Transcription

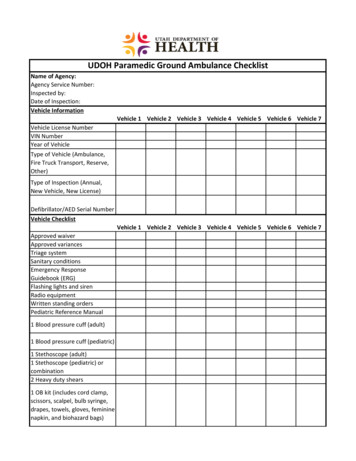

Jeremiah W. (Jay) NixonDepartment of InsuranceFinancial Institutionsand Professional RegistrationJohn M. Huff, DirectorGovernorState of MissouriDIVISION OF FINANCE301 West High Street, Room 630P.O. Box 716Jefferson City, MO 65102-0716(573) 751-3242(573) 751-9192 FAXwww.finance.mo.govDebra HardmanActing CommissionerCHAPTER 365 – MOTOR VEHICLE TIME SALES ACTLICENSING APPLICATION PACKET(Licensing Year January 1 through December 31)Instructions:1. The enclosed application must be completed in its entirety.2. You may complete the balance sheet portion of the application either directly on the applicationitself or by attaching a copy of the same.3. Application must be signed before a notary public.4. The licensing fee of 500 made payable to the "Division of Finance" must be submitted withyour completed application.5. Should your company move to a new location, you must notify our office immediately andsurrender your original license for amendment.6. If you have any further questions regarding the filing of this application, please call our office at573-751-3463.

NEW LICENSED LOCATIONInstructions: Please complete this form and submit, along with the 500.00 licensing fee, to the Division of Finance, 301West High Street, Harry S. Truman State Office Bldg., Room 630, P.O. Box 716, Jefferson City, MO 65102. PLEASENOTE: THE LICENSING FEE APPLIES TO EACH LOCATION TRANSACTING BUSINESS. Should you haveany questions, please contact the Consumer Credit Licensing Section at 573-751-3463.MISSOURI DIVISION OF FINANCEApplication forMotor Vehicle Time Sales ActChapter 365License Year: January 1 – December 31OFFICE USE ONLY --365 -Rec#Check No.Amount: Date:Initials:Information for Licensed Location:Company Name:Address:City: State: Zip:Telephone: Fax:County (MO only):Internet address:Hours of Operation:Name:Licensing Contact forRenewal Applications:Mailing Address:City/State/Zip:Telephone: ()Fax: ()E-Mail:Fax: ()E-Mail:)Fax: ()E-Mail:)Fax: ()E-Mail:Name:Contact Person toReceive ExaminationReports:Mailing Address:City/State/Zip:Telephone: ()Name:Contact Person forOffice and ConsumerInquiries/Complaints:Mailing Address:City/State/Zip:Telephone: (Information RegardingPreparer of Application:Mailing Instructions forthis License Certificate:365-07/15Name:Telephone: (Mail to Licensed LocationMail to Licensing Contact aboveOther (please specify):- Page 1 of 2 -

If applicant is: Individual, complete Section I. Partnership, Corporation, or LLC complete Section III. INDIVIDUALName:Phone Number: ()Phone Number: ()Residence Address:Business Address:II. PARTNERSHIP,ASSOCIATION ,CORPORATIONName:Principal Business Address:Names, Titles ofPartners/OfficersDate ofIncorporationBusiness AddressResidence AddressPrincipal Office in Missouri (if applicable)ASSETSA. Cash on HandAmount LIABILITIESJ. Stock - CommonB. Cash in BankK. Stock - PreferredName of Bank:L. SurplusC. Accounts ReceivableM. Undivided ProfitsD. Notes ReceivableN. ReservesE. Stock OwnedO. BondsF. Bonds OwnedP. MortgagesG. Mortgages OwnedQ. Accounts PayableH. Real Estate OwnedR. Notes PayableI. Other Assets:(Itemize)S. Other Liabilities:(Itemize)TOTAL ASSETS TOTAL LIABILITIESAmount STATE OF ))COUNTY OF )(Name of Officer/Partner/Principal) , being duly sworn, upon his/her oath,states that the facts contained in the foregoing application are true.Signature / Officer, Partner, PrincipalSubscribed and sworn to before me this day of , 19 .Notary PublicMy Commission expires:- Page 2 of 2 -

