Transcription

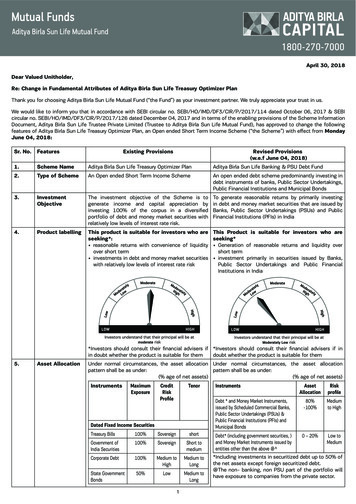

April 30, 2018Dear Valued Unitholder,Re: Change in Fundamental Attributes of Aditya Birla Sun Life Treasury Optimizer PlanThank you for choosing Aditya Birla Sun Life Mutual Fund (“the Fund”) as your investment partner. We truly appreciate your trust in us.We would like to inform you that in accordance with SEBI circular no. SEBI/HO/IMD/DF3/CIR/P/2017/114 dated October 06, 2017 & SEBIcircular no. SEBI/HO/IMD/DF3/CIR/P/2017/126 dated December 04, 2017 and in terms of the enabling provisions of the Scheme InformationDocument, Aditya Birla Sun Life Trustee Private Limited (Trustee to Aditya Birla Sun Life Mutual Fund), has approved to change the followingfeatures of Aditya Birla Sun Life Treasury Optimizer Plan, an Open ended Short Term Income Scheme (“the Scheme”) with effect from MondayJune 04, 2018:Sr. No.FeaturesExisting ProvisionsRevised Provisions(w.e.f June 04, 2018)1.Scheme NameAditya Birla Sun Life Treasury Optimizer PlanAditya Birla Sun Life Banking & PSU Debt Fund2.Type of SchemeAn Open ended Short Term Income SchemeAn open ended debt scheme predominantly investing indebt instruments of banks, Public Sector Undertakings,Public Financial Institutions and Municipal Bonds3.InvestmentObjectiveThe investment objective of the Scheme is togenerate income and capital appreciation byinvesting 100% of the corpus in a diversifiedportfolio of debt and money market securities withrelatively low levels of interest rate risk.To generate reasonable returns by primarily investingin debt and money market securities that are issued byBanks, Public Sector Undertakings (PSUs) and PublicFinancial Institutions (PFIs) in India4.Product labellingThis product is suitable for investors who areseeking*: reasonable returns with convenience of liquidityover short term investments in debt and money market securitieswith relatively low levels of interest rate riskThis Product is suitable for investors who areseeking* Generation of reasonable returns and liquidity overshort term investment primarily in securities issued by Banks,Public Sector Undertakings and Public FinancialInstitutions in India*Investors should consult their financial advisers if *Investors should consult their financial advisers if inin doubt whether the product is suitable for themdoubt whether the product is suitable for them5.Asset AllocationUnder normal circumstances, the asset allocation Under normal circumstances, the asset allocationpattern shall be as under:pattern shall be as under:(% age of net assets)(% age of net TenorDated Fixed Income SecuritiesTreasury Bills100%SovereignshortGovernment ofIndia Securities100%SovereignShort tomediumCorporate Debt100%Medium toHighMedium toLongState GovernmentBonds50%LowMedium toLong1InstrumentsAssetAllocationRiskprofileDebt * and Money Market Instruments,issued by Scheduled Commercial Banks,Public Sector Undertakings (PSUs) &Public Financial Institutions (PFIs) andMunicipal Bonds80%-100%Mediumto HighDebt* (including government securities, )and Money Market Instruments issued byentities other than the above @ 0 – 20%Low toMedium*Including investments in securitized debt up to 50% ofthe net assets except foreign securitized debt.@The non- banking, non PSU part of the portfolio willhave exposure to companies from the private sector.

