Transcription

Personal Choice 65 PPOSM2021Summary of BenefitsEffective January 1, 2021 through December 31, 2021 Personal Choice 65 Prime Rx PPO Personal Choice 65 Medical-Only PPO Personal Choice 65 Rx PPOSMSMSMH3909Y0041 H3909 PC 89318 M

This page intentionally left blank.2

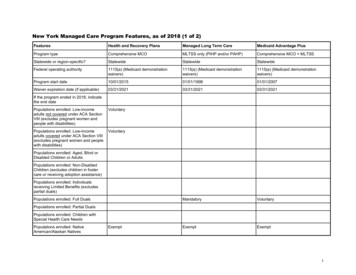

This booklet gives you a summary of what we coverand what you pay. It doesn’t list every service that wecover or list every limitation or exclusion. To get acomplete list of services we cover, call us and ask for theEvidence of Coverage or go online at www.ibxmedicare.com.This Summary of Benefits booklet gives you a summary of what Personal Choice 65SMPrime Rx PPO, Personal Choice 65SM Medical-Only PPO, and Personal Choice 65SMRx PPO cover and what you pay.Personal Choice 65SM Prime Rx PPO, Personal Choice 65SM Medical-Only PPO,and Personal Choice 65SM Rx PPO are Medicare Advantage PPO (PreferredProvider Organization) plans. With a PPO plan, members don’t have to choose aPCP and can go to doctors in or out of the plan’s network. If members use out-ofnetwork doctors, hospitals, or other health care providers, they will pay more fortheir services.If you want to compare our plans with other available Medicare health plans,ask the other plan(s) for their Summary of Benefits booklet. Or, use the MedicarePlan Finder at www.medicare.gov.If you want to know more about the coverage and costs of Original Medicare,look in your current “Medicare and You” handbook. View it online atwww.medicare.gov or get a copy by calling 1-800-MEDICARE (1-800-633-4227),24 hours a day, 7 days a week. TTY users should call 1-877-486-2048.Sections of this booklet Monthly Premium, Limits on How Much You Pay for Covered Services Covered Medical and Hospital Benefits P rescription Drug Benefits for Personal Choice 65SM Prime Rx PPOand Personal Choice 65SM Rx PPOWho can join?To join Personal Choice 65SM Prime Rx PPO, Personal Choice 65SM Medical-OnlyPPO, and Personal Choice 65SM Rx PPO, you must be entitled to Medicare Part A,be enrolled in Medicare Part B, and live in our service area.The service area for Personal Choice 65SM Medical-Only PPO is Bucks andPhiladelphia counties in Pennsylvania.The service area for Personal Choice 65SM Prime Rx PPO and Personal Choice 65SMRx PPO is Bucks, Chester, Delaware, Montgomery, and Philadelphia countiesin Pennsylvania.3

Which doctors, hospitals, and pharmacies can I use?Personal Choice 65SM Prime Rx PPO, Personal Choice 65SM Medical-Only PPO,and Personal Choice 65SM Rx PPO have a network of doctors, hospitals,pharmacies, and other providers. If you use the providers that are not in ournetwork, a higher cost-sharing may apply. Personal Choice 65SM Prime Rx PPOand Personal Choice 65 Rx PPO have a preferred pharmacy network; costsharing for drugs may vary depending on the pharmacy you use. To view our listof network providers and pharmacies (Provider/Pharmacy Directory), please visitwww.ibxmedicare.com.Personal Choice 65SM Prime Rx PPO and Personal Choice 65SM Rx PPO coverPart D drugs. In addition, the plans cover Part B drugs such as chemotherapyand some other drugs administered by your provider. You can see our complete planFormulary (List of Covered Drugs) and any restrictions on our website,www.ibxmedicare.com.Personal Choice 65SM Medical-Only PPO covers Part B drugs, includingchemotherapy and some other drugs administered by your provider.However, the plan does not cover Part D prescription drugs.4

