Transcription

Cost ReportingJulie Quinn, CPAVP, Cost Reporting & ProviderEducationHealth Services AssociatesSoutheast Regional OfficeHealth Services Associates, Inc.Promoting Access to Health Care2 East Main StreetFremont, MI 49412Ph: 231.924.0244Fx: 231.924.488254 Pheasant LnRinggold, GA231.250.0244888.200.4788

Objectives What you need to need to complete thecost reportWhere it is located on the cost reportCommon cost report calculationsHealth Services Associates, Inc.

RHC DesignationProvider based – owned, operated byHospital, SNF, HHA (Schedule M)Independent – (Freestanding) – may beMD/DO owned, privately owned orowned by other health professionals(CMS Form 222)Health Services Associates, Inc.

Why a Cost Report? Cost reports are due five months afterFYE Medicare will cut off payments to theclinic for an unfiled cost reportHealth Services Associates, Inc.

Why a Cost Report? Reconciles Medicare’s interim payment method toactual cost per visit Allowable RHC Costs/RHC Visits RHC Cost PerVisit RHC rate; not to exceed the maximumallowable reimbursement rate for current period Determines future reimbursement rates Reimburses for Pneumococcal and Influenzavaccine costsHealth Services Associates, Inc.

RHC Cost Report Cost reports must be submitted in electronicformat (ECR File) on CMS approved vendorsoftware via CD.Signed Hard Copy must also be submittedwith an electronic “fingerprint” matching theelectronic cost report.Health Services Associates, Inc.

Cost ReportingInformation Neededto Completethe RHC Cost ReportHealth Services Associates, Inc.

Information Needed to Completethe RHC Cost Report Financial Statements Visits by type of practitioner Clinic hours of operation FTE calculations Total number of clinical staff hours workedduring the cost report period.Health Services Associates, Inc.

Information Needed to Completethe RHC Cost Report Salaries by employee type Vaccine Information Related Party Transactions Depreciation ScheduleHealth Services Associates, Inc.

Information Needed to Completethe RHC Cost Report Medicare Bad Debt Laboratory Costs Non-RHC X-ray Costs PSR - obtained on-line through IACSHealth Services Associates, Inc.

Information Needed to Completethe RHC Cost ReportNEW FOR 2011 and forward:Preventative Charges for MedicareBeneficiariesHealth Services Associates, Inc.

Worksheet SStatistical DataReportingPromoting Access to Health Care

Statistics on Worksheet S –Independent/S-8 Provider Based Facility Name Entity Status Hours of Operation If combined cost report for multiple locations,worksheet S, Part III If filing a ‘No Utilization’, “N” for line 13(independent)Health Services Associates, Inc.

Clinic Hours of Operation Should reflect hours practitioners areavailable to see patientsBroken between hours operating as an RHCor a Non-RHC, if applicableReported on worksheet S, lines 11 & 12(independent)Reported in military time formatHealth Services Associates, Inc.

Worksheet A / Worksheet M-1ExpenseReportingPromoting Access to Health Care

Financial Statements Balance Sheet Profit and Loss Statement Trial BalanceHealth Services Associates, Inc.

Financial Statements Must match cost reporting period–– For most this will be 1/1/12 – 12/31/12.For new clinics in 2012, financial statements mustreflect costs from the date of the clinic’scertification to 12/31/12.Reasonable & NecessaryHealth Services Associates, Inc.

Financial Statements All costs from the financial statements mustbe reflected in columns 1 and 2 of worksheetA (independent) or M-1 (provider-based)–– Column 1: CompensationColumn 2: All OtherExpenses should be detailed enough toproperly classify within cost report categoriesHealth Services Associates, Inc.

Cost Report CategoriesCost Report has three main cost classifications:–Healthcare Costs–Facility Overhead–Non-RHC/Non-AllowableHealth Services Associates, Inc.

Cost Report CategoriesHealthcare Costs Compensation for providers, nurses andother healthcare staff Compensation for physician supervision Cost of services and supplies incident toservices of physicians (including drugs &biologicals incident to RHC service) Cost related to the maintenance of licensesand insurance for medical professionalsHealth Services Associates, Inc.

Allowable Cost of Compensation– Health Care Staff Salaries & Wages Paid vacation or leave, including holidaysand sick leave Educational courses Unrecovered cost of medical servicesrendered to employeesHealth Services Associates, Inc.

Physicians Services UnderAgreement Supervisory services of non-owner, nonemployee physician Medical services by non-owner, nonemployee physician at clinic (can be cost orfee-for-service) Medical services by non-owner, nonemployee physician at location other thanclinic (can be cost or fee-for-service)Health Services Associates, Inc.

Other Health Care Costs Malpractice and other insurance (Premiumcan not exceed amount of aggregatecoverage)DepreciationTransportation of Health Center PersonalOverhead Costs: FacilityAdministrationHealth Services Associates, Inc.

