Transcription

Fast Settlement ServiceInformation Paper 3Requirements PhaseApril 2014Fast PaymentsSPRINT Program

GlossaryBelow is a list of selected terms used in this document. Relevant definitions have been adoptedfrom documents related to the New Payments Platform.Addressing ServiceA service that delivers the ability to identify an account at a Participant as thedestination for a message using the Alias Identifier (such as a mobile phonenumber or email address) of the Payee rather than the account number.ADIAuthorised deposit-taking institution. ADIs (banks, building societies and creditunions and other ADIs) are supervised by the Australian Prudential RegulationAuthority (APRA).Alias IdentifierThe unique identifier of an Alias. Examples include a phone number or an emailaddress.BasicInfrastructure (BI)The set of proposed arrangements comprising a Switch, Addressing Service,communications network and linked RBA real-time settlement through the FastSettlement Service.ExchangeSettlementAccount (ESA)An account held at the RBA by financial institutions to settle financial obligationsarising from the clearing of payments.Fast SettlementService (FSS)The RBA RITS settlement service that will be used by the Basic Infrastructure tocomplete transfer of value associated with NPP payments.FSS AllocationThe portion of the RITS Member’s Exchange Settlement (ES) Funds balanceavailable to the Fast Settlement Service for settlement of New Payments Platform(NPP) payments.Initial ConvenienceService (ICS)The proposed set of arrangements constituting the first Overlay Service. The RealTime Payment Committee’s proposal is for the ICS to focus on personalconvenience payments, particularly those using mobile channels.Overlay ServiceA payment service that connects to the Basic Infrastructure to provide addedfunctionality to users. Overlay services are likely to be tailored to particularcontexts and/or types of customers and may be commercial and competitive innature.Payee ParticipantThe participating institution of the Payee. The Payee Participant is responsible forclearing a payment instruction coordinated by the Basic Infrastructure. PayeeParticipants may include ADIs, Non-ADIs and other payment service providers.[For the purposes of this paper, it is assumed that the Payee Participant is an ESAholder]Payer ParticipantAn institution participating in the NPP capable of initiating payment instructionsinto the Basic Infrastructure for clearing and settlement. Payer Participants mayinclude ADIs, Non-ADIs and other payment service providers. [For the purposes ofthis paper, it is assumed that the Payer Participant is an ESA holder]Reserve BankInformation andTransfer System(RITS)Australia's real-time gross settlement (RTGS) system, which is used by banks andother approved institutions to settle obligations arising from the exchange ofpayments and securities transactions. RITS shares its user interface and liquiditywith the FSS. FSS is a separate 24x7 infrastructure for high speed settlement ofhigh volume NPP payments.RITS AllocationThe portion of the RITS Member’s ES Funds balance available to RITS for RTGSsettlements during RITS opening hours.SwitchThe component of the Basic Infrastructure that provides Switching Servicesincluding the receipt and transmission of messages to other components andParticipants of the NPP.Utility CompanyThe proposed mutual organisation, which will own and govern the NPP BasicInfrastructure. The Utility Company's membership consists of Participants andother approved entities.1

