Transcription

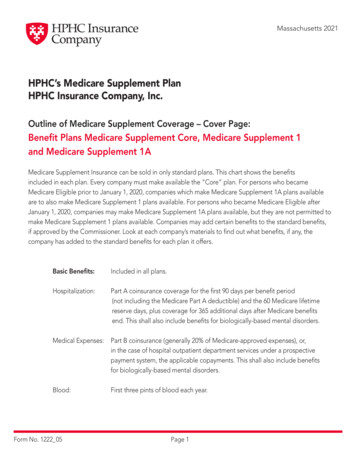

Massachusetts 2021HPHC’s Medicare Supplement PlanHPHC Insurance Company, Inc.Outline of Medicare Supplement Coverage – Cover Page:Benefit Plans Medicare Supplement Core, Medicare Supplement 1and Medicare Supplement 1AMedicare Supplement Insurance can be sold in only standard plans. This chart shows the benefitsincluded in each plan. Every company must make available the “Core” plan. For persons who becameMedicare Eligible prior to January 1, 2020, companies which make Medicare Supplement 1A plans availableare to also make Medicare Supplement 1 plans available. For persons who became Medicare Eligible afterJanuary 1, 2020, companies may make Medicare Supplement 1A plans available, but they are not permitted tomake Medicare Supplement 1 plans available. Companies may add certain benefits to the standard benefits,if approved by the Commissioner. Look at each company’s materials to find out what benefits, if any, thecompany has added to the standard benefits for each plan it offers.Basic Benefits:Included in all plans.Hospitalization:Part A coinsurance coverage for the first 90 days per benefit period(not including the Medicare Part A deductible) and the 60 Medicare lifetimereserve days, plus coverage for 365 additional days after Medicare benefitsend. This shall also include benefits for biologically-based mental disorders.Medical Expenses:Blood:05Form No. 1222 04Part B coinsurance (generally 20% of Medicare-approved expenses), or,in the case of hospital outpatient department services under a prospectivepayment system, the applicable copayments. This shall also include benefitsfor biologically-based mental disorders.First three pints of blood each year.Page 1

Medicare Supplement CoreMedicare Supplement 1Medicare Supplement 1AStandard BenefitsBasic BenefitsStandard BenefitsBasic BenefitsStandard BenefitsBasic BenefitsHospitalization:For biologically-based mentaldisorders, stays in a licensed mentalhospital, less Part A deductibles; forother mental disorders: stays in alicensed mental hospital for at least60 days per calendar year less dayscovered by Medicare or alreadycovered by plan in that calendar yearfor the other mental disorders, lessPart A deductibles.Hospitalization:For biologically-based mental disorders,stays in a licensed mental hospital; forother mental disorders: stays in a licensedmental hospital for a minimum of 120days per benefit period (at least 60 daysper calendar year) less days covered byMedicare or already covered by plan inthat calendar year for the other mentaldisorders.Hospitalization:For biologically-based mentaldisorders, stays in a licensed mentalhospital; for other mental disorders:stays in a licensed mental hospitalfor a minimum of 120 days perbenefit period (at least 60 days percalendar year) less days covered byMedicare or already covered by planin that calendar year for the othermental disorders.Skilled Nursing coinsuranceSkilled Nursing coinsurancePart A deductiblePart A deductiblePart B deductibleForeign TravelForeign TravelAdditional BenefitsAdditional BenefitsFitness Reimbursement ProgramFitness Reimbursement ProgramFitness Reimbursement ProgramPremium Rate Effective 1/1/21Premium Rate Effective 1/1/21Premium Rate Effective 1/1/21Billed Monthly: 136Billed Monthly: 242Billed Monthly: 195Additional BenefitsForeign TravelForm No. 1222 05Page 2