Sr. No.FeaturesExisting ProvisionsRevised Provisions(w.e.f June 04, 2018)(% age of net assets) The scheme will invest in State Development Loansand UDAY Bonds issued by PSU &PFI as reRiskPublic sector entities/undertakings to include thoseProfileentities,: in which the Government of India / a StateGovernment has atleast 51% shareholding. notified / qualifies as public sector entities, inDated Fixed Income Securitiesaccordance with norms / notified by Government ofGovernment50%LowMedium toIndia / a State GovernmentGuaranteedLong the debt of which is guaranteed by Government ofBondsIndia / a State Government.Public Sector100%MediumMedium to“Public Financial Institution” means UndertakingLong(i) the Life Insurance Corporation of India, establishedBondsunder section 3 of the Life Insurance CorporationAsset Backed75%Low toShort toAct, 1956;SecuritiesMediumMedium(ii) the Infrastructure Development Finance CompanyLimited, referred to in clause (vi) of sub-sectionFinancial75%Low toMedium to(1) of section 4A of the Companies Act, 1956 soInstitution &MediumLongrepealed under section 465 of this Act;Banking SectorBonds(iii) specified company referred to in the Unit Trust ofIndia (Transfer of Undertaking and Repeal) Act,Money Market Securities2002;Call Money100%LowShort(iv) institutions notified by the Central GovernmentCommercial Paper100%Medium toShortunder sub-section (2) of section 4A of theHighCompanies Act, 1956 so repealed under section465 of this Act;Certificate of100%Low toShort(v) such other institution as may be notified by theDepositsMediumCentral Government in consultation with theDiscounted Trade75%Low toShortReserve Bank of India:BillsMediumProvided that no institution shall be so notified unlessThe Fund manager may also make investments in(A) it has been established or constituted by or underTerm/Fixed deposits from time to time. The Fundany Central or State Act; orManager will review the portfolio for adherence with(B)notless than fifty-one per cent of the paid-upthe above asset allocation pattern and rebalance thesharecapital is held or controlled by the Centralsame within 30 days to conform to the above limits.Government or by any State Government orInvestment objectives of the Scheme are proposedGovernments or partly by the Central Governmentto be achieved by investing, under normal marketand partly by one or more State Governments;conditions, 100% of the corpus in a diversified portfolioBanks will include all scheduled commercial banks whichof debt (fixed income) and money market securities.are regulated by Reserve Bank of India.The Scheme retains the flexibility to invest across all ofthe various securities in the debt and money markets. The scheme may use fixed income derivative uptoFrom time to time it is possible that the portfolio may 50% of the net assets, for the purpose of hedging andhold cash. The Scheme reserves the right to invest its portfolio rebalancing or to undertake any other strategyentire allocation in any one or more of the debt security as permitted under SEBI (MF) Regulations from time toclasses to the extent stated hereinabove. For instance, time75% of the entire asset allocation, may be invested The scheme shall participate in repo transactions Thein asset-backed securities. Investment policies of gross exposure to repo transactions in corporate debtthe Scheme comply with the rules, regulations and securities shall not be more than 10 % of the net assets.guidelines laid out in the SEBI (MF) Regulations 1996, In terms of provisions of SEBI circular no. CIR / IMD / DFspecifically the Seventh Schedule. All of the Scheme’s / 19 / 2011 dated November 11, 2011 read with SEBIassets will be invested in transferable securities. The circular no. CIR / IMD / DF / 23 / 2012 dated Novembercorpus of the