Transcription

Retail in VietnamNavigating the digital retail landscapeFebruary 2019

Foreword03Drivers of growth04The new retail landscape13Deloitte’s retail survey191. Purchasing channels202. Digital behaviours24Looking ahead27Contact us28

Retail in Vietnam Navigating the digital retail landscapeForewordWith the fastest-growing middle class in Southeast Asia, Vietnam has been experiencingphenomenal growth rates in its retail sector. This trend looks set to continue into thefuture, given its relatively young population demographics and robust consumer spendingbehaviours. Indeed, the rise of e-commerce and digital retail channels in Vietnam is oneof the top trends to watch: by 2025, Vietnam’s e-commerce market size is expected to besecond only to Indonesia in the Southeast Asia region.In this report, we explore the drivers of growth in Vietnam’s retail sector, and take a look atsome of the defining features of its new retail landscape. In particular, we examine the riseof Modern Trade channels in Vietnam, including commercial centres, convenience stores,and digital platforms. Later, we also highlight some of the findings from Deloitte’s latestretail survey, which was conducted across nearly 700 households in the two metropolitancities of Hanoi and Ho Chi Minh City in late 2018.There are several key takeaways. Firstly, although Vietnam’s retail sector holds immensepotential for growth, the level of competition is intense. Across different retail formats,such as commercial centres, convenience stores and electronics chain stores, we arewitnessing domestic and foreign retail giants engaged in a battle for dominance as theyembark on aggressive expansion strategies. As online shopping begins to take off inVietnam, a similar story is also playing out across digital platforms, where players areattempting to build scale amidst the proliferation of new players in the market.Secondly, despite the rise of digital channels, physical channels continue to dominate theretail scene in Vietnam. For companies, this underscores the importance of developingomni-channel strategies, and the need for them to curate coherent and seamlessconsumer experiences that integrate both online and offline consumer journeys across alltheir touchpoints.Finally, companies will also need to address several impediments that remain for onlineshopping, such as concerns relating to payments and data security, and find innovativeways to provide a differentiated consumer experience in this new digital retail landscape.Nguyen Vu DucConsumer Industry LeaderDeloitte Vietnam03

Retail in Vietnam Navigating the digital retail landscapeDrivers of growthIn recent years, Vietnam has been experiencing rapid retail growth. From 2013-2018, the retail sector recorded acompound annual growth rate (CAGR) of 10.97%1. Total retail revenue is also expected to reach USD 180 billion by2020, which would represent an increase of 26.6% from 2018 (see Figure 1)2. With the influx of investments intothe sector, it is poised to witness further growth in the near future (see Figure 2).Figure 1: Retail revenue and growth in Vietnam ue, USD billion1230425%20152016201720182020Growth rateDeloitte analysis“Hoi thao ‘Thi truong ban le Viet Nam- Co hoi va Thach thuc’”. Vien Nghien cuu Thuong mai. 20 May 2016. -co-hoi-va-thach-thuc201dGeneral Statistics Office, https://www.gso.gov.vn/default.aspx?tabid 621

Retail in Vietnam Navigating the digital retail landscapeFigure 2: Key statistics on Vietnam’s retail sectorUSD 142 billion10.97%Retail sales in 2018, thehighest ever recorded4CAGR of retail salesfrom 2013-20185#1#2The fastest-growingmarket forconvenience stores inAsia by 20216#3Rank of the retail sector interms of total investmentinflows in 20188456789Rank of the consumerand retail sector in termsof mergers andacquisitions (M&A) dealvalue in Vietnam for the2016-2017 period7USD 15 billionEstimated size of e-commercemarket in 2025, second onlyto Indonesia in the SoutheastAsia region9General Statistics Office, https://www.gso.gov.vn/default.aspx?tabid 621&ItemID 19037Deloitte analysisIGD Research, test-growingconvenience-market/i/16565M&A Vietnam Forum Report 2017Foreign Investment Agency, Ministry of Planning and Investment, t-Dau-tu-nuoc-ngoainam-2018Google Temasek’s E-conomy SEA 2018, 5