Monthly Plan PremiumPersonal Choice 65SM Prime Rx PPOAnd you have If you live in Personal Choice 65SM Prime Rx PPOYou pay 0Chester, Delaware, orMontgomery CountyBucks or Philadelphia County 0Personal Choice 65SM Medical-Only PPOAnd you have If you live in Personal Choice 65SM Medical-Only PPOYou pay n/aChester, Delaware, orMontgomery CountyBucks or Philadelphia County 184Personal Choice 65SM Rx PPOAnd you have If you live in Personal Choice 65SM Rx PPOYou pay 161Chester, Delaware, orMontgomery CountyBucks or Philadelphia County 2905

Personal Choice 65SMPrime Rx PPODeductibleThis plan does not have a deductible for coveredmedical services or for Part D prescription drugs.Maximum Out-of-PocketIn-Network: 7,550 each year(the amounts you pay for your premium,Part D prescription drugs, and some medicalservices do not count toward your maximumout-of-pocket amount)6Our plan has a yearly coverage limit for certainin-network benefits. Contact us for the servicesthat apply.Combined In-Network and Out-of-Network: 11,300 each year

Personal Choice 65SMMedical-Only PPOPersonal Choice 65SMRx PPOThis plan does not have a deductible for coveredmedical services.This plan does not have a deductible for coveredmedical services or for Part D prescription drugs.In-Network: 5,000 each yearIn-Network: 5,000 each yearOur plan has a yearly coverage limit for certainin-network benefits. Contact us for the servicesthat apply.Our plan has a yearly coverage limit for certainin-network benefits. Contact us for the servicesthat apply.Combined In-Network and Out-of-Network: 10,000 each yearCombined In-Network and Out-of-Network: 10,000 each year7

Covered Medical and Hospital BenefitsPersonal Choice 65SMPrime Rx PPOInpatient Hospital Coverage (1)In-Network: 250 copayment per day for days 1through 7 per admissionYou pay nothing per day for days 8 and beyond peradmission. No copayment on day of discharge.Out-of-Network: 40% coinsuranceInpatient Hospital Stay Acute due to COVID-19 diagnosis 0 copaymentOut-of-network: 40% coinsuranceOutpatient Hospital Coverage Ambulatory Surgical Center (1)In-Network: 245 copaymentOut-of-Network: 40% coinsurance Outpatient Hospital Facility (1)In-Network: 375 copayment per stayOut-of-Network: 40% coinsurance Observation ServicesIn-Network: 375 copayment per stayOut-of-Network: 40% coinsuranceDoctor’s Office Visits8 Primary Care PhysicianIn-Network: 5 copaymentOut-of-Network: 40% coinsurance SpecialistIn-Network: 40 copaymentOut-of-Network: 40% coinsuranceServices with a (1) may require prior authorization.

Personal Choice 65SMMedical-Only PPOPersonal Choice 65SMRx PPOIn-Network: 240 copayment per day for days 1through 6 per admissionIn-Network: 240 copayment per day for days 1through 6 per admissionYou pay nothing per day for days 7 and beyond peradmission. No copayment on day of discharge.You pay nothing per day for days 7 and beyond peradmission. No copayment on day of discharge. 1,440 maximum copayment per admission 1,440 maximum copayment per admissionOut-of-Network: 30% coinsuranceOut-of-Network: 30% coinsurance 0 copaymentOut-of-Network: 30% coinsurance 0 copaymentOut-of-network: 30% coinsuranceIn-Network: 150 copaymentOut-of-Network: 30% coinsuranceIn-Network: 150 copaymentOut-of-Network: 30% coinsuranceIn-Network: 300 copayment per stayOut-of-Network: 30% coinsuranceIn-Network: 300 copayment per stayOut-of-Network: 30% coinsuranceIn-Network: 300 copayment per stayOut-of-Network: 30% coinsuranceIn-Network: 300 copayment per stayOut-of-Network: 30% coinsuranceIn-Network: 5 copaymentOut-of-Network: 30% coinsuranceIn-Network: 5 copaymentOut-of-Network: 30% coinsuranceIn-Network: 35 copaymentOut-of-Network: 30% coinsuranceIn-Network: 35 copaymentOut-of-Network: 30% coinsurance9

