Transcription

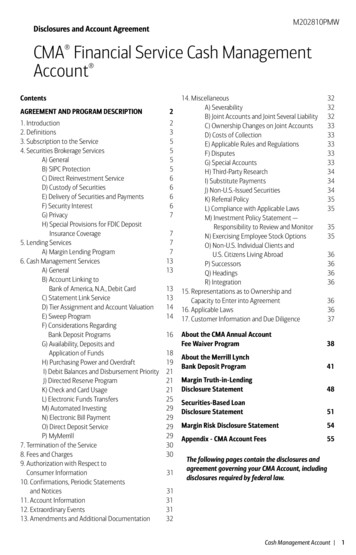

M202810PMWDisclosures and Account AgreementCMA Financial Service Cash ManagementAccount ContentsAGREEMENT AND PROGRAM DESCRIPTION21. Introduction2. Definitions3. Subscription to the Service4. Securities Brokerage ServicesA) GeneralB) SIPC ProtectionC) Direct Reinvestment ServiceD) Custody of SecuritiesE) Delivery of Securities and PaymentsF) Security InterestG) PrivacyH) Special Provisions for FDIC DepositInsurance Coverage5. Lending ServicesA) Margin Lending Program6. Cash Management ServicesA) GeneralB) Account Linking toBank of America, N.A., Debit CardC) Statement Link ServiceD) Tier Assignment and Account ValuationE) Sweep ProgramF) Considerations RegardingBank Deposit ProgramsG) Availability, Deposits andApplication of FundsH) Purchasing Power and OverdraftI) Debit Balances and Disbursement PriorityJ) Directed Reserve ProgramK) Check and Card UsageL) Electronic Funds TransfersM) Automated InvestingN) Electronic Bill PaymentO) Direct Deposit ServiceP) MyMerrill7. Termination of the Service8. Fees and Charges9. Authorization with Respect toConsumer Information10. Confirmations, Periodic Statementsand Notices11. Account Information12. Extraordinary Events13. Amendments and Additional 1252929292930303114. MiscellaneousA) SeverabilityB) Joint Accounts and Joint Several LiabilityC) Ownership Changes on Joint AccountsD) Costs of CollectionE) Applicable Rules and RegulationsF) DisputesG) Special AccountsH) Third-Party ResearchI) Substitute PaymentsJ) Non-U.S.-Issued SecuritiesK) Referral PolicyL) Compliance with Applicable LawsM) Investment Policy Statement —Responsibility to Review and MonitorN) Exercising Employee Stock OptionsO) Non-U.S. Individual Clients andU.S. Citizens Living AbroadP) SuccessorsQ) HeadingsR) Integration15. Representations as to Ownership andCapacity to Enter into Agreement16. Applicable Laws17. Customer Information and Due Diligence32323233333333333434343535363637About the CMA Annual AccountFee Waiver Program38About the Merrill LynchBank Deposit Program41Margin Truth-in-LendingDisclosure Statement48Securities-Based LoanDisclosure Statement51Margin Risk Disclosure Statement54Appendix - CMA Account Fees55353536363636The following pages contain the disclosures andagreement governing your CMA Account, includingdisclosures required by federal law.31313132Cash Management Account 1

Agreement and ProgramDescription1. INTRODUCTIONThis Agreement and Program Description(“Agreement”), as amended from time to time byMerrill Lynch, Pierce, Fenner & Smith Incorporated(“Merrill Lynch”), sets forth the terms and conditionsgoverning the Cash Management Account (CMA ) financial service (“Service”). After youopen an account, you will receive a welcome kit,which includes confirmation about the accountfeatures and services you have selected as wellas other important disclosures. The Serviceis an integrated financial service linking twocomponents: (1) securities brokerage services; and(2) Cash Management Services including the Visa deferred debit card and check writing features.Although these Cash Management Services areintended to provide you with access to assets inthe account, CMA Accounts are not bank accounts.In addition, the Service includes the CMA MasterFinancial Service consisting of: (1) a Master CMAAccount established with the services describedabove; and (2) one or more CMA SubAccounts .CMA SubAccounts have the same investmentcapabilities as CMA Accounts, but do not offer Visacards, check writing and certain optional services.CMA SubAccounts are also charged a differentannual account fee and may be used to segregateinvestments (for another family member,for instance, or for a specific purpose such ascollege funding). For more information on fees,see the Appendix.Certain aspects of the Service, such as Checks,Cards, and/or the Margin Lending Program, maynot be available for Accounts that are enrolled in aninvestment advisory program or are in the processof enrolling in an investment advisory program.Additionally, your ability to direct trades andpurchase securities in your Account2 Cash Management Accountmay be limited if your Account is enrolled in aninvestment advisory program or in the process ofenrolling in an investment advisory program. Theservices provided by, and the terms and conditionsof, the investment advisory program you select willbe described