Massachusetts Medicare Supplement InsuranceOutline of CoverageHPHC Insurance Company, Inc.Policy Category: Medicare Supplement Insurance“NOTICE TO BUYER: This Policy may not cover all of the costs associated with medical care incurred bythe buyer during the period of coverage. The buyer is advised to review carefully all Policy limitations.”PREMIUM INFORMATIONWe, HPHC Insurance Company, Inc. can only raiseyour premium if we raise the premium for all Policieslike yours in Massachusetts, and if approved by theCommissioner of Insurance. If you choose to pay yourpremium on a monthly basis, upon your death, wewill refund the unearned portion of the premiumpaid. If you choose to pay your premium on amonthly basis and you cancel your Policy, we willrefund the unearned portion of the premium paid.In the case of death the unearned portion of thepremium will be refunded on a pro-rata basis.DISCLOSURESUse this outline to compare benefits and premiumsamong Policies.READ YOUR POLICY VERY CAREFULLYThis is only an outline describing your Policy’s mostimportant features. The Policy is your insurancecontract. You must read the Policy itself tounderstand all the rights and duties of both you andyour insurance company.Form No. 1222 05RIGHT TO RETURN POLICYIf you find that you are not satisfied with your Policy,you may return it to HPHC Insurance Company, Inc.1600 Crown Colony Drive ATTN: Enrollment/BillingQuincy, MA 02169. If you send the Policy back to uswithin 30 days after you receive it, we will treat thePolicy as if it had never been issued and return allyour payments.POLICY REPLACEMENTIf you are replacing another health insurance Policy,do NOT cancel it until you have actually receivedyour new Policy and are sure you want to keep it. Ifyou cancel your present Policy and then decide thatyou do not want to keep your new Policy, it may notbe possible to get back the coverage of the presentPolicy.If you newly enroll in a Medicare Supplement 1plan and you became Medicare Eligible beforeJanuary 1, 2020, you will not be able to switch intothe same company’s Medicare Supplement 1A planuntil you have been covered under the MedicareSupplement 1 plan for a period of at least 12 months.Page 3

Massachusetts Medicare Supplement InsuranceOutline of CoverageNOTICEThis Policy may not fully cover all your medical costs.Neither HPHC Insurance Company, Inc. nor its agentsare connected with Medicare.This outline of coverage does not give all the details ofMedicare coverage. Contact your local Social SecurityOffice or consult “Medicare & You” for more details.COMPLETE ANSWERS ARE VERY IMPORTANTWhen you fill out the application for the new Policy, besure to answer truthfully and completely all questions.The company may cancel your Policy and refuse topay any claims if you leave out or falsify importantinformation.Review the application carefully before you sign it. Becertain that all information has been properly recorded.MASSACHUSETTS SUMMARYThe Commissioner of Insurance has set standards forthe sale of Medicare Supplement Insurance Policies.Such Policies help you pay hospital and doctor bills,and some other bills, that are not covered in full byMedicare. Please note that the benefits provided byMedicare and this Medicare Supplement InsurancePolicy may not cover all the costs associated with yourtreatment. It is important that you becomefamiliar with the benefits provided by Medicare andyour Medicare Supplement Insurance Policy. ThisPolicy summary outlines the different coverage youhave if, in addition to this Policy, you are alsocovered by Part A (hospital bills, mainly) and Part B(doctors’ bills, mainly) of Medicare.Form No. 1222 05Under M.G.L. c. 112, §.2, no physician who agrees totreat a Medicare beneficiary may charge to or collectfrom that beneficiary any amount in excess of thereasonable charge for that service as determined bythe United States Secretary of Health and HumanServices. This prohibition is commonly referred to asthe ban on balance billing. A physician is allowed tocharge you or collect from your insurer a copaymentor coinsurance for Medicare-Covered Services.However, if your physician charges you or attempts tocollect from you an amount which together with yourcopayment or coinsurance is greater than theMedicare-approved amount, please contact the Boardof Registration in Medicine at (781) 876-8200.We cannot explain everything here. Massachusetts lawrequires that personal insurance Policies be writtenin easy-to-read language. So, if you have questionsabout your coverage not answered here, read yourPolicy. If you still have questions, ask your agent orcompany. You may also wish to get a copy of“Medicare & You”, a small book put out by Medicarethat describes Medicare benefits.Page 4

