Transcription

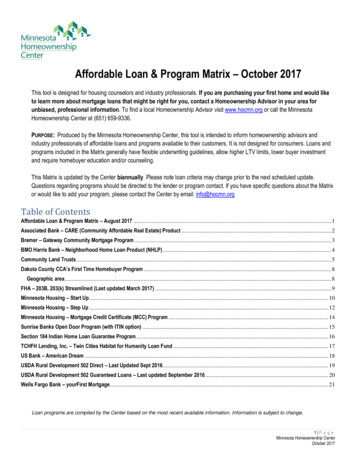

Affordable Loan & Program Matrix – October 2017This tool is designed for housing counselors and industry professionals. If you are purchasing your first home and would liketo learn more about mortgage loans that might be right for you, contact a Homeownership Advisor in your area forunbiased, professional information. To find a local Homeownership Advisor visit www.hocmn.org or call the MinnesotaHomeownership Center at (651) 659-9336.PURPOSE: Produced by the Minnesota Homeownership Center, this tool is intended to inform homeownership advisors andindustry professionals of affordable loans and programs available to their customers. It is not designed for consumers. Loans andprograms included in the Matrix generally have flexible underwriting guidelines, allow higher LTV limits, lower buyer investmentand require homebuyer education and/or counseling.This Matrix is updated by the Center biannually. Please note loan criteria may change prior to the next scheduled update.Questions regarding programs should be directed to the lender or program contact. If you have specific questions about the Matrixor would like to add your program, please contact the Center by email: info@hocmn.orgTable of ContentsAffordable Loan & Program Matrix – August 2017 . 1Associated Bank – CARE (Community Affordable Real Estate) Product . 2Bremer – Gateway Community Mortgage Program . 3BMO Harris Bank – Neighborhood Home Loan Product (NHLP) . 4Community Land Trusts . 5Dakota County CCA’s First Time Homebuyer Program . 8Geographic area . 8FHA – 203B, 203(k) Streamlined (Last updated March 2017) . 9Minnesota Housing – Start Up . 10Minnesota Housing – Step Up . 12Minnesota Housing – Mortgage Credit Certificate (MCC) Program . 14Sunrise Banks Open Door Program (with ITIN option) . 15Section 184 Indian Home Loan Guarantee Program . 16TCHFH Lending, Inc. – Twin Cities Habitat for Humanity Loan Fund . 17US Bank – American Dream . 18USDA Rural Development 502 Direct – Last Updated Sept 2016 . 19USDA Rural Development 502 Guaranteed Loans – Last updated September 2016 . 20Wells Fargo Bank – yourFirst Mortgage . 21Loan programs are compiled by the Center based on the most recent available information. Information is subject to change.1 P a g eMinnesota Homeownership CenterOctober 2017

Associated Bank – CARE (Community Affordable Real Estate) ProductGeographic areaRatiosMaximum incomeInformationAnoka, Chisago, Dakota, Hennepin, Ramsey, Scott,Washington, Pierce, St. Croix county, Rochester:Fillmore, Olmsted37% / 47% maximum100% of Area Median Income (AMI)Income not considered-Rental income-Gross up non-taxable incomeNoAdjustment to gross incomeNoMaximum loan amountFirst time homebuyer onlyEligible propertiesRefinanceInterest rateDown payment and/or closing costassistance programBuyer's minimum investmentMortgage insuranceClosing costsWork historyCredit history 424,100NoCannot own another propertySingle Family detached, Townhome, Condo, PUD attached,PUD Detached, 2-unit propertiesWarrantable Condos only. Manufactured Homes are noteligible. Must be primary residence.Available with limited cash out.Market rateContact lender for detailsGift funds and Down Payment Assistance ProgramsMaximum CLTV 105% if using a Community Second1 Unit2-UnitNo buyer investment required.Requires a min investments of 3%Up to 97% LTVUp to 95% LTVNo mortgage insurance required.Seller contributions allowed: 3% for LTV/CLTV 90% & 97% 6% for LTV/CLTV 75% & 90% 9% for LTV/CLTV 75%Minimum Credit Score 640Minimum Credit Score 670 for 2-Unit PropertiesRequires clean credit for previous 12 months. All delinquentcredit obligations paid prior to application.Discharged minimum of 4 years.Chapter 13Discharged minimum of 4 years.Short Sales/Deed in Lieu4 years since the sale/execution with re-established credit.ForeclosureSettled for a minimum of 7 years with credit re-established.Liens & JudgmentsPaid prior to closing.Collection accountsPaid prior to closing.AmortizationCash reservesPurchase rehab optionSeller contributions may include mortgage financingcosts, closing costs and/or prepaids/escrows.2 years employmentChapter 7Education requirementsCommentsContact: Joannette Cintrón 651-306-1785 (office)Contact: Sandy Warner651-306-1662 (office)Contact: Lance Couch651-544-8739 (office)First time buyers requires at least one borrower to completehomebuyer educationNon-traditional Credit: Must have three sources;One housing-related source, rent payment history, utilitypayments, telephone or cable bills, or other sources ofcredit or services for which the borrower has/had aregular financial obligation.Home Stretch accepted.30 yearsPITI Reserve Requirements: 1 monthNot available2 P a g eMinnesota Homeownership CenterOctober 2017

