Transcription

ÒцBALANCES & TRANSACTIONSCSV EXPORT GUIDEDownloading Data Exports in Commercial Banking Online

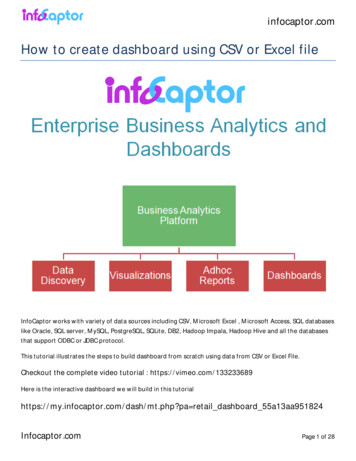

Balances & Transactions CSV Export GuideBalances & TransactionsCSV ExportThe Balances & Transactions data export file in Commercial BankingOnline contains 8 fields with key transaction information, balancesthrough the day and opening and closing ledger balances.It replaces the transaction (TRN) and balance (ACC) statementdownloads available on Corporate Online and is available for today’stransactions, yesterday’s transaction or for transactions across yourchosen date range.This guide includes: What’s changed from Corporate Online. Specifications for the new Commercial Banking Online Export File.Important InformationPlease use this information to make changes to your local processes, to avoid anyproblems with reconciliation after your move to Commercial Banking Online.2

Balances & Transactions CSV Export GuideHow to download the Balances & Transactions CSV ExportYou’ll find the Balances & Transactions Export in the Download Data Export screen in Commercial Banking Online.Select the Export Type CSV (Balances and Transactions) and the required date and account parameters to downloadyour export.Further guidance on downloading the export file is available on the Commercial Banking Online Support CentreUsing the Balances & Transactions CSV ExportWe recommend you download the Balances & Transactions CSV Export if you need to use transaction and balance data tocomplete reconciliations and other finance processes.Alternatively, you can use the Reports section in Commercial Banking Online to: view advices create reports to view within Commercial Banking Online export reports in a similar format to a traditional bank statement.Further guidance on using reports is available on the Commercial Banking Online Support Centre3

Balances & Transactions CSV Export GuideFile Structure ChangesThe structure of the CSV Export Files will be different in Commercial Banking Online.Corporate Online has four different export files: Transaction (TRN) statement – Sterling Accounts Account Balance (ACC) Information – Sterling Accounts Transaction (TRN) statement – International Currency Accounts Account Balance (ACC) Information – International Currency Accounts.In Commercial Banking Online a single CSV Export contains the same information as the four files above. You will need toupdate your local accounting software to use a single file.Sterling AccountsField level changes:Key changes for export file structure in Commercial Banking Online: A header row is included. Account Name and Customer Reference are new fields. Forward Posting Flag field does not exist. Amount and Transaction Description fields are not fixed length. Post Date is in format DD/MM/YYYY. The amount is merged into one field, with positive values for credits and negative values for debits. Sort code and Account number are combined into one field.Transaction Statement – TRN:CorporateOnline.TRN ionTypeForward PostedFlagSortingCodeAccountNumberSee 'TransactionNarrativeChanges' sectionfor detail. 80 or149 characteroptions availableN/AD or CT or FSSSSSSAAAAAAAANNNNNNNNNNNNN.NN(16 char – DetailBalance2DD/MM/YYSSSSSSAAAAAAAACCC16 character MAXaccount nameType of Payment(see list of keyentries below)( ve or -ve)NNNNNNNNNNNNN.NN18 character MAXreferenceSee transactionnarrative analysisbelow( ve or -ve)NNNNNNNNNNNNN.NN4

