Transcription

Riverwalk Ruby Building AssociationPO Box 8690Avon, CO 81620

P.O. Box A-H 39 Public SquareWilkes-Barre, PA 18703-00291-800-673-2465www.guard.comWE’RE HERE TO HELP.During these extraordinary times, Berkshire Hathaway GUARD wishes to reaffirm ourcommitment to our policyholders and sincerely thank you for your business. We stand readyto protect you in good times and bad.We want to retain your business and recognize the financial hardship being faced by many ofour customers. We want you to know that we are here to help.If you or your business is experiencing a financial difficulty due to the COVID-19pandemic and would like to discuss alternative ways to keep your insurancecoverage active with us, please contact your insurance agent or our CustomerService staff directly at 1-800-673-2465 or via email at csr@guard.com or viaonline chat through our Policyholder Service Center available at www.guard.com.On behalf of the entire Berkshire Hathaway GUARD Team, I wish you and your family thebest in the weeks and months ahead.Sincerely,Sy FoguelCEO/President

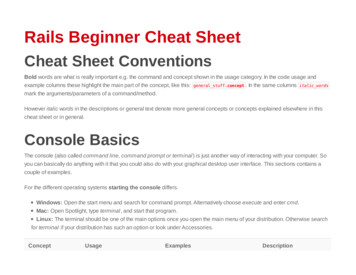

DOWNLOAD OUR MOBILE APP!Policyholder Service CenterRegisterToday!www.guard.com/pscregister/We value our policyholders, so we take advantageof technology to offer fast and easy onlineself-service solutions.Available from www.guard.com/pscregister/ or mobile app, ourPolicyholder Service Center is the gateway to a wide range ofresources used by our customers to manage their insurancewith us. From reporting a claim to making a payment online toreviewing helpful loss control information, our service center isdesigned to offer convenient access to the tools you use most!ACCOUNT MANAGEMENTView and print policy documentsGenerate a Certificate ofInsurance (COI)Download loss control materialsSearch our video libraryChat live with a representativeGo paperlessAccess other news and resourcesOur BHGUARD mobile app offers many of the same featureswith the latest technology always in mind. Get the app onGoogle Play or download from the Apple App Store, today!Need help? Contact 1-800-673-2465 or csr@guard.com.BILLING & PAYMENTSMake a credit card paymentTransfer funds from your bankSubmit multi-policy paymentsCOVERAGE-SPECIFIC FEATURESSet up re-occurring paymentsWorkers’ Compensation Find a physician Complete a premium audit Download state posting notices Implement a return-to-work program Report payroll (self-reporting policy)View billing historyCommercial Auto Access vehicle insurance ID cards View all vehicles under a policyCLAIMSReport a new claimUpload photos and documentsView policy loss historyMonitor the status of a claimChat with an adjusterVisit www.guard.com/pscregister/ ordownload the BHGUARD app today!Some features and resources are only available for specific lines of insurance. Not all features may be currently available on the mobile app. Insurance may be underwritten byAmGUARD Insurance Company, EastGUARD Insurance Company, NorGUARD Insurance Company, and/or WestGUARD Insurance Company, members of Berkshire HathawayGUARD Insurance Companies (BHGIC) with principal place of business at 39 Public Square, Wilkes-Barre, PA 18701. BHGIC September 11, 2020.FLPSC091120