Scheme shall not in any manner be 15, 2012, Repo in Corporate debt securities shall be inused in option trading, short selling or carry forward accordance with guidelines as prescribed by the Boardtransactions as stipulated in SEBI (MF) Regulations and of Directors of the Aditya Birla Sun Life AMC Limited andamended from time to time. Investments in debt and Aditya Birla Sun Life Trustee Private Limited, subject tomoney market instruments will be made in securities directions issued by RBI and SEBI from time to time.rated as investment grade by atleast one recognised The cumulative gross exposure in debt and moneyrating agency. Investments in unrated securities will be market instruments and derivative positions shall notmade with the prior approval of the Boards of Directors exceed 100% of the net assets of the scheme.of the Trustee Company and the Asset ManagementCompany or a committee thereof.2

Sr. No.FeaturesExisting ProvisionsRevised Provisions(w.e.f June 04, 2018)The Scheme reserves the right to invest in newerinvestment products at a future date subject toapproval of the Trustee Company and in accordancewith any applicable SEBI and / or RBI guidelinesthat may be issued in this regard, and after makingthe required disclosures prescribed under SEBI (MF)Regulations or by any other regulatory body.However, such investments also entail additionalrisks. Such investment opportunities may bepursued by the Scheme provided they are consideredappropriate in terms of the overall investmentobjectives of the Scheme.It is the intention of the Scheme to use fixed incomederivatives to achieve investment objectives incompliance with SEBI (MF) Regulations, 1996.The scheme may also invest upto 100% of theportfolio (i.e. net assets including cash) in suchderivative instruments as may be introduced fromtime to time subject to framework specified by SEBI,for the purpose of hedging and portfolio balancingand other uses as may be permitted under SEBIRegulations. Under normal circumstances thescheme shall not have an exposure of more than25% of its net assets in foreign debt securitiessubject to the overall cap as specified by SEBI.The Scheme proposes to invest in fixed income andmoney market securities. The liquidity of certainof these investments may be restricted by tradingvolumes and settlement periods. Different segmentsof the Indian financial markets have settlementsranging from one-to-fourteen days, and suchperiods may be extended significantly by unforeseencircumstances. Investment in unlisted and / orunrated securities too may become realisable onlyupon maturity of the securities.Due consideration will be given to the liquidity ofthe Scheme’s investments keeping in mind that theScheme is open-ended. Liquidity will be providedthrough investment allocation, staggering maturitiesand investing in structured securities. Liquidity willalso be managed by opportunistically investing inthe call money market when call money yields areattractive relative to other money market yieldsand by laddering coupon payments and maturitieswithin the Scheme’s investments. Additionalliquidity will also be provided through borrowing tomeet redemptions in accordance with the SEBI (MF)Regulations.Investments may be made in listed or unlistedinstruments. Securities may be listed on any ofthe recognised Indian stock exchanges includingthe National Stock Exchange and the Over theCounter Exchange of India. Investments may bemade as secondary market purchases, initial publicoffers, private placements, negotiated investments,rights offers, etc. The portion of the Scheme’sportfolio invested in each type of security will varyin accordance with economic conditions, interestrates, liquidity and other relevant considerations,including the risks associated with each investment.The scheme shall borrow through repo transactions onlyif the tenor of the transaction does not exceed a periodof six months.The scheme shall not invest in Foreign Securities andCredit Default Swaps. The scheme shall not engage inshort selling and securities lending activities.3