Bremer – Gateway Community Mortgage ProgramInformationGeographic areaBremer Bank lending areas of MN, ND and WIRatiosMaximum incomeIncome not consideredMaximum Loan to ValueGross up non-taxable incomeAdjustment to gross incomeMaximum loan amountFirst time homebuyer onlyEligible propertiesRefinanceInterest rateDown payment and/or closing costassistance programBuyer's minimum investmentMortgage insuranceAdditional closing costsWork historyCredit history43%No income litmit Self-employed with duration less than 1 year Part-time received for less than 1 year Income if returned to workforce for less than 6 months97%Combined Loan to Value to 105% with acceptable downpayment assistance programs approved by BremerBankAvailable contact lender for detailsMust follow current portfolio guidelines-- 307,900No minimumNo Single FamilyCondominiums and townhomes (conforming to FNMA req.)Planned Unit DevelopmentsCommunity Land TrustsAcreage limited to 10 acre parcelsOnly permitted to improve Bremer Bank’s position for aloan held in our in-house portfolioNoSlightly higher than Market Rate, FixedAllowable from acceptable sourcesContact lender for details1% or 1000Whichever is lessNot applicableNoTwo years continuous stable income No foreclosure within the last 7 years Minimum 640 credit score All collections, judgements and liens must be paid in fullChapter 7Follow FNMA GuidelinesChapter 13Follow FNMA GuidelinesLiensForeclosureJudgmentsCollection accountsEducation requirementsAmortizationCash reservesPurchase rehab optionCommentsHome must be located in a low or moderate censustractCollege is acceptable as part of the two year history anddocumentedNon-traditional credit: must have 3 sources – rentreceipts, utility payments, telephone or cable bills, or othersources of credit or services for which the borrowerhas/had a regular financial obligationPaid in fullNone within the last 7 yearsExplanations required3rdPaid in full with party verification required of reason fordefault (default must be beyond borrower’s control).Paid in fullYes. Sole borrower must attend. For co-borrowers, at leastone borrower must attend.www.hocmn.org to find a Home Stretch workshop orregister for the online course Framework30 years fixed, fully amortizingOne month reserves of PITIMust be accessibleNot available3 P a g eMinnesota Homeownership CenterOctober 2017

