Transcription

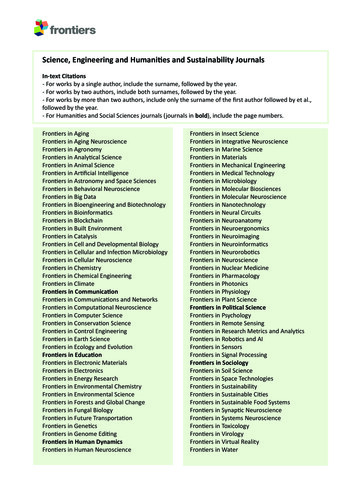

IAM/LSE Hedge Fund Conference‘Research Frontiers inHedge Fund Investment’Conference Summaryiaminternational asset management

IAM PROGRAMME IN HEDGE FUND MANAGEMENTOctober 11, 2002Research Frontiers in Hedge Fund InvestmentThis is the inaugural conference for the Financial Markets Group’s new research programme in hedgefund management. We are grateful to International Asset Management Ltd. for their generous support inestablishing this new research programme. The new programme’s objective is to support very high-calibre,non-profit research on topics of interest to the hedge fund research community. Our inaugural conferencereflects this objective.09:00 – 09:15Conference Registration09:15 – 09:20Albert Fuss (International Asset Management) Welcome09:20 – 09:30Sushil Wadhwani, Conference Overview09:30 – 10:30Peter Cripwell (Pioneer Alternative Investments), “Operating Diversified Meanreverting Strategies in Abnormally Correlated and Volatile Markets”Discussion: Matthew Bowyer (Citigroup Asset Management)10:30 – 11:00Coffee Break11:00 – 12:00Panel Discussion “The Role of Alternative Investments in Institutional Portfolios”Panel members include: Kerrin Rosenberg (Hewitt, Bacon & Woodrow), SushilWadhwani, Chris Mansi (Watson Wyatt) and Ros Altmann (LSE Governor)12:00 – 13:00David Modest (Morgan Stanley), “Beaches, Lightning and Financial Markets”Discussion: Gregory Connor (London School of Economics)13:00 – 14.00Lunch Break14:00 – 15:00Maria Vassalou (Columbia), “Investing in Size and Value Portfolios UsingInformation about the Macroeconomy”Discussion: Jason Hathorn (Concordia Advisors)15:00 – 15:30Coffee Break15:30 – 16:30Michael Brandt (Wharton), “On the Relationship between the Conditional Meanand Variance of Stock Returns: A Latent VAR Approach”Discussion: Gerard Gennotte (Meriwether Associates)16:30 – 17:30Christopher Jones (University of Southern California)“The Dynamics of Stochastic Volatility”Discussion: Andrew Patton (London School of Economics)17:30Conference Ends

Opening RemarksI am very excited about this new venture for IAM, sponsoring a leading global institution to carry outindependent research into hedge fund issues.Hedge funds make up a relatively new and, therefore, quite under-researched asset class. This is partlybecause they have not been established for as long as traditional asset classes, partly because institutions weregenerally quite late in getting into hedge funds and partly because there is a shortage of good dataon performance and other characteristics of these funds.I have been investing in hedge funds since the early 1980s and, together with Tony Forward and AlanDjanogly, I started IAM in 1989. We have been around hedge funds for a long time (probably longer thanmost other people in this business) and have seen this asset class develop significantly since those early days.We have experienced many market cycles and we have spent huge sums of money to build up our own hugeproprietary database. This contains data on about 4000 hedge funds, covering all the major hedge fundmanagement styles and has detailed information on funds’ performance and a large number of different riskcharacteristics. We are making this data available to the Research team at LSE, because we believe it is abouttime that serious academic research is conducted, to identify the factors driving hedge fund performance andto analyse hedge funds in much more depth than has hitherto been possible.Hedge funds have proved themselves in the last couple of years. They have substantially outperformedtraditional asset classes and have generally achieved their aim of protecting capital (i.e. hedging) in fallingmarkets. Obviously, there are exceptions to this rule and there will always be funds that do not perform well,or fail and the differential of returns between best and worst will always be large. But, I believe thatexperienced professionals, who know what to look for, will always be able to identify superior hedge fundmanagers and styles.But there is a great deal of scepticism still. I hope that, with serious academic research, such as that whichyou will hear about today and more that will be done in the coming years on the IAM Hedge Fund ResearchProgramme at LSE, we will all come to accept hedge fund investing as a natural part of any portfolio and bebetter able to understand the drivers of their performance and their general characteristics. We want the LSEteam to subject them to rigorous academic analysis and undertake high quality theoretical studies, which canthen inform the practitioners in the industry as well as potential investors.I do hope you will enjoy today’s conference and I look forward very much to welcoming you at our futureconferences too.Albert Fuss