Balances & Transactions CSV Export GuideAccount Balance Information – ACC:CorporateOnline.ACC y'sCredits2SSSSSSAAAAAAAA35 charactermax SSSAAAAAAAACCC16 character MAXaccount nameType of Payment(see list of keyentries below)( ve or -ve)NNNNNNNNNNNNN.NN18 character MAXreferenceSee transactionnarrative analysisbelow( ve or -ve)NNNNNNNNNNNNN.NNUnderstanding the formats:Dates:DD/MM/YYYYDate written in numerical format e.g. 13/01/2018DD-MMM-YYDate in short written format e.g. 13-Jan-18Account Details:SSSSSSSort CodeAAAAAAAAAccount NumberCCCISO Currency Code e.g. GBPBalance and Transaction Amounts:N Numeric CharacterPlease see the following pages for full specifications for the Commercial Banking Online CSV Export.Row level changes:Commercial Banking Online has the same transaction lines as Corporate Online.However, there are changes in the lines provided for summary balance and transaction information: Commercial Banking Online has two summary lines for balances for each account. These can be identified with OpeningLedger and Closing Ledger in the Type field. Corporate Online has balance information in the ACC file. It also includes a total of debits and credits to the account which isnot available on Commercial Banking Online.5

Balances & Transactions CSV Export GuideInternational Currency AccountsField level changes:Key changes for export file structure in Commercial Banking Online: A header row is included. Account Name and Customer Reference are new fields. Forward Posting Flag field does not exist. Amount and Transaction Description fields are not fixed length. Post Date is in format DD/MM/YYYY. The amount is merged into one field, with positive values for credits and negative values for debits. Sort code and Account number are combined into one field.See how the fields are ordered and formatted differently in Commercial Banking Online below:Transaction Statement – TRN:CorporateOnline.TRN ionTypeProcessingDateForwardPosted FlagSortingCodeAccountNumberSee 'TransactionNarrativeChanges' sectionfor detail. 80 or149 characteroptions availableN/AD or CYYYYMMDDT or FSSSSSSAAAAAAAAYYYYMMDDNNNNNNNNNNNNN.NN(16 char – ance2DD/MM/YYYYSSSSSSAAAAAAAACCC16 character MAXaccount nameType of Payment(see list of keyentries below)( ve or -ve)NNNNNNNNNNNNN.NN18 character MAXreferenceSee transactionnarrative analysisbelow( ve or -ve)NNNNNNNNNNNNN.NNAccount Balance Information – ACC:CorporateOnline.ACC lanceToday'sDebitsToday'sCreditsNotUsed235 charactermax YYYYSSSSSSAAAAAAAACCC16 character MAXaccount nameType of Payment(see list of keyentries below)( ve or -ve)NNNNNNNNNNNNN.NN18 character MAXreferenceSee transactionnarrative analysisbelow( ve or -ve)NNNNNNNNNNNNN.NN6

Balances & Transactions CSV Export GuideUnderstanding the formats:Dates:DD/MM/YYYYDate written in numerical format e.g. 13/01/2018DD-MMM-YYDate in short written format e.g. 13-Jan-18Account Details:SSSSSSSort CodeAAAAAAAAAccount NumberCCCISO Currency Code e.g. GBPBalance and Transaction Amounts:N Numeric CharacterPlease see the following pages for full specifications for the Commercial Banking Online CSV Export.Row level changes:Commercial Banking Online has the same transaction lines as Corporate Online.However, there are changes in the lines provided for summary balance and transaction information: Commercial Banking Online has two summary lines for balances for each account. These can be identified with OpeningLedger and Closing Ledger in the Type field. Corporate Online has balance information in the ACC file. It also includes a total of debits and credits to the account which isnot available on Commercial Banking Online.7

