Transcription

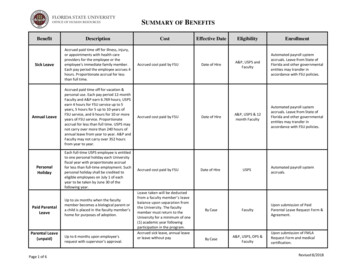

FRS EMPLOYER NewsletterFlorida Retirement SystemThird Quarter, July 2021Florida LegislatureApproves Changeto FRS EmployerContribution Rates New UniformContribution Rates New OptionalProgram ContributionRates Investment PlanContribution RatesLegislative RoundupMembers GrantSDBA Access at TheirOwn Risk!Annual Fee DisclosureStatement NoticeWorkshops Employer EmployeeUpcoming 1st ElectionDeadlinesFlorida Legislature Approves Changeto FRS Employer Contribution RatesDuring the 2021 session, the Florida Legislature passed Senate Bill 7018,changing the employer contribution rates for the FRS, effective July 1, 2021.This bill has been signed by the Governor.What’s Changing? The uniform normal cost and unfunded actuarial liability contributionrates for the FRS Unfunded actuarial liability contribution rates for the FRS that are paid bythe employer on the compensation of members in the optional programs:SUSORP, SMSOAP, and SCCSORPWhat’s Not Changing? The required 3% contribution rate paid by employees into any FRS plan The administrative and education assessment The Health Insurance Subsidy contribution rate The total amount paid into members’ Investment Plan accountsEmployer contribution rates are the same by membership class for members inboth the Investment Plan and the Pension Plan. These contribution rates providefor funding of the normal cost of benefits of both plans and provide for theactuarially determined contributions required for the Pension Plan’s unfundedactuarial liability.RemindersThe Division of Retirement provided all FRS-participating employers withInformation Release 2021-219 detailing contribution rate information(by reporting plan codes).ResourcesTo review contribution rates, refer to the tables on the following pages.HomePrintThree More Bills YouShould Know AboutDuring the 2021 session, the FloridaLegislature passed three bills that willhave an impact on the Florida RetirementSystem: House Bill 35, House Bill 873,and House Bill 781. For a quick summaryof these bills, refer to the LegislativeRoundup on page 4.To keep up with legislation, visitMyFRS.com and click “Legislation” in the“Alerts & Hot Topics” box.Check Out the NewlyRedesigned FRS OnlineThe Division of Retirement is excited toannounce a newly redesigned FRS Onlinefor members. This refresh enhancesthe look of the website to improve userexperience and provides for additionalsecurity measures using multifactorauthentication. Learn more about this FRSOnline upgrade here. Improvements to theemployer page are coming soon.1 Next

FRS EMPLOYER NewsletterJuly 2021FRS Employer Contribution RatesFlorida LegislatureApproves Changeto FRS EmployerContribution RatesTable 1: Uniform Contribution Rates (new rates effective July 1, 2021)Paid by EmployeeMembership Class New UniformContribution RatesRetirementPaid by EmployerNormal CostUnfunded ActuarialLiabilityAdministrative andEducationHealth InsuranceSubsidyTotal Paid byEmployerTotal Paid byEmployee tNew1CurrentNew1CurrentNew1CurrentNew1Regular 0.00%10.82%13.00%13.82%Special Risk %24.45%25.89%27.45%28.89% Investment PlanContribution RatesSpecial Risk AdministrativeSupport %35.84%37.76%38.84%40.76%Elected Officers’ Class %1.66%39.73%40.91%42.73%43.91%Legislative RoundupElected Officers’ Class(Legislature/Cabinet/PublicDefender/State 1.66%58.91%63.73%61.91%66.73%Elected Officers’ Class(County and .66%49.18%51.42%52.18%54.42%Senior Management Service 45%0%0%1.66%1.66%16.98%18.34%16.98%18.34% New OptionalProgram ContributionRatesMembers GrantSDBA Access at TheirOwn Risk!Annual Fee DisclosureStatement Notice1Rates for local annuity programs are not listed since those rates are established by local authority, per Section 121.055(1)(b)2., Florida Statutes.Workshops Employer EmployeeUpcoming 1st ElectionDeadlinesRemindersResourcesHomePrintBack 2 Next