IntroductionThe Fast Settlement Service (FSS) will be a new RITS service supporting settlement ofpayments from the New Payments Platform (NPP). The FSS will provide line by linesettlement of individual Settlement Requests received from the NPP’s Switch provider,testing each request against the paying participant’s balance of Exchange Settlement(ES) Funds in the FSS in near real time. If testing is successful, settlement will occurirrevocably and unconditionally.During February/March 2014, the Reserve Bank held consultation meetings with eachNPP participant1 to discuss their liquidity management, monitoring, reporting andalerting requirements in relation to the FSS. This Information Paper has been updatedto include the outcomes of this consultation process. It replaces FSS Information Paper2 issued in February 2014.BackgroundIn June 2012, the Payments System Board (PSB) of the RBA released its StrategicReview of Innovation in the Payments System: Conclusions. The PSB identified certainstrategic objectives that it considered would address gaps in the payments system. Oneof the key objectives was the establishment of a system that would provide real-timeretail payments, with real-time funds availability, by the end of 2016. In November2012, the PSB endorsed the RBA Core Criteria as the framework to assess any industryProposal. In February 2013, the Real-Time Payments Committee (RTPC) established bythe Australian Payments Clearing Association (APCA), finalised a Proposal to deliver afast payments solution for Australia. The Payments System Board (PSB) welcomed theProposal as making substantial initial progress towards meeting the strategic objectivesestablished.The Proposal aimed to deliver the strategic objectives by facilitating fast payments forconsumers and businesses by end 2016. This includes the ability to send moreremittance information with payments, provide for easier addressing of payments as analternative to specifying a BSB and account number, and enable close to immediatefunds availability to the recipient on a 24x7 basis. The Proposal addressed the gapsthrough a layered solution consisting of the Basic Infrastructure (BI) and OverlayServices, including an Initial Convenience Service, intended to address the customerpropositions (e.g. real-time funds availability).In June 2013, the industry initiated the NPP project to deliver the program and createda program Steering Committee (which includes RBA representation) to oversee itsdelivery. The NPP Program will establish a Utility Company which will be an industryowned and operated mutual company responsible for the operation of the BI. Currently16 Authorised Deposit-Taking Institutions (ADIs) and the RBA have signed up tosupport the NPP Program and its funding. The Program has recently completed theplanning and requirements phase for the NPP and is currently involved in the process ofselecting a suitable vendor for the provision of BI services. The NPP SteeringCommittee will remain responsible for the project until its implementation.NPP OverviewThe BI will consist of three main components: Network services, Switch services, andan Addressing Service. Settlement services will be provided by the FSS. The BI willsupport the exchange of fast, flexible payments messaging between ADIs and otherapproved participants. The FSS will provide for the immediate settlement of NPPtransactions using Exchange Settlement (ES) Funds.1Meetings were held with NPP participants who hold an Exchange Settlement Account.2

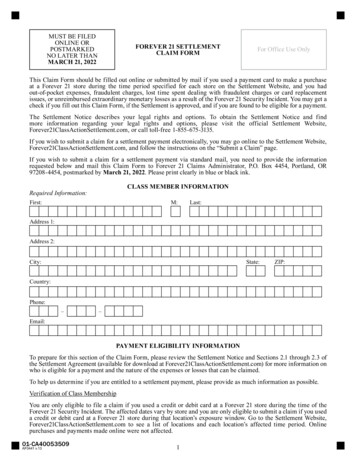

Overlay Services will use the BI to offer payment schemes and services tailored toparticular contexts and types of customers, and may be commercial and competitive innature. The industry has a process in place to determine the services to be provided byan Initial Convenience Service (ICS), as the first Overlay Service, and to identify avendor to provide these services. It is anticipated that the ICS will be ready tocommence operation at the same time as the BI. Participation in the ICS may requireminimum service standards for ADIs such as timely funds to customer accounts.Participants in the BI will be able to send credit payments to each other without theneed to join Overlay Services. However, the BI will not specify any ADI/customerstandards, including any minimum timing for funds availability to the payee.Figure 1 below provides a simplified view of the proposed solution components using a‘Clearing before Settlement’ model. Each credit payment instruction received by theSwitch (flow 1) will be validated and passed on to the Payee Participant (flow 2). ThePayee Participant will confirm that it has received a valid payment for processing(including validation of the Payee account) and will respond with a confirmation back tothe Switch (flow 3) within a specified timeframe. The Switch will pass this confirmationback to the Payer Participant (flow 4) and send a Settlement Request to the FSS (flow5). Following receipt of a Settlement Response from the FSS (flow 6), the Switch willgenerate a Settlement Notification message to both the Payer and Payee Participant(flow 7). In the event that the FSS is unavailable clearing may still continue. Theserelationships are shown in Figure 1 below.Figure 1: Simplified NPP Business FlowsThe Fast Settlement ServiceThe FSS, including systems, software IP and settlement message formats, will beowned and operated by the RBA. The FSS will have an interface to the BI Switch tofacilitate settlement processing for each NPP payment. Although the FSS is part ofRITS, the settlement processes used by the FSS will be independent from the existingRITS system queue and settlement testing process. Each Exchange Settlement Account(ESA) holder will continue to have only one ESA; however funds within the ESA will bespecifically allocated to RITS and to the FSS.3

