Transcription

10STOCKSFºR 2021

Inside THIS REPORTClick an article to read more:Thank You & 3Wishes for 2021What 2020 Taught MeAbout the FutureAppianCloudflareLemonadeMercadoLibreTom GardnerNasdaq: APPNNasdaq: LMNDMorgan HouselNYSE: NETNew Tool:The Allocator10 Favorites FromAcross the FoolFiverrFulgent GeneticsOktaPinterestAmanda KishNYSE: FVRRNasdaq: MELINasdaq: OKTAShopifyZoom VideoCommunicationsNYSE: SHOPNasdaq: ZMRich GreifnerNasdaq: FLGTNYSE: PINS

WELCOME:THANK YOU & 3WISHES FOR 2021results, not the investor who’s ignoring allHello, Fools, and Happy New Year!of the stakeholders in an organization andThank you for being a part of everythinghoping that their position as a shareholderthat we brought to the world together.will be the primary focus of a company.As you know, 2020 was a survival year,Instead, we are all stakeholders andand now we head into one of the greatestlong-term thinkers hoping we can find greatrebuilding opportunities in our lifetime, cerTOM GARDNERcompanies that are going to make a diftainly in the 27-year history of The Motleyference in the world and profit from beingFool — the opportunity to be supportive ofassociated with them. So I hope for you and for all ofentrepreneurs and innovators, to invest our time andus that we continue to look at the data that shows thatour capital in solving the most important problems.really all the wealth of the public markets ends up inI’m happy that we get to do it together.the hands and in the pockets and the digital accounts ofOur mission is to make the world smarter, happier,long-term, business-focused investors.and richer in all of our Foolish experiences together. SoAnd my third wish for you, and in the year ahead, isI have three wishes I’d love to share with you for thethat we do everything we can to make the lives of thenew year.people around us smarter, happier, and richer — andFirst, we take even more pleasure and find eventhat we do so for ourselves as well. We want to domore success in identifying the great organizations ofeverything we can to make 2021 the unforgettable yearour time. How they’re priced in the short term really isthat it deserves to be and that we all hope for.a secondary or tertiary concern. It’s much more aboutThank you for being a part of The Motley Fool inwhere they’re going, what they’re trying to solve, and2020. So many of you have been with us since 2015,how much they care about all the stakeholders, all the2010, 2000, 1993. We debuted in the spring of 1993, andpartners, everyone connected to that organization.some of you are still hanging out in Fooldom with usThe great companies are going to build a pathwayand investing for the long term.to prosperity over the next 25 years. They’re goingThank you so much for being a part of our mission,to be innovating, they’re going to be organizing andhelping to lead our mission and co-owning our brandprioritizing their work to make sure that they’re doingwith us as we try to help as many people as we cansomething of consequence. Those are the businessesmake better decisions in their financial and theirthat we want to support here at The Motley Fool, andprofessional lives. So thank you.I wish that for you and for me and for all of us that weBest of good health and happiness for you and yourcontinue to do a better and better job of locating themfamily, and let’s go make 2021 a year that we’ll neverand preparing to invest in them for the long term.forget.That’s my second wish. As the days and weeks pass,Fool on!I want to demonstrate even more that the Motley Foolcommunity is dedicated to being the investor that greatorganizations deserve — and that is not the short-termthinker. Not the investor who’s using leverage to juice10 STOCKS FOR 20211

LOOKING AHEAD:WHAT 2020TAUGHT ME ABOUTTHE FUTUREMORGAN HOUSEL2This was the year that felt like a decade.That’s probably the most commonthing you’ll hear about 2020: the feelingthat time slowed down. The early daysof spring, when COVID-19 first enteredour lives, felt like it lasted an eternity.February feels like a different lifetime ago.The leading theory for why timeoccasionally feels like it slows is thattime perception is driven by the numberof memories formed in a period, andmemories are created by experiencesthat are new and surprising. It’s why themonotony of commuting to work on thesame road for 20 years passes withoutleaving a mark, but summer break seemsto last forever for a child experiencing herfirst summer camp.Time seems to have slowed in 2020because for the first time since childhoodmany of us have been bombarded withnew and surprising experiences.We learned how to work from home.How to use new technologies.How powerful exponential growthcan be.We learned that the economy can stopovernight.And that isolation is exhausting, evenfor introverts.10 STOCKS FOR 2021Entrepreneur Derrik Sivers oncewrote:“ People only really learn when they’resurprised. If they’re not surprised, thenwhat you told them just fits in with whatthey already know. No minds werechanged. No new perspective. Justmore information. ”As we head into a new year — avaccine in hand, light seemingly at theend of the tunnel despite a virus stillraging — I’ve been thinking about whatI’ve learned from this surprising year andwhat it means for 2021 and beyond.Three things come to mind.1. Risk is what you don’t see,aren’t talking about, andaren’t prepared for.The investment industry spent the betterpart of the last decade debating whatthe biggest risk to the stock market andeconomy was.We wondered: Was it budget deficits?The Federal Reserve printing money?Trade wars? High valuations? Profitmargins? Interest rate hikes? Tax hikes?An incredible amount of energy was

