Transcription

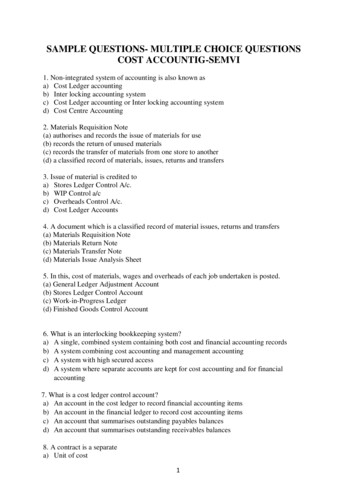

SAMPLE QUESTIONS- MULTIPLE CHOICE QUESTIONSCOST ACCOUNTIG-SEMVI1. Non-integrated system of accounting is also known asa) Cost Ledger accountingb) Inter locking accounting systemc) Cost Ledger accounting or Inter locking accounting systemd) Cost Centre Accounting2. Materials Requisition Note(a) authorises and records the issue of materials for use(b) records the return of unused materials(c) records the transfer of materials from one store to another(d) a classified record of materials, issues, returns and transfers3. Issue of material is credited toa) Stores Ledger Control A/c.b) WIP Control a/cc) Overheads Control A/c.d) Cost Ledger Accounts4. A document which is a classified record of material issues, returns and transfers(a) Materials Requisition Note(b) Materials Return Note(c) Materials Transfer Note(d) Materials Issue Analysis Sheet5. In this, cost of materials, wages and overheads of each job undertaken is posted.(a) General Ledger Adjustment Account(b) Stores Ledger Control Account(c) Work-in-Progress Ledger(d) Finished Goods Control Account6. What is an interlocking bookkeeping system?a) A single, combined system containing both cost and financial accounting recordsb) A system combining cost accounting and management accountingc) A system with high secured accessd) A system where separate accounts are kept for cost accounting and for financialaccounting7. What is a cost ledger control account?a) An account in the cost ledger to record financial accounting itemsb) An account in the financial ledger to record cost accounting itemsc) An account that summarises outstanding payables balancesd) An account that summarises outstanding receivables balances8. A contract is a separatea) Unit of cost1

b) Accountc) Cost centred) Contractor's A/c9. The work done & certified by the architect isa) Work completedb) Work uncertifiedc) Work certifiedd) Contract price10. Sale of plant from site isa) Credited to contract A/cb) Debited to contract A/cc) Debited to Insurance claim A/cd) Credited to Insurance claim A/c11. Sale of material is credited toa) Contract A/cb) Materials A/cc) Contractee’s A/cd) Contractor's A/c12. Loss of material by fire is debited toa) Financial Profit and Loss A/cb) Costing Profit and Loss A/cc) Contract A/cd) Contractee's A/c13. Contract costing is usually applicable in .(a) Constructional Works(b) Textile Mills(c) Cement Industries(d) Chemical Industries14. Retention Money is equal to .(a) Work certified Less Work uncertified(b) Contract price Less Work certified(c) Work certified Less Payment received by contractor(d) Amount paid to contractor15. Notional Profit is equal toa) Work certified Less Cost of work certifiedb) Work certified Less Cost of work completedc) Payment received Less Work certifiedd) Profit actually earned16. If a contract is 40% complete, credit taken to the profit and loss account is .(a) 40% of the notional profit(b) 1/3 rd. of Notional profits. reduced in the ratio of cash received to work certified2

(c) NIL(d) 2/3 rd. of Notional profits, reduced in the ratio of cash received to work certified17. Process costing should be used when .a) Product is standardized.b) Product is made to orderc) Product of different categories is manufacturedd) Products are manufactured in large quantities18. Which of the following does not use process costing?(a) Oil refining(b) Distilleries(c) Sugar(d) Air-craft manufacturing19. Normal loss is .a) Debited to process A/cb) Credited to process A/cc) Ignoredd) Credited to Costing P/L A/c20. Abnormal loss is calculated by .a) Normal output - Actual outputb) Actual output - Normal outputc) Input - Normal outputd) Input - Actual output21. After adjustment of scrap value, balance on abnormal toss A/c is transferred toa) Balance sheetb) Costing P & L A/cc) Process A/cd) Normal Loss22. Abnormal gain is valued ata) Cost of inputb) Cost of outputc) Standard costd) Market value23. Process costing is applicable toa) Paper industryb) Printing pressc) Transport companyd) Repairs works24. Input is 950 units Normal Loss is 10% output is 840 units abnormal loss isa) 20 unitsb) 15 unitsc) 25 units3

