Transcription

MissouriMedigapShoppingGuideMedigap (Medicare Supplement) insurance plansMedigap rate informationPart D drug plansMissouri Rx programMedicare Advantage plansDIFPJeremiah W. (Jay) NixonGovernorDepartment of Insurance,Financial Institutions &Professional RegistrationJohn M. HuffDirector

Medicare questions?Get answers for freeState Health Insurance Assistance ProgramCall 800-390-3330orVisit missouriclaim.orgThis free nonprofit Medicare counselingprogram will answer questions about:zMedigapzinsurance (MedicareSupplement)zEnrollmentzand billingzMedicarezprescription drug planszLong-termzcare planning and insurancezMedicarezAdvantage planszAppealszand grievanceszLimitedzincome assistance programszSuspectedzwaste, fraud and abuseTrained volunteers throughout Missouriwill help answer your questions.CLAIM is sponsored by the federal Centers for Medicare and Medicaid Services andthe Department of Insurance, Financial Institutions and Professional Registration (DIFP)2MISSOURI MEDIGAP SHOPPING GUIDE

Book designed to answer questionsabout Medicare, related insuranceThis book also walks youthrough the different parts ofMedicare and assistance that’savailable for those who needhelp paying for medication.Along with this guide,the DIFP funds a statewidevolunteer program to helpMedicare consumers with these toughdecisions. I urge you to contact theCLAIM program for help answeringyour Medicare questions. Moreinformation about the program and itscontact number can be found on theprevious page.Medicare can be complicatedand at times confusing, but withgood resources like this bookletand the CLAIM program, you cansort through the options and makedecisions that best meet your healthcare needs.Dear Missourian,At the MissouriDepartment of Insurance,Financial Institutions andProfessional Registration(DIFP), we work to providecomplete information aboutinsurance to people onMedicare.As you have learned, becomingMedicare eligible does not mean allof your health care needs expensesare covered. Medigap insurance, alsocalled Medicare Supplement, canbe an important part of your overallhealth insurance plan. It is available toMissourians who are at least 65 yearsold or disabled.Medigap is sold by private insurancecompanies, and the prices thosecompanies charge are listed in oursupplemental Medigap Rate Guide.Sincerely,John M. HuffDirector, DIFPDIFP’s Insurance Consumer HotlineIf you have questions about your insurance policy orwant to file a complaint against an insurer, contact us:800-726-7390difp.mo.govordifp.mo.gov1

Medigap insurance topicsAbout Medigap insurance5Medicare basics6Medigap plans7Medigap enrollment information8How to use this guideContact CLAIM for free answersAre you eligible?Parts of MedicarePlans no longer sold, new plans, basic benefits, plans D and GEnrolling for the first timeRenewingChanging to a new companyPremium informationSpecial rates for disabled Missourians“Select” plansWhere you live could affect insurance rates9Guaranteed issue rights for Medigap policies10Medigap plan shopping tips12Medigap plan options14Situations where your insurance company cannot denyyou a Medigap policyShop for benefits and priceResearch insurance companyDo’s and Don’ts of buying MedigapMedigap policy optionsMedigap policy benefits are explainedQuestions to ask when buying a Medigap planMake shopping easier with this easy-to-use worksheet.Know who pays first if you have other health insurance or coverageMedicare Part D prescription drug plansEnrollmentDrug coverage gap (doughnut hole)Changes in Medicare Part D16171920REVISED JUNE 2016DIFP is an equal opportunity employer2MISSOURI MEDIGAP SHOPPING GUIDE

