Transcription

CHAR 1M 202Promotion. For Investment Professionals Only. Not for public DistributionNORDIC HEDGE FUNDINDUSTRY REPORT 2021

www.hedgenordic.com – March 2021www.hedgenordic.com – March 2021INTRODUCTIONHedgeNordic is the leading mediacoveringtheNordicalternativeinvestment and hedge fund universe.The website brings daily news, research,analysis and background that is relevantto Nordic hedge fund professionals fromthe sell and buy side from all tiers.NORDIC HEDGEFUND INDUSTRYREPORT 2021HedgeNordicpublishesmonthly,quarterly and annual reports on recentdevelopments in her core market aswell as special, indepth reports on “hottopics”.HedgeNordic also calculates andpublishes the Nordic Hedge Index(NHX) and is host to the Nordic HedgeAward and organizes round tables andseminars.Contents4610141822263034Editor's Note. Nothing to Write Home About.2020: A Tale of Two ExtremesThe White CrowFundamentally DrivenTruly Nordic Hidden GemsCapitalising on Nordic MarketInefficiencies and Volatility"Small" CompoundersUnderstanding and Capturing ChangeBoring is Good384448545862667074PUBLICATION PLAN 2021:Lynx Wins 20 Year Award – But is Not Relaxing2020 Nordic Hedge AwardFinding Alpha in EquitiesMay:Illiquid StrategiesJune:Private MarketsAugust:Quant StrategiesSeptember: Value / Quality InvestingSecrets of Long Livers: Crisis AlphaOctober:Multi AssetNovember:Alternative Fixed IncomeDecember:ESG and AlternativesWhere Are the Diversifiers?CONTACT:SuperStrategiesKamran George GhalitschiNordic Business Media ABKungsgatan 8DNB’s All-in-OneSE-103 89 Stockholm, SwedenCorporate Number: 556838-6170VAT Number: SE-556838617001You Can’t Eat a Sharpe RatioDirect: 46 (0) 8 5333 8688Mobile: 46 (0) 706566688The Multi-Strategy AppealThe Hedge Fund PandemicPROMOTION. FOR INVESTMENT PROFESSIONALS ONLY. NOT FOR PUBLIC DISTRIBUTION2April:Email: kamran@hedgenordic.comwww.hedgenordic.comPicture Index: Drazen Zigic--shutterstock, FerGregory--shutterstock, Dirk Ercken--shutterstock,Shutterstock,Design & Layout: Sara Ahlström3