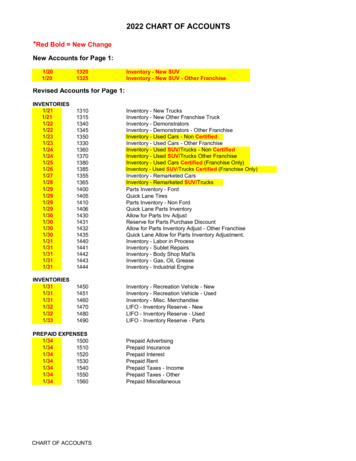

Retail in Vietnam Navigating the digital retail landscapeFigure 3: List of some retailers in Vietnam’s marketNo. Name of retail owner/storeCountryof originFirstoutlet inVietnamNumberof stores(updated onJan 2019)Operation formatVietnam2006140Baby&Mom Specialty StoreFPT ShopVietnam2012473Electronics Specialty StoreStudio by FPTchainVietnam201213Authorised Apple ProductsStoreHapro MartVietnam20066Supermarket20044Grocery Store200614Home appliance,Electronics Specialty StoreNote1.PHYSICAL STORE1.1 Domestic players1.BiBoMart2.FPT Retail3.Hapro4.Home d’s PlazaVietnam200991Baby&Mom Specialty Store7.Media MartVietnam200895Home appliance,Electronics Specialty Store8.Nguyen KimVietnam199264Home appliance,Electronics Specialty Store9.PicoVietnam200723Home appliance,Electronics Specialty Store10.Saigon Co.OpCo.Op SmileVietnam201641Convenience StoreCo.Op FoodVietnam2008233Grocery StoreCo.Op SupermarketCo.OpXtra permarket2011182Grocery StoreHapro Food11.SatraSatra Food12.06Thegioididong(Mobile World)Thegioididong.com StoreVietnam20041,058Electronics Specialty StoreBach HoaXanhVietnam2015384Grocery StoreDien May XanhVietnam2010724Home Appliance SpecialtyStoreIn 2015, Central Grouppurchased 49% stakeof Nguyen KimIn early 2018,Thegioididongcompleted theacquisition ofelectronics retailer TranAnh Digital

Retail in Vietnam Navigating the digital retail landscapeNo. Name of retail owner/store13.VingroupCountryof originFirstoutlet inVietnamNumberof stores(updated onJan 2019)Operation formatNoteVinMartVietnam201467VinMart Vietnam20141,700SupermarketIn 2017, Vinroup’s retailarm, Vincom Retail JSC.raised US 740 millionin its IPO10.VinProVietnam201536Electronics Specialty StoreVinComVietnam200446Shopping Mall (4 VincomCenter, 3 Vincom MegaMall, 30 Vincom Plaza and9 Vincom )Convenience StoreIn 2018, Vingroupacquired supermarketchain FiviMart andelectronics store chainVien Thong A.1.2 Foreign players14.7- Eleven15.AEONJapan201724Convenience StoreVietnam’s first 7-Elevenstore was opened in HoChi Minh City in 2017.AEON MallJapan20134Shopping MallIn 2019, AEON Mallwill open the fifth mallin Ha Dong district,Ha Noi Aeonmall HaiPhong will go intooperation in 2020.Mini StopJapan2011115Convenience StoreAEON ce201620Supermarket17.Big CFrance199836Supermarket18.B’s MartThailand2013168Convenience Store19.Circle KUS2008300Convenience Store20.E-MartKorea2016110Since AEON purchased49% stake of Citimartin 2014, Citimart hasbeen renamed AEONCitimartIn 2015, Central Group(Thailand) purchasedBig C Vietnam with thedeal value of US 1.05billionHypermarket“Vietnam: Vincom Retail raises 740m from GIC, Templeton, HSBC, others in IPO”. DealStreetAsia. 7 November, 2017.07

