Transcription

Bajaj Allianz LifePOS Goal SurakshaA Non-Participating Non-linked Life Insurance Plan

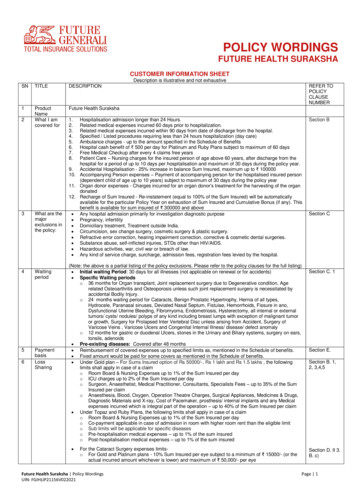

Bajaj Allianz LifePOS Goal SurakshaA Non-Participating Non-linked Life Insurance PlanKEY FEATURES1Guaranteed maturity benefit1Offers Guaranteed Additions at maturityOption to take policy loanOption to alter premium payment modeLimited premium payment term1Conditions Apply-The Guaranteed benefits are dependent on policy term, premium payment term availed along with other variable factors.For more details please refer to sales brochure.MATURITY BENEFITOn the maturity date, if all premiums are paid, the Guaranteed Sum Assured on Maturity plus Guaranteed Additions, under your policy, will be paid andthe policy will terminate.DEATH BENEFITIn case of unfortunate death of the Life Assured due to accident during the waiting period or in case of death of the Life Assured after the waiting period due to any cause, the death benefit is payable to the nominee(s)/beneficiaries. Such death benefit is stated as Sum Assured on Death# which is as below.The Sum Assured on Death# is the higher of:(i) 10 times of Annualized Premium*, (ii) 105% of Total Premiums** paid as on date of death, (iii) Sum Assured#In case of death of the Life Assured during the Waiting period other than due to an accident, the death benefit payable to the nominee(s)/beneficiarieswill be the 100% of Total Premiums** paid till date, excluding any extra premium & Goods & Service Tax/any other applicable tax levied, subject tochanges in tax laws.The policy will terminate on payment of the death benefit.

Bajaj Allianz LifePOS Goal SurakshaThe death benefit is payable provided the policy is in-force and all due premiums have been paid.*Annualized Premium is exclusive of extra premium, loadings for modal premiums and Goods &Service Tax/any other applicable tax levied, subject tochanges in tax laws, if any.**Total Premiums paid is equal to (Annualized Premium * number of years for which premiums have been paid)#Guaranteed Sum Assured on Maturity and Sum Assured is 10 times the Annualized Premium Waiting period is the first 90 days from the date of commencement of risk. Waiting period is not applicable in case of revival.GUARANTEED ADDITIONSOn maturity date, if all due premiums have been paid, Guaranteed Additions as a multiple of one Annualized Premium will be paid along with thematurity benefit. The Guaranteed Additions payable are as per the table given below –GA as Multiple of one (1) Annualised PremiumPolicy Term- Premium Payment TermAge Band(Age at 0-1218 - 240.010.0225 - 340.010.0235 - 450.010.0246 - 38NAGuaranteed additions will not be payable in case of a lapsed or paid-up policy.SAMPLE ILLUSTRATIONSubhash is 40 years old and is taking a Bajaj Allianz Life POS Goal Suraksha. The below table gives a illustration of different premium ticket size, policyterm and premium payment term combinations along with the Death & Maturity Benefit which will be received by Subhash or hisnominee(s)/beneficiaries as the case maybe.

Bajaj Allianz LifePOS Goal SurakshaMaturity BenefitAnnualizedPremium( )TotalPremiumPaid ( it( )GuaranteedAdditions (A)( )GuaranteedSum Assuredon MaturityBenefit (B) ( )TotalMaturity Benefit(A) (B) ( ,2007 years10 049,5001,50,0001,99,5005 years15 73,60010,00080,0001,00,00047,2001,00,0001,47,2007 years8 years15 years15 years

Bajaj Allianz LifePOS Goal SurakshaMaturity BenefitAnnualizedPremium( )TotalPremiumPaid ( )PremiumPaymentTermPolicyTermDeathBenefit( )15,0001,20,0008 years15 yearsGuaranteedAdditions (A)( )GuaranteedSum Assuredon MaturityBenefit (B) ( )TotalMaturity Benefit(A) (B) ( ,00050,5501,50,0002,00,55010 years12 years5 years15 years15 years20 years

