![WELCOME [ Spencersavings ]](/img/37/business-conversion-guide.jpg)

Transcription

WELCOMETO SPENCER SAVINGS BANKBUSINESS CONVERSION GUIDEFOR MARINER’S BANK CUSTOMERS

ABOUT SPENCER SAVINGS BANKCOMMITMENT TO OUR COMMUNITIESOriginally founded in 1893 as the Saddle RiverSpencer Savings Bank has deep roots in theTownship Building and Loan Association, Spencercommunity and is wholeheartedly committed toSavings Bank’s history and values are deeply rootedgiving back at the local level. The bank supports ain the history and values of the neighborhoods invariety of local businesses, charitable organizations,New Jersey. Over 100 years later, the bank maintainsand community groups to make the communities weits distinct image of trust, security and commitmentcall home a better place to live and work for all ofto its customers. Today, Spencer is a full service,us. We believe strongly in making a difference in themutually owned and operated community bank thatlives of our community members. Spencer has beenis headquartered in Bergen County and operatesrecognized with numerous awards for its community26 financial centers across the state. With about 4service work, including the Financial Managersbillion in assets and a team of nearly 300 dedicatedSociety (FMS) Community Service Award (2021) andemployees who specialize in delivering premierthe NJBankers Community Service Award (2017, 2016business banking products and services, Spencerand 2013). Our team has been recognized as beingprides itself on being one of New Jersey’s strongestleaders and visionaries who work tirelessly to inspire,community banks.help and create opportunities for our communities inWe’re focused on helping businesses grow andNew Jersey.prosper. Spencer is the local community bank thatinvestors, entrepreneurs and business owners dependupon for strength, stability and service excellence.We provide lending solutions that span the entirestate of New Jersey and meet the full range ofbusiness, commercial and municipal banking needs.Our broad menu of business banking products andservices are on par with those of the larger bankswhile our highly experienced commercial lendingteam is focused on providing a high level of personalservice and exceptional care, rarely found atlarger banks.To learn more about Spencer Savings Bank, visit ourwebsite at www.spencersavings.com.LetterFrom The CEODear Valued New Customer,Welcome to Spencer! We are excited to have you on board and trulylook forward to serving you. This merger has combined two communityfocused banks that share a deep commitment to their customers and localcommunities. We’re proud to have joined to create a better bank for you!Spencer Savings Bank is one of New Jersey’s strongest community banks,serving local communities with integrity and pride for over 100 years. Withabout 4 billion in assets, a team of almost 300 dedicated employees, 26financial centers and an expanding footprint, we provide greater access andresources to business customers looking to grow their business and achievetheir financial goals.America is small business. At Spencer, we believe in providing great care andservice to our business customers. We offer business owners communityfocused banking with big bank capabilities - that’s exceptional servicecombined with high-quality banking products and services. As a Spencerbusiness customer, you will now enjoy an expanded business lending capacity,fast and reliable access to working capital, a full suite of cash managementservices and much more. We also understand the unique banking needs ofmunicipalities and provide a full array of banking solutions for state and localgovernment and related entities.In March, we are undergoing the conversion process. At that time, youraccounts will be seamlessly transitioned to Spencer, and you should seelittle to no difference in how you bank. Please review this guide which willprovide you with helpful information regarding the conversion process. Wetruly appreciate your business and loyalty and look forward to serving yourbusiness for many years to come!LETTER FROM THE CHAIRMAN & CEOABOUT SPENCER SAVINGS BANKAbout Spencer Savings BankSincerely,José B. GuerreroChairman and CEO, Spencer Savings Bank12

Table OfContentsGENERAL INFORMATION IMPORTANT CONVERSIONDATES IMPORTANT DETAILS ABOUTTHE CONVERSION57 PRODUCT CONVERSION CHARTS 9PRODUCTS & SERVICES11CORPORATE 17& FINANCIAL CENTER LOCATIONSTERMS AND CONDITIONS19