MOTOR VEHICLE TIME SALES(Licensing and Rates)Sec.365.010. Citation of law.365.020. Definitions.365.030. Sales finance company, licenserequired - exceptions - application fee.365.040. License denied or suspended grounds - hearing and review.365.050. Director may examine persons, inspectrecords - complaints of violations.365.060. Rules and regulations, procedure subpoenas, enforced how.365.070. Retail installment contracts to be inwriting - form, contents.365.080. Insurance included in retail installmenttransactions - restrictions.365.090. Transfer of equity in motor vehicle fee.365.100. Late payment charges, interest ondelinquent payments, attorney fees dishonored or insufficient funds fee.365.110. Blank spaces in contract prohibited exceptions.365.120. Time price differential, computed how.365.125. Rates, parties may agree to a rate,restrictions.365.130. Assignment of contract - refinancecharge, computed how - extension ordeferral of due dates, when.365.140. Prepayment of debt under retailinstallment contract - refund, howcomputed.365.145. Default - discrimination, law applicableto retail installment transactions.365.150. Violation a misdemeanor - penalty recovery barred - correction ofviolation, effect.365.160. Waiver unenforceable.365.200. Additional time sales contracts definitions20 CSR 1140-4.02020 CSR 1140-4.03020 CSR 1140-4.040365.010. Citation of law. - Sections365.010 to 365.160 shall be known and may becited as the "Missouri Motor Vehicle Time SalesLaw".(L. 1963 p. 466 § 1, A.L. 1999 S.B. 386)365.020.Definitions. - Unlessotherwise clearly indicated by the context, thefollowing words and phrases have the meaningsindicated:(1) "Cash sale price", the price statedin a retail installment contract for which the sellerwould have sold to the buyer, and the buyer wouldhave bought from the seller, the motor vehiclewhich is the subject matter of the retail installmentcontract, if the sale had been a sale for cash or ata cash price instead of a retail installmenttransaction at a time sale price. The cash saleprice may include any taxes, registration,certificate of title, license and other fees andcharges for accessories and their installment andfor delivery, servicing, repairing or improving themotor vehicle;(2) "Director", the office of the directorof the division of finance;(3) "Holder" of a retail installmentcontract, the retail seller of the motor vehicleunder the contract or, if the contract is purchasedby a sales finance company or other assignee, thesales finance company or other assignee;(4) "Insurance company", any form oflawfully authorized insurer in this state;(5) "Motor vehicle", any new or usedautomobile, mobile home, manufactured home asdefined in section 700.010, excluding amanufactured home with respect to which therequirements of subsections 1 to 3 of section700.111, as applicable, have been satisfied,motorcycle, all-terrain vehicle, motorized bicycle,moped, motortricycle, truck, trailer, semitrailer,truck tractor, or bus primarily designed or used totransport persons or property on a public highway,road or street;(6) "Official fees", the fees prescribedby law for filing, recording or otherwise perfectingand releasing or satisfying any title or lien retainedor taken by a seller in connection with a retailinstallment transaction;RecordkeepingLicensingExtension FeesCROSS REFERENCESAll license, permit and certificate applications shall contain theSocial Security number of the applicant, 324.024Default procedures, sections 408.551 to 408.562 applicable,408.551Rev. 8/141

