Transcription

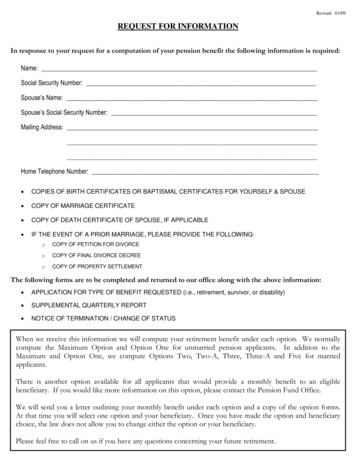

Revised 01/09REQUEST FOR INFORMATION COPIES OF BIRTH CERTIFICATES OR BAPTISMAL CERTIFICATES FOR YOURSELF & SPOUSE COPY OF MARRIAGE CERTIFICATE COPY OF DEATH CERTIFICATE OF SPOUSE, IF APPLICABLE IF THE EVENT OF A PRIOR MARRIAGE, PLEASE PROVIDE THE FOLLOWING:oCOPY OF PETITION FOR DIVORCEoCOPY OF FINAL DIVORCE DECREEoCOPY OF PROPERTY SETTLEMENT APPLICATION FOR TYPE OF BENEFIT REQUESTED (i.e., retirement, survivor, or disability) SUPPLEMENTAL QUARTERLY REPORT NOTICE OF TERMINATION / CHANGE OF STATUS!"#!!# !

Revised 5/1001/09RevisedAPPLICATION FORBACK-DEFERRED RETIREMENT OPTION PLAN(Back-DROP)APPLICANT’S NAME BACK-DROP PARTICIPATION BEGINS / /SOCIAL SECURITY # BACK-DROP PARTICIPATION ENDS/ /PARISH BACK-DROP PARTICIPATION PERIOD: YEARS MONTHSEMPLOYMENT DATE BREAK IN CONTINUOUS SERVICE (If applicable)From / / thru / /Applicant is applying for regular retirement benefits effective .Applicant’s salary as sheriff, deputy sheriff or member for the thirty-six (36) highest successive months of employment beforethe beginning of the Back-DROP period specified was: (If an interruption of service occurred, the highest thirty-six (36)successive, joined months of employment are applicable.) Salary for the highest sixty (60) successive or joined months ofemployment will be needed for those members whose first employment making them eligible for membership in the retirementsystem began on or after July 1, 2006.Jan Jan Jan Jan Feb Feb Feb Feb Mar Mar Mar Mar Apr Apr Apr Apr May May May May Jun Jun Jun Jun Jul Jul Jul Jul Aug Aug Aug Aug Sep Sep Sep Sep Oct Oct Oct Oct Nov Nov Nov Nov Dec Dec Dec Dec I understand that my decision to participate in BackDROP for the period designated above is an irrevocable decision.REQUESTED BYDATE / /CERTIFIED CORRECTDATE / /Applicant’s SignatureSignature of Sheriff or Authorized Representative

Revised 01/09EMPLOYEE NAMEHOME ADDRESS (STREET/P.O. BOX)CITY, STATE & ZIP CODEHOME TELEPHONE NUMBERSOCIAL SECURITY NUMBERPARISH OF EMPLOYMENTDATE CONTINUOUS SERVICE BEGANLAST DATE OF EMPLOYMENT.I wish to leave my funds on deposit:Due to change in status to Part-time.Due to call to Active Duty.For possible later employment. If termination is due to Leave of Absence, expected date ofreturn .For Retirement when I become eligible. Expected date of retirementI wish to leave my funds on deposit due to transfer of employment from presentParish to Parish, effectivedate .I have terminated employment and have no plans to work for another sheriff’s office inLouisiana. I wish to apply for a refund of my employee contributions. (This form must becompleted, signed by the member and submitted with the refund form to be eligible to receive arefund.)I wish to make application for Regular Retirement Benefits.I wish to make application for Back-Deferred Retirement Option Plan Benefits.I wish to make application for Disability Retirement Benefits.EMPLOYEE’S SIGNATURESHERIFF OR AUTHORIZED REPRESENTATIVEDATEDATE

