Transcription

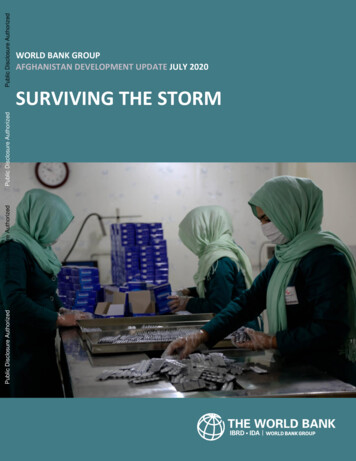

Public Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedWORLD BANK GROUPAFGHANISTAN DEVELOPMENT UPDATE JULY 2020SURVIVING THE STORM[

Disclaimer:This volume is a product of the staff of the International Bank for Reconstruction andDevelopment/The World Bank. The findings, interpretations, and conclusions expressed inthis paper do not necessarily reflect the views of the Executive Directors of The World Bankor the Governments they represent. The World Bank does not guarantee the accuracy of thedata included in this work. The boundaries, colors, denominations, and other informationshown on any map in this work do not imply any judgment on the part of The World Bankconcerning the legal status of any territory or the endorsement or acceptance of suchboundaries.Copyright Statement:The material in this publication is copyrighted. Copying and/or transmitting portions or all ofthis work without permission may be a violation of applicable law. The International Bank forReconstruction and Development/The World Bank encourages dissemination of its work andwill normally grant permission to reproduce portions of the work promptly.For permission to photocopy or reprint any part of this work, please send a request withcomplete information to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers,MA 01923, USA, telephone 978-750-8400, fax 978-750-4470, http://www.copyright.com/.All other queries on rights and licenses, including subsidiary rights, should be addressed to theOffice of the Publisher, The World Bank, 1818 H Street NW, Washington, DC 20433, USA,fax 202-522-2422, e-mail pubrights@worldbank.org.Photo Credits:Cover: The World Bank, 2020

AFGHANISTAN DEVEL OPMENT UPDATEJuly 2020

PrefaceThe Afghanistan Development Update, which is published twice a year, provides acomprehensive report of the state of the Afghan economy. It covers recenteconomic developments and the medium-term outlook for Afghanistan. Eachedition includes Special Focus sections providing in-depth analysis on specific topics.The Afghanistan Development Update is intended for a wide audience, includingpolicy makers, the donor community, the private sector, and the community ofanalysts and professionals engaged in Afghanistan’s economy.This report was prepared by Habiburahman Sahibzada, Sayed Murtaza Muzaffari,Tobias Haque, and Anna Custers. Assistance was provided by Sardar GhaniAhmadzai. The special topic section was provided by Cesar Cancho and Tejesh ManPradhan (Section C), and Anna Custers and Cesar Cancho (Section D). The reportwas prepared under the overall guidance of Manuela Francisco (Manager for SouthAsia, Macroeconomics, Trade, and Investment) and Henry G.R. Kerali (CountryDirector).The authors are grateful for the cooperation received from Government officials insharing data and statistics and providing comments on draft versions of the report.From 2021, the World Bank will be aligning publication of Development Updatesfor all countries across the South Asia region. The next Afghanistan DevelopmentUpdate is therefore now planned for May 2021.

Table of ContentsKEY MESSAGES IN CHARTS . IEXECUTIVE SUMMARY .IIA. RECENT ECONOMIC DEVELOPMENTS . 11.2.3.4.5.Context .1Real Sector Activity . 3Monetary and financial sector developments . 6External sector . 9Fiscal sector . 13B. OUTLOOK AND MEDIUM-TERM PROSPECTS . 15C. FOCUS SECTION: HOUSEHOLD WELFARE IMPACTS OF COVID-19 INAFGHANISTAN . 20D. FOCUS SECTION: REVENUE AND DISTRIBUTIONAL IMPACTS OFINTRODUCING THE VAT IN AFGHANISTAN. 25