Balances & Transactions CSV Export GuideFile Specification for the Balances & Transactions CSV ExportFile Delimiter: Comma (,)Text Qualifier: Double quotes (")Header Lines: 1FieldNameDescriptionFieldFormat1Post DateDate on which the transaction information wasposted to your accountDD/MM/YYYY102AccountNumberThe account number and currency of the accountto which the transaction and balance informationis postedSSSSSS-AAAAAAAA CCC193Account NameThe account name registered onCommercial Banking OnlineAlphanumeric(no special characters)184TypeThe type of transaction – common entries are providedin the Transaction Code sectionAlphanumeric(no special characters)355AmountThe amount of the transaction in the account currencyN.NN6CustomerReferenceThe payment reference for the transaction,previously only provided within the Narrative fieldon Corporate OnlineAlphanumeric(no special characters)187TransactionDetailDetail of the transaction – this will change basedon the transaction type. Examples for common entriesare provided in the Transaction Narratives sectionMax 90 characters, split into18 characters section. SeeTransaction Narrative sectionfor detail908BalanceThe intra-day balance of the account post processingof the transactionN.NNFieldPosition8MaxCharacters18,218,2

Balances & Transactions CSV Export GuideTransaction Code ChangesCommercial Banking Online shows information about each transaction in a different way to Corporate Online.Transaction TypeThe Balance & Transaction report in Commercial Banking Online includes a Type field, to describe the type of transaction.This replaces the information provided in the Type field and by the 3-character transaction code within the Narrative field onCorporate Online.See how the Corporate Online transaction code and Type entries map to the Type description in Commercial BankingOnline below.Debit / CreditDebitCreditCommercial Banking OnlineType entryCorporate OnlineTypeCorporate Online transaction code(within Narrative)Faster PaymentDFPOCHAPS PaymentDTFRDirect Debit or Bacs PaymentDDDAccount DebitDTFRMiscellaneousD-ATM WithdrawalD-Counter WithdrawalD-Card TransactionDCDStanding Order PaidDSOFaster PaymentCFPICHAPS Payment or InternationalPaymentCTFRBank Giro CreditCBGCAccount CreditCTFRChequeC-Cash DepositC-Counter DepositC-Standing OrderCSOIdentifying Debits & CreditsIn Corporate Online debits to your accounts are indicated by a positive value in the Amount field and entry D in the TransactionType field, with credits to your accounts identified by a positive vale in the Amount field and entry C in the TransactionType field.In Commercial Banking Online a single field Amount is provided with debits to your account indicated by a negative valueand credits to your accounts identified by a positive value.9

Balances & Transactions CSV Export GuideTransaction Narrative ChangesThe following pages include descriptions for the transaction detail field in the Commercial Banking Online CSV Export.Payment CategoryDomestic PaymentsInternational PaymentsNon-channel TransactionsPayment TypeDebit or CreditPage NumberFaster PaymentDr11Faster -Account TransferDr17Inter-Account TransferCr18Euro / InternationalMoneyMoverDr19Euro / d TransactionDr23Bank Giro CreditCr24ATM/Counter WithdrawalDr25ATM/Counter DepositCr26Direct DebitDr27Unpaid Direct DebitCr28Standing Order (Paid)Dr29Standing Order (Received)Cr3010

Balances & Transactions CSV Export GuideTransaction Narrative ChangesPayment TypeFaster PaymentsDebit or Credit to the AccountDrKey DifferencesThe Commercial Banking Online Faster Payments transaction narrative for debits from your accounts is different fromCorporate Online in the following ways:Corporate Online – two options are available for export:Characters 149 characters, in 4 sections of 25 and a final section of 49. 80 characters, in 3 sections of 25 and final section of 5 characters.This is the same as the 149 character narrative but cut off at 80 characters.Commercial Banking – 54 characters, in 3 sections of 18.TransactionCodeToday’s vs.historic statementCorporate Online – the FPO transaction code is included in characters 23-25.Commercial Banking Online – the narrative does not include the transaction code,which is now found in the Type field.Corporate Online – on today’s statement the Transaction Timestamp is not provided.Commercial Banking Online – there is no difference between today’s and a historic statement and transactionposting is real-time.Transaction Narrative ChangesApart from the transaction code, the transaction narrative on Commercial Banking Online includes the same informationfound in Corporate Online. However, the structures of the narratives have changed.See how the transaction narrative information is structured differently in the table below:Commercial Banking OnlineCharacter No.Commercial Banking OnlineFormatCorporate OnlineCharacter No.Beneficiary Name &Transaction Code1-18Free text – variable lengthNo Transaction Code included1-25Unique Faster Payment ID19-36Fixed length – 18 characters26-50Payment Reference37-54Free text – variable length51-75Remitter Sort Code & IFPTransaction Code55-72Sort Code: SSSSSS(characters 55-60)IFP Transaction Code: '10'(characters 66-67)76-100Transaction Timestamp73-90DDMMMYYYY HH:MI101-149 (not includedon today’s statement)ContentTransaction Narrative Example11

