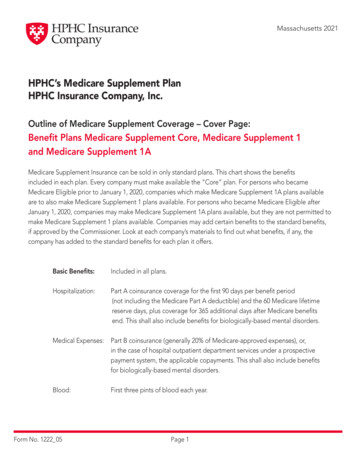

Transcription

MedicareSupplementPolicy2021-2022

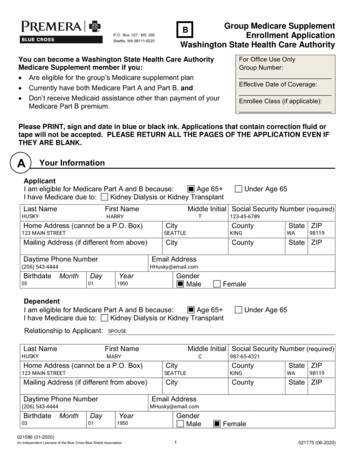

Medicare Supplement PolicySecurity Health Plan of Wisconsin, Inc.HOME OFFICE1515 North Saint Joseph’s AvenuePO Box 8000Marshfield, WI 54449-80001.844.622.0805 715.221.9425 TTY 711PREMIUMS ARE SUBJECT TO CHANGEMEDICARE SUPPLEMENT INSURANCEThe Wisconsin Insurance Commissioner has set standards for Medicare SupplementInsurance. This policy meets these standards. It, along with Medicare, may notcover all of your medical costs. You should review carefully all policy limitations.For an explanation of these standards and other important information, see the“Wisconsin Guide to Health Insurance for People with Medicare.” This guide wasgiven to you when you applied for this policy. Do not buy this policy if you did notget this guide.THIS POLICY PROVIDES BENEFITS FOR LOSS DUE TO INJURY OR SICKNESS AS HEREIN LIMITEDAND PROVIDED.Security Health Plan settles claims on certain Wisconsin-mandated and other benefits basedon usual, customary and reasonable charges as determined by the Plan. Usual and Customarycharges may not be the same as the actual charges you incur.Notice to buyer: This policy may not cover all of the costs associated with medical careincurred by the buyer during the period of coverage. The buyer is advised to review all policylimitations.In this policy the person insured is also called “you” or “your.” Security Health Plan of Wisconsin,Inc., is called “us,” “we,” “our” or “the company.” Terms capitalized in this policy are defined in theDefinitions section at the end of this policy.In consideration of your payment of the required premiums for this policy, the company insuresyou against Loss caused by Injury or Sickness as herein limited and provided. Coverage is providedsubject to the terms of this policy. The amount of the initial premium and the Effective Date ofyour policy are shown on the Schedule of Benefits. This policy will renew on July 1 of each year,for the period of one year, regardless of when you first began coverage under the policy. Thispolicy is a legal contract between you and the company. READ YOUR POLICY CAREFULLY.1

Security Health PlanIMPORTANT NOTICE CONCERNING STATEMENTS IN THE APPLICATION FOR YOUR INSURANCETABLE OF CONTENTSPlease read a copy of your application. Omissions or misstatements in the application couldcause an otherwise valid claim to be denied. Carefully check the application and write to uswithin 10 days if any information shown on the application is not correct and complete or ifany medical history has not been included. The application is part of the insurance contract.The insurance contract was issued on the basis that the answers to all questions and anyother Material Information shown on the application are correct and complete.Section 1 – Eligibility and Enrollment .4GUARANTEED RENEWABLE: You have the right to renew this policy, for consecutive terms, bypaying the required premium before the end of each grace period. You have the right to renewthis policy regardless of changes in your physical, mental or health conditions.PREMIUM AGREEMENT: On July 1, the annual renewal date of this policy, premiums mayincrease due to the increase in your age. The renewal premium for this policy will be therenewal premium then in effect for your attained age. The premium may also change for otherreasons. For any premium change less than 25%, we will give you at least 30 days advancenotice in writing of such premium change. For any premium change greater than or equal to25%, we will give you at least 60 days advance notice in writing. If your policy was issued asan under age 65 policy due to disability, when you turn 65 your premiums will remain at thedisabled rates.RIGHT TO RETURN POLICY FOR 30 DAYS: You have 30 days after receipt of this policy to examineits provisions. During that 30-day period, if you are dissatisfied with the policy, it may be returnedto the company at its Home Office, to any state office of the company or to the agent from whomit was purchased. Immediately upon such return, this policy shall be void from the beginning andany premium paid will be refunded.2Medicare Supplement PolicySection 2 – Basic Medicare Supplement Coverage .4Section 3 – Renewal Terms, Reinstatement andMidterm Cancellation by Insured .8Section 4 – Premiums and Coverage.9Section 5 – How to Claim Benefits.12Section 6 – Grievance Procedure.12Section 7 – External Review.14Section 8 – Miscellaneous Provisions.16Section 9 – Definitions .17Notice of Nondiscrimination .21Language Assistance Services .22Notice of Privacy Practices .233