Massachusetts Medicare Supplement InsuranceOutline of CoverageTHE BENEFITS TO PREMIUM RATIO FORMEDICARE SUPPLEMENT CORE IS 77%.This means that during the anticipated life of yourPolicy and others just like it, the company expects topay out 77 in claims made by you and all otherPolicyholders for every 100 it collects in premiums.The minimum ratio allowed for Policies of this type is65%. A higher ratio is to your advantage as longas it allows the company a reasonable return so thatthe product remains available.THE BENEFITS TO PREMIUM RATIO FOR PLANMEDICARE SUPPLEMENT 1A IS 87%.This means that during the anticipated life of yourPolicy and others just like it, the company expectsto pay out 87 in claims made by you and all otherPolicyholders for every 100 it collects in premiums.The minimum ratio allowed for Policies of this type is65%. A higher ratio is to your advantage as long as itallows the company a reasonable return so that theproduct remains available.COMPLAINTSIf you have a complaint, call us at (877) 907-4742 oryour agent. If you are not satisfied, you may write orcall the Massachusetts Division of Insurance, ConsumerService Department 1000 Washington St. Suite 810Boston, MA 02118, Consumer Services Unit at (617)521-7794.THE BENEFITS TO PREMIUM RATIO FORMEDICARE SUPPLEMENT 1 IS 84%.This means that during the anticipated life of yourPolicy and others just like it, the company expects topay out 84 in claims made by you and all otherPolicy holders for every 100 it collects in premiums.The minimum ratio allowed for Policies of this type is65%. A higher ratio is to your advantage as longas it allows the company a reasonable return so thatthe product remains available.Form No. 1222 05Page 5

MEDICARE SUPPLEMENT COREMEDICARE (PART A) – HOSPITAL SERVICES – PER BENEFIT PERIODSERVICESMEDICARE PAYSPLAN PAYSYOU PAYHOSPITALIZATION*Semiprivate room and board, general nursing and miscellaneous services and supplies,and licensed mental hospital stays for biologically-based mental disorders or other mental disordersprior to the 190-day Medicare lifetime maximumFirst 60 days of a benefit periodAll but 1,484 0 1,484(Part A Deductible)61st through 90th day of a benefit periodAll but 371 a day 371 a day 0All but 742 a day 742 a day 0- Additional 365 days 0100% of Medicareeligible expenses 0- Beyond the additional 365 days 0 0All Costs91st day and after of a benefit period:- While using 60 lifetime reserve daysOnce lifetime reserve days are used:Licensed mental hospital stays not covered by Medicare for biologically-based mental disordersFirst 60 days of a benefit period 0All but 1,484 1,484(Part A Deductible)61st through 90th day of a benefit period 0100% of Medicareeligible expenses 0 0100% of Medicareeligible expenses 0- Additional 365 days 0100% of Medicareeligible expenses 0- Beyond the additional 365 days 0 0All Costs91st day and after of a benefit period:- While using 60 lifetime reserve daysOnce lifetime reserve days are used:*A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you havebeen out of the hospital and have not received skilled care in any other facility for 60 days in a row.The deductible and coinsurance amounts listed above reflect the 2021 Medicare deductible and coinsurance amounts.Beginning 1/1/22, these amounts will be replaced with the 2022 Medicare deductible and coinsurance amounts.Form No. 1222 05Page 6

MEDICARE SUPPLEMENT COREMEDICARE (PART A) – HOSPITAL SERVICES – PER BENEFIT PERIODSERVICESMEDICARE PAYSPLAN PAYSYOU PAYLicensed mental hospital stays not covered by Medicare for other mental disordersFirst 60 days per calendar year lessdays covered by Medicare or alreadycovered by the plan in that calendaryear for other mental disorders 0All but 1,484 1,484(Part A Deductible)61st day and after of a benefit period 0100% of Medicareeligible expenses 0 0 0All Costs- Days after 60 days per calendar yearless days covered by Medicare orplan in that calendar yearSKILLED NURSING FACILITY CARE* (Participating with Medicare)You must meet Medicare’s requirements including having been in a hospital for at least three days and entered aMedicare-approved facility within 30 days after having left the hospitalFirst 20 daysAll approved amounts 0 021st through 100th dayAll but 185.50 a day 0Up to 185.50 a day101st day and after 0 0All CostsFirst three pints 0Three pints 0Additional amounts100% 0 0All but very limitedcoinsurance foroutpatient drugs andinpatient respite careCoinsurance 0BLOODHOSPICE CAREAvailable as long as your doctor certifiesyou are terminally ill and you elect toreceive these servicesNOTICE: When your Medicare Part A hospital benefits are exhausted, the insurer stands in the place of Medicareand will pay whatever amount Medicare would have paid for up to an additional 365 days as provided in thePolicy’s “Core Benefits”. During this time the hospital is prohibited from billing you for the balance based onany difference between its billed charges and the amount Medicare would have paid.*A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you havebeen out of the hospital and have not received skilled care in any other facility for 60 days in a row.The deductible and coinsurance amounts listed above reflect the 2021 Medicare deductible and coinsurance amounts.Beginning 1/1/22, these amounts will be replaced with the 2022 Medicare deductible and coinsurance amounts.Form No. 1222 05Page 7

