Transcription

U.S. Company Recycled PlasticContent Goals Analysis –Supply & DemandPREPARED BY: Circular MattersCOMMISSIONED BY: AMERIPEN – American Institute for Packaging and the EnvironmentMARCH 2021

ACKNOWLEDGEMENTSCIRCULAR MATTERS LED THE COLLECTION OF CORE TECHNICAL DATA AND ANALYSIS FOR THIS REPORT.The genesis behind this report came from the AMERIPEN State Market Development Taskforce. Appreciation goes to: BOB BYLONE – Pennsylvania Recycling Markets CenterANNA DELANGE – South Carolina Department of Commerce – RecyclingMATT FLECHTER – Michigan Department of Environmental QualityWAYNE GJERDE – Minnesota Pollution Control AgencyLYNN RUBINSTEIN – Northeast Recycling Council (NERC)WILL SAGAR – Southeast Recycling Development Council (SERDC)KARA STEWART AND TINA SCHAEFER – Washington State Recycling Market Development CenterAMERIPEN is grateful to the following peers who provide significant input into the direction and editing of this report. STEVE ALEXANDER – Association of Plastic Recyclers (APR)ALASDAIR CARMICHAEL – National Association for PET Container Resources (NAPCOR)LYNN DYER – Pactiv EvergreenBRENT HEIST – Procter & GambleLYNN RUBINSTEIN – Northeast Recycling Council (NERC)LAURIE HANSEN SHEETS – Western Plastics Association (WPA)WWW.AMERIPEN.ORG2

EXECUTIVE SUMMARYAs interest in the circular economy grows, an increasingnumber of companies have been setting goals toincrease the recyclability and recycled content oftheir packaging. AMERIPEN – the American Institutefor Packaging and the Environment – a policy-basedtrade association for the U.S. packaging industry,wanted to understand the relationship betweenthese goals and domestic packaging supply andreprocessing capacity, and what, if any, additionalpolicies or program supports could be leveraged toclose potential gaps. Success with company goals forpost-consumer recycled (PCR) content will requirecoordination across this value chain. Understandingwhere and why challenges may be occurring canprovide further insight into effective interventions toensure success.When we began this study, we assumed that mostgoals would be developed for a broad portfolio ofpackaging formats and materials and that we would beable to drill down into demand and supply curves forall those materials. To our surprise, we found very fewarticulated quantifiable recycled content objectivesbeyond plastics. AMERIPEN therefore narrowed thisstudy to evaluate the potential of meeting plastic PCRresin goals only.Since this study was based on existing data and someestimates and assumptions were required, we cautionthat this data should be seen as general trends andnot a complete assessment of available supplyand reprocessing capacity for packaging-specificapplications.Overall, our data indicates that only two plastic resinshave enough collection and capacity to support goals– high density polyethylene (HDPE) and polyethyleneterephthalate (PET). But despite their larger scale,they are still unlikely to provide sufficient material tomeet the stated demand for PCR by 2025. Increasesin collection, reprocessing capacity and quality acrossall materials, but particularly for HDPE and PET, willbe needed. While other materials are emerging, andinvestments are being made, to date very few resinsother than HDPE and PET have sufficient volume tohelp companies meet their PCR commitments.Evaluating where the shortfalls exist across packagingspecific collection, reprocessing capacity and quality,AMERIPEN has also generated a list of suggestedpolicies and program supports that warrant furtherdialogue as potential strategies to help increasedomestic PCR processing to meet packaging PCRgoals. These suggestions are intended to advance adialogue on economic and environmental impact anddo not necessarily reflect the positions of AMERIPENor our members. Further dialogue with stakeholdersacross the packaging value chain is warranted toexplore next steps.It is our hope in providing an analysis of PCR demand,supply, and reprocessing capacity for plastic packagingspecific PCR, we can advance a dialogue towardsleveraging the most effective strategies to close thegaps and ensure success to meet everyone’s goals.WWW.AMERIPEN.ORG3