Personal Choice 65SMPrime Rx PPOPreventive Care —(e.g., flu vaccine, diabetic screenings)In-Network: You pay nothingOut-of-Network: 40% coinsurancePlease refer to the Evidence of Coverage for acomplete listing of services. If you receive a separateadditional non-preventive evaluation and/or service,a copayment will apply. The copayment amountdepends on the provider type or place of service.Emergency Care — covered worldwideWorldwide copayment outside the U.S. does notcount towards the annual MOOPIn-Network: 90 copaymentNot waived if admittedOut-of-Network: 90 copaymentNot waived if admittedUrgently Needed Services —covered worldwideWorldwide copayment outside the U.S. does notcount towards the annual MOOPIn-Network: 10 copayment in a retail clinicNot waived if admittedOut-of-Network: 10 copayment in a retail clinicNot waived if admittedIn-Network: 40 copayment inan urgent care centerNot waived if admittedOut-of-Network: 40 copayment inan urgent care centerNot waived if admittedIn-Network: 90 copayment per visit outside ofU.S. Not waived if admittedOut-of-Network: 90 copayment per visit outside ofU.S. Not waived if admittedDiagnostic Services (1), Lab and RadiologyServices (1), and X-rays Diagnostic Radiology Services 0 copayment for certain diagnostic tests(e.g. home-based sleep studies provided by a homehealth agency; diagnostic mammogram thatresults from a preventive mammogram).In-Network: 45 or 275 copaymentdepending on serviceOut-of-Network: 40% coinsurance Lab ServicesIn-Network: You pay nothingOut-of-Network: 40% coinsurance Diagnostic Tests and ProceduresIn-Network: You pay nothingOut-of-Network: 40% coinsurance Outpatient X-rays10Services with a (1) may require prior authorization.In-Network: 45 copayment for routineradiology servicesOut-of-Network: 40% coinsurance for routineradiology services

Personal Choice 65SMMedical-Only PPOPersonal Choice 65SMRx PPOIn-Network: You pay nothingOut-of-Network: 30% coinsurancePlease refer to the Evidence of Coverage for acomplete listing of services. If you receive a separateadditional non-preventive evaluation and/or service,a copayment will apply. The copayment amountdepends on the provider type or place of service.In-Network: You pay nothingOut-of-Network: 30% coinsurancePlease refer to the Evidence of Coverage for acomplete listing of services. If you receive a separateadditional non-preventive evaluation and/or service,a copayment will apply. The copayment amountdepends on the provider type or place of service.In-Network: 90 copaymentNot waived if admittedOut-of-Network: 90 copaymentNot waived if admittedIn-Network: 90 copaymentNot waived if admittedOut-of-Network: 90 copaymentNot waived if admittedIn-Network: 5 copayment in a retail clinicNot waived if admittedOut-of-Network: 5 copayment in a retail clinicNot waived if admittedIn-Network: 40 copayment inan urgent care centerNot waived if admittedOut-of-Network: 40 copayment inan urgent care centerNot waived if admittedIn-Network: 90 copayment per visit outside ofU.S. Not waived if admittedOut-of-Network: 90 copayment per visit outside ofU.S. Not waived if admittedIn-Network: 5 copayment in a retail clinicNot waived if admittedOut-of-Network: 5 copayment in a retail clinicNot waived if admittedIn-Network: 40 copayment inan urgent care centerNot waived if admittedOut-of-Network: 40 copayment inan urgent care centerNot waived if admittedIn-Network: 90 copayment per visit outside ofU.S. Not waived if admittedOut-of-Network: 90 copayment per visit outside ofU.S. Not waived if admitted 0 copayment for certain diagnostic tests(e.g. home-based sleep studies provided by a homehealth agency; diagnostic mammogram thatresults from a preventive mammogram).In-Network: 40 or 175 copaymentdepending on serviceOut-of-Network: 30% coinsurance 0 copayment for certain diagnostic tests(e.g. home-based sleep studies provided by a homehealth agency; diagnostic mammogram thatresults from a preventive mammogram).In-Network: 40 or 175 copaymentdepending on serviceOut-of-Network: 30% coinsuranceIn-Network: You pay nothingOut-of-Network: 30% coinsuranceIn-Network: You pay nothingOut-of-Network: 30% coinsuranceIn-Network: You pay nothingOut-of-Network: 30% coinsuranceIn-Network: You pay nothingOut-of-Network: 30% coinsuranceIn-Network: 40 copayment for routineradiology servicesOut-of-Network: 30% coinsurance for routineradiology servicesIn-Network: 40 copayment for routineradiology servicesOut-of-Network: 30% coinsurance for routineradiology services11