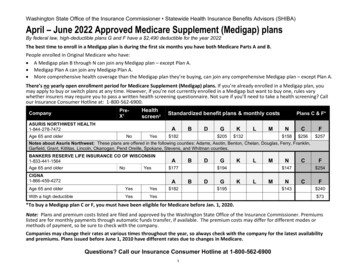

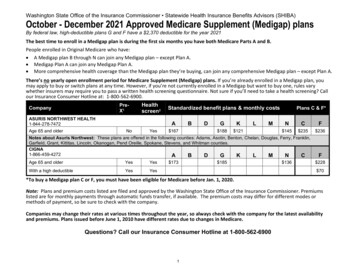

Prescription drug coverage,Medicare Advantage topicsMissouri Rx Plan: Help with drug costs21Medicare Advantage plans: What you need to knowEnrollmentWhen you pair Medicare with a Medigap plan or a Medicare Advantage plan2223My Questions/Notes24Insurance terms26Basic factsBenefitsEnrollment: How to get a MoRx applicationEligibility requirementsWhat those words and phrases meanCompare Medigap rates2013MissouriMedigap Rate1 Use supplemental rate guideCompare prices using Medigap insurance rate chartsRate guide lists statewide average rates of the 11 availableMedigap plans. Also listed: Consumer complaint historyfor Medigap insurers.GuideFor ages under 65 Page 365670975128015Jay NixonGovernorDIFPDepartmentofFinancial Inst Insurance,Professiona itutions &l RegistrationJohn M.HuffDirector2 Use online toolto view current Medigap ck on “Medigap (Medicare Supplement) insurance” toview the searchable rates.difp.mo.gov3

DIFPDepartment of Insurance,Financial Institutions &Professional RegistrationInsurance Consumer Hotline: 800-726-7390Missouri TTY user: 800-735-2966 or 711 for Relay MissouriWeb: insurance.mo.govAddress: Consumer Affairs DivisionTruman State Office Building, Room 830PO Box 690Jefferson City, MO 65102Hours: 8 a.m. to 5 p.m. weekdaysOther resourcesCLAIM HELP LINE (State Health Insurance Assistance Program)Phone: 800-390-3330Web: missouriclaim.orgMEDICAREPhone: 800-MEDICARE (800-633-4227)Web: medicare.govU.S. SOCIAL SECURITY ADMINISTRATIONPhone: 800-772-1213Web: socialsecurity.govMISSOURI Rx Plan (state pharmacy assistance program)Phone: 800-375-1406Web: morx.mo.govMISSOURI VETERANS COMMISSIONPhone: 866-838-4636 or 573-751-3779Web: mvc.dps.mo.govTRICAREPhone: 888-874-9378Web: tricare.milRAILROAD RETIREMENT BOARD (eligibility and enrollment)Phone: 877-772-5772Web: www.rrb.gov4MISSOURI MEDIGAP SHOPPING GUIDE

About Medigap insuranceAlso known as Medicare Supplement insurance, consumerscan buy a Medigap policy to cover deductibles required undertheir traditional Medicare benefits. The companies sellingMedigap insurance in Missouri can offer up to 11 plans.How to use this guideThe Missouri Department of Insurance,Financial Institutions and ProfessionalRegistration (DIFP) regulates the insurancecompanies that offer Medigap policies inMissouri.The Missouri Medigap Shopping Guideexplains the basics of Medigap policies andthe 11 plans offered in Missouri. It also liststhe companies authorized to sell these policiesin the state. The statewide, average annualpremium charged for each plan can be foundin the accompanying Medigap Rate Guide.Charges can vary for a number of reasonsincluding age at time of application, whereyou live and what company you will be using.Another publication you may find helpfulis Choosing a Medigap Policy: A Guide toHealth Insurance for People with Medicare.Written by Medicare and the NationalAssociation of Insurance Commissioners,it has excellent information about Medicareas well as health insurance. Any agent orcompany that offers to sell you Medigapinsurance must give you a copy of the guide.The guide can be found at mo.govContact CLAIM for free answersFor any questions about Medicare, youcan contact CLAIM, a free, nonprofit servicethat counsels Missourians with Medicare andtheir caregivers.Trained volunteers throughout Missouriwill help answer your questions.Call: 800-390-3330Visit: missouriclaim.orgThis free Medicare counseling program willanswer questions about:zzMedigap insurancezzEnrollment and billingzzMedicare prescription drug planszzLong-term care planning and insurancezzMedicare Advantage planszzAppeals and grievanceszzLimited income assistance programszzSuspected waste, fraud and abuseCLAIM services are funded by the FederalCenters for Medicare and Medicaid Servicesand the DIFP.5