Security Health PlanSECTION 1 - ELIGIBILITY& ENROLLMENTMedicare Supplement PolicySPECIAL ENROLLMENT PERIOD You must have been enrolled in Medicare Part Aand Part B by the date your coverage under thispolicy startsIf you have lost or are losing other health insurancecoverage, you may be guaranteed acceptance intothis policy. You may have received a notice fromyour prior insurer saying that you had certain rightsand were eligible for guaranteed issue of a MedicareSupplement insurance policy. If you received such anotice from your prior insurer, you must submit a copyof the notice with your application to us. You mustsubmit the notice to us no later than 63 days after yourother coverage ends. Coverage begins the first of themonth after we accept your application and premium.It could also begin on the Effective Date you requestedon your application. (This is within the 63 days fromthe termination of your previous policy.) You must not be covered by Medicaid(BadgerCare Plus) or a Medicare Advantage planEnrollments made during this period are guaranteedissue.To apply, fill out an application and return it toSecurity Health Plan or your independent insuranceagent.OTHER ENROLLMENT PERIODELIGIBILITYYou must meet the following criteria to be eligible toenroll: You must be at least 65 years of age or under 65with certain disabilities including end-stagerenal disease You must reside in Wisconsin on the EffectiveDate of this policyOPEN ENROLLMENT PERIODYour open enrollment period lasts 6 consecutivecalendar months, beginning with the month forwhich you were first enrolled in Medicare Part B orthe month in which you turned age 65 if you werefirst enrolled in Medicare Part B on any of thefollowing grounds: Health status Claims experience Receipt of health care Medical conditionCoverage begins the first of the month after we acceptyour application. If you are applying before you turn65, coverage could begin up to 3 months after youcompleted your application.Enrollments made during the open enrollment periodare guaranteed issue.4Enrollments made outside of the open enrollmentperiod or a special enrollment period may be subjectto medical underwriting. If the policy is underwritten,an applicant may be declined based on health historyor medical condition. We may alter our underwritingstandards from time to time.SECTION 2 - BASIC MEDICARESUPPLEMENT COVERAGETO SUPPLEMENT BENEFITS UNDER PART A OFMEDICARE:1. We will pay all Part A Medicare-Eligible Expensesfor hospitalization to the extent not covered byMedicare from the 61st day through the 90th dayin any Medicare Benefit Period.2. We will pay all Part A Medicare-Eligible Expensesincurred as daily Hospital charges during use ofMedicare’s Lifetime Hospital Inpatient ReserveDays to the extent not covered by Medicare.Lifetime Inpatient Reserve Days are nonrenewableand limited to 60 days during your lifetime.3. Upon exhaustion of all Medicare Hospitalinpatient coverage including the LifetimeHospital Inpatient Reserve Days, we will pay100% of the Part A Medicare-Eligible Expensesfor hospitalizations not covered by Medicare foran additional 365 days to the extent the Hospitalis permitted to charge Medicare by federal lawand regulation and subject to the Medicarereimbursement rate and a lifetime maximumbenefit. The provider shall accept our payment aspayment in full and may not balance bill you.4. We will pay under Medicare Part A eligibleexpenses for the first three pints of blood orequivalent quantities of packed red blood cells,to the extent not covered by Medicare.5. We will pay the copayment or coinsurance forall Part A Medicare-Eligible Expenses for hospiceand Respite Care.6. Once Medicare Hospital inpatient psychiatriccoverage has been exhausted, we will pay 100%up to an aggregate of 175 days per your lifetime.7. We will pay the coinsurance or copaymentamounts you incur for Part A Medicare-EligibleExpenses in a Skilled Nursing Facility from the21st through the 100th day in a Benefit Period.TO SUPPLEMENT BENEFITS UNDER PART B OFMEDICARE:1. We will pay the coinsurance or copaymentamount for Part B Medicare-Eligible Expenses tothe extent not paid by Medicare, or in the caseof Hospital outpatient department services paidunder a prospective payment system includingoutpatient psychiatric care, regardless of Hospitalconfinement, subject to the Medicare Part Bcalendar year Deductible.2. We will pay the cost of the first three pints ofblood payable under Medicare Part B. If you arenot enrolled in Medicare Part B and you incurPhysician charges allowable by Medicare and/orany other Medicare covered service or supply,we will pay 20% of what would have beenMedicare-Eligible Expenses.OTHER POLICY BENEFITS1. Preventive health care services - We will paythe actual charges up to 100% of the Usualand Customary charge for each service. Theservice must be identified in the AmericanMedical Association Current ProceduralTerminology codes (AMA CPT). The servicemust be prescribed by your Physician as beingmedically appropriate. This benefit does notpay for any service that is sometimes coveredby Medicare, such as routine eye exams. In asituation where a service that is