OUR SERVICESClaims ReportingWe encourage policyholders to inform us of incidents, accidents,and potential claims as soon as possible so that we can get rightto work! Prompt reporting can be key to a successful resolution.Only the administration of emergency care comes first.WAYS TO REPORT A CLAIMCall 1-888-NEW-CLMS(1-888-639-2567)Log into our Policyholder ServiceCenter at guard.com/pscregisterGet the BHGUARD app fromthe App Store or Google PlayVisit guard.com to completean online formHELPFUL INFORMATIONFOR EXPEDITING YOUR CLAIM Policy numberTIPS FOR CONTROLLINGTHE LOSSTake reasonable steps to protectany covered persons, property,autos, etc., from immediatefurther harm or damage and keepa record of any expenses incurredin the process for considerationin the settlement. If possible, setproperty aside for examination.Allow our adjusters to officiallyinspect the property/auto beforeany non-immediate repairs ordisposition take place.Promptly notify the police of anystolen property or suspectedillegal activity.Preserve any closed-circuitsurveillance video.If possible, photograph the scene;cell phone pictures can be helpful. Description of how, when, and where the incident occurred Names, addresses, phone numbers of anyinjured/involved parties or witnesses The insured driver’s name, address, phone number(for Commercial Auto claims) The employer’s tax ID number, the injured/ill employee’sSSN and personnel file and any accident reports(for Workers’ Compensation claims) Legal correspondence (for Liability claims)CONTACT US1-888-NEW-CLMSGUARDClaimsTeam@guard.comFax: 570-825-0611Berkshire Hathaway GUARDP.O. Box 1368Wilkes-Barre, PA 18703-1368 Special forms for Disability claims available on guard.comInsurance may be underwritten by AmGUARD Insurance Company , EastGUARD Insurance Company , NorGUARD Insurance Company , WestGUARD Insurance Company, or AZGUARDTM Insurance Company, members of Berkshire Hathaway GUARD Insurance Companies (BHGIC) with principal place ofbusiness at 39 Public Square, Wilkes-Barre, PA 18701. All claims will be evaluated upon submission. We will not pay for any subsequent loss or damageresulting from an occurrence that is not a “Covered Cause of Loss.” Only the relevant insurance policy and endorsements can provide the actual terms andconditions for an insured. Some restrictions, all state laws, and all company claims/underwriting guidelines apply. BHGIC 2020.CFAL063020

In cooperation withDC INSURERS-MOUNTAIN, LLCwww.guard.comRiverwalk Ruby Building AssociationPO Box 8690Avon, CO 81620Policy Number: RIUM247056Customer Number: 4166356Insurance Company: AmGUARD Insurance CompanyEffective Date: 07/01/2021Commercial Umbrella Policy Renewal OfferWe are pleased to offer to renew your policy. The policy is underwritten by AmGUARD Insurance Company, amember of Berkshire Hathaway GUARD Insurance Companies.EASY ways to pay:1. Online via our Policyholder Service Center (PSC) – www.guard.com/psc/2. By setting up automatic Direct Draft payments through the PSC Billing & Payments section3. Through our BHGUARD mobile app – Find us on the App Store and Google Play!4. By phone – Call our Customer Service Center Monday through Friday, 8:00 AM to 7:30 PM at 800-6732465 to pay via credit card or direct draft from your bank account.Manage your policy online through our Policyholder Service Center (PSC) and BHGUARD mobile app.In addition to making payments, you can: view and print policy documents review our value-added services find information to report a claim (use our app to upload photos and documents) go paperless – set up electronic document deliveryIf you haven’t already done so, register now at www.guard.com/pscregister.Who to Contact For coverage changes, policy provisions, etc. call your insurance agent at 303-420-4774. With questions about billing, claims, and other services, contact us by phone at 800-673-2465, fax at570-823-2059, email at csr@GUARD.com, or chat with us online through our PSC. To report fraud or suspicious activity, contact our Fraud Investigative Unit at 800-673-2465, ext. 8477(TIPS) or via email at fraudsiu@guard.com. To Report a Claim 24/7, call 888-NEW-CLMS. Upload claims documents and photos using our mobileapp or online at our PSC.If you are enrolled in direct draft, payroll billing, or any other type of automated billing, your paymentwill be sent to us automatically. Otherwise, please review the payment options available above underEASY ways to pay. A billing statement, sent separately, will have additional information. Pleasenote payment is required to maintain uninterrupted insurance coverage.We appreciate your business and look forward to serving your insurance needs for another year!enclosed: Commercial Umbrella Policy #RIUM247056H Q : CO /UMDEC TO IThe Security You Need. The Name You Trust.