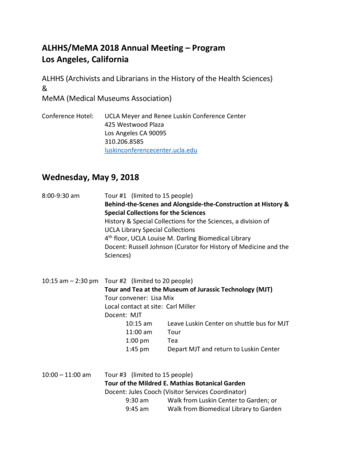

Important Conversion DatesMARCH 25, 2022 The final customer statement from Mariner’s Bankwill be mailed. Mariner’s Bank Online Banking, Mobile Bankingand Mobile Deposit will be permanently disabled.Please be sure to log in and save any e-Statementsneeded prior to this date. Mariner’s Bank Online Bill Pay will be disabled.Please make arrangements to schedule allpayments prior to this date. Future dated andrecurring payments should be confirmed onceyour access is moved to Spencer Online Bill Pay.IMPORTANT CONVERSION DATES All former Mariner’s Bank Financial Centers willclose at the end of business, March 25, to performthe system conversion to Spencer Savings Bankand reopen for business on March 28.MARCH 27, 2022 If you currently have a Mariner’s Bank Visa DebitCard, it will remain active until March 27. EffectiveMarch 28, you will need to begin using yourSpencer Savings Bank Visa Debit Card, which youreceived in the mail.MARCH 28, 2022 All former Mariner’s Bank Financial Centers willreopen as Spencer Savings Bank. Former Mariner’sBank customers can now access and use any ofthe 26 Spencer financial center locations locatedthroughout New Jersey. Your new Spencer Savings Bank Visa Debit Cardwill be mailed to you on March 14. Upon receipt,you should activate your new card by calling1-800-992-3808. Effective March 28, your Mariner’sBank Visa Debit Card will be deactivated and youshould begin using your new Spencer SavingsBank Visa Debit Card. Customers can begin using Spencer SavingsBank’s Online Banking by visiting spencersavings.com to access account information and using yourexisting username and temporary password (last6 digits of your social security number). Access to Spencer Savings Bank’s Online BillPay will be available. Bank-By-Phone will also beavailable by calling 1-877-402-2265. You can access Spencer Savings Bank’s MobileBanking by downloading the app from the AppStore or Google Play using your mobile device.Once downloaded, customers can sign in withtheir existing username and temporary password(last 6 digits of your social security number).5MARCH 31, 2022 The first checking statement for business customerswill be mailed by Spencer Savings Bank whichreflects all transactions from March 28 – March 31.After this time, each statement cycle will end basedon the product you have.CHECKSYou can continue to use Mariner’s Bank checks afterthe conversion. Once you run out of your existingsupply, you can order additional checks by visiting ourwebsite, visiting your local financial center or callingSpencer’s Customer Service Center at 1-800-363-8115.