U.S. COMPANY RECYCLED PLASTIC CONTENT GOALS ANALYSIS –SUPPLY & DEMANDINTRODUCTIONAs interest in the circular economy grows, an increasing number ofcompanies have been setting goals to increase the recyclability andrecycled content of their packaging. Companies are recognizingthat robust domestic markets for recycled goods can reduceenvironmental impact, increase packaging value through reuseand recycling, and create economic opportunities. AMERIPEN- the American Institute for Packaging and the Environment - apolicy-based trade association for the U.S. packaging industry,wanted to understand what the relationship between these goalsand domestic supply and capacity is, and what, if any, additionalpolicies or program supports might be needed to close potentialgaps. Success with company goals for post-consumer recycled(PCR) content will require coordination across this value chain.Understanding where and why challenges may be occurringcan provide further insight into effective interventions to ensuresuccess.AMERIPEN works with state and non-profit coordinators ofrecycling market development organizations to understand howthe association can support recycling market development effortsand how we can increase communication between packagingproviders and those managing packaging recovery. This reportreflects our mutual interests in evaluating the opportunities andchallenges facing increased domestic consumption of PCR.AMERIPEN engaged Circular Matters, a consulting firm with anemphasis on packaging and recovery systems, to help evaluatethe demand and supply relationship in the U.S. We also circulatedthis report to key peers across the packaging value chain toensure our findings were robust and bias free.Commitment and the Sustainable Packaging Coalition’s GoalsDatabase, along with an AMERIPEN member survey and U.S.media scan, AMERIPEN compiled a list of 57 companies with U.S.sales and recycled content goals for their packaging.Packaging was defined as primary, secondary, or tertiary packagingthat would appear in a consumer’s home through the purchaseof fast-moving consumer goods. We did not examine foodservicepackaging or busines-to-business packaging. Packaging forhousehold furnishings and appliances were also excluded – onlybecause we found very few company goals in this category.When we began this study, we assumed that most goals would bedeveloped for a broad portfolio of packaging formats and varietyof materials and that we would be able to drill down into demandand supply curves for those materials. To our surprise, outside ofplastics goals, we found most goals were framed in an either/or context (recyclable or sustainably sourced) or, there were norecycled content objectives publicly stated. Since we found veryfew articulated quantifiable recycled content objectives beyondplastics, AMERIPEN restricted this study to evaluate the potentialof meeting plastic PCR resin goals.Finally, Circular Matters conducted a supply and demandanalysis to identify the ability of the existing plastics recyclinginfrastructure to meet increasing packaging demand for PCRresins, and obstacles and opportunities to expand the recyclinginfrastructure across U.S. regions and states to meet the increasingdemand for PCR resins. Data for this was pulled from existingliterature.1EVALUATING PLASTIC PCR DEMANDSTUDY BACKGROUND AND METHODOLOGYASSUMPTIONS AND LIMITATIONSThe purpose of this project was to:Assessing demand was rather difficult given the way manycompany goals have been articulated. The first challenge was thenon-specificity of some companies’ commitments. For example,one company’s goal was that “50 percent of product packagingportfolio to be either fully recyclable, compostable, biodegradableor made with recycled content.” Such a broad statement does notcommit it to any specific amount of recycled content. Companieswith such goals that were not specific or quantifiable with respectto their PCR demand were not included in the analysis. Evaluate the expected increase in U.S. PCR demand to meetcompany packaging commitments;Identify barriers to meet company commitments;Identify potential approaches and actions to overcome thosebarriers; andIdentify opportunities for states and regions to invest in andgrow their recycling infrastructure to create local economicactivity and help companies meet their recycled contentcommitments.We started with a comprehensive evaluation of publicly statedcorporate sustainable packaging goals related to reuse andrecycling. Using sources from the New Plastics Economy Global1Commitments also span different levels of the packaging chain.Brand owners can make a commitment and their packagingsupplier can also make a commitment. If all companies withcommitments were included in this study, double counting ofcommitments would occur since both the brand owner and theA complete list of corporate packaging commitments is included in Appendix B of this report.WWW.AMERIPEN.ORG4