www.hedgenordic.com – March 2021www.hedgenordic.com – March 2021an all-time high. We recorded ten new fund launches,and unfortunately many more closures.One of the most exciting things I find, is when we“discover” new funds. We received an e-mail forinstance from Jonathan Copplestone in the weeksrunning up to Christmas inquiring whether his fund,Lucerne Nordic Fund, would meet the criteria to belisted in the Nordic Hedge Index. By experience,when the manager asks for index inclusion, we havelearned that the track-record typically did not look allthat bad.Then there are those funds which we happen to findby knocking on doors, turning over stones or hearingof elsewhere. More often than not there are hedgefund strategies and funds buried deep in the bigbanks, SEB and Nordea being prime candidates forsuch hiding places. They are hard to bring to surface,get access to or even identify the right people or geta hold of the required information. Now, this does nothappen all too often, but just last week, we unearthedtwo new index constituents falling into that category.Editor s Note.Nothing to Write Home About.Looking back at this last year since publishingour last Nordic Hedge Fund Industry Report inMarch of 2020, there is really very little to writehome about. Not that it was not an eventful year, onthe contrary, this one will sure stick in our minds andwe will be discussing it for decades to come. It isjust, most of us have spent more time than enoughat home, so there is probably really not much news tospread in our own four walls.For the Nordic hedge fund universe however, there arestories to tell a plenty – entire sagas were written andwill be sung. As a whole, the industry recorded thebest annual performance in a decade and closed at4On the one hand, it is quite a frustration to learn thatthere are funds and managers out there that we donot know of, or cannot access or who, for whateverreason, choose not to be listed in the Nordic HedgeIndex. At HedgeNordic, we do want to claim to knowevery Nordic fund and manager and have good,established relations to them.On the other hand, it is part of the fuel that drivesus. It is like a treasure hunt, knowing there are somehidden few out there still to be discovered by us.These random e-mails or calls that come pointingout a new fund. And some of them turn out to begems we will be looking at in this publication, too.One of the newer additions to the NHX, St. PetriCapital describes how “Understanding and CapturingChange” leads to the Danish manager’s success.Fredrik Sjöstrand is convinced that “Boring is Good”when it comes to the strategies used by their factoringfund or Scandinavian Credit Fund.“Lynx wins 20 Year Award – but it is not relaxing” tellsthe tale of the journey behind, and also ahead of oneof the Nordic’s oldest hedge funds.For a PhD dissertation, Danielius Kolisovas dissectsthe equity sub-index to the Nordic Hedge Index anddiscovers “The Secrets of Long Livers – Crisis Alpha.”The CIO of Veritas Pension Insurance, Kari Vatanenasks the all-important question “Where Are theDiversifiers?” while the head of Nordea’s multi-assetteam is turning to “SuperStrategies.”It has become a tradition that we highlight three newlaunches in the Nordic Hedge Fund Industry report,and 2021 shall be no different in that aspect andFeature “DNB s All-in-one,” Coeli’s Multi-Asset Fundinsisting “You Can’t Eat a Sharpe Ratio” and AnnaSvahn and Martin Sandquist, portfolio managers atAntiloop Hedge, explain “The Multi-Strategy Appeal.”The Nordic hedge fund universe now for many yearsin a row has seen more graves than cradles, withmore funds going out of business than are beinglaunched. Reason enough for our very own EugeniuGuzun to investigate “The Hedge Fund Pandemic.”KAMRAN GHALITSCHICEO & PUBLISHER HEDGENORDICThe 2021 Nordic Hedge Fund Industry Report kicks offwith a review of 2020, a tale of two extremes beforewe turn to “The White Crow,” interviewing JonathanCopplestone who manages the Lucerence NordicFund out of New York. In “Fundamentally Driven,” wevisit Volt Capital Management, a CTA using not price,but fundamental data in their trading models. StaffanÖstlin of Adrigo lets us in on how to find “Truly NordicHidden Gems” and SEB’s team managing Eurekadescribes how they are “Capitalising on NordicMarket Inefficiencies and Volatility,” while AndreasAaen at Symmetry bets on “Small Compounders.”5