ACCOUNT NUMBERSE-STATEMENTSYour account numbers will remain the same unlessotherwise notified. Also, Spencer acquired Mariner’sBank routing number, therefore, customers cancontinue to use the same routing number for all debitsand credits.If you receive e-Statements from Mariner’s Bank,you will automatically be converted to paperstatements and will be required to re-enroll to receivee-Statements from Spencer Savings Bank. Mariner’sBank e-Statements will no longer be available afterMarch 25. Please make arrangements to download andarchive your e-Statements prior to this date to ensureyou will always have access to your past statements.To sign up, please visit spencersavings.com and loginto Online Banking. Select “Additional Services” fromthe top header, followed by e-Statements. Step-bystep instructions will follow to get you enrolled.BANK-BY-MAILIMPORTANT DETAILS ABOUT THE CONVERSIONThe mailing address for Bank-By-Mail will be:Spencer Savings BankCustomer Service Center611 River DriveElmwood Park, NJ 07407BANK-BY-PHONEOn March 28, you can use Spencer’s Bank-By-Phoneservice. You can access your accounts by dialing1-877-402-2265. Your password will automatically beset to the last 4 digits of your social security number.BUSINESS CHECKING ACCOUNT STATEMENTSYou will receive a final Mariner’s Bank statement whichwill include account activity from March 1 - March25. You will then receive a statement from SpencerSavings Bank, reflecting activity from March 28 –March 31. Going forward, you will receive your monthlystatement based on the product you have.CHECKSYou can continue to use Mariner’s Bank statementchecks after the conversion. Once you run out of yourexisting supply, you can order additional checks byvisiting your local financial center, calling Spencer’sCustomer Service Center or by visiting our website.COMMERCIAL LOANSIf you currently have a commercial loan serviced byMariner’s Bank, the rate, terms and conditions of yourloan will not change. However, you will have a newpayment mailing address beginning on March 28.Please see the Loan Service Notice on page 15 for loanpayment instructions.DEBIT CARDSIf you have a Mariner’s Bank Visa Debit Card, youwill receive a Spencer Savings Bank Visa Debit Cardas a replacement. Upon receipt, you will be able toactivate your new card by calling 1-800-992-3808.On March 28, you will be able to start using your newSpencer Savings Bank Visa Debit Card to access yourSpencer accounts.DIRECT DEPOSITS AND WITHDRAWALSIf you are enrolled in direct deposit or automaticwithdrawals, your transactions will continue to post asthey normally do. You will not experience any changes.7IMPORTANT DETAILS ABOUT THE CONVERSIONImportant DetailsAbout The ConversionFDIC COVERAGE DURING AN ACQUISITIONSpencer Saving Bank is a member of the Federal DepositInsurance Corporation (FDIC). Your deposit accountsfrom Mariner’s Bank will continue to be separatelyinsured for six months following the acquisition dateand longer in the case of some Certificate of Deposit(CD) accounts.The acquisition date of Mariner’s Bank by SpencerSavings Bank was November 17, 2021. This meansthat Checking, Money Market, Savings and Clubaccounts will be separately insured until May 17, 2022and CD accounts (including IRA CD accounts) will beseparately insured as follows:Mariner’s Bank CDs that mature after May 17, 2022 areseparately insured until the first maturity date afterMay 17, 2022.Mariner’s Bank CDs that mature between November17, 2021 and May 17, 2022 are renewed for the sameterm and in the same dollar amount (either with orwithout accrued interest) continue to be separatelyinsured until the first maturity date after May 17, 2022.If a Mariner’s Bank CD matures between November 17,2021 and May 17, 2022 and is renewed on any otherbasis (the term or dollar amount are different), itwould be separately insured only until May 18, 2022.MOBILE BANKING & MOBILE DEPOSITSAfter March 25, Mariner’s Bank Mobile Banking andMobile Remote Deposit will be disabled. On March28, you will be able to access the Spencer SavingsBank Mobile Banking and Mobile Remote Deposit withyour current username and temporary password (last6 digits of your social security number). Our MobileBanking app is free to download for both iPhonedevices and iPads throughout the App store and forAndroid phones and tablets through Google Play.ONLINE BANKINGOn March 25, Mariner’s Bank Online Banking will bedisabled. On March 28, you will be able to accessSpencer Savings Bank Online Banking system atspencersavings.com. You will be able to use yourexisting username and a temporary password. Forassistance, please contact Spencer’s Customer ServiceCenter at 1-800-363-8115.ONLINE BILL PAYAll Bill Pay payees will carry over and be automaticallytransferred with your new registration. Your access tothe Spencer Savings Bank Online Bill Payment systemwill be available on March 28.Please note that your payees history, scheduledrecurring payments and e-Bills to external billers willNOT carry over automatically and will require youto manually reset them. If you have any questions,please feel free to call our Customer Service Center at1-800-363-8115.All payments after this date will be processed anddebited from your account according to the followingschedule:PAYMENTMETHODEARLIEST PAYMENTCAN BE RECEIVEDWHEN YOURACCOUNT ISDEBITEDElectronic(most common)1 to 2 business daysafter scheduling*Date payment isreceived by payeePaper Check5 to 7 business daysafter scheduling*Date check iscashed by payee*A business day is any day that the bank is openQUICKEN WEBCONNECT / QUICKBOOKSIf you download your Mariner’s Bank financialinformation into your Quicken or QuickBooks personalfinance software, you may continue to do so withSpencer Savings Bank’s Online Banking Webconnect.TAX REPORTINGSpencer Savings Bank will be reporting and issuing1098 and 1099 IRS forms for the full year of 2021.8