Sr. No.FeaturesExisting ProvisionsRevised Provisions(w.e.f June 04, 2018)The Scheme will, in order to reduce the risksassociated with any one security, utilize a varietyof investments. Performance will depend on theAsset Management Company’s ability to assessaccurately and react to changing market conditions.While it is the intention of the Scheme to maintainthe maximum exposure guidelines provided in thetable above there may be instances when thesepercentages may be exceeded. Typically, this mayoccur when the net assets of the scheme fall belowRs. 30 Crores.The Scheme may enter into securities lendingas allowed under the SEBI (MF) Regulations.Notwithstanding the foregoing investment policiesfor the scheme, for temporary defensive purposes(e.g., during periods in which the Asset ManagementCompany believes changes in the securities marketor economic or other conditions warrant), thescheme may invest in Indian Government T-Billsand hold cash or cash equivalents and other moneymarket instruments. The Trustee of the Mutual Fundmay from time to time alter these limitations inconformity with the SEBI (MF) Regulations, 1996and other guidelines or notifications that may beissued by SEBI6.InvestmentStrategyThe AMC aims to identify securities, which offersuperior levels of yield at lower levels of risks. Asper the asset allocation pattern, the Fund investsin various debt securities and money marketinstruments issued by corporates and/or state andcentral government. With the aim of controlling risks,rigorous in depth credit evaluation of the securitiesproposed to be invested in will be carried out by theinvestment team of the AMC. The credit evaluationincludes a study of the operating environment ofthe company, the past track record as well as thefuture prospects of the issuer, the short as well aslong-term financial health of the issuer. The AMC isalso guided by the ratings of rating agencies such asCRISIL, CARE and ICRA or any other rating agency asapproved by the regulators.In addition, the Investment Team of the AMCstudies the macro economic conditions, includingthe political, economic environment and factorsaffecting liquidity and interest rates. The AMC usethis analysis to attempt to predict the likely directionof interest rates and position the portfolioThe Scheme will invest in securities issued by banks andfinancial institutions across maturities with an intentionto offer reasonable level of yields at lower levels of riskwhile maintaining sufficient portfolio liquidity. The fundmanager will focus on credit quality as an importantcriterion for investment decision making. The Fund willtypically invest in short to medium term securities and asa result significant proportion of the total returns is likelyto be in the form of income yield or accrual. The generalmaturity range for the portfolio will be determinedafter considering the prevailing political conditions, theeconomic environment (including interest rates andinflation),the performance of the corporate sector andgeneral liquidity as well as other considerations in theeconomy and markets.The above modifications (other than change in Scheme Name and type of scheme and Investment Strategy) are changes in the FundamentalAttributes of the Scheme as per Regulation 18(15A) of the SEBI (Mutual Funds) Regulations, 1996 and SEBI circular no. SEBI/HO/IMD/DF3/CIR/P/2017/114 dated October 06, 2017The Securities and Exchange Board of India has communicated its no-objection for the above changes vide its letter