Transcription

Mississippi Insurance DepartmentReport of ExaminationofSOUTHERN FARM BUREAU CASUALTYINSURANCE COMPANYas ofDecember 31, 2020

TABLE OF CONTENTSExaminer Affidavit . 1Salutation . 2Scope of Examination . 3Comments and Recommendations of Previous Examination . 3History of the Company . 3Corporate Records . 5Management and Control . 5Stockholders . 5Board of Directors . 5Committees . 7Officers . 8Conflict of Interest . 9Holding Company Structure . 9Organizational Chart. 9Affiliated and Related Party Transactions . 12Fidelity Bond and Other Insurance . 14Pensions, Stock Ownership and Insurance Plans . 14Territory and Plan of Operation . 14Growth of Company . 15Mortality and Loss Experience . 16Reinsurance . 16Accounts and Records. 19Statutory Deposits . 19Financial Statements . 20Introduction . 20

Statement of Admitted Assets, Liabilities, Surplus and Other Funds - Statutory . 21Statement of Income - Statutory . 22Reconciliation of Capital and Surplus - Statutory . 23Reconciliation of Examination Adjustments to Surplus .24Market Conduct Activities . 25Commitments and Contingent Liabilities . 25Subsequent Events . 25Comments and Recommendations . 26Acknowledgment . 27

EXAMINER'S AFFIDAVIT AS TO STANDARDS ANDPROCEDURES USED IN AN EXAMINATIONState of Mississippi,County of Madison,R. Dale Mil le r, being duly sworn , states as follows:I.I have authority to represent the Mississippi Insurance Department in the examination ofSouthern Farm Bureau Casualty Insurance Company as of December 31, 2020.2.The Mississippi Insurance Department is accredited under the Natio nal Association ofInsurance Commi ssioners Financial Regulation Standards and Accreditation.3.I have reviewed the examination work papers and exam ination report, and the examinatio nof Southern Farm Bureau Casualty [nsurance Companywas performed in a mannercons istent with the standards and procedures required by the National Association ofInsurance Commissioners and the Mississippi Insurance Department.The affiant says nothing further.f2ilzbJti.J!Lday ofMy commission expires();}obP,r- /0 ;J.0:)3/ [date]I1Southern Farm Bureau Casualty Insurance CompanyMID Examination as of December 3 1, 2020Page I

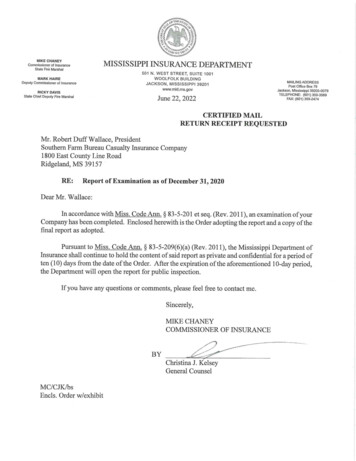

MIKE CHANEYCommissioner of InsuranceState Fire MarshalMISSISSIPPI INSURANCE DEPARTMENT501 N. WEST STREET, SUITE 1001WOOLFOLK BUILDINGJACKSON, MISSISSIPPI 39201www.mid.ms.govMARK HAIREDeputy Commissioner ofInsuranceMAILING ADDRESSPost Office Box 79Jackson, MS 39205-0079TELEPHONE: (601) 359-3569FAX: (601) 576-2568June 15, 2022Honorable Mike ChaneyCommissioner of InsuranceMississippi Insurance Department1001 Woolfolk Building501 North West StreetJackson, Mississippi 39201Dear Commissioner Chaney:Pursuant to your instructions and authorization and in compliance with statutory provisions, anexamination has been conducted, as of December 31, 2020, of the affairs and financial condition of:SOUTHERN FARM BUREAU CASUALTY INSURANCE COMPANY1800 East County Line RoadRidgeland, Mississippi 39157License #7700932NAIC Group #0483NAIC #18325FEETS #18325-MS-2020-1This examination was commenced in accordance with Miss. Code Ann. §83-5-201 et seq. and wasperformed in Ridgeland, Mississippi, at the statutory home office of the Company. The report ofexamination is herewith submitted.Southern Farm Bureau Casualty Insurance CompanyMID Examination as of December 31, 2020Page 2