Medicare basicsMedicare is a federal program that provideshealth insurance for those 65 and older, andsome people under 65 with certain disabilities.It is the largest health insurance program in theU.S.Medicare was signed into law by PresidentLyndon Johnson on July 30, 1965, inIndependence, Mo. The first person enrolledin the program was former President Harry S.Truman, who was from Missouri.Am I eligible?Most people can join Medicare when theyturn 65. You also can join if you:zzReceive Social Security disability checksfor 24 months, orzzHave permanent kidney failure, known asend-stage renal disease (ESRD), orzzHave Lou Gehrig’s Disease, known asAmyotrophic Lateral Sclerosis (ALS)PARTS OF MEDICAREMedicare Part A (hospital insurance): No monthly premium with exceptionszzHelps pay for inpatientzzHelps cover home health, hospice and skilled nursing facilitycare in hospitals.care (but not long-term care).A deductible and copays may apply.Medicare Part B (medical insurance): Monthly premium with right to delay enrollmentzzHelps pay for medical care not covered by Part A, suchMedicareas doctorPartzBzHelps(medicalcoverinsurance):some preventivevisits, outpatient hospital services and medical equipment.Monthly premium serviceswith righttotomaintaindelay health.The monthly premium is usually withheld from your monthly Social Security check.A deductible and coinsurance may apply.Medigap insurance: Optional coverage with monthly premiumAlso called Medicare Supplement insurance,these plans are offered by private insurancecompanies. Generally anyone with Parts A &B is eligible. These plans are assigned lettersA-N. This is not to be confused with “parts”of Medicare, such as Parts A & B. Most ofthese plans cover the deductibles and/orcoinsurance required in Parts A & B.Medicare Advantage plans (like an HMO or PPO): Optional coverage with monthly premiumAlso called Medicare Part C, these plans areoffered by private insurers that contract withMedicare to provide your benefits. You musthave Parts A & B to qualify. The companyhandles all aspects of a beneficiary’s healthcare – from enrollment to payment of providers.You cannot buy a Medigap and a MedicareAdvantage policy. Deductibles, copays andcoinsurance can apply.Medicare Part D: Optional coverage with monthly premiumHelps pay for medicine through a plan offeredby a private insurer approved by Medicare.You normally will pay some money when you6pick up your medicine.You must have Medicare Part A and/or Part B.MISSOURI MEDIGAP SHOPPING GUIDE

Medigap plansSeveral changes were made to Medigap plans in 2010. These policies give you choices inhealth care coverage to fill gaps in payment of deductibles, copayments and coinsurancethat Original Medicare does not pay. There are 11 plans from which to choose. (Plans E, H,I, J and high-deductible J are no longer being offered to new clients, which means futurerate increases may be very high since there will be fewer policyholders in the plans.)Lower premium plans M and NPlans M and N are designed to give you alower premium:zzPlan M covers 50 percent of the Part Adeductible but none of Part B deductible.zzPlan N includes full coverage of the Part Adeductible but no coverage for the Part Bdeductible.zzCoverage for Part B coinsurance (as partof basic benefits) is subject to a newcopay structure. The copay obligation isup to 20 for office visits and up to 50for emergency room visits.Basic benefitsHospice Part A coinsurance (outpatientprescription drug and inpatient respite carecoinsurance) is now covered as a basicbenefit. You will not have to pay:zzCopay of 5 or less for outpatientprescription drug plans for pain andsymptom management.zz5 percent of the Medicare-approvedamount for inpatient respite care (notincluding room and board).zzPlan K will cover 50 percent, and Plan Lwill cover 75 percent of these costs.Part B coinsurance: Plans K, L and Nnow require you to pay a portion of Part Bcoinsurance and copayments, which may resultin lower premiums for these plans. All otherMedigap policies pay Part B coinsurance orcopayments at 100 percent.difp.mo.govMedigapplansOpen enrollment for new policiesIf you have a Medigap policy but would liketo switch companies, you have an annualguaranteed open enrollment period.See page 8 for more information.Plans D and GPlans D and G bought on or after June 1,2010, have different benefits than the D orG plans bought earlier. If you bought Plan Dor G before June 1, 2010, you can keep thatplan and the benefits won’t change. For plansbought later:zzAt-home recovery benefit has beeneliminated from plans D and G.zzPart B excess charge benefit in PlanG increases from 80 percent to 100percent.7