LIST OF FIGURESFigure 1: COVID-19 cases are concentrated in main urban centers and continue to grow rapidly . 2Figure 2: Continued insecurity led to high civilian casualties and ongoing displacement . 2Figure 3: Non-agriculture economy contracted significantly in first half of the year . 4Figure 4: Low social mobility strained services sector since end-March. 4Figure 5: Consumer prices increased more modestly than expected, reflecting lower energy prices globally . 5Figure 6: Growth of money supply was moderate and banks deposit remained highly dollarized . 6Figure 7: Bank loans remained concentrated in trade and service sectors . 7Figure 8: Banks are highly liquid while financial soundness indicators are weak . 8Figure 9: Decline in imports narrowed the trade deficit in 2019 despite weaker exports . 9Figure 10: Afghanistan trade is remains undiversified . 10Figure 11: Exports increased while imports declined across all categories of goods except for cement . 11Figure 12: The Afghani appreciated against the currencies of most major trade partners in the region . 12Figure 13: Depreciation of the Afghani slowed and gross international reserves continued to accumulate . 12Figure 14: Revenue growth slowed even before the pandemic . 13Figure 15: Execution of development budget remained strong in 2019 . 14Figure 16: Government will remain highly dependent on aid inflows . 18Figure 17: Household income sources by definition of vulnerability . 21Figure 18: Impact on households income and poverty from the pandemic . 22Figure 19: Impact on household consumption, by scenario assumed, location and percentile . 23Figure 20: Coping strategies of Afghan households . 24Figure 21: Revenue forecast (Afs billion/percent of GDP) . 27Figure 22: VAT and BRT collection by agency (2021, Afs billion). 27Figure 23: Change in post fiscal income across income groups . 28Figure 24: Implicit rates for selected groups of products and services . 29Figure 25: Consumption pattern by household income level . 30Figure 26: Change in post fiscal income across income groups without VAT exemptions . 30List of TablesTable 1: Fiscal outlook in baseline and downside scenario . 17Table 2: Macro-fiscal outlook with the pandemic shock . 18Table 3: Post-fiscal Lorenze curves and Gini coefficients . 31Table 4: Macroeconomic indicators . 32Table 5: Selected fiscal indicators (billion Afs) . 33Table 6: Selected fiscal indicators (percent of GDP) . 34Table 7: Selected fiscal indicators (billion USD) . 35

A fgh an ista n D ev el op m ent Up dat eKey Messages in ChartsEconomic impacts of the pandemic are already severe and could worsenReal GDP Growth by Sector (Percent)4.52.50.5(1.5)(3.5)(5.5)(7.5)20172018 (est.)2019 (est.)Agriculture2020 (proj.)Industry2021 (proj.)Services2022 (proj.)2023 (proj.)Real GDPSource: National Statistics and Information Authority and World Bank staff forecastIncomes are expected to substantially declineGDP per capita (US )560540520500480460440420201920202021Pre COVID20222023Baseline COVID20242025Downside COVIDThe pandemic is posing challenges for fiscal and economic managementNominal billion AfsCPI Inflation (12 month percent 9 TargetsSource: Ministry of Finance, 6Jan-16May-16Sep-15M 1 M 2 M 3 M 4 M 5 M 6 M 7 M 8 M 9 M 1 0M 1 1M 1 2May-15-6.00Non-FoodSource: National Statistics and Information Authroity, AfghanistanTHE WOR LD BA NK I