Each valid payment instruction received will be tested for settlement against the payingESA Holder’s FSS Allocation, and will either settle if there are sufficient ES Funds, or berejected. Rejected payments will not be queued for retesting. Based on the currentrequirements, the FSS will authenticate Settlement Requests directly with the Switchrather than the individual Participants2.The FSS Project comprises an IT system build, associated changes to RITS, connectivityto the BI Switch and the introduction of 24x7 operations. The FSS will target equivalentor higher levels of resilience, availability and performance as the Switch. The existingsettlement arrangements and session times in RITS for other payment systems willremain unchanged.Liquidity arrangementsNew liquidity arrangements for ESA holders were implemented in November 2013 tofacilitate the late evening settlement of direct entry obligations. These liquidity facilitieswill provide the basis for supporting the operation of the FSS on a 24x7 basis. As partof its regular reviews of Member open repo positions, the RBA’s Domestic MarketsDepartment will liaise with RITS Members on their liquidity requirements in advance ofthe introduction of the FSS.Legal basisThe FSS will operate as a RITS service, governed by the RITS Regulations andConditions of Operation. The relationship between the Reserve Bank and the UtilityCompany is expected to be governed by a separate legal agreement.The FSS will provide irrevocable and unconditional settlement finality in the samemanner as other transactions settled across RITS.AccessParticipants in the NPP (ADIs and other approved entities) must either operate theirown ESA at the RBA or use another ESA holder as their settlement agent. ADIs andother approved entities that do not currently operate an ESA, and are admitted into theNPP, may be eligible to establish an ESA and operate it for the FSS only.The FSS will be available to any ESA Holder for settlement of obligations arising fromthe NPP (subject to any particular conditions of an ESA holder’s RITS membership, as isthe case now). It is possible that the FSS could be used by other payment hubs.Operational standardsAs the FSS forms part of the RITS system, it will be treated by the RBA as part of itscritical payments infrastructure. The FSS will have: High availability – remain operational even if the RITS functionality for high-valuesettlement is temporarily unavailable High performance – target a very high Transactions per Second (TPS) capabilityto provide real-time settlement while meeting response time requirements.Initially the FSS is targeting to achieve around 1,000 TPS (a single transactioninvolves processing a Settlement Request and returning a Settlement Response) A high degree of security Scalability to meet growth in payments volumes.2 This is an element of the ‘trust model’ which is still under discussion with the Industry.4