SCOPE OF EXAMINATIONWe have performed our full-scope financial examination of Southern Farm Bureau CasualtyInsurance Company (“SFBCIC” or “Company”). The last examination covered the period ofJanuary 1, 2011 through December 31, 2015. This examination covers the period of January 1,2016 through December 31, 2020. This examination was coordinated with Mississippi as the leadstate and Arkansas, Florida, and Louisiana as participating states.We conducted our examination in accordance with the National Association of InsuranceCommissioners (“NAIC”) Financial Condition Examiners Handbook (“Handbook”). TheHandbook requires that we plan and perform the examination to evaluate the financial condition,assess corporate governance, identify current and prospective risks of the Company and evaluatesystem controls and procedures used to mitigate those risks. An examination also includesidentifying and evaluating significant risks that could cause an insurer’s surplus to be materiallymisstated both currently and prospectively.All accounts and activities of the Company were considered in accordance with the risk-focusedexamination process. This may include assessing significant estimates made by management andevaluating management’s compliance with Statutory Accounting Principles. The examination doesnot attest to the fair presentation of the financial statements included herein. If, during the courseof the examination an adjustment is identified, the impact of such adjustment will be documentedseparately following the Company’s financial statements.This examination report includes significant findings of fact, as mentioned in the Miss. Code Ann.§83-5-201 and general information about the insurer and its financial condition. There may beother items identified during the examination that, due to their nature (e.g., subjective conclusions,proprietary information, etc.), are not included within the examination report but separatelycommunicated to other regulators and/or the Company.COMMENTS AND RECOMMENDATIONS OF PREVIOUSEXAMINATIONThere were no comments and/or recommendations made by the Mississippi Insurance Department(“MID”) examination team in the previous examination report, which covered the period fromJanuary 1, 2011 through December 31, 2015.HISTORY OF THE COMPANYIn 1947, the Farm Bureau Federations located in the states of Arkansas, Florida, Mississippi andTexas organized individual investment corporations for the purpose of organizing the Company.On September 25, 1947, the Company was formed under the laws of the State of Mississippi as aas a property and casualty insurance company, with business commencing on September 30, 1947.Southern Farm Bureau Casualty Insurance CompanyMID Examination as of December 31, 2020Page 3

Subsequently, the Louisiana, South Carolina and Colorado Farm Bureau Federations acquiredequal shares of the Company’s capital stock and Florida sold its interest back to the Company.Through December 31, 2008, the outstanding shares of SFBCIC were owned by the Farm BureauFederations in the states of Arkansas, Colorado, Louisiana, Mississippi, South Carolina and Texas.Each entity held 666.6 shares or 16.67% of the 4,000 authorized shares of SFBCIC. The Texasparties withdrew from SFBCIC as of December 31, 2008, and surrendered its 666.6 shares of stockin exchange for shares of SFBCIC’s wholly owned subsidiary operating in the State of Texasformed for purposes of the withdrawal. Because of the withdrawal of the Texas parties, SFBCICand its remaining shareholders desired to amend the Articles of Association, the Bylaws and theAmended Membership Treaty under which it had operated. On December 14, 2009, the Treatywas terminated and a new organization structure for the Company was created (the “originalreorganization”). Subsequent to the original reorganization, there were 10,428,000 shares of 1par value common stock authorized and 1,082,842 issued. Of the issued shares, 2,640 shares werevoting shares and 1,080,202 were non-voting shares which were owned by the followingshareholders: Arkansas Casualty Investment Corporation, Colorado Farm Bureau Investment Company, FFBF Investment Corporation, Louisiana Farm Bureau Investment Corporation, Mississippi Farm Bureau Holding Corporation and South Carolina Farm Bureau Investment LLC(collectively referred to as the “Investment Companies”). The Investment Companies weremajority owned by their respective Farm Bureau Federation/Organization (“Farm BureauOrganization”).Effective February 3, 2015, SFBCIC’s ownership structure underwent another change whereby anew holding company, named Southern Casualty Holding Company (“SCHC”), was insertedbetween SFBCIC and its previous shareholders as part of a reorganization. The 2015reorganization was done for regulatory purposes and did not impact the financial condition, e.g.,the capital and surplus of SFBCIC remained the same immediately before and after thereorganization. In connection with the 2015 reorganization, the previous shareholder agreementsbetween SFBCIC, the Farm Bureau Organizations and the Investment Companies were terminatedand new shareholder agreements between SCHC, the Farm Bureau Organizations and theInvestment Companies were entered into with substantially the same terms as the originalshareholders agreement.Subsequent to the 2015 reorganization, SFBCIC had 1,082,842 issued and outstanding shares ofone class of common stock, all of which was owned exclusively by SCHC. The InvestmentCompanies owned the following number of SCHC shares, which was the exact same number eachinvestment company owned of existing shares in SFBCIC prior to the 2015 reorganization.Southern Farm Bureau Casualty Insurance CompanyMID Examination as of December 31, 2020Page 4