MEDICARE SUPPLEMENT COREMEDICARE (PART B) MEDICAL SERVICES – PER CALENDAR YEARSERVICESMEDICARE PAYSPLAN PAYSYOU PAYMEDICAL EXPENSES IN OR OUT OF THE HOSPITAL AND OUTPATIENT HOSPITAL TREATMENT, such asphysician’s services, inpatient and outpatient medical and surgical services and supplies, physical and speechtherapy, diagnostic tests, and durable medical equipmentFirst 203 of Medicare-approved amounts** 0 0 203(Part B Deductible)Remainder of Medicare-approved amountsGenerally 80%Generally 20% 0Outpatient treatment for biologically-based mental disorders(for services covered by Medicare)First 203 of Medicare-approved amounts** 0 0 203(Part B Deductible)Remainder of Medicare-approved amounts80%20% 0Outpatient treatment forbiologically-based mental disorders(for services not covered by Medicare) 0100% of expenses 0Outpatient treatment for other mental health disorders(for services covered by Medicare)First 203 of Medicare-approved amounts** 0 0 203(Part B Deductible)Remainder of Medicare-approved amounts80%20% 0Outpatient treatment for other mental health disorders(for services not covered by Medicare)First 24 visits per calendar year 0100% 0Visits 25 and after 0 0All Costs**Once you have been billed 203 of Medicare-approved amounts for covered services (which are noted with adouble asterisk), your Part B Deductible will have been met for the calendar year.The deductible and coinsurance amounts listed above reflect the 2021 Medicare deductible and coinsurance amounts.Beginning 1/1/22, these amounts will be replaced with the 2022 Medicare deductible and coinsurance amounts.Form No. 1222 05Page 8

MEDICARE SUPPLEMENT COREMEDICARE (PART B) MEDICAL SERVICES – PER CALENDAR YEARSERVICESMEDICARE PAYSPLAN PAYSYOU PAYFirst three pints 0All Costs 0Next 203 of Medicare-approved amounts** 0 0 203(Part B Deductible)Remainder of Medicare-approved amounts80%20% 0 0 0BLOODCLINICAL LABORATORY SERVICES –100%BLOOD TESTS FOR DIAGNOSTIC SERVICESSPECIAL MEDICAL FORMULAS MANDATED BY LAW (Covered by Medicare)First 203 of Medicare-approved amounts** 0 0 203(Part B Deductible)Remainder of Medicare-approved amounts80%20% 0Not covered by Medicare 0All allowed chargesBalanceMEDICARE (PARTS A & B)SERVICESMEDICARE PAYSPLAN PAYSYOU PAY100% 0 0First 203 of Medicare-approved amounts** 0 0 203(Part B Deductible)Remainder of Medicare-approved amounts80%20% 0HOME HEALTH CARE – Medicare-Approved ServicesMedically necessary skilled care servicesand medical suppliesDurable Medical Equipment**Once you have been billed 203 of Medicare-approved amounts for covered services (which are noted with adouble asterisk), your Part B Deductible will have been met for the calendar year.The deductible and coinsurance amounts listed above reflect the 2021 Medicare deductible and coinsurance amounts.Beginning 1/1/22, these amounts will be replaced with the 2022 Medicare deductible and coinsurance amounts.Form No. 1222 05Page 9

MEDICARE SUPPLEMENT COREMEDICARE (PART B) – MEDICAL SERVICES PER CALENDAR YEARSERVICESMEDICARE PAYSPLAN PAYSYOU PAY 0OTHER BENEFITS – NOT COVERED BY MEDICAREFOREIGN TRAVEL – NOT COVERED BY MEDICAREOnly the services listed above while travelingoutside of the United States 0Remainder ofcharges (includingportion normallypaid by Medicare)OUTPATIENT PRESCRIPTION DRUGS –NOT COVERED BY MEDICARE 0 0All CostsFITNESS REIMBURSEMENT PROGRAM –NOT COVERED BY MEDICARE 0Up to 150All charges after 150Form No. 1222 05Page 10