BMO Harris Bank – Neighborhood Home Loan Product (NHLP)Geographic areaRatiosMaximum incomeIncome not consideredRental incomeInformationCommentsProperties located in designated counties in MinnesotaThe property must be located in a Low or ModerateIncome Census Tract or borrower income must bebelow Low Income Limit40% for FICO 680; 45% for FICO 680 NoneMust follow Freddie Mac’s guidelinesNoGross up non-taxable income-Adjustment to gross incomeMaximum loan amount-First time homebuyer onlyEligible propertiesRefinanceInterest rateDown payment and/or closing costassistance programBuyer's minimum investmentMortgage insuranceClosing costsWork historyCredit historyConformingNoHomebuyer education required for purchase transactions.Single Family, Condominium, Townhouse, PUD andManufactured Homes1‐2 Units only, Primary Residence (owner-occupied) OnlyNon‐occupant co‐borrowers are not eligible.Yes - Rate/Term Refinance onlyNote Rate /Fixed for Life of Loan for the 30 year FRMMust be borrower own funds. Minimum Borrower Contribution:Greater of 1,000 or 1% of loan amount (3% if FICO 660)Seller contributions allowed, cannot exceed 3% of the lesser ofsales price or appraised value on LTVs 90% and 6% onLTVs 90%. Seller contributions may include mortgagefinancing costs, closing costs and/or prepaids/escrows.2 years verifiable incomeMust follow Freddie Mac’s guidelinesRefinance: 660 FICOLTV 93%: 620 FICO; LTV 93.01-94%: 640 FICO; LTV94.01-95%: 660 FICO; LTV 95.01-97%: 680 FICOFICO score is required for all NHLP transactionsRegardless of the credit score, borrowers need three validtrade lines but those do not have to be on the creditreport. The trade lines need to meet Freddie Mac’sguideline for non‐traditional or alternative credit (seeFreddie Mac. All Regs, Chapter 37.4 (b) for furtherdetails).Chapter 13Must follow Freddie Mac’s guidelinesLiens-Foreclosure-Judgments-Collection accounts-Cash reservesPurchase rehab optionNote: On refinance transactions, Equity can be used tomeet the minimum borrower contribution.Down payment Requirements:Purchase (1 unit): 3%, Purchase (2 unit): 5%Refinance (1‐2 unit): 5%, Manufactured Homes: 20%NoMust follow Freddie Mac’s guidelinesAmortization5/1 ARM also availableApproved affordable seconds and/or Grants availableChapter 7Education requirementsBorrowers with NHLP mortgages may not have anyownership interest in any other residential properties as ofthe Note Date.Homebuyer education is required for all purchase transactions.The Purchase Counseling Advisory Letter must be signedat closing as it is required for all purchase transactions.Home Stretch and Framework are accepted.30 YearsInsurance and tax escrows are required.None requiredNo- limited repair loan.Repairs limited to those which do not affect the livability of thehome. Max amount of repairs cannot exceed 15% ( 10,000 forConv., 5,000 for FHA) of “As Completed” value.Escrow requirements: 110% for Conventional or 150% forFHA ( 500 minimum). Percentage based on estimatedcost of repairs.4 P a g eMinnesota Homeownership CenterOctober 2017

Community Land TrustsCommunity land trusts provide permanently affordable homes to our workforce and ensure the homes remain affordable over time. They accomplishthis by purchasing and retaining ownership of the land, while the homeowner owns the home. The ability to stabilize land costs keeps homesaffordable while providing homeowners the same benefits as market rate homeownership. Community land trusts use a shared equity model thatallows the land trust organization to share in the equity when the home is sold. Nonprofits that provide land trust homes are located throughoutMinnesota and the organization’s requirement and eligibility may vary. For information on land trust not included here visit www.mncltc.orgCOMMUNITY LAND TRUSTS DO NOT PROVIDE FIRST MORTGAGE FINANCINGCarver County CLT ProgramInformationGeographic area servedCLT Contact InformationFirst time homebuyer onlyCarver County952-448-7715 x 2782705 Walnut Street NorthChaska, MN 55318www.carvercda.orgNot RequiredMaximum income limit80% of Median Income or BelowProgram RequirementsApplication, Homebuyer Education, CLT Orientation and lenderPre-approvalBuyer’s minimum investmentAdditional closing costsCommentsCLT Homes are available in most communities inCarver Co.Approved lenders only. 1,000NoneAssistance available varies by lender and borrower incomeCity of Lakes Community Land TrustInformationGeographic area servedCLT Contact InformationCommentsCity of Minneapolis1930 Glenwood AvenueMinneapolis, MN 55405612-594-7150www.CLCLT.orgFirst time homebuyer onlyNot RequiredMaximum income limit80% Metropolitan Median IncomeProgram RequirementsApplication, Homebuyer Education, CLT Orientation andlender Pre-approvalBuyer’s minimum investmentAdditional closing costsCLCLT also has a Contract for Deed ProgramBuyers mortgage product determines minimum investmentVaries, depending on program/ProjectCurrently, all types of closing cost assistance work with CLT5 P a g eMinnesota Homeownership CenterOctober 2017