SharesOutstanding ArkansasColoradoInvestment CompaniesFlorida Louisiana MississippiClass AClass 157,454Total1,3201,081,5221,082,842Class C shares were automatically converted to Class B shares at the end of the reorganizationtransition period in December 2019. At December 31, 2020, there were 1,081,522 Class B sharesand no Class C Shares outstanding.CORPORATE RECORDSThe Articles of Incorporation, Bylaws and amendments thereto were reviewed and duly applied inother sections of this report where appropriate. Minutes of the meetings of the Stockholders, Boardof Directors (“Board”) and various committees, as recorded during the period covered by thisexamination, were reviewed and appeared to be complete and in order with regard to actionsbrought up at the meetings for deliberation and appropriate action, which included the approvaland support of the Company’s transactions and events, as well as the review of the audit andexamination report.MANAGEMENT AND CONTROLStockholdersAs of December 31, 2020, the Company had 10,428,000 shares of 1 par value common stockauthorized with 1,082,842 shares issued and outstanding. All issued and outstanding shares werevoting shares. SCHC owned 100% of the shares issued and outstanding. The Company paid thefollowing amounts as dividends to stockholders during the examination period.20162017201820192020 52,800 52,800 52,800 52,800 52,800Board of DirectorsThe Articles of Incorporation and Bylaws vest the management and control of the Company’sbusiness affairs with the Board. The members of the duly elected Board, along with their place ofresidence, year elected/appointed, and principal occupation, at December 31, 2020, were asfollows:Southern Farm Bureau Casualty Insurance CompanyMID Examination as of December 31, 2020Page 5

Name and ResidenceYearElected/AppointedPrincipal OccupationRonald Roy AndersonChairman of the BoardEthel, LA1985Farmer and President ofLouisiana Farm BureauFederationJohn Lawrence Hoblick, Sr.Vice Chairman of the BoardDeLeon Springs, FL2000Farmer and President of FloridaFarm Bureau FederationRichard Bryan FontenotVille Platte, LA2016FarmerHarry Legare Ott, Jr.Orangeburg, SC2016Farmer and President of SouthCarolina Farm BureauCarlyle Wallace CurrierMolina, CO2011RancherThomas Michael FreezeKeo, AR2014-2018: 2020Fish FarmerRodney Roscoe LandMayo, FL2020FarmerGeorge Newton BryantEasley, SC2016FarmerDanny Russell WrightWaldron, AR2018Poultry FarmerLouis Joseph Breaux, IVKiln, MS2019Farm ManagerRichard Edward Hillman, IICarlisle, AR2009Farmer and President ofArkansas Farm BureauFederationSteve Allen JohnsonWauchula, FL2015Citrus Grower/Cattle RancherTheodore Hastings Kendall IVBolton, MS2011Farm ManagerConstance Jean HassTrinidad, CO2020RancherSouthern Farm Bureau Casualty Insurance CompanyMID Examination as of December 31, 2020Page 6