U.S. COMPANY RECYCLED PLASTIC CONTENT GOALS ANALYSIS –SUPPLY & DEMANDpackaging converter are making commitments about the sameamount of plastic packaging used in the U.S. To avoid doublecounting and overestimating future PCR demand, the researchfor this project focused on consumer packaged goods companybrand-owners (CPGs).Lastly, many companies sell their products globally. This projectattempted to gather data on the U.S. portion only of packaginggenerated. Requested data, therefore, was specific to the U.S.market. Many companies however do not have data quantifiedspecifically by the U.S. market only – sometimes it is North America(e.g., U.S, and Canada), or other times quantified by the Americas,including U.S., Canada, Mexico, and the rest of Latin America andthe Caribbean island nations). In these cases, Circular Matters tooktheir global commitment PCR tonnage and apportioned it to anestimate of their U.S. sales using the best available data.After reviewing company commitments and excluding companieswithout clear PCR commitments and converter commitments toavoid double counting, Circular Matters settled on 36 companiesfor inclusion in this study.2 Of the 36 companies we approachedto provide data on their U.S. plastic packaging produced and useof recycled resin, only 15 percent provided data.3 Circular Mattersestimated packaging generation by resin type for the companiesthat did not participate in our data request, as well as recycledplastic usage, using a variety of data sources.4We note the future PCR demand estimates presented in thissection are useful as order of magnitude estimates, butotherwise are not precise and should be considered as lowand conservative estimates.INTENTIONAL FLEXIBILITY OF PCR RESIN GOALSAnother challenge we found in estimating demand based uponcompany goals was the intentional flexibility with which goalswere stated. Most goals were based upon a portfolio of plasticpackaging and not specified by resin or packaging format type.This portfolio approach provides companies with the flexibilityto meet these goals based upon available market supply andtechnical requirements.For example, assume a company’s packaging portfolio iscomposed of 50 percent polyethylene terephthalate (PET)water bottles and 50 percent multilayer flexible pouches. If that234company’s commitment was to use “15 percent recycled contentacross all plastic packaging” it could meet its commitmentby using 30 percent PET PCR in its water bottles and zero PCRin the pouch packaging, where they face increased technicalchallenges to include PCR and less availability of PCR resins. Usingthis strategy, the company average would be 15 percent overalland it would still meet its goal. For the purposes of our study,we assigned demand based upon those resins which currentlyhave competitive PCR supply. We recognize that as recyclingtechnology advances some of these demand curves couldchange to reflect new opportunities.Additionally, some companies have stated their goals in terms ofreducing their use of virgin petrochemical-based plastics using acombination of PCR content and plastics made from renewableresources. Because the amount of plastics made from renewableresources is currently limited and small in relative terms topetrochemical plastics, and only available for PET, low-densitypolyethylene (LDPE), high-density polyethylene (HDPE), andpolylactic acid (PLA) in commercial quantities, Circular Mattersassumed that at least 70 percent of company commitmentsmust be met through the use of PCR where a goal is phrased as“renewable or PCR resin.”Because of the limitations we faced in quantifying goals, webelieve the PCR demand estimates may be conservative. We alsorecognize that given the flexible approach of these goals, strategiesto achieve goal realization may fluctuate as advancements inrecycling are made and emerging strategies and solutions mayreduce some of the pressures we identify today. This should beseen as an initial attempt to quantify what should become aniterative process.A list of the companies evaluated for demand can be found in Appendix A Companies Included in Analysis of Corporate Demand.Companies approached who chose not to participate in this project cited a lack of U.S.-specific data versus global data or confidentiality as reasons for notparticipating.Sources included: Ellen MacArthur Foundation (Nov 5, 2020) Global Commitment 2020 Progress Report; World Wildlife Fund (June 2020) ReSource Plastic Report (note the report is no longer publcily available); and Company sustainability reports and annual financial reports (used to estimate U.S. versus global packaging generation).WWW.AMERIPEN.ORG5