sometimescovered by Medicare is billed and Medicaredenies, then you are responsible for the entirecost of the charge.2. Skilled Nursing Facility benefits fornon-Medicare eligible confinement - Wewill pay the expenses you incur during anyBenefit Period for confinement in a licensedSkilled Nursing Facility, up to a maximum of30 days. The daily rate payable shall be noless than the maximum daily rate establishedfor skilled nursing care in that facility by theDepartment of Health and Human Services.Your confinement must be certified initially asMedically Necessary by the attending Physicianand recertified every 7 days. Benefits are notpayable for services provided by or paid for bythe Veterans Administration or Custodial Careor Skilled Nursing Facility confinement certifiedby Medicare.3. Home Health Care - We will pay the costfor Usual and Customary Home Health Careexpenses you incur that are not covered byMedicare for 40 Home Health Care visits in any12-month period, unless you have elected theAdditional Home Health Care Rider.4. Kidney disease benefits - We will pay theexpenses you incur for treatment of kidneydisease by dialysis, transplantation and/ordonor-related services up to a maximum of 30,000 each calendar year. We will not pay5

Security Health Planfor charges covered by another policy coveringkidney disease expenses or for charges coveredby Medicare.5. Diabetes benefits - We will pay the charges forexpenses incurred, and not covered by Medicare,for the installation and use of an insulin infusionpump or other equipment and supplies, includinginsulin, hypodermic needles and syringes usedin the treatment of diabetes and coverage ofdiabetic self-management education programs.Coverage for an insulin infusion pump is limited toone pump per year and is subject to a 30-day trialperiod prior to purchase.6. Chiropractic benefits - We will provide coveragefor services performed by a chiropractor if thesame services would be covered when performedby a Physician. We do not cover extraspinalmanipulations.7. Hospital and Ambulatory Surgical Centercharges and anesthetics for dental care - Wewill pay for Usual and Customary chargesincurred, and anesthetics provided, in conjunctionwith dental care that is provided to a coveredindividual in a Hospital or Ambulatory SurgicalCenter, if any of the following applies:a) You have a chronic disability that isattributable to a mental or physicalimpairment which results in a substantialfunctional limitation in an area of your majorlife activity, and the disability is likely tocontinue indefinitely.b) You have a medical condition that requireshospitalization or general anesthesia fordental care.8. Breast reconstruction benefits - We will pay thecharges incurred, not payable under Medicare,in the manner recommended by the attendingPhysician for breast reconstruction of the affectedtissue incident to a mastectomy.9. Nurse practitioner benefits - We will pay theMedicare fee schedule for charges incurred forpap tests, pelvic exams or associated laboratoryfees performed by a licensed nurse practitioner.6Medicare Supplement Policy10. Reconstructive surgery benefits – We will paythe Medicare fee schedule for charges incurredfor surgery to repair an accidental Injury or toimprove function of a malformed body part.11. Routine patient costs in cancer clinicaltrials - We will pay the charges incurred forroutine patient care that is administered toa member in a cancer clinical trial and that isotherwise a covered service. Routine patient caredoes not include: The health care service, item or investigationaldrug that is the subject of the cancer clinical trial Any health care service, item or drug providedsolely to satisfy data collection and analysisneeds that are not used in the direct clinicalmanagement of the member An investigational drug or device that has notbeen approved for market by the federal Foodand Drug Administration Transportation, lodging, food or other expensesfor the member or a family member orcompanion of the member that are associatedwith travel to or from a facility providing thecancer clinical trial Any services, items or drugs provided by thecancer clinical trial sponsors free of charge forany patient Any services, items or drugs that are eligible forreimbursement other than Security Health Plan,including the sponsor of the cancer clinical trial.To qualify as a cancer clinical trial under thisprovision, it must satisfy all of the following:a) A purpose of the trial is to test whetherthe intervention potentially improves themember’s health outcomes.b) The treatment provided as part of the trialis given with the intention of improving themember’s health outcomes.c) The trial has therapeutic intent and is notdesigned exclusively to test toxicity ordisease pathophysiology.d) The trial (i) tests how to administer a healthcare service, item or drug for the treatmentof cancer; (ii) tests responses