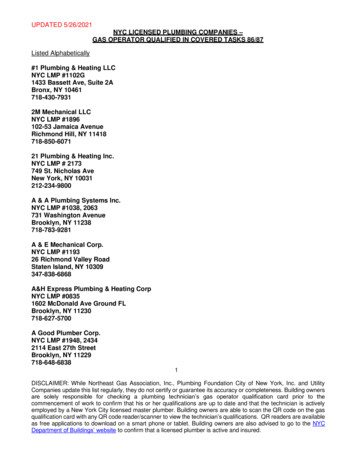

MARINER’S BUSINESS STATEMENT AND ACCELERATORSAVINGS BECOME BUSINESSEDGE SAVINGSBuild your business and its capital by earning interest while you save.InterestMARINER’S FREE COMMERCIAL CHECKINGThis account will remain active for all customers who currently havethis product. However, no new accounts will be opened after the endof business March 25, 2022.MARINER’S BUSINESS AND PREMIER BUSINESS CHECKINGBECOME BUSINESSEDGE CHECKINGThis business account is built for owners looking for a basic checkingaccount with low volume activity!InterestNon-Interest-Bearing 0.25 per item over 500CONVERSION CHARTSUnlimited deposits & deposit itemsMonthly Service Charge 15Minimum Daily Balance to AvoidService Charge 500MARINER’S BUSINESS INTEREST CHECKING BECOMESSPENCER BUSINESSEDGE PLUS CHECKINGThis interest-bearing business checking is designed for businesses withlow activity and higher balances.InterestInterest-Bearing 3Minimum Daily Balance to AvoidService Charge 100Transaction LimitsNoneMARINER’S ATTORNEY TRUST CHECKING BECOMESSPENCER ATTORNEY TRUST CHECKINGThis specialized account targets lawyers and their clients.InterestNon-Interest-Bearing 0.15 per check feeTransaction Fees 0.25 per deposit fee 0.10 per deposited item feeMonthly Service Charge 10Minimum Daily Balance to AvoidService Charge 100MARINER’S IOLTA CHECKING BECOMESSPENCER IOLTA CHECKINGThis specialized account is available only for Attorney Trust accountsapproved by the NJ State IOLTA Bar.InterestInterest-BearingTransaction LimitsNoneUnlimited deposits & deposit itemsMonthly Service Charge 25.00 analyzed against monthlyinterest paidMonthly Service Charge 25Transaction FeesNoneMinimum Daily Balance to AvoidService Charge 10,000MARINER’S MUNI CHECKING BECOMESSPENCER MUNI CHECKING300 free debits per monthTransaction Limits 0.25 per item over 300MARINER’S BUSINESS MONEY MARKET &BUSINESS RATE CHASER MONEY MARKET BECOMEBUSINESSEDGE MONEY MARKETThis account is designed for businesses that prefer to earn a higher rate ofinterest while still maintaining a level of liquidity.Interest9Interest is compounded daily andcredited monthlyMonthly Service Charge500 free debits per monthTransaction LimitsCompetitive tiered interest onbalances of 100 or more.Competitive tiered interest onbalances of 5,000 or moreInterest is compounded andcredited monthlyMonthly Service Charge 15Minimum Daily Balance to AvoidService Charge 5,000Transaction LimitsNoneCONVERSION CHARTSProductConversion ChartsThis interest-bearing checking account is targeted towards municipalities,boards of education, and government agencies.InterestInterest-Bearing 0.15 per check feeTransaction Fees 0.25 per deposit fee 0.10 per deposited item feeMonthly Service Charge 12Minimum Balance 10010