FRS EMPLOYER NewsletterJuly 2021FRS Employer Contribution Rates, continuedFlorida LegislatureApproves Changeto FRS EmployerContribution RatesTable 2: Optional Program Contribution Rates (new rates effective July 1, 2021)Optional Programs1 New UniformContribution Rates New OptionalProgram ContributionRates Investment PlanContribution RatesLegislative RoundupMembers GrantSDBA Access at TheirOwn Risk!12Paid by FRS UnfundedActuarial LiabilityTotal Paid byEmployee wCurrentNewState University System Optional Retirement 34%Senior Management Service Optional Annuity tate Community College System Optional Retirement ates for local annuity programs are not listed since those rates are established by local authority, per Section 121.055(1)(b)2., Florida Statutes.Administrative cost is determined by each state college offering this program.Table 3: Investment Plan Contribution Rates (no changes were made to these rates)Annual Fee DisclosureStatement NoticeWorkshops Employer EmployeeUpcoming 1st ElectionDeadlinesPaid by Employee1Membership ClassPaid by EmployeePaid by Employer1Total to Employee AccountRegular Class3%3.30%6.30%Special Risk Class3%11.00%14.00%Special Risk Administrative Support Class3%4.95%7.95%Elected Officers’ Class (Judges)3%10.23%13.23%Elected Officers’ Class (Legislature/Cabinet/Public Defender/State Attorney)3%6.38%9.38%Elected Officers’ Class (County and Local)3%8.34%11.34%Senior Management Service Class3%4.67%7.67%Paid by employers via the uniform contribution rates specified in Table 1. Built into the uniform contribution rates is a contribution thatfunds guaranteed monthly benefits for Investment Plan members who are totally and permanently disabled from all employment.RemindersResourcesHomePrintBack 3 Next

FRS EMPLOYER NewsletterJuly 2021Legislative RoundupFlorida LegislatureApproves Changeto FRS EmployerContribution Rates New UniformContribution Rates New OptionalProgram ContributionRates Investment PlanContribution RatesLegislative RoundupMembers GrantSDBA Access at TheirOwn Risk!Annual Fee DisclosureStatement NoticeWorkshopsHouse Bill 35 (Chapter 2021-017, Laws of Florida) — This bill allows legalnotices to be posted on a newspaper’s website as an option to solely beingpublished in a newspaper. For retirement purposes, this will impact notices givenregarding positions to be included in the Senior Management Service Class(SMSC) and revocation of FRS participation by municipalities and independentspecial districts. This bill has been signed by the Governor and is effectiveJanuary 1, 2022.House Bill 873 — This bill adds certain military positions to the SMSC, includingthe Department of Military Affairs’ Inspector General and Executive Officer.It also renames the Director of Military Personnel to the Director of HumanResources and the Director of Administration to the Director of LegislativeAffairs. This bill is effective July 1, 2021.House Bill 781 — This bill allows members whose information is exempt frompublic records requests to request to have their names removed from the taxcollector or property appraiser public listing subject to certain conditions. The billalso includes new request requirements from members or employers on behalfof members to extend personnel information exemptions from public recordsrequests to records held by a non-employer custodian. For retirement purposes,as a non-employer custodian of employer personnel information, future requeststo extend the exemption of employer personnel information must be notarized,include the statutory basis for the exemption request, and confirm the member’seligibility for exempt status. This bill is effective July 1, 2021.To keep up with legislation, visit MyFRS.com and click “Legislation” in the“Alerts & Hot Topics” box. Employer EmployeeUpcoming 1st ElectionDeadlinesRemindersFRS ResourcesAre UnbiasedAll resources used by the MyFRS FinancialGuidance Program, including publications,website, workshops, and EY and Alight callcenters, are unbiased and do not favorone retirement plan over the other. Bothretirement plans are good and our role isto provide new hires and existing memberswith the information they need to choosethe correct plan for themselves. We strictlyfollow the education directive provided ins.121.4501(10)(b), Florida Statutes, whichstates: “The education component mustprovide system members with impartial andbalanced information about plan choices.”EY Is Our ExclusiveFinancial Planning PartnerThe FRS has a contract with EY to provideall FRS members free, unbiased financialplanning and counseling services. EYdoes not sell any investment or insuranceproducts. No other financial planners,financial institutions, or firms are affiliatedwith or endorsed by the Florida RetirementSystem, by Alight Financial Solutions, orby Alight Solutions, the Investment PlanAdministrator.ResourcesHomePrintBack 4 Next