(7)"Person",anindividual,partnership, corporation, association, and anyother group however organized;(8) "Principal balance", the cash saleprice of the motor vehicle which is the subjectmatter of the retail installment transaction plus theamounts, if any, included in the sale, if a separateidentified charge is made therefor and stated inthe contract, for insurance and other benefits,including any amounts paid or to be paid by theseller pursuant to an agreement with the buyer todischarge a security interest, lien, or lease intereston property traded in and official fees, minus theamount of the buyer's down payment in money orgoods. Notwithstanding any law to the contrary,any amount actually paid by the seller pursuant toan agreement with the buyer to discharge asecurity interest, lien or lease on property tradedin which was included in a contract prior to August28, 1999, is valid and legal;(9) "Retail buyer" or "buyer", aperson who buys a motor vehicle from a retailseller in a retail installment transaction under aretail installment contract;(10) "Retail installment contract" or"contract", an agreement evidencing a retailinstallment transaction entered into in this statepursuant to which the title to or a lien upon themotor vehicle, which is the subject matter of theretail installment transaction is retained or takenby the seller from the buyer as security for thebuyer's obligation. The term includes a chattelmortgage or a conditional sales contract;(11) "Retail installment transaction",a sale of a motor vehicle by a retail seller to aretail buyer on time under a retail installmentcontract for a time sale price payable in one ormore deferred installments;(12) "Retail seller" or "seller", aperson who sells a motor vehicle, not principallyfor resale, to a retail buyer under a retailinstallment contract;(13) "Sales finance company", aperson engaged, in whole or in part, in thebusiness of purchasing retail installment contractsfrom one or more sellers. The term includes but isnot limited to a bank, trust company, loan andinvestmentcompany,savingsandloanassociation, financing institution, or registrantpursuant to sections 367.100 to 367.200, if soengaged. The term shall not include a person whomakes only isolated purchases of retail installmentcontracts, which purchases are not being made inthe course of repeated or successive purchasesof retail installment contracts from the same seller;(14) "Time price differential", theamount, however denominated or expressed, aslimited by section 365.120, in addition to theRev. 8/14principal balance to be paid by the buyer for theprivilege of purchasing the motor vehicle on timeto be paid for by the buyer in one or moredeferred installments;(15) "Time sale price", the total of thecash sale price of the motor vehicle and theamount, if any, included for insurance and otherbenefits if a separate identified charge is madetherefor and the amounts of the official fees andtime price differential.(L. 1963 p. 466 § 2, A.L. 1999 S.B. 386, A.L. 2000 S.B. 896,A.L. 2004 S.B. 1233, et al., A.L. 2010 S.B. 630)365.030. Sales finance company,license required - exceptions - application fee. - 1. No person shall engage in the businessof a sales finance company in this state without alicense as provided in this chapter; except, that nobank, trust company, savings and loanassociation, loan and investment company orregistrant under the provisions of sections367.100 to 367.200, RSMo, authorized to dobusiness in this state is required to obtain alicense under this chapter but shall comply with allof the other provisions of this chapter.2. The application for the license shallbe in writing, under oath and in the formprescribed by the director. The application shallcontain the name of the applicant; date ofincorporation, if incorporated; the address wherethe business is or is to be conducted and similarinformation as to any branch office of theapplicant; the name and resident address of theowner or partners or, if a corporation orassociation, of the directors, trustees and principalofficers, and such other pertinent information asthe director may require.3. The license fee for each calendaryear or part thereof shall be the sum of threehundred dollars for each place of business of thelicensee in this state. The director may establish abiennial licensing arrangement but in no caseshall the fees be payable for more than one yearat a time.4. Each license shall specify thelocation of the office or branch and must beconspicuously displayed there. In case thelocation is changed, the director shall eitherendorse the change of location on the license ormail the licensee a certificate to that effect,without charge.5. Upon the filing of the application,and the payment of the fee, the director shallissue a license to the applicant to engage in thebusiness of a sales finance company under and inaccordance with the provisions of this chapter fora period which shall expire the last day of2