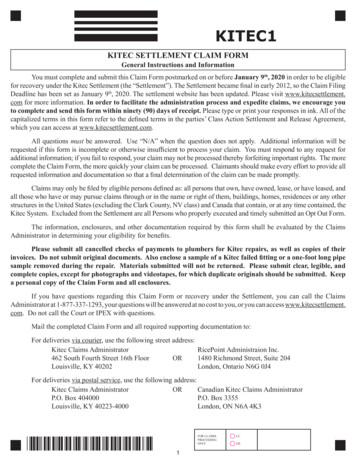

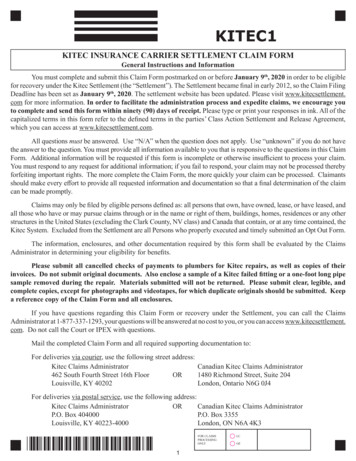

Business continuity plans for the FSS will aim for continuation of settlement, includingin the event of a wide-scale disruption, and rapid recovery of operations in the event ofan outage. This will require highly resilient architecture with high availability and nosingle point of failure across multiple sites.FSS High Level ScheduleThe FSS delivery is a stream of work within the overall NPP program. The RBA reportsthe progress on the FSS project to the NPP Steering Committee on a monthly basis.The following diagram provides an outline of the current indicative BI and related FSStimetable and key milestones for Members.Figure 2: BI and FSS Summary SchedulesIn determining the final FSS design, the RBA will be consulting with the selected BISwitch vendor to validate the FSS interface requirements. The FSS schedule aims toensure that the design and build will be completed ahead of the BI schedule, so as notto be on the critical path of the industry project.System FunctionalitySettlement processEach eligible Settlement Request, irrespective of its value, will be tested for settlementagainst the Payer Participant’s ESA credit balance available to the FSS (called the FSSAllocation), as illustrated in Figure 3 below. If a Settlement Request fails due toinsufficient funds or any other validation error, it will be rejected, without thesettlement being completed. There will be no provision for a failed Settlement Requestto be queued and retested.ESA holders will be encouraged to ensure that there is always a sufficient level of ESFunds available for FSS settlement. Unlike RITS, there will be no facilities available tochange the order or priority of Settlement Requests processed by the FSS. Uponsuccessful settlement, the Payee Participant’s FSS Allocation will be credited5

simultaneously with the debiting of the Payer’s FSS Allocation. This will removesettlement risk from the exchange of NPP payments.This settlement model obviates the need for complex batch processes and failure tosettle arrangements.Figure 3: Key interactions between the FSS and the Switch The Switch creates a Settlement Request based on the details of a cleared valid payment and sends it to theFSS for settlement. FSS receives the Settlement Request and carries out validations. If any of the validations fail, the SettlementRequest is rejected with an appropriate code in the Settlement Response. The FSS will not validate any daterelated information. FSS settles valid Settlement Requests by debiting the Payer Participant and crediting the Payee ParticipantFSS Allocations based on the details of the underlying Settlement Request. FSS sends information about the settled transaction or the rejected Settlement Request back to the Switchwith relevant settlement or rejection details. For settled transactions, this is expected to include, as aminimum, the Settlement date/time and resulting FSS Allocation for both Payer and Payee Participants. Thesettlement dates will rollover at midnight. The Switch receives the settlement details and sends it to the Payee Participant and the Payer Participant.This step enables the Payer and Payee Participants to receive confirmation on whether interbanksettlement is complete for that payment instruction or whether it has been rejected.6

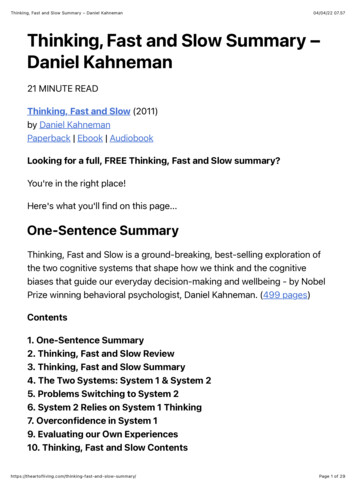

Liquidity management - Allocation TransfersThe RITS user interface will provide members with access to view their FSS Allocation,settled transactions and any related administration functionality. RITS Members willalso be able to view their Total ESA Balance (including their FSS Allocation) at any timethrough the user interface. Existing RITS functionality will be upgraded to assist withthe management of a Member’s FSS Allocation through automated allocation tools (seeFigure 4 below) during RITS settlement hours, and for enquiries, reports andstatements.The proposed liquidity management arrangements will enable RITS Members to setupper and lower trigger points to automatically allocate ES Funds to or from the FSSAllocation (see Figure 4 below) so that: If the balance in the FSS Allocation falls below the lower trigger point (in theexample below, 10 million), RITS will automatically initiate a top-up from theRITS Allocation to restore the FSS Allocation to a Member nominated reset point(which must be between the upper and lower trigger points). These top-uprequests will have a “Priority” status on the RITS queue. If the balance in the FSS Allocation rises above the upper trigger point (in theexample below, 50 million), funds above the reset point will be automaticallywithdrawn from the FSS Allocation and those ES Funds will be added to the RITSAllocation.The use of upper and lower trigger points to automatically top-up or withdraw fundsbetween RITS and the FSS will only occur during RITS settlement hours. This will helpensure that the FSS Allocation balance stays within a Member determined range duringRITS settlement hours.ESA holders will also be able to manually request the FSS balance be moved back tothe defined reset point during RITS hours.ES Funds not allocated to the FSS will be available for other settlements in RITS.Figure 4: ES Funds Allocations between FSS and RITSDuring periods when RITS is not open for settlement, the FSS Allocation will revert tothe Member’s entire ES Funds balance. When RITS reopens for settlement eachbusiness day morning, the FSS Allocation will be returned to the Member nominatedreset point with excess ES Funds transferred to the RITS Allocation.7