COMMERCIAL LIABILITYUMBRELLADECLARATIONSAmGUARD Insurance Company – A Stock CompanyIssue Dated: 05/28/2021NAME INSURED POISSUE Policy No.: RIUM247056Renewal of: RIUM199257POLICY INFORMATION PAGE[1]Named Insured and Mailing AddressRiverwalk Ruby Building AssociationPO Box 8690Avon, CO 81620[2]AgencyDC INSURERS-MOUNTAIN, LLC3705 Kipling Street#104Wheat Ridge CO 80033[3]Policy PeriodFrom 07/01/2021 to 07/01/2022, 12:01 AM, standard time at the insured’s mailingaddress.[4]Description of BusinessCondo Association[5]CoverageThis policy consists of the Coverage Forms listed on the Schedule of Forms andEndorsements.[6]PremiumThe premium shown below may be subject to adjustment.Commercial Umbrella PremiumTOTAL POLICY PREMIUM (subject to adjustment)* Includes terrorism premium of 1.00[7] 800.00 * 800.00Payment of PremiumIn return for your payment of premium, and subject to all terms of this policy,we agree with you to provide insurance as stated in this policy.THIS POLICY CONTAINS AGGREGATE LIMITS; REFER TO SECTION III – LIMITS OF INSURANCE FOR DETAILS.UM DS 01 04 09P.O. Box AH 39 Public Square Wilkes-Barre, PA 18703-0020 www.guard.comPage 1 of 2

COMMERCIAL LIABILITYUMBRELLADECLARATIONSUmbrella Limits of InsuranceEach Occurrence LimitPersonal and Advertising Injury LimitAggregate LimitSelf-Insured RetentionCertified Acts of Terrorism under TRIA 2,000,0002,000,0002,000,00010,000IncludedSchedule of Underlying InsuranceCommercial General LiabilityPolicy NumberRIBP246361CarrierAmGUARD Insurance CompanyPolicy FormBusinessownersInception Date07/01/2021Expiration Date07/01/2022Policy TypeOccurrenceLimitsEach Occurrence 1,000,000General Aggregate2,000,000Products-Completed Operations Aggregate2,000,000Hired Auto CoverageNoNon-Owned Auto CoverageNoUM DS 01 04 09P.O. Box AH 39 Public Square Wilkes-Barre, PA 18703-0020 www.guard.comPage 2 of 2

COMMERCIAL LIABILITY UMBRELLAPOLICY DECLARATIONSSCHEDULE OF FORMS AND ENDORSEMENTSPolicy No.: RIUM247056NUMBERCOVID-19UM DS 01END SCHIL 99 00CU 00 01CU 00 0404 0908 1312 0705 09CU 01 46 09 00CU 21 23 02 02CU 21 31 01 15CU 21 36 01 14CU 34 01 04 0411110909090909981307IL 09 85 12 20IL P 001 01 04CU PRV POLEffective Date: 07/01/2021TITLECOVID-19 MessageCommercial Liability Umbrella DecEndorsement ScheduleAuthorization and AttestationCommercial Liability Umbrella Coverage FormRecording and Distribution of Material or Information inViolation of Law ExclusionColorado Changes - Representations or FraudNuclear Energy Liability Exclusion EndorsementExclusion of Other Acts of Terrorism Committed Outsidethe United States; Cap on Losses from Certified Acts ofTerrorismExclusion of Punitive Damages Related to a Certified Actof TerrorismExclusion - Exterior Insulation and Finish SystemsSilica or Silica-Related Dust ExclusionAuto Exclusion of Terrorism CoverageCommunicable Disease ExclusionExclusion - Access or Disclosure of Confidential orPersonal Information and Data-related Liability - WithLimited Bodily Injury ExceptionColorado - Limitation of Coverage to Designated Premises,Project or OperationUmbrella Policy CustomizationsAsbestos ExclusionLead ExclusionFungi or Bacteria ExclusionCommon Policy ConditionsColorado Changes Civil UnionColorado Changes - Cancellation and NonrenewalEndorsementDisclosure Pursuant to Terrorism Risk Insurance ActU.S. Treasury Department's Office Of Foreign AssetsControl (OFAC) Advisory Notice To PolicyholderPrivacy PolicyPage 1 of 1