SUMMARY OF PANEL DISCUSSION – INCLUDING Q & A SESSION“The Role of Hedge Funds in Institutional Portfolios”Chris Mansi – Watson WyattChris joined Watson Wyatt, the world’s largest independent investment consultingfirm, in 1999. He provides consulting advice to a broad range of institutional clientsto help them meet their investment goals. Previously, Chris spent over five years withanother benefits consultancy, working initially in their retirement practice beforemoving into the investment consulting team.Kerrin Rosenberg – Hewitt, Bacon & WoodrowKerrin is a Partner at Hewitt, Bacon & Woodrow, a global management consultingfirm which he joined in 1992 and where he is the specialist on venture capital,derivatives, stochastic modelling, risk analysis and financial economics. Kerrinadvises the trustees and sponsoring employees of UK pensions funds on a wide rangeof investment issues.Ros Altmann – LSE GovernorRos is an independent consultant specialising in investment banking and pensionsrelated issues. She was a consultant to the Treasury and Paul Myners on the Mynersreview of Institutional Investment in 2001. Ros managed institutional investmentportfolios for 15 years and continues to advise policymakers and institutions oninvestment issues.Sushil Wadhwani – Formerly Monetary Policy Committee, Bank of EnglandSushil was a member of the Bank of England’s Monetary Policy Committee from1999 to 2002. He was previously Director of Research and Partner at The TudorGroup and, prior to that, Director of Equity Strategy at Goldman SachsInternational Ltd. Sushil has lectured extensively and for eight years wasReader/Lecturer in Economics at the London School of Economics.

Chris Mansi, Watson WyattChris Mansi started by describing the Watson Wyatt view of Asset Allocation for pension funds. This can bedivided into two parts:a) matching assets – which are bondsb) return-seeking assets – which are dominated by equities and some property, but there is also a need todiversify this part, so that high yield bonds, private equity and hedge funds fit in here.In order to persuade Watson Wyatt to recommend hedge funds as part of the diversification of these ‘returnseeking assets’, hedge funds would need to:i. deliver much higher returns than equities without much greater riskii. or deliver similar returns to equities with low correlationiii. or even lower returns than equities if there was zero or negative correlation with equity returns.Looking at past returns, one would conclude that even the average hedge fund has produced return/riskprofile that is attractive to pension fund portfolios. But can one rely on these return/risk characteristicspersisting in future?Watson’s view is that hedge funds are not an asset class – they don’t have fundamental market or economiccharacteristics like equities, bonds or property. Hedge funds are a collection of 6000 active managers,and returns depend on the manager’s skill. Therefore, whether hedge funds should be included in apension fund portfolio depends on whether one believes that hedge fund managers, as a group, havesuperior skills. It is likely over time, as barriers to entry into hedge fund management have fallen, thatthe average hedge fund may no longer have superior skills relative to the market, especially after fees.However, more skilled hedge fund managers exist and there are the merits of the hedge fund style ofinvesting. The ability to short, increased flexibility, hedge fund features allow skilled hedge fund managersto generate an attractive return stream with suitable risk and low correlation.There is a role for hedge funds in a pension portfolio, but this role is dependent on being able to identifyand access the better managers. Watsons favours the fund of funds route, again believing it important topick the best fund of funds managers too, who can identify the better hedge fund managers for you. Thereis a concern, however, going forward about capacity issues and it may become harder for fund of fundsmanagers to access the best funds.

