Transcription

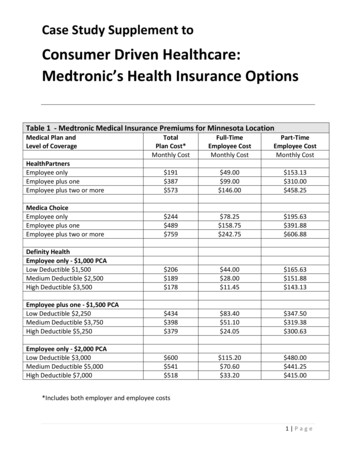

Case Study Supplement toConsumer Driven Healthcare:Medtronic’s Health Insurance OptionsTable 1 - Medtronic Medical Insurance Premiums for Minnesota LocationMedical Plan andLevel of CoverageTotalPlan Cost*Monthly CostFull-TimeEmployee CostMonthly CostPart-TimeEmployee CostMonthly CostHealthPartnersEmployee onlyEmployee plus oneEmployee plus two or more 191 387 573 49.00 99.00 146.00 153.13 310.00 458.25Medica ChoiceEmployee onlyEmployee plus oneEmployee plus two or more 244 489 759 78.25 158.75 242.75 195.63 391.88 606.88Definity HealthEmployee only - 1,000 PCALow Deductible 1,500Medium Deductible 2,500High Deductible 3,500 206 189 178 44.00 28.00 11.45 165.63 151.88 143.13Employee plus one - 1,500 PCALow Deductible 2,250Medium Deductible 3,750High Deductible 5,250 434 398 379 83.40 51.10 24.05 347.50 319.38 300.63Employee only - 2,000 PCALow Deductible 3,000Medium Deductible 5,000High Deductible 7,000 600 541 518 115.20 70.60 33.20 480.00 441.25 415.00*Includes both employer and employee costs1 Page

Table 2 - Medtronic Health Insurance Enrollment Summary for Minnesota LocationMedical Plan andLevel of CoverageFull TimePart TimeTotal EmployeesHealthPartnersEmployee onlyEmployee plus oneEmployee plus two or more1984032,3471101824093085852,756Medica ChoiceEmployee onlyEmployee plus oneEmployee plus two or more1904102,0834846382384562,121Employee only - 1,000 PCALow Deductible 1,500Medium Deductible 2,500High Deductible 3,5001,0848552202118121,105873232Employee plus one - 1,500 PCALow Deductible 2,250Medium Deductible 3,750High Deductible 5,25094054311226184966561116Employee only - 2,000 PCALow Deductible 3,000Medium Deductible 5,000High Deductible 7,00090542911301015729Table 3 - Medtronic Employee Demographics for Minnesota LocationMaleFemale21 – 301,0981,20131-451,1591,299Full TimePart Time1,1043462,752399Age Cohorts46-551,4991,4062,80011356-65 or 1,6021,240Total5,3585,1462,893889,5589462 Page

Competitor A DescriptionCompetitor A, based in the New England area, has taken an aggressive strategy to contain rising healthcare costs.One strategy has been the implementation of a higher tier of healthcare contribution for employees who aretobacco users. In order to reduce the number of individuals covered on its healthcare insurance plans the companyalso implemented a “working spouse” policy that requires spouses of employees who have the option of coveragewith their own employer to pay an additional 75 per month over the premium to be enrolled on Competitor A’shealth insurance plan. Competitor A offers employees the option of two different health plans. The Value PPOplan has lower monthly premiums but higher out-of-pocket costs at the time of service. The Value PPO plan alsouses a narrow network of providers with higher penalties for use of out of network providers. The Choice Plus PPOplan has a higher monthly premium but lower out-of-pocket costs. This plan also offers a broader network ofproviders for participants to choose from. Competitor A promotes the use of generic drugs by establishing a 0 copay for generic prescriptions. The company has also partnered to offer employees a “CareCompare” tool thatcompares the cost of procedures at various providers and offers employees a financial incentive for selecting alower cost provider of care.Table 4 - Competitor A Medical Insurance PremiumsMedical Plan andLevel of CoverageTotalPlan Cost*Monthly CostValue PPO – 80% Co-InsuranceEmployee onlyEmployee plus oneEmployee plus two or more 154 313 516Choice Plus PPO – 100% Co-InsuranceEmployee onlyEmployee plus oneEmployee plus two or more 298 597 926Full-TimeEmployee CostMonthly CostNonSmokerSmoker 23 34 63 94 103 154 60 122 179 90 183 268Part-TimeEmployee CostMonthly CostNonSmokerSmoker 92 138 252 378 412 618 223 477 741 268 547 876Table 5 - Competitor A Health Plan DesignValue PPO80% Co-InsuranceIn-NetworkOut ofNetworkCopaysOffice VisitUrgent CareEmergency RoomInpatientOut-of-Pocket MaximumEmployeeEmployee plus oneEmployee plus twoChoice Plus PPO100% Co-InsuranceIn NetworkOut of Network 25 35 250 500 75 85 250 1,250 10 20 100 250 20 45 100 250 1,000 2,000 3,000 3,000 5,000 7,000 750 1,500 2,250 1,250 2,500 3,7503 Page