AlertsA suite of alerts and advices will be set up in the FSS to provide Members withautomated notifications when certain triggers or events occur. These optional alerts willbe generated when: an Allocation Transfer occurs (only applicable during RITS settlement hours) an FSS top-up request to RITS does not immediately settle (only applicableduring RITS settlement hours) there is an FSS settlement failure due to lack of funds the FSS balance falls below a Member-nominated level(s)Email and SMS alerting capability will be provided. Members will be able to nominate upto 5 email addresses and 10 mobile phone numbers to receive these alerts.Additionally, an optional periodic email advice providing relevant FSS information willbe produced and sent to Members outside of normal RITS settlement hours.ESA interestESA interest will be calculated on the basis of total end-of-day ESA balance, atmidnight, seven days a week. ES Funds in both the RITS Allocation and FSS Allocationwill be included in the end of day calculation. Interest will be paid monthly in arrears asis the case with existing ESA interest payments i.e. on the first RITS business day ofeach month.ReportingStatements and reports will be available for transactions settled in the FSS. Reports willinclude a daily listing of all settled NPP transactions and a daily listing of all settledAllocation Transfers. Members may elect to receive these reports via SWIFT FileAct orCOIN in either (ISO XML or CSV format) or alternatively download them via the RITSuser interface (PDF or Excel).It is expected that existing RITS reports (i.e. for RTGS transactions) will remain largelyunchanged. The SWIFT End of Day ESA statement (MT950) will be amended to includeone line item representing the net FSS movement for the calendar day. The statementwill be sent seven days a week shortly after midnight.Internal monitoring of FSS AllocationA few ESA holders currently mirror their running RITS ESA balances within their internalsystems through the combination of unsolicited advices from RITS (via SWIFT FIN) andthe Fin-Copy Settlement Response for SWIFT high-value payments. These messageswill continue to be provided, and the unsolicited advices will include the option of beingadvised of top-up and withdrawal transactions that change the RITS Allocation.For NPP settlements, the FSS will return the resulting FSS Allocation balance for bothPayer Participant and Payee Participant in the Settlement Response to the Switch,which will then send the relevant notification to the respective parties. No separatemessage will be provided to advise the resulting FSS Allocation balance after anAllocation Transfer has taken place.FeesThe RBA intends to operate the FSS using cost recovery principles similar to RITS.These currently provide for the RBA to recover its operating costs from Members, withthe capital and development costs of major upgrades and functional enhancementsbeing absorbed as a policy-related expense. The RBA is in the process of determining8

the fee structure for the FSS to assist the industry in making price related decisions.The NPP Steering Committee will be advised of these estimates in due course.Next stepsThe RBA is in the process of incorporating feedback from the FSS Member consultationsinto business specifications. Once the industry firms up on the NPP vendor, the externaldesign of the FSS will be finalised and issued to NPP Members. This process is expectedto complete by the end of 2014. The final build of the FSS is expected to complete aftermid-2015 by when it will be ready for external testing with the BI Switch.Updates to this Information PaperThis Information Paper will be updated from time to time to reflect developments anddecisions taken relating to the FSS.Further InformationQuestions about the Fast Settlement Service should be directed to:Warren WiseSenior Manager, Payment System ProjectsPayments Settlements Departmentwisew@rba.gov.au (61 2) 9551 9894OrDavid BrownProgram DirectorPayments Settlements Departmentbrownd@rba.gov.au (61 2) 9551 9952Payments Settlements Department14 April 20149

The Fast Settlement Service (FSS) will be a new RITS service supporting settlement of payments from the New Payments Platform (NPP). The FSS will provide line by line settlement of individual Settlement Requests received from the NPP's Switch provider, testing each request against the paying participant's balance of Exchange Settlement