SMALL BUSINESS LENDINGBUSINESS DEPOSIT ACCOUNTSSpencer is focused on helping businesses grow andprosper. We know business owners, like you, are busyand need a bank that delivers real solutions fast. Yourbusiness will receive fast, reliable access to workingcapital. Our BusinessEdge Express suite providesseveral small business lending options - with simplifiedapplications, expedited approvals and local decisions.Our business customers span a wide range of industries,but they all share the same need for convenient, hasslefree business banking that lets them focus on runningtheir companies. Our tailored business products offercompetitive pricing, convenient services and a highlevel of personal attention and care. We pride ourselveson being the private banker for your business needs.BUSINESSEDGE EXPRESS LINES OF CREDITBUSINESSEDGE CHECKINGGive your business access to liquid capital, fast. If youneed a small business loan, our BusinessEdge ExpressLine of Credit will get you what you need faster thanever before. Enjoy competitive rates with dedicatedlocal service and rapid decision-making. Manage yourseasonal cash flow and expand your buying power withthe working capital you need to reach your businessgoals. Loan amounts are available up to 300,000.Our BusinessEdge Checking account offers uniquebenefits and makes it easy to avoid monthly servicefees. We offer the support and digital technologies tohelp take your business to the next level.BUSINESSEDGE EXPRESS TERM LOANSWhen you’re ready to invest in your business, it’s wiseto work with a bank that’s ready to invest in you witha quality business loan. Our BusinessEdge ExpressTerm Loan will get you the funds needed to makethat critical machinery or equipment purchase. Thisproduct, offers loan amounts up to 300,000, fixedmonthly payments, 3-Year to 5-Year term optionsand more.BUSINESSEDGE EXPRESS REVOLVING LINESOF CREDITWhen it comes time to invest in smaller equipmentpurchases or to boost your working capital, ourBusinessEdge Express Revolving Line of Credit willhelp get you there. This product offers loan amounts upto 300,000, monthly interest and principal payments,a competitive variable rate and more. We know busybusiness owners, like you, need real solutions fast.11COMMERCIAL CHECKINGFor businesses that keep high balances and have a lotof activity, we offer our commercial checking account.Save more money by offsetting fees with an earningscredit based on the average daily investable balanceand apply that credit against monthly service charges.This account is the perfect checking solution for yourbusiness banking needs, including our signature levelof superior service and convenience.PRODUCTS & SERVICESPRODUCTS & SERVICESBusinessProducts & ServicesATTORNEY TRUST ACCOUNTThis specialized checking account is available to allattorneys that receive and disburse client funds. Theattorney has the option of establishing a single trustaccount and commingling client funds or establishingsub-accounts for each client, which are linked tothe attorney disbursement account. Spencer is alsoapproved to accept IOLTA deposits.TENANT SECURITY ACCOUNTSpencer works closely with landlords and managingagents to maintain their Tenant Security Accounts.Tenant rent security deposits are managed by linkinginterest-bearing tenant accounts with a masterchecking account. The landlord is responsible forpassing along the interest earned on the accountto the tenant. This grouping of accounts is used forapartment complexes and multiple dwellings with aminimum of 10 units.BUSINESSEDGE SAVINGSBUSINESSEDGE MONEY MARKETBuild your business and its capital by earning interestwhile you save. With a low minimum balance andcompetitive interest rate, use this account to save andspend more time on what’s most important, growingyour business.This account is designed for businesses that preferto earn a higher rate of interest while still maintaininga level of liquidity. Tiered interest rates allow higherbalances to grow faster. With a BusinessEdge MoneyMarket account, you can put your excess funds to workand still rest easy knowing that your money is safe andavailable when you need it.12