Personal Choice 65SMPrime Rx PPOHearing Services Hearing ExamIn-Network: 40 copayment forMedicare-covered hearing examsOut-of-Network: 40% coinsurance forMedicare-covered hearing examsIn-Network and Out-of-Network: 10 copaymentfor routine non-Medicare-covered hearing examsonce every year. Hearing AidIn-Network and Out-of-network: 699 standarddigital hearing aid or 999 premium digital hearingaid copayment per year, per ear. Premium includesrechargeable hearing aid option; 3 hearing aidfittings per year; up to 2 hearing aids every year,one hearing aid per ear.Routine hearing services and aids are covered whenprovided by a TruHearing provider. Routine hearingservices do not count towards annual MOOP.12

Personal Choice 65SMMedical-Only PPOPersonal Choice 65SMRx PPOIn-Network: 35 copayment forMedicare-covered hearing examsIn-Network: 35 copayment forMedicare-covered hearing examsOut-of-Network: 30% coinsurance forMedicare-covered hearing examsOut-of-Network: 30% coinsurance forMedicare-covered hearing examsIn-Network and Out-of-Network: 10 copaymentfor routine non-Medicare-covered hearing examsonce every year.In-Network and Out-of-Network: 10 copaymentfor routine non-Medicare-covered hearing examsonce every year.In-Network and Out-of-network: 499 standarddigital hearing aid or 799 premium digital hearingaid copayment per year, per ear. Premium includesrechargeable hearing aid option; 3 hearing aidfittings per year; up to 2 hearing aids every year,one hearing aid per ear.In-Network and Out-of-network: 499 standarddigital hearing aid or 799 premium digitalhearing aid copayment per year, per ear. Premiumincludes rechargeable hearing aid option;3 hearing aid fittings per year; up to 2 hearingaids every year, one hearing aid per ear.Routine hearing services and aids are covered whenprovided by a TruHearing provider. Routine hearingservices do not count towards annual MOOP.Routine hearing services and aids are covered whenprovided by a TruHearing provider. Routine hearingservices do not count towards annual MOOP.13

Personal Choice 65SMPrime Rx PPODental ServicesIn-Network: 40 copayment for non-routineMedicare-covered dental servicesOut-of-Network: 40% coinsurance for non-routineMedicare-covered dental services in a specialist officeIn-Network: 0 copayment for routine nonMedicare-covered exam and cleaning everysix months 0 copayment for 1 set of dental bitewing X-raysevery year, 1 periapical X-ray every 3 years, and1 full-mouth X-ray (panoramic) every three years20% coinsurance for restorative services,endodontics, periodontics, and extractions40% coinsurance for prosthodontics, other oral/maxillofacial surgery, and other services 1,500 combined plan allowance every yearfor restorative dental services, endodontics,periodontics, extractions, prosthodontics, otheroral/maxillofacial surgery, and other servicesOut-of-Network: 80% coinsurance for routinenon-Medicare-covered dental services80% coinsurance for dental X-ray80% coinsurance for restorative services,endodontics, periodontics, extractions,prosthodontics, other oral/maxillofacial surgery,and other services 1,500 combined plan allowance every yearfor restorative dental services, endodontics,periodontics, extractions, prosthodontics, otheroral/maxillofacial surgery, and other servicesRoutine and non-Medicare-covered comprehensivedental services do not count toward the annual MOOP14