AUTHORIZATIONAND ATTESTATIONIL 99 00 08 13THIS ENDORSEMENT AUTHORIZES THE POLICY.AUTHORIZATION AND ATTESTATIONThis endorsement authorizes the insurance contract between you and the GUARD insurance company subsidiary listedon the DECLARATIONS PAGE of your insurance policy.In Witness Whereof, this page executes and fully attests to this policy. If required by state law, the policy shall not bevalid unless countersigned by our authorized representatives.Authorizing signaturesMatthew O’ConnorGeneral Counsel and SecretarySy Foguel, ACAS, FILAAChief Executive Officer and PresidentIL 99 00 08 13Page 1 of 1

COMMERCIAL LIABILITY UMBRELLACU 00 01 12 07COMMERCIAL LIABILITY UMBRELLA COVERAGE FORMVarious provisions in this policy restrict coverage.Read the entire policy carefully to determine rights,duties and what is and is not covered.Throughout this policy the words "you" and "your"refer to the Named Insured shown in the Declarations,and any other person or organization qualifying as aNamed Insured under this policy. The words "we","us" and "our" refer to the company providing thisinsurance.The word "insured" means any person or organizationqualifying as such under Section II – Who Is An Insured.Other words and phrases that appear in quotationmarks have special meaning. Refer to Section V –Definitions.SECTION I – COVERAGESCOVERAGE A – BODILY INJURY AND PROPERTYDAMAGE LIABILITY1. Insuring Agreementa. We will pay on behalf of the insured the "ultimate net loss" in excess of the "retained limit"because of "bodily injury" or "property damage"to which this insurance applies. We will havethe right and duty to defend the insured againstany "suit" seeking damages for such "bodily injury" or "property damage" when the "underlying insurance" does not provide coverage orthe limits of "underlying insurance" have beenexhausted. When we have no duty to defend,we will have the right to defend, or to participate in the defense of, the insured against anyother "suit" seeking damages to which this insurance may apply. However, we will have noduty to defend the insured against any "suit"seeking damages for "bodily injury" or "property damage" to which this insurance does notapply. At our discretion, we may investigateany "occurrence" that may involve this insurance and settle any resultant claim or "suit", forwhich we have the duty to defend. But:(1) The amount we will pay for the "ultimate netloss" is limited as described in Section III –Limits Of Insurance; and(2) Our right and duty to defend ends when wehave used up the applicable limit of insurance in the payment of judgments or settlements under Coverages A or B.CU 00 01 12 07No other obligation or liability to pay sums orperform acts or services is covered unless explicitly provided for under Supplementary Payments – Coverages A and B.b. This insurance applies to "bodily injury" and"property damage" only if:(1) The "bodily injury" or "property damage" iscaused by an "occurrence" that takes placein the "coverage territory";(2) The "bodily injury" or "property damage"occurs during the policy period; and(3) Prior to the policy period, no insured listedunder Paragraph 1.a. of Section II – Who IsAn Insured and no "employee" authorizedby you to give or receive notice of an "occurrence" or claim, knew that the "bodily injury" or "property damage" had occurred, inwhole or in part. If such a listed insured orauthorized "employee" knew, prior to thepolicy period, that the "bodily injury" or"property damage" occurred, then any continuation, change or resumption of such"bodily injury" or "property damage" duringor after the policy period will be deemed tohave been known prior to the policy period.c. "Bodily injury" or "property damage" whichoccurs during the policy period and was not,prior to the policy period, known to have occurred by any insured listed under Paragraph1.a. of Section II – Who Is An Insured or any"employee" authorized by you to give or receive notice of an "occurrence" or claim, includes any continuation, change or resumptionof that "bodily injury" or "property damage" after the end of the policy period.d. "Bodily injury" or "property damage" will bedeemed to have been known to have occurredat the earliest time when any insured listed under Paragraph 1.a. of Section II – Who Is AnInsured or any "employee" authorized by you togive or receive notice of an "occurrence" orclaim:(1) Reports all, or any part, of the "bodily injury"or "property damage" to us or any other insurer;(2) Receives a written or verbal demand orclaim for damages because of the "bodilyinjury" or "property damage"; or ISO Properties, Inc., 2007Page 1 of 17