Retail in Vietnam Navigating the digital retail landscapeNo. Name of retail owner/storeCountryof originFirstoutlet inVietnamNumberof stores(updated onJan 2019)Operation formatNote21.Fuji MartJapan20181SupermarketFujiMart Vietnamstores are operatedby Fujimart VietnamRetail - a joint venturebetween Sumitomoand local real estateconglomerate BRGGroup22.GS25SouthKorea20185Convenience StoreGS25 Vietnam is ajoint venture betweenKorea’s GS Retail andVietnam’s Son KimGroup23.Guardian(owned byDairy Farm)Singapore201179Health & Beauty SpecialtyStore24.LotteLotte MartKorea200814SupermarketLotte HanoiDepartmentStoreKorea20141Department StoreLotte DutyFreeKorea20172Duty-free storeThe duty-free storesare opened at DaNang and Nha TrangInternational AirportAfter being acquired byTCC Group (Thailand)in 2016, METRO Cash& Carry Vietnam wasrenamed MM MegaMarket25.MM sia20056Department Store27.RobinsThailand20142Department Store28.Shop&GoSingapore200595Convenience Store29.TakashimayaJapan20171Department Store30.WatsonHongKong20191Health & Beauty Store08

Retail in Vietnam Navigating the digital retail landscapeNo. Name of retail owner/storeCountryof originFirstoutlet inVietnamNumberof stores(updated onJan 2019)Operation formatNote2015B2CE-commerce site ofVinGroup2. ONLINE STORE2.1 Domestic C33.Thegioididong.comBach e site of FPT36.Tiki.vnVietnam2010B2B2CIn 2016, VNGCorporation purchased38% stake in Tiki11E-commerce sites ofThegioididong2.2 Foreign ormerlyknown asZalora)Thailand2017B2B2CLazada Vietnam is partof Lazada Group. In2016, Allibaba acquiredcontrolling stake ofSouth East Asia’sLazada12Zalora merged withCentral-owned fashionbrand Robins tobecome Robins.vn13Note: The list is in alphabetical order for each category, not necessarily reflecting the business scale/importanceB2C Business to Customer Model; C2C Customer to Customer Model; B2B2C Business to Business to Consumer ModelSource: Compiled from the companies’ websites, companies’ annual reports, public sources (as of January, 2019)11 “Vietnam’s VNG buys 38% stake in ecommerce platform Tiki for 17m”. TechinAsia. 17 May, 2016. in-ecommerce-platform-tiki12 “Alibaba buys control of Lazada in 1 billion bet on SE Asia ecommerce”. Reuters. 12 April, 2016. -on-se-asia-ecommerce-idUSKCN0X90HT13 “Zalora Vietnam becomes Robin.vn”. Vietnam Economic Times. 17 May, 2017. vietnam-becomes-robin-vn09