in separate documentation.Once you have established a CMA Account and wehave your signed and returned Client RelationshipAgreement, you may be eligible to open additionalCMA Accounts and/or enroll in optional servicesat a later date without completing a new ClientRelationship Agreement. Please see the ClientRelationship Agreement for more details.You agree to read this Agreement and retain a copyfor your records. You acknowledge receipt of theMerrill Lynch Bank Deposit Program DisclosureStatement, Appendix: CMA Account Fees, theMargin Truth-in-Lending Disclosure Statement andthe Securities-Based Loan Disclosure Statement,if applicable, all of which are referred to as the“Documents” for purposes of this Agreement.The Documents, which contain additional termsgoverning the Service, are incorporated into thisAgreement and made a part hereof. Unless thecontext otherwise requires, the term “Agreement”shall include the Documents, as amended fromtime to time by Merrill Lynch. You certify thatall information you provide in connection withthe establishment of your accounts, includingin reference to checks and Visa cards, is trueand correct and that Merrill Lynch and the Banksmay rely on and verify such information. Unlessotherwise indicated, the Agreement applies toCMA Accounts. Merrill Lynch offers CMA Accounts,as well as various products and services, throughdifferent service models, including the clientself-directed and full-service channels. Based onthe service model, the same or similar account,product or service may vary in its price or feescharged to clients.

2. DEFINITIONSIn this Agreement:“Account Value” means the value of cash, BankDeposits, and long market value of securities heldas part of the Statement Link.“ACH” means Automated Clearing House.The ACH Network is a nationwide electronicpayment system used to transfer funds betweenparticipating financial institutions.“Agreement” means the CMA Financial ServiceCash Management Account Disclosures andAccount Agreement and the Documents asamended from time to time.“Authorized cardholder(s)” means thecardholder(s) selected by you on the Additionalcheck and/or Visa card Authorization andAgreement Form to have a Visa card that isattached to your CMA Account. Authority includesthe power, on your behalf, to use credit/chargecards and execute sales drafts or cash advancedrafts on your CMA Accounts and borrow moneyfrom Merrill Lynch’s affiliate should an overdraftadvance be made through your CMA Account.“Availability Delay” means the amount oftime before a deposit to your CMA Account willbecome available for the Sweep Program or to payDisbursements and other amounts due.“BA-CA” means Bank of America California, N.A., itssuccessors or assigns.“BANA” means Bank of America, N.A., itssuccessors or assigns.“Cash Balance” means any uninvested cashbalance resulting from incoming receipts suchas check deposits, cash deposits, ACH deposits,Fedwire receipts or the proceeds from the saleof securities. This is also known as your freecredit balance.“Cash Management Services” means servicessuch as bank deposit programs available throughthe Sweep Program, check writing, Visa debit cardand ACH.“Checks” means checks provided by Merrill Lynchfor use with the CMA Account.“CMA Account” means a Cash ManagementAccount established for you, which is either a cashaccount or, if you elect, a margin account.“CMA Master Financial Service” means theservice that consists of a Master CMA Account andone or more related CMA SubAccounts.“CMA SubAccount” means the underlyingaccounts, tied to a CMA Master Account,established as part of the CMA Master FinancialService.“CMAT” means CMA for Trust. A CMA for TrustAccount is a CMA Account that holds personaltrust assets.“Customer,” “Client,” “You,” “Your” or “Yours”means the individual(s) entering into thisAgreement.“DDA” means Demand Deposit Account.“Deposit Account” means the BTA and MMDAsestablished through the Merrill Lynch Bank Deposit“Banks” means BANA, BA-CA, MLBTC and any other Program.affiliated depository institutions participating from“Disbursement Priority” means the order intime to time.which available cash, Money Account balances or“Bank Deposits” means the MLBDP, ISA,credit facilities are used to pay for Disbursements.International Bank Variable Rate Deposit Facility and“Disbursements” means the items paid fromPreferred Deposit.the CMA Account and includes Visa transactions,“BTA” means Bank Transaction Account.checks, cash advances, Fedwire and ACH“Business Day” means any day in which both thetransactions and similar items.New York Stock Exchange and New York banks are“FDIC” means the Federal Deposit Insuranceopen for business.Corporation.“Card” or “Card(s)” means a Merrill Lynch CMAAccess Visa Debit card(s) issued by BANA for usewith the CMA Account.Cash Management Account 3