Personal Choice 65SMMedical-Only PPOPersonal Choice 65SMRx PPOIn-Network: 35 copayment for non-routineMedicare-covered dental services in a specialist officeIn-Network: 35 copayment for non-routineMedicare-covered dental services in a specialist officeOut-of-Network: 30% coinsurance for non-routineMedicare-covered dental services in a specialist officeOut-of-Network: 30% coinsurance for non-routineMedicare-covered dental services in a specialist officeIn-Network: 0 copayment for routine nonMedicare-covered exam and cleaning everysix monthsIn-Network: 0 copayment for routine nonMedicare-covered exam and cleaning everysix months 0 copayment for 1 set of dental bitewing X-raysevery year, 1 periapical X-ray every 3 years, and1 full-mouth X-ray (panoramic) every three years 0 copayment for 1 set of dental bitewing X-raysevery year, 1 periapical X-ray every 3 years, and1 full-mouth X-ray (panoramic) every three years20% coinsurance for restorative services,endodontics, periodontics, and extractions20% coinsurance for restorative services,endodontics, periodontics, and extractions40% coinsurance for prosthodontics, other oral/maxillofacial surgery, and other services40% coinsurance for prosthodontics, other oral/maxillofacial surgery, and other services 1,500 combined plan allowance every yearfor restorative dental services, endodontics,periodontics, extractions, prosthodontics, otheroral/maxillofacial surgery, and other services 1,500 combined plan allowance every yearfor restorative dental services, endodontics,periodontics, extractions, prosthodontics, otheroral/maxillofacial surgery, and other servicesOut-of-Network: 80% coinsurance for routinenon-Medicare-covered dental servicesOut-of-Network: 80% coinsurance for routinenon-Medicare-covered dental services80% coinsurance for dental X-ray80% coinsurance for dental X-ray80% coinsurance for restorative services,endodontics, periodontics, extractions,prosthodontics, other oral/maxillofacial surgery,and other services80% coinsurance for restorative services,endodontics, periodontics, extractions,prosthodontics, other oral/maxillofacial surgery,and other services 1,500 combined plan allowance every yearfor restorative dental services, endodontics,periodontics, extractions, prosthodontics, otheroral/maxillofacial surgery, and other services 1,500 combined plan allowance every yearfor restorative dental services, endodontics,periodontics, extractions, prosthodontics, otheroral/maxillofacial surgery, and other servicesRoutine and non-Medicare-covered comprehensivedental services do not count toward the annual MOOPRoutine and non-Medicare-covered comprehensivedental services do not count toward the annual MOOP15

Personal Choice 65SMPrime Rx PPOVision ServicesIn-Network: 40 copayment for Medicare-coveredeye exams; 0 copayment for diabetic retinal eyeexam and 0 copayment for Medicare-coveredglaucoma screening; 0 copayment for one pair ofMedicare-covered eyeglasses or contact lenses aftercataract surgeryOut-of-Network: 40% coinsurance for Medicarecovered eye exams, diabetic retinal exam, glaucomascreening and for one pair of eyeglasses or contactlenses after cataract surgery 10 copayment for routine eye exam every year;1 pair of eyeglass frames and lenses or one pairof contact lenses are covered in full every year ifpurchased from the Davis Vision Collection 200 allowance every year for eyewear(glasses and lenses) purchased from Visionworks 150 allowance every year for all other eyewear(frames and lenses) purchased at a network DavisVision provider 150 allowance every year for contact lenses inlieu of routine eyewear (frames and lenses)Eyewear coverage does not include lens options,such as tints, progressives, Transitions lenses, polishand insurance.Routine vision services do not count towards theannual MOOPOut-of-Network: 80% coinsuranceEyewear (frames and lenses, or contact lenses)have a 150 combined in- and out-of-network planmaximum benefit payable per year.Visionworks providers are national, so up to 200combined maximum applies when in or out of theservice area.16