RETURN OF EMPLOYEE CONTRIBUTIONS REMITTED DURINGBACK-DROP PERIODRevised 02 / 09MONTH / QUARTERENDING DATEEMPLOYEECONTRIBUTIONSPENSIONABLEWAGES MONTHLYWAGESignature of Sheriff or Authorized RepresentativeTOTAL EMPLOYEE CONTRIBUTIONSLESS BACK-DROP PERIOD REFUNDNET EMPLOYEE CONTRIBUTIONS BALANCERetirement AnalystDateRetirement AnalystDate

Louisiana Sheriffs’ Pension & Relief FundDESIGNATION OF BENEFICIARYBENEFICIARY DESIGNATION FOR BACK-DROP ACCOUNTMember’s Name:SSN:Address:PARISH:Marital Status:MarriedDivorcedSingleLouisiana law permits you to designate a beneficiary for your back-DROP account if you diebefore you have received by rollover or payment to you of the entire balance of your back-DROPaccount. If you do not designate a beneficiary, the balance of your back-DROP account will be paid toyour estate. The beneficiaries of your back-DROP account may, but need not be, the same as thebeneficiaries of your balance of unpaid employee contributions.You may designate one or more primary beneficiaries. If you designate more than one primarybeneficiary and one primary beneficiary dies before you, the benefit will be distributed to the remainingprimary beneficiaries unless all primary beneficiaries die before you. Only then will the LSPRF look toyour designated contingent beneficiaries. Careless designations can lead to results you do not want.For example, if you list your children by name as primary beneficiaries and a child dies before you, thebenefit will be paid to your remaining children and not to your grandchildren by the deceased child eventhough the grandchildren are listed as contingent beneficiaries. To prevent this result, you should listyour “descendants by roots” as the primary beneficiary and not list your children by name and providethe LSPRF with the names and social security numbers of your children and grandchildren on Exhibit “A”attached to this document . The term “descendants by roots” is a legal phrase that means your backDROP account balance will be divided equally by reference to your children. If a child dies before you,that deceased child’s share will be divided equally among that deceased child’s children. If a child andgrandchild die before you, the share of the grandchild will be divided equally among your greatgrandchildren by the deceased grandchild. If you name your spouse as primary beneficiary, you may listyour descendants by roots as the contingent beneficiary. You may also name your spouse as primarybeneficiary for a percentage of your back-DROP benefit and your descendants by roots both as primarybeneficiary for a percentage and as alternate beneficiaries if your spouse dies before you.You are permitted to name beneficiaries with percentages of the benefit you wish them toreceive, and the percentages do not have to be equal. However, they must total 100%. You are notlimited in naming beneficiaries to the number of boxes in the chart below. You may continue listingbeneficiaries on Exhibit “B” attached to this document . If a primary percentage beneficiary dies beforeyou, the benefit designated for the deceased primary percentage beneficiary will be allocated pro rataamong the surviving primary percentage beneficiaries unless you provide that the share of the deceasedRevised Oct. 10, 2017