Kerrin Rosenberg, Hewitt, Bacon & WoodrowKerrin started by saying he was largely in agreement with Chris Mansi, so he did not want to just repeatChris’ points, but decided to outline some of his own insights.There is a 2-stage investment decision-making process for a pension fund, which is:1. the strategic decision – i.e. which asset allocation, how much in equities/bonds/property2. the implementation phase – i.e. how should one allocate each part of the portfolio, e.g. should equitiesbe managed on a global/industrial/regional basis, passive or active, which firms to use?It is generally accepted that Stage 1 is the most important, so deciding how much to allocate to equities ismuch more important than deciding which equity managers to use. But, with hedge funds, this priority isreversed, because there is such a wide dispersion of returns that the ‘average’ is quite meaningless and,therefore, for pension fund trustees it is more important for the portfolio to choose a good hedge fundmanager than whether or not to go into hedge funds. This makes it very difficult for trustees, because theyare much more comfortable ‘owning’ the asset allocation decision than ‘owning’ the manager selectiondecision. This could be a barrier for trustees, because they may not be confident in picking the right manageror the right fund of funds manager.If there is a role for hedge funds, it is because they provide better access to active manager skill, assuming onethinks that skill exists and can be identified. In this context, it is important to consider different hedge fundstrategies separately. He stated that most UK consultants are very familiar with long only equity or bondmanagers and the extension to choosing good long/short equity or bond managers is an easy one, since thesame sort of knowledge base and understanding is transferable. But this does not apply to other hedge fundstrategies, such as convertible arbitrage or macro, which use very different types of analysis from long-only.This is less familiar to consultants and trustees.If there is superior skill, a hedge fund environment should be better for accessing this skill, due to greaterflexibility, the ability to short, use more esoteric instruments and to be more nimble than long-only managers.Another significant factor is that hedge fund managers prefer the incentivisation structure of hedge funds,they like to manage their own business, get more directly rewarded for good performance and it has beeneasier to get funding for smaller hedge fund boutiques than for long-only management boutiques.There is generally very little pension fund interest in hedge funds at the moment. This may seem surprising,given the bear market in equities and the relative attractions of ‘absolute return’ funds. However, mosttrustees are worried about the solvency of their funds at the moment and are looking to switch more intobonds, in order to better match their liabilities. They are not so concerned about using absolute returnfunds for this.In conclusion, there is a role for hedge funds, but it is probably quite a narrow one. The exposure to hedgefunds is likely to increase over time, as more trustees become familiar with them, but it is likely to be quitea peripheral decision for them. Their main thought is how much to invest in bonds versus equities and heexpects hedge funds will be a sub-section of the decision about how to allocate the equity portion of theportfolio.

Ros Altmann, LSE GovernorRos said that she, like Sushil, found UK institutions’ low exposure to hedge funds surprising. UK consultantshad been later than those in the US in starting to look at hedge funds for their pension fund clients, partlydue to lack of data. She hoped that the LSE academic hedge fund research would help address some ofthese problems.Two years ago, the UK Treasury’s Myners Review of Institutional Investment recommended that pensionfund trustees should consider investing in hedge funds – especially fund of funds. Trustees had told Ros theyhad not considered hedge funds because their consultants had not recommended them, but the consultantssaid they had not recommended them because the trustees did not seem interested! With hindsight, this is agreat shame because they could have significantly outperformed any traditional portfolio.Hedge funds can be included in an institutional portfolio in various ways, for example as a separate asset classor as an extension of an existing asset class. Including hedge funds in an institutional portfolio as a separateasset class could present difficulties, due to the many different styles of hedge fund management. As a group,hedge funds do have different risk/return characteristics from traditional assets. Hedge funds as an asset classin their own right, can generate useful diversification benefits to an institutional portfolio. However, it mightbe possible that only certain types of hedge fund would be in the ‘asset class’ itself, such as market neutral,while other types, such as long/short equity, could just become part of the traditional allocation to equities.Using hedge funds as an extension of an existing asset class, such as equities or fixed income, it is crucial toselect the best managers, but this is no different from long-only active management. Most active managersfail to outperform their benchmarks, implying institutions would usually do better with a passive portfolio,so manager selection is extremely important in both long-only and hedge fund management.Within the equity or fixed income allocation of an institutional portfolio, the long/short manager could bethe truly ‘active’ manager in a core/satellite allocation – with a passive core of index funds and a selection oflong/short funds as the satellites. Long/short equity funds could displace long-only active managers who havenot outperformed their benchmarks. The UK Treasury’s recent Sandler Review found that total costs foractive long-only management (including trading/administration/custody costs) were often as high as 3%,implying that even a long-only manager who outperforms the index by 3% may not generate outperformanceafter total costs. Ros therefore prefers long/short funds, because they have more freedom to generatesuperior returns and exploit inefficiencies – concentrating on the alpha, rather than the beta of a portfolio.Hedge fund management requires a different skill set from long-only management because a hedge fund willmanage the downside and control risk. Hedge funds have proved themselves in the recent bear market andhave done precisely what they were supposed to do. They have protected capital in falling markets andcaptured returns in rising markets, so that the power of compounding over time generates significantoutperformance.Of course it is important to select good managers and a good fund of funds manager should be able todo this for institutions who do not feel confident doing it themselves. An experienced hedge fund multimanager should understand the different hedge fund strategies and know how they behave through the cycle,will demand transparency, ask the right questions, not just chase the latest popular strategy, use detailed duediligence and continuous monitoring of managers and their portfolios.