David Michael McCormickUnion Church, MS2015Farmer and President ofMississippi Farm BureauFederationMichael Gerard MelanconBreaux Bridge, LA2015Sugar Cane FarmerDonald James ShawcroftAlamosa, CO2010Farmer and President ofColorado Farm BureauWilliam Keistler ColemanBlair, SC2016FarmerCommitteesDuring the period covered by this examination, the following Board appointed committees wereutilized by the Company to carry out certain specified duties: Audit Committee, CompensationCommittee, Executive Committee and Investment Committee.Audit Committee:The Audit Committee had six members, all of whom were outside directors, which met therequirements set forth by the Model Audit Rule. The Audit Committee’s responsibilities includedreviewing the audit report prepared by the outside accounting firm and making recommendationsto the Board regarding the audit report and the selection of an outside accounting firm. The AuditCommittee was also responsible for overseeing the Company’s compliance with the AnnualFinancial Reporting Model Regulation and for making sure management established,implemented, and monitored the system of internal controls over financial reporting.Compensation Committee:The Compensation Committee was comprised of the Presidents from each of the Farm BureauFederations. The Chairman of the Board was also the Chairman of the Compensation Committee.The Compensation Committee duties included reviewing and making recommendations to theBoard with respect to compensation and to perform such other duties as appropriate for thecommittee or as delegated by the Board.Executive Committee:The Executive Committee consisted of the Presidents from each of the Farm Bureau Federationswho serve on the Board. The Chairman of the Board was also the Chairman of the ExecutiveCommittee. The Executive Committee had the power to exercise, conduct and control the businessof the Company between meetings of the Board. The Executive Committee had the sole andexclusive power and authority to declare additional dividends.Investment Committee:The Investment Committee was comprised of Board and non-Board members; however, onemember of the committee must be the Chairman of the Board. The committee delegated to theSouthern Farm Bureau Casualty Insurance CompanyMID Examination as of December 31, 2020Page 7

Investment Department the authority to transact the routine day-to-day investment dutiesincluding, but not limited to, the sale, purchase, and transfer of stocks, bonds, securities, and otherinvestments, both real and personal. The Investment Committee reported to the Board regardingthe condition of the funds, securities and investments of the Company.The following members served on the committees mentioned above at December 31, 2020.AuditCompensationJohn Lawrence Hoblick, Sr., ChairmanRonald Roy Anderson, ChairmanRonald Roy AndersonJohn Lawrence Hoblick, Sr.David Michael McCormickDavid Michael McCormickRichard Edward HillmanRich Edward HillmanDonald James ShawcroftDonald James ShawcroftHarry Legare Ott, Jr.Harry Legare Ott, Jr.ExecutiveInvestmentRonald Roy Anderson, ChairmanRonald Roy Anderson, ChairmanJohn Lawrence Hoblick, Sr.John Lawrence Hoblick, Sr.David Michael McCormickRobert Duff WallaceRich Edward HillmanMax Turner CourtneyDonald James ShawcroftThomas Herndon ArthurHarry Legare Ott, Jr.OfficersThe senior officers of the Company as of December 31, 2020 were:Name of OfficerNumber ofYears withCompanyTitleRobert Duff Wallace36President and Chief Executive OfficerMax Turner Courtney29Senior Vice President – Chief Financial OfficerRichard Ross Sims30Senior Vice President – Chief OperatingOfficerLydia Catherine Warren35Senior Vice President – Legal and SecretarySouthern Farm Bureau Casualty Insurance CompanyMID Examination as of December 31, 2020Page 8

Jerry Joseph Keating, Jr.35Senior Vice President – State Manager (MS)Blaine Vernon Briggs34Senior Vice President – State Manager (LA)Steven Clay Murray39Senior Vice President (Florida)Kevin Eugene McKenzie33Senior Vice President – State Manager(Arkansas)William O’Neil Courtney35Senior Vice President – State Manager (SouthCarolina)Duane Burton Hardy32Senior Vice President – ClaimsLaura Sorey Watkins34Senior Vice President – Human ResourcesConflict of InterestThe Company had formal procedures whereby disclosures were made to the Board of any materialinterest or affiliation on the part of any officer or director that was, or would likely be, a conflictwith their official duties.HOLDING COMPANY STRUCTUREDuring the time period covered by this examination, the Company reported as a member of aninsurance company holding system as defined by Miss. Code Ann. §83-6-1. For each year of theexamination period, Holding Company Registration Statements were filed with the MID inaccordance with Miss. Code Ann. §83-6-5 and §83-6-9.Organizational ChartThe organizational chart below displays the identities of the members of the holding companystructure that included the Company, and is followed by a brief description of the Company’s othersubsidiaries and interests.Southern Farm Bureau Casualty Insurance CompanyMID Examination as of December 31, 2020Page 9