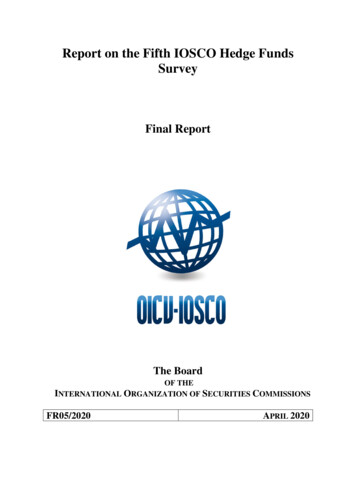

www.hedgenordic.com – March 2021www.hedgenordic.com – March 2021Figure 1. A Tale of Two Extremes for Nordic Hedge Funds.2020: A Tale of TwoExtremesBy Eugeniu Guzun – HedgeNordicSource: HedgeNordic.fund industry lost 6.8 percent in the first quarter oflast year, its worst quarterly decline on record. Thequarterly decline was mainly attributable to the 5.4percent-loss in March, which was the industry’sworst month on record.2020 was a year of extremes for markets,investors and hedge funds managers alike.For the Nordic hedge fund industry, 2020could be summed up as a tale of two extremes. Thefirst quarter of last year was exceptionally difficultfor Nordic hedge funds, which recorded their worstquarterly decline since HedgeNordic started trackingthe industry back in 2005. The industry’s sizeabledrawdown was quickly offset by strong performancewhen markets bounced back starting in April.Following the worst quarterly decline on record in6the first quarter, the Nordic hedge fund industry wenton to enjoy its best three-quarter performance since2005.The Nordic hedge fund industry, as reflected by theNordic Hedge Index, advanced 8.5 percent last year,its strongest annual performance since 2009. Viewedon a standalone basis, 2020 was an exceptionallystrong year for Nordic hedge funds. When lookingbeneath the surface, last year was indeed a tale oftwo extremes for the industry. The Nordic hedgeStarting with a loss of 1.8 percent in February andthen enduring an additional decline of 5.4 percent inMarch, the Nordic hedge fund industry experiencedits second-worst drawdown on record in the firstquarter of last year. Drawdowns are peak to trough,what about climbing out from the trough back toa new peak? How long did it take for the Nordichedge fund industry to recover from its secondworst drawdown? The recovery from the valley of theindex to a new high lasted only four months. In thefinal three quarters of 2020, the Nordic hedge fundindustry enjoyed a cumulative return of 16.4 percent,its best three-quarter performance on record.THE NORDIC HEDGE INDEXOVERCOMES THE SURVIVORSHIP BIASHedge fund indices are often (perhaps wrongfully)associated with exhibiting “survivorship bias,” whichreflects the tendency of certain data providers tosolely reflect the returns only generated by existingfunds – thereby, ignoring the performance of alreadydefunct funds. With no less than 30 Nordic hedgefunds delisted from the Nordic Hedge Index last year– funds either closed down or merged into otherfunds, an inappropriate calculation methodologyfor the Nordic Hedge Index could have resulted insignificant survivorship bias.The Nordic Hedge Index tackles this bias by reflectingthe aggregate performance of both defunct and upand-running funds. The index was up 8.5 percent lastyear, but the 138 active Nordic hedge funds returned7

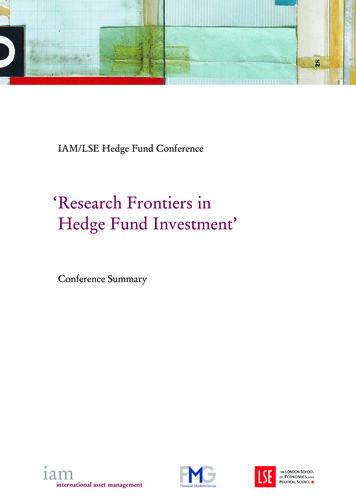

www.hedgenordic.com – March 202110.9 percent on average last year. The 240 percentagepoints-difference reflects the performance detractionfrom the funds that closed during 2020 (which,unsurprisingly, performed worse than the up-andrunning funds).in the NHX Equities. The 50 up-and-running equityhedge funds within the Nordic Hedge Index gained19.9 percent on average in 2020, while the NHXEquities was up 16.1 percent as 13 members of thissub-index closed down last year.The most noticeable difference between theperformance of a sub-index and the performance ofactive funds underlying that sub-index is observedUp-and-running Nordic multi-strategy hedge fundsreturned 6.8 percent on average last year, whereasthe NHX Multi-Strategy was up 4.0 percent. This 280www.hedgenordic.com – March 2021In the graph below, the grey boxes show that theNordic hedge funds that were not in the top andbottom 30 percent in terms of performance returnedbetween 1.8 percent and 16.9 percent last year. Aboutone in every five members of the Nordic Hedge Indexachieved a return higher than 16.9 percent in 2020,while eight percent returned above 30 percent. A littlemore than seven percent of all members returnedabove 40 percent last year.About 47 percent of Nordic equity hedge fundsoutperformed the MSCI World’s 16.5 percent-returnlast year, but one should not forget that mostNordic equity hedge fund maintain a net marketexposure below 100 percent. Some members of theNHX Equities employ a market-neutral approachto investing, and some even maintain negativenet exposure to the market. The average equityFigure 2. Lack of Survivorship Bias in the Nordic Hedge Index.25,00hedge fund in the Nordic Hedge Index was up 16.1percent last year, but, again, the average hides widedisparities.The top 20 percent of performers in the NHX Equitesreturned 63.1 percent on average last year, whilethe bottom 20 percent were down 6.5 percent onaverage. The equity hedge funds that were neitherin the top 30 percent nor in the bottom 30 percentreturned between 3.6 percent and 33.4 percent. Ina similar fashion, the great majority of fixed-incomehedge funds returned between 1.6 percent and 9.7percent last year. The top 20 percent, meanwhile,were up 13.8 percent on average, whereas the bottom20 percent lost 3.0 percent on average. The majorityof multi-strategy hedge funds returned between 1.1percent and 10.0 percent.20,003,8015,0010,00Figure 3. 2020 Performance Statistics on the Nordic Hedge Index and NHX Sub-Indices.2,4116,075,00-8,49Nordic Hedge IndexEquity Funds1,590,802,774,184,624,03Fixed-Income FundsMulti-Strategy FundsCTAsIndex Performance1,732,58Funds of FundsDetraction from Defunct FundsSource: HedgeNordic.105100959085807570St. Petri L/S, 98.3%656055percentage points-difference stems from the worsethan-average performance of the 13 multi-strategyhedge funds that closed down last year. Similarly, theexisting funds of hedge funds in the Nordic HedgeIndex were up 4.3 percent last year, while the NHXFunds of Funds, which reflects the performance ofdefunct funds too, gained only 2.6 percent.AVERAGES HIDE DISPARITIESThe Nordic hedge fund industry gained 8.5 percentnet-of-fees last year and active Nordic hedge fundswere up 10.9 percent on average. While these averagefigures are useful for comparison, averages do hide8disparities. With a return of 98.3 percent, thematicfocused long/short equity fund St. Petri L/S was lastyear’s best-performing member of the Nordic HedgeIndex. The worst performing fund that is still partof the index, meanwhile, was down 17.4 percent.The dispersion between last year’s best- and worstperforming hedge fund was wide, very wide in fact.The top 30 percent of all members of the NordicHedge Index gained 30.2 percent on average, whereasthe bottom 30 percent was down slightly over twopercent. The top 20 percent, meanwhile, gained 37.9percent last year and the bottom 20 percent lost 3.9percent on average.St. Petri L/S, 98.3%Average (10.9%)5045Volt Diversified Alpha Fund, 41%4035302520151050-5Nordic Cross Stable Return, 27.3%70th percentile (16.9%)Asgard Fixed Income Fund, 16.2%Brummer Multi-Strategy, 12.5%30th percentile (1.8%)-10-15-20-25NHXEquitiesFixed IncomeMulti-StrategyFund of FundsCTASource: HedgeNordic.9