Retail in Vietnam Navigating the digital retail landscapeInvestment trendsTo promote the growth of Vietnam’s retail sector, the government has introduced a number of new regulations toattract investments and enhance the linkages between local enterprises and global markets (see Figure 4).Figure 4: Timeline of regulationsNew Law onInvestmentintroduced toincrease the easeof doing businessin Vietnam byrelaxing certainrules for foreigninvestorsDecree 09/2018/ND-CP onthe Law on Commerce andthe Law on Foreign TradeManagement was issued toincorporate severalfavourable changes forretailers establishing orexpanding their businessesin areas pertaining to thetrading of goods by foreigninvestors and enterprisesDecision No.1563/QD-TTg wasmade to approvethe e-commercedevelopment planfor the 2016-2020period201420162015As part of itscommitment to theWorld TradeOrganisation, Vietnamofficially allowed foreignretailers to establish100% owned businesses2018201754 out of 63provinces issuedtheir specifice-commercedevelopmentplans for the2016-2020 periodDecision No.1513/QD-TTg was madeto approve the schemepromoting Vietnameseenterprises’ directparticipation in foreigndistribution systemsuntil 2020As a result of the favourable investment climate, both local and foreign retailers have been scaling up theiroperations in Vietnam through the adoption of various expansion strategies, including M&A, franchising, andother partnership models. Local player Vingroup, for example, has been acquiring smaller competitors – includingFivimart and Vien Thong A, in addition to its earlier acquisitions of Ocean Mart, MaxiMark, and Vinatexmart – in abid to grow its retail revenues, which are expected to contribute up to 50% of the conglomerate’s total revenues,up from its current 20%14.At the same time, foreign investors have also successfully secured a number of M&A deals to further theirexpansion plans in the market. Several high-profile transactions include the purchase of a 49% stake in NguyenKim and acquisition of Big C Vietnam by Central Group15; acquisition of METRO Cash & Carry Vietnam by TCCGroup16; and purchase of a 20% stake in Bibo Mart by ACA Investments17.14 “Vingroup to focus on its retail business”. BDG Vietnam. 9 August 2016. /vingroup-tofocus-on-its-retail-business/15 “Thailand's Central Group wins Vietnam's Big C for 1bn”. Nikkei Asian Review. 29 April 2016. -Group-wins-Vietnam-s-Big-C-for-1bn16 “Thailand’s TCC Holding acquires METRO Cash & Carry’s Vietnamese ops for 711m”. DealStreetAsia. 7 January 2016. arry-26128/17 “ACA Investments takes 20% stake in Vietnamese baby product retailer Bibomart”. DealStreetAsia. 29 May 2017. omart-73612/10

Retail in Vietnam Navigating the digital retail landscapeConsumption trendsVietnam’s retail sector is benefiting from the rise of the fastest-growing middle class in Southeast Asia – its middleclass population is expected to reach 33 million by 2020, up from 12 million in 201218 – whose growing affluence isdriving increasing expenditures.At the same time, it also possesses a relatively young population, with 40% of its population below the age of2419. With their greater propensity for digital technology, many of these younger consumers are driving the rapidexpansion of Vietnam’s e-commerce market, as they spend more time shopping on their digital devices than inphysical stores.Ranked 6th globally in terms of revenue in 201820, Vietnam’s e-commerce market is well-poised to witness furthergrowth. Currently, online Business-to-Consumer (B2C) sales account for a modest 3.6% of total retail salesnationwide21. This figure, however, is expected to soar to 5% in 2020, with a total value of USD 10 billion (see Figure5)22.Notably, Consumer-to-Consumer (C2C) or social commerce channels, are also becoming increasingly popular.Typically hosted on social media platforms such as Facebook, Instagram, and Zalo, these platforms offerbuyers the ability to interact directly with their sellers, and to share information, such as photos, reviews orrecommendations with one another in real-time.Figure 5: Online B2C sales in .9754.072%6.20.720122013Online B2C sales, USD billion20142015201620172020*0%% of total retail sales18 “ASEAN Connected”. HSBC. nconnected-final-report.pdf19 “The World Factbook”. Central Intelligence Agency. -factbook/fields/2010.html20 “Vietnam ranks sixth globally in ecommerce revenue in 2018: report”. TuoitreNews. 20 January 2019. 018-report/48620.html21 E-commerce Vietnam White book 2018, MoIT, http://www.idea.gov.vn/?page document22 E-commerce Vietnam White book 2018, MoIT, http://www.idea.gov.vn/?page document11