(3) Becomes aware by any other means that"bodily injury" or "property damage" has occurred or has begun to occur.(2) The furnishing of alcoholic beverages to aperson under the legal drinking age or under the influence of alcohol; ore. Damages because of "bodily injury" includedamages claimed by any person or organization for care, loss of services or death resultingat any time from the "bodily injury".(3) Any statute, ordinance or regulation relatingto the sale, gift, distribution or use of alcoholic beverages.2. ExclusionsThis insurance does not apply to:a. Expected Or Intended Injury"Bodily injury" or "property damage" expectedor intended from the standpoint of the insured.This exclusion does not apply to "bodily injury"resulting from the use of reasonable force toprotect persons or property.b. Contractual Liability"Bodily injury" or "property damage" for whichthe insured is obligated to pay damages byreason of the assumption of liability in a contract or agreement. This exclusion does notapply to liability for damages:(1) That the insured would have in the absenceof the contract or agreement; or(2) Assumed in a contract or agreement that isan "insured contract", provided the "bodilyinjury" or "property damage" occurs subsequent to the execution of the contract oragreement. Solely for the purposes of liability assumed in an "insured contract", reasonable attorney fees and necessary litigation expenses incurred by or for a partyother than an insured are deemed to bedamages because of "bodily injury" or"property damage", provided:(a) Liability to such party for, or for the costof, that party's defense has also beenassumed in the same "insured contract";and(b) Such attorney fees and litigation expenses are for defense of that partyagainst a civil or alternative dispute resolution proceeding in which damages towhich this insurance applies are alleged.c. Liquor Liability"Bodily injury" or "property damage" for whichany insured may be held liable by reason of:(1) Causing or contributing to the intoxication ofany person;Page 2 of 17This exclusion applies only if you are in thebusiness of manufacturing, distributing, selling,serving or furnishing alcoholic beverages.This exclusion does not apply to the extent thatvalid "underlying insurance" for the liquor liability risks described above exists or would haveexisted but for the exhaustion of underlying limits for "bodily injury" and "property damage".Coverage provided will follow the provisions,exclusions and limitations of the "underlying insurance" unless otherwise directed by this insurance.d. Workers' Compensation And Similar LawsAny obligation of the insured under a workers'compensation, disability benefits or unemployment compensation law or any similar law.e. E.R.I.S.A.Any obligation of the insured under the Employees' Retirement Income Security Act(E.R.I.S.A.), and any amendments thereto orany similar federal, state or local statute.f. Auto Coverages(1) "Bodily injury" or "property damage" arisingout of the ownership, maintenance or use ofany "auto" which is not a "covered auto"; or(2) Any loss, cost or expense payable under orresulting from any first party physical damage coverage; no-fault law; personal injuryprotection or auto medical payments coverage; or uninsured or underinsured motoristlaw.g. Employer's Liability"Bodily injury" to:(1) An "employee" of the insured arising out ofand in the course of:(a) Employment by the insured; or(b) Performing duties related to the conductof the insured's business; or(2) The spouse, child, parent, brother or sisterof that "employee" as a consequence ofParagraph (1) above. ISO Properties, Inc., 2007CU 00 01 12 07