spent on these topics.But in hindsight, we know noneof those things were the biggest risk.The biggest risk by far was avirus no one was talking about untilthis year, because no one knew itexisted before this year.This year was a blunt-forcereminder that the biggest economicand investing risk is what no one’stalking about, because if no one’stalking about it, no one’s preparedfor it, and if no one’s prepared forit, its damage will be amplifiedwhen it arrives.Think about the four biggesteconomic and investing risks of thelast century. They were, I’d argue:the Great Depression, Pearl Harbor,September 11, and COVID-19.The common denominator ofthese events is how surprising theywere to virtually everyone whenthey occurred.Sure, some people warned theeconomy was getting overheated inthe late 1920s, and epidemiologistshave been warning about a viralpandemic for years. But a GreatDepression? Or an economic shutdown requiring trillions of dollarsin government stimulus? It justwasn’t on people’s radar.Surprise wreaks economic havocfor two reasons.One, people aren’t preparedfinancially. The amount of debtthey hold, the size of their emergency funds, and their annualbudget forecasts can break underthe pressure of an event they neveranticipated.Two, people aren’t preparedpsychologically. Surprises canshake your beliefs about how youassume the world works in waysthat leave you paranoid, pessimistic,and overestimating the odds of therecent surprise occurring again.Paying attention to known risksis smart. But we should acknowledge that what we can’t see andaren’t talking about will likely bemore consequential than all theknown risks combined.That’s usually how it worksevery year. I doubt 2021 will bemuch different.Nobel-prize winning psychologist Daniel Kahneman once said:“ Whenever we are surprised bysomething, even if we admitthat we made a mistake, we say,‘Oh I’ll never make that mistakeagain.’ But, in fact, what youshould learn when you make amistake because you did notanticipate something is that theworld is difficult to anticipate.That’s the correct lesson to learnfrom surprises: that the world issurprising. ”The solution isn’t to become afatalist. It’s to value room for error,and expect that things like recessions and bear markets can occur atany moment, rather than relying onspecific forecasts of when they willoccur.The Foolish investing approachis, in many ways, centered aroundlong-term optimism and an acceptance that market volatility doesnot prevent a company from innovating and creating value over thelong run. Buying good companiesand holding them for a long time10 STOCKS FOR 2021does not rely on knowing whenthe next recession will come, whatthe market will do next quarter, orwhether the biggest economic riskis an interest rate hike, a change tothe tax code, or a pandemic. Andgood thing, too — because I don’tthink anyone can forecast thosethings.2. Innovation and progressdon’t tend to happen wheneveryone is calm, happy,and safe. They happenwhen there’s a shock to thesystem and problems aresolved out of necessity.In some ways, 2020 is what technologists in 1995 assumed the worldwould look like in 2000.At the beginning of the dot-comboom in the early 1990s, the visionwas that the internet would createa world where you could work fromanywhere, buy everything online,and do most of your socializationonline instead of in person.But fast forward to, say, 2019,and that vision hadn’t reallyplayed out — at least not to its fullpotential.Physical offices were packed,and if your company was based inChicago, you probably had to livein Chicago. Grocery stores werepacked. Airlines had their bestyear ever as business travel was inrecord demand.Then 2020 hit.In April, Microsoft CEO SatyaNadella said, “We’ve seen two years’worth of digital transformation intwo months.”3