Q&AQuestion 1.Do you think that pension fund stock lending and hedge fund short selling artificiallydistorts market prices and has caused excessive volatility in markets?Mansi:Chris replied that securities lending and short selling are probably not creating a volatilemarket and in fact the presence of short selling may actually help the market find itsnatural level. Just the borrowing of stock doesn’t of itself cause market volatility, soshort selling does not artificially distort the market. Additionally, short selling is only asmall component of total trading volume, so pension funds lending securities areunlikely to have created market volatility.Rosenberg:Kerrin added that the much debated topic of excessive volatility is controversial and onewonders whether it’s actually the insurance companies that have directly contributed toit through their forced selling.Question 2.Why have UK consultants not looked more at hedge funds?Rosenberg:Kerrin replied that UK consultants must always assess whether any research activity isgoing to be commercially worthwhile, just as fund managers must do before launchinga product. In addition, consultants only have a limited annual budget of air time withtheir clients. Consultants and clients must prioritise the issues regarding the time budgetand how much time to spend on investment issues. The average client has moved from4 hours a year on investment 5 years ago to 10 or 12 hours a year on investment at themoment. Kerrin’s leading clients are spending 20 or 30 hours a year on investment.However, hedge funds are certainly not 1, 2 or 3 on the agenda of importance. The mostimportant topics for clients, particularly today, is to decide the appropriate degree towhich they should mismatch their liabilities and how much non-bond investment riskthey should be taking. In fact many clients are focusing top priority on whether to havea pension fund at all! Trustees should be willing to spend a couple of hours a year on atraining session to understand hedge funds (and private equity, property, currencyhedging etc) and whether these are potentially of interest. However, these issues are notin the top 3 of the priority list. At the beginning of the year, consultants agree an annualtime budget with the client and then help set the agenda for the next 12 months, to agreethe priorities for the funds. Most clients are spending a lot of their senior managementtime asking themselves whether they should have a pension fund, and, if so, what sort ofpension fund should it be?Mansi:Kerrin echoed Chris’ points about governance resource. It is really only clients whohave a significant level of governance resource who have been considering hedge funds.For others there are more important issues than, ‘do we allocate to hedge funds?’. Chrissaid he believes it is important that those trustees should take the time to consider it.Watson’s has been looking at hedge fund investment in detail for five years, and has ateam in total of about 15 people globally who spend some time looking at hedge funds,however not all full time. Watson’s do not think that all clients will go into hedge funds