“FTS” means “The Funds Transfer Service.” FTSprovides clients a way to move money by phone orthrough MyMerrill at no charge. Clients can movemoney between eligible Merrill Lynch accounts orbetween eligible Merrill Lynch accounts and nonMerrill Lynch accounts such as checking, savingsor money market deposit accounts at their bank,savings association or credit union.“Investment Advisory Service” means one of themanaged money services made available from timeto time by or through Merrill Lynch or an affiliatedcompany.the Primary Money Account means the MLBDP orthe International Bank Variable Rate Deposit Facility.“Purchasing Power” means the amount availablefor cash management transactions, securitiespurchases or Disbursements.“Secondary Money Account” means a MoneyAccount that is available for deposit by contactingyour financial advisor. A Secondary Money Accountprovides automatic withdrawal to cover Visacharges, checks and other cash managementtransactions, including security purchases whenyour Primary Money Account is depleted.“ISA” or “ISA Program” means the Insured SavingsAccount.“Securities and Other Property” includes, butis not limited to, money, securities, securitiesentitlements, financial assets, investment property,“LMA” means the Loan Management Account financial instruments and commodities of everycredit facility provided by BANA.kind and nature, and all contracts and options“Master CMA Account” means the CMA Accountrelating thereto, whether for present or futuredesignated as the Master Account in the CMAdelivery. This includes Securities and Other PropertyMaster Financial Service.currently or in the future held, carried or maintained“Merrill Lynch” means Merrill Lynch, Pierce, Fenner by us or by any of our affiliates, in our possession& Smith Incorporated, its successors and/or assigns. or control (or the possession or control of our“Merrill Lynch Bank Deposit Program,” “MLBDP” affiliates) for any purpose, for any of your accountsnow or in the future opened, including any accountsor “MLBD Program” is available through thein which you may have an interest.Sweep Program. MLBDP balances may receivea tiered interest rate based on the total value of“Service” means the CMA Financial Service.a Statement Link. MLBDP balances are held in“SIPC” means the Securities Investor Protectionspecified deposit accounts established for you byCorporation.Merrill Lynch as your agent with BANA and/or BA-CAfor the CMA Account. Deposits in the Merrill Lynch “SMDIA” means the Standard Maximum DepositInsurance Amount.Bank Deposit Program are insured by the FDICfor up to 250,000 per depositor, per ownership“Statement Link” means the accounts that havecategory, per bank.been linked for valuation and mailing purposes.“MLBTC” means Merrill Lynch Bank and TrustCompany (Cayman) Limited, an affiliated bankincorporated in the Cayman Islands.“MMDA” means Money Market Deposit Account.“Money Accounts” means the Merrill Lynch BankDeposit Program and the ISA Program. For non-U.S.residents that are also non-U.S. citizens, “MoneyAccounts” means the International Bank VariableRate Deposit Facility.“PIN” means personal identification number.“Primary Money Account” means the automaticsweep of Cash Balances into the MLBDP or for nonU.S. resident clients who are also non-U. S. citizens,4 Cash Management AccountYou are able to link eligible Merrill Lynch accountstogether for valuation and other purposes, such asthe ability to have all of your statements packagedin one envelope, offering convenience and effectiveaccount management.“Stock Borrow Charge” or “SB Charge” refers to apremium charged for borrowing certain securities inconnection with short sale transactions.“Sweep Program” means the automatic depositof available Cash Balances into the Primary MoneyAccount as well as an automatic withdrawal to coverVisa charges, checks and other cash managementtransactions, including security purchases.“TMA account” means Trust Management Account.