Balances & Transactions CSV Export GuideTransaction Narrative ChangesPayment TypeFaster PaymentsDebit or Credit to the AccountCrKey DifferencesThe Commercial Banking Online Faster Payments transaction narrative for credits to your accounts is different from CorporateOnline in the following ways:Corporate Online – two options are available for export:Characters 149 characters, in 4 sections of 25 and a final section of 49. 80 characters, in 3 sections of 25 and final section of 5 characters.This is the same as the 149 character narrative but cut off at 80 characters.Commercial Banking – 90 characters, in 5 sections of 18.TransactionCodeToday’s vs.historic statementCorporate Online – the FPI transaction code is included in characters 23-25.Commercial Banking Online – the narrative does not include the transaction code,which is now found in the Type field.Corporate Online – on today’s statement the Transaction Timestamp is not provided.Commercial Banking Online – there is no difference between today’s and a historic statement and transactionposting is real-time.Transaction Narrative ChangesApart from the transaction code, the transaction narrative on Commercial Banking Online includes the same informationfound in Corporate Online. However, the structures of the narratives have changed.See how the transaction narrative information is structured differently in the table below:Commercial Banking OnlineCharacter No.Commercial Banking OnlineFormatCorporate OnlineCharacter No.Debit Account Name1-18Free text – variable lengthNo Transaction Code included1-25Payment Reference19-36Free text – variable length26-50Unique Faster Payment ID37-54Fixed length – 18 characters51-75Remitter Sort Code &IFP Transaction Code55-72Sort Code: SSSSSS(characters 55-60)IFP Transaction Code: '10'(characters 66-67)76-100Transaction Timestamp73-90DDMMMYYYY HH:MI101-149 (not includedon today’s statement)ContentTransaction Narrative Example12

Balances & Transactions CSV Export GuideTransaction Narrative ChangesPayment TypeCHAPS PaymentsDebit or Credit to the AccountDrKey DifferencesThe Commercial Banking Online CHAPS transaction narrative for debits from your accounts is different from Corporate Onlinein the following ways:Corporate Online – two options are available for export:Characters 149 characters, in 4 sections of 25 and a final section of 49. 80 characters, in 3 sections of 25 and final section of 5 characters.This is the same as the 149 character narrative but cut off at 80 characters.Commercial Banking – maximum 54 characters, in 3 sections of 18.TransactionCodePaymentReferenceCorporate Online – the TFR transaction code is included in characters 23-25.Commercial Banking Online – the narrative does not include the transaction code, which is now foundin the Type field.Corporate Online – the debit account reference appears is provided two sections in characters26-43 and 51-68.Commercial Banking Online – the debit account reference is provided in characters 19-36 and a 10 digitautomated reference provided in characters 37-54.Transaction Narrative ChangesApart from the transaction code, the transaction narrative on Commercial Banking Online includes the same informationfound in Corporate Online. However, the structures of the narratives have changed.See how the transaction narrative information is structured differently in the table below:Commercial Banking OnlineCharacter No.Commercial Banking OnlineFormatCorporate OnlineCharacter No.Beneficiary Name1-11Free text – variable length1-11F/FLOW13-18Fixed text – "F/FLOW"No Transaction Code included13-18Debit Account Reference19-36Free text – variable length26-75Auto-generatedPayment Reference37-54Numeric – variable length-ContentTransaction Narrative Example13

