Transcription

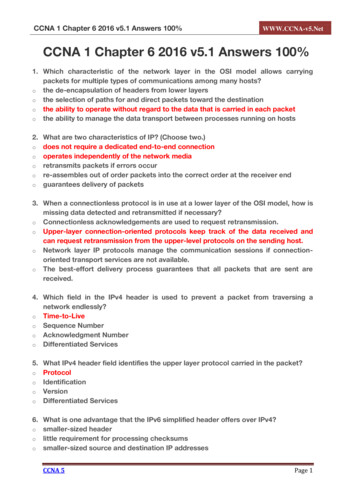

Chapter1-1

CHAPTER 1MANAGERIALACCOUNTINGManagerial Accounting, Fourth EditionChapter1-2

Study Objectives1.Explain the distinguishing features of managerialaccounting.2. Identify the 3 broad functions of management.3. Define the 3 classes of manufacturing costs.4. Distinguish between product and period costs.5. Explain the differences between a merchandisingand a manufacturing income statement.Chapter1-3

Study Objectives6. Indicate how cost of goodsmanufactured is determined.7. Explain the difference between amerchandising and amanufacturing balance sheet.8. Identify trends in managerialaccounting.Chapter1-4

Preview of ChapterManagerial Accounting BasicsCompare managerial and financial accounting,Management functions, Organizational structure,and Business ethicsManagerial Cost ConceptsManufacturing costsProduct vs. period costsManufacturing Costs in Financial StatementsIncome Statement and Balance SheetCost concepts – A reviewManagerial Accounting TodayChapter1-5Service industry trendsManagerial accounting practices

Managerial erial ionalstructureBusiness gcostsProduct vs.period costsManufacturingCosts inFinancialStatementsIncomestatementBalance sheetCost concepts –A trytrendsManagerialaccountingpractices

Managerial Accounting BasicsDefinition of Managerial AccountingA field of accounting that provides economic andfinancial information for managers and otherinternal users.Also called Management AccountingChapter1-7

Managerial Accounting BasicsManagerial Accounting ActivitiesExplaining manufacturing and nonmanufacturing costsand how they are reported in the financialstatements. (Chapter 1)Computing the cost of providing a service ormanufacturing a product. (Chapters 2, 3, and 4)Determining the behavior of costs and expenses asactivity levels change and analyzing cost-volumeprofit relationships within a company. (Chapters 5 and 6)Chapter1-8

Managerial Accounting BasicsManagerial Activities: ContinuedAccumulating and presenting data formanagement decision making. (Chapter 7)Determining prices for external and internaltransactions. (Chapter 8)Assisting management in profit planning andformalizing these plans in the form ofbudgets. (Chapter 9)Chapter1-9

Managerial Accounting BasicsManagerial Activities: ContinuedProviding a basis for controlling costs andexpenses by comparing actual results withplanned objectives and standard costs.(Chapters 10 and 11)Accumulating and presenting data for capitalexpenditure decisions. (Chapter 12)Chapter1-10

Managerial Accounting BasicsDistinguishing FeaturesApplies to all types of business Service, Merchandising, and ManufacturingApplies to all forms of business organizations –Proprietorships, Partnerships, and CorporationsApplies to not-for-profit as well as profit-orientedcompaniesChapter1-11LO 1 Explain the distinguishing features of managerial accounting.

Managerial Accounting BasicsDistinguishing Features: ContinuedChanged role in collecting and reporting costs tomanagement as a result of increasingly automatedbusiness environmentNow more responsible for strategic cost management –assisting in evaluating how well resources are employed bythe company.Teams with people from production,marketing, engineering, etc.Aid in making critical strategic decisionsChapter1-12LO 1 Explain the distinguishing features of managerial accounting.

Comparing Managerial and Financial AccountingSimilaritiesBoth managerial and financial accounting deal witheconomic events of a business –Thus, interests overlapBoth require that economic events bequantified and communicated tointerested parties –Determining unit cost is part ofmanagerial accounting,Reporting cost of goods manufacturedis a part of financial accountingChapter1-13LO 1 Explain the distinguishing features of managerial accounting.

Comparing Managerial and Financial AccountingDifferencesChapter1-14LO 1 Explain the distinguishing features of managerial accounting.

Managerial Accounting BasicsReview QuestionManagerial accounting:a.Is governed by generally accepted accountingprinciples.b. Places emphasis on special-purpose information.c.Pertains to the entity as a whole and is highlyaggregated.aggregatedd. Is limited to cost data.Chapter1-15LO 1 Explain the distinguishing features of managerial accounting.