no. IMD/DF3/OW/P/2018/7315/1 dated March 08, 2018.Apart from above, the other features and terms & conditions of the Scheme will remain unchanged and all references to the above modificationsshall be suitably incorporated in the SID and KIM of the Scheme.EXIT OPTIONAs the above proposal is a change in Fundamental Attributes of the Scheme, in accordance with Regulation 18(15A) of the SEBI (Mutual Funds)Regulations, 1996, the existing unitholders (i.e. whose names appear in the register of unitholders as on close of business hours on April 30,2018) under the scheme are hereby given an option to exit, i.e. either redeem their investments or switch their investments to anyother schemes of Aditya Birla Sun Life Mutual Fund, within the 30 days exit period starting from May 02, 2018 till June 01, 2018(both days inclusive and upto 3.00 pm on June 01, 2018) at Applicable NAV, without payment of any exit load.4

Thus, all the applications for redemptions/switch-outs received under the Scheme shall be processed at Applicable NAV of the day of receipt ofsuch redemption / switch request, without payment of any exit load, provided the same is received during the exit period of 30 days mentionedabove. Unitholders who have pledged or encumbered their units will not have the option to exit unless they procure a release of their pledges/encumbrances prior to the submission of redemption / switch requests. Unitholders should ensure that their change in address or pay-out bankdetails are updated in records of Aditya Birla Sun Life Mutual Fund as required by them, prior to exercising the exit option for redemption of units.The redemption proceeds shall be despatched within 10 business days of receipt of valid redemption request to those unitholders who chooseto exercise their exit option.The updated SID & KIM of the scheme containing the revised provisions shall be made available with our Investor Service Centres and also displayed on the website www.adityabirlasunlifemf.com immediately after completion of duration of exit option.RATIONALEIn order to ensure that schemes launched by a Mutual Fund are clearly distinct in terms of asset allocation, investment strategy etc. and tostandardize the scheme categories and characteristics of each category, SEBI vide its circular no. SEBI/HO/IMD/DF3/CIR/P/2017/114 datedOctober 6, 2017 has introduced Categorization and Rationalization of Mutual Fund Schemes. In view of the above circular and to build presenceand size of the Scheme in Banking and PSU Fund category it is proposed to carry out the above modifications.SCHEME DETAILSTo enable you to take an informed decision and understand the Scheme better, please find the following details pertaining to the scheme (Dataas on March 31, 2018): Portfolio statement of the scheme (Refer ‘Annexure A’) Performance of the scheme (Refer ‘Annexure B’) Current norms/guidelines for participating in Repo in Corporate debt securities (Refer ‘Annexure C’)Expense RatioRegular Plan - 0.64%Folios17,001Direct Plan - 0.34%Assets Under Management (AUM) (Rs in crs) 6,318.82The Notice-cum-Addendum informing the details of the modification is published in newspapers and uploaded on our website www.adityabirlasunlifemf.com. We request you to go through the same.TAX IMPLICATIONSRedemption / switch-out of units from the Scheme, during the exit period, may entail capital gain/loss in the hands of the unitholder. Similarly,in case of NRI investors, TDS shall be deducted in accordance with the applicable Tax laws, upon exercise of exit option and the same would berequired to be borne by such investor only. In view of individual nature of tax implications, unitholders are advised to consult theirtax advisors. For details on Tax implications, please refer to SID of the Scheme and Statement of