Transcription

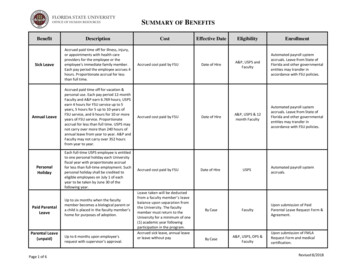

SUMMARY OF BENEFITSBenefitDescriptionSick LeaveAccrued paid time off for illness, injury,or appointments with health careproviders for the employee or theemployee's immediate family member.Each pay period the employee accrues 4hours. Proportionate accrual for lessthan full time.Annual LeaveAccrued paid time off for vacation &personal use. Each pay period 12-monthFaculty and A&P earn 6.769 hours; USPSearn 4 hours for FSU service up to 5years, 5 hours for 5 up to 10 years ofFSU service, and 6 hours for 10 or moreyears of FSU service. Proportionateaccrual for less than full time. USPS maynot carry over more than 240 hours ofannual leave from year to year. A&P andFaculty may not carry over 352 hoursfrom year to year.Accrued cost paid by FSUPersonalHolidayEach full-time USPS employee is entitledto one personal holiday each Universityfiscal year with proportionate accrualfor less than full-time employment. Suchpersonal holiday shall be credited toeligible employees on July 1 of eachyear to be taken by June 30 of thefollowing year.Accrued cost paid by FSUPaid ParentalLeaveParental Leave(unpaid)Page 1 of 6Up to six months when the facultymember becomes a biological parent ora child is placed in the faculty member’shome for purposes of adoption.Up to 6 months upon employee’srequest with supervisor's approval.CostAccrued cost paid by FSULeave taken will be deductedfrom a faculty member’s leavebalance upon separation fromthe University. The facultymember must return to theUniversity for a minimum of one(1) academic year followingparticipation in the program.Accrued sick leave, annual leaveor leave without payEffective DateEligibilityEnrollmentA&P, USPS andFacultyAutomated payroll systemaccruals. Leave from State ofFlorida and other governmentalentities may transfer inaccordance with FSU policies.Date of HireA&P, USPS & 12month FacultyAutomated payroll systemaccruals. Leave from State ofFlorida and other governmentalentities may transfer inaccordance with FSU policies.Date of HireUSPSAutomated payroll systemaccruals.By CaseFacultyUpon submission of PaidParental Leave Request Form &Agreement.By CaseA&P, USPS, OPS &FacultyDate of HireUpon submission of FMLARequest Form and medicalcertification.Revised 8/2018

SUMMARY OF BENEFITSBenefitDescriptionFamily &MedicalLeaveEntitlement up to 12 weeks of unpaidleave in a rolling calendar year forserious health condition or qualifyingexigency of self, child, spouse, or parentof the employee, as applicable. Accruedleave may be used in lieu of leavewithout pay.UniversityHolidaysAdministrativeLeaveSocial SecurityWorkers’CompensationMilitary LeavePage 2 of 6 New Year's Day Martin Luther King, Jr. Day Memorial Day Independence Day Labor Day Veterans' Day Thanksgiving Day Friday after Thanksgiving Christmas DayPaid leave under specific conditionssuch as jury duty, emergency closings ofthe University, etc. May take up to twodays of bereavement for death of animmediate family member.Administrative leave must be approvedin advance.Legally required disability, survivors, &retirement insurance, sponsored by theFederal GovernmentMedical or disability benefits foremployees injured or who develop anoccupational disease as a direct result ofperforming assigned job duties.Entitled to first 30 days paid for activeduty military tours, plus 240 hours forshort-term training provided to thoseserving as a reservist or in the NationalGuard.CostAccrued sick leave, annual leaveor leave without payEffective DateEligibilityEnrollmentBy CaseA&P, USPS, Faculty,& OPS. Employeeswho have beenemployed for acumulative or totalof 12 months, andwho have worked1,250 hours in thelast 12 monthsUpon submission of FMLARequest Form and medicalcertification.Exempt employee holiday pay isautomated. Non-exemptemployees must report theirholiday on their timesheet.Paid by FSUDate of HireA&P, USPS & FacultyPaid by FSUDate of HireA&P, USPS, andFacultyRecorded upon submission of anemployee’s timesheet.Funded by payroll tax (FICA)shared equally by employer andemployeeDate of HireAll employees,unless specificallyexempted by lawProcessed by Human Resources.Contingent upon duration,impact of injury, etc.Date of HireAll employees andvolunteersProcessed by FSU EnvironmentalHealth & Safety.Paid by FSUDate of HireA&P, USPS, andFacultyUpon submission of MilitaryOrders/Memorandum toHuman Resources.Revised 8/2018