Medigap enrollment informationEnrolling for the first timeTo be eligible for Medigap coverage,you generally must be enrolled in MedicareParts A and B. You have a six-month openenrollment period from the date when yourPart B takes effect. This applies to those whoare disabled as well as those 65 or older.During open enrollment, an insurancecompany cannot refuse to sell youany Medigap policy it carries.The insurer may impose up to a sixmonth waiting period before paying for anytreatment related to a pre-existing condition.You must be given credit for prior creditablecoverage to offset any six-month waiting period.RenewingEach year, you have the right to renew yourcurrent plan. While your rates may increase,your insurance company cannot refuse torenew your coverage or impose any waitingperiod based on pre-existing conditions, aslong as you stay in the same plan as before.Changing to a new companyYou have the right to switch insurancecompanies each year during the 30 daysbefore or after your policy’s anniversarydate (the date on which your policy firststarted). For example, if your policy expiresJune 30, you can switch policies betweenJune 1 and July 30. You can call the insurancecompany to get your anniversary date.If you change to the same-lettered plan – forexample, from Plan F at Insurer XYZ to PlanF at Insurer ABC, the new insurer cannot denyyou coverage and cannot impose a waitingperiod based on pre-existing conditions.To demonstrate that you qualify to changeinsurers, you are required to show only8Make sure you get a simple outline of coveragewhen buying a Medigap policy.minimal proof. Simply produce a renewalnotice (from your old insurer), invoice, theold policy or other confirmation of policyownership to the agent or new company.If you are told that you don’t qualify,immediately call the Insurance ConsumerHotline at 800-726-7390.If you change to a plan with fewer benefits,such as from Plan F to Plan C, you may ormay not be subject to underwriting when aninsurance company considers your health. Notall insurers allow you to change to a plan withfewer benefits.If you elect to go with a more extensiveplan (later in the alphabet, such as from PlanC to Plan F) you will likely be subject tounderwriting, and may be denied coverage orthe insurance company may impose a waitingperiod, based on a pre-existing condition, forany new benefits under your new plan.Once you receive the new policy and youare certain it meets your needs, you shouldcancel the old policy.Note: If you switch to a MedicareAdvantage plan, you will lose the benefits ofyour Medigap policy.Make sure your new policy hastaken effect before your old policyis canceled.MISSOURI MEDIGAP SHOPPING GUIDE

Premium informationMost companies will allow you to pay premiumsmonthly.If you pay annual premiums, a new law signedby Gov. Nixon requires insurers to refund yourpremium if you cancel coverage before the endof the policy year. For example, if you pay yourannual premium and cancel six months later,you’ll get a refund for six months of premiums.Premiums for all policies likely will increase eachyear to account for changes in Medicare benefitsor increasing medical costs. If your insurer raisesyour premiums, it must do so for all policyholdersof your rating class for the company.Special rates for disabled MissouriansEveryone under age 65, who has been approvedfor Social Security disability, also has theguaranteed right to buy Medigap insurance whenthey enroll in Part B.The cost may differ from policies availableto seniors. Pricing information for disabledMissourians under age 65 is in the accompanyingMedigap Rate Guide.When disabled Medigap policyholders turn65, they have a second open enrollment period,and can exercise the rights of any 65-year-oldbecoming eligible for Medicare for the first time.They may pick the plan of their choice from anyinsurer and pay the same rates as other Medicarebeneficiaries.“Select” plansA few Medigap policies are called “select”plans. Similar to an HMO, they require you togo to specific health care providers for coveredservices, but the benefits offered under selectplans A-N are the same as those in regularMedigap plans.The rates for these plans are usually lower thanregular Medigap policies. Select plans are notavailable in all parts of Missouri.difp.mo.govMake sure you compare plans in theMedigap Rate Guide. Such factors aswhere you live and gender could affectyour rates. You can go to insurance.mo.gov to find the most recent rates.Where you live couldaffect insurance ratesPremium rates in the rate guide arebased on statewide, average yearly rates.Actual rate: Your rate may varybased on factors such as whereyou live, your gender, whether yousmoke and whether the policy is foran individual or a group.Individual insurance: Anindividual Medigap policy isa direct contract between youand the insurer. It provides themaximum number of consumerprotections. These policies areeither “guaranteed renewable” or“non-cancelable.”Group insurance: Group Medigapinsurance is a contract betweenthe insurer and a group masterpolicyholder such as AARP or anemployer. You receive a certificaterather than a policy. The groupnegotiates the terms of the insuranceand has the option to terminate thepolicy or change insurance carriers.Some insurance policies will requireyou to join a group or association.9