to a healthcare service, item or drug for the treatmentof cancer; (iii) compares the effectiveness ofhealth care services, items or drugs for thetreatment of cancer with that of other healthcare services, items or drugs for the treatmentof cancer; or (iv) studies new uses of healthcare services, items or drugs for the treatmentof cancer.e) The trial is approved by (i) a National Instituteof Health, or one of its cooperative groupsor centers, under the federal Department ofHealth and Human Services; (ii) the federalFood and Drug Administration; (iii) the federalDepartment of Defense; or (iv) the federalDepartment of Veterans Affairs.12. Over-the-counter (OTC) health products - Wewill provide a 30 stipend each quarter for OTCproducts. OTC products include allergy and coldmedications, sunscreen, pain relievers, vitaminsand other products listed in the OTC DrugCatalog at www.securityhealth.org/OTC.CHANGES IN MEDICARE COINSURANCE ANDDEDUCTIBLESBenefits designed to cover cost sharing amountsunder Medicare will be changed automatically tocoincide with any changes in the applicable Medicaredeductible amount, copayment and coinsurancepercentage factors. Premiums may be modified tocorrespond with such changes and rate regulations(ch. 625, Stats.).POLICY LIMITATIONSExcept as stated in the To Supplement Benefits andOther Policy Benefits sections above and the optionalriders, only covered charges, as defined in Part A ofMedicare, and allowable charges, as defined in Part Bof Medicare, are covered under this policy. Benefitsfor the Part A deductible, Part B deductible, Part Bexcess charges, Home Health Care and foreign travelemergency will be provided only if these optionalriders are selected at the time of application. ThePart B deductible rider is not available to persons firsteligible for Medicare on or after Jan. 1, 2020.EXCLUSIONSThe following services not required under Medicarearen’t covered under this policy:A. Treatment, services or supplies Medicare doesn’tcover, unless this policy specifically providesfor them.B. Treatment, services or supplies which neither younor a party on your behalf has a legal obligationto pay in the absence of insurance.C. Treatment, services or supplies: to the extent that they are paid for byMedicare; or that would have been paid for by Medicare butfor your failure to notify your provider that youare covered by Medicare; or that are paid for by another government entity/program, or for which you are reimbursed byanother government entity/program.D. Treatment, services or supplies you need as aresult of war, or an act of war, occurring on orafter the Effective Date of this policy.E. Personal comfort items.F. Routine physical exams, eye exams, hearingexams and directly related tests, except asotherwise stated in your Schedule of Benefits.G. Eyeglasses or the preparation or fitting of suchthings as eyeglasses or hearing aids except forthose services covered by Medicare.H. Orthopedic shoes or other supporting devicesfor the feet; or routine foot care not covered byMedicare.I. Custodial Care, including maintenance care andsupportive care.7

Security Health PlanJ. Cosmetic surgery, but we do cover such surgery ifit’s for repair of accidental Injury or for improvingthe functioning of a malformed body part.K. Services provided by members of yourimmediate family or anyone else living in yourhousehold.L. Care, treatment, filling, removal or replacementof teeth, or for dental X-rays, root canal therapy,surgery for impacted teeth, or for other surgicalprocedures involving the teeth or structuresdirectly supporting them.M. Treatment, services or supplies to the extent thata worker’s compensation law or other U.S. orstate plan covers them.N. Drugs and medicines you buy with or without aPhysician’s prescription.O. Treatment, services or supplies for confinement,surgery or care before your insurance becomeseffective, or after coverage ends except asotherwise stated in your Schedule of Benefits.P. Treatment, services or supplies that are deemednot Medically Necessary by Medicare. Thisincludes but is not limited to the following: Drugs or devices that have not been approvedby the Food and Drug Administration (FDA) Medical procedures and services performedusing drugs or devices not approved by FDA Services including drugs or devices notconsidered safe and effective because theyare experimental or investigational exceptfor the HIV drugs as described in Section632.895(9) Wis. Stat. as amendedThe decision regarding whether or not a service,drug or device is experimental or investigationalshall be made by the Security Health PlanMedical Director. The criteria defining whethera service, drug or device is experimental orinvestigational is available to enrollees uponrequest.Q. Treatment, services or supplies received outsidethe United States, except as otherwise stated inyour Schedule of Benefits.8Medicare Supplement PolicyR. Physician