percentage beneficiary goes to an Alternate Beneficiary. Below is a table for naming alternatebeneficiaries. Unlike primary beneficiaries, alternate beneficiaries only get the percentage youdesignate for them if the primary beneficiary ahead of them dies before you and nothing else. Ask forhelp with completing the form if this is the case.Contingent beneficiaries will receive money only if all primary beneficiaries are deceased, minusany percentage benefit which has been allocated to an alternate beneficiary. Since alternatebeneficiaries receive only the percentage interest designated for them and are not entitled to anyadditional distributions, your contingent beneficiaries will receive the unallocated percentage of yourbenefit unless you clearly provide otherwise.If you have executed a “power of attorney” or similar document which gives another person theright to alter your beneficiary designation, a certified true copy must be filed with the LSPRF or theLSPRF will not permit your designee to make changes to the beneficiary designation.Primary Beneficiary(ies):NameRelationshipDate of BirthPercentage %Social Security #Alternate Beneficiary(ies):(Not a Requirement) (First Alternate Beneficiary)If , a primary beneficiary named in the preceding chart with a % interest in myback-DROP balance dies before me, then instead of distributing his/her share among the surviving primarybeneficiaries, I instruct the LSPRF to divide that percentage according to the following chart:NameRelationshipDate of BirthPercentage %Social Security #Alternate Beneficiary(ies):(Not a Requirement) (Second Alternate Beneficiary)If , a primary beneficiary named in the preceding chart with a % interest in myback-DROP balance dies before me, then instead of distributing his/her share among the surviving primarybeneficiaries, I instruct the LSPRF to divide that percentage according to the following chart:Revised Oct. 10, 2017

NameRelationshipDate of BirthPercentage %Social Security #Contingent Beneficiary(ies):(Not a Requirement)If my primary beneficiaries all die before I die, and the designated alternate beneficiaries, if any, have also diedbefore me, then I instruct the LSPRF to divide my benefit as follows:NameRelationshipDate of BirthRevised Oct. 10, 2017Percentage %Social Security #

I hereby request that my beneficiary(ies) be designated as above. I understand that the beneficiary(ies) designatedon this form will receive my undistributed remaining back-DROP account balance. Payment of the remaining backDROP account balance will be made only upon receipt of the deceased member’s death certificate. This paymentto the named beneficiary(ies) or the estate cancels all liability of the Louisiana Sheriffs’ Pension & Relief Fund tothe deceased member, their named beneficiary(ies), or the estate.Member’s SignatureDate (MM/DD/YYYY)SWORN TO AND SUBSCRIBED BEFORE ME, Notary Public, in and for the State of .Parish of , this day of , 20 .NOTARY PUBLIC (Signature)Notary ID# or Bar Roll #(affix seal here)NOTARY PUBLIC (Type, Print or Stamp Name)Revised Oct. 10, 2017

Louisiana Sheriffs’ Pension & Relief FundDESIGNATION OF BENEFICIARYEXHIBIT “A”I HAVE DESIGNATED MY PRIMARY BENEFICIARY AS MY “DESCENDANTS BY ROOTS”. I HEREBY CERTIFYTHAT THE FOLLOWING IS A TRUE AND ACCURATE LISTING OF MY CHILDREN AND GRANDCHILDREN BYNAME AND SOCIAL SECURITY sn:Name:ssn:2. Parent:ssn:Name:Parent:ssn:Name:Parent:ssn:Revised Oct. 10, 2017

:Parent:ssn:Name:Parent:ssn:Name:Parent:ssn:I HEREBY CERTIFY THAT THE INFORMATION SET FORTH ABOVE IS TRUE AND CORRECTMEMBER SIGNATUREDATERevised Oct. 10, 2017

Louisiana Sheriffs’ Pension & Relief FundDESIGNATION OF BENEFICIARYEXHIBIT “B”I HEREBY DESIGNATE THE FOLLOWING ADDITIONAL BENEFICIARIES:Primary Beneficiary(ies):NameRelationshipDate of BirthRevised Oct. 10, 2017Percentage %Social Security #

I HEREBY CERTIFY THAT THE INFORMATION SET FORTH ABOVE IS TRUE AND CORRECTMEMBER SIGNATUREDATERevised Oct. 10, 2017

Revised 02/09REPORT OF WAGES/CONTRIBUTIONS FOR THOSE BEING REFUNDED OR RETIRING!BETWEEN REPORTING PERIODS"

Revised Oct. 10, 2017 percentage beneficiary goes to an Alternate Beneficiary. Below is a table for naming alternate beneficiaries. Unlike primary beneficiaries, alternate beneficiaries only get the percentage you