Guaranteed issue rights for Medigap policiesIn all eight situations below, your insurance company cannot:zzDeny you the Medigap (Medicare Supplement) policy.zzPlace conditions on the Medigap policy, such as waiting periods.zzApply a pre-existing condition exclusion.zzDiscriminate in the price of the Medigap policy based on your health status.You have a Medigapguaranteed issue right if .You have theright to buy .You can/must applyfor a Medigap policy .(DAYS ARE CALENDAR DAYS)1 You have a Medicare Advantage planand:zzYour plan is leaving Medicare; orzzStops giving care in your area; orzzYou move out of plan’s servicearea.Note: If you immediately join anotherMedicare Advantage plan, you canstay in that plan for up to one yearand still have the rights described insituations 4 and 5.Medigap policy A,B, C, F, K or L soldin Missouri by anyinsurance company.You only have thisright if you switchto Original Medicarerather than joininganother MedicareAdvantage plan.2 You have Original Medicare and anemployer group health plan(including retiree or COBRA coverage)or union coverage. The employergroup or you are terminatingcoverage.Medigap policy A,B, C, F, K or L soldin Missouri by anyinsurance company.If you have COBRAcoverage, you caneither immediatelybuy a Medigap policyor wait until COBRAcoverage ends.No later than 63 days afterthe latest of these dates:zzDate coverage ends.Medigap policy A,B, C, F, K or L soldby any insurancecompany in the stateto which you aremoving.As early as 60 days beforeyour health care coverageends but no later than 63days after it ends.3 You have Original Medicare and aMedicare Select policy. You moveout of the Medicare Select policy’sservice area.You can keep your Medigap policy,however the hospitals in your newarea may not be a network provider,or you may want to switch toanother Medigap policy.10As early as 60 days beforeyour health care coverageends but no later than 63days after it ends. Medigapcoverage can’t begin untilyour Medicare Advantageplan coverage has ended.zzDate on notice telling youcoverage is ending (if youget one).zzDate on a claim denial, ifthis is only way your wereinformed.MISSOURI MEDIGAP SHOPPING GUIDE

You have a Medigapguaranteed issue right if .You have theright to buy .You can/must applyfor a Medigap policy .4 (Trial right) You joined aMedicare Advantage plan orProgram of All-inclusive Carefor the Elderly (PACE) whenfirst eligible for MedicarePart A at age 65, and withinthe first year of joining, youdecide to switch to OriginalMedicare.Any Medigap policy sold inMissouri by any insurancecompany.As early as 60 days beforeyour health care coverageends but no later than 63days after it ends.Note: Your rights may last foran extra 12 months undercertain circumstances. Also,Medigap coverage can’tbegin until your Advantageplan coverage has ended.5 (Trial right) You droppeda Medigap policy to join aMedicare Advantage plan orswitch to a Medicare Selectpolicy for the first time; youhave been in the plan forless than a year and want toswitch back.The Medigap policy youhad before you obtainedthe Advantage plan orSelect policy, if the samecompany you had beforestill sells it. (Drug coveragewon’t be included.) If itisn’t available, you can buyMedigap policy A, B, C, F, Kor L sold in Missouri by anyinsurer.As early as 60 days beforeyour health care coverageends but no later than 63days after it ends.Note: Your rights may last foran extra 12 months undercertain circumstances.6 Your Medigap policy endsthrough no fault of your own,such as bankruptcy by yourinsurance company.Medigap policy A, B, C, F, Kor L sold in Missouri by anyinsurance company.No later than 63 days aftercoverage ends.7 You leave a MedicareAdvantage plan or drop aMedigap policy because yourcompany hasn’t followed therules or misled you.Medigap policy A, B, C, F, Kor L sold in Missouri by anyinsurance company.No later than 63 days aftercoverage ends.8 You can change your Medigappolicy to another insurancecompany 30 days before or30 days after your policy’sannual anniversary date.The Medigap policy youhad before switching. If itisn’t available, you can buya Medigap policy A, B, C,F, K or L sold in Missouriby any insurance company.This also applies topersons switching from adiscontinued plan.As early as 30 days beforethe anniversary date of yourpolicy and no later than 30days after the anniversarydate.difp.mo.gov11