3. SUBSCRIPTION TO THE SERVICETo open an account (includes CMA Account, CMASubAccount or CMAT), you must provide certaininformation about yourself and other accountholders. Once you have provided this informationand completed a Client Relationship Agreement,you may be eligible to open or activate newaccounts or certain services without completingadditional documentation. If you need a copy of ourClient Relationship Agreement, call your financialadvisor or 800.MERRILL (800.637.7455), or visityour nearest Merrill Lynch branch office. You mayopen a CMA Account with a minimum of 20,000in any combination of cash and securities ( 2,000for CMA SubAccounts). For certain group plans andspecial accounts, the minimums may be different.You may only open CMA SubAccounts for yourselfor with members of your household who resideat your address and share a Merrill Lynch financialadvisor. Unless you indicate otherwise, all CMASubAccount statements and notices will go tothe mailing address we have on record for yourMaster CMA Account. In addition, to the extentconfirmed to you when your CMA SubAccount wasestablished, you authorize Merrill Lynch to acceptinstructions from the CMA Account holder for thetransfer of any cash and securities between suchaccounts. If an erroneous transfer is made, youauthorize us to initiate appropriate corrections.These authorizations will remain in effect untilwe are notified otherwise in writing. Merrill Lynchwill establish accounts for you with BANA or anysuccessor processing bank for cards, for checkclearing, incoming Fedwires and receiving ACHtransactions. Merrill Lynch reserves the right toalter or waive the conditions of subscription to theService and also reserves the right to reject anyapplication to subscribe to the Service or any of itsfeatures for any reason.CMA ACCOUNT FOR TRUSTMerrill Lynch understands that trustees haveunique needs. Through the U.S. Trust Companydivision of BANA, we offer a full range of fiduciaryservices. We also offer trust services directly toour CMAT clients. You can enroll your CMAT in theTrust Administrative Advantage service. Throughthis service, U.S. Trust Company provides trustaccounting, fiduciary income tax preparation andbill payment services, as well as other trust-relatedservices. You can access the U.S. Trust Company’selder care services provider at preferred prices.Through this service you can gain access to anational provider of comprehensive long-termcare services for beneficiaries. You can access ourhistorical pricing and valuation service (describedwithin) to assist you in the valuation of trust assetsfor gift, estate tax or other administrative purposes.Call your financial advisor for more informationabout these services.4. SECURITIES BROKERAGE SERVICES(A) GENERALThe CMA Account may be used to purchase,sell and hold securities and other investmentsavailable from or through Merrill Lynch. Trades aremade through your financial advisor upon yourinstructions. If the CMA Account includes theMargin Lending Program, it may also be used topurchase and sell securities on credit or to obtainloans based on the current margin loan value ofsecurities in the CMA Account. Whether or not theAccount is a margin account, Merrill Lynch shallhave all of the legal rights of secured credit withrespect to the CMA Account, including the rightsdescribed in Section 5(A).(B) SIPC PROTECTIONThe securities and cash that Merrill Lynch holds inyour CMA Account are protected by the SIPC. If aU.S. broker-dealer fails, SIPC funds are available tomake up for any shortfall of clients’ assets that thebroker-dealer was required to maintain — up toa maximum of 500,000 per client for securities,inclusive of up to 250,000 per client for cash. Inaddition, Merrill Lynch has obtained “excess-SIPC”coverage from a Lloyd’s of London syndicate forlarge client accounts. This policy provides furtherprotection (including up to 1.9 million for cash)for customers who have received full SIPC limits,subject to an aggregate loss limit of 1 billion forall customer claims. SIPC and the excess coveragedo not protect against investment losses frommarket action. You may obtain further informationabout the SIPC, including the SIPC brochure, via theSIPC’s website at sipc.org or by calling the SIPC at202.371.8300.Each account held by a separate customer (asdefined by applicable law) is treated separately forpurposes of SIPC protection.Cash Management Account 5