Managerial Accounting BasicsManagement FunctionsManagement’s activities and responsibilities can beclassified into the following three broad O 2 Identify the 3 broad functions of management.

Management FunctionsPlanningLook ahead and establish objectives such as –Maximize short-term profit andmarket shareCommit to environmental protectionand social programsKey Objective: Add value to the businessValue measured by trading price of stock and by potentialselling price of the companyChapter1-17LO 2 Identify the 3 broad functions of management.

Management FunctionsDirectingCoordinate diverse activities and human resourcesImplement planned objectivesProvide incentives to motivate employeesHire and train employees including executives, managers,and supervisorsProduce smooth-running operationChapter1-18LO 2 Identify the 3 broad functions of management.

Management FunctionsControllingProcess of keeping activities on trackDetermine whether goals are metDecide changes needed to get backon trackMay use an informal or formal system of evaluationsDecision making is not a separate management function,but the outcome of the exercise of good judgment inplanning, directing, and controlling.Chapter1-19LO 2 Identify the 3 broad functions of management.

Organizational StructureWithin a company, organization charts show:The interrelationships of activities andThe delegation of authority and responsibilityChapter1-20

Good Ethics – Good BusinessBusiness EthicsAll employees are expected to act ethicallyAn increasing number of organizations have codesof business ethicsDespite organizational efforts:Business scandals have caused massiveinvestment losses and employee layoffs.Corporate fraud has increased 13% in last 5years.Employee fraud – 60% of all fraudIntentional misstatement of financial reportsAka financial reporting fraud is most costlyChapter1-21

Good Ethics – Good BusinessCreating Proper IncentivesCompanies like Motorola, IBM, and Nikeexpend substantial resources to monitor andevaluate the actions of employees & managers.Monitoring can have the negative result ofproducing incentives for unethical actions.Employees may feel that they must succeed nomatter what.Ineffective and unrealistic controls may alsoresult in declining product quality.Chapter1-22

Good Ethics – Good BusinessCode of Ethical StandardsSarbanes-Oxley Act of 2002Clarifies management’s responsibilitiesCertifications by CEO and CFO fairness of financial statements andadequacy of internal controlSelection criteria for Board of Directors and AuditCommitteeSubstantially increased penalties for misconductIMA Statement of Ethical Professional PracticesChapter1-23

Management FunctionsReview QuestionThe management of an organization performs severalbroad functions. They are:a.Planning, directing, and selling.sellingb. Directing, manufacturing, and controlling.c.Planning, manufacturing, and controlling.d. Planning, directing, and controlling.Chapter1-24LO 2 Identify the 3 broad functions of management.

Managerial Cost ConceptsManufacturing CostsManufacturing consists of activities and processesto convert raw materials into finished goods.In contrast, a merchandising firm sells goods in theform in which they were purchased.Manufacturing costs are typically classified as:Chapter1-25LO 3 – Define the three classes of manufacturing costs.

Manufacturing CostsMaterialsRaw MaterialsBasic materials and parts usedin manufacturing processMaterialsDirect MaterialsRaw materials that can bephysically and directly associatedwith the finished productduring themanufacturing processChapter1-26LO 3 Define the three classes of manufacturing costs.

Manufacturing CostsMaterialsIndirect MaterialsRaw materials that cannot be easily associatedwith the finished productNot physically part of the finished product orthey are an insignificant part of finishedproduct in terms of costConsidered part of manufacturing overheadChapter1-27LO 3 Define the three classes of manufacturing costs.

Manufacturing CostsLaborDirect LaborWork of factory employeesthat can be physically anddirectly associated withconverting raw materialsinto finished goodsIndirect LaborWork of factory employees that has nophysical association with the finished productor for which it is impractical to trace costs tothe goods producedChapter1-28LO 3 Define the three classes of manufacturing costs.

Manufacturing CostsManufacturing OverheadCosts that are indirectly associated withmanufacturing the finished productIncludes all manufacturing costs except directmaterials and direct laborAllocation of overhead to products can presentproblemsAlso called factory overhead, indirectmanufacturing costs, or burdenChapter1-29LO 3 Define the three classes of manufacturing costs.

Manufacturing CostsReview QuestionWhich of the following is not an element ofmanufacturing overhead?:a.Sales manager’s salary.b. Plant manager’s salary.c.Factory repairman’s wages.d. Product inspector’s salary.Chapter1-30LO 3 Define the three classes of manufacturing costs.