Medigap plan shopping tipsShop for benefits and priceCheck the benefits in each of the 11 plans.Every company must use the same letters(A through N) to label its policies. PlanA is always a company’s lowest-pricedMedigap policy. It contains basic benefits andmust be sold by every company.Plans B through N add other benefits tofill different gaps in your Medicare coverage.Options K and L provide a product for those whocan afford a higher deductible and are healthy.Few companies sell all policies. The chartsin the Medigap Rate Guide show the statewideaverage premiums for companies’ plans.Research insurance companyBesides rates, consider a company’scomplaint index (see Medigap Rate Guide).This numerical score helps you understandhow many consumer complaints an insurerreceives, compared to other companies its size.When you cancel a policy: It is your responsibilityto request cancellation (in writing) with your priorinsurer. Do not rely on the insurance agent.A complaint index of 100 is average. Below100 means the company gets fewer complaintsthan average, and a score above 100 means theinsurer gets more complaints than average.This information also is available by callingDIFP’s Insurance Consumer Hotline at 800726-7390 and by visiting insurance.mo.gov.Do’s and don’ts of buying MedigapWhat to doAsk questions of friends and family.Know what you are buying. Insist ongetting a simple outline of coverage.Choose the benefits you want and need.Benefits are standardized in Medigappolicies. For example, the Plan C policyhas exactly the same benefits with anycompany.Compare benefits for different policiesbefore buying. Consider family andmedical history.Check a company’s consumer complainthistory with DIFP at 800-726-7390.Keep proof of prior creditable coverage.Keep the agent’s name and informationfor later reference.12Carefully read the policy. You have a 30-day“free look” period. If you are unsatisfiedand cancel, you can get a full refund.What not to doDon’t feel pressured to buy now. You have a sixmonth open enrollment period.Don’t drop a current insurance policy until youhave your new coverage.Don’t buy more than one Medigap policy.Never pay cash. Always use a check made out tothe insurance company, not the agent.Don’t buy from agents who claim to be fromthe government. The government does not sellinsurance.Don’t buy a Medigap policy if you have a MedicareAdvantage plan. They won’t work together.MISSOURI MEDIGAP SHOPPING GUIDE

Plan Availability changes due to MACRA(Medicare Access and CHIP ReauthorizationAct) of 2015As a result of the passage of the federal law, MACRA in 2015, Medicare eligibles will seechanges to plan offerings as of January 1, 2020. While the benefits under the current MedicareSupplement plans do not change, PLAN AVAILABILITY does change.While the year 2020 may seem a ways off, miscommunication about the impact of MACRA isalready stirring. So, please read the following carefully so you know your options and rights.Only those Medicare eligible on or after January 1, 2020 are impacted by the changes to planavailability. Those Medicare eligible prior to January 1, 2020 are not impacted and can keep theircurrent plans. MACRA prohibits coverage of the Part B deductible under Medicare Supplementplans as of 1/1/2020.Impacts of MACRA on those eligible for Medicare PRIOR to January 1, 2020:zz All Medicare Supplement plan options are available to you.zz If you are enrolled in Plans C and F, you can keep your plan. These plans remain availableto you.zz You can buy Plans C and F after January 1, 2020.zz Can purchase the new Plan G High Deductible Plan in 2020.Impact of MACRA on those eligible for Medicare ON or AFTER January 1,2020:zz Cannot buy Plans C and F;zz Creates a new Plan G High Deductible;zz Re-designates the guaranteed issued plans from Plans C and F to Plans D and G;zz Makes Plan G High Deductible available to all eligible for Medicare.difp.mo.gov13