A fgh an ista n D ev el op m ent Up dat eExecutive summaryRecent economic developmentsAfghanistan’seconomy is facingmultiple overlappingchallengesThe global COVID-19 crisis has compounded the daunting challenges currentlyfacing Afghanistan. Afghanistan has officially recorded 31,238 cases and 733 deathsas of end-June, with actual cases and fatalities expected to be far higher. The numberof cases is increasing rapidly, with no sign that the pandemic is under control. Withmajor disruptions to domestic economic activity, regional trade, and remittanceflows, the economy is now contracting rapidly. With declining incomes andincreasing food prices, hardship is increasing, with the poverty rate expected toincrease to up to 72 percent over 2020. Due to reduced trade, administrativedisruptions, and declining economic output, government revenues fell by more thana third below target levels in May, placing major pressure on government finances.COVID-19 has hit Afghanistan in the midst of a difficult political transition, anintensifying conflict, and significant uncertainty regarding future grant support. Apower-sharing agreement has now been signed between the two parties contestingthe outcome of the September 2019 presidential elections. Implementation is nowunderway, leading to changes in senior staff across key ministries. While a peaceagreement has been signed between the US and the Taliban, laying the foundationsfor negotiation of a comprehensive political settlement, Taliban attacks on Afghansecurity forces have intensified. The future of international assistance remains inquestion. The US has substantially reduced troop numbers over 2020, with furtherreductions likely. Current grant pledges expire at the end of 2020, and internationalpartners are due to consider future aid commitments at an international conferencein November. Without progress towards a sustainable peace and commitments tocontinued grant support from international partners, medium-term prospects appearincreasingly grim.Nascent recovery has Growth is estimated to have reached 2.9 percent in 2019. The agriculture sector isbeen undermined by estimated to have grown by 7.5 percent, driven by recovery from drought conditionsin 2018. Industry and services, on the other hand, are estimated to have grown byCOVID-19two and 1.8 percent respectively reflecting weak confidence associated with politicaluncertainties and continued conflict.The economy is estimated to have contracted sharply over the first half of 2020, dueto the impacts of the COVID-19 crisis. Wheat production (mostly in the subsistencesector) has supported continued agricultural growth, but industry and service outputhave been heavily impacted by lockdowns and border closures. Householdconsumption is expected to have declined significantly due to reduced incomes,disruption to services and retail activities, and lower remittances (expected to declineby around 40 percent from 2019 levels). Investment is also expected to have sharplydeclined given the negative impacts of COVID-19 on already-weak confidence.Prices were stable over 2019, with inflation reaching just 2.3 percent, largely due tolow international energy prices. The COVID-19 crisis drove a significant spike infood prices over the first half of 2020, with prices for some basic food itemsincreasing by more than 20 percent. Prices have since moderated due to distributionTHE WOR LD BA NK II

A fgh an ista n D ev el op m ent Up dat eof wheat from strategic grain reserves, enforcement of anti-price-gougingregulations, and the reopening of borders for food imports.Reflecting high levels of political uncertainty, credit to private sector grew by onlytwo percent in 2019 reaching 3.15 percent of GDP. With the outbreak of COVID19, credit to private sector shrank by 3.3 percent in the first four months of 2020,wiping out growth over 2019. The loan to deposit ratio declined by around 1.7percentage points from 17.2 percent to 15.5 percent.The trade deficit hasnarrowed withdeclining importsIn 2019, the trade deficit narrowed slightly to 30.11 percent of GDP (from 32.72percent of GDP in 2018) driven by a US 513 million decline in imports. Goodsexports grew by 11 percent (year-on-year) in the first quarter of 2020 due to recoveryin agricultural output, but are expected to have since declined sharply due to supplyand trade disruptions. Imports shrank by 14 percent over the first quarter of 2020,driven by closure of border points, decreasing demand, and bans on wheat exportsin neighboring countries.The pandemicnecessitatedsignificant fiscaladjustmentsRevenue performance has collapsed since the onset of the COVID-19 crisis,reflecting lower economic activity, trade disruptions, and weaker compliance.Government revenue estimates for 2020 were revised downward from Afs 209billion to Afs 144 billion in the budget mid-year review. Grants support increasedby US 500 million, partially offsetting the decline in revenues. Both recurrent anddevelopment expenditures were reallocated towards COVID-19 response activities,including in social protection and healthcare.OutlookAfghanistan is facingoverlappinguncertainties.Economic prospects are subject to high levels of uncertainty. Real GDP is expectedto contract by between 5.5 percent and 7.4 percent in 2020 due to economicdisruptions associated with COVID-19. Industry and services are expected to be hithard by the imposition of urban lockdowns, while agricultural production continuesto expand due to favorable weather conditions. With impacts of the COVID-19crisis expected to persist through winter, the economy is expected to grow by onepercent over 2021, with the possibility of further contraction. Both per capita andreal GDP are expected to sharply decline and likely remain below pre-COVID-19levels over the medium-term.Higher food pricesand lower incomes arelikely to increasehardshipReflecting higher food prices, consumer prices are expected to increase by fivepercent in 2020. The inflation rate is expected to slow to 3.5 percent in 2021 beforestabilizing at around five percent over the medium term. Higher prices combinedwith lower incomes are expected to harm household welfare and increasehumanitarian pressures. The poverty rate is expected to increase to up to 72 percentin 2020.The current account is expected to remain in surplus over 2020, reflecting increasedgrants and weaker imports. The trade deficit is expected to decline from 30.11percent of GDP to 27 percent in 2020, and further narrow to around 28 percent ofGDP by 2023. Foreign exchange reserves are expected to remain at comfortablelevels, reaching US 9,166 million (equal to 16 months of import cover) by end2020. From 2021, the current account balance is expected to deteriorate, due todeclining grants, reaching a deficit of 3.6 percent of GDP by 2023.THE WOR LD BA NK III