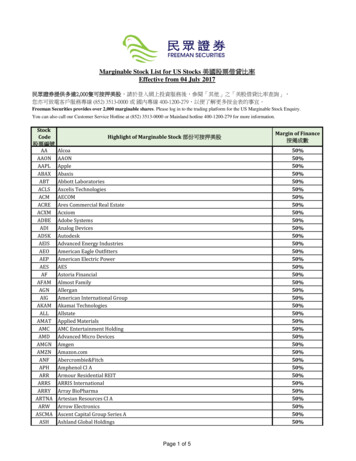

He’s not exaggerating. Considerthis chart from investment firmAlger:U.S. business investment55%Digital50%Physical45%201520162017When technology was niceto have, companies embraced itwarmly. When it was essential tosurvival, they bet the farm on itvirtually overnight.A lot of the history of innovationworks that way.The biggest innovations rarelyoccur when everyone’s happy andsafe, or when the future looks bright.They happen when people are alittle panicked and worried, andwhen the consequences of not acting quickly are too painful to bear.That was true during WorldWar II and the Cold War, wheneverything from penicillin to jets torockets to atomic energy, interstatehighways, synthetic rubber, microprocessors, GPS, radar, and digitalphotography were created.It was true in the 1930s duringthe Great Depression, which,according to economist AlexanderField, was the most productivedecade the U.S. economy has everseen. For all the suffering andunemployment, surviving businesses were forced — not nudged,but forced — to find new efficiencies and new ways to sell productsto consumers who had less moneyand patience. That gave rise to thesupermarket, laundromats, and the4201820192020widespread adoption of assemblylines.It’s true in 2020, too. And I thinkit bodes well for 2021 and beyond.The hardest thing aboutstress-induced innovation isreconciling that positive long-termtrends can be born when peopleare suffering the most. It makesthe topic difficult to even discusswithout looking insensitive.But think about what’s happened in the past year.The first documented case ofCOVID-19 was December 1, 2019.Twelve months and two weekslater, tens of millions of vials ofa 95%-effective vaccine are beingshipped around the world. That isthe fastest vaccine developmentin history, by far. And we’ve doneit with a technology — mRNA —that’s not only the first of its kindbut has the potential to teach usthings useful in treating otherdiseases, most notably cancer.Nicole Lurie of the Coalitionfor Epidemic PreparednessInnovations recently said: “I don’tthink the world of vaccine development will ever be the same again.”Things tend to move quicklyfrom there. In his book How We Gotto Now, Steven Johnson writes:10 STOCKS FOR 2021“ Innovations usually begin lifewith an attempt to solve aspecific problem, but once theyget into circulation, they end uptriggering other changes thatwould have been extremelydifficult to predict. An innovation, or cluster of innovations,in one field ends up triggeringchanges that seem to belong toa different domain altogether. ”That, I believe, is happeningin medicine as we speak. There’scurrently so much experimentation,with stakes so high, that you knowwe’re going to look back in thefuture — maybe next year, maybenext decade — and recognizethe incredible developments thathappened that wouldn’t have beenpossible without the frenzied rushto find a cure for COVID-19 in 2020.This doesn’t end with medicine.New business applications for allindustries surged 77% in the thirdquarter. More people than ever arestriking out on their own, startingsomething new, trying somethingdifferent.Or think about entire cities. Ifjust a handful of big tech companies allow their employees to workremotely, one of the biggest socialproblems of the last generation

— affordable housing — suddenlymoves in the right direction.Having so much economicpotential clustered in a few neighborhoods in California and NewYork created 2 million starterhomes in cities with good jobs andcheap homes in cities with pooreconomic prospects. Even a smallshift to permanent remote workcould make cities more livable, withless traffic and more affordablehomes, and rural areas more prosperous with good, high-paying jobs.It’s a rebalancing of geographicadvantages that wouldn’t have beenpossible without COVID-19.As we look ahead to 2021, thefocus is mostly on recovery fromthe damage inflicted in 2020. That’show it should be: some 10 millionfewer Americans have jobs todaythan did a year ago, and the toppriority should be getting themback to work.But beyond recovery, we shouldalso recognize that we are — rightnow — in what is probably thegreatest period of n periods we’ve seen in perhaps80 years.I’m always a long-term optimist.But I think there’s good reason tobelieve the future of innovation isbrighter today than it was a year ago.3. Optimism beginswell before it’s obvious.On February 24, Wa

Appian’s revenue rose 17% year over year to 77 million in the third quarter of 2020, fueled by a 40% surge in its cloud subscription revenue to 34 million. The gains