Transcription

FOCUSFRS 116 LEASESFRS 116LEASESBeat the DeadlineBYLIM JU MAYAT14o the victor goes theglory. The startingpistol for FRS 116 willgo off on 1 January 2019for companies witha December 31 yearend. How companiesprepare today willdetermine the typeof future race course they encounterand how they finish in the FRS 1162019 race.In fact, many companies in theaffected industry sectors, such asretail and airline, would agree that theFRS 116 race began on 30 June 2016,upon issuance of the standard bythe Accounting Standards Council.This is because the implementationrequirement of FRS 116 is akin to amarathon and not a century sprint.FRS 116 will be like a tsunamito affected entities that are notprepared. But to the well-prepared,it is an opportunity to reap variousbenefits from the improved quality offinancial reporting. More importantly,companies which manage this wellwould demonstrate to investors andother stakeholders the quality of theirmanagement, Board of Directors andcorporate governance.IS Chartered Accountant

. the challenge goesbeyond the accountingdepartment and accountingimplementation – tothe boardroom wherecommercial and businessconsiderations are equallyif not more challenging.Companies have slightly overtwo years to prepare and for affectedcompanies, this is actually a very shorttimeframe. It is thus critical for affectedcompanies which have not alreadystarted preparations to begin now.BEYOND ACCOUNTINGPHOTO SHUTTERSTOCKFor the accounting compliancerequirements alone, preparing forFRS 116 is a massive exercise withhuge accounting implications andcomplexities. But the challenge goesbeyond the accounting departmentand accounting implementation – tothe boardroom where commercial andbusiness considerations are equallyif not more challenging. Commercialaspects which include areas suchas project/investment evaluation,lease negotiations, re-assessment ofcontract terms and funding will needconsiderable time and effort, andwould involve other departments suchas business, legal and treasury. Thetime and effort required to addressthe commercial aspects of FRS 116 maybe overlooked by companies that donot have an in-depth understanding ofthe implications of FRS 116. This mayexplain why the recent study by ISCAand Nanyang Business School, titled“Getting ready for FRS 116 (Leases)”,found that half the companies surveyedhave not started making preparations toadopt/implement FRS 116. Singapore’sEnglish business newsdaily The BusinessTimes reported on 26 August 2016September 201615

FOCUSFRS 116 LEASESthat “more than half (54%) of thecompanies surveyed considered thechallenge in adopting and implementingFRS 116 to be moderate to major. Yet,most have not made preparations interms of upgrading and modifyingtheir accounting information system,analysing the new standard’s taxconsiderations, or preparing animplementation roadmap”.Going forward, lessees willrecognise leases on the single on-balancesheet lease accounting model, andaccount for operating leases in a mannersimilar to finance leases. The newaccounting standard, FRS 116 Leasesdoes not change substantially theaccounting for finance lease under theold accounting standard FRS 17 Leases.The main difference relates to thetreatment of residual value guaranteeprovided by a lessee to a lessor, forwhich FRS 116 requires that the lesseerecognises only amounts expected to bepayable under residual value guarantees,rather than the maximum amountguaranteed, as required by FRS 17.In an exclusive interview, LeeFook Chiew, Chief Executive Officer ofISCA, speaks about preparing for theimpending changes.1. How will the new accountingstandard regarding thetreatment of leases affect theway businesses operate?Under FRS 17, companies that leaseassets which qualify as operating leasesdo not recognise any lease liabilities(together with the correspondingright-of-use asset) on the balance sheet.Lessors could always structure leaseagreements so as to meet the operatinglease classification requirements,providing companies with the benefitof not having to recognise these leaseobligations on the balance sheet, whichin most cases also have the effect ofreducing gearing.Businesses that currently leasesizeable assets under “off-balance sheetoperating leases” may decide to reassesstheir business decisions on “buy or lease”.With off-balance sheet operating. lessors also need toraise their game asthey would now operatein a more competitiveenvironment in whichthere is little or nodistinction betweenan operating lease, afinance lease or an assetbacked loan, which arealso provided by otherfinancial institutions.Lee Fook Chiew,Chief Executive Officer, ISCA16IS Chartered Accountant