December next following the date of its issuance.The license shall not be transferable orassignable. No licensee shall transact anybusiness provided for by this chapter under anyother name.the production of all relevant books, records,accounts and documents of licensees and otherpersons with respect to their retail installmenttransactions.2. Any retail buyer having reason tobelieve that this chapter relating to his retailinstallment contract has been violated may filewith the director a written complaint setting forththe details of the alleged violation and the director,upon receipt of the complaint, may inspect thepertinent books, records, letters and contracts ofthe licensee and other persons and of the retailseller involved, relating to the specific writtencomplaint.(L. 1963 p. 466 § 3, A.L. 1986 H.B. 1195, A.L. 2003 S.B. 346)365.040.License denied orsuspended - grounds - hearing and review. - 1.Renewal of a license originally granted under thischapter may be denied, or a license may besuspended or revoked by the director on thefollowing grounds:(1) Material misstatement in theapplication for license;(2) Willful failure to comply with anyprovision of this chapter relating to retailinstallment contracts;(3) Defrauding any retail buyer to thebuyer's n or concealment by the licenseethrough whatever subterfuge or device of any ofthe material particulars or the nature thereofrequired to be stated or furnished to the retailbuyer under this chapter.2.If a licensee is a partnership,association or corporation, it shall be sufficientcause for the suspension or revocation of alicense that any officer, director or trustee of alicensed association or corporation, or anymember of a licensed partnership, has so acted orfailed to act as would be cause for suspending orrevoking a license to the party as an individual.Each licensee shall be responsible for the acts ofany or all of his employees while acting as hisagent, if the licensee after actual knowledge of theacts retained the benefits, proceeds, profits oradvantages accruing from the acts or otherwiseratified the acts.3.No license shall be denied,suspended or revoked except after hearingthereon. The hearing and review thereof shall beconducted according to chapter 536, RSMo.(L. 1963 p. 466 § 5)365.060.Rules and regulations,procedure - subpoenas, enforced how. - 1.The director may adopt and promulgate suchreasonable rules and regulations as shall benecessary to carry out the intent and purposes ofthis chapter. A copy of every rule or regulationshall be mailed to each licensee and to eachbank, trust company, loan and investmentcompany, financing institution, and registrantunder sections 367.100 to 367.200, RSMo,postage prepaid, at least fifteen days in advanceof its effective date, but the failure of a licensee orother person to receive a copy of the rules orregulations does not exempt him from the duty ofcompliance with rules and regulations lawfullypromulgated hereunder. No rule or portion of arule promulgated under the authority of thischapter shall become effective unless it has beenpromulgated pursuant to the provisions of section536.024, RSMo.2. The director shall issue subpoenasto compel the attendance of witnesses and theproduction of documents, papers, books, recordsand other evidence before him in any matter overwhich he has jurisdiction, control or supervisionpertaining to this chapter. The director mayadminister oaths and affirmations to any personwhose testimony is required.3. If any person refuses to obey anysubpoena, or to give testimony, or to produceevidence as required thereby, any judge of thecircuit court of the county in which the licensedpremises are located may, upon application andproof of the refusal, make an order awardingprocess of subpoena or subpoena duces tecumfor the witness to appear before the director andto give testimony, and to produce evidence asrequired thereby. Upon filing the order, in theoffice of the clerk of the court, the clerk shall issueprocess of subpoena, as directed, under the sealof the court, requiring the person to whom it is(L. 1963 p. 466 § 4)365.050.Director may examinepersons, inspect records - complaints ofviolations. - 1.The director, or his dulyauthorized representative, may make suchinvestigation as he shall deem necessary and, tothe extent necessary for this purpose, he mayexamine the licensee or any other person havingpersonal knowledge of the matters underinvestigation, and shall have the power to compelRev. 8/143

You are entitled to an exactcopy of the contract you sign.Under the law you have the rightto pay off in advance the full amount dueand to obtain a partial refund of the timeprice differential."directed, to appear at the time and place thereindesignated.4. If any person served with anysubpoena refuses to obey the same, and to givetestimony, and to produce evidence as requiredthereby, the director may apply to the judge of thecourt issuing the subpoena for an attachmentagainst the person, as for a contempt. The judge,upon satisfactory proof of the refusal, shall issuean attachment, directed to any sheriff, constableor police officer, for the arrest of the person, and,upon his being brought before the judge, proceedto a hearing of the case. The judge may enforceobedience to the subpoena, and the answering ofany question, and the production of any evidencethat may be proper by a fine, not exceeding onehundred dollars, or by imprisonment in the countyjail, or by both fine and imprisonment, and tocompel the witness to pay the costs of theproceeding to be taxed.3. The contract shall also contain, in asize equal to at least ten point bold type, a specificstatement that liability insurance coverage forbodily injury and property damage caused toothers is not included if that is the case.4. The seller shall deliver to the buyer,or mail to him at his address shown on thecontract, a copy of the contract signed by theseller. Until the seller does so, a buyer who hasnot received delivery of the motor vehicle mayrescind his agreement and receive a refund of allpayments made and return of all goods traded into the seller on account of or in contemplation ofthe contract, or if the goods cannot be returned,the value thereof. Any acknowledgment by thebuyer of delivery of a copy of the contract shall bein a size equal to at least ten point bold type and, ifcontained in the contract, shall appear directlyabove the buyer's signature.5.The contract shall contain thenames of the seller and the buyer, the place ofbusiness of the seller, the residence of the buyerand a brief description of the motor vehicleincluding its make, year model, model andidentification numbers or marks.6.The contract shall contain thefollowing items:(1) The cash sale price of the motorvehicle;(2) The amount of the buyer's downpayment, and whether made in money or goods,or partly in money and partly in goods, including abrief description of the goods traded in;(3) The difference between items oneand two;(4) The aggregate amount, if any, if aseparate identified charge is made therefor,included for all insurance on the motor vehicleagainst loss, damage to or destruction of themotor vehicle, specifying the types of coverageand period;(5) The aggregate amount, if any, if aseparate identified charge is made therefor,included for all bodily injury and property damageliability insurance for injuries to the person orproperty of others, specifying the types ofcoverage and coverage period;(6) The aggregate amount, if any, if aseparate identified charge is made therefor,included for all life, accident or health insurance,(L. 1963 p. 466 § 6, A.L. 1993 S.B. 52, A.L. 1995 S.B. 3)365.070. Retail installment contractsto be in writing - form, contents. - 1. Each retailinstallment contract shall be in writing, shall besigned by both the buyer and the seller, and shallbe completed as to all essential provisions prior tothe signing of the contract by the buyer. Inaddition to the retail installment contract, the sellermay require the buyer to execute and deliver anegotiable promissory note to evidence theindebtedness created by the retail installmenttransaction and the seller may require security forthe payment of the indebtedness or theperformance of any other condition of thetransaction. Every note executed pursuant to aretail installment contract shall expressly state thatit is subject to prepayment privilege required bylaw and the refund required by law in such cases.Any such note, if otherwise negotiable under theprovisions of sections 400.3-101 to 400.3-805,RSMo, shall be negotiable. The retail installmentcontract may evidence the security.2. The printed portion of the contract,other than instructions for completion, shall be inat least eight point type. The contract shallcontain the following notice in a size equal to atleast ten point bold type:"Notice to the Buyer.Do not sign this contract beforeyou read it or if it contains any blankspaces.Rev. 8/144