First HomesInformationGeographic area servedCLT Contact Information:CommentsRochester & 30-mile surrounding area507-287-711712 Elton Hills Drive NWRochester, MN 55901shirley@rochesterarea.orgFirst time homebuyer onlyNot RequiredMaximum income limit80% of State Median IncomeProgram RequirementsMeet income limit; Qualify for Mortgage; Home Buyer EducationBuyer’s minimum investmentAdditional closing costs1% of purchase priceNoneGap loan available if neededInformationCommentsWestern Suburbs of Hennepin CountyBloomington, Brooklyn Park, Deephaven, Eden Prairie,Edina, Golden Valley, Maple Grove, Minnetonka, NewHope, Richfield, St. Louis Park and WayzataHomes Within ReachGeographic area servedCLT Contact InformationFirst time homebuyer only5101 Thimsen Avenue, Suite 202Minnetonka, MN 55345www.homeswithinreach.org 952-401-7071Not RequiredMaximum income limit80% of Hennepin County Housing Consortium Income Limits(HUD)Program RequirementsApplication, Homebuyer Education, CLT Orientation andlender Pre-approvalBuyer’s minimum investmentAdditional closing costs 1,000NoneOne Roof Community HousingInformationGeographic area servedCLT Contact InformationFirst time homebuyer onlyCommentsDuluth and surrounding communities.12 East 4th StreetDuluth, MN 55805www.1roofhousing.org 218-727-5372Not requiredMaximum income limit80% Area Median IncomeProgram RequirementsApplication, Homebuyer education, CLT Orientation andlender PreapprovalBuyer’s minimum investmentAdditional closing costsSome units available up to 115% AMI 1000Recording fees for ground lease and related documents.6 P a g eMinnesota Homeownership CenterOctober 2017

Rondo Community Land TrustInformationGeographic area servedCLT Contact InformationFirst time homebuyer onlyCommentsCity of St. Paul and Ramsey County Suburban Communities651-221-9884626 Selby AvenueSt. Paul, MN. 55104www.rondoclt.orgNot RequiredMaximum income limit80% of HUD median IncomeProgram RequirementsOrientation, Application and Homebuyer Education WorkshopBuyer’s minimum investmentAdditional closing costsEligible Ramsey County Cities: Arden, Blaine, FalconHeights, Gem Lake, Lauderdale, Little Canada,Maplewood, Mounds View, New Brighton, North Oaks,North St. Paul, Roseville, Shoreview , St. Anthony, St.Paul, Spring Lake Park, Vadnais Heights, White BearLake and White Bear Township.Approved lenders Only - See Rondo CLT for list. 500 - 1000Assistance varies on lender availability and borrowersincomeNoneTwo Rivers Community Land TrustGeographic area servedCLT Contact InformationFirst time homebuyer onlyInformationCommentsWashington CountiesSome cities within the counties listed are not currentlyserved651-994-9194PO Box 25451Woodbury, MN 55125www.tworiversclt.comNot RequiredMaximum income limitMust be at 80% or less of the Area Median Income forWashington or Anoka Counties depending on where you buy.*Request updated limits by contacting Two Rivers CLTProgram RequirementsApplication, Homebuyer Education: Home Stretch, CLTOrientation and lender Pre-approvalBuyer’s minimum investmentAdditional closing costsConventional loan products only. No FHA. ApprovedLenders Only; contact Two Rivers CLT for list. 1,000Recording fees for ground lease and related documentsAssistance varies based on lender availability andborrower’s income.7 P a g eMinnesota Homeownership CenterOctober 2017