Personal Choice 65SMMedical-Only PPOPersonal Choice 65SMRx PPOIn-Network: 35 copayment for Medicare-coveredeye exams; 0 copayment for diabetic retinal eyeexam and 0 copayment for Medicare-coveredglaucoma screening; 0 copayment for one pair ofMedicare-covered eyeglasses or contact lenses aftercataract surgeryIn-Network: 35 copayment for Medicare-coveredeye exams; 0 copayment for diabetic retinal eyeexam and 0 copayment for Medicare-coveredglaucoma screening; 0 copayment for one pair ofMedicare-covered eyeglasses or contact lenses aftercataract surgeryOut-of-Network: 30% coinsurance for Medicarecovered eye exams, diabetic retinal exam, glaucomascreening and for one pair of eyeglasses or contactlenses after cataract surgeryOut-of-Network: 30% coinsurance for Medicarecovered eye exams, diabetic retinal exam, glaucomascreening and for one pair of eyeglasses or contactlenses after cataract surgery 10 copayment for routine eye exam every year;1 pair of eyeglass frames and lenses or one pairof contact lenses are covered in full every year ifpurchased from the Davis Vision Collection 10 copayment for routine eye exam every year;1 pair of eyeglass frames and lenses or one pairof contact lenses are covered in full every year ifpurchased from the Davis Vision Collection 200 allowance every year for eyewear(glasses and lenses) purchased from Visionworks 200 allowance every year for eyewear(glasses and lenses) purchased from Visionworks 150 allowance every year for all other eyewear(frames and lenses) purchased at a network DavisVision provider 150 allowance every year for all other eyewear(frames and lenses) purchased at a network DavisVision provider 150 allowance every year for contact lenses inlieu of routine eyewear (frames and lenses) 150 allowance every year for contact lenses inlieu of routine eyewear (frames and lenses)Eyewear coverage does not include lens options,such as tints, progressives, Transitions lenses, polishand insuranceEyewear coverage does not include lens options,such as tints, progressives, Transitions lenses, polishand insuranceRoutine vision services do not count towards theannual MOOPRoutine vision services do not count towards theannual MOOPOut-of-Network: 80% coinsuranceOut-of-Network: 80% coinsuranceEyewear (frames and lenses, or contact lenses)have a 150 combined in- and out-of-network planmaximum benefit payable per year.Eyewear (frames and lenses, or contact lenses)have a 150 combined in- and out-of-network planmaximum benefit payable per year.Visionworks providers are national, so up to 200combined maximum applies when in or out of theservice area.Visionworks providers are national, so up to 200combined maximum applies when in or out of theservice area.17

