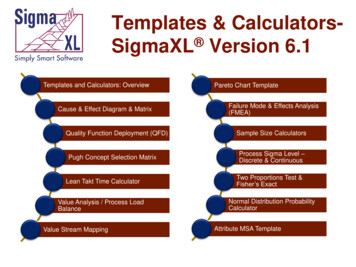

Transcription

PRE-AUDIT CALCULATORSPersonnel Assistant Training,May 2015

CALCULATORS AVAILABLEThe calculators available in the Pre-Audit Calculators Spreadsheet include: Biweekly Salary (BW Salary) – typically used to calculate advanced appointment ratesPay Increase and Back Pay Owed for Retroactive Increase (Pay Incr - Back Pay)Regular Vacation and Sick Payout (Regular Vac-Sick Payout)SLIP Vacation and Sick Payout (SLIP Vac-Sick Payout)Average of Past Six Pay Periods (Average 6PPs)Step Increase / Vacation Anniversary Date (Step Incr - Vac Ann Date)Pay AdjustmentsLead Worker / SPOC 4%Age – use to determine whether employee is eligible to retire

REGULAR VACATION & SICK PAYOUT Use the regular vacation & sick payout calculator when an employee is separatingfrom employment and has vacation hours that need to be paid. Sick leave hourscan be paid if the employee is retiring (non-SLIP), or if an employee is age 55 orolder and passes away. Complete the fields in the top box (Enter Values Here). If the employee isconverting sick leave to vacation in the final pay period, also enter the applicablenumber of hours in the “Converted” fields in the Payout Calculation boxes.

REGULAR VACATION & SICK PAYOUT“ENTER VALUES HERE” BOX Enter the employee’s biweekly base, plus any shift differential, med passer, orother pay received. If the employee received varying amounts of shift, med passer pay, and/or standby pay each payperiod, calculate the average of the last six pay periods. The employee must have received the payfor at least 3 of the last six pay periods for the pay to be included in the payout calculation. Theexception is if an employee had a shift designation and is terminating, but has not worked six payperiods – as long as the employee received shift pay in each pay period worked it would beincluded in the calculation. Enter the balances and accrual rates from the D7 screen, and the employee’shours in the final pay period from the timesheet or PAYN. Also enter any vacationand/or sick leave hours used. If the employee had less than 80 regular hours, but had overtime or holiday hours, those hoursshould be added to the regular hours and entered in the “Hrs in Final PP” field.

Shift found on D9 screen (or if employeereceives varying amount, refer to warrants)SALARY CALCULATIONEnter the employee’s base salaryfrom the main EmployeeInformation screen. Also enter anyshift, med passer, or other paysreceived.

D7 SCREEN – HOURS & BALANCESEnter balances and accrual ratesas they appear on the D7 screen.The vacation maximum is theVacation Conversion Ceiling plusthe Vacation Accrual Maximum.

TIMESHEETEnter the hours worked in the finalpay period and any vacation orsick used. If the employee had lessthan 80 regular hours, include anyovertime or holiday hours. Thisemployee should earn accruals on40.13 hours.

“ENTER VALUES” BOXUsing the information from theprevious slides, the above iswhat the “Enter Values Here”box should look like.

CALCULATIONSThe formulas in the spreadsheet willthen calculate the vacation and sick(if applicable) amounts owed to theemployee. This employee resigned,so is not eligible for a sick payout.

P1 REMARKSRemarks in the payout P1. Can usetemplate and fill in information, orcopy/paste straight fromcalculator.

SLIP VACATION & SICK PAYOUT Use the SLIP vacation & sick payout calculator when an employee is retiring underthe Sick Leave Insurance Program. The calculator is exactly the same as the regular vacation & sick payout calculator,except it only calculates the accruals to two decimal places, because that is all thatcan be entered on page two of the P1. Even though the 470 SLIP Calculation P1 will calculate the payout amounts, youwill still want to use the calculator to calculate the accruals earned in the final payperiod, and so you can enter remarks showing the calculations.

SLIP CALCULATION – PAGE 1This screen will automaticallypopulate with the employee’ssalary and any recurring pays.You will need to enter any shift,med passer, or standby pay, ifapplicable.

SLIP CALCULATION – TIMESHEETTo calculate the accruals earnedin the final pay period, enter thehours from the employee’stimesheet or PAYN. This personalso converted sick to vacationin the final pay period, whichwill need to be entered in thecalculator and on the P1.

SLIP CALCULATORHere is what the employee’sinformation would look likeentered into the SLIP Vac-SickPayout Calculator.

SLIP CALCULATION – PAGE 2This screen will automaticallypopulate with the employee’scurrent balances. You will needto enter the current pay period’saccruals and any sick or vacationused.

SLIP CALCULATION – PAGE 3There is nothing to enter on thefinal page of the P1. The P1 willautomatically calculate thebeginning SLIP balance andvacation payout based on theprevious two pages of the P1.

SLIP CALCULATION REMARKSEven though the P1 will do thepay calculations, you still needto enter remarks to show thefinal accrual calculations.

AVERAGE OF PAST 6 PAY PERIODS (NEW) This calculator can be used to calculate the average shift (if the employee’s shiftvaried), med passer, and/or standby pay received over the past six pay periods.Average shift, med passer and/or standby should be added to the base pay whencalculating the hourly rate for vacation and sick leave payouts if an employee isterminating or retiring. Use the Warrant Information module to look up the pay the employee received ineach of the past six pay periods and enter the amount in the corresponding box forthat pay period. From the main page of a pay period warrant, enter “L”, then F8 to the next page. Shift, medpasser, and standby amounts received in a pay period can all be found on this page.

AVERAGE OF PAST 6 PAY PERIODSEnter the current pay period atthe top of the calculator and itwill populate the dates of thepast six pay periods for you tolook up. Enter the amount theemployee received each payperiod and the calculator willgive you the average pay.

STEP INCREASE DATE / VACATION ANNIVERSARY DATE This calculator can be used to calculate: The new step increase date for an employee who has either returned from leave without pay, orwho was recalled to employment after having been laid off.The new vacation anniversary date for an employee who is being reinstated to employment. Referto Administrative Rule 57.5 and the Reemployment vs. Reinstatement document for moreinformation about eligibility for reinstatement.

STEP INCREASE DATE CALCULATOREnter the dates described on thecalculator. If the employeemissed an increase while onleave or laid off, enter yes andthe adjusted step increase datewill be moved out a year.

VACATION ANNIVERSARY DATECALCULATOREnter the dates described on thecalculator. The number of daysthe employee was gone will becalculated and the new vacationanniversary date will beprovided.

from employment and has vacation hours that need to be paid. Sick leave hours can be paid if the employee is retiring (non-SLIP), or if an employee is age 55 or older and passes away. Complete the fields in the top box (Enter Values Here). If the employee is converting sick leave to vacation in the final pay period, also enter the applicable