(C) DIRECT REINVESTMENT SERVICEBy enrolling in the Direct Reinvestment Service,you can have dividends from all New York StockExchange, American Stock Exchange and NasdaqStock Market-listed stocks and most mutualfunds automatically reinvested into more sharesof the same stock or fund without commissioncharges. Call your financial advisor or 800.MERRILL(800.637.7455) for more information onthis service.(D) CUSTODY OF SECURITIESMerrill Lynch will hold all securities for the CMAAccount in a control location acceptable tothe U.S. Securities and Exchange Commission(SEC), which may include, but is not limited to:(i) a securities depository, such as the federallyregulated Depository Trust Company for U.S.issuers and Euroclear for European issuers; (ii) aFederal Reserve member bank; or (iii) a mutualfund’s transfer agent. Securities are commingledin a Merrill Lynch book-entry account, generallyheld in nominee name at the control location,along with securities belonging to otherMerrill Lynch customers. Your securities will at alltimes be separately identified on the books andrecords of Merrill Lynch as belonging to you, andMerrill Lynch will provide you with statementsthat reflect your holdings. This method of custody,which has significantly increased efficienciesand reduced the risks associated with holdingcustomer securities, is used by all major banks,trust companies and brokerage firms, and has beenrecognized as providing unsurpassed safety forholders of securities. With regard to the custodyof your securities, Merrill Lynch acts as your agentand transmits your instructions through theappropriate control location. Where securities arenot held in nominee name, the issuer or controllocation, as appropriate, recognizes Merrill Lynchas your agent and honors instructions provided byMerrill Lynch on your behalf.or when securities are due for sales. Unless youare enrolled in our Margin Lending Program, tradesmust be conducted on a “fully paid basis,” meaningthey must be paid in full on the settlement date. Ifyou wish to trade on margin, your account must beenrolled in our Margin Lending Program. If paymentis not received promptly, Merrill Lynch will liquidatethe position unless an extension is obtained.Under exceptional circumstances and subject toMerrill Lynch’s rights to liquidate, Merrill Lynch,on your behalf, may (in its sole discretion) applyfor an extension from a regulatory organization.If Merrill Lynch does so, you will be charged anextension fee. If the position is liquidated, youwill be responsible for any resulting deficiency,fees and late charges. Fees will be automaticallydebited from the CMA Account and are subject tochange. If you elect to take delivery of securities,the account statement will evidence delivery oncethey have been mailed to you. If you do not receivethem, you agree to notify Merrill Lynch promptlyso that replacement proceedings can begin. If youfail to notify Merrill Lynch within six months of thedelivery date shown on the account statement,you will be responsible for replacing the securitiesthrough the transfer agent and will have to pay allcosts.Securities purchased will be held in the CMAAccount unless you request delivery to you or yourdesignee, in which case Merrill Lynch will forwardyour instructions to the company’s transfer agentafter payment is received. Delivery normally takesseveral weeks after the purchase has been settledand fully paid for. Delivery of securities may not beavailable for issues that are held in book-entry form.Depending on the issuer, you may have the optionof taking delivery of a security to be held in directregistration with the issuer’s transfer agent.(F) SECURITY INTERESTWhether or not the CMA Account is a marginaccount, all Securities and Other Property inany account, now or hereafter held, carried or(E) DELIVERY OF SECURITIES AND PAYMENTSmaintained by Merrill Lynch or by any of itsWhen buying or selling securities, there are twokey dates involved in the transaction. The first date affiliates in Merrill Lynch’s possession and control,or in the possession and control of any suchis the trade date, which is the date that the orderaffiliate, for any purpose, in or for any accountis executed. The second is the settlement date, atwhich time the transfer of ownership passes from of yours, now or hereafter opened, includingany account in which you may have an interestthe seller to the buyer. Typically, the settlementdate is the day when payment is due for purchases (other than retirement accounts, such as IRAs),6 Cash Management Account