Personal Choice 65SMPrime Rx PPOMental Health Services Inpatient Mental Health Care (2)In-Network: 250 copayment per day for days1 through 5 per admissionYou pay nothing per day for days 6 and beyondOut-of-Network: 40% coinsurance Outpatient Therapy(Group and Individual) Outpatient Substance Abuse Services(Group and Individual) Partial Hospitalization (2)In-Network: 40 copayment per therapy session Outof-Network: 40% coinsuranceIn-Network: 40 copayment per therapy session Outof-Network: 40% coinsuranceIn-Network: 40 copayment per visitOut-of-Network: 40% coinsuranceSkilled Nursing Facility (1)In-Network: You pay nothing per day for days 1through 20 184 copayment per day for days 21 through 100per admissionOut-of-Network: 40% coinsurance per day for days1 through 100100 days per benefit periodPhysical Therapy (1)In-Network: 30 copayment per visitOut-of-Network: 40% coinsurance per visitAmbulance (1) 300 copayment for a one-way tripNot waived if admittedNon-emergency ambulance services require priorauthorizationTransportationNot coveredMedicare Part B Drugs (1)20% coinsurance for Part B drugs, such aschemotherapy drugsFor a description of the types of drugs available underPart B, see your Evidence of Coverage.Out-of-Network: 40% coinsuranceAmbulatory Surgical Center18In-Network 245 copayOut-of-Network 40% coinsuranceServices with a (1) may require prior authorization.(2) Prior authorization is required by Magellan Behavioral Health.

Personal Choice 65SMMedical-Only PPOIn-Network: 240 copayment per day for days1 through 6 per admission.You pay nothing per day for days 7 and beyondOut-of-Network: 30% coinsurance 1,440 maximum copayment per admission190-day lifetime maximum in a mental health facilityPersonal Choice 65SMRx PPOIn-Network: 240 copayment per day for days1 through 6 per admission.You pay nothing per day for days 7 and beyondOut-of-Network: 30% coinsurance 1,440 maximum copayment per admission190-day lifetime maximum in a mental health facilityIn-Network: 40 copayment per therapy sessionOut-of-Network: 30% coinsuranceIn-Network: 40 copayment per therapy sessionOut-of-Network: 30% coinsuranceIn-Network: 40 copayment per therapy sessionOut-of-Network: 30% coinsuranceIn-Network: 40 copayment per therapy sessionOut-of-Network: 30% coinsuranceIn-Network: 40 copayment per visitOut-of-Network: 30% coinsuranceIn-Network: 40 copayment per visitOut-of-Network: 30% coinsuranceIn-Network: You pay nothing per day for days 1through 20 184 copayment per day for days 21 through 100per admissionOut-of-Network: 30% coinsurance per day for days1 through 100100 days per benefit periodIn-Network: You pay nothing per day for days 1through 20 184 copayment per day for days 21 through 100per admissionOut-of-Network: 30% coinsurance per day for days1 through 100100 days per benefit periodIn-Network: 20 copayment per visitOut-of-Network: 30% coinsurance per visitIn-Network: 20 copayment per visitOut-of-Network: 30% coinsurance per visit 175 copayment for a one-way tripNot waived if admitted 175 copayment for a one-way tripNot waived if admittedNon-emergency ambulance services require priorauthorizationNon-emergency ambulance services require priorauthorizationNot coveredNot covered20% coinsurance for Part B drugs, such aschemotherapy drugs20% coinsurance for Part B drugs, such aschemotherapy drugsFor a description of the types of drugs available underPart B, see your Evidence of Coverage.Out-of-Network: 30% coinsuranceFor a description of the types of drugs availableunder Part B, see your Evidence of Coverage.Out-of-Network: 30% coinsuranceIn-Network 150 copayOut-of-Network: 30% coinsuranceIn-Network 150 copayOut-of-Network: 30% coinsurance19

Prescription Drug Benefits (Part D)Part D Prescription Drug Benefits are available for members of Personal Choice 65 Rx PPO and Personal Choice 65Prime Rx PPO. This benefit is not available for members of Personal Choice 65SM Medical-Only PPO.Personal Choice 65SMPrime Rx PPOInitial Coverage StageYou pay the following until your total yearly drug costsreach 4,130. “Total yearly drug costs” are the totaldrug costs paid by both you and our Part D plan.You may get your drugs at network retailpharmacies and mail-order pharmacies.Cost-sharing may change depending on thepharmacy you choose and when you move intoeach stage of your Part D benefits. You may fillyour prescriptions at either a preferred orstandard pharmacy. Tier 1 and 2 prescriptions(which include most generic drugs) will have lowercopayments when you have them filled at preferredpharmacies. For information, please review thePersonal Choice 65 SM Prime Rx PPO Evidenceof Coverage.20Services with a (1) may require prior authorization.