FRS EMPLOYER NewsletterJuly 2021 New OptionalProgram ContributionRates Investment PlanContribution RatesLegislative RoundupMembers GrantSDBA Access at TheirOwn Risk!Annual Fee DisclosureStatement NoticeWorkshops Employer EmployeeUpcoming 1st ElectionDeadlinesIf a member does grant someone access to their SDBA, they are encouraged to: Monitor their Investment Plan account closelyWays to Submit aRetirement Plan ChoiceFASTEST New UniformContribution RatesInvestment Plan members should be very cautious about providing accessto their self-directed brokerage account (SDBA) to any investment advisor orother outside party. This access could include SDBA trading authorization, themember’s PIN, and/or their MyFRS.com user ID and password. Such agreementsare permissible, but they are made directly between the member and theinvestment advisor. Review any trades made on their behalf Ensure no unauthorized distributions are made Be aware of any fees charged by their outside investment advisorGo to ChooseMyFRSplan.com.Call the MyFRS FinancialGuidance Line at1-866-446-9377, Option 4.Good option if the employeehas questions.If a member has any questions, have them call the MyFRS Financial GuidanceLine toll-free at 1-866-446-9377, Option 2 (TRS 711).Use the online EZ RetirementPlan Enrollment Form.Annual Fee Disclosure Statement NoticeFax a form to:1-888-310-5559The Annual Fee Disclosure Statement for the Investment Plan providesinformation concerning the Investment Plan’s structure, administrative andindividual expenses, and investment funds, including performance, benchmarks,fees, and expenses. This statement is designed to set forth relevant informationin simple terms to help Investment Plan members make better investmentdecisions. The statement is available online (will be updated for 2021 in mid-July),or members can request a printed copy, mailed at no cost to them, by calling theMyFRS Financial Guidance Line toll-free at 1-866-446-9377, Option 4.SLOWESTFlorida LegislatureApproves Changeto FRS EmployerContribution RatesMembers Grant SDBA Access atTheir Own Risk!Mail a form to:Plan Choice AdministratorP.O. Box 785027Orlando, FL 32878-5027Forms are available onMyFRS.com.RemindersResourcesHomePrintBack 5 Next

FRS EMPLOYER NewsletterJuly 2021FRS Employer Training WorkshopsFlorida LegislatureApproves Changeto FRS EmployerContribution Rates New UniformContribution Rates New OptionalProgram ContributionRates Investment PlanContribution RatesLegislative RoundupMembers GrantSDBA Access at TheirOwn Risk!Annual Fee DisclosureStatement NoticeFRS employer training workshops are presented by representatives from theDMS, Division of Retirement, and the State Board of Administration. They arean excellent opportunity for you and your staff to receive an overview of theFRS plans and the various areas, functions, and processes that involve youragency and its employees.To register:By phone:1-866-377-2121, Option 1Be ready to provide your name, your contact information, the date andtime of the workshop you want to attend, and the number of people fromyour agency who will be attending.Online: Locate the Webinar Link or Meeting ID from the workshop calendar.Upcoming WorkshopsPension Plan8:30 to 11:30 a.m. ETAugust 3, 2021November 9, 2021Investment Plan1:00 to 4:00 p.m. ETAugust 3, 2021November 9, 2021 Click on the Webinar Link and you will be directed to the WebinarRegistration on Zoom. If registering with Meeting ID: Go to Zoom.com. Click “Join a Meeting.” Enter the Meeting ID and click “Join.”Workshops Enter your first name, last name, and email address. Employer Click “Register.” EmployeeUpcoming 1st ElectionDeadlines You will receive a confirmation email after registration and a reminderemail the day prior to the webinar date.You must register separately for each workshop you wish to attend.RemindersResourcesHomePrintBack 6 Next