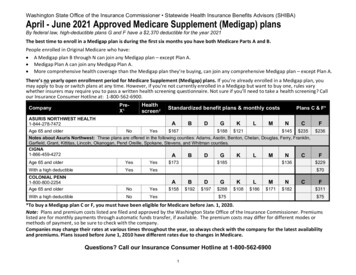

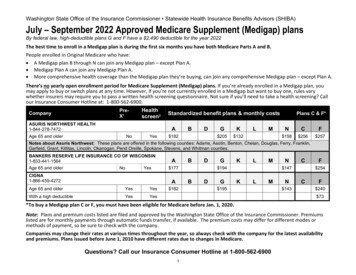

Medigap insurance plan optionsAPLANSBasicbenefitsBCDFF high asicbenefitsPart AdeductiblePart AdeductiblePart AdeductiblePart coinsuranceSkillednursingcoinsuranceThis optionhas the samebenefits asPlan F but ahigh deductiblefirst mustbe paid. Thetrade-off is alower monthlypremium.The beneficiarypays the plan’sdeductible eachyear before thesupplementalpolicy pays forany services.This deductibleamount issubject toincrease eachyear.Part BdeductiblePart BdeductiblePart B excess(100%)Foreign travelemergencyForeign travelemergencyForeign travelemergencyExplanation of Medigap plan benefitsBasic benefits(Plans A-N)zzCoverage for coinsurance for day 61-90 of inpatient hospitalization.zzCoverage for coinsurance for lifetime reserve days 91-150.zzCoverage for an additional 365 days of inpatient hospital care in yourlifetime.zzCoverage for first three pints of blood.zzCoverage for 20% coinsurance for Part B services.zzCoverage for the hospice 5% coinsurance for Medicare-approvedcharges for inpatient respite care and 5% coinsurance forprescription pain medications.Part A deductible(Plans B, C, D, F, G, N)zzCoverage for inpatient hospital deductible for each benefit period.zzPartial coverage on Plans K, L and M.(Partial coverage on K, L, M)14MISSOURI MEDIGAP SHOPPING GUIDE

Medigap insurance plan options ive carepaid at 100%;other basic benefitspaid at 50%Hospitalization,preventive carepaid at 100%;other basic benefitspaid at 75%BasicbenefitsBasic benefits,except up to 20copay for officevisit & up to 50copay for ERPart Adeductible50% of Part Adeductible75% of Part Adeductible50% of Part AdeductiblePart A deductibleSkillednursingcoinsurance50% of skillednursingcoinsurance75% of Skilled nursingcoinsuranceForeign travelemergencyForeign travelemergencyPart B excess(100%)Foreign travelemergencyBenefits paidat 100% afterout-of-pocketlimit reachedExplanationBenefits paidat 100% afterout-of-pocketlimit reachedcontinuedSkilled nursing coinsurance(Plans C, D, F, G, M, N)(Partial coverage on K, L)zzCoverage for skilled nursing coinsurance for days 21-100 foreach benefit period.zzPartial coverage on Plans K & L.Part B deductible (Plans C, F)zzCoverage for the yearly deductible.Part B excess(Plans F, G)zzCoverage for Part B charges over approved amount.zzPlan F pays for 100% of excess charge.zzPlan G pays for 100% of excess charge.Foreign travel emergency(Plans C, D, F, G, M, N)zzCoverage for emergency care for first 60 days of a tripoutside the U.S.zzBeneficiary pays for 250 deductible and 20% of cost upto 50,000.difp.mo.gov15

Buying a Medigap plan worksheetQUESTIONSTO ASKDATEWhenyou call an insurance company about a Medigap policy, here are someQUESTIONSquestionsTO ASK you might want to ask. Write down the responses for later reference.PHONE NUMBERPLAN LETTERCOMPANY NAMECOMPANY REPRESENTATIVE'S NAME and TITLEHow much is the monthly premium for plan?How long has the company been selling Medigap policies?When did the plan’s rate last increase? How many increases in last three years?When do you expect to have another rate increase?How many complaints has your company received in the last 12 months?What is the most common complaint your company receives?Why should I buy a policy from this company?How long does it take for your company to pay a claim?What is A.M. Best's financial rating of your company? (They range from A to F )Is this plan underwritten? (See page 22 for definition.)Is this a group plan and, if so, how do I join the group?16MISSOURI MEDIGAP SHOPPING GUIDE

Know who pays first if you have otherhealth insurance or coverageIf you have Medicare and other health insurance coverage, eachtype of coverage is called a “payer.” When there is more than onepayer, there are “coordination of benefits” rules that decide whichone pays first. The primary payer pays what it owes on y

4 MISSOURI MEDIGAP SHOPPING GUIDE DIFP Department of Insurance, Financial Institutions & Professional Registration Other resources CLAIM HELP LINE (State Health Insurance Assistance Program) Phone: 800-390-3330 Web: missouriclaim.org MEDICARE Phone: 800-MEDICARE (800-633-4227) Web: medicare.gov U.S. SOCIAL SECURITY ADMINISTRATION