www.hedgenordic.com – March 2021www.hedgenordic.com – March 2021The White CrowBy Eugeniu Guzun – HedgeNordicJonathan Copplestone, Portfolio Manager – Lucerne Capital Management.The term “White Crow” is a Russian languageoriginating metaphor for a person who isdifferent from others, one variant of the “blacksheep” metaphor used for someone with exceptionalability and an outsider who does not fit in somewhere.One new member of the Nordic Hedge Index appearsto be epitomizing this concept.The funds included in the Nordic Hedge Indexhave typically either been managed by Nordic-bornmanagers, have been domiciled in one of the Nordiccountries, or have been run by teams out of theNordic countries. The latest addition to the Nordic10“I have never seenany correlationbetween managers’location and theirperformance.”Hedge Index has a different claim to being listed. TheLucerne Nordic Fund is a Cayman Islands-domiciledhedge fund run by a Brit out of New York but runs astrictly Nordic investment theme.in the Nordic region. “One of the most frequentquestions that comes up when talking with potentialinvestors is how can you have an investing edgesitting in New York?” Copplestone tells HedgeNordic.Warren Buffett famously said that allocating moneyout of Omaha, far away from Wall Street, helped himachieve investing success by being “undisturbed byirrelevant factors and the noise generally of businessinvestments.” While Jonathan Copplestone ofLucerne Capital Management lives in New York Cityin the heart of Wall Street, he is an ocean away fromhis hunting ground: small- and mid-sized companies“Part of my answer is that we have better accessto management than we would have by sitting inLondon, Stockholm or other cities because everyNordic company, large or small, comes to NewYork and we get to talk to them,” says Copplestone.Since Lucerne Capital Management is a uniqueorganization in New York because of its pure focuson small- and mid-sized European companies, “we11