shall be subject to a lien for the discharge of allthe indebtedness and other obligations of youto Merrill Lynch and are held by Merrill Lynchas security for the payment of any liability orindebtedness of you to Merrill Lynch in any of saidaccounts. Securities and Other Property held inretirement accounts, such as IRAs, are not subjectto this lien and are not used as security for thepayment of your obligations or indebtedness forother accounts you maintain with Merrill Lynch.Merrill Lynch, subject to applicable laws, withoutgiving you prior notice, shall have the right to useand/or transfer Securities and Other Property soheld by Merrill Lynch from or to any of the accountsof yours whenever, in its judgment, Merrill Lynchconsiders such a transaction necessary for itsprotection. In enforcing its lien, Merrill Lynchshall have the discretion to determine whichSecurities and Other Property are to be sold andwhich contracts are to be closed. All Securitiesand Other Property will be treated as financialassets under Article 8 of the New York UniformCommercial Codes. Provide promptly the necessary data in therequired format.In the event of bank failure, the FDIC would beappointed as receiver and a hold would be placedon your account so that the FDIC can conduct thedeposit insurance determination; that hold will notbe released until the FDIC obtains the necessarydata to enable the FDIC to calculate the depositinsurance. You understand and agree if you do notprovide the necessary data to Merrill Lynch in atimely manner, it may result in a delay in receiptof insured funds and your ability to transact withthese funds.5. LENDING SERVICES(A) MARGIN LENDING PROGRAM[i] Margin requirements and credit charges.Our Margin Lending Program allows you toborrow against the value of eligible securitiesin your CMA Account. Merrill Lynch maintainsthe right, in our sole discretion at any timeand without prior notice to you, to determinewhich securities are eligible to borrow against.We may refer to the program as the Margin(G) PRIVACYLending Program. You can use a margin loanYou understand that Merrill Lynch sharesto buy securities or sell securities “short,”information with its affiliates and the Banks inor as a source of credit for purchases usingaccordance with our privacy policies. For moreyour CMA Visa card or checks. If enrolled ininformation on how and why we can sharethe Margin Lending Program, you agree toinformation, please read our “U.S. Consumer Privacymaintain such Securities and Other Property inNotice” by visiting ml.com/privacy. You mayyour account as required by Merrill Lynch. Youalso ask your financial advisor or read the Clientagree that your monthly margin loan balanceRelationship Agreement for more information.shall be charged interest at a rate permitted by(H) SPECIAL PROVISIONS FOR FDIC DEPOSITthe laws of the State of New York. If interestINSURANCE COVERAGEcharges are not paid at the close of a chargeIf you have opened a Merrill Lynch account thatperiod, they will be added to the openingholds bank deposits on your behalf or on behalf ofbalance for the next charge period. Interestthe beneficial owners of the assets in the account,will then be charged upon the entire openingyou, as the account holder or representative, mustbalance of that next charge period. Currently,be able to provide information, in the event ofyou can borrow up to 50% of the market valueadverse circumstances, about your ownershipof most exchange-listed stocks in your CMAof the deposits or information regarding theAccount or CMA SubAccount. A greater orinterests of the beneficial owner(s) or beneficiarieslesser percentage of the value of bonds andto Merrill Lynch in accordance with the FDIC’sother types of investments is available. Withrequirements.margin lending, you pay interest only on theamount you borrow. Payments are not requiredIn the event of adverse circumstances, you agree to:as long as your account meets minimum Cooperate fully with us and the FDIC inequity requirements. There are no filing fees,connection with determining the insured statusapplication fees or points.of funds in such accounts at any time;Cash Management Account 7