MEDICARE SUPPLEMENT 1MEDICARE (PART A) – HOSPITAL SERVICES – PER BENEFIT PERIODSERVICESMEDICARE PAYSPLAN PAYSYOU PAYHOSPITALIZATION*Semiprivate room and board, general nursing and miscellaneous services and supplies,and licensed mental hospital stays for biologically-based mental disorders or other mental disordersprior to the 190-day Medicare lifetime maximumFirst 60 days of a benefit periodAll but 1,484 1,484(Part A Deductible) 061st through 90th day of a benefit periodAll but 371 a day 371 a day 0All but 742 a day 742 a day 0- Additional 365 days 0100% of Medicareeligible expenses 0- Beyond the additional 365 days 0 0All Costs91st day of a benefit period and after:- While using 60 lifetime reserve daysOnce lifetime reserve are used:Licensed mental hospital stays for biologically-based mental disorders not covered by MedicareFirst 60 days of a benefit period 0100% of Medicareeligible expenses 061st through 90th day of a benefit period 0100% of Medicareeligible expenses 0 0100% of Medicareeligible expenses 0- Additional 365 days 0100% of Medicareeligible expenses 0- Beyond the additional 365 days 0 0All Costs91st day and after of a benefit period:- While using 60 lifetime reserve daysOnce lifetime reserve days are used:*A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you havebeen out of the hospital and have not received skilled care in any other facility for 60 days in a row.The deductible and coinsurance amounts listed above reflect the 2021 Medicare deductible and coinsurance amounts.Beginning 1/1/22, these amounts will be replaced with the 2022 Medicare deductible and coinsurance amounts.Form No. 1223 05Page 11

MEDICARE SUPPLEMENT 1MEDICARE (PART A) – HOSPITAL SERVICES – PER BENEFIT PERIODSERVICESMEDICARE PAYSPLAN PAYSYOU PAYLicensed mental hospital stays not covered by Medicare for other mental disorders:First 120 days per benefit period (at least 60 days per calendar year) less days covered by Medicare or alreadycovered by the plan in that calendar year for other mental disordersFirst 60 days of a benefit period 0100% of Medicareeligible expenses 061st through 120th day and after of a benefitperiod 0100% of Medicareeligible expenses 0- Beyond the additional 365 days 0 0All Costs- Days after 120 days per benefit period(or 60 days per calendar year) less dayscovered by Medicare or plan in thatcalendar year 0 0All CostsSKILLED NURSING FACILITY CARE*(Participating with Medicare) You must meet Medicare’s requirements, including having been in a hospital for at leastthree days and entered a Medicare-approved facility within 30 days after having left the hospitalFirst 20 daysAll approved amounts 0 021st through 100th dayAll but 185.50 a dayUp to 185.50 a day 0101st day through 365th day of a benefitperiod 0 10 a dayBalanceBeyond the 365th day of a benefit period 0 0All Costs(Not participating with Medicare) You must meet Medicare’s requirements, including having been in a hospital for atleast three days and transferred to the facility within 30 days after having left the hospital1st day through 365th day of a benefit period 0 8 a dayBalanceBeyond the 365th day of a benefit period 0All Costs 0*A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you havebeen out of the hospital and have not received skilled care in any other facility for 60 days in a row.The deductible and coinsurance amounts listed above reflect the 2021 Medicare deductible and coinsurance amounts.Beginning 1/1/22, these amounts will be replaced with the 2022 Medicare deductible and coinsurance amounts.Form No. 1223 05Page 12

MEDICARE SUPPLEMENT 1MEDICARE (PART A) – HOSPITAL SERVICES – PER BENEFIT PERIODSERVICESMEDICARE PAYSPLAN PAYSYOU PAYFirst three pints 0Three pints 0Additional amounts100% 0 0HOSPICE CAREAvailable as long as your doctor certifiesyou are terminally ill and you elect toreceive these servicesAll but very limitedcoinsurance foroutpatient drugs andinpatient respite careCoinsurance 0BLOODNOTICE: When your Medicare Part A hospital benefits are exhausted, the insurer stands in the place ofMedicare and will pay whatever amount Medicare would have paid for up to an additional 365 days as providedin the Policy’s “Core Benefits”. During this time the hospital is prohibited from billing you for the balancebased on any difference between its billed charges and the amount Medicare would have paid.The deductible and coinsurance amounts listed above reflect the 2021 Medicare deductible and coinsurance amounts.Beginning 1/1/22, these amounts will be replaced with the 2022 Medicare deductible and coinsurance amounts.Form No. 1223 05Page 13