This exclusion applies whether the insuredmay be liable as an employer or in any othercapacity, and to any obligation to share damages with or repay someone else who mustpay damages because of the injury.This exclusion does not apply to liability assumed by the insured under an "insured contract".With respect to injury arising out of a "coveredauto", this exclusion does not apply to "bodilyinjury" to domestic "employees" not entitled toworkers' compensation benefits. For the purposes of this insurance, a domestic "employee"is a person engaged in household or domesticwork performed principally in connection with aresidence premises.This exclusion does not apply to the extent thatvalid "underlying insurance" for the employer'sliability risks described above exists or wouldhave existed but for the exhaustion of underlying limits for "bodily injury". Coverage providedwill follow the provisions, exclusions and limitations of the "underlying insurance" unless otherwise directed by this insurance.h. Employment-Related Practices"Bodily injury" to:(1) A person arising out of any:(a) Refusal to employ that person;(b) Termination of that person's employment; or(c) Employment-related practices, policies,acts or omissions, such as coercion,demotion, evaluation, reassignment,discipline, defamation, harassment, humiliation, discrimination or maliciousprosecution directed at that person; or(2) The spouse, child, parent, brother or sisterof that person as a consequence of "bodilyinjury" to that person at whom any of theemployment-related practices described inParagraphs (a), (b), or (c) above is directed.This exclusion applies whether the injurycausing event described in Paragraphs (a), (b)or (c) above occurs before employment, duringemployment or after employment of that person.This exclusion applies whether the insuredmay be liable as an employer or in any othercapacity, and to any obligation to share damages with or repay someone else who mustpay damages because of the injury.CU 00 01 12 07i. Pollution(1) "Bodily injury" or "property damage" whichwould not have occurred in whole or partbut for the actual, alleged or threateneddischarge, dispersal, seepage, migration,release or escape of "pollutants" at anytime; or(2) "Pollution cost or expense".This exclusion does not apply if valid "underlying insurance" for the pollution liability risks described above exists or would have existed butfor the exhaustion of underlying limits for "bodily injury" and "property damage". Coverageprovided will follow the provisions, exclusionsand limitations of the "underlying insurance".j. Aircraft Or Watercraft"Bodily injury" or "property damage" arising outof the ownership, maintenance, use or entrustment to others of any aircraft or watercraftowned or operated by or rented or loaned toany insured. Use includes operation and "loading or unloading".This exclusion applies even if the claimsagainst any insured allege negligence or otherwrongdoing in the supervision, hiring, employment, training or monitoring of others by thatinsured, if the "occurrence" which caused the"bodily injury" or "property damage" involvedthe ownership, maintenance, use or entrustment to others of any aircraft or watercraft thatis owned or operated by or rented or loaned toany insured.This exclusion does not apply to:(1) A watercraft while ashore on premises youown or rent;(2) A watercraft you do not own that is:(a) Less than 50 feet long; and(b) Not being used to carry persons orproperty for a charge;(3) Liability assumed under any "insured contract" for the ownership, maintenance oruse of aircraft or watercraft.(4) The extent that valid "underlying insurance"for the aircraft or watercraft liability risksdescribed above exists or would have existed but for the exhaustion of underlyinglimits for "bodily injury" or "property damage". Coverage provided will follow the provisions, exclusions and limitations of the"underlying insurance" unless otherwise directed by this insurance; or ISO Properties, Inc., 2007Page 3 of 17