specifying the types of coverage and coverageperiod;(7) The amounts, if any, if a separateidentified charge is made therefor, included forother insurance and benefits, specifying the typesof coverage and benefits and the coverageperiods and separately stating each amount foreach insurance premium or benefit;(8) The amount of official fees;(9) The principal balance which is thesum of items (3), (4), (5), (6), (7) and (8);10) The amount of the time pricedifferential expressed in the contract as a percentper annum;(11) The total amount of the timebalance stated as one sum in dollars and cents,which is the sum of items (9) and (10), payable ininstallments by the buyer to the seller, the numberof installments, the amount of each installmentand the due date or period thereof based on thecontract's original amortization schedule; and(12) The time sale price. The aboveitems need not be stated in the sequence or orderset forth.vehicle and is purchased by the holder, it shall besubject to the limitations provided for in theregulations promulgated and issued by the directorpursuant to the provision of subsection 1 ofsection 365.060. The holder shall within thirty daysafter the execution of the retail installment contractsend or cause to be sent to the buyer a policy orcertificate of insurance, clearly setting forth theamount of the cost of the policy or certificate ofinsurance, the kinds of insurance, and, if a policy,all the terms, exceptions, limitations, restrictionsand conditions of the contract of insurance, or, if acertificate, a summary of the certificate. The sellershall not decline existing insurance written by aninsurance company authorized to do business inthis state and the buyer shall have the privilege ofpurchasing insurance from an agent or broker ofhis own selection and of selecting his insurancecompany; except, that the insurance companyshall be acceptable to the holder, and further, thatthe inclusion of the cost of the insurance in theretail installment contract when the buyer selectshis agent, broker or company, shall be optionalwith the seller.2. If any insurance is canceled, or thepremium adjusted, any refund of the insurancepremium received by the holder shall be creditedto the final maturing installments of the contractexcept to the extent applied toward payment forsimilar insurance protecting the interests of thebuyer and the holder or either of them.3. The amount of any life insuranceshall not exceed the amount of the total unpaidbalance from time to time; except, that where thebuyer's obligation is repayable in payments whichare not substantially equal in amount, theinsurance may be level term insurance in anamount which shall not exceed by more than fivedollars the time balance as determined undersubsection 6 of section 365.070.4. Nothing in this chapter shall beconstrued to prohibit the sale of a deficiencywaiver addendum, guaranteed asset protection,extended service contract, or other similarproducts purchased at the time of sale, as part ofa retail sale transaction involving any motorvehicle, or including the cost therefor within aretail installment transaction, provided therequirements of section 365.070 are met.(L. 1963 p. 466 § 7, A.L. 1969 H.B. 670 merged with H.B. 684,A.L. 2002 H.B. 2008)365.080. Insurance included in retailinstallment transactions - restrictions. - 1. Theamount, if any, included in any retail installmenttransaction for insurance, if a separate identifiedcharge is made for the insurance, which insurancemay be purchased by the holder of the contract,shall not exceed the applicable premiumschargeable in accordance with the rates approvedby the department of insurance, financialinstitutions and professional registration of thisstate where the rates are required by law to beapproved by the department. All insurance shallbe written by an insurance company authorized todo business in this state and all policies written inthis state shall be countersigned by a dulylicensed resident agent authorized to engage inthe insurance business in this state, unlessotherwise provided by law. A buyer may berequired to provide insurance on the motor vehicleat his own cost for the protection of the seller orholder, as well as the buyer, but the insuranceshall be limited to insurance against substantialrisk of loss, damage or destruction of the motorvehicle. Any other insurance, including insuranceproviding involuntary unemployment coverage,may be included in a retail installment transactionat the buyer's expense only if contracted forvoluntarily by the buyer. If the insurance for whichthe identified charge is made insures the safety orhealth of the buyer or his interest in the motorRev. 8/14(L. 1963 p. 466 § 8, A.L. 1989 H.B. 615 & 563, A.L. 2004 S.B.1233, et al.)365.090. Transfer of equity in motorvehicle - fee. - A buyer may transfer his equity inthe motor vehicle in which the holder has aproperty interest at any time to another personupon agreement by the holder, but in that event5