www.hedgenordic.com – March 2021get to see Nordic companies one-on-one when theyare in town,” according to Copplestone, who was afounding member of Enskilda Securities in Londonin 1982. “The other part of the answer is that I havenever seen any correlation between managers’location and their performance,” he continues. “Oneof best fund shops investing globally that I knew wasbased in Alaska, and they were absolutely spectacularinvestors.”“We havebetter access tomanagement thanwe would have bysitting in London,Stockholm or othercities because everyNordic company, largeor small, comes toNew York and we getto talk to them.”12Copplestone relies on a bottom-up investmentprocess to build a concentrated portfolio between 20to 50 names from a universe of around 400 Nordiccompanies with market capitalizations between 200 million and 5 billion. A fund manager’sinvesting success “is all about the process,” considersCopplestone. And his proven and repeatable researchprocess has borne fruit despite him being thousandsof kilometers away from the Nordic region. LucerneNordic Fund has delivered an annualized returnof about 33 percent since Copplestone startedmanaging the fund in early 2015.BOTTOM-UP FOCUSED, RETURNON CAPITAL-OBSESSED“The investment process starts with the companies,”says Copplestone, who has more than 30 years ofexperience working in Nordic capital markets. “Iwork very comfortably with the broking communityin the Nordics, which is of a very high standard,” heemphasizes. “But the key aspect of my process ismeeting with the company management and meetingwith the other stakeholders such as board membersto discuss strategic priorities,” adds Copplestone.“Those things you don’t read in a research report.”Regular discussions and meetings with corporatemanagement help Copplestone avoid surprises inthe portfolio.www.hedgenordic.com – March 2021Copplestone regards return on invested capital asone of the best measures of financial success fora business, sharing the same opinion with the likesof Charlie Munger or Terry Smith. “When looking atindividual companies, we focus on what they canmake on the capital reinvested in the business,”Copplestone tells HedgeNordic. “If businesses aredeploying a lot of capital now because they aregrowing and are generating negative cash flows asa result, that’s fine,” he continues. “I don’t need to seecash flows straight away, but I do have to see thatin the next few years the companies can get goodreturns on that capital invested.”“We are fixated on how much capital a businessneeds, and the potential returns on that capital,”elaborates Copplestone. “That doesn’t put us in thecorner of value investors or cash flow-obsessedinvestors,” he emphasizes. “In a nutshell, we arevery much bottom-up focused, return on capitalobsessed,” says Copplestone. “If I were to highlighta style preference, I definitely have a skew towardsgrowth, but at the moment, I equally own low-growthbusinesses because the returns on capital are sogood. Adaptability and flexibility are very important,they have served us very well.”but it is so much harder to make money on shorts,” heacknowledges. “If you try to make money by shorting,the window of opportunity is very narrow unless youare able to short the right stocks at the exact righttime.”“I haven’t come across better corporate governanceanywhere, including the United States, which is oneof the reasons the Nordic markets are so fantasticfor investors,” says Copplestone. “It is not only thelaws but also the culture that supports the laws,”he continues. This environment makes shortingin Scandinavia harder than elsewhere, “becauseunderperforming management teams are identifiedand replaced much more quickly,” according toCopplestone. “You don’t see those long-lingeringdecaying businesses where the shareholders are nottaking responsibility and not making managementchanges. It is a smaller pool of opportunities to shortin the Nordics.” For that reason, Copplestone spends“the vast majority of my limited mental bandwidthlooking for longs.”UNATTRACTIVE RISK-REWARDFOR NORDIC SHORTSDespite running the Lucerne Nordic Fund with a netmarket exposure in the range of 29 percent to 106percent over the last five years, Copplestone mostlyruns a long-biased portfolio. Partly because profitableshort ideas are more difficult to uncover but mostlybecause Copplestone is an “optimist, equity guy” whobelieves equity markets will continue to rise overtime, “I am skewed very long,” says Copplestone. “Irun a hedge fund and I do short stocks occasionally,13