A fgh an ista n D ev el op m ent Up dat eThe fiscal deficit isThe fiscal deficit is expected to reach around four percent of GDP in 2020 due toconstrained by limited weak revenue performance. Constrained by limited financing options, the fiscalfinancing optionsdeficit is expected to remain below two percent of GDP over the medium-term,with contraction of available fiscal space leading to substantial reductions indevelopment spending.Risks and medium-term prospectsImproved outcomesdepend on carefulmanagement of fiscalresources andcommitment frominternational partnersThe COVID-19 crisis will have a serious and sustained impact on Afghanistan’seconomy. Recovery is expected to take several years, with new investmentconstrained by political uncertainties, continued insecurity, and questions aroundongoing international support.With declining grants and lower revenues, fiscal space is expected to remain highlyconstrained over the medium-term. Available fiscal resources should be used toprotect vulnerable households and maintain delivery of basic services includinghealthcare. Recovery could be supported by rapid action to improve the businessregulatory environment, including through measures to expand access to credit.For development partners, the highest priority is ensuring continued and predictablegrant support. Precipitous declines in grant flows over coming years would forcemajor contraction in government services, undermining development outcomes andfuture growth prospects. Clear commitment to continued grant support is vital forany improvement in confidence and investment.THE WOR LD BA NK IV

A fgh an ista n D ev el op m ent Up dat eA. Recent Economic Developments1. ContextAfghanistan has beenheavily impacted bythe global COVID-19crisisThe global COVID-19 crisis is having a major impact in Afghanistan. 30,000 casesand 600 deaths have been officially recorded, with actual cases and fatalities farhigher. Case numbers are currently increasing rapidly, with no sign that spread ofthe pandemic is yet under control. Policy measures to contain the spread of the virus,including border closures and lockdowns, have had a large and immediate negativeeconomic impact.The COVID-19 crisis has struck in the context of ongoing political instability. Apower-sharing agreement between the two major factions contesting the outcomesof the September 2019 presidential elections was finally reached in May.Implementation of this agreement is currently underway, including through theallocation of leadership roles for key ministries. Risks of further political instabilityand administrative disruption remain, constraining confidence and investment.Conflict continues toimpose a heavy tollInsecurity has continued throughout 2019 and into 2020, despite calls for a ceasefireamid the pandemic. Total civilian causalities reached 10,392 in 2019 slightly lowerthan 2018, with 3,403 deaths and 6,989 injured. Anti-government elements wereresponsible for most of the civilian causalities, despite a reduction in attacks by ISILKP. Internal displacement induced by the conflict increased to around 399,087 in2019, with the number of displaced increasing eight percent over 2018 levels.Civilian casualties have recently declined, partly reflecting the Taliban’s efforts tocomply with terms of its agreement with the United States. Civilian causalities overthe first quarter of 2020 reached 1,293 (533 deaths and 760 injured), among thelowest levels observed since 2013 and a decline of 29 from the same period in 2019.Government and international partners are preparing for intra-Afghan negotiationswith the Taliban, with the goal of a comprehensive peace agreement. Taliban attackson Afghan security forces continue, however, and prospects for a sustainablepolitical settlement remain highly uncertain. Calls from the government andinternational community to extend the brief Eid ceasefire were rejected by theTaliban.THE WOR LD BA NK 1