Balances & Transactions CSV Export GuideTransaction Narrative ChangesPayment TypeCHAPS PaymentsDebit or Credit to the AccountCrKey DifferencesThe Commercial Banking Online CHAPS transaction narrative for credits to your accounts is different from Corporate Onlinein the following ways:Corporate Online – two options are available for export:Characters 149 characters, in 4 sections of 25 and a final section of 49. 80 characters, in 3 sections of 25 and final section of 5 characters.This is the same as the 149 character narrative but cut off at 80 characters.Commercial Banking – maximum 54 characters, in 3 sections of 18.TransactionCodeCorporate Online – the TFR transaction code is included in characters 23-25.Commercial Banking Online – the narrative does not include the transaction code,which is now found in the Type field.Transaction Narrative ChangesApart from the transaction code, the transaction narrative on Commercial Banking Online includes the same informationfound in Corporate Online. However, the structures of the narratives have changed.See how the transaction narrative information is structured differently in the table below:ContentCommercial Banking OnlineCharacter No.Commercial Banking OnlineFormatCorporate OnlineCharacter No.F/FLOW1-6Fixed text – "F/FLOW"1-6Debit Account Name8-18Free text – variable lengthNo Transaction Code included8-18Payment Detail19-54Free text – variable length26-75Transaction Narrative Example14

Balances & Transactions CSV Export GuideTransaction Narrative ChangesPayment TypeBACSDebit or Credit to the AccountDrKey DifferencesThe Commercial Banking Online BACS transaction narrative for debits from your accounts is different from Corporate Onlinein the following ways:Corporate Online – two options are available for export:Characters 149 characters, in 4 sections of 25 and a final section of 49. 80 characters, in 3 sections of 25 and final section of 5 characters.This is the same as the 149 character narrative but cut off at 80 characters.Commercial Banking – 36 characters, in 2 sections of 18.TransactionCodePaymentReferenceCorporate Online – the DD transaction code is included in characters 24-25.Commercial Banking Online – the narrative does not include the transaction code,which is now found in the Type field.Corporate Online – for BACS multiple payments the Beneficiary Name is replaced by text PAYMENT BATand a five digit numeric reference number.Commercial Banking Online – for BACS multiple payments the Beneficiary Name is replaced by a 10 digitnumeric reference number.Transaction Narrative ChangesThe transaction narrative on Commercial Banking Online contains different information to Corporate Online and thestructures of the narratives have changed.See how the transaction narrative information is structured differently in the table below:Commercial Banking OnlineCharacter No.Commercial Banking OnlineFormatCorporate OnlineCharacter No.Beneficiary NameOrBatch Reference(for BACS multiple payments)1-18Free text – variable lengthOr10 digit numeric referencenumber: NNNNNNNNNNNo Transaction Code included1-18Payment Reference19-36Free text – variable length26-43ContentTransaction Narrative ExampleBACS Single:BACS Multiple:15

Balances & Transactions CSV Export GuideTransaction Narrative ChangesPayment TypeBACSDebit or Credit to the AccountCrKey DifferencesThe Commercial Banking Online BACS transaction narrative for credits to your accounts is different from Corporate Online inthe following ways:Corporate Online – two options are available for export:Characters 149 characters, in 4 sections of 25 and a final section of 49. 80 characters, in 3 sections of 25 and final section of 5 characters.This is the same as the 149 character narrative but cut off at 80 characters.Commercial Banking – 36 characters, in 2 sections of 18.TransactionCodeCorporate Online – the BGC transaction code is included in characters 23-25.Commercial Banking Online – the narrative does not include the transaction code,which is now found in the Type field.Transaction Narrative ChangesThe transaction narrative on Commercial Banking Online contains different information to Corporate Online and thestructures of the narratives have changed.See how the transaction narrative information is structured differently in the table below:Commercial Banking OnlineCharacter No.Commercial Banking OnlineFormatCorporate OnlineCharacter No.Debit Account Name1-18Free text – variable lengthNo Transaction Code included1-18Payment Reference19-36Free text – variable length26-43ContentTransaction Narrative Example16