Retail in Vietnam Navigating the digital retail landscapeUnderpinning this rapid e-commerce growth are the Vietnamese consumer’s robust spending behaviours. In 2018,the average annual spending for an online shopper in Vietnam was USD 350, nearly double the figure of USD 186 in201723. In addition, online conversion rates, broadly defined as the proportion of visits to online websites that havebeen converted to sales, are high in Vietnam. According to one survey, Vietnam posted the highest conversionrates amongst six Southeast Asia markets, with a conversion rate that was 30% higher than the regional average24(see Figure 6).Furthermore, the Vietnamese consumer is becoming accustomed to online payment solutions. Currently, 50% ofall e-commerce expenditures are processed through card payments25, and the uptake of new cashless methods isexpected to accelerate: estimates suggest that e-wallet payments will make up 28% of the total e-commerce salesin Vietnam in 201926.Figure 6: Online conversion index across six markets in Southeast hailand0.8The Philippines0.800.511.5Note: The online conversion index represents a market’s performance relative to the overall average conversion rate across all six markets,which has been assigned a reference value of 1.23 E-commerce Vietnam White book 2018, MoIT, http://www.idea.gov.vn/?page document24 “State of eCommerce in Southeast Asia 2017”. iPrice. https://iprice.ph/insights/stateofecommerce2017/25 “Vietnamese increasingly prefer electronic payments”. Vietnam Economic Times. 5 April 2017. s26 Statista. /vietnam#market-age12

Retail in Vietnam Navigating the digital retail landscapeThe new retail landscapeIn Vietnam, the retail landscape continues to be dominated by Traditional Trade channels, such as street shops,which are a vital part of the community and everyday life, especially in rural areas, where they account for 90%of the market. Even in urban areas, where Modern Trade channels, these channels continue to account for asignificant 50% of the market27 (see Figure 7).Figure 7: Market share of different purchasing channels in rural and urban areas2%2%2%5%6%Small street shops32%14%Urbanareas9%9%5%Medium-sized street shops23%Wet marketsSpecialty storesHypermarkets & supermarketsMinimarts, convenience stores11%15%Ruralareas65%OnlineOthers27 Kantar Worldpanel FMCG Report, Nov 2018. tor-November-2018#download13

Retail in Vietnam Navigating the digital retail landscapeHowever, in recent years, there has been an explosionin the number of Modern Trade channels acrossVietnam, with a variety of players offering differentretail formats. This phenomenon is especiallypronounced in the two key cities of Ho Chi Minh Cityand Hanoi, which account for the majority of total retailsales at 22% and 11% respectively. They are followedby three dynamic cities with large industrial parks –Binh Duong, Dong Nai and Hai Phong – which togetheraccount for nearly 10% (see Figure 8)28.Figure 8: Geographical breakdown of total retailsales in VietnamHCM City22%HanoiDong Nai57%Binh Duong11%Hai Phong4%4%2%Other cities/provincesThe rise of Modern TradeWith the rise of Modern Trade retail formats in Vietnam, some of the most notable recent developments can befound in commercial centres, convenience stores, as well as digital platforms. Ho Chi Minh City, in particular, hasemerged as a particular area of focus for many retail players in Vietnam. For instance, it has experienced a surgein the number of supermarkets in recent years, and now accounts for nearly one-fifth of the total number ofsupermarkets nationwide (see Figure 9)29. It also accounts for the most number of commercial centres, with nearlytwo times as many outlets as Hanoi (see Figure 10)30.Figure 9: Number of supermarkets in Hanoi andHo Chi Minh City13710320141242412419201528 General Statistics Office29 General Statistics Office30 General Statistics Office2016Ho Chi Minh 179173Figure 10: Number of commercial centres inHanoi and Ho Chi Minh City222220162017Ho Chi Minh City

