Transcription

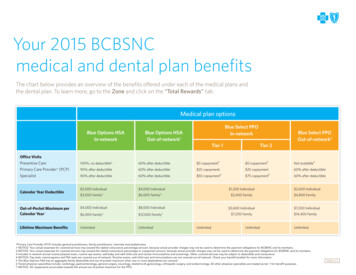

Your 2015 BCBSNCmedical and dental plan benefitsThe chart below provides an overview of the benefits offered under each of the medical plans andthe dental plan. To learn more, go to the Zone and click on the “Total Rewards” tab.Medical plan optionsBlue Options HSAIn-networkBlue Select PPOIn-networkBlue Options HSAOut-of-network1Tier 1Blue Select PPOOut-of-network2Tier 2Office VisitsPreventive Care100%, no deductible360% after deductible 0 copayment3 0 copayment3Not available4Primary Care Provider* (PCP)90% after deductible60% after deductible 25 copayment 25 copayment60% after deductibleSpecialist90% after deductible60% after deductible 50 copayment6 75 copayment660% after deductible 2,000 Individual 4,000 Individual 3,000 Family 6,000 FamilyCalendar Year Deductible5 2,400 FamilyOut-of-Pocket Maximum perCalendar Year 7 4,000 Individual 8,000 Individual 6,000 Family 12,000 FamilyLifetime Maximum BenefitsUnlimitedUnlimited5 1,200 Individual5 3,600 Individual 7,200 Family5UnlimitedUnlimited 2,400 Individual 4,800 Family 7,200 Individual 14,400 FamilyUnlimited*Primary Care Provider (PCP) includes general practitioners, family practitioners, internists and pediatricians.1 NOTICE: Your actual expenses for covered services may exceed the stated coinsurance percentage amount, because actual provider charges may not be used to determine the payment obligations for BCBSNC and its members.2 NOTICE: Your actual expenses for covered services may exceed the stated coinsurance percentage or copayment amount, because actual provider charges may not be used to determine the payment obligations for BCBSNC and its members.3 Includes in-network annual routine physical exam, routine eye exams, well-baby and well-child care and certain immunizations and screenings. Other covered services may be subject to deductible and coinsurance.4 NOTICE: Pap tests, mammograms and PSA tests are covered out-of-network. Routine exams, well-child care and immunizations are not covered out-of-network. Check your benefit booklet for more information.5 The Blue Options HSA has an aggregate family deductible and out-of-pocket maximum when one or more dependents are covered.6 Tiered physician specialties include: cardiology, gastroenterology, general surgery, neurology, obstetrics & gynecology, orthopedic surgery, and endocrinology. All other physician specialties are treated as tier 1 for benefit purposes.7 NOTICE: All copayments accumulate towards the annual out-of-pocket maximum for the PPO.PAGE 1 of 6

Medical plan optionsBlue Options HSAIn-networkBlue Select PPO In-networkBlue Options HSAOut-of-network1Tier 1Tier 2Blue Select PPOOut-of-network2Outpatient opractic Therapy(30 visits per calendar year)90% after deductible60% after deductible 25 copayment – PCP 50 copayment – Specialist 25 copayment – PCP 75 copayment – Specialist60% after deductible90% after deductible60% after deductible 25 copayment – PCP 50 copayment – Specialist 25 copayment – PCP 75 copayment – Specialist60% after deductibleWithout admission to hospital90% after deductible90% after deductible 200 copayment 200 copayment 200 copaymentWith admission to hospital90% after deductible90% after deductible90% after deductible70% after deductible, 500 copayment perinpatient admission60% after deductibleUrgent Care Center90% after deductible90% after deductible 50 copayment 50 copayment 50 copaymentPreventive100%60% after deductible100%100%Not coveredDiagnostic Lab or X-ray90% after deductible60% after deductible90% after deductible70% after deductible60% after deductibleDiagnostic Imaging (such asMRI, PET and CAT scans)90% after deductible60% after deductible90% after deductible70% after deductible60% after deductibleDiagnostic Mammogramif performed alone90% after deductible60% after deductible100%100%60% after deductibleDiagnostic Mammogram ifperformed with any otherservice90% after deductible60% after deductible90% after deductible70% after deductible60% after deductibleSpeech Therapy(30 visits per calendar year)Emergency RoomOutpatient Lab/X-ray/Mammogram1 NOTICE: Your actual expenses for covered services may exceed the stated coinsurance percentage amount, because actual provider charges may not be used to determine the payment obligations for BCBSNC and its members.2 NOTICE: Your actual expenses for covered services may exceed the stated coinsurance percentage or copayment amount, because actual provider charges may not be used to determine the payment obligations for BCBSNC and its members.PAGE 2 of 6