Balances & Transactions CSV Export GuideTransaction Narrative ChangesPayment TypeInter-Account Transfer (GBP)Debit or Credit to the AccountDrKey DifferencesThe Commercial Banking Online Inter-Account Transfer (IAT) transaction narrative for debits from your accounts is differentfrom Corporate Online in the following ways:Corporate Online – two options are available for export:Characters 149 characters, in 4 sections of 25 and a final section of 49. 80 characters, in 3 sections of 25 and final section of 5 characters.This is the same as the 149 character narrative but cut off at 80 characters.Commercial Banking – 36 characters, in 2 sections of 18.TransactionCodeAccountIdentifierToday’s vs.historic statementCorporate Online – the TFR transaction code is included in characters 23-25.Commercial Banking Online – the narrative does not include the transaction code, which is now found in theType field.Corporate Online – does not contain a reference for the payment.Commercial Banking Online – characters 1-18 contain the debit account reference for the paymentor an auto-generated payment ID.Corporate Online – on today’s statement the narrative will initially appear as SUNDRY DEBIT.Commercial Banking Online – there is no difference between today’s and a historic statement and transactionposting is real-time.Transaction Narrative ChangesThe transaction narrative on Commercial Banking Online contains different information to Corporate Online and thestructures of the narratives have changed.See how the transaction narrative information is structured differently in the table below:Commercial Banking OnlineCharacter No.Commercial Banking OnlineFormatCorporate OnlineCharacter No.Debit Account Reference1-18Free text – variable length(auto-generated 10 digit numberif reference not entered)No Transaction Code included-TO19-20Fixed text – "TO"1-6 (text 'TO A/C')Beneficiary Accountand Sort Code22-36Sort Code: characters 31-36Account Number:characters 22-2926-42(Sort Code: characters 35-40Account Number:characters 26-33)ContentTransaction Narrative Example17

Balances & Transactions CSV Export GuideTransaction Narrative ChangesPayment TypeInter-Account Transfer (GBP)Debit or Credit to the AccountCrKey DifferencesThe Commercial Banking Online Inter-Account Transfer (IAT) transaction narrative for credits to your accounts is differentfrom Corporate Online in the following ways:Corporate Online – two options are available for export:Characters 149 characters, in 4 sections of 25 and a final section of 49. 80 characters, in 3 sections of 25 and final section of 5 characters.This is the same as the 149 character narrative but cut off at 80 characters.Commercial Banking – 36 characters, in 2 sections of 18.TransactionCodePaymentReferenceToday’s vs.historic statementCorporate Online – the TFR transaction code is included in characters 23-25.Commercial Banking Online – the narrative does not include the transaction code, which is now found in theType field.Corporate Online – does not contain a reference for the payment.Commercial Banking Online – characters 1-18 contain the debit account reference for the payment or anauto-generated payment ID.Corporate Online – on today’s statement the narrative will initially appear as SUNDRY CREDIT.Commercial Banking Online – there is no difference between today’s and a historic statement and transactionposting is real-time.Transaction Narrative ChangesThe transaction narrative on Commercial Banking Online contains different information to Corporate Online and thestructures of the narratives have changed.See how the transaction narrative information is structured differently in the table below:Commercial Banking OnlineCharacter No.Commercial Banking OnlineFormatCorporate OnlineCharacter No.Beneficiary Reference1-18Free text – variable length(auto-generated 10 digit numberif reference not entered)No Transaction Code included-FR19-20Fixed text – "FR"1-8 (text 'FROM A/C')Debit Accountand Sort code22-36SSort Code: characters 31-36Account Number:characters 22-2926-42(Sort Code: characters 35-40Account Number:characters 26-33)ContentTransaction Narrative Example18