Product Versus Period CostsProduct CostsComponents: direct material cost,direct labor cost, and manufacturingoverheadCosts that are a necessary and integralpart of producing the productRecorded as inventory when incurred,thus may be called inventoriable costsNot an expense until the finished goodsinventory is sold then cost of goods soldChapter1-31LO 4 Distinguish between product and period costs.

Product Versus Period CostsPeriod CostsMatched with revenue of a specifictime period and charged to expense asincurredNon-manufacturing costsDeducted from revenues in periodincurred to determine net incomeIncludes all selling and administrativeexpensesChapter1-32LO 4 Distinguish between product and period costs.

Product Versus Period CostsChapter1-33LO 4 Distinguish between product costs and period costs.

Manufacturing Costs in Financial StatementsIncome StatementThe income statement for a manufacturer issimilar to that of a merchandiser exceptfor the cost of goods sold section.Chapter1-34LO 5 Explain the difference between a merchandisingand a manufacturing income statement.

Manufacturing Costs in Financial StatementsCost of Goods Sold ComponentsMerchandiser versus ManufacturerChapter1-35LO 5 Explain the difference between a merchandisingand a manufacturing income statement.

Manufacturing Costs in Financial StatementsCost of Goods Sold Section of the Income StatementChapter1-36LO 5 Explain the difference between a merchandisingand a manufacturing income statement.

Manufacturing Costs in Financial StatementsReview QuestionFor the year, Red Company has cost of goodsmanufactured of 600,000, beginning finishedgoods inventory of 200,000, and ending finishedgoods inventory of 250,000.The cost of goods sold isa. 450,000.b. 500,000.c. 550,000.d. 600,000.Chapter1-37LO 5 Explain the difference between a merchandisingand a manufacturing income statement.

Manufacturing Costs in Financial StatementsDetermining the Cost of Goods ManufacturedWork in Process – partially completed units of productTotal Manufacturing Costs – sum of direct material costs,direct labor costs, and manufacturing overhead; allincurred in the current periodChapter1-38LO 6 Indicate how cost of goods manufactured is determined.

Manufacturing Costs in Financial StatementsChapter1-39LO 6 Indicate how cost of goods manufactured is determined.

Manufacturing Costs in Financial StatementsBalance Sheet - InventoriesMerchandising CompanyOne category ofinventory:Merchandise InventoryChapter1-40Manufacturing CompanyMay have threeinventories:Raw MaterialsWork in ProcessFinished GoodsLO 7 Explain the difference between a merchandising and amanufacturing balance sheet.

Manufacturing Costs in Financial StatementsBalance Sheet - InventoriesChapter1-41LO 7 Explain the difference between a merchandising and amanufacturing balance sheet

Manufacturing Costs in Financial StatementsReview QuestionA cost of goods manufactured schedule showsbeginning and ending inventories for:a.Raw materials and work in process onlyb. Work in process onlyc.Raw materials onlyd. Raw materials, work in process, and finished goodsChapter1-42

Managerial Accounting TodayService Industry TrendsU.S. economy, in general, has shifted toward anemphasis on providing services rather than goodsOver 50% of U.S. workers are now employed byservice companiesTrend is expected to continue in the futureMost of the techniques learned for manufacturingfirms are applicable to service companiesChapter1-43LO 8 Identify trends in management accounting.

Managerial Accounting TodayManagerial Accounting PracticesValue ChainRefers to all activities associated with providing a product orserviceFor a manufacturing firm these include the following:Chapter1-44LO 8 Identify trends in management accounting.

Managerial Accounting TodayManagerial Accounting PracticesTechnological ChangeEnterprise Resource Planning (ERP) – softwareprograms designed to manage all major businessprocessesComputer-Integrated Manufacturing (CIM) –manufacturing products with increased automationJust-In-Time (JIT) Inventory MethodsInventory system in which goods are manufacturedor purchased just in time for useChapter1-45LO 8 Identify trends in management accounting.

Managerial Accounting TodayManagerial Accounting PracticesQualityIncreased e

Chapter 1-8 Managerial Accounting Basics Managerial Accounting Activities Explaining manufacturing and nonmanufacturing costs and how they are reported in the financial statements. (Chapter 1) Computing the cost of providing a service or manufacturing a product. (Chapters 2, 3, and 4) Determining the behavior of costs and expenses as