SUMMARY OF BENEFITSBenefitDescriptionFloridaRetirementSystem (FRS)Pension PlanDefined benefit plan with vesting timeof 8 years. Retirement income dependson years of service, age andcompensation (average of eight highestfiscal years).Employee makes mandatorycontribution of 3% bi-weekly.FSU contributes the majority ofyour contribution.(Contributions do not directlyaffect monthly benefit amount)Date of HireA&P, USPS, andFacultyFloridaRetirementSystem (FRS)InvestmentPlanDefined contribution plan with vestingtime of 1 year. Employee decides how toinvest money.Employee makes mandatorycontribution of 3% bi-weekly.FSU contributes the majority ofthe contribution. The totalcontribution foremployee/employer is 6.30%.Date of HireA&P, USPS, andFacultyOptionalRetirementProgram (ORP)Defined contribution plan with novesting. Employee chooses an approvedprovider company and decides how toinvest the money contributed byFSU. Employees may also makeadditional voluntary contributions up tothe IRS limits. Deductions are takenfrom employee’s paycheck on a taxdeferred basis.Employee makes a mandatory3% bi-weekly contribution. FSUprovides the majority of thecontribution. The totalcontribution foremployee/employer is 8.14%.Employee has the option tomake an additional contributionup to 5.14% of gross salary.Date of HireA&P and FacultyTax sheltering/savings plan intended tosupplement retirement income.Employee contributions onlyDate of HireA&P, USPS, Faculty,and OPSEnroll through annuitycompanies. May enroll at anytime.Tax sheltering/savings plan intended tosupplement retirement income.Employee contributions onlyDate of HireA&P, USPS, Faculty,& OPSEnroll through annuitycompanies. May enroll at anytime.Roth 403 (b)Post-tax savings plan intended tosupplement retirement income.Employee contributions onlyDate of HireA&P, USPS, Facultyand OPSEnroll through annuitycompanies. May enroll at anytime.FICAAlternativePlan (Bencor)Tax sheltering/savings plan intended tosupplement retirement income.7.5% of bi-weekly gross pay.(Employee contributions only)Upon eligibilityMandatory for OPSemployees notexempted by lawfrom participationProcessed automatically uponeligibility for evenue Code457)Tax DeferredAnnuity Plans[403(b)]Page 3 of 6CostEffective DateEligibilityEnrollmentA&P, Faculty and USPS mustchoose between the FRS PensionPlan and FRS Investment Plan bythe end of the 8th monthfollowing the month of hire.Otherwise, enrollment in the FRSInvestment Plan is automatic.A&P, Faculty and USPS mustchoose between the FRS PensionPlan and FRS Investment Plan bythe end of the 8th monthfollowing the month of hire.Otherwise, enrollment in the FRSInvestment Plan is automatic.A&P and Faculty must choosebetween ORP & FRS in the first90 days of employment.Otherwise, enrollment in FRSInvestment Plan is automatic.There is the option through theend of the 8th month to choosethe 'Pension' Plan.Revised 8/2018