Southern Casualty Holding CompanySouthern Farm Bureau Casualty Insurance CompanyArkansasFarm BureauCasualty Ins.Rural InsuranceAgency100% interestGrants Ferry Parkway LLC49% Membership interestColorado FarmBureau InsuranceCompany 13641FloridaFarm BureauCasualty Ins. Co.31216FloridaFarm BureauGeneral Ins. Co.21817LouisianaFarm BureauCasualty Ins. Co.40924MississippiFarm BureauCasualty Ins. Co.27669South CarolinaFarm BureauInsurance Company14114FloridaFarm BureauIns. AgencyHighland Colony LandCompany, LLC 33%Membership interestVenture Properties50% PartnershipinterestSCHC was reported as the ultimate controlling person in the Holding Company RegistrationStatement filed with the MID as of December 31, 2020. SCHC was formed in 2015 for the solepurpose of holding all of the voting stock of the Company, the lead insurer in the group.Below is a description of the Company’s wholly owned subsidiaries at December 31, 2020:Arkansas Farm Bureau Casualty Insurance Company (“AFBCIC”) was incorporated onFebruary 6, 2004, under the laws of the State of Arkansas and its principal business purpose wasproviding casualty insurance in the State of Arkansas.Colorado Farm Bureau Insurance Company (“CFBIC”) was demutualized and converted to astock company effective July 1, 2019 thereby becoming a wholly owned subsidiary of SFBCIC.Its principal business was providing property and casualty insurance coverage in the State ofColorado.Florida Farm Bureau Casualty Insurance Company (“FFBCIC’) was incorporated in Floridaon April 16, 1974, under the laws of the State of Florida. Its principal business, in association withits wholly owned subsidiary, Florida Farm Bureau General Insurance Company (“FFBGIC”), wasproviding property and casualty insurance coverage (principally automobile, property and generalliability) in the State of Florida. FFBCIC was also the parent of Florida Farm Bureau Agency, Inc.,a noninsurance brokerage operation that provided an outlet for placing business for customers inFlorida which its parent did not wish to write.Louisiana Farm Bureau Casualty Insurance Company (“LFBCIC”) was incorporated onFebruary 16, 1981, under the laws of the State of Louisiana, and its principal business wasproviding casualty insurance coverage (principally automobile) in the State of Louisiana.Southern Farm Bureau Casualty Insurance CompanyMID Examination as of December 31, 2020Page 10

Mississippi Farm Bureau Casualty Insurance Company (“MFBCIC”) was incorporated onMay 19, 1986, under the laws of the State of Mississippi, and its principal business was providingproperty and casualty insurance coverage (principally automobile and homeowner) in the State ofMississippi. Also, the Company was an authorized surplus lines writer in various other states.South Carolina Farm Bureau Insurance Company (“SCFBIC”) was incorporated on February11, 2011, under the laws of the State of South Carolina to provide casualty insurance, primarilyprivate passenger automobile. Effective April 1, 2014, SFBCIC purchased 100% of the company’soutstanding common stock from South Carolina Farm Bureau Mutual Insurance Company.SCFBIC began writing business during 2015.Below is a description of the Company’s wholly owned subsidiaries that were dissolved duringthe exam period:Southern Farm Bureau Brokerage Company (“SFBBC”), in 1994, a noninsurance companywas organized and incorporated in the state of Mississippi as a wholly owned subsidiary ofSFBCIC. SFBBC was a noninsurance company formed primarily for conducting certaininvestment and reinsurance brokerage activities for the Southern Farm Bureau group. In 2020,SFBCIC’s management reviewed the group’s operations and organizational structure, andconcluded that operational efficiencies and expense reductions could be achieved if SFBBCtransferred its operations to SFBCIC. SFBBC’s Board approved the dissolution of the entity onOctober 9, 2020. On November 30, 2020, SFBBC ceased operations and transferred all assets andliabilities to SFBCIC, its parent and sole shareholder.As a result of the dissolution of its former subsidiary, SFBBC, SFBCIC directly owns thefollowing: 100% of all the issued and outstanding voting securities of Rural Insurance Agency 33% of the membership interest of Highland Colony Land Company, LLC 49% of the membership interest of Grants Ferry Parkway, LLC 50% of the partnership interest of Venture PropertiesSouthern Farm Bureau Property Insurance Company (“SFBPIC”) was formed in August 1994as a wholly owned subsidiary of SFBCIC to write property and casualty reinsurance for certainassociated Farm Bureau mutual companies in Arkansas, Mississippi, Louisiana, and SouthCarolina. SFBPIC ceased assumption of new business after 2005 and entered into a “dormant”state while managing run-off of outstanding claims related to the 2005 tropical storms andhurricanes. Effectively all outstanding claims that were assumed by SFBPIC were settled in 2011.As a way to eliminate operating costs, SFBCIC management sought permission from the MID todissolve SFBPIC in 2019. On October 4, 2019, the MID approved the Articles of Dissolution,which terminated all operations and transferred all assets and liabilities to its parent, SFBCIC.SFBCIC realized a loss of 21.1 million in investment income from the dissolution.Southern Farm Bureau Casualty Insurance CompanyMID Examination as of December 31, 2020Page 11