PHOTO SHUTTERSTOCKleases required to be recognised onthe balance sheet together with therequirement to determine the interestcharged in these leases, the efficiencyof such leases comes into question andcompanies may rethink how best tofinance or operate their business. Forsome, taking loans to buy assets maynow be a more efficient way of financingtheir business while for others, leasingcould still be the preferred option.Alternatively, they may decide to enterinto service contracts instead of leasecontracts, or negotiate for shorter leasetenures to minimise the recognition oflease liabilities.On the other hand, lessors alsoneed to raise their game as they wouldnow operate in a more competitiveenvironment in which there is little orno distinction between an operatinglease, a finance lease or an assetbacked loan, which are also providedby other financial institutions. This isbecause from the lessees’ perspective,under the new FRS 116 Leases,operating leases will no longer beoff-balance sheet, resulting in moredebt on the balance sheet (just liketraditional debt instruments), frontloading of total lease expenses, andincreased volatility. Total leaseexpenses are front loaded becausehigher interest expenses are chargedin earlier years together withtypically straight-line depreciation ofright-of-use asset. Previously, lessorscan differentiate themselves fromother financiers like banks in helpingto keep financing off the balancesheet through operating leases (evenin marginal circumstances) as longas the financing structure meets thecriteria stipulated under FRS 17 inform. With the new standard, thisadvantage for lessors is nullified.With the new financial reportingstandard, key financial metrics such asgearing, liquidity and return on capitalwill be affected, which will in turnimpact assessments of a company’soperating performance and creditworthiness, as well as possibly costof borrowings. More importantly,September 201617

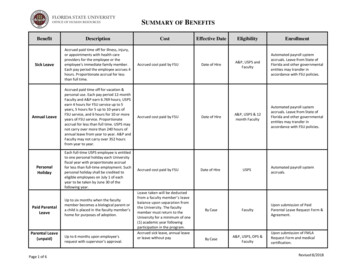

FOCUSFRS 116 LEASESFive questions for a CFO to askwhen preparing the FRS 116implementation roadmapQ1 Does my accounting teamhave adequate knowledge andunderstanding of the accountingrequirements of FRS 116, do I knowthe impact on key financial metrics/ratios (example, gearing, EBITA,liquidity, return on capital), and am Iable to prepare post-FRS 116 mockup financial statements?Q2 Will my debt covenants be affectedand do I need to engage the banks?Q3 Do I need to change my businessmodel and re-negotiate myleases contracts?Q4 Do I need to align my processesand internal controls to capturethe required data?Q5 Is my IT and accounting systemrobust enough to handle theFRS 116 requirements?with more debt on the balance sheet,businesses may now find themselvesbreaching their financial debt covenantsand risk loan defaults (which wereagreed with lenders based on previousfinancing reporting standards).For businesses that obtainimportant economic benefits fromlease transactions such as financingand reduced exposure to risks of assetownership, switching from leasing tobuying would not be a viable option.Such businesses may consider switchingto service contracts if they can foregotheir rights over the control of the use ofthe leased assets.2. Which industries will bemost affected and how canthey prepare for the changes?The airline, retail, travel, transportation,telecommunications, and energy sectorswill be more affected than others, asbusinesses in these industries tend tolease big-ticket items.18IS Chartered Accountant

With the new financialreporting standard, keyfinancial metrics such asgearing, liquidity and returnon capital will be affected,which will in turn impactassessments of a company’soperating performance andcredit worthiness, as well aspossibly cost of borrowings.PHOTO SHUTTERSTOCKTo prepare for the change, companieswill first need to identify arrangementsthat are lease contracts or contain a leasein accordance with a “right-to-controlthe use of an asset” framework. This isthe most challenging aspect of FRS 116and requires the exercise of substantialjudgement because the line between alease contract and a service contract canbe blurred at times.Companies should first perform aninitial scoping of all arrangements thatmay contain a lease. The next step wouldbe for the terms of the arrangementsto be scrutinised and examined forthe existence of stipulated rights todetermine if the arrangement is a lease.The Leases Roadmap by ISCA providesguidance for companies to performa step-by-step assessment of eachstipulated right in determining whetheran arrangement contains a lease.Designing systems, processesand controls to capture, store andvalidate lease data is another importantpreparation step. IT and accountingsystems need to be equipped to performlease calculations and to generate theinformation to satisfy the requirementsof the new leases standard. Taking thenecessary steps to identify existingsystem gaps would aid companies indeciding whether to upgrade theirexisting systems or to invest in newsoftware solutions or IT systems.September 201619

