Transcription

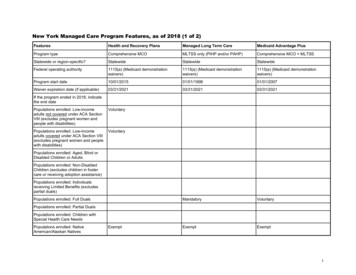

July 2012 You Have an Important Choice to Make!As a new employee, you must choose one of three retirement plans available to eligible State UniversitySystem employees. They are the: State University System Optional Retirement Program (SUSORP) FRS Investment Plan FRS Pension PlanAll three plans are funded by you and your employer and offer important benefits. You need to choose theone that’s best for you.Some Key Differences Between the PlansSUSORPFRS Investment PlanFRS Pension PlanWho Is Eligible?Faculty, Administrative andProfessional (A&P), and UniversityPresident and Executive Serviceemployees.Faculty, Administrative andProfessional (A&P), UniversityPresident and Executive Service,and support employees (USPS).Faculty, Administrative andProfessional (A&P), UniversityPresident and Executive Service,and support employees (USPS).Plan TypeA retirement plan designed for amore mobile workforce.A retirement plan designed for amore mobile workforce.A traditional retirement plandesigned for longer-serviceemployees.VestingYou qualify for a benefit immediatelyupon signing a contract.You qualify for a benefit after1 year of service.2You qualify for a benefit after8 years1,2 of service.ContributionsYour employer provides themajority of your SUSORPretirement plan contribution basedon a fixed percentage of your grosssalary (total employee and employerrate is 8.14%). A mandatory 3%pretax contribution is deductedfrom your paycheck and depositedinto your retirement account. Youhave the option to make additionalpretax contributions of up to 5.14%of your gross salary.Your employer provides themajority of your FRS retirementplan contribution based on a fixedpercentage of your gross salary(for example, total employee andemployer rate is 6.3% for RegularClass employees; rates vary bymembership class). A mandatory3% pretax contribution isdeducted from your paycheck anddeposited into your retirementaccount.Your employer provides themajority of your FRS retirementplan contribution based on afixed percentage of your grosssalary as determined by thestate legislature. A mandatory3% pretax contribution isdeducted from your paycheckand deposited into theretirement trust fund.Your BenefitIn both plans, your benefit depends on the amount of moneycontributed to your account and its growth over time. You decidehow to allocate the money in your account among the availableinvestment funds.The following pages provide more detailed plan comparisons, including the advantages and disadvantages ofeach plan. The “New Employee FRS Enrollment Kit,” which will be mailed to you approximately 60 days afteryour date of hire, provides further details about the Investment Plan and the Pension Plan, along with a BenefitComparison Statement and your Personal Identification Number (PIN). In the meantime, you can learn moreabout the two FRS Plans by calling the MyFRS Financial Guidance Line for free personalized assistance or byvisiting MyFRS.com. You can learn more about the SUSORP by contacting your University’s Human Resourcesoffice or SUSORP contract providers for SUSORP contract and investment product information.12Pays a guaranteed lifetime monthlybenefit using a formula based onyour service and salary while youare working for an FRS-coveredemployer.If you are a rehired employee who has any Pension Plan service prior toJuly 1, 2011, you will vest in your benefit after 6 years of FRS-covered service.You are always fully vested in your own contributions, as long as youremain enrolled in the FRS Plan you chose as a new employee. How youremployee contributions are distributed or refunded to you depends on anumber of factors, especially if you use your 2nd Election to switch plansin the future.