SUMMARY OF BENEFITSBenefitDescriptionHealthInsurance(State Plan)Preferred Provider Organization (PPO)allows patient to visit physician ofchoice worldwide. Health MaintenanceOrganization (HMO) provides service topatients that live or work within theservice area (choices are based uponcounty). There is also a High DeductibleHealth Plan (HDHP) option for bothHMO and PPO.Basic LifeInsurance(State Plan)EligibilityEnrollmentA&P, USPS andMonthly CostFaculty is effectiveIndividual Coverage: Employeethe first day of thepays 50.00, FSU pays 642.84.month followingFamily Coverage: Employee payshire. Eligible OPS is 180.00, FSU pays 1,379.60.effective the firstRates might be prorated for partday of the thirdtime employees. (Pre-Tax)month after hire.A&P, USPS, Facultyand eligible OPSemployees and theireligible dependentsEmployee has 60 days from thedate of hire to enroll. Planchanges are only allowed duringannual open enrollment or uponan IRS qualifying event.Basic Term Life Insurance that providescoverage of 25,000 for all employees.Basic Life includes Accidental Death &Dismemberment and a living benefitplan.OPS employees pay fullpremium. No cost to participatefor full-time A&P, USPS andFaculty employees. Premiums forpart-time employees are prorated, based on FTE. (Pre-Tax)The first of themonth following afull payrolldeduction.A&P, USPS, Facultyand eligible OPSemployeesEmployee has 60 days from thedate of hire to enroll. Openenrollments held annually.Optional,Spouse andChild LifeInsurance(State Plan)Additional Optional Life, Spouse Life andChild Life Insurances are also available.Optional, Spouse and Child:Full cost paid by employee.(Post-Tax)The first of themonth following afull payrolldeduction.Optional: A&P, USPSand Faculty.Spouse/Child: A&P,USPS, Faculty andeligible OPSEmployee has 60 days from thedate of hire to enroll. Openenrollments held annually.Short TermDisabilityInsurance(State Plan)Insurance may pay from the first day ofdisability up to 1 year. Coverage is 580- 3,480/month based on level ofcoverage selected.Premiums are paid in full byemployee and vary by plans andoptions.(Pre-tax)First of the monthfollowing the dateof enrollment anda full payrolldeduction.A&P, USPS,Faculty, and eligibleOPS employees ages18 - 70 and live inthe United States.Employee has 60 days from thedate of hire to enroll. Openenrollments held annually.Vision Benefits(State Plan)Supplement that provides eye carebenefits from a network of Optometristsand Ophthalmologists. Insuranceincludes coverage for exams plusmaterials.Premiums are paid in full byemployee and vary by coverageoptions.(Pre-tax)A&P, USPS,Faculty, and eligibleOPS employeesMust occur in the first 60 days ofemployment. Plan changes areonly allowed during annual openenrollment or upon IRSqualifying event.DentalInsurance(State Plan)Five dental companies are available,including indemnity, DPPO, and prepaidoptions.Premiums are paid in full byemployee and vary by plans andoptions.(Pre-tax)A&P, USPS,Faculty, and eligibleOPS employeesEmployee has 60 days from thedate of hire to enroll. Planchanges are only allowed duringannual open enrollment or uponIRS qualifying event.Page 4 of 6CostEffective DateFirst of the monthfollowing the dateof enrollment anda full payrolldeduction.First of the monthfollowing the dateof enrollment anda full payrolldeduction.Revised 8/2018