Affiliated and Related Party TransactionsThe Company’s transactions with its related parties were reviewed and the following items weredeemed notable for purposes of this report.The Company, along with its subsidiaries and affiliates, filed a consolidated federal income taxreturn. The method of allocation among the companies was made primarily on a separate returnbasis with current credit for any net operating losses or other items utilized in the consolidatedreturn. Intercompany tax balances were settled annually in the subsequent year.Surplus debentures of related companies were purchased by SFBCIC to strengthen the issuer’sfinancial position. These investments are carried at cost and reported as other invested assets.Repayment of the surplus debentures (including interest) and certificates was permitted when andif the issuing company met certain surplus requirements and required approval of the domiciliaryInsurance Department of the issuing company. Below are the surplus debentures with relatedparties held as of December 31, 2020: On April 19, 2006, MFBCIC issued a 25,000,000 surplus note to SFBCIC with an interestrate equal to the interest payable on twenty year U.S. Treasury Bonds as of the date of thenote. The interest rate was adjusted every second anniversary date and at December 31,2020, the stated interest rate was 3.27%. The note was for a twenty year term with interestdue annually. The principal balance owed was 25,000,000 at December 31, 2020. On December 22, 2005, Louisiana Farm Bureau Mutual Insurance Company (“LAMutual”) issued a 15,000,000 surplus note to SFBCIC with an interest rate of 4.70% perannum. The note is for a twenty year term with interest due annually. LA Mutual retired 1,000,000 of the principal balance during 2015 reducing the carrying value to 14,000,000. During the exam period, an additional 10,000,000 in principal paymentswere received by the Company leaving an outstanding principal balance of 4,000,000 atDecember 31, 2020. On March 29, 2013, South Carolina Farm Bureau Mutual Insurance Company (“SCMutual”) issued a 12,500,000 subordinated surplus note to SFBCIC with an interest rateof 6.00% per annum. The note was for a twenty year term with interest due annually.During the exam period, SC Mutual retired 2,500,000 of the principal balance leaving anoutstanding principal balance of 10,000,000 at December 31, 2020.As result of the dissolution of its former subsidiary, SFBBC, the following notes were assigned toSFBCIC in connection with the transfer of various levels of ownership in the following entities: Rural Insurance Agency note with an unpaid principal balance of 1,800,000 at December31, 2020.Brandon Land, LLC note with an unpaid principal balance of 3,126,819 at December 31,2020.Southern Farm Bureau Casualty Insurance CompanyMID Examination as of December 31, 2020Page 12

Grants Ferry Parkway LLC note with an unpaid principal balance of 822,750 at December31, 2020.Shiloh Land, LLC note with an unpaid principal balance of 2,826,052 at December 31,2020.On May 4, 2020, MFBCIC entered into a 10,000,000 line of credit and promissory note withSFBCIC with an interest rate of 3.75%. The note has a maturity date of May 31, 2021. AtDecember 31, 2020, there were no amounts outstanding on the note.As part of the 2009 original reorganization which was approved by the MID, SFBCIC issued notesto certain shareholders in 2009. Each note bore interest at 8.00% based upon a 365-day year, withinterest and principal paid annually on December 1st of each year. The notes were paid in fullduring 2019.During 2019, as part of the demutualization and re-domestication of CFBIC to become a whollyowned subsidiary of SFBCIC, the Company received an extraordinary dividend whereby nearlyall assets and liabilities were transferred. The extraordinary dividend received by the Companyhad an approximate fair value and carrying value of 41,000,000 and 32,000,000, respectively.The Company had joint expense allocation agreements with M

This examination was commenced in accordance with Miss. Code Ann. §83-5-201 . et seq. and was . performed in Ridgeland, Mississippi, at the statutory home office of the Company. . Southern Farm Bureau Casualty Insurance Company Florida Farm Bureau Ins. Agency Florida Farm Bureau General Ins. Co. 21817 ColoradoFarm Bureau Insurance Company .