BUSINESS SERVICESMORTGAGE INVESTMENT PROPERTIESONLINE & MOBILE BANKINGSpencer offers a wide array of mortgage products.Whether you are a first-time buyer with rental realestate or a seasoned landlord looking to add toyour growing rental portfolio, we will provide youwith several niche financing solutions to suit yourborrowing needs. Our mortgage experts take thetime to get to know you, so we can match you withthe right mortgage for your unique situation. LetSpencer secure your rental property financing andhelp you get started on the road to building your realestate portfolio today!Whether at home or out, we strive to make yourbusiness banking experience easy and convenient!Enjoy securely accessing your business accountinformation anytime and anywhere with SpencerOnline Banking and Mobile Banking. We’ve combinedthe latest digital banking technologies with exceptionalservice. Check your business account balances,transfer money, open an account, view transactions,approve ACH files, transfer funds and much more!PRODUCTS & SERVICESONLINE BILL PAYEnjoy the flexibility of paying one, several or all ofyour business bills online from one simple secure site.Set up recurring payments so you never have to thinkabout them again. With convenient e-Statements, gopaperless and simplify your monthly business banking.Pay your bills without the hassles of writing checks andbuying stamps. Online Bill Pay also provides you withthe convenience of receiving, viewing and managingyour bills at the same online location. Receive billselectronically, set up a payee list, stay on top ofmonthly expenses with email reminders, run paymentreports, create customized payment records to trackmonthly spending habits and more!CASH MANAGEMENT SERVICESSpencer moves at the speed of business, providinga full suite of cash management services designedto simplify, streamline and safeguard your finances.We offer the latest technology needed to keep yourbusiness moving forward, while ensuring your dayto-day operations run smoothly. Our suite of cashmanagement services is designed to help manage yourcash flow. Services include Remote Deposit Capture,Online Wire Transfers, ACH Originations, Positive Pay,Remote Official Check Printing and Deposit EscrowService. Let Spencer keep your business runningsmoothly with powerful Cash Management Services!MERCHANT SERVICESMerchant Services from Spencer is a payment solution,custom-tailored for you. By combining our bankingexpertise with Global Payment’s premier paymentprocessing network, you can enjoy a one-stopsolution for all of your payment processing needs.From point-of-sale to point-of-settlement, everyelectronic payment transaction is secured and verified,minimizing your risk and satisfying your customers.BUSINESS CREDIT CARDSFrom low rates to great rewards, Spencer has theright credit card option for you. Our suite of creditcard options can help you manage daily expenses,build credit and more. You will also enjoy worldwideacceptance, secure chip-enhanced technology, zeroliability protection against fraud and the 24-hoursupport that comes with the Visa name.13BUSINESS ENTITY MORTGAGEThis unique mortgage loan option is available forbusiness entities (Partnership, LLC, S Corp) providinga great vehicle to help you achieve all of yourinvestment property goals, while protecting yourpersonal assets. The product features a borrowinglimit of 3 million, unique loan types (cash outrefinance eligible), a variety of terms available andmore. This is for 1-4 family homes and mixed-useproperties up to 4 units.INVESTMENT PROPERTY MORTGAGEGrow your rental property portfolio with anInvestment Property Mortgage with competitiverates from Spencer. As experts in the local market,we pair serious know-how with attractive investmentproperty mortgage rates. This product features aborrowing limit of up to 3 million (personally deededproperties), fixed and adjustable-rate options, noprepayment penalties and more.