A fgh an ista n D ev el op m ent Up dat e140035120030100025800206001540010200500Daily CasesTotal DeathThousandsFigure 1: COVID-19 cases are concentrated in main urban centers and continue to grow rapidlyTotal Cases(RHS)Source: MoPH and WHO140a. Civilian casualitiesb. Conflict induced displacement120ThousandsHundredsFigure 2: Continued insecurity led to high civilian casualties and ongoing 09 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019Civilian DeathsCivilian Injured020122013201420152016201720182019Source: United Nations Assistance Mission in Afghanistan (UNAMA) and UNHCRBox 1: COVID-19 in AfghanistanThe first case of COVID-19 in Afghanistan was reported in Herat province on 24 February 2020. A very smallnumber of positive cases were registered throughout March. The rate of infection subsequently accelerated rapidly,with an influx of returnees from Pakistan and Iran (around 150,000 Afghans retruned from Iran, one of the virus’global epicenters, during March). In a bid to contain the spread of the virus, the government introduced socialdistancing measures in major cities from mid-March. Restrictions were eased following the Eid holidays, despite anincreasing number of daily cases.While actual cases much higher, official COVID-19 cases exceeded 31 thousands as of end-June, with casesreported in every province. Total COVID-19 fatalities are reported at 733, with a total fatality rate of 2.3 percent.Around 76,000 people have been tested. Healthcare personnel constitute more than five percent of total positivecases, and 13 healthcare workers have died of COVID-19. Kabul, with more than 13,448 cases, is the most affectedprovince of the country followed by Herat (4,998 cases), Balkh (1,715), Nangarhar (1,360 cases), and Kandahar(1,305 cases).THE WOR LD BA NK 2

A fgh an ista n D ev el op m ent Up dat eOverwhelmed by the spread of virus, the already fragile public health system has faced shortages of medicalequipment, personnel, and testing capacity. Government and donor resources were mobilized to establish andrepurpose a number of new laboratories, testing faciltiies, and treatment centers in cities with high numbers ofcases. As of June, Afghanistan's COVID-19 testing centers had capacity to undertake 790 tests a day, with eighthospitals allocated for exclusive use by COVID-19 patients.2. Real Sector ActivityA sustained period ofslow growthcontinued into 2019Afghanistan’s economic growth averaged just 2.3 percent over 2014-2019reflecting declining aid, political instability, and rising insecurity. Growth isestimated to have reached 2.9 percent in 2019, mainly driven by recovery fromdrought conditions in 2018. The agriculture sector is estimated to have grown by7.5 percent, driven by 17 percent growth in cereals, following a drought-inducedcontraction of 16 percent in 2018. Output of fruit is estimated to have increasedby around five percent after contracting by 10 percent in 2018. Industry andservices, on the other hand, are estimated to have grown by two and 1.8 percentrespectively in 2019. Slow growth in industry and services reflected weakconfidence associated with the presidential elections, continuing conflict, potentialdeclines in international security and development support, and the uncertainoutcome of peace discussions with the Taliban.The COVID-19 crisisis having significantnegative impacts onthe economyAvailable indicators show signs of a sharply contracting economy in the first halfof 2020, reflecting the impacts of the COVID-19 crisis in the context of continuedinsecurity and political uncertainty. Consumption and investment have beencompressed by social distancing measures and weak confidence. Revenue declineshave constrained scope for effective counter-cyclical fiscal policy to maintaineconomic activity over the first half of the year, with government spendingdeclining over recent months as a result of both declining revenues andadministrative disruptions to development project spending associated with socialdistancing measures.Impacts of COVID-19 on the agriculture sector have been limited to date.Favorable weather condition during the planting season are expected to seecontinued recovery in wheat production from the 2018 drought. Lockdownmeasures have so far had limited impact on agricultural production, remainingunenforced in rural areas. Production of fruit and nuts for processing and export,however, is being negatively impacted by disruption to supply chains and closureof export routes.Industry and services, on the other hand, have been severely impacted by theCOVID-19 crisis. Border closures are impacting exporting firms and those thatrely on imported inputs. Demand for goods and services is being suppressed bylockdown measures. Business activity is also being negatively impacted by acontraction in consumer demand associated with declines in remittances and joblosses. Following the imposition of lockdowns in urban areas, travel to retailstores, transit service locations, and workplaces remain more than 50 percentbelow pre-lockdown levels. Grocery stores have seen a decline in the number ofvisitors by around 40 percent compared to baseline levels.THE WOR LD BA NK 3