FRS EMPLOYER NewsletterJuly 2021In-Person Employee Workshops Are BackFlorida LegislatureApproves Changeto FRS EmployerContribution Rates New UniformContribution Rates New OptionalProgram ContributionRatesThe temporary suspension of in-person workshops due to the COVID-19pandemic has been lifted. Because conditions have improved, we will startscheduling workshops at employer locations beginning July 1. Hosting in-personworkshops is solely up to each employer. Live webinars will still be offered as analternative.To schedule an in-person workshop or live webinar for your FRS employees,please reach out to Angela Ko by email at Angela.Ko@ey.com or by telephoneat 201-872-0176.To register:By phone:1-866-446-9377, Option 2Online: Locate the Webinar Link or Meeting IDfrom the workshop calendar. Click on the Webinar Link and youwill be directed to the WebinarRegistration on Zoom.July 12Taking Control of Your Finances (60 minutes)10:00 a.m. to NoonJuly 12Investment Planning1:00 to 3:00 p.m.Legislative RoundupJuly 13Education Planning10:00 a.m. to NoonMembers GrantSDBA Access at TheirOwn Risk!July 13Understanding the FRS Investment Plan1:00 to 3:00 p.m.October 6Social Security and Your Retirement10:00 a.m. to Noon Enter your first name, last name,and email address.Annual Fee DisclosureStatement NoticeOctober 6Protecting Yourself and Your Loved Ones1:00 to 3:00 p.m. Click “Register.”October 7Nearing Retirement in the FRS10:00 a.m. to NoonOctober 7Group Health Insurance (state employees only)1:00 to 3:00 p.m. Investment PlanContribution RatesWorkshops EmployerALL TIMES ARE ET Employee If registering with Meeting ID: Go to Zoom.com. Click “Join a Meeting.” Enter the Meeting ID andclick “Join.” You will receive a confirmation emailafter registration and a reminder emailthe day prior to the webinar date.You must register separately for eachworkshop you wish to attend.Upcoming 1st ElectionDeadlinesRemindersResourcesHomePrintBack 7 Next

FRS EMPLOYER NewsletterJuly 2021Upcoming 1st Election DeadlinesFlorida LegislatureApproves Changeto FRS EmployerContribution Rates New UniformContribution Rates New OptionalProgram ContributionRates Investment PlanContribution RatesLegislative RoundupMembers GrantSDBA Access at TheirOwn Risk!Annual Fee DisclosureStatement NoticeDeadline dates and times apply to all members, no matter how they submittheir retirement plan choice. To confirm a new hire’s deadline, call the FRSEmployer Assistance Line at 1-866-377-2121, Option 3, or refer to themember’s benefit comparison statement.Plan Defaults1Special Risk ClassSpecial Risk ClassAll classes (exceptSpecial Risk Class)What Happens If a Member Misses the Deadline?A member whose retirement plan choice is not received by their 1st Electiondeadline will be enrolled in the plan default based on their membership classas shown at right. Employer EmployeeUpcoming 1st ElectionDeadlinesRemindersResourcesPrint Pension Plan Investment PlanPension Plan1st Election DeadlinesWhat About Members with Prior Pension Plan Service?Monthof HireEnrollmentDeadline2October 2020June 30, 2021The plan defaults at right apply to any members who had not submitted aretirement plan choice prior to January 1, 2018 — even if they were previouslyenrolled in the FRS. Here’s an example:November 2020July 30, 2021December 2020August 31, 2021 April 1, 1999 — The member initially enrolls in the FRS. (At that time,the Pension Plan was the only retirement program available, so noretirement plan choice was made.)January 2021September 30, 2021February 2021October 29, 2021March 2021November 30, 2021April 2021December 30, 2021May 2021January 31, 2022 October 30, 2020 — No election is received for this member.June 2021February 28, 2022 November 1, 2020 — The member will be enrolled in the default planbased on their membership class. If enrolled in the Investment Plan,the member’s prior Pension Plan service will be transferred to theInvestment Plan as an opening account balance, which is subject to thePension Plan’s vesting provisions.July 2021March 31, 2022August 2021April 29, 2022September 2021May 31, 2022 May 2001 — The member terminates employment. February 1, 2020 — The member returns to work. (The enrollmentdeadline based on the member’s month of hire is October 30, 2020.)WorkshopsHomeMaking an active retirement plan choice by the election deadline is the bestway for members to ensure they participate in their preferred plan.1Applies to members initially enrolled in theFRS on or after January 1, 2018.2By 4:00 p.m. ET.Back 8 Next