Dakota County CDA’s First Time Homebuyer Program (NEW)Geographic areaRatiosMaximum incomeInformationCommentsDakota CountyFor specific Information call:Shari Larson 651-675-4472Maximum 45% DTI 90,400 1-2 person & 103,900 3 household sizeIncome not consideredPer loan product guidelines – FHA, VA, ConventionalRental incomePer loan product guidelines – FHA, VA, ConventionalGross up non-taxable incomePer loan product guidelines – FHA, VA, ConventionalAdjustment to gross incomePer loan product guidelines – FHA, VA, ConventionalMaximum loan amountFirst time homebuyer onlyEligible propertiesRefinanceInterest rateDown payment and/or closing costassistance programBuyer's minimum investmentMortgage insuranceAdditional closing costsWork historyCredit history 285,780YesPer loan product guidelines – FHA, VA, ConventionalPurchase program onlyVaries with marketYes, available in conjunction with 1st mortgage 1,000Charter Minimum Mortgage Insurance on ConventionalFHA and VA per product guidelinesUp to 858, depending on program optionsPer loan product guidelines – FHA, VA, ConventionalConventional and VA: 640 minimum credit scoreFHA: 650 minimum credit scoreChapter 7Per loan product guidelines – FHA, VA, ConventionalChapter 13Per loan product guidelines – FHA, VA, ConventionalLiensPer loan product guidelines – FHA, VA, ConventionalForeclosurePer loan product guidelines – FHA, VA, ConventionalJudgmentsPer loan product guidelines – FHA, VA, ConventionalCollection accountsPer loan product guidelines – FHA, VA, ConventionalEducation requirementsAmortizationCash reservesPurchase rehab optionSee Web-site: ership/first-time-homebuyer-program/Up to 10,000 Deferred, 0% Interest Down PaymentAssistance Mortgage (repayable when 1st mortgage ispaid off) and Mortgage Credit Certificate availableYes, All borrowers and spousesHomestretch orFramework and pre-purchase appointment30 year fixed ratePer loan product guidelines – FHA, VA, ConventionalFHA 203k available8 P a g eMinnesota Homeownership CenterOctober 2017

FHA – 203B, 203(k) Streamlined (Last updated March 2017)InformationGeographic areaRatiosMaximum incomeIncome not consideredNationwide31 / 43Gross up non-taxable incomeAdjustment to gross incomeYesEligible propertiesRefinanceInterest rateDown payment and/or closing costassistance programBuyer's minimum investmentMortgage insuranceClosing costsWork historyCredit historyChapter 7Chapter 13Liens and JudgmentsForeclosureCollection accountsEducation requirementsAmortizationCash reservesPurchase rehab optionMust demonstrate compensating factors to exceedpercentages.Food StampsYesFirst time homebuyer onlyTo find lenders visit:https://portal.hud.gov/hudportal/HUD?src /program offices/housing/sfh/lender/lenderlistNoneRental incomeMaximum loan amountCommentsWith proper documentationNoneMetro Area Effective 1/1/16 326,000 (1 Family)NoEffective 1/1/14: Cook County 282,900 (1 Family)All other 271,050 (1 Family)Borrower cannot own other property as primaryresidence.1-4 units, condos, townhomes, manufactured housingMust meet FHA appraisal standardsYes. *NOTE: Effective 6/11/12 special ref. program forunderwater FHA to FHA borrowers. See ML 2012-04Streamline and cash-out refinance (85% limit)Market RatePre-approved programs are allowed; must have HUD approvalletter.Gifts OK per guidelines. Funds from instrumentality ofGovernments per HB 4155.Credit Score at or above 580 requires minimum 3.5%Credit Score between 500-579 required minimum 10%See handbook 4155.1 Rev-5 & Mortgagee Letter 201029YesEffective 4/9/2012: Upfront payment 1.75% of base loanamountEffective 1/1/15 Annual Mortgage Insurance Premium (MIP) is80-85 bpsSee Mortgagee Letter 2015-1, Appendix 1.0The seller may contribute up to 6% of the property's salesprice toward closing costs and pre-paid.Annual Mortgage Insurance Premiumduration: Effective 4/1/2013 (Mortgagee Letter 201304):Loan To Value at origination: 90% LTV – 11 years -90% but 95% LTV – Mortgage Term 90 – Mortgage Term2 years verifiable incomeMinimum 500 credit scoreNon-traditional accepted see mortgagee letter 2008-11*minimum credit score depends on lender’s overlaySalaries and wage income must be verifiable and stableover the past 2 years.Non-traditional credit: must have 3 sources: rentreceipts, utility payments, telephone or cable bills, orother sources of credit or services for which theborrower has/had a regular financial obligation.At least 2 full years since dischargedRe-establish good credit 12-month history.At least 1 full year into established repayment plan.Re-establish good credit 12-month history.Paid in fullNo exceptions. Satisfied prior to endorsement.36 months from date claim was paid.Extenuating circumstances can grant exception. SeeBack to Work Mortgage Letter 2013-26Explanation of collection account requiredNoEncouraged15 to 30 year fixed rateMax. term is 30 years; shorter loan terms are available.1-2 units: 0. 3-4 units: 3 months PITIYes. 203(k) Streamlined allows up to 35,000 added to theloan balance, placed in escrow. Acquisition plus rehabcannot exceed 110% expected market value.To be used for repairs outline in Mortgagee Letter 200550. Rehab more than 15k must be inspected by lenderprior to draw.9 P a g eMinnesota Homeownership CenterOctober 2017