charges exceeding theMedicare-Eligible Expense for treatment, servicesor supplies except as otherwise stated in yourSchedule of Benefits.S. Routine immunizations, except as otherwisestated in your Schedule of Benefits, or if eligibleunder Medicare.T. Treatment of service-related conditions formembers or ex-members of the armed forcesby any military or veterans’ Hospital or soldierhome or any Hospital contracted for or operatedby any national government or agency.U. Medicare Part A Deductible, except as otherwisestated in your Schedule of Benefits.V. Medicare Part B Deductible, except as otherwisestated in your Schedule of Benefits.W. Home Health Care above 40 visits mandated bys. 632.895(2), statutes, except if shown in theSchedule of Benefits as being applicable.X. Nursing home care costs beyond what is coveredby Medicare and the additional 30-day skillednursing mandated by s. 632.895 (3), Stats.Y. Chiropractic care considered maintenance careor not Medically Necessary will not be covered.Services that are never covered when receivedfrom a Physician or chiropractor, such asextraspinal subluxation, will not be covered.FRAUDAny person who knowingly presents a false orfraudulent claim for payment of a Loss or benefit orknowingly presents false information in an applicationfor insurance is guilty of a crime and may be subjectto fines and confinement in prison.SECTION 3 - RENEWAL TERMS,REINSTATEMENT AND MIDTERMCANCELLATION BY INSUREDRENEWAL TERMSThis policy is guaranteed renewable for life subjectto timely payment of premium. Security Health Planshall neither cancel nor non-renew your policy forany reason other than nonpayment of premiumor material misrepresentation. Your policy may berevised to comply with federal or state law. Thispolicy can’t be canceled or non-renewed solely onthe grounds of deterioration of health. This policyautomatically terminates on the date you die. Ofcourse, you can end your policy at any time by writingto us. No refusal of renewal will affect an existing validclaim for Medicare-Eligible Expenses covered underthis policy and incurred prior to the date on which thispolicy ends.REINSTATEMENTReinstatement is subject to our right to change orterminate this policy form (see Renewal Terms). If youend the contract by not paying your premium, it maybe reinstated. The following rules all apply: (a) Your coverage must be lapsed due tononpayment of premium; (b) you must apply forreinstatement within 1 year of the lapse date; and(c) you want to reinstate the same coverage youhad We must approve your application to reinstate;we can approve or decline it If we reinstate you, Losses resulting fromAccidents occurring or Sickness beginningbetween the termination and the Effective Dateof the reinstatement of the new policy arenot covered Claims that occur in the lapse period aren’tcovered If your application is approved, the new policywill be effective on the first day of the monthfollowing approval provided the required firstpremium has been paid; any premium receivedshall be applied to future Losses under thenew policy You must pay premiums on a quarterly basis;we won’t accept monthly payments forreinstated applicationsMIDTERM CANCELLATION BY INSUREDThis policy provides for midterm cancellation at yourrequest and that, if you cancel this policy midterm orthis policy terminates midterm because of yourdeath, we shall issue a pro rata refund to you or toyour estate.SECTION 4 - PREMIUMS ANDCOVERAGEPREMIUM RATESWe determine the premium rates for this policy andall subsequent premiums due under this policy.Each premium after the initial period of coveragemust be paid directly to Security Health Plan by thePremium Due Date in order to maintain this policyin force.For subsequent periods, your payment of therequired premium by the Premium Due Date shallmaintain your coverage and this policy in force forthat period, subject to this policy’s grace period.Your failure to pay to Security Health Plan thepremium due shall terminate this policy.Security Health Plan will only raise your premiumif we raise the premium for all policies like yoursin this state. Premiums may change on the renewaldates of your policy. Age categories as applicable topremiums are detailed in the Medicare SupplementOutline of Coverage.Security Health Plan shall send you written noticeof a premium rate change at least 30 days beforeany such change take effect for this policy. However,when this policy’s premium rate is increased 25%or more for a renewal period, Security Health Planshall send written notice of the new premium rateto you at least 60 days before any change takeseffect. The premium rate change takes effect onthe first day of the renewal period as described in9