A fgh an ista n D ev el op m ent Up dat eFigure 3: Non-agriculture economy contracted significantly in first half of the year(percent)Contribution to Real GDPReal GDP growth by 18(est.)2019(est.)2020(proj.)(4.0)(4)2013 2014 2015 2016 2017 2018 2019 2020(est.) (est.) (proj.)(6)(8)(6.0)AgricultureReal GDPAgricultureIndustryIndustryServicesReal GDPServicesSources: National Statistics and Information Authority (NSIA) for 2013-17 data, World Bank staff projections for 2018Figure 4: Low social mobility strained services sector since end-March(percent change compared to cesRetailTransit Stations-60-80Source: Google COVID-19 Community Mobility ReportsThe pandemic hasdriven significantvolatility in pricesInflation reached just 2.3 percent over 2019. Food prices increased by around fourpercent, mainly driven by increased cereal prices due to rising global prices, despitestrong recovery in domestic production. Non-food prices increased by less thanone percent, partly due to low international energy prices.The COVID-19 crisis drove a significant spike in food prices over the first half of2020. Food prices increased by around 17 percent in April year-on-year followingimposition of border control and lockdown measures in main urban centers. Theimpact of trade disruptions on prices for basic household goods has so farTHE WOR LD BA NK 4

A fgh an ista n D ev el op m ent Up dat esignificantly outweighed impacts of lower prices for key imports including oil.Prices seem to have moderated since April, following distribution of wheat fromstrategic grain reserves, enforcement of anti-price-gouging regulations, and thereopening of borders for food imports.Figure 5: Consumer prices increased more modestly than expected, reflecting lower energy prices globally(12-month percentage change)b. World commodity an-16Sep-15May-15-6.0GrainSource: Central Statistics Organization, and World Bank Global Economic Monitor (GEM)Poverty is expected tohave deepened andworsened due to theimpacts of COVID-19The COVID-19 crisis is expected to have significantly exacerbated poverty. WorldBank analysis suggests that the poverty rate may increase to between 61 percentand 72 percent over 2020 as a result of declining incomes and increasing prices forfood and other vital household goods (see Focus Section). The impact onhousehold incomes is expected to be larger than the projected decline in GDP.This is because many households depend on informal, low-productivity activitieswhich contribute little to overall GDP and are highly vulnerable to economicshocks. Poverty impacts are expected to be concentrated among households thatdepend on activities that are vulnerable to the impacts of lockdowns, includingsmall-scale retail activities and daily labor in construction, agriculture, or personalservices. Approximately 15 million Afghans live in households that derive morethan

economic developments and the medium-term outlook for Afghanistan. Each edition includes Special Focus sections providing in-depth analysis on specific topics. The Afghanistan Development Update is intended for a wide audience, including policy makers, the donor community, the private sector, and the community of