MEDICARE SUPPLEMENT 1MEDICARE (PART B) – MEDICAL SERVICES – PER CALENDAR YEARSERVICESMEDICARE PAYSPLAN PAYSYOU PAYMEDICAL EXPENSES IN OR OUT OF THE HOSPITAL AND OUTPATIENT HOSPITAL TREATMENT, suchas physician’s services, inpatient and outpatient medical and surgical services and supplies, physical and speechtherapy, diagnostic tests, and durable medical equipmentFirst 203 of Medicare-approved amounts 0 203(Part B Deductible) 0Remainder of Medicare-approved amountsGenerally 80%Generally 20% 0Outpatient treatment for biologically-based mental disorders(for services covered by Medicare)First 203 of Medicare-approved amounts 0 203(Part B Deductible) 0Remainder of Medicare-approved amounts80%20% 0Outpatient treatment forbiologically-based mental disorders(for services not covered by Medicare) 0100% 0Outpatient treatment for other mental health disorders(for services covered by Medicare)First 203 of allowed charges 0 203(Part B Deductible) 0Remainder of Medicare-approved amounts80%20% 0Outpatient treatment for other mental health disorders(for services not covered by Medicare)First 24 visits per calendar year 0100% 0Visits 25 and after 0 0All CostsThe deductible and coinsurance amounts listed above reflect the 2021 Medicare deductible and coinsurance amounts.Beginning 1/1/22, these amounts will be replaced with the 2022 Medicare deductible and coinsurance amounts.Form No. 1223 05Page 14

MEDICARE SUPPLEMENT 1MEDICARE (PART B) – MEDICAL SERVICES – PER CALENDAR YEARSERVICESMEDICARE PAYSPLAN PAYSYOU PAYFirst three pints 0All Costs 0Next 203 of Medicare-approved amounts 0 203(Part B Deductible) 0Remainder of Medicare-approved amounts80%20% 0CLINICAL LABORATORY SERVICES –BLOOD TESTS FOR DIAGNOSTIC SERVICES100% 0 0BLOODSPECIAL MEDICAL FORMULAS MANDATED BY LAW(Covered by Medicare)- First 203 of Medicare-approved amounts 0 203(Part B Deductible) 0- Remainder of Medicare-approved amounts80%20% 0 0All allowed chargesBalanceNot covered by MedicareThe deductible and coinsurance amounts listed above reflect the 2021 Medicare deductible and coinsurance amounts.Beginning 1/1/22, these amounts will be replaced with the 2022 Medicare deductible and coinsurance amounts.Form No. 1223 05Page 15

MEDICARE SUPPLEMENT 1MEDICARE (PARTS A & B)SERVICESMEDICARE PAYSPLAN PAYSYOU PAY100% 0 0- First 203 of Medicare-approved amounts 0 203(Part B Deductible) 0- Remainder of Medicare-approved amounts80%20% 0HOME HEALTH CARE – Medicare-Approved ServicesMedically necessary skilled care services andmedical suppliesDurable Medical EquipmentOTHER BENEFITS – NOT COVERED BY MEDICARESERVICESMEDICARE PAYSPLAN PAYSYOU PAY 0FOREIGN TRAVEL – NOT COVERED BY MEDICAREOnly the services listed above while travelingoutside the United States 0Remainder ofcharges (includingportion normallypaid by Medicare)OUTPATIENT PRESCRIPTION DRUGS –NOT COVERED BY MEDICARE 0 0All CostsFITNESS REIMBURSEMENT PROGRAM –NOT COVERED BY MEDICARE 0Up to 150All charges after 150The deductible and coinsurance amounts listed above reflect the 2021 Medicare deductible and coinsurance amounts.Beginning 1/1/22, these amounts will be replaced with the 2022 Medicare deductible and coinsurance amounts.Form No. 1223 05Page 16