and if the original buyer is released from furtherliability the holder of the contract shall be entitledto a transfer of equity fee which shall not exceedfifteen dollars.its execution, and except that the contract may beso signed provided the buyer is given at the timeof the execution a bill of sale, invoice or similarmemorandum clearly indicating the cash saleprice, the gross down payment and the types ofinsurance coverage.The buyer's writtenacknowledgment, conforming to the requirementsof subsection 4 of section 365.070, of delivery of acopy of a contract shall be conclusive proof of thedelivery, that the contract when signed did notcontain any blank spaces except as hereinprovided, and of compliance with section 365.070in any action or proceeding by or against a holderof the contract without knowledge to the contrarywhen he purchased the contract.(L. 1963 p. 466 § 9)365.100.Late payment charges,interest on delinquent payments, attorney fees- dishonored or insufficient funds fee. - Forcontracts entered into on or after August 28, 2005,if the contract so provides, the holder thereof maycharge, finance, and collect:(1) A charge for late payment on eachinstallment or minimum payment in default for aperiod of not less than fifteen days in an amountnot to exceed five percent of each installment dueor the minimum payment due or twenty-fivedollars, whichever is less; except that, a minimumcharge of ten dollars may be made, or when theinstallment is for twenty-five dollars or less, acharge for late payment for a period of not lessthan fifteen days shall not exceed five dollars,provided, however, that a minimum charge of onedollar may be made;(2) Interest on each delinquentpayment at a rate which shall not exceed thehighest lawful contract rate. In addition to suchcharge, the contract may provide for the paymentof attorney fees not exceeding fifteen percent ofthe amount due and payable under the contractwhere the contract is referred for collection to anyattorney not a salaried employee of the holder,plus court costs;(3) A dishonored or insufficient fundscheck fee equal to such fee as provided in section408.653*, RSMo, in addition to fees charged by abank for each check, draft, order or like instrumentwhich is returned unpaid; and(4) All other reasonable expensesincurred in the origination, servicing, andcollection of the amount due under the contract.(L. 1963 p. 466 § 11)365.120.Time price differential,computed how. - 1. Notwithstanding theprovisions of any other law, the time pricedifferential included in a retail installmenttransaction on any motor vehicle without regard tothe year model designated by the manufacturer,the retail seller may charge, contract and receiveany time price differential agreed to by the retailbuyer, expressed in the contract as a percent perannum that shall apply to the contract regardlessof its repayment schedule.2. The time price differential shall becomputed on the principal balance as a percentper annum. A minimum time price differential oftwenty-five dollars may be charged on any retailinstallment transaction.(L. 1963 p. 466 § 12, A.L. 1980 H.B. 1195, A.L. 1981 S.B. 5Revision, A.L. 2002 HB 2008)365.125. Rates, parties may agree toa rate, restrictions. - As an alternative to the timeprice differential authorized by section 365.120,the parties may agree to any rate or amount oftime price differential not exceeding a rate oramount authorized by section 408.450, RSMo, butany such agreement shall be subject to therestrictions and conditions of sections 408.450 to408.467, RSMo.(L. 1963 p. 466 § 10, A.L. 1994 S.B. 718, A.L. 2002 S.B. 895,A.L. 2004 S.B. 1233, et al.)*Section 408.653 was repealed by H.B. 221 and also S.B. 346in 2003.(L. 1984 H.B. 1170)365.110. Blank s

a sale of a motor vehicle by a retail seller to a retail buyer on time under a retail installment contract for a time sale price payable in one or more deferred installments; (12) "Retail seller" or "seller", a person who sells a motor vehicle, not principally for resale, to a retail buyer under a retail installment contract; (13) "Sales .