Personal Choice 65SMMedical-Only PPOPart D prescription drugs are not available withthis plan.Personal Choice 65SMRx PPOYou pay the following until your total yearly drug costsreach 4,130. “Total yearly drug costs” are the totaldrug costs paid by both you and our Part D plan.You may get your drugs at network retailpharmacies and mail-order pharmacies.Cost-sharing may change depending on thepharmacy you choose and when you move intoeach stage of your Part D benefits. You may fillyour prescriptions at either a preferred orstandard pharmacy. Tier 1 and 2 prescriptions(which include most generic drugs) will have lowercopayments when you have them filled at preferredpharmacies. For information, please review thePersonal Choice 65SM Rx PPO Evidenceof Coverage.21

Personal Choice 65SMPrime Rx PPORetail Cost-sharing(what you pay at a pharmacy Supply 1 copayment 2 copayment 2 copayment 9 copayment 18 copayment 27 copayment 10 copayment 20 copayment 20 copayment 20 copayment 40 copayment 60 copayment 47 copayment 94 copayment 141 copayment 47 copayment 94 copayment 141 copaymentTier 1 (Preferred Generic Drugs)Preferred PharmacyStandard PharmacyTier 2 (Generic Drugs)Preferred PharmacyStandard PharmacyTier 3 (Preferred Brand Drugs)Preferred PharmacyStandard PharmacyTier 4 (Non-Preferred Drugs)Preferred PharmacyStandard Pharmacy 100 copayment 200 copayment 300 copayment 100 copayment 200 copayment 300 copaymentTier 5 (Specialty Drugs)Preferred PharmacyStandard PharmacyMail-Order Cost-sharing(what you pay when youorder a prescription by mail)2233% coinsurance 33% coinsurance 33% coinsurance33% coinsurance 33% coinsurance 33% thSupplyTier 1 (Preferred Generic Drugs) 1 copayment 2 copayment 2 copaymentTier 2 (Generic Drugs) 10 copayment 20 copayment 20 copaymentTier 3 (Preferred Brand Drugs) 47 copayment 94 copayment 94 copaymentTier 4 (Non-Preferred Drugs) 100 copayment 200 copayment 200 copaymentTier 5 (Specialty Drugs)33% coinsurance 33% coinsurance 33% coinsurance

Personal Choice 65SMMedical-Only PPOPart D prescription drugs are not available with this plan.Part D prescription drugs are not available with this plan.Part D prescription drugs are not available with this plan.Part D prescription drugs are not available with this plan.Personal Choice 65SMRx PPOOne-MonthSupplyTwo-MonthSupplyThree-MonthSupply 1 copayment 2 copayment 2 copayment 9 copayment 18 copayment 27 copayment 9 copayment 18 copayment 18 copayment 20 copayment 40 copayment 60 copayment 47 copayment 94 copayment 141 copayment 47 copayment 94 copayment 141 copayment 100 copayment 200 copayment 300 copayment 100 copayment 200 copayment 300 copaymentPart D prescription drugs are not available with this plan.33% coinsurance 33% coinsurance 33% coinsurance33% coinsurance 33% coinsurance 33% thSupplyPart D prescription drugs are not available with this plan. 1 copayment 2 copayment 2 copaymentPart D prescription drugs are not available with this plan. 9 copayment 18 copayment 18 copaymentPart D prescription drugs are not ava

2 3 This Summary of Benefits booklet gives you a summary of what Personal Choice 65 SM Prime Rx PPO, Personal Choice 65 SM Medical-Only PPO, and Personal Choice 65 SM Rx PPO cover and what you pay. Personal Choice 65SM Prime Rx PPO, Personal Choice 65 SM Medical-Only PPO, and Personal Choice 65SM Rx PPO