www.hedgenordic.com – March 2021www.hedgenordic.com – March 2021Fundamentally DrivenBy Kamran Ghalitschi – HedgeNordicPatrik SäfvenbladCIOVolt Capital ManagementAfter a period of drought, 2020 was a goodyear for CTAs. CTA indices advanced broadly,with the CTA sub-index for the Nordic HedgeIndex, for instance, advancing by 4.2 percent duringthe year. In this heterogeneous space with manydifferent approaches, styles, and strategies, somestars shone brighter than others, and some appearedin the sky as high voltage bolts of lightning.Volt Diversified Alpha Fund returned beyond 40percent in 2020, over 22 percent in the first quarter,and 11.5 percent alone in March, when many otherCTAs struggled. The average CTA would have gone14"We are not activelybasing our positionson market prices,fundamentals are afar superior indicatorto predict marketdevelopments.”into the volatile period that initially saw global equityindices sharply declining, with strong, long positions.Whereas many funds, hedge funds, and CTAs werecaught flat-footed by the coronavirus-fueled marketsell-off, Volt Diversified Alpha successfully capturedtrends triggered by the deteriorating sentiment.FUNDAMENTAL EDGE“When volatility picked up in late February and onward,there were a lot of noisy signals from market prices.If you are price-based, volatility is your enemy,” PatrikSäfvenblad, Volt’s CIO explains. Market volatilityoften means that fundamentals have changed, andthat markets are searching for a new equilibrium.In contrast to many other commodity tradingadvisors, price data is not the key driver for enteringor exiting positions for Volt. “We observe marketprices, and they help determine things such as timingor stop losses. However, we are not actively basingour positions on market prices,” explains Säfvenbladand continues, “fundamentals are a far superiorindicator to predict market developments.”15

www.hedgenordic.com – March 2021“In the two major market moves of 2020, the initialcrash triggered by the pandemic and the followingrally supported by economic stimulus, fundamentalsbehaved largely normally and we were able to predictmoves early, ahead of the curve,” Tommi Lindeman,Volt’s Head of Business Development observes. Volt,therefore, relies on fundamental data for its tradingsignals."Getting yourstop-losses right,determining whichpositions to keepor cut is one of thehardest achieved, butmost crucial part ofthe secret sauce toa good risk-returnprofile."The manager’s models are classified in five maingroups: market fundamentals, economic data,market sentiment, relative value and calendar effects.Market fundamentals host the highest risk allocationbased on expected returns and the low correlationto other models. They could include mining output,shipping activity or weather data. An especially wetor hot period in the American Midwest, for instance,during harvesting or planting season may give goodindications on the future pricing of wheat, or othergrains.“You can see Volt as a conglomerate of many marketspecialists. There are many specialist ideas, and keymarket factors driving individual markets,” explainsLindeman. “Some of our modeling would be lookingat a market just as a discretionary trader in a specificmarket might. Weather data is crucial for someonetrading grains but largely irrelevant for a metalstrader.”The portfolio breakdown, too, shows a sectordiversification that is distinct from most peers.Exposure to equity indices, for example, only accountfor 11 percent of the portfolio, whereas metals, softs,and energy combined account for more than half theportfolio, the remainder falling to fixed income andFX.16www.hedgenordic.com – March 2021Well over 8000 independent, bottom-up signals feed200 different fundamental models weighted by theirexpected contribution in the current market regime.MACHINE LEARNING ANDSMOOTH OPERATIONSMachine learning supports areas such as datacollection, signal generation, and real-time execution.Machine learning also evaluates each model andmarket based on expected contributions in thecurrent environment. “We have an open architecture,and new models coming up from research arestraightforward to plug in. However, our machinelearning framework will determine if and when thesenew models will be allocated to, and to what extent,”Säfvenblad explains.Säfvenblad is pleased that operations workedsmoothly and uninterrupted even in the volatilemarkets of last spring and under work-from-homeconditions. “It gave us the opportunity to stresstest the entire system in a real-life environment, andevery part of it worked to perfection,” he says. Therewere also no hiccups with external service providerssuch as the fund’s administrator, Northern Trust, andclearing broker Goldman Sachs. “Here, our investmentin a robust infrastructure and an institutional qualityoperational setup really paid off.”RISK MANAGEMENT IN DNArisk management in mind, maybe more than anythingelse. “Risk management is inherent in our DNA,”Lindeman explains. “Risk management stretchesfrom a model level, to portfolio construction, tradeexecution to operation. It covers all areas; frominvesting in diversified, liquid markets, having abottom-up view rather than having a biased in-houseview, not making use of high leverage, working adisciplined reduction of losing positions with stoploss in every market and more.”“Getting your stop-losses right, determining whichpositions to keep or cut is one of the hardest achieved,but most crucial part of the secret sauce to a goodrisk-return profile,” explains Säfvenblad. “Gettingstopped out too often can be costly, and then, whendo you get back in? The period of March to April wasa perfect example of there being no point in gettingback in too early.”VIRTUAL PROCESS, REALINVESTORSVolt Diversified Alpha Fund, launched in March of2017, reached its three-year track record last year.This, in combination with the strong performanceshown during 2020, has enabled Volt to attractnew investors with fresh capital to the fund. “Weonboarded new investors and managed to growassets under management during the year. Theentire process from due diligence to investment wasdone remotely through digital channels,” Lindemanexplains.Säfvenblad stressed that 2020 was the year ofrisk management where all could be won or lost,showing that Volt Diversified Alpha was built with17