Q&Abecause there are significant implementation and governance issues. Pension fundsrealise it’s a very complex area. Unless they have sufficient resources to implement itsuccessfully it’s probably not worth doing.Altmann:Ros suggested that, even if a pension fund did not want to consider including hedgefunds as an asset class, the trustees should still consider using long/short equity hedgefund management as part of an active satellite with a passive core. She pointed out thatthe record of active managers that UK pension funds have used is certainly not as goodas the typical long/short equity fund manager.Rosenberg:Kerrin added that his firm’s main focus with clients was on asset allocation, ratherthan manager selection. Choosing a UK long-only equity manager will generate aUK equity like return and the trustees are aiming to achieve an equity type return.However, if one ‘equitises’ a long/short equity manager, this is much the same as havinga long-only manager, and the only reason to go with the one approach rather than theother is if they have greater confidence in their ability to pick a good long/short equitymanager rather than a long-only equity manager. Kerrin said he did not have greatconfidence that anyone can pick good active managers, although he did have reasonableconfidence in measuring the risks of being in different asset classes.Altmann:Ros suggested that the logical extension of Kerrin’s comments was that one shouldn’tbother having active long-only managers, but just use a passive approach to capture theequity returns. However, one should have active managers and should use activemanagers who have more flexibility to add value and are not constrained by havingto outperform a benchmark by X%, but can actually add value in different ways.Long/short managers can help trustees to control the risk of underperforming relativeto an equity benchmark by having a passive core and allowing the active long/shortmanagers to be truly active and outperform.Question 3.What is the pension fund allocation to hedge funds compared to other Europeancountries?Mansi:Chris said it’s very hard to give an exact number but the pension fund allocation ispredominantly zero but sometimes up to 5%. He advises clients that, since deciding onan allocation to hedge funds requires a significant amount of work to learn about thearea, invest in it and then monitor it, there’s really not much point in doing that if it’sonly going to be 1% of the assets. Otherwise, all the benefits or potential benefits justwon’t come through at a portfolio level. Watson’s are seeing a lot more interest anddemand over the last year than over the previous year, which was much more than theprevious year again. Between 1% and 2% of pension schemes in the UK currently havean allocation to hedge funds. He thought in Europe the number was slightly higher andin the US the number would be slightly higher again. It is not vast numbers, but hewould expect it to increase over time.

Q&AQuestion 4.How can trustees monitor hedge fund managers and cope with the extra risks and lackof transparency?Mansi:Chris replied that he would typically advise appointing a specialist fund of fundsmanager to manage the risks, because they have more knowledge and experience ofhedge fund strategies and risks.Rosenberg:Kerrin explained that the methodology he uses is to start with assumptions about assetclasses in relation to the liabilities. For hedge funds he would assume they have similarvolatility and correlation statistics as cash does. He would then make an assumptionabout the expected return for his efficient frontier analysis and would need to considerhow much excess return above cash would be required from the hedge fund for it to finda role on the efficient frontier. Normally it would need around 2 to 3%. If it’s less, itdoesn’t really find a role on the efficient frontier, so one would really need cash plus2 or 3% as a minimum to vindicate the inclusion of hedge funds.Wadhwani:Sushil pointed out that this type of analysis was significantly deviating from thehistorical performance of hedge funds. He wondered why Kerrin would ignore thehistorical data and just assume the cash like returns, which did not seem the mostplausible assumption.Rosenberg:Kerrin explained that he believed a long/short manager with zero skill, who makes asmany wrong decisions as right decisions, will generate a return minus fees. Thereforewhat he is trying to do is to disaggregate the returns into those that may be due to hedgefunds being an underlying asset class and then adding active manager skill on top andtrying to make separate assumptions about those two components.Mansi:Chris added that he thought Watson’s use a similar process in terms of sensitivity testing.They make a central assumption for hedge fund returns, such as, what return over cashmust funds generate to look attractive in the portfolio context. However, this is notnecessarily ‘the’ central assumption because hedge fund returns are also affected not justby the amount of skill, but also by the market return at the time, the level of interest ratesand so on. He would not want to assume that the returns in the future will be the sameas in the past. There should also be some sensitivity testing too.Wadhwani:Sushil said that he was surprised that the issue of hedge funds was not number 1, 2 or 3on the agenda of pension fund trustees. Playing devil’s advocate he pointed out thatlooking across the Atlantic many endowment funds have come through the recent 3 yearbear market, making consistent positive returns. They’ve had allocations often of 25 to30% to hedge funds. Sushil said he just wondered whether the number one question forUK pension funds would still have been ‘should we have a pension scheme’ had 25 to 30%been invested in hedge funds thereby generating positive returns overall.