Facility OverheadFacility Overhead – Facility Cost Rent Insurance Interest on Mortgage or Loans Utilities Other building expensesHealth Services Associates, Inc.

Facility OverheadFacility Overhead – Administrative Office Salaries Office Supplies Legal/Accounting Contract Labor Other Administrative CostsHealth Services Associates, Inc.

Prudent Buyer PrincipleThe Prudent & Cost Conscious Buyer: Refuses to pay more than going price for anitem or service. Seeks to economize by minimizing cost.Health Services Associates, Inc.

Worksheet A-1 / A-2 - IndependentAdjustments toCostPromoting Access to Health Care

Adjustments Worksheet A-1:Used to reclassify costs toappropriate cost centers Worksheet A-2: Used to include additional orexclude non-allowable costsHealth Services Associates, Inc.

Lab/X-ray/EKG AllocationsWorksheet A-1Lab, X-ray, EKG Billed to Part B by independent RHCs Billed through hospital and included inhospital costs for provider-based RHCsHealth Services Associates, Inc.

Lab/X-ray/EKG AllocationsWorksheet A-1 Staff performing lab, X-ray, EKG duties Allocate % of time for non-RHC carve out forstaff performing non-RHC lab/X-ray/EKGduties vs. RHC duties Time studies of staff to support the allocatedcarve outHealth Services Associates, Inc.

Healthcare Wages AllocationsWorksheet A-1 Cost report calculations require wages to beclassified by practitioner type/healthcareworker qualificationsMost clinics do not have separate accountson their financials for each type of healthcareprovider/employeeA reclassification is often required to ensureproper classification of healthcare staffwagesHealth Services Associates, Inc.

Administrative AllocationsWorksheet A-1 If a practitioner also performs administrativeduties for the clinic, a portion of theircompensation should be reflected in theOffice Salaries cost centerA reclassification may be requiredCalculate administrative reclassificationbased on ratio of administrative timeMAINTAIN TIME STUDIESHealth Services Associates, Inc.

Non-allowable Costs – Wksht A-2 EntertainmentGiftsCharitable ContributionsAutomobile Expense – where not related topatient carePersonal expenses paid out of clinic fundsHealth Services Associates, Inc.

Other CostsAdvertising Costs: Staff recruitmentadvertising allowable Yellow pages advertisingallowable Advertising to increasepatients not allowable Fund-raising advertising,not allowableTaxes: Taxes levied by state andlocal governments areallowable if exemption notavailable Fines and penalties notallowableHealth Services Associates, Inc.

Other CostsMembership Costs:Generally Professional, technical or business relatedorganization allowable Social & Fraternal not allowableResearch costs not allowableTranslation services costs allowableHealth Services Associates, Inc.

Non-RHC Expenses/Carve outsWorksheet A-1 or A-2Where an RHC operates for certain specifiedhours as a non-RHC, a carveout/reclassification of related cost isnecessary. See recent updates to Medicare BenefitPolicy Manual – Section 90 – are benefit policy manual - rev. 1-31-13.pdf Health Services Associates, Inc.

Inpatient Allocations – Wksht A-2 Keep time studies for practitionersCalculate ratios: Clinic time versus InpatienttimeExclude compensation and benefit costsrelated to Inpatient activities (calculatedusing ratios above)Health Services Associates, Inc.

Adjustments to MedicareDepreciation Schedule – A-2 Date Asset PurchasedDescription of AssetCost of AssetTax basis depreciation must be adjusted toMedicare (Straight Line) depreciationHealth Services Associates, Inc.

Worksheet B / Worksheet M-2Visit ReportingPromoting Access to Health Care

RHC Visits Definition: Face-to-face encounter withqualified provider during which coveredservices are performed.Issues: RHCs count non-billableencounters* No Charges* Injections* Non-qualified providers* Non-covered servicesHealth Services Associates, Inc.

RHC Visits Broken down by provider type (MD, PA, NP) Count only face-to-face encounters Do not include visits for hospital, noncovered services, non qualified providers orinjectionsHealth Services Associates, Inc.

FTE CalculationHow are FTEs calculated? FTE is based upon how many hours thepractitioner is available to provide patient care FTE is calculated by practitioner type(Physician, PA, NP)Health Services Associates, Inc.

Hours worked for FTE Calculation Only clinical hours should be used in the FTEcalculationCategorize each practitioner’s work into:– Administrative (used to reclassify wages ofprovider)– Patient care – Clinic/Nursing Home (used tocalculate the FTE input on the cost report for theprovider)– Inpatient care hours - if inpatient work is part ofthe provider’s clinic compensation package (usedto adjust wages of provider)Health Services Associates, Inc.