Additional Information available with ourInvestor Service Centres and on our website www.adityabirlasunlifemf.com.It may be noted that the offer to exit is purely optional and is not compulsory.Alternatively, you can continue to remain invested in the Scheme. In that case, no action is required by you and Unitholders who do notexercise the exit option by 3.00 p.m. on June 01, 2018 would be deemed to have consented to the above proposal.Aditya Birla Sun Life AMC Ltd / Aditya Birla Sun Life Mutual Fund would like the unitholders to remain invested in the Scheme.Also, please note that in case you choose to continue with your investments in the aforesaid scheme, there shall be no tax implications arisingout of the above proposal.CONTACT USIf you have any further queries regarding your investments you can Write in at care.mutualfunds@adityabirlacapital.com Visit your nearest Investor Service Centres (ISCs). To locate your nearest ISC we request you to visit www.adityabirlasunlifemf.com.Thanking you once again and looking forward to a long and enduring relationship.For Aditya Birla Sun Life AMC Ltd.(formerly known as Birla Sun Life Asset Management Company Limited)(Investment Manager for Aditya Birla Sun Life Mutual Fund)sd/Authorised Signatory5

Annexure AADITYA BIRLA SUN LIFE TREASURY OPTIMIZER PLANPortfolio as on March 31, 2018Name of the InstrumentISINRatingQuantity Market/Fair Value(Rs. in Lacs)Debt Instruments(a) Listed / awaiting listing on Stock Exchange8.80% Capital First Limited (23/03/2021) **INE688I07717CARE AA 2,00020,095.264.00% Indiabulls Housing Finance Limited (27/11/2019) ** INE148I07AO0CARE AAA1,30016,333.151.50% Housing Development Finance CorporationINE001A07QM8CRISIL AAA15015,692.19Limited (29/06/2020) **7.18% Rural Electrification CorporationINE020B08AO4CRISIL AAA1,40013,834.34Limited (21/05/2021) **4.00% Indiabulls Housing Finance Limited (02/12/2019) ** INE148I07AQ5CARE AAA1,00012,555.797.04% National Bank For Agriculture and RuralINE261F08881IND AAA1,25012,474.11Development (08/06/2020) **9.32% Power Finance Corporation Limited (17/09/2019) ** INE134E08GJ4CRISIL AAA1,10011,252.598.56% Rural Electrification Corporation LimitedINE020B08864CRISIL AAA1,10011,166.28(13/11/2019) **LIC Housing Finance Limited (02/09/2019) (ZCB) **INE115A07FQ0CRISIL AAA75010,542.239.15% ICICI Bank Limited (20/06/2023) **INE090A08UB4ICRA AA 1,00010,076.477.90% LIC Housing Finance Limited (28/03/2019) **INE115A07MY0CRISIL AAA1,00010,009.948.15% Aditya Birla Housing Finance Limited (21/09/2018) ** INE831R07045ICRA AA 1,00010,003.107.80% LIC Housing Finance Limited (18/03/2020) **INE115A07LJ3CRISIL AAA1,0009,976.999.20% Tata Motors Finance Limited (20/07/2018) **INE909H07DH5CRISIL AA9509,528.238.18% LIC Housing Finance Limited (27/09/2018) **INE115A07JZ3CRISIL AAA7507,524.207.85% Power Finance Corporation Limited (15/04/2019)INE134E08IC5CRISIL AAA7507,521.157.95% PNB Housing Finance Limited (18/10/2019) **INE572E09395CARE AAA7507,497.169.95% Food Corporation Of India (07/03/2022)INE861G08035CRISIL AAA (SO)6506,955.908.53% Power Finance Corporation Limited (24/07/2020) ** INE134E08HP9CRISIL AAA6006,110.368.74% Shriram Transport Finance Company LimitedINE721A07LB5CRISIL AA 6006,008.84(05/07/2018) **8.95% Reliance Jio Infocomm Limited (04/10/2020) **INE110L08029CRISIL AAA (SO)5005,146.129.69% Power Finance Corporation Limited (02/03/2019) ** INE134E07513CRISIL AAA5005,096.849.63% Export Import Bank of India (29/11/2018) **INE514E08DE5CRISIL AAA5005,067.028.04% Small Industries Dev Bank of India (15/03/2019) ** INE556F09601CARE AAA5005,029.747.85% Small Industries Dev Bank of India (26/03/2021) ** INE556F08JC4CARE AAA5005,023.747.73% Rural Electrification Corporation LimitedINE020B08AW7CRISIL AAA5005,017.14(15/06/2021) **7.74% Small