Retail in Vietnam Navigating the digital retail landscapeCommercial centresCurrently, there are nearly 200 commercial centres operated by both domestic and foreign players acrossVietnam31. Typically, these commercial centres accommodate a variety of different facilities, includingentertainment and shopping options, with major players in this space including conglomerates such as AEON,Lotte, and Vingroup. In particular Vingroup’s retail arm, Vincom, accounts for 60% of the market share in terms ofretail floor operations for the two major cities of Hanoi and Ho Chi Minh City, covering nearly 1.2 million squaremetres of gross retail area32.Competition heats up for commercial centresCommercial centres are sprouting across all the major cities in Vietnam as retail players jostle for marketshare. Local player Vingroup, for instance, has embarked on an aggressive expansion strategy, increasingits number of commercial centres from 5 to 4933 as it advances towards its eventual goal of 200 commercialcentres34.Foreign players, too, have demonstrated their growth ambitions. Japanese player, AEON, recently kickedoff the construction of its sixth commercial centre, AEON Hai Phong, which is expected to be ready in early2019. Having opened its first commercial centre in Vietnam in 2015, AEON now aims to increase its portfolioto 20 outlets nationwide35.To begin its foray into Vietnam, South Korean player Lotte has also invested USD 400 million in theconstruction of its first commercial centre, the 65-storey Lotte Centre Hanoi36. Lotte is also in the process ofbuilding its second mall in the West Lake area, which it aims to complete by 202037.As the retail market becomes increasingly saturated, however, the competition is intensifying. For instance,in a bid to avoid the fierce competition with the other retail giants in Ho Chi Minh City, Saigon Co.op is aimingto target the Southwest provinces, where there remains a shortage of quality entertainment facilities, withplans to develop one to two Sense City centres per year38.The recent closure of Parkson’s department store outlets in Hanoi is also another evidence of the overallpressure that is mounting in the market. After opening its first outlet in Vietnam in June 2005, and expandingto 9 retail properties across Da Nang, Hai Phong, Hanoi, and Ho Chi Minh City, Parkson has recordedcontinued losses since 201439. This can be partly attributed to the growth of commercial centres, whichoffer a greater variety of options than department stores. In a similar vein, several other department stores,including Pico Sai Gon and Zen Plaza, have also closed or curtailed their scope of operations40.31 General Statistics Office32 “Vincom Retail tops 3bn market cap in stock debut”. Nikkei Asian Review. 8 November 2017. ncom-Retail-tops-3bn-market-cap-in-stock-debut233 “Vincom”. December 2018. http://vincom.com.vn34 “Vincom Retail: Dac dia, dac thi phan”. Nhipcaudautu. 7 February 2018. dac-dia-dacthi-phan-332252235 “Japanese retailers rush to open more shops in Vietnam”. VietnamNet. 12 April 2018. am.html36 “Korea’s Lotte expands Vietnam real estate business footprint via M&As”. DealStreetAsia. 24 October 2016. a-acquisitions-5624237 “Lotte plans second Hanoi mall”. Insider Retail Asia. 1 March 2017. econd-hanoi-mall38 “Saigon Co.op da dang hoa mo hinh ban le hien dai”. Saigon Co.op. coop-da-danghoa-mo-hinh-ban-le-hien-dai 1212.html39 “Parkson Holdings to expand in new malls, pull out from less popular ones”. The Star Online. 12 March 2018. 2018/03/12/parksons-plan40 “Kinh doanh trung tam thuong mai”. Vietnam Finance. 26 November 2016. 1121040730122.htm15

Retail in Vietnam Navigating the digital retail landscapeConvenience storesConvenience stores are becoming strong and direct competitors of many Traditional Trade channels, such as momand pop stores, as they offer consumers close proximity and greater convenience.Across Vietnam, the number of convenience stores have quadrupled since 2012, and minimarkets accounted forthe most number of store openings in the first nine months of 201841. The attractiveness of convenience storeshave not only captured the attention of local players, but also foreign players, with convenience stores emerging asthe preferred retail format for many foreign retail investors (see Figure 11).Figure 11: Domestic and Foreign market share across different retail formats42Covenience Store70%Online storesCommercial centres 85%Domestic41 “Nielsen Shopper Trends 2018”. Nielsen. vn/docs/Reports/2018/Nielsen-ShopperTrend-EN.pdf42 Ministry of Industry and Trade16