Consider Your Length of ServiceIf you stay with an FRS-covered employer for: The best retirement plan for you:Less than 1 yearIs likely to be the SUSORP (you wouldnot be eligible for employer-fundedbenefits under the FRS Plans).Is likely to be the Investment Planor the SUSORP (you would not beeligible for employer-funded benefitsunder the Pension Plan).Depends on a number of factors.Call the toll-free MyFRS FinancialGuidance Line to learn more.1 to 8 years1HotTipAccording to FRS data, the average employeeworks for the FRS for 5 to 10 years. Try not tooverestimate or underestimate the number ofyears you’ll work for an FRS-covered employer.9 or more years111 to 6 years, or 7 or more years if you have Pension Plan service before July 1, 2011.You Have a Short Time in Which to Decide:SUSORP, Investment Plan, or Pension Plan?“New EmployeeFRS EnrollmentKit” ismailed to you.2You are automatically enrolled in theSUSORP on your hire date, but canchoose any of the three plans beforeyour specified deadline dates.Monthof Hire12Kit includes yourPIN. Watch thevideo CD inyour deadlineforSUSORPFRS remindersmailed to youif SUSORP isnot chosenFinalenrollmentdeadline forthe FRSPlans3Deadline4EnrollmentDeadline5Make your choiceSUSORP,early and avoidInvestmentreminder mailings!Plan, orPension Plan?InvestmentPlan orPensionPlan? Even though you are automatically enrolled in the SUSORP, you must execute If you do not elect a plan within 3 monthsa contract with a SUSORP provider4 during your first 90 days of employmentor you will default into the Pension Plan.5To avoid delays, make sure your employer has your correct mailing address.4:00 p.m. ET on the last business day of the 5th month after your month of hire.4SUSORP contract and investment product information (available from your University’s Human Resources office or SUSORPcontract providers).5Your decision to choose the SUSORP is a one-time irrevocable decision. If you elect the SUSORP, you will remain in this planfor as long as you remain at this employer in a SUSORP-eligible position. If you enroll in the Investment Plan or the PensionPlan, you will have a one-time second opportunity (known as your 2nd Election) during your FRS career to switch to the otherFRS retirement plan. (The SUSORP is not available as a 2nd Election.)Note: An employee in a faculty position at a college with a faculty practice plan is a mandatory SUSORP participantand cannot elect to participate in the FRS Plans.23See page 3 for enrollment tips.PAGE 2(90 days) and you default into the PensionPlan, you can either remain in the PensionPlan or elect the Investment Plan by the endof the 5th month after your month of hire.

Free Personalized Help Is Available to YouSUSORPFRS PlansContact your University’s HumanResources office or SUSORPcontract providers for SUSORPcontract and investment productinformation.Visit MyFRS.com and reviewthe “New Hire Roadmap.”Call the MyFRS FinancialGuidance Line toll-free at1-866-446-9377 (or TRS 711). Select Option 1 to speakwith an unbiased Ernst &Young financial plannerwho can answer questionsabout the Investment Planand Pension Plan.Enrollment Tips To enroll in the SUSORP, you must use theenrollment form (Form ORP-16) and executea contract with a SUSORP provider1 withinthe first 90 days of your election window.You cannot enroll in the SUSORP using theMyFRS Financial Guidance Line or MyFRS.com. If you do not enroll in the SUSORP, you canenroll in an FRS retirement planby your enrollment deadline using theenrollment form (Form ORP-16), the MyFRSFinancial Guidance Line, or MyFRS.com. If you do not make an election by the lastbusiness day of the 5th month following yourmonth of hire, you will automatically defaultinto the FRS Pension Plan.Plan OverviewSUSORPFRS Investment PlanFRS Pension PlanYour employer provides themajority of your FRS retirementplan contribution based on a fixedpercentage of your gross salary(total employee and employerrate is 6.3% for Regular Classemployees). A mandatory 3%pretax contribution is deductedfrom your paycheck and depositedinto your retirement account.Your employer provides themajority of your FRS retirement plan contribution basedon a fixed percentage of yourgross salary as determined bythe state legislature. A mandatory 3% pretax contribution isdeducted from your paycheckand deposited into the retirement trust fund.Into an account(s) that is establishedWhere are themonthly contribu- in your name by the contractprovider(s) you choose.tions deposited?Into an account that is establishedin your name by the FRS.Into a single pension trustfund for all FRS Pension Planmembers.Who invests themoney?You can elect how to allocate yourand your employer’s contributionsamong the funds available to Investment Plan participants. You are responsible for managing your accountand you can change your investmentelections at any time. Investmentresults will affect your benefit.The State Board ofAdministration of Floridainvests the assets of thePension Plan trust fund forall FRS-covered employees.Investment results do notaffect your benefit.After 1 year of FRS-covered service. You are always fully vested inyour own contributions, as long asyou remain in the Investment Plan.3After 8 years2 of FRS-coveredservice. You are always fully vestedin your own contributions, as longas you remain in the Pension Plan.3Who contributesand how much?Your employer provides the majorityof your SUSORP retirement plan contribution based on a fixed percentageof your gross salary (total employeeand employer rate is 8.14%). Amandatory 3% pretax contributionis deducted from your paycheckand deposited into your retirementaccount. You have the option tomake additional pretax contributionsof up to 5.14% of your gross salary.The Division of Retirementdesignates the contract providers.1You decide how to allocatecontributions among the investmentfunds offered by the contractprovider(s) you choose. Investmentresults will affect your benefit.When am I vested Immediately.in my benefit?12SUSORP contract and investment product information (available from your University’sHuman Resources office or SUSORP contract providers).If you are a rehired employee who has any Pension Plan service prior to July 1, 2011, youwill vest in your benefit after 6 years of FRS-covered service.3How your employee contributions are distributed or refunded to youdepends on a number of factors, especially if you use your 2nd Electionto switch plans in the future. For information, please call the MyFRSFinancial Guidance Line at 1-866-446-9377, Option 2.Continues on page 4PAGE 3