Let our commercial and industrial lending specialistshelp you secure the loan that’s right for your businessand future goals. Our various product lines and creativefinancing solutions will drive long term growth andserve all your lending needs!OWNER-OCCUPIED MORTGAGESFinancing or refinancing your commercial propertywith Spencer has never been easier with an owneroccupied mortgage. Enjoy the benefits of propertyownership including controlling operating costs, nolandlord restrictions and real estate appreciation.Financing is available for multi-family, office, industrial,retail and mixed-use properties. Commercial propertyownership is a viable goal thanks to Spencer. Theloan can be structured to meet your needs, helping toensure your success.PRODUCTS & SERVICESLINES OF CREDITThe liquidity of a line of credit allows you the flexibilityof managing your seasonal cash flow with consistentbuying power. Lines are available up to 10 millionwith flexible repayment terms. This is a great solutionto have on hand so that you can take advantage ofyour working capital to meet your cash flow needs.TERM LOANSTerm Loans provide a specific amount of credit topurchase assets or meet specific financing needs. Theloan is paid based on a predetermined schedule ormonthly principal and interest payments. This loan isgreat for financing machinery, equipment or companyvehicle purchases. Our term loans can cover your longterm financing needs, with loan amounts available upto 10 million.REVOLVER-TO-TERM LOANSThis revolving loan can help with the financing ofmachinery, equipment or company vehicle purchases.Interest-only is paid for the first year, allowing lowermonthly payments to give your business a headstart. Following this period, the loan revolves into afixed rate term loan, which can be tailored to yourcompany’s needs.COMMERCIAL REAL ESTATE LENDINGSpencer offers flexible financing solutions s. Our seasoned real estate professionalswill design a customized financing solution to meetyour objectives with local decision making and timelyexecution of your transaction.COMMERCIAL MORTGAGESpencer offers financing for multi-family and commercialproperties. We provide investment property financing15for acquisitions as well as refinancing of existinginvestment property loans. Our team works with realestate owners and developers in New Jersey, New YorkCity and Eastern Pennsylvania to provide permanentcommercial mortgages - loan amounts ranging from 1- 20 million and terms from 5-10 years. Financingis available for multi-family, medical office, industrial,retail and mixed-use properties.CONSTRUCTION LOANSSpencer specializes in construction financing andwill work with you to custom tailor your constructionloan. We work with real estate developers to provideconstruction loans - financing amounts up to 15million and terms from 6 months-2 years. Financing isavailable for multi-family properties.BRIDGE LOANAs a business owner, you need capital to operateand grow your business. If you are looking for interimfinancing, a bridge loan may be just the right fit! Youcan count on a quick closing while taking advantageof this short-term opportunity in order to securelong term financing. We work with real estate ownersand developers to provide bridge loans - financingamounts up to 5 million and terms from 6-12 months.Financing is available for multi-family, industrial, retailand mixed-use properties. Let Spencer help youbridge the gap!PRODUCTS & SERVICESCOMMERCIAL & INDUSTRIAL LENDINGLOAN SERVICING NOTICEAs a result of the Spencer Savings Bank merger ofthe Mariner’s Bank loan portfolio, loan servicing wasmoved to Spencer Savings Bank on November 17, 2021.New Servicer:Spencer Savings Bank611 River DriveElmwood Park, NJ 07407Take note that the transfer of servicing for your loandoes not affect any term or condition of the loan otherthan terms directly related to the servicing of the loan.The loan number/account number will remain the same.Until our computer systems merge, which is scheduledto occur on March 28, 2022, please continue to makeyour monthly loan payments at the same location andvia the same method as payments you have made inthe past.You have a 60 day grace period from the effectivedate of the transfer of loan servicing to send yourpayment to the new Spencer Savings Bank paymentaddress provided above. During this time period, youwill not be assessed any late fee and your payment willnot be reported as late if you sent the payment to theMariner’s Bank payment address before your paymentdue date. It is best to start sending your payments tothe new servicer’s (Spencer Savings Bank) addresseffective March 28, 2022.As your new servicer, Spencer Savings Bank will collectyour payments going forward. We will start acceptingpayments received from you on March 28, 2022. Fromthat date forward, please send all payments to theaddress listed on your loan billing statement.Payments can also be made in person at any SpencerSavings Bank Financial Center. Those of you that haveauthorized auto drafts from your deposit account tosatisfy a monthly loan payment obligation should seeno change to this process as a result of this transfer ofservicing. If you have any questions, you may continueto use your first point of contact, the Edgewatercorporate office at 201-224-9110 or if needed,the Customer Service Center at Elmwood Park at1-800-363-8115.16

Corporate &Financial Center LocationsCORPORATE HEADQUARTERS26 FINANCIAL CENTER LOCATIONS611 River DriveElmwood Park, NJ 07407spencersavings.com/locationsCORPORATE & FINANCIAL CENTER LOCATIONS1-800-363-8115CUSTOMER SERVICE CENTER611 River DriveElmwood Park, NJ 074071-800-363-8115Hours of operation are Monday to Friday,8:00 AM - 8:00 PM, and Saturday, 8:00 AM 2:00 PM. Speak with a bank representative,at our corporate headquarters, by calling1-800-363-8115 to: Open a new account Access information on all types ofaccounts, loans and lines of credit Receive help with online banking Renew a maturing CD Request a loan applicationCliffside Park1 Towne Centre Drive, Suite 1006(201) 282-5475Lodi107 South Main Street(973) 472-1581Clifton (2 loca

Spencer Savings Bank's Online Banking Webconnect. TAX REPORTING Spencer Savings Bank will be reporting and issuing 1098 and 1099 IRS forms for the full year of 2021. ACCOUNT NUMBERS Your account numbers will remain the same unless otherwise notified. Also, Spencer acquired Mariner's Bank routing number, therefore, customers can