SUMMARY OF BENEFITSBenefitDescriptionCostEffective DateEligibilityEnrollmentFirst of the monthfollowing the dateof enrollment anda full payrolldeduction.First of the monthfollowing the dateof enrollment anda full payrolldeduction.First of the monthfollowing the dateof enrollment anda full payrolldeduction.A&P, USPS, Faculty,and eligible OPSemployees and theirdependentsPremiums are paid in full byemployee and vary byemployee's election amount.(Pre-tax)First payroll datefollowing the datepaperwork hasbeen received.A&P, USPS, andFaculty. Eligible OPSemployees canenroll into theDependent FSA.A program administered and financiallyguaranteed by the State which allowsfamilies to save for future college costsbased on today's tuition rates.Premiums are paid in full byemployee and vary by plans andoptions.The first day ofApril following theenrollmentperiod.A&P, USPS, andFacultyAnnual enrollment period isOctober through January.Florida CollegeInvestmentPlan (StatePlan)An easy, affordable way to save forcollege with a wide range of investmentoptions and tax benefits. The moneygrows tax deferred, and the earnings onqualified withdrawals are tax-free.Employee contributions only.Date of HireA&P, USPS, andFacultyEnroll through Florida PrepaidCollege Board.Short/LongTerm DisabilityInsurance(FSU Plan)Monthly benefit equal to 60% of basicmonthly earnings, less other income,and begins on the 31st or 91st day ofdisability.Premiums are paid in full byemployee. (Post-tax)First of the monthfollowing the dateof enrollment anda full payrolldeduction.A&P, USPS, andFaculty employeesworking at least 50%FTE.Employee has 60 days from thedate of hire to enroll. Openenrollments held periodically.Two hospital insurance companies thatprovide additional insurance to coverhospital expenses not covered by thebasic health plans.Premiums are paid in full byemployee and vary by plans andoptions. (Pre-tax)CancerInsurance(State Plan)Covers expenses for cancer treatment.Premiums are paid in full byemployee and vary by plans andoptions. (Pre-tax)AccidentInsurance(State Plan)Provides coverage for accidents thatoccur on and off the job.Premiums are paid in full byemployee and vary by plans andoptions. (Pre-tax)FlexibleSpendingAccounts(State Plan)Medical and Dependent FlexibleSpending Account (FSA) options provideemployees with the opportunity to payfor out-of-pocket expenses, includingbut not limited to co-payments,uncovered dental, hearing aids, contactlens solution, etc., using pre-tax funds.Health Savings Account (HSA) isavailable to HDHP health planparticipants.FloridaPrepaidCollege Plan(State Plan)HospitalInsurance(State Plan)Page 5 of 6A&P, USPS, Faculty,and eligible OPSemployeesA&P, USPS, Faculty,and eligible OPSemployees and theirdependentsEmployee has 60 days from thedate of hire to enroll. Planchanges are only allowed duringannual open enrollment or uponIRS qualifying event.Employee has 60 days from thedate of hire to enroll. Planchanges are allowed duringannual open enrollment or uponIRS qualifying event.Employee has 60 days from thedate of hire to enroll. Planchanges are allowed duringannual open enrollment or uponIRS qualifying event.Employee has 60 days from thedate of hire to enroll. Planchanges are only allowed duringannual open enrollment or uponIRS qualifying event.Revised 8/2018

SUMMARY OF BENEFITSBenefitDescriptionCostEffective DateEligibilityLong TermCare(FSU Plan)Provides coverage for care received athome, or in a facility for a person unableto perform activities of daily living.Premiums are paid in full byemployee and vary by plans andoptions.(Post-tax)First of the monthfollowing the dateof enrollment anda full payrolldeduction.A&P, USPS andFaculty employeesworking at least 75%FTE.Employee has 60 days from thedate of hire to enroll. Openenrollment held periodically.Life insurance plans including groupterm, whole life, or universal. Availableto employee, spouse and dependentchildren.Premiums are paid in full byemployee and vary by plans andoptions.(Post-tax)The first of themonth following afull payrolldeduction.A&P, USPS andFaculty employees.Employee has 60 days from thedate of hire to enroll. Openenrollment held periodically.Eligible moving expenses, according toFSU policy.Paid by FSU (under certaincircumstances)By CaseAt University'sdiscretionFull-service gym located on FSU'scampusFees paid in full by the employeeEmployees are provided the opportunityto take up to six hours of course workper semester at FSU.Tuition paid in full by FSUSupplementalLifeInsurance(FSU Plan)MovingExpensesLeach ct DepositProgramPage 6 of 6Electronic Funds Transfer (EFT) ofpaycheck funds directly to your bankaccount.N/AAssigned by LeachFitness CenterEligible toparticipate uponDate of HireImmediately whenupdated in theOMNI PayrollSystem.Faculty, A&P andUSPSA&P, USPS andFaculty employeesworking 100% FTE.Employee must beadmitted to FSUprior to takingcourses with thescholarship.Faculty, A&P, USPSand OPSEnrollmentUpon obtaining proper approval.Contact Leach Center@ (850) 644-0544.Contact Registrar's Office@ (850) 644-1050.Enrollment is done at time ofhire with appropriatedocumentation and can also beupdated in Employee SelfService.Revised 8/2018

choose between the FRS Pension Plan and FRS Investment Plan by the end of the 8th month following the month of hire. Otherwise, enrollment in the FRS Investment Plan is automatic. Florida Retirement System (FRS) Investment Plan Defined contribution plan with vesting t im e of1 year. E pl edec s how to invest money. E mpl oyee akes and t ry