Balances & Transactions CSV Export GuideTransaction Narrative ChangesPayment TypeEuro & International MoneyMoverDebit or Credit to the AccountDrKey DifferencesOn Corporate Online the transaction and balance statements for international currency accounts are different from thosefor domestic GBP accounts. On Commercial Banking Online a single Balances & Transactions CSV export is available forall accounts.The Commercial Banking Online Euro & International MoneyMover transaction narrative for debits from your accounts isdifferent from Corporate Online in the following ways:Corporate Online – two options are available for export:Characters 149 characters, in 4 sections of 25 and a final section of 49. 80 characters, in 3 sections of 25 and final section of 5 characters.This is the same as the 149 character narrative but cut off at 80 characters.Commercial Banking – 36 or 54 characters, in 2 or 3 sections of 18.Today’s vs.historic statementCorporate Online – on today’s statement the narrative changes for today’s transaction vs. historic transactions.The historic view of the transaction is updated to no longer include the reference, amount and exchange rate.Commercial Banking Online – there is no difference between today’s and a historic statement and transactionposting is real-time.Transaction Narrative ChangesThe transaction narrative on Commercial Banking Online includes the same information found in Corporate Online.However, the structures of the narratives have changed.See how the transaction narrative information is structured differently in the table below:Commercial Banking OnlineCharacter No.Commercial Banking OnlineFormatCorporate OnlineCharacter No.Foreign ational PaymentIndicator19-25Text 'FOREIGN'25-31Currency27-29CCCOnly provided for certaininternational payments33-35Exchange Rate Detail37-54N.NN AT N.NNNNOnly provided for certaininternational payments-ContentTransaction Narrative Example19

Balances & Transactions CSV Export GuideTransaction Narrative ChangesPayment TypeEuro & International MoneyMoverDebit or Credit to the AccountCrKey DifferencesOn Corporate Online the transaction and balance statements for international currency accounts are different from thosefor domestic GBP accounts. On Commercial Banking Online a single Balances & Transactions CSV export is available forall accounts.The Commercial Banking Online Euro & International MoneyMover transaction narrative for credits from your accounts isdifferent from Corporate Online in the following ways:Corporate Online – two options are available for export:Characters 149 characters, in 4 sections of 25 and a final section of 49. 80 characters, in 3 sections of 25 and final section of 5 characters.This is the same as the 149 character narrative but cut off at 80 characters.Commercial Banking – 18 characters.Debit AccountInformationToday’s vs.historic statementCorporate Online – provides a currency transaction identifier and foreign transaction reference.Commercial Banking Online – F/FLOW code and the payment remitter’s name is provided.Corporate Online – on today’s statement the narrative changes for today’s transaction vs. historic transactions.Commercial Banking Online – there is no difference between today’s and a historic statement and transactionposting is real-time.Transaction Narrative ChangesThe transaction narrative on Commercial Banking Online contains different information to Corporate Online and thestructures of the narratives have changed.See how the transaction narrative information is structured differently in the table below:Commercial Banking OnlineCharacter No.Commercial Banking OnlineFormatCorporate OnlineCharacter No.Funds Flow Indicator1-7F/FLOW-Remitter Name8-18ContentFree text - variable lengthNo Transaction Code includedTransaction Narrative Example2026-50

Balances & Transactions CSV Export GuideTransaction Narrative ChangesPayment TypeChequeDebit or Credit to the AccountDrKey Difference

Card Transaction Dr 23 Bank Giro Credit Cr 24 ATM/Counter Withdrawal Dr 25 ATM/Counter Deposit Cr 26 Direct Debit Dr 27 Unpaid Direct Debit Cr 28 Standing Order (Paid) Dr 29 Standing Order (Received) Cr 30 Balances & Transactions CSV Export Guide 10. Transaction Narrative Changes