Bajaj Allianz LifePOS Goal SurakshaMaturity BenefitAnnualizedPremium( )TotalPremiumPaid ( )PremiumPaymentTermPolicyTermDeathBenefit( )25,0001,25,0005 years20 years50,0005,000GuaranteedAdditions (A)( )GuaranteedSum Assuredon MaturityBenefit (B) ( )TotalMaturity Benefit(A) (B) ( ,00,0003,82,0005,00,0008,82,0007 years20 5,0002,50,0002,62,5003,51,7502,50,0006,01,7508 years10 years20 years20 years

Bajaj Allianz LifePOS Goal SurakshaMaturity BenefitAnnualizedPremium( )TotalPremiumPaid ( nefit( )5,25,000GuaranteedAdditions (A)( )GuaranteedSum Assuredon MaturityBenefit (B) ( )TotalMaturity Benefit(A) (B) ( 050,0006,00,0006,30,0008,19,0005,00,00013,19,00012 years20 years1) The death benefit will be receivable by the nominee(s)/beneficiaries and demonstrated as death of Life Assured at the end of PPT2) The premiums mentioned above are exclusive of any extra premium loading and Goods & Service Tax/any other applicable tax levied,subject to changes in tax laws.

Bajaj Allianz LifePOS Goal SurakshaEligibility ConditionParameterMinimum Entry AgeMaximum Entry AgeMinimum Age at MaturityMaximum Age at MaturityPolicy Term (PT) & PremiumPayment Term (PPT)Minimum PremiumMaximum PremiumMinimum Sum AssuredMaximum Sum AssuredPremium Payment FrequencyDetails18 years55 years28 years65 yearsPT (In years)PPT (In years)ModePremium ( )10715205, 7, 8, 10, & 125, 7, 8, 10, & 50450As per Maximum Sum Assured 30,000 25,00,000Yearly, Half yearly, Quarterly and Monthly*Quarterly & Monthly premium payment frequency will be allowed only under\auto-debitprocess (as per the approved RBI facilities)Prohibition of Rebate: Section 41 of the Insurance Act, 1938:“No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out orrenew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part ofthe commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing orcontinuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses ortables of the insurer.Any person making default in complying with the provision of this section shall be liable for a penalty that may extend up to tenlakh rupees.”

Bajaj Allianz LifePOS Goal SurakshaFraud & Misstatement - Section 45 of the Insurance Act, 1938Fraud & Misstatement would be dealt with in accordance with provisions of Section 45 of the Insurance Act 1938 as amended fromtime to time.1800 209 4040 bajajallianzlife.comBajaj Allianz Life Insurance Co. Ltd.Risk Factors and Warning Statements: Bajaj Allianz Life Insurance Company Limited and Bajaj Allianz Life POS Goal Suraksha arethe names of the company and the product respectively and do not in any way indicate the quality of the product and its futureprospects or returns. For more details on risk factors, terms and conditions please read sales brochure & policy document(available on www.bajajallianzlife.com) carefully before concluding a sale. Bajaj Allianz Life POS Goal Suraksha - A NonParticipating Non-linked Life Insurance Plan. Regd. Office Address: Bajaj Allianz House, Airport Road, Yerawada, Pune - 411006.Reg. No.: 116. CIN : U66010PN2001PLC015959 Mail us : customercare@bajajallianz.co.in Call on : Toll free no. 1800 209 7272 Fax No: 02066026789. Bajaj Allianz Life POS Goal Suraksha (UIN: 116N155V07), The Logo of Bajaj Allianz Life Insurance Co. Ltd. isprovided on the basis of license given by Bajaj Finserv Ltd. to use its “Bajaj” Logo and Allianz SE to use its “Allianz” logo. All charges/taxes, as applicable, will be borne by the Policyholder.BJAZ-PPT-EC-01761/21BEWARE OF SPURIOUS PHONECALLS AND FICTITIOUS /FRAUDULENT OFFERS IRDAI is not involved in activities likeselling insurance policies,announcing bonus or investment ofpremiums. Public receiving suchphone calls are requested to lodge apolice complaint.

Subhash is 40 years old and is taking a Bajaj Allianz Life POS Goal Suraksha. The below table gives a illustration of different premium ticket size, policy term and premium payment term combinations along with the Death & Maturity Benefit which will be received by Subhash or his nominee(s)/beneficiaries as the case maybe. GUARANTEED ADDITIONS