Retail in Vietnam Navigating the digital retail landscapeThe battle for convenience storesAccording to estimates, Vietnam’s growth in convenience stores is expected to outperform many of itsneighbouring economies, with a CAGR of 37.4% from 2017-202143 (see Figure 12).Currently, Vietnam possesses a relatively low concentration of convenience stores: while convenience storestypically represent about 20% of the market in other economies, the figure in Vietnam is less than 10%44.Its ratio of convenience stores to residents is also lower, at one store for every 54,400 residents. This is incontrast to markets such as South Korea, where the figure is one for every 2,100 residents, and China, wherethe figure is one for every 24,900 residents45.This opportunity for growth has not escaped the attention of domestic and foreign retailers alike. Vingroup,for instance, has plans to open 4,000 convenience stores by 202046, while Saigon Co.op has acquired existingnetworks of small grocery stores, mostly in rural areas, to expand its market presence47. At the same time,retail giant 7-Eleven aims to increase its number of stores to 1,000 within 10 years, while South Korea’s GS25embarks on an endeavour to open 2,500 stores in the next 10 years48.Figure 12: CAGR of retail sales for convenience stores for 2017-202137.4%24.2%15.8%10.5%VietnamThe Philippines ndJapan43 IGD Research, test-growingconvenience-market/i/1656544 “Mini-marts boom as Vietnam's shoppers shift spending patterns”. Reuters. 14 October 2015. tterns-idUSL3N11Y2IH20151014?feedType RSS&feedName financialsSector45 “Vietnam Retail Sector 2017”. Savills. ution-vi-0911.pdf46 “Vinmart & Vinmart se co 200 sieu thi va 4000 cua hang vao nam 2020”. Vingroup. 16 January 2018. a-4000-cua-hang-vao-nam-2020-3154.aspx47 “Saigon Co.op nhay vao kenh ban le truyen thong bien cua hang tap hoa thanh dai ly hien dai”. Tapchibanle. 16 March 2017. thanh-dai-ly-hien-dai/48 “Cuoc chien cua hang tien loi”. VnExpress. 21 May 2018. ep/cuoc-chien-cua-hang-tienloi-3676214.html17

Retail in Vietnam Navigating the digital retail landscapeDigital platformsAmidst the proliferation of physical channels, digital platforms are also emerging in the retail market, with playerssuch as Adayroi, Lazada, Shopee, and Tiki leading the pack. The growth potential of Vietnam’s digital retail markethas also captured the attention of several e-commerce giants, with Amazon launching an initiative with theVietnam e-Commerce Association to provide e-commerce services to a group of 140 local businesses49.Tiki moves from B2C to B2B2C50Founded in 2010 as a web-based book retail business, Tiki has since expanded its offerings to a wider rangeof products, including home appliances, electronics products, and health care products.Earlier in March 2017, Tiki announced that it would be transforming its business model from a B2C platformto a Business-to-Business-to-Consumer (B2B2C) platform. This strategic shift appeared to be well-receivedby investors: following a USD 50 million investment from JD.com at the end of 201751, Tiki received anotherUSD 10 million from STIC Investments in early 201852.The demand for digital experiencesAs Vietnamese consumers become increasingly sophisticated, they are constantly on the lookout for newproducts and experiences. In response, retailers are offering several different concepts that integrate offlineshopping experiences with digital experiences to cater to this demand.Zalora, for instance, introduced the “click-and-mortar” format that aims to combines its offline and onlineshopping experiences53. Under this format, consumers can visit a physical store to try on products, makepurchases on computer terminals located in the showrooms, and wait for their products to be deliveredto them. Another retailer, Toromart, also opened its first “checkout-free” store in Ho Chi Minh City, whereconsumers only need to scan a QR code on their e-wallet app to pay for products54.49 “Amazon is entering Vietnam”. Business Insider. 13 Marc

ion-point/ Figure 2: Key statistics on Vietnam's retail sector illin Retail sales in 2018, the highest ever recorded4 #1 . 16 "Thailand's TCC Holding acquires METRO Cash & Carry's Vietnamese ops for 711m". DealStreetAsia. 7 January 2016. https://www.