Plan OverviewSUSORPWhat if I changejobs aftervesting?If you go to work for anotherState University System (SUS)institution in a SUSORP-eligibleposition, you’ll remain enrolled inthe SUSORP unless, during yourfirst 90 days of employment, youelect to participate in the FRSInvestment Plan or Pension Plan.You must complete a new enrollment form.If you leave SUS employment,you have the option of: Leaving your money in theSUSORP. Taking a distribution/rollover(in which case you will beconsidered retired).1Your distribution options are basedon those offered by your contractprovider(s). (See “How is mybenefit paid to me at retirement?”)Talk to your tax advisor andcontract provider(s) before takinga distribution.1Cash distributions will be taxed accordingto your tax bracket. Penalties may applydepending on your age at distribution.FRS Investment PlanIf you go to work for anotherFRS-covered employer,you will remain enrolled inthe Investment Plan, andcontributions will continue to bemade to your account.If you leave FRS-coveredemployment, you have theoption of: Leaving your money in thePlan.2 Taking a distribution/rollover(in which case you will beconsidered retired).32Account maintenance fees of 6 per quartermay apply. Distribution is mandatory if theaccount balance is 1,000 or less.3Cash distributions will be taxed accordingto your tax bracket. Penalties may applydepending on your age at distribution.FRS Pension PlanIf you go to work for anotherFRS-covered employer, yourPension Plan benefit willcontinue to grow. If you go towork for a non-FRS-coveredemployer, your Pension Planbenefit will be frozen until youeither begin receiving yourmonthly retirement benefitor you return to FRS-coveredemployment.Call the MyFRS Financial Guidance Line toll-free at1-866-446-9377 (TRS 711) before taking a distribution. TheMyFRS Financial Guidance Line is staffed with unbiased Ernst& Young financial planners who can offer you knowledgeable,personalized assistance.Can I switch plansafter I make myinitial election?No.Yes. You have a one-time 2nd Election that you can use during yourFRS career to switch to the other FRS retirement plan, providedyou are actively employed by an FRS-covered employer at the timeyour election is received.How does mybenefit/accountgrow?Your SUSORP benefit shouldaccumulate steadily over yourcareer, despite short-term upsand downs in the market. Yourbenefit ultimately depends onthe investment returns earnedon contributions. In the earlyyears of your SUS career, mostof your benefit comes from thecontributions paid into youraccount by your employer andyou. Over time, your investmentearnings may account for a largerportion of your account balance.Your Investment Plan benefitshould accumulate steadily overyour career, despite short-termups and downs in the market.Your benefit ultimately dependson how well you manage youraccount, and the investmentreturns earned on contributions.In the early years of your FRScareer, most of your benefitcomes from the contributionspaid into your account by youremployer and you. Over time,your investment earnings mayaccount for a larger portion ofyour account balance.PAGE 4Your Pension Plan benefitgrows slowly at first, andthen, because the PensionPlan formula is based on theaverage of your highest yearsof pay and your total years ofcreditable service, it takes asteep climb near retirementage. A 33-year employee willearn over 50% of their benefitin the last 10 years of their FRScareer.