Medicare Productivity Standard Productivity Standard applied in aggregate Total visits (all providers subject to the FTEcalculation) is compared to total minimumproductivity standard. A productive midlevel with visits in excess oftheir productivity standard can be used tooffset a physician shortfall.Health Services Associates, Inc.

Medicare Productivity Standard 4,200 visits per employed or independentcontractor physician FTE2,100 visits per midlevel FTEAggregated for application of minimumproductivity standardPhysician Services under agreement notsubject to productivity standards – limitedapplication (cannot work on a regular basis)Health Services Associates, Inc.

Worksheet B-1 / Worksheet M-4VaccineReportingPromoting Access to Health Care

Vaccine InformationSeasonal Influenza and Pneumovax Total vaccines given of each to ALL insurancetypes Total Medicare vaccines given of each (Medicarelog must accompany cost report) Cost of vaccines (include invoices if possible) Total clinical hours worked – ALL clinical staffHealth Services Associates, Inc.

Vaccine Cost Clinic must maintain logs of Influenza andPneumococcal vaccines administered Invoices for the cost of Influenza andPneumococcal vaccine should be submittedwith the cost report Submit vaccine logs electronically if possibleHealth Services Associates, Inc.

Vaccine Ratios Ten minutes is the accepted time per vaccineadministration Total Vaccines x 10 minutes/60 minutes ‘total vaccine administration hours’ Divide ‘total vaccine administration hours’ bytotal clinical hours worked for Staff TimeRatioHealth Services Associates, Inc.

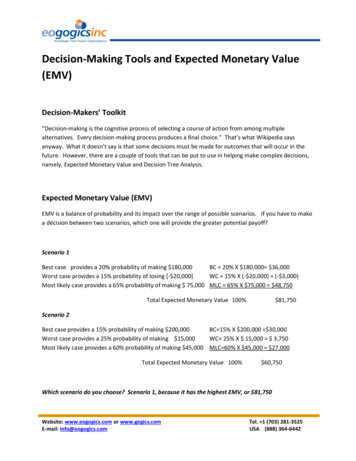

Vaccine RatiosCLINIC NAMEF.Y.E:VaccinationABC Family Practice12/31/2011Total VaccinesMedicareTotal MedicalGivenVaccines Given Supplies CostF.T.E.Total StaffHours From Staff Time RatioWorksheet 4Pneumovax74 56210,6170.000110Seasonal Influenza19883 2,14710,6170.003108Health Services Associates, Inc.

Vaccine WorksheetHealth Services Associates, Inc.

Influenza LogHealth Services Associates, Inc.

Pneumo LogHealth Services Associates, Inc.

Worksheet A-2-1/A-8-1Related PartyTransactionsPromoting Access to Health Care

Related Party Transactions Most common related party transaction isrelated party building ownership (e.g.building is owned by the doctors which alsoown the clinic – clinic pays ‘rent’ to docs)Cost must be reduced to the ‘cost ofownership’ of the related partyCost is adjusted to actual expense incurredby the related partyHealth Services Associates, Inc.

Related Party Transactions Related party building ownership cost itemsfor reporting––––––Mortgage InterestProperty TaxesBuilding DepreciationProperty InsuranceRepairs & Maintenance paid by building ownersLawn Service, etc. – if not already in clinicexpensesHealth Services Associates, Inc.

Worksheet C / Worksheet M-3Settlement DataPromoting Access to Health Care

Settlement DataData is pulled from the clinic’s PS&R Medicare visits Deductibles Total Medicare charges (new in 2011) Medicare preventative charges (new in 2011)Health Services Associates, Inc.

PSR A copy of your PS&R (Provider Statisticaland Reimbursement System report) will needto be obtained by the clinic electronicallyfrom IACS (Identity Management andAuthentication System)This link provides detail instructions for oads/Registration Tips Providers.pdfHealth Services Associates, Inc.

PSR Compare PSR total to your Medicare visitcount. Is this accurate? If not, determinewhy:–––Were incidental services included in the visitcountWere dual-eligible counted twiceDid more than one visit get counted on one day(surgical procedure/office visit)Health Services Associates, Inc.

Medicare Bad Debt Medicare bad debt form must accompanycost report of total bad debt being claimed. Medicare bad debt is claimed on the costreport based on the fiscal year in which thebad debt was written off, not date of service.Health Services Associates, Inc.

Medicare Bad DebtHealth Services Associates, Inc.

Questions?Health Services Associates, Inc.

VP, Cost Reporting & Provider Education Health Services Associates Southeast Regional Office Health Services Associates, Inc. 2 East Main Street 54 Pheasant Ln Fremont, MI 49412 Ringgold, GA Ph: 231.924.0244 231.250.0244 Fx: 231.924.4882 888.200.4788 Promoting Access to Health Care