(5) Aircraft that is:(a) Chartered by, loaned to, or hired by youwith a paid crew; and(b) Not owned by any insured.k. Racing Activities"Bodily injury" or "property damage" arising outof the use of "mobile equipment" or "autos" in,or while in practice for, or while being preparedfor, any prearranged professional or organizedracing, speed, demolition, or stunting activity orcontest.l. War"Bodily injury" or "property damage", howevercaused, arising, directly or indirectly, out of:(1) War, including undeclared or civil war;(2) Warlike action by a military force, includingaction in hindering or defending against anactual or expected attack, by any government, sovereign or other authority usingmilitary personnel or other agents; or(3) Insurrection, rebellion, revolution, usurpedpower, or action taken by governmental authority in hindering or defending against anyof these.m. Damage To Property"Property damage" to:(1) Property:(a) You own, rent, or occupy including anycosts or expenses incurred by you, orany other person, organization or entity,for repair, replacement, enhancement,restoration or maintenance of suchproperty for any reason, including prevention of injury to a person or damageto another's property; or(b) Owned or transported by the insuredand arising out of the ownership,maintenance or use of a "covered auto".(2) Premises you sell, give away or abandon, ifthe "property damage" arises out of anypart of those premises;(3) Property loaned to you;(4) Personal property in the care, custody orcontrol of the insured;(5) That particular part of real property onwhich you or any contractors or subcontractors working directly or indirectly on yourbehalf are performing operations, if the"property damage" arises out of those operations; orPage 4 of 17(6) That particular part of any property thatmust be restored, repaired or replaced because "your work" was incorrectly performed on it.Paragraph (2) of this exclusion does not applyif the premises are "your work" and were neveroccupied, rented or held for rental by you.Paragraphs (1)(b), (3), (4), (5) and (6) of thisexclusion do not apply to liability assumed under a sidetrack agreement.Paragraphs (3) and (4) of this exclusion do notapply to liability assumed under a written Trailer Interchange agreement.Paragraph (6) of this exclusion does not applyto "property damage" included in the "productscompleted operations hazard".n. Damage To Your Product"Property damage" to "your product" arising outof it or any part of it.o. Damage To Your Work"Property damage" to "your work" arising out ofit or any part of it and included in the "productscompleted operations hazard".This exclusion does not apply if the damagedwork or the work out of which the damage arises was performed on your behalf by a subcontractor.p. Damage To Impaired Property Or PropertyNot Physically Injured"Property damage" to "impaired property" orproperty that has not been physically injured,arising out of:(1) A defect, deficiency, inadequacy or dangerous condition in "your product" or "yourwork"; or(2) A delay or failure by you or anyone actingon your behalf to perform a contract oragreement in accordance with its terms.This exclusion does not apply to the loss of useof other property arising out of sudden and accidental physical injury to "your product" or"your work" after it has been put to its intendeduse.q. Recall Of Products, Work Or ImpairedPropertyDamages claimed for any loss, cost or expense incurred by you or others for the loss ofuse, withdrawal, recall, inspection, repair, replacement, adjustment, removal or disposal of:(1) "Your product"; ISO Properties, Inc., 2007CU 00 01 12 07

(2) "Your work"; or(10) Body piercing services;(3) "Impaired property";(11) Services in the practice of pharmacy; butthis exclusion does not apply if you are aretail druggist or your operations are thoseof a retail drugstore;if such product, work, or property is withdrawnor recalled from the market or from use by anyperson or organization because of a known orsuspected defect, deficiency, inadequacy ordangerous condition in it.r. Personal And Advertising Injury"Bodily injury" arising out of "personal and advertising injury".s. Professional Services"Bodily injury" or "property damage" due torendering or failure to render any professionalservice. This includes but is not limited to:(1) Legal, accounting or advertising services;(2) Preparing, approving, or failing to prepareor approve, maps, shop drawings, opinions,reports, surveys, field orders, change orders or drawings and specifications by anyarchitect, engineer or surveyor performingservices on a project on which you serve asconstruction manager;(3) Inspection, supervision, quality control,architectural or engineering activities doneby or for you on a project on which youserve as construction manager;(4) Engineering services, includingsupervisory or inspection services;related(5) Medical, surgical, dental, x-ray or nursingservices treatment, advice or instruction;(6) Any health or therapeutic service treatment,advice or instruction;(7) Any service, treatment, advice or instructionfor the purpose of appearance or skin enhancement, hair removal or replacement, orpersonal grooming or therapy;(8) Any service, treatment, advice or instructionrelating to physical fitness, including service, treatment, advice or instruction inconnection with diet, cardio-vascular fitness, body building or physical training programs;(9) Optometry or optical or hearing aid servicesincluding the prescribing, preparation, fitting, demonstration or distribution of ophthalmic lenses and similar products or hearing aid devices;CU 00 01 12 07(12) Law enforcement or firefighting services;and(13) Handling, embalming, disposal, burial,cremation or disinterment of dead bodies.t. Electronic DataDamages arising out of the loss of, loss of useof, damage to, corruption of, inability to accessor inability to manipulate electronic data.As used in this exclusion, electronic datameans information, facts or programs stored asor on, created

Insurance may be underwritten by AmGUARD Insurance Company , EastGUARD Insurance Company , NorGUARD Insurance Company , WestGUARD Insurance Company, or AZGUARDTM Insurance Company, members of Berkshire Hathaway GUARD Insurance Companies (BHGIC) with principal place of business at 39 Public Square, Wilkes-Barre, PA 18701.