Plan OverviewHow is myretirement benefitcalculated?SUSORPFRS Investment PlanYour retirement benefit is based onyour account balance, made up of:Your retirement benefit is basedon your account balance, madeup of:Your retirement benefit is aguaranteed benefit based on aformula that includes your: Employer and employeecontributions to youraccount. Age. Employer and employeecontributions to your account. Plus your voluntary employeecontributions, if any. Plus or minus investmentreturns (gains and losses). Years of FRS-covered service. An average of your 8 highestyears2 of salary.Depends on the options offered byyour contract provider(s). SUSORPdistribution options1 are as follows:Flexible distribution options areavailable. As long as your balanceis more than 1,000, you can: A lump-sum distribution. Leave your money in theplan until age 70½, whenmandatory distributionsmust begin.Guaranteed monthly checks forlife. A cost-of-living adjustmentwill be applied to the portionof your benefit that is basedon service earned prior toJuly 1, 2011.You can choose payout optionsthat provide continued monthlypayments to your survivingbeneficiary/joint annuitant. A lump-sum direct rollover ofyour accrued benefits, includinginterest and investment earningsinto another qualified plan. Periodic distributions. A partial lump-sum payment inwhich you are paid a portionof the accrued benefit andyou direct your remainingaccount balance to be rolledinto another qualified retirement plan. Other distribution optionsas allowed by your optionalretirement program contract.Does the planprovide otherbenefits? FRS membership class(e.g., Regular Class, SpecialRisk Class). Minus expenses and fees. Minus expenses and fees.How is my benefitpaid to me atretirement?Note that you cannotreceive a distributionfrom any plan unlessyou have terminatedfrom all FRS-coveredemployment. Plus or minus investmentreturns (gains and losses).FRS Pension PlanNo. The higher employercontributions are designed toenable you to pay for your ownhealth and disability coverage inretirement.123 Purchase an annuity thatprovides guaranteed monthlypayments for life using all orpart of your account balance.Surviving beneficiary andcost-of-living adjustmentoptions are available. Receive periodicdistributions.1 Elect a lump sum when youretire or at any future date.1Yes, including disability benefitsand retiree Health InsuranceSubsidy (HIS) payments.Yes, including DROP,3 disabilitybenefits, and retiree HealthInsurance Subsidy (HIS)payments.Cash distributions will be taxed according to your tax bracket. Penalties may apply depending on your age at distribution.If you are a rehired employee who has any Pension Plan service prior to July 1, 2011, your retirement benefit will be calculated basedon your 5 highest years of pay, averaged.Deferred Retirement Option Program. Visit MyFRS.com for details.Important note: Your decision to elect the SUSORP is a one-time opportunity. If you elect the SUSORP, you will remain inthis plan for as long as you remain at this employer in a SUSORP-eligible position. If you elect the FRS Investment Plan orthe FRS Pension Plan, you will have a one-time second opportunity (known as the 2nd Election) during your FRS career toswitch to the other FRS retirement plan. (The SUSORP is not available as a 2nd Election.)PAGE 5

Each Plan Has Advantages andDisadvantagesAll three retirement plans have advantages and disadvantages. The planthat’s best for you (i.e., the one that will provide the highest income toyou at retirement) will depend on your personal situation. Following aresome pros and cons to consider for each plan.AdvantagesSUSORP You are vested in your benefitimmediately upon signing acontract. If you’re a younger employee,your account balance has moretime to grow. Your account could growsignificantly if the underlyinginvestments do well. You currently have five contractproviders and over 60 investmentfunds to choose from. You can choose to make voluntarypretax contributions to yourSUSORP1 account. You have access to your contractprovider representative forfinancial guidance.Disadvantages Any prior nonvested FRS PensionPlan service will not be vestedunless you return to FRS-coveredemployment and complete thevesting requirements. There is investment risk involved.Your benefit may decrease in valueif the investments in your accountdon’t perform well. Disability insurance and HealthInsurance Subsidy (HIS) benefits arenot provided as part of the Plan. You are not eligible for DROP.2 Your decision to choose the SUSORPis irrevocable. You cannot changeyour retirement plan election at alater date. You will remain in theSUSORP throughout your SUSORPeligible career. Pension Plan underfunding or futurecost increases to fund the FRS maymake it necessary for the FloridaLegislature to lower the amountthat universities contribute toSUSORP members’ accounts or toincrease the amount that employeescontribute to their own SUSORPaccounts.PAGE 61SUSORP contract and investment product information (available from your University’s Human Resources office or SUSORPcontract providers).2Deferred Retirement Option Program. Visit MyFRS.com for details.