Minnesota Housing – Start UpMinnesota Housing is a trusted state agency that works with local lenders to offer loan programs to help low- and moderate-incomeMinnesotans buy a home statewide. Homebuyers apply for the program directly through a participating lender. To find a MinnesotaHousing lender, visit mnhousing.gov and click on Find a Lender under the Homebuyers & Homeowners heading.Start Up is a first-time homebuyer program that is available with conventional and government loan products.Benefits: Access to Minnesota Housing down payment and closing cost loans. Affordable, fixed interest rates As little as 3% down and reduced mortgage insurance costs with our exclusive conventional loans:o Freddie Mac HFA Advantage o Fannie Mae HFA Preferred o Fannie Mae HFA Preferred Risk Sharing Eligibility Requirements:Borrowers may be eligible if they: Are a first-time homebuyer (not owned a home in the past three years) Have a minimum 640 credit score; some products require a higher credit score Meet Minnesota Housing income limits Purchase a home under the Minnesota Housing home cost limits Take an approved homebuyer education course (required for borrowers using a Minnesota Housing down payment andclosing cost loan or getting a conventional loan). Approved courses:oHome StretchoFrameworkoPathways Home: A Native Homeownership GuideoRealizing the American Dream (offered through the Minneapolis Urban League)More information:Visit our website: mnhousing.gov Under Homebuyers & Homeowners, click on Find a Lender to find a participating lender.oHomebuyers are encouraged to let the lender know they are interested in a Minnesota Housing loan. The lender willhelp them apply for the loan if it's a good fit. The lender will explain the loan options and work to qualify thehomebuyer for a Minnesota Housing first mortgage and, if desired, a down payment and closing cost loan. Under Lenders & Homeownership Partners, click on the Start Up page to find:oStart Up Program DescriptionoStart Up Procedural ManualoCredit and DTI Matrix10 P a g eMinnesota Homeownership CenterOctober 2017