Medical plan optionsBlue Options HSAIn-networkBlue Options HSAOut-of-network1Blue SelectBlue SelectPPO PPO In-networkBlue Select PPOTier 11TierTierTier 22Blue Select PPOOut-of-network2Outpatient Surgery90% after deductible60% after deductible90% after deductible70% after deductible60% after deductibleHospital and HospitalBased Services90% after deductible60% after deductible90% after deductible70% after deductible, 500 copayment perinpatient admission60% after deductibleInpatient/outpatient certification is required to receive certified level of benefits. Call Magellan Behavioral Health at 1-800-359-2422.Mental CertifiedOffice90% after deductible60% after deductible 50 copayment 50 copayment60% after deductibleInpatient/Outpatient90% after deductible60% after deductible90% after deductible70% after deductible, 500 copayment perinpatient admission60% after deductibleInpatient/outpatient certification is required to receive certified level of benefits. Call Magellan Behavioral Health at 1-800-359-2422.Substance Abuse ServicesOffice90% after deductible60% after deductible 50 copayment 50 copayment60% after deductibleInpatient/Outpatient90% after deductible60% after deductible90% after deductible70% after deductible, 500 copayment perinpatient admission60% after deductible1 NOTICE: Your actual expenses for covered services may exceed the stated coinsurance percentage amount, because actual provider charges may not be used to determine the payment obligations for BCBSNC and its members.2 NOTICE: Your actual expenses for covered services may exceed the stated coinsurance percentage or copayment amount, because actual provider charges may not be used to determine the payment obligations for BCBSNC and its members.PAGE 3 of 6

Medical plan optionsBlue Options HSAIn-network*Blue Options HSAOut-of-network1*Blue Select PPOTier 1Blue Select PPOTier 2Blue Select PPOOut-of-network2Prescription CoverageTier 1 (generic)MAC C pricing4MAC C pricing4MAC A pricing3MAC A pricing3MAC A pricing390% after deductible 8 copayment 8 copaymentTier 2 (preferred brand)90% after deductible 35 copayment 35 copaymentTier 3 (brand)90% after deductible 50 copayment 50 copaymentTier 4 (specialty brand)90% after deductible90% after deductible amount overin-network allowed amount90% after deductible amount overin-network allowed amount90% after deductible amount overin-network allowed amount90% after deductible amount overin-network allowed amount25% coinsurance**25% coinsurance**Copayment amount overin-network allowed amountCopayment amount overin-network allowed amountCopayment amount overin-network allowed amountCoinsurance amount overin-network allowed amountSelect preventive drugs covered at 100%. See full list on the Zone.* All prescriptions for maintenance medications must be filled by mail order from Prime Therapeutics ondrugs in Tiers 1, 2 and 3. A 90-day supply can be purchased for 2.5 times the retail copayment.** There is a 50 per drug minimum and a 100 per drug maximum for each 30-day supply of Tier 4specialty brand drugs. For a list of specialty drugs currently classified as Tier 4 go /findDrugs/NCBCBS/190#!/ViewFindDrugsEvent.Certain specialty medications in Tier 1, 2, 3, and 4 must be obtained through Prime Therapeutics. 30-day supply only.Lens and Frame CoveragePrescribed eyeglass lens andframe calendar year maximum90% after in-network deductible90% after in-network deductibleLimited to one pair of prescription eyeglasses, one pair of hard or soft contact lenses, or a one year supply of disposable contact lenses per benefit period.Member must file claims manually using the medical claim form located at: ims/BE236.pdfDental plan optionDental ServicesBenefit period is calendar yearDiagnostic & preventive care100%Basic restorative care (includes endodontics)80% after dental deductibleMajor restorative care (includes periodontics)50% after dental deductibleIndividual dental deductible (per benefit period) 50Family dental deductible (per benefit period) 150Combined benefit period maximum (includes diagnostic and preventive, basic and major restorative care) 2,000Orthodontic care (dependent children under age of 19)50%Lifetime orthodontic maximum 2,000Dental benefit period rollover5 4001 NOTICE: Your actual expenses for covered services may exceed the stated coinsurance percentage amount, because actual provider charges may not be used to determine the payment obligations for BCBSNC and its members.2 NOTICE: Your actual expenses for covered services may exceed the stated coinsurance percentage or copayment amount, because actual provider charges may not be used to determine the payment obligations for BCBSNC and its members.3 MAC A: If you purchase a name brand drug when a generic is available, you may be charged the name brand copayment or coinsurance and the difference in cost from the generic to the name brand.4 MAC C: If you purchase a name brand drug when a generic is available, you will NOT be charged the difference in cost from the generic to the name brand.5 If you have been enrolled for at least 6 months, your dental claims are less than 800 a year and you complete an annual preventive service, 400 of your remaining annual benefit period maximum will roll over to the next year for up to three years.This document is a summary of the Blue Options benefits. This is meant only to be a summary. Final interpretation and a complete listing of benefits and what is not covered are in and governed by the BCBSNC groupcontract and benefit booklet. You may request a copy of the benefit booklet from BCBSNC Customer Services. Under the Blue Options HSA plan, the HSA is provided to you directly by a separate HSA Administrator.Detailed information regarding your HSA is provided by that Administrator.PAGE 4 of 6