Industries Dev Bank of India (22/03/2021) ** INE556F08JB6CARE AAA5005,016.027.65% Indian Railway Finance Corporation LimitedINE053F07918CRISIL AAA5005,014.88(30/07/2019) **7.74% LIC Housing Finance Limited (05/06/2020) **INE115A07LR6CRISIL AAA5004,977.807.44% PNB Housing Finance Limited (31/10/2019) **INE572E09536CARE AAA5004,954.598.03% Idea Cellular Limited (31/01/2022) **INE669E08292CARE AA 5004,882.97IDFC Bank Limited (08/04/2019) (ZCB) **INE092T08121ICRA AAA5004,624.999.38% Rural Electrification Corporation Limited (06/11/2018) INE020B07HY0CRISIL AAA4504,546.527.09% Small Industries Dev Bank of India (19/06/2020) ** INE556F08IW4CARE AAA4003,993.829.00% Yes Bank Limited (18/10/2022) **INE528G08394ICRA AA4003,915.36Tata Motors Finance Limited (12/03/2019) (ZCB) **INE909H07CR6CRISIL AA3003,601.069.04% Rural Electrification Corporation LimitedINE020B08856CRISIL AAA3503,572.03(12/10/2019) **8.36% Power Finance Corporation Limited (26/02/2020) ** INE134E08GX5CRISIL AAA3503,546.5810.15% U.P. Power Corporation Limited (20/01/2021) **INE540P07285CRISIL A (SO)3523,529.9510.15% U.P. Power Corporation Limited (20/01/2022) **INE540P07293CRISIL A (SO)3523,528.8410.15% U.P. Power Corporation Limited (20/01/2023) **INE540P07301CRISIL A (SO)3523,528.5510.15% U.P. Power Corporation Limited (19/01/2024) **INE540P07319CRISIL A (SO)3523,519.1410.15% U.P. Power Corporation Limited (20/01/2025) **INE540P07327CRISIL A (SO)3523,515.1410.15% U.P. Power Corporation Limited (20/01/2026) **INE540P07335CRISIL A (SO)3523,506.346% to Net %0.56%0.56%0.56%0.56%0.55%

ADITYA BIRLA SUN LIFE TREASURY OPTIMIZER PLANPortfolio as on March 31, 2018Name of the InstrumentISINRatingQuantity Market/Fair Value(Rs. in Lacs)10.15% U.P. Power Corporation Limited (20/01/2027) **INE540P07343CRISIL A (SO)3523,501.5410.15% U.P. Power Corporation Limited (20/01/2028) **INE540P07350CRISIL A (SO)3523,495.378.20% National Bank For Agriculture and RuralINE261F08AE6CRISIL AAA2502,574.44Development (16/03/2028)9.02% Rural Electrification Corporation LimitedINE020B08799CRISIL AAA2502,555.22(19/11/2019) **8.70% Power Finance Corporation Limited (14/05/2020) ** INE134E08CX4CRISIL AAA2502,551.668.09% Rural Electrification Corporation Limited (21/03/2028) INE020B08AX5CRISIL AAA2502,549.448.96% Power Finance Corporation Limited (21/10/2019) ** INE134E08GN6CRISIL AAA2502,547.938.36% Rural Electrification Corporation LimitedINE020B08955CRISIL AAA2502,545.19(22/09/2020) **9.02% Rural Electrification Corporation LimitedINE020B07IV4CRISIL AAA2502,542.07(18/06/2019) **12.25% Cholamandalam Investment and FinanceINE121A08LZ5ICRA AA2502,529.87Company Limited (01/08/2018) **8.28% Small Industries Dev Bank of India (26/02/2019) ** INE556F09619CARE AAA2502,520.518.75% Shriram Transport Finance Company LimitedINE721A07LC3CRISIL AA 2502,504.93(04/08/2018) **8.20% Tata Capital Financial Services LimitedINE306N07IP4CRISIL AA 2502,501.32(06/09/2018) **7.97% Fullerton India Credit Company LimitedINE535H07944CARE AAA2502,493.24(22/03/2019) **7.59% LIC Housing Finance Limited (12/07/2019) **INE115A07LV8CRISIL AAA2502,489.457.35% Bharat Petroleum Corporation Limited (10/03/2022) ** INE029A07075CRISIL AAA2502,488.497.20% Indian Railway Finance Corporation LimitedINE053F07991CRISIL AAA2502,486.31(29/05/2020) **7.70% HDB Financial Services Limited (12/06/2020) **INE756I07BJ8CRISIL AAA2502,480.607.63% PNB Housing Finance Limited (14/07/2020) **INE572E09460CARE AAA2502,475.857.63% PNB Housing Finance Limited (15/12/2020) **INE572E09452IND AAA2502,473.967.50% PNB Housing Finance Limited (15/09/2020) **INE572E09478CARE AAA2502,467.807.40% Sundaram BNP Paribas Home Finance LimitedINE667F07GV7ICRA AA 2502,451.91(04/09/2020) **9.05% Essel Lucknow Raebareli Toll Roads LimitedINE465N07132CARE AAA(SO)2222,269.02(31/03/2022) **9.05% Essel