FOCUSFRS 116 LEASESCompanies should also ensuretimely communications withstakeholders on the impact of thenew leasing standard, kick-startre-negotiations on financial debtcovenants on existing and futurefinancing arrangements, and considertax consequences.3. What do companies andauditors need to do to ensuresmooth implementation of thisnew set of accounting rules?To ensure the smooth implementation,both companies and auditors needto commence preparations andstakeholder communications early.By now, companies should have animplementation roadmap in place, andcommenced impact assessments, whiletaking into consideration materiality andthe practical expedients for short-termleases and leases of low-value assets.Auditors need to engage theirclients early to kick-start discussionsand agree on the audit plan to addressthe new accounting rule for leases. Foraudit engagements with significantoff-balance sheet operating leases, itis advisable that auditors first discussand agree with their clients on thefeasibility of their implementationroadmap. Subsequent audit procedurescan then be performed interlaced withthe client’s implementation roadmap, ona piecemeal basis.4. Now that “operating leases”are on the balance sheet forlessees, how far does this gotowards meeting investors’needs, and strengtheningmarket confidence?With the new standard, financialstatements would provide a morefaithful representation of a company’sfinancial position and greatertransparency about the company’sfinancial leverage and capital employed.Investors would see such leasesreported on the lessees’ balance sheetsand have a more complete picture of theassets controlled and used in operations,20IS Chartered AccountantThe new standardwould pave theway for a morelevel playing fieldfor all investorsand companies,resulting in thestrengthening ofmarket confidence.as well as unavoidable lease payments.This helps investors better assess andcompare the financial leverage andoperating flexibility of companies.Under the existing accountingstandard for leases, information about acompany’s undiscounted commitmentsfor off-balance sheet leases are providedin the notes to the financial statements.While more sophisticated investorscould use this information to estimate

Five “non-accounting” areascompanies must consider whenimplementing FRS 1161.Time, involvement and resourcesrequired of other departments such astreasury, IT, internal audit, legal andbusiness departments2. Resources consideration, for example, isthere a need for a task force committee?3. Key performance indicator re-assessments4. Tax and dividend policy considerations5. Engage internal (example, board ofdirectors, audit committees) andexternal stakeholders (example,analysts, investors)on variable lease payments have beensubstantially simplified to addressconcerns about costs and complexity.Variable lease payments linked to futureperformance or use of an underlyingasset are excluded from the measurementof lease liabilities.CLOSING REMARKSPHOTO SHUTTERSTOCKassets and liabilities arising from suchleases, many investors, especially retailinvestors, are not in a position to makesuch adjustments and do not havevisibility on information such as theactual financial leverage of companies.The new standard would pave theway for a more level playing field forall investors and companies, resultingin the strengthening of marketconfidence. Hence, limiting operatingleases as a mechanism for off-balancesheet financing is a significant steptowards increased transparency andcomparability in financial reportingbetween companies that lease and thosethat borrow to buy.While the new standard is a step inthe right direction, investors should bemindful that not all lease obligations arecaptured in the financial statements.This is because particular requirementsThis is the third article in ISCA’s seriesof articles on leases, with a call forcompanies to start thinking about theimplications of FRS 116 on their businessand to commence preparations early.Early preparation is vital. Thismessage also came through loudand clear during ISCA’s SingaporeAccountancy Convention in August,where a panel of distinguished membersincluding an accounting standard-setter,CFOs, analysts and practitioners, haddiscussed the implications of FRS 116on businesses and decision-making,implementation challenges faced bypreparers, benefits to analysts andinvestors, and the necessary steps totake in order to embrace the new leasingaccounting requirements. ISCALim Ju May is Deputy Director, FinancialReporting Standards & Corporate Reporting, ISCA.September 201621

when preparing the FRS 116 implementation roadmap Q1 Does my accounting team have adequate knowledge and understanding of the accounting requirements of FRS 116, do I know the impact on key financial metrics/ ratios (example, gearing, EBITA, liquidity, return on capital), and am I able to prepare post-FRS 116 mock-up financial statements?