2015 Full Time semi-monthly employee medical and dental rates1While the contribution varies by the plan you choose, BCBSNC pays, on average, 80% of the premium for employees’ medical coverage.2Full-timeemployees (EE)3Semi-monthly deductionsDentaldeductionsMedical deductionsHSA 800HSA 550HSA 500HSA 250With Healthy DividendsHSA(With or withoutHealthy Dividends)W/O Healthy DividendsEE Only 0.00 11.27 13.35 23.77 34.19 10.13EE Spouse ordomestic partner4 113.42 123.84 125.92 136.34 146.76 22.25EE Child 21.84 32.26 34.34 44.76 55.18 14.25EE Children 37.95 48.37 50.45 60.87 71.29 19.94EE Family (Child[ren] and spouse ordomestic partner4) 132.38 142.80 144.88 155.30 165.72 32.46Full-timeemployees (EE)3Semi-monthly deductionsDentaldeductionsMedical deductionsPPO 800PPO 550PPO 500PPO 250With Healthy DividendsPPO(With or withoutHealthy Dividends)W/O Healthy DividendsEE Only 40.55 50.97 53.05 63.47 73.89 10.13EE Spouse ordomestic partner4 180.47 190.89 192.97 203.39 213.81 22.25EE Child 52.59 63.01 65.09 75.51 85.93 14.25EE Children 82.92 93.34 95.42 105.84 116.26 19.94 204.86 215.28 217.36 227.78 238.20 32.46EE Family (Child[ren] and spouse ordomestic partner4)1 Medical premiums (rates) are separate from dental premiums (rates) and both are deducted on a semi-monthly basis.2 BCBSNC internal data.3 To be eligible for full-time rates, you must be regularly scheduled to work a minimum of 30 hours per week.4 Domestic partner coverage is subject to imputed income for the company-provided value of the domestic partner’s medical and/or dental coverage.PAGE 5 of 6

2015 Part Time semi-monthly employee medical and dental rates1While the contribution varies by the plan you choose, BCBSNC pays, on average, 80% of the premium for employees’ medical coverage.2Part-timeemployees (EE)3Semi-monthly deductionsDentaldeductionsMedical deductionsHSA 800HSA 550HSA 500HSA 250With Healthy DividendsHSA(With or withoutHealthy Dividends)W/O Healthy DividendsEE Only 41.88 52.30 54.38 64.80 75.22 13.45EE Spouse ordomestic partner4 178.11 188.53 190.61 201.03 211.45 29.54EE Child 71.50 81.92 84.00 94.42 104.84 18.91EE Children 102.11 112.53 114.61 125.03 135.45 26.47EE Family (Child[ren] and spouse ordomestic partner4) 245.67 256.09 258.17 268.59 279.01 43.10Part-timeemployees (EE)3Semi-monthly deductionsDentaldeductionsMedical deductionsPPO 800PPO 550PPO 500PPO 250With Healthy DividendsPPO(With or withoutHealthy Dividends)W/O Healthy DividendsEE Only 90.51 100.93 103.01 113.43 123.85 13.45EE Spouse ordomestic partner4 267.25 277.67 279.75 290.17 300.59 29.54EE Child 125.96 136.38 138.46 148.88 159.30 18.91EE Children 184.82 195.24 197.32 207.74 218.16 26.47EE Family (Child[ren] and spouse ordomestic partner4) 356.71 367.13 369.21 379.63 390.05 43.101 Medical premiums (rates) are separate from dental premiums (rates) and both are deducted on a semi-monthly basis.2 BCBSNC internal data.3 To be eligible for part-time rates, you must be regularly scheduled to work between 20–29 hours per week.4 Domestic partner coverage is subject to imputed income for the company-provided value of the domestic partner’s medical and/or dental coverage. Marks of the Blue Cross and Blue Shield Association. Blue Cross and Blue Shield of North Carolina is an independent licensee of the Blue Cross and Blue Shield Association. U6257a, 10/14PAGE 6 of 6

4,800 Family Out-of-Pocket Maximum per Calendar Year 7 4,000 Individual 6,000 Family5 8,000 Individual 12,000 Family5 3,600 Individual 7,200 Family 7,200 Individual 14,400 Family Lifetime Maximum Benefits Unlimited The chart below provides an overview of the benefits offered under each of the medical plans and the dental plan.