Lucknow Raebareli Toll Roads LimitedINE465N07124CARE AAA(SO)2222,268.66(30/09/2021) **9.05% Essel Lucknow Raebareli Toll Roads LimitedINE465N07116CARE AAA(SO)2102,152.34(31/03/2021) **9.05% Essel Lucknow Raebareli Toll Roads LimitedINE465N07108CARE AAA(SO)2042,082.11(30/09/2020) **8.50% Power Finance Corporation Limited (29/06/2019) ** INE134E08HO2CARE AAA2002,021.189.05% Essel Lucknow Raebareli Toll Roads LimitedINE465N07082CARE AAA(SO)1982,004.73(30/09/2019) **7.60% ICICI Bank Limited (07/10/2023) **INE090A08TU6CARE AAA2001,970.1910.15% U.P. Power Corporation Limited (20/01/2020) **INE540P07277CRISIL A (SO)1761,764.478.85% Power Grid Corporation of India LimitedINE752E07KM1CRISIL AAA1201,582.71(19/10/2027) **9.05% Essel Lucknow Raebareli Toll Roads LimitedINE465N07140CARE AAA(SO)1501,535.08(30/09/2022) **7.09% LIC Housing Finance Limited (23/04/2019) **INE115A07MK9CARE AAA1501,488.329.70% India Infradebt Limited (28/05/2019) **INE537P07018CRISIL AAA1341,364.577.05% Power Finance Corporation Limited (15/05/2020) ** INE134E08IS1CRISIL AAA1361,346.278.85% Power Grid Corporation of India LimitedINE752E07KL3CRISIL AAA801,050.39(19/10/2026) **8.65% Power Finance Corporation Limited (28/11/2019) ** INE134E08GQ9CRISIL AAA1001,015.869.61% Rural Electrification Corporation LimitedINE020B07HZ7CRISIL AAA1001,015.32(03/01/2019) **7% to Net %0.28%0.25%0.24%0.24%0.22%0.21%0.17%0.16%0.16%

ADITYA BIRLA SUN LIFE TREASURY OPTIMIZER PLANPortfolio as on March 31, 2018Name of the InstrumentISINRatingQuantity Market/Fair Value % to Net Assets(Rs. in Lacs)8.65% PNB Housing Finance Limited (28/06/2019) **INE572E09379CARE AAA1001,008.720.16%6.91% NHPC Limited (15/09/2018) **INE848E07AD7ICRA AAA100998.120.16%7.84% Bajaj Finance Limited (29/06/2020) **INE296A07OY4CRISIL AAA100995.550.16%6.91% NHPC Limited (13/09/2019) **INE848E07AE5ICRA AAA100992.410.16%6.91% NHPC Limited (15/09/2020) **INE848E07AF2ICRA AAA100986.350.16%7.50% Tata Motors Limited (20/10/2021) **INE155A08316CARE AA 100986.030.16%7.20% Housing Development Finance Corporation LimitedINE001A07QY3CRISIL AAA10983.690.16%(01/09/2020) **6.91% NHPC Limited (15/09/2021) **INE848E07AG0ICRA AAA100978.620.15%6.91% NHPC Limited (15/09/2022) **INE848E07AH8ICRA AAA100969.580.15%8.54% NHPC Limited (25/11/2028) **INE848E07773CARE AAA500519.060.08%7.25% Reliance Utilities & Power Pvt Limited (29/08/2019) ** INE936D07091CRISIL AAA50496.250.08%7.33% Reliance Utilities & Power Pvt Limited (28/02/2020) ** INE936D07109CRISIL AAA50495.980.08%7.40% Reliance Utilities & Power Pvt Limited (29/07/2020) ** INE936D07117CRISIL AAA50495.440.08%7.14% Rural Electrification Corporation LimitedINE020B08AB1CRISIL AAA50492.030.08%(09/12/2021) **7.65% Reliance Utilities & Power Pvt Limited (29/08/2022) ** INE936D07133CRISIL AAA50489.830.08%7.60% Reliance Utilities & Power Pvt Limited (27/05/2022) ** INE936D07125CRISIL AAA50489.750.08%7.65% Reliance Utilities & Power Pvt Limited (29/12/2022) ** INE936D07141CRISIL AAA50489.450.08%7.67% Reliance Utilities & Power Pvt Limited (28/02/2023) ** INE936D07158CRISIL AAA50489.450.08%14.50% IOT Utkal Energy Services Limited (20/07/2020) ** INE310L07654CRISIL AAA (SO)387415.290.07%14.50% IOT Utkal Energy Services Limited (20/06/2020) ** INE310L07647CRISIL AAA (SO)387414.320.07%14.50% IOT Utkal Energy Services Limited (20/05/2020) ** INE310L07639CRISIL AAA (SO)387413.250.07%14.50% IOT Utkal Energy Services Limited (20/04/2020) ** INE310L0

features of Aditya Birla Sun Life Treasury Optimizer Plan, an Open ended Short Term Income Scheme ("the Scheme") with effect from Monday June 04, 2018: Sr. No. Features Existing Provisions Revised Provisions (w.e.f June 04, 2018) 1. Scheme Name Aditya Birla Sun Life Treasury Optimizer Plan Aditya Birla Sun Life Banking & PSU Debt Fund 2.