Competitor B DescriptionCompetitor B has its headquarters on the west coast. The healthcare strategy used by Competitor B has been tocreate a “culture of wellbeing” for its workforce. Competitor B has a progressive workplace wellness program andhas engaged the majority of its workforce in health improvement activities by deploying mobile applications thatinclude campaigns and contests on various topics. Competitor B has an onsite wellness center for it’s headquarteremployees and also offers on-site clinics that are staffed to provide employees with primary healthcare at a nominalcost. Competitor B has also embraced the use of telehealth, where employees can be assessed and get prescriptionsfor routine illnesses from the comfort of their home or office. Competitor B offers two health plan options: a PPOplan and a High Deductible Healthcare Plan. The PPO plan has a narrow network that encourages the use ofhealthcare provider selected on the basis on their overall value (cost and quality). In conjunction with its HighDeductible Health Plan the company offers a Health Savings Account (HSA) which allows both the employee andemployer to make contributions to an account to pay for healthcare expenses. The company funds 500 forindividual coverage and 1,000 for dependent coverage for all employees. In addition, employees can earnadditional contributions through participation in wellness activities. Wellness activities encourage employees tocomplete all recommended preventative screenings for their age and gender. Over 80% of covered employees areenrolled in the Qualified High Deductible Health Plan option.Table 6 - Competitor B Medical Insurance PremiumsMedical Plan and Level of CoverageTotalPlan Cost*Monthly CostFull-TimeEmployee CostMonthly CostPart-TimeEmployee CostMonthly CostPPO Advantage Plan – 90% CoInsuranceEmployee onlyEmployee / Child(ren)Employee / SpouseEmployee with Children/Spouse 197 295 401 593 39 73 100 148 89 147 200 296Qualified High Deductible Health Planwith Health Savings Account - 2,000individual / 4,000 dependentdeductibleEmployee onlyEmployee / Child(ren)Employee / SpouseEmployee /Child(ren)/Spouse 168 251 361 553 32 51 72 110 71 113 180 2674 Page

Table 7 - Competitor B Health Plan DesignPPO Advantage Plan – 90%Co-InsuranceIn NetworkOut ofNetworkCopaysOffice Visit 20 40Urgent Care 30 60Emergency Room 100 100Inpatient 250 750 2,500 5,000 5,000 5,000 5,000 7,500 7,500 7,500Out-of-Pocket MaximumEmployee OnlyEmployee /Child(ren)Employee / SpouseEmployee/Child(ren)/SpouseQualified High Deductible HealthPlan with Health Savings Account 2,000 individual / 4,000dependent deductibleIn NetworkOut of Network0% afterdeductible0% afterdeductible0% afterdeductible0% afterdeductible20% afterdeductible20% afterdeductible20% afterdeductible20% afterdeductible 2,000 4,000 4,000 4,000 4,000 6,000 6,000 6,0005 Page

Medtronic's Health Insurance Options Table 1 - Medtronic Medical Insurance Premiums for Minnesota Location Medical Plan and Level of Coverage Total Plan Cost* Full-Time Employee Cost Part-Time Employee Cost Monthly Cost Monthly Cost Monthly Cost HealthPartners Employee only 191 49.00 153.13