MEDICARE SUPPLEMENT 1AMEDICARE (PART A) – HOSPITAL SERVICES – PER BENEFIT PERIODSERVICESMEDICARE PAYSPLAN PAYSYOU PAYHOSPITALIZATION*Semiprivate room and board, general nursing and miscellaneous services and supplies, and licensedmental hospital stays for biologically-based mental disorders or other mental disorders prior to the190-day Medicare lifetime maximumFirst 60 days of a benefit periodAll but 1,484 1,484(Part A Deductible) 061st through 90th day of a benefit periodAll but 371 a day 371 a day 0All but 742 a day 742 a day 0- Additional 365 days 0100% of Medicareeligible expenses 0- Beyond the additional 365 days 0 0All Costs91st day of a benefit period and after:- While using 60 lifetime reserve daysOnce lifetime reserves are used:Licensed mental hospital stays for biologically-based mental disorders not covered by MedicareFirst 60 days of a benefit period 0100% of Medicareeligible expenses 061st through 90th day of a benefit period 0100% of Medicareeligible expenses 0 0100% of Medicareeligible expenses 0- Additional 365 days 0100% of Medicareeligible expenses 0- Beyond the additional 365 days 0 0All Costs91st day and after of a benefit period:- While using 60 lifetime reserve daysOnce lifetime reserve days are used:*A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you havebeen out of the hospital and have not received skilled care in any other facility for 60 days in a row.The deductible and coinsurance amounts listed above reflect the 2021 Medicare deductible and coinsurance amounts.Beginning 1/1/22, these amounts will be replaced with the 2022 Medicare deductible and coinsurance amounts.Form No. 1224 05Page 17

MEDICARE SUPPLEMENT 1AMEDICARE (PART A) – HOSPITAL SERVICES – PER BENEFIT PERIODSERVICESMEDICARE PAYSPLAN PAYSYOU PAYLicensed mental hospital stays not covered by Medicare for other mental disorders:First 120 days per benefit period (at least 60 days per calendar year) less days covered by Medicare or alreadycovered by the plan in that calendar year for other mental disordersFirst 60 days and after of a benefit period 0100% of Medicareeligible expenses 061st through 120th day and after of abenefit period 0100% of Medicareeligible expenses 0- Beyond the additional 365 days 0 0All Costs- Days 120 days per benefit period(or 60 days per calendar year) less dayscovered by Medicare or plan in thatcalendar year 0 0All CostsSKILLED NURSING FACILITY CARE*(Participating with Medicare) You must meet Medicare’s requirements, including having been in a hospital for at leastthree days and entered a Medicare-approved facility within 30 days after having left the hospitalFirst 20 daysAll approved amounts 0 021st through 100th dayAll but 185.50 a dayUp to 185.50 a day 0101st day through 365th day of a benefitperiod 0 10 a dayBalanceBeyond the 365th day of a benefit period 0 0All Costs(Not participating with Medicare) You must meet Medicare’s requirements, including having been in ahospital for at least three days and transferred to the facility within 30 days after having left the hospital1st day through 365th day of a benefit period 0 8 a dayBalanceBeyond the 365th day of a Benefit Period 0All Costs 0*A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you havebeen out of the hospital and have not received skilled care in any other facility for 60 days in a row.The deductible and coinsurance amounts listed above reflect the 2021 Medicare deductible and coinsurance amounts.Beginning 1/1/22, these amounts will be replaced with the 2022 Medicare deductible and coinsurance amounts.Form No. 1224 05Page 18

MEDICARE SUPPLEMENT 1AMEDICARE (PART A) – HOSPITAL SERVICES – PER BENEFIT PERIODSERVICESMEDICARE PAYSPLAN PAYSYOU PAYFirst three pints 0Three pints 0Additional amounts100% 0 0HOSPICE CAREAvailable as long as your doctor certifiesyou are terminally ill and you elect toreceive these servicesAll but very limitedcoinsurance foroutpatient drugs andinpatient respite careCoinsurance 0BLOODNOTICE: When your Medicare Part A hospital benefits are exhausted, the insurer stands in the place ofMedicare and will pay whatever amount Medicare would have paid for up to an additional 365 days as providedin the Policy’s “Core Benefits”. During this time the hospital is prohibited from billing you for the balancebased on any difference between its billed charges and the amount Medicare would have paid.The deductible and coinsurance amounts listed above reflect the 2021 Medicare deductible and coinsurance amounts.Beginning 1/1/22, these amounts will be replaced with the 2022 Medicare deductible and coinsurance amounts.Form No. 1224 05Page 19

MEDICARE SUPPLEMENT 1AMEDICARE (PART B) – MEDICAL SERVICES – PER CALENDAR YEARSERVICESMEDICARE PAYSPLAN PAYSYOU PAYMEDICAL EXPENSES IN OR OUT OF THE HOSPITAL AND OUTPATIENT HOSPITAL TREATMENT, suchas physician’s services,

and Medicare Supplement 1A Medicare Supplement Insurance can be sold in only standard plans. This chart shows the benefits included in each plan. Every company must make available the "Core" plan. For persons who became Medicare Eligible prior to January 1, 2020, companies which make Medicare Supplement 1A plans available