspective 2015. The work group agreed that training iskey to maximizing the success of a retailer’s web portal. Thoughtful training can ensure that a supplieris familiar with the portal’s content and knows how to navigate it. Retailer portals contribute to properhandling of retail debit balances because they provide the supplier with valuable information regardingpayment amounts and timing.Exhibit 3Supplier Insights: “What information should be on portals?”Source: Attain Consulting, Vendor Portals – The Supplier Perspective 2015.10 ASC X9, Inc. 2016 – All rights reserved

–201-2016X9 TR-45Exhibit 4Supplier Insights: “What features/functionality are important for portals?”Source: Attain Consulting, Vendor Portals – The Supplier Perspective 2015. ASC X9, Inc. 2016 – All rights reserved11

–201-2016X9 TR-45Exhibit 5Supplier Insights: “How long should information be maintained on portals?”6 months, 2%1 year, 30%2 years, 57%1 1/2 years,11%Source: Attain Consulting, Vendor Portals – The Supplier Perspective 2015.Suppliers suggested that the retention of historical information on a retailer’s portal shouldmatch the retailer’s post audit timeframe.12 ASC X9, Inc. 2016 – All rights reserved

–201-2016X9 TR-455. Summary of Survey of Retail PractitionersTo create a snapshot of industry practices regarding retail debit balances, a web survey of retailindustry practitioners including both suppliers and retailers was conducted from January 13 to February6, 2015. A link to the survey was sent via email to all work group members and to selected members ofthe Association for Financial Professionals, the Credit Research Foundation, the National Associationof Credit Management Connect, and the Retail Value Chain Federation. In response, 436 retailindustry practitioners participated, with 231 of those responses considered complete. This sectionsummarizes the survey findings.Survey objectives:1. Gather feedback to help benchmark current practices surrounding debit balances2. Identify gaps and pain points3. Document inconsistencies observed among various trading partners4. Solicit input on how to improve debit balance handling practices in the retail industryDefinitions of Terms Used in the SurveyDebit BalanceAn accounts payable account should have a credit balance; a credit balance indicates theamount that a retailer owes a supplier for goods received. A debit balance means theaccount is in deficit status, that is, the supplier owes the retailer. A debit balance canoccur when a retailer creates a chargeback after the invoice has been paid. Thus, a debitbalance in a retailer’s accounts payable area is a credit balance in the supplier’s accountsreceivable area, once it is resolved by credit memo or repayment is made.RetailerMerchant or store that sells goodsSupplierVendor or manufacturer that supplies goods to retailerChargeback orDeductionA deduction taken by a retailer on a payment to a supplier; can be for a shortage, auditclaims, return of goods, vendor allowance, etc.Credit MemoA document prepared by the supplier to approve / support a deduction taken or to be takenby a retailer / customer. It may include the products, quantities, and agreed upon pricesfor products or services the supplier provided to the retailer but the retailer returned or didnot receive. It may be issued in the case of damaged goods, errors, or allowances.Debit MemoA document provided by the retailer/customer to support a deduction taken or to be taken.It may include the products, quantities, and agreed upon prices for products or services thesupplier provided to the retailer but the retailer returned or did not receive. It may beissued in the case of damaged goods, errors, or allowances. ASC X9, Inc. 2016 – All rights reserved13

–201-2016X9 TR-45Survey RespondentsThree-fourths (77 percent) of the survey respondents classified themselves as suppliers. About8 percent identified themselves as retailers, and the remaining 15 percent chose the “other”classification.In the exhibits that follow, N indicates how many respondents answered the survey question. Insome cases, a question was tailored to a specific segment: R refers to retailers and S refers tosuppliers.Notification MethodsExhibit 6 below indicates that email is the notification method used by most retailers and is alsothe notification method preferred by suppliers. Notably, nearly half of surveyed retailers notify viatelephone, but only 16 percent of suppliers prefer that method.Exhibit 6Notification Methods Used by Retailers vs. Preferred by SuppliersNotification Methods Used by Retailers vs.Preferred by SuppliersQuestions R2; N 30 and S3; N-31773%Email47%Debit memo / Statement / Report32%47%Telephone Call16%40%Web PortalSnail Mail19%27%4%Retailers could check all responses that applied. Suppliers could check up to two responses.How Retailers Notify a Supplier that a Debit Balance is DueNotification Methods Preferred by Suppliers14 ASC X9, Inc. 2016 – All rights reserved

–201-2016X9 TR-45Notification Practices of RetailersNearly six out of ten (58 percent) of retailers have a team that specializes in settling debitbalances. [Question R8; N 24] As Exhibit 7 below illustrates, most retailers (72 percent) reported thatthe

At the time this Technical Report was published, the X9 Subcommittee on Corporate Banking had the following members: [[Chairperson Name]], Chairman Organization Represented Representative . Hayley Doyle Nordstrom Grace Rainey Nordstrom Christopher Hernandez Perry Ellis Jenni Larson Target Cami Mueller Target .