d) 30 units25. Normal Loss is 10%, Input is 950 units Abnormal Loss 15 units The output isa) 840 unitsb) 750 unitsc) 740 unitsd) 800 units26. Unit Cost is equal to(a) Normal Cost Normal Output(b) Total Cost Normal Output(c) Normal Cost Total Output(d) Total Cost Total Output27. When production is below standard specification or quality and cannot be rectified byincurring additional cost, it is called(a) Defective(b) Spoilage(c) Waste(d) Scrap28. You are required to identify how many good units were outputs from the process.Units put in process4.000Lost units500Units in process200(a) 3.300 units(b) 4,000 units(c) 4.200 units(d) 4.500 units29. By - product is valued at standard cost undera) Standard cost methodb) Marginal cost methodc) Estimated cost methodd) Historical cost method30. Sale of By - Product isa) Debited to process A/cb) Credited to process A/cc) Credited to Profit & Loss A/cd) Debited to Normal A/c31. Contribution margin is known as .a) marginal incomeb) gross marginc) net incomed) net profit4

32. Fixed cost per unit decreases when .a) production volume increasesb) production volume decreasesc) variable cost per unit decreasesd) prime cost per unit decreases33. Contribution margin is equal toa. Fixed cost variable costb. Sales - variable costc. Sales - fixed assetsd. Sales - profit34. Sales are Rs. 1,00,000, variable cost is Rs. 70,000 and fixed cost is Rs. 15,000. The PVratio will be .a) 30%b) 20%c) 35%d) 25%35. Difference between standard cost and actual cost is called as .a) Varianceb) Profitc) Lossd) Wastage36. Excess of standard cost over actual cost is a .a) Favourable varianceb) Unfavourable variancec) Abnormal gaind) Abnormal Loss37. Labour mix, variance isa) SLH - ALHb) SLR - ALRc) std. cost - actual costd) SCSLM - SCALM38. Labour yield variance isa) SLC - ALCb) SLR - ALRc) Idle hrs x std. rated) SLY - ALY x SR39. The objective of standard costing is to control througha) Standard costb) Estimated costc) Variance analysisd) Statistical sampling40. Material price standard is set by5

a)b)c)d)Production DepartmentPurchase DepartmentSales DepartmentCosting Department41. The difference between the actual price and the standard price, multiplied by the actualquantity of materials purchased is thea) materials cost varianceb) materials usage variancec) materials price varianced) materials efficiency variance42. What is the primary benefit of a standard costing system?a) It records costs at what should have been incurredb) It allows for a comparison of differences between actual and standard costsc) It is easy to implementd) It is inexpensive and easy to use43. The standard which can be attained under the most favourable conditions possiblea) Ideal Standardb) Expected Standardc) Current Standardd) Normal Standard44. The amount of work achievable in an hour, at standard efficiency levels, isa) An ideal standardb) The direct labour usage per hourc) A standard hourd) The direct labour efficiency variance45. While evaluating deviations of actual cost from standard cost, the technique used isa) Regression analysisb) Variance analysisc) Linear progressiond) Trend analysis46. ABC is aa) Method of costingb) Method of allocationc) Technique of costingd) Method and technique of costing47. Most of a product's life-cycle costs are locked in by decisions made during thebusiness function of the value chain.a) Designb) Manufacturingc) Customer-serviced) Marketing6

48. The comparison of a company's practices and performance levels against those of otherorganizations is most commonly known asa) Benchmarkingb) Continuous improvementc) Re-engineeringd) Comparative analysis.49. Cost allocation bases in activity-based costing should bea) Cost driversb) Cost poolsc) Activity centresd) Resources50. Costs that are common to many different activities within an organization are known ascosts.a) Product-levelb) Facility-levelc) Batch-leveld) Unit-levelAnswer 383940babaaaddbc41424344454647484950cbacbbaaab

a) A single, combined system containing both cost and financial accounting records b) A system combining cost accounting and management accounting c) A system with high secured access d) A system where separate accounts are kept for cost accounting and for financial accounting 7. What is a cost ledger control account?