Security Health Planthe required notice or on the date the policy orbenefits change as required by law.INITIAL PERIOD OF COVERAGE AND RENEWALPERIODSCoverage begins the first of the month after weaccept your application and premium. If you areapplying before you turn 65, coverage couldbegin up to 3 months after you completed yourapplication. This policy will renew on July 1 of eachyear, for the period of one year, regardless of whenyou first began coverage under the policy.PREMIUM DUE DATEAfter your initial period of coverage, we’ll renewthis policy for additional periods if you pay yourpremium timely to us in accordance with thispolicy, subject to all other terms, conditions, andprovisions of this policy. The Premium Due Date isthe first day of the month as dictated by your modeof premium payment.Your premium payment should be sent to us atour Marshfield office by the 20th day of the monthprior to your next Premium Due Date. If you choseautomatic withdrawal on your application for thispolicy, your premium payment will be withdrawnfrom your bank account on the 20th day of themonth prior to your next Premium Due Date.GRACE PERIODExcept for the first premium, any premium notpaid to us by the date due is in default. For eachpremium not paid when due, there is a grace periodbeginning with first day of the period for whichthe premium is due. The grace period shall be atleast 7 days for weekly premium policies, 10 daysfor monthly premium policies and 31 days for allother policies, for each premium after the first,during which the policy shall continue in force. Youmust pay the premium unless you’ve notified us inadvance that you want to end this policy.10Medicare Supplement PolicyThis policy’s coverage is in force during the graceperiod, but coverage will be terminated back to thebeginning of the month if payment is not received bythe close of the grace period.REQUIRED NOTICESWe generally are not responsible for notifying youwhen premiums are due for coverage provided duringrenewal periods under this policy. However, you mayoccasionally receive notices from us regarding yourpremiums. For example, you may receive a noticefrom us if your premium will increase for reasonsother than your attained age.SUSPENSION OF BENEFITS AND PREMIUMS FORPOLICYHOLDERS ENTITLED TO MEDICAIDBenefits and premiums under this policy shall besuspended at your written request for a period of upto 24 months in which you have applied for and aredetermined to be entitled to medical assistance underTitle XIX of the Social Security Act. This applies onlyif you provide proof of such entitlement to SecurityHealth Plan within 90 days after the date you becomeentitled to such assistance.If such suspension occurs and you lose entitlementto such medical assistance, this policy shall beautomatically reinstituted (effective as of the dateof termination of such entitlement) if you:was in force. Any such extension of benefits shall onlybe available for such Loss while you are continuouslytotally disabled and shall continue to be subject to allthe maximum benefit amount and duration limitationsof the policy. Receipt of Medicare Part D shall not beconsidered in determining a continuous Loss.For the purpose of this subsection totally disabledmeans a Physician says: You are confined in a Hospital or Medicare-certifiedSkilled Nursing Facility; or You are unable to perform the substantial duties ofany job or occupation for which you are qualifiedand in fact you are not working for any salary orprofit; or You are substantially unable to engage in thenormal activities of an individual in good health ofthe same age or sexSUBROGATIONYou agree that we shall be subrogated to all of yourrights to the extent of the benefits we provide underthe policy. Those rights are hereby assigned to us tothat extent. The assigned rights include, but are notlimited to, rights against: All persons or organizations, and their insurers,liable or responsible for paying for Losses ordamages sustained by you Provide written proof of loss of such entitlementwithin 90 days after the date of such loss Automobile liability insurance coverage Pay the premium attributable to the policy,beginning on the date you lost entitlement tomedical assistance Uninsured motorists insurance coverageIf notice is not given or premium paid in accordancewith the preceding paragraph, the suspendedpolicy shall be canceled as of the end of the24-month period. Medical malpractice insurance coverageEXTENSION OF BENEFITSTermination of this policy shall be without prejudice toa continuous Loss which commenced while the policy Underinsured motorists insurance coverage Homeowner and business liability insurancecoverage Patient compensation funds Any applicable umbrella insurance coverageThe a

We may alter our underwriting standards from time to time. SECTION 2 - BASIC MEDICARE SUPPLEMENT COVERAGE TO SUPPLEMENT BENEFITS UNDER PART A OF MEDICARE: 1. We will pay all Part A Medicare-Eligible Expenses for hospitalization to the extent not covered by Medicare from the 61st day through the 90th day in any Medicare Benefit Period. 2.