AdvantagesThe FRSInvestmentPlan You are vested1 after 1 year ofservice, rather than the 8 years2 ittakes to vest in the Pension Plan. If you’re a younger employee,your account balance has moretime to grow. Your account could growsignificantly if the underlyinginvestments do well. You have a diversified choiceof investment funds, includingbalanced funds, stock funds,bond funds, a Treasury InflationProtected Securities (TIPS)fund, and a money market fund. If you leave your job, you cankeep your benefit growing byleaving it in the Plan or rollingit over to another qualifiedretirement plan. Flexible distribution options areavailable. If you have a retirement planbenefit from a former employer,you may be able to roll it overto the Investment Plan. If you meet Health InsuranceSubsidy (HIS) requirements, youmay be eligible for the HIS. You may be eligible for disabilitybenefits. You have access to the free,unbiased MyFRS FinancialGuidance Program resources. You can name anyone as yourbeneficiary.123Disadvantages There is investment risk involved.Your benefit may decrease in value ifthe investments in your account don’tperform well. A long-term approach to investing willbe required for your benefit to reachits maximum potential. You need to actively monitor yourinvestments. Consider your age. If you’re an olderemployee, you may not have enoughtime to accumulate a large accountbalance before you retire. You could outlive your benefit if youdon’t plan carefully or buy an annuitythat provides a guaranteed monthlypayment option for life. You’re not eligible for DROP.3 If you decide to use your 2nd Electionto transfer to the Pension Plan, andyour Investment Plan account balanceis lower than the amount needed tofully fund your Pension Plan account,it is your responsibility to make upthe difference using your personalresources. This “buy-in” cost couldmake transferring to the Pension Planunaffordable. Pension Plan underfunding or futurecost increases to fund the FRS maymake it necessary for the FloridaLegislature to lower the amount thatemployers contribute to InvestmentPlan members’ accounts or to increasethe amount that employees contributeto their own Investment Plan accounts.You are always fully vested in your own contributions, as long as you remain enrolled in the FRS Plan you chose as anew employee. How your employee contributions are distributed or refunded to you depends on a number of factors,especially if you use your 2nd Election to switch plans in the future.If you are a rehired employee who has any Pension Plan service prior to July 1, 2011, you will vest in your benefit after6 years of FRS-covered service.Deferred Retirement Option Program. Visit MyFRS.com for details.Continues on page 8PAGE 7

AdvantagesThe FRSPension Plan You earn a substantial benefit ifyou spend your full career as aPension Plan member or startyour FRS-covered service laterin life. You don’t have to worry aboutinvesting with this Plan; theSBA is responsible for managingthe Pension Plan trust fund’sinvestments. You will receive a benefit even ifyou retire early. You cannot outlive your benefit.Your DecisionCountsAs you can see, there aremany factors to considerwhen choosing a plan.Please take the time tolearn as much as youcan about your options,and make your decisioncarefully. Call the MyFRSFinancial Guidance Linetoll-free at 1-866-446-9377,Option 2 (TRS 711) or visitMyFRS.com for informationabout the FRS InvestmentPlan and Pension Plan,and ask your University’sHuman Resources office orSUSORP contract providersfor SUSORP contractand investment productinformation. You can participate in DROP1 ifyou’re eligible. You are eligible for the HealthInsurance Subsidy (HIS). You may be eligible for disabilityand in-line-of-duty survivorbenefits. A cost-of-living adjustment will beapplied to the portion of your benefit that is based on service earnedprior to July 1, 2011, if any. You have access to the free,unbiased MyFRS FinancialGuidance Program resources.Disadvantages This Plan rewards longer service. If you leave FRS-coveredemployment before you are vested,you will have no benefit (you are notvested in the Pension Plan until youhave completed 8 years2,3 of service). You have no say in how the money isinvested. All your distribution options aremonthly payments; there are nolump sums (except under DROP1). Your benefit is reduced if you chooseearly retirement. If you decide to use your 2nd Electionto transfer to the Investment Plan,the money transferred from thePension Plan to the Investment Planwill not be vested until you have8 years2,3 of service credit under theFRS. If you terminate employmentwith fewer than 8 years2,3 of servicecredit, the amount transferred fromthe Pension Plan may be forfeited. During years when the PensionPlan is determined to be less than100% actuarially funded, theFlorida Legislature may take stepsto improve the funding level byincreasing employee or employercontributions or to lower plan costsby reducing future Pension Planbenefits. Beneficiary designation is limited.1Deferred Retirement Option Program. Visit MyFRS.com for details.2If you are a rehired employee who has any Pension Plan service prior to July 1, 2011, you will vest in your benefitafter 6 years of FRS-covered service.3You are always fully vested in your own contributions, as long as you remain enrolled in the FRS Plan you choseas a new employee. How your employee contributions are distributed or refunded to you depends on a number offactors, especially if you use your 2nd Election to switch plans in the future.This publication is a summary of the retirement plan options available to SUSORP-eligible State University System employees.It is not intended to include every program detail. Complete details can be found in Chapter 121, Florida Statutes, Title60S and 60U, Florida Administrative Code, and the rules of the State Board of Administration of Florida in Title 19, FloridaAdministrative Code. In case of a conflict between the information in this publication and the statutes and rules, theprovisions of the statutes and rules will control.PAGE 8 2012 MyFRS Florida Retirement System — all rights reserved.

you remain in the Investment Plan.3 Plan Overview SUSORP FRS Investment Plan FRS Pension Plan Your employer provides the majority of your SUSORP retirement plan con-tribution based on a fixed percentage of your gross salary (total employee and employer rate is 8.14%). A mandatory 3% pretax contribution is deducted from your paycheck