Minnesota Housing – Start UpInformationCommentsGeographic areaRatiosMaximum incomeStatewideDepends on product guidelines (FHA, RD, VA, Conventional)11 Co. Metro Dodge & OlmsteadAll Other Counties1-2 person3 person 86,600 - 90,400 99,500- 103,900 88,600 101,800 80,400 92,400Program works with industry-standard loan products. MinnesotaHousing provides an affordable, fixed interest rate and access todown payment and closing loans for eligible borrowers.See the Credit and DTI MatrixEach loan file contains both Minnesota Housing’s Eligibility Incomecalculation and credit underwriting qualifying income. Lenders willcalculate this income to check eligibility.Income not consideredDepends on product guidelines (FHA, RD, VA, Conventional)Qualifying income guidelinesRental incomeDepends on product guidelines (FHA, RD, VA Conventional)Qualifying income guidelinesGross up non-taxable incomeDepends on product guidelines (FHA, RD, VA, Conventional)Qualifying income guidelinesDepends on product guidelines (FHA, RD, VA, Conventional)11 County Metro - 306,000Balance of State - 253,800Qualifying income guidelinesAdjustment to gross incomeMaximum House PriceFirst-time homebuyer onlyEligible propertiesRefinanceInterest rateDown payment and closing cost loanoptionsBuyer's minimum investmentYesDepends on product guidelines (FHA, RD, VA, Conventional)Community Land Trusts: Only eligible with Fannie Mae HFA Preferred Manufactured Homes: Must be taxed as real property Only eligible with FHA, RD, or VANoVisit: www.mnhousing.gov Monthly Payment Loan Deferred Payment Loan (DPL):o DPL option or DPL Plus optionDepends on product guidelines (FHA, RD, VA, Conventional)Down payment and Closing Cost Comparison SheetOther Community Seconds are also eligible.The lower of 1,000 or 1% of the purchase price is required forborrowers receiving a Minnesota Housing down payment andclosing cost loanMinnesota Housing offers conventional loans that save borrowersmoney on mortgage insurance. Conventional no-MI product:Mortgage insuranceDepends on product guidelines (FHA, RD, VA, Conventional)Fannie Mae HFA Preferred Risk SharingTM: Conventional reduced-MI products:Fannie Mae HFA PreferredTM and Freddie Mac HFA Advantage Upfront Paid Mortgage Insurance:In exchange for a slightly higher interest rate, the lender pays the MIupfront, eliminating the need for monthly MI payments. Minimum creditscore of 740 is recommended to access lower MI rates.Closing CostsOrigination Fee Options: 1% fee or 0% fee with a slightly higherinterest rate.Work historyDepends on product guidelines (FHA, RD, VA, Conventional)Credit historyDepends on product guidelines (FHA, RD, VA, Conventional)Chapter 7 & 13Depends on product guidelines (FHA, RD, VA, Conventional)Liens, Foreclosure, JudgmentsCollection accountsDepends on product guidelines (FHA, RD, VA, Conventional)Education requirementsAmortizationCash reservesPurchase/rehab option 175 servicing fee for Monthly Payment Loan.640 minimum credit score (if a score is available). Higher creditscore required for some products. Non-traditional credit allowed perproduct guidelines. See the Credit and DTI MatrixDepends on product guidelines (FHA, RD, VA, Conventional)Required for first-time borrowers receiving a conventional loan or aMinnesota Housing down payment and closing cost loanWhen applicable, one borrower must complete HomebuyerEducation prior to the loan closing.15 or 30 yearsSome products require amortization of 30 years.Depends on product guidelines (FHA, RD, VA, Conventional)A purchase repair option (FHA 203(k) Streamlined) is available.Deferred Payment Loan has maximum cash reserverequirement. Maximum of 8 months PITI or 8,000Lenders must apply to Minnesota Housing’s servicer in order toparticipate in this option. Contact Minnesota Housing for moredetails.11 P a g eMinnesota Homeownership CenterOctober 2017

Minnesota Housing – Step UpMinnesota Housing is a trusted state agency that works with local lenders to offer loan programs to help low- and moderate-incomeMinnesotans buy a home statewide. Homebuyers apply for the program directly through a participating lender. To find a MinnesotaHousing lender, visit mnhousing.gov and click on Find a Lender under the Homebuyers & Homeowners heading.Step Up is designed for repeat homebuyers or current homeowners to purchase or refinance a home.Benefits: Access to Minnesota Housing’s Monthly Payment Loan for down payment and closing costs for eligible borrowers. FHA 203(k) Streamlined purchase/repair product option available Flexible refinance options for borrowers with an existing Minnesota Housing down payment assistance l

If you are purchasing your first home and would like . Pierce, St. Croix county, Rochester: Fillmore, Olmsted Contact: Joannette Cintrón 651-306-1785 (office) Contact: Sandy Warner 651-306-1662 (office) . Education requirements Home Stretch First time buyers requires at least one borrower to complete homebuyer education