FRS EMPLOYER NewsletterJuly 2021Florida LegislatureApproves Changeto FRS EmployerContribution Rates New UniformContribution Rates New OptionalProgram ContributionRates Investment PlanContribution RatesLegislative RoundupMembers GrantSDBA Access at TheirOwn Risk!Annual Fee DisclosureStatement NoticeEncourage your inactive and retired FRS members to keep their contactinformation current so they don’t miss any important information from youor the FRS.Investment Plan MembersActive EmployeesNames and addresses are automatically updated on the FRS database whenyou submit your agency’s monthly payroll report.How to Reach the DMS,Division of RetirementDepartment of ManagementServices, Division of RetirementP.O. Box 9000Tallahassee, FL 32315-9000850-410-2010Inactive or RetiredSee the online FAQ “How can I change my name or mailing address ifretired or terminated from the Investment Plan?”1-844-377-1888 (toll-free)or 850-907-6500(Tallahassee local calling area)Pension Plan MembersActive EmployeesNames and addresses are automatically updated on the FRS database whenyou submit your agency’s monthly payroll report.Inactive (Not Currently Employed)Address Change — The member must call the DMS, Division of Retirement; orscan, mail, or fax a signed and dated letter to the Division of Retirement.Workshops EmployerRetired and Receiving a Benefit EmployeeUpcoming 1st ElectionDeadlinesAddress Change — The member can log in to their FRS Online account; call theDMS, Division of Retirement; or send a signed letter or Form ADDCH-1 to theDivision of Retirement by mail or fax.Name Change — The member must mail or fax a signed letter to the DMS,Division of Retirement. The letter must be accompanied by a copy of the courtorder, marriage certificate, or driver license reflecting the member’s new name.RemindersResourcesHomeHelp Keep All Members’ Namesand Addresses CurrentPrintBack 9 Next

FRS EMPLOYER NewsletterJuly 2021ResourcesFlorida LegislatureApproves Changeto FRS EmployerContribution RatesFRS Employer Assistance Line1-866-377-2121 (toll-free) New UniformContribution RatesDivision of Retirement staff are available from 8:00 a.m. to 5:00 p.m. ET,Monday through Friday, except holidays. New OptionalProgram ContributionRates Investment PlanContribution RatesLegislative RoundupMembers GrantSDBA Access at TheirOwn Risk!EY and Alight Solutions representatives are available from 8:00 a.m. to 6:00 p.m. ET,Monday through Friday, except holidays. Alerts & Hot Topics — Keep up with the latest legislation and more Contribution Rates — See “Retirement and Health Insurance Subsidy (HIS)Contribution Rates” Employer Forms — Current forms available to print on demand Employer Handbooks — Technical guides for Retirement Coordinators, payroll staff,and others who have FRS responsibilities FAQs — Frequently asked questions and glossary Helpful Websites — Links to agencies, departments, and other resourcesWorkshops Order Materials — Online catalog of printed materials that you can order freeof charge Laws and Rules — Florida Statutes and Administrative Code governing the FRS Public Records — State Board of Administration and Division of Retirement PublicRecords Policy EmployeeUpcoming 1st ElectionDeadlinesRemindersFRS forms are routinely updatedthroughout the year. To use up-to-dateforms and save paper, go to the Formssection on MyFRS.com to download andprint the forms as you need them.MyFRS.com ResourcesAnnual Fee DisclosureStatement Notice EmployerAre You Using OutdatedFRS Forms? Publications — All available online publications Request for Intervention/Final Orders — Interventions may include unresolvedcustomer service complaints and allegations of misconduct or misrepresentation Videos — New hire, educational, and training videosHelp Keep YourCo-Workers InformedIf you know a co-worker who shouldreceive this newsletter, send an emailto walter.kelleher@sbafla.com with theco-worker’s name, title, agency name,and email address.ResourcesHomePrintFL3Q21 2021 MyFRS Financial Guidance Program. All rights reserved.Back 10 Next

the Department of Military Affairs' Inspector General and Executive Officer. It also renames the Director of Military Personnel to the Director of Human Resources and the Director of Administration to the Director of Legislative Affairs. This bill is effective July 1, 2021. House Bill 781 — This bill allows members whose information is .