Q&ARosenberg:Kerrin pointed out that there are many differences between managing endowments andmanaging pension funds. Endowments don’t have specific liabilities and regulatoryrequirements. In reality it would have been preferable to have held cash rather thanhedge funds. The returns from most hedge fund of funds over the last 12 months havetypically been lower than cash. Finance directors are now for the first time, asked tojustify the existence of the pension fund to the shareholders. That is why the wholequestion of should we have a pension fund has come to the fore. Finance directors arerealising that this is an expensive thing to do and wondering how to generate a return ontheir investment for the shareholders from doing this. The investment allocation is onlya relatively small part of that question.Question 5.What do you think would be a reliable benchmark to use to encourage pensionfunds into hedge funds and do you think there could be an ‘indexed’ passive hedgefund approach?Mansi:Chris said he believed one should not use a ‘passive’ benchmark approach since this cancause difficulties for some pension fund trustees who want to compare managers witheach other or relative to some benchmark. They should adopt a longer-term view andadopt a range of different comparators for hedge fund managers. Selecting the bestmanagers is the most crucial part of the process. Looking at an ‘average’ manager is notproductive due to increased dispersion of returns.Question 6.If long/short hedge fund managers can outperform markets they are the winners.If there are winners, there must be losers. Who do you think the losers are?Altmann:Ros said she thought the losers are probably the traditional active managers who areconstrained by benchmarks to hold stocks that they don’t think offer good value.To have truly active management which can outperform a benchmark, one needs toallow managers to have the freedom to prove their skill.

Summary of PapersPeter Cripwell – Pioneer Alternative Investments“Operating Diversified Mean-reverting Strategiesin Abnormally Correlated and Volatile Markets”Discussion: Matthew Bowyer (Citigroup Asset Management)Peter Cripwell discussed the practicalities of managing specific hedge fund strategies in the current highlyvolatile and correlated markets. In particular he concentrated on equity arbitrage, convertible bond arbitrageand fixed income relative value. Practical examples of the issues that impact managing low volatility fundsare given and methods by which these issues may be addressed are suggested. Particular emphasis was givento fixed income relative value where a number of different aspects of the management style and the problemsthat they face were given.David Modest – Morgan Stanley“Beaches, Lightning and Financial Markets”Discussion: Gregory Connor (London School of Economics)David presented his views as to why markets are not efficient and never will be, but markets do tendto become more efficient over time and the duration of the inefficiencies which exist will shorten.He therefore disputes the “Efficient Markets Hypothesis”. He presented his views that hedge funds shouldbe able to exploit these inefficiencies and the “smart money” should generate better performance. Althoughthe number of hedge funds has grown over time, they are still a small proportion of total assets.Christopher Jones – University of Southern California“The Dynamics of Stochastic Volatility”Discussion: Andrew Patton (London School of Economics)Professor Jones discussed how previously unobserved dynamic patterns in stock market volatility relateto the presence of extreme stock market returns and contribute to high prices for index put options.Specifically, as market volatility rises, its own volatility rises as well, making even more volatile marketsincreasingly likely. His research demonstrated that standard volatility models are misspecified and do notcapture important sources of return non-normality.

Summary of PapersMichael Brandt – The Wharton School, University of Pennsylvania“On the Relationship between the Conditional Mean and Variance of Stock Returns:A Latent VAR Approach”Discussion: Gerard Gennotte (Meriwether Associates)Professor Brandt presented the latest results of his research on the co-variation of the expected return andvolatility of US equities. Using a flexible statistical model for returns that does not rely on exogenouspredictors, he showed that changes in the mean and volatility are strongly negatively correlated (i.e., theexpected return drops when returns become riskier); however, the levels of the moments are stronglypositively correlated (i.e., stocks tend to have a higher expected return when they are more risky). The sourceof these conflicting correlations is an intriguing and statistically robust lead-lag relationship between the twomoments that appears to be direc

pension fund portfolio depends on whether one believes that hedge fund managers, as a group, have superior skills. It is likely over time, as barriers to entry into hedge fund management have fallen, that the average hedge fund may no longer have superior skills relative to the market, especially after fees.