www.hedgenordic.com – March 2021www.hedgenordic.com – March 2021Truly Nordic HiddenGemsBy Eugeniu Guzun – HedgeNordicMaking money in the stock market sometimesinvolves going places everybody else isneglecting or outright avoiding. Placessuch as an unloved company getting its houseback in order or a small, little-known company withsignificant upside potential. Staffan Östlin and hisco-portfolio manager Johan Eriksson are focusedon finding undiscovered and unloved gems amongsmaller companies in the Nordics for Adrigo Small &Midcap L/S. Since launching the stock-picking hedgefund back in late 2017, Östlin has found plenty ofsuch gems.THE COREAdrigo Small & Midcap L/S maintains a truly Nordicconcentrated, high-conviction portfolio that housesbetween 25 to 30 long positions allocated acrossthree building blocks: Core Five, Dynamic, and HighPotential. The Core Five block, which “can essentiallybe called Core Four to Six,” accounts for about half of18the fund’s portfolio over time, with each Core positionusually accounting between eight and 11 percentof the entire portfolio. These four to six positionsrepresent core, high-conviction investment ideasin companies undergoing some form of long-termchange. “That is really where we take a very longterm view,” explains Östlin, adding that “we look forsignificant change within a company or an industry.”Staffan ÖstlinPortfolio ManagerAdrigo.“We like to invest in low expectations, and lowexpectations could involve a share price that has goneSouth, a company run by mistrusted management, acompany experiencing some problems in a division, ora business with a long history of underperformance,but a new management coming in,” Östlin explainsthe most common traits of the Core holdings. Östlinalso emphasizes the importance of aligning hisfund’s interests with the ones of management teamsand other owners in these long-term investments. “Itis very important that we have the right owners andalso the right management in the sort of long-termcases, really transformation cases, that tend to have19

www.hedgenordic.com – March 2021an investment horizon between two to five years,”says the fund manager, who has a little more than 30years of investing experience.DYNAMICThe Dynamic block contains about 15 names andaccounts for around 35 percent of the entire portfolio,investments with a shorter investment horizonbetween one and 12 months. “That is a more tradingintensive part of the portfolio,” says Östlin. “We havea good view and understanding of at least 400 stocksfrom our Nordic universe and quite often we find that,shorter term, the stock market is hammering downsome stocks a little bit too much around quarterlyearnings releases or other announcements,” explainsÖstlin. “We might use these shorter-term pricedrifts as opportunities to generate returns,” says thearchitect of the strategy powering Adrigo Small &Midcap L/S. “Our dynamic investments allow us toreact when market conditions are changing.”FINDING UNDISCOVERED STOCKSThe High-Potential block includes long-term, highreturn potential ideas that collectively account for15 percent of the fund’s portfolio on average. “Highpotential investment ideas clearly involve muchhigher risk levels compared to the Core Five,” pointsout Östlin. “We usually make these investmentsin very small companies that are below the radarscreens of many investors and even many traditionalsmall-cap funds,” he continues. “Our high-potentialideas have limited sell-side analyst coverage, strongmanagement teams, and commercially viableproducts on the mark

the first quarter, the Nordic hedge fund industry went on to enjoy its best three-quarter performance since 2005. The Nordic hedge fund industry, as reflected by the Nordic Hedge Index, advanced 8.5 percent last year, its strongest annual performance since 2009. Viewed on a standalone basis, 2020 was an exceptionally