You must keep a minimum of 2,000 in equityin your CMA Account to remain eligible formargin lending. In general, you may enroll onlyone account. Certain fiduciary accounts, such ascustodial accounts, are not eligible for this program.Margin requirements are subject to change andmay vary depending upon factors such as securitytype, market price and concentration. Certaininternet-related and other volatile securities andholders of controlled and restricted securities maybe subject to higher initial equity and maintenancerequirements. Merrill Lynch may change initialequity and maintenance requirements at any timewithout notice. Borrowing against tax-exemptbonds, tax-exempt municipal funds and tax-exemptunit investment trusts may involve the loss of theinterest deduction from taxable income. You shouldcheck with your tax advisor before borrowingagainst tax-exempt investments or having thempriced in your account. If the account holders haveenrolled in the Margin Lending Program, all accountholders further agree that all Securities and OtherProperty that Merrill Lynch may be holding for anyof them, either in this account or otherwise, shallbe subject to a lien for the discharge of obligationsof this account to Merrill Lynch. Such lien is inaddition to any rights and remedies Merrill Lynchmay otherwise have.[ii] Security interest in favor of Merrill Lynch.Whether you enroll in the Margin LendingProgram or not, the following additionalprovisions will apply to your account. You agree that at all times you are liable for thepayment of, and agree to pay on demand, anydebit balance or other obligations owing in anyof your accounts at Merrill Lynch. You are liablefor any deficiency remaining in such accounts inthe event of the liquidation thereof, in whole or inpart, by us or by you. You agree that to the extent permitted by NewYork law, Merrill Lynch shall collect from youreasonable costs and expenses of collectionof any such debit balance(s) and any unpaiddeficiency in your account, including but notlimited to attorneys’ fees, that Merrill Lynchincurs or pays in connection with such efforts.You agree that all Securities and Other Propertyin any account — margin or cash — in whichyou have an interest, or which at any time are8 Cash Management Accountin your possession or under your control (otherthan retirement accounts, such as IRAs), shallbe subject to a lien for the discharge of all yourindebtedness and any other obligations thatyou may owe to Merrill Lynch and are held by usor our affiliates as security for payment of anyindebtedness or obligations to Merrill Lynch inany of your accounts with us, including accountsin which you have an interest. Securities and Other Property held in retirementaccounts, such as IRAs, are not subject to thislien and are not used as security for the paymentof your obligations or indebtedness for otheraccounts, cash or margin you maintain withMerrill Lynch. Merrill Lynch, subject to applicable laws, retainsthe right to transfer Securities and OtherProperty between accounts without giving priornotice whenever, in our judgment, we consider itnecessary for our protection. In enforcing our lien, we shall have the discretionto determine which Securities and OtherProperty are to be sold and which contracts areto be closed. All Securities and Other Property will be treatedas financial assets under Article 8 of the New YorkCommercial Codes.[iii]Calls for additional collateralliquidation rights(a) Merrill Lynch has the right to make amargin or maintenance call and requireaddi

for use with the CMA Account. "CMA Account" means a Cash Management Account established for you, which is either a cash account or, if you elect, a margin account. "CMA Master Financial Service" means the service that consists of a Master CMA Account and one or more related CMA SubAccounts. "CMA SubAccount" means the underlying .