U.S. COMPANY RECYCLED PLASTIC CONTENT GOALS ANALYSIS –SUPPLY & DEMANDEVALUATING PLASTIC PCR SUPPLY ANDPRODUCTION CAPACITYASSUMPTIONS AND DATA LIMITATIONSIn assessing supply, Circular Matters compiled data from existingpublic reports on plastics recovery within the U.S.5 Additionally,for the purposes of this study we attempted to restrict supplyand capacity to U.S.-based processing only. We recognize U.S.manufacturers may rely on imports of PCR resins from Canada andMexico which may slightly increase available supply or capacitybeyond what is noted here. Lastly, in calculating an estimateof supply and capacity we did not account for fluctuations indemand between competing end use markets—rather weassumed we could not draw from other end users to meetincreased demand. Nor did we address limitations because oftechnical and regulatory requirements. While we address this isin our discussion around materials-specific challenges, calculatingdemand based upon other specific challenges and needs wasbeyond the scope of this study. As a result of these limitations,we caution that this data should be seen as general trends andnot a complete assessment of available supply and capacity forpackaging-specific applications.The existing available data demonstrate that the packagingindustry typically consumes less than 50 percent of the marketfor post-consumer plastic resins. At 50 percent, the packagingindustry has the greatest influence on PET end markets. It drops toaround 40 percent for HDPE, and at the time of this study virtuallyno recycled LDPE was believed to go into consumer goodspackaging.As we evaluate domestic capacity to help reach companypackaging goals, we have not assumed that current marketswill reduce their consumption of PCR to allow CPG companiesto increase their consumption to meet their commitments.Our numbers are based upon the sum of current PCR sales intopackaging applications plus unused capacity that could be usedto recycle more collected post-consumer plastics for use as PCR inconsumer packaging. The portion of current reclamation capacityand PCR resin production that goes to non-consumer packaginguses, such as PET PCR recycled into fiber and HDPE bottles whichare recycled into pipe, are assumed to remain at current levels.FIGURE 1: PCR Consumption by End Market UsesEND MARKETS FOR RESINSIn exploring interventions to help drive increased PCR contentfor packaging materials, it is important to understand the currentend market uses for materials to ensure that interventions into thesystem do not inadvertently disrupt existing processes that workwell. Should efforts to increase PCR content within packagingdraw from other end markets we can anticipate instability acrossthe system and a rise in costs for all parties competing for limitedresins. Therefore, we wanted future PCR demand estimates toassume that increases for packaging would not be withdrawingPCR resins from existing end users.Figure 1: PCR Consumption by End Market Uses provides data onwhere volumes of resin collected through recycling programstypically goes after reprocessing.Data were not available for consumption of PCR frompolypropylene (PP) packaging that was recycled nor for LDPE.Industry data sources note that PP PCR is typically used asrecycled content in pallets, crates, buckets, auto parts, and lawnand garden products. Packaging use for PP PCR is increasing butstill in very early stages.6 Recycled LDPE film and sheet primarilygoes into bags and sacks, such as trash oks-tweaks-reverse-falling-pet-recycling-rate, postconsumer-bottlerecycling-report.pdf, tleReport18 jsf 1.pdf, ort18 jsf 1.pdf.The Recycling Partnership’s Polypropylene Recycling Coalition.WWW.AMERIPEN.ORG6

U.S. COMPANY RECYCLED PLASTIC CONTENT GOALS ANALYSIS –SUPPLY & DEMANDCOMPARING DEMAND TO AVAILABLE SUPPLYFOR USE AND RECLAMATION CAPACITYAcross all plastic resin types, we found when we quantified thedemand needed to meet company commitments for PCR, in allcases except HDPE, demand in the U.S. exceeds the availability ofdomestic supply available for packaging specific use and potentialreclamation processing capacity. This indicates that we willneed to offer some interventions in the U.S. recycling systemto help brands making PCR commitments achieve their goals.FIGURE 2: U.S. Annual Production Capacity, Current Usage, andFuture Committed Use (Goals) for Consumer Packaging PCR7With a focus mainly on PET and HDPE we note that only HDPE mayoffer sufficient current reclamation capacity to meet companygoals. However, that conclusion is simplified and does not addressthe additional complications inherent to supply and capacityonce we consider technical specifications and other packagingdesign needs.SUPPLY CONSIDERATIONS: BARRIERS TOPCR USE IN PACKAGINGIn designing packaging, there are numerous technical andregulatory concerns which impact the use of PCR. Theseconsiderations further complicate the challenge of using PCRbeyond what is simply stated as available supply for packaging andpotential capacity as outlined in Figure 2: U.S. Production Capacity,Current Usage and Future Committed Use (Goals) for ConsumerPackaging PCR. These limitations can further hinder availability ofresin supply, by restricting where PCR use can best be directed.These packaging design specifications help clarify why some reprocessors complain they have additional PCR available whichpackaging providers are not purchasing.FOOD CONTACT REGULATORY CONSIDERATIONSSOURCES: Circular Matters LLC for commitment and PCR capacities, and the followingreports for current usage amounts in packaging: aks-reverse-falling-pet-recycling-rate, postconsumer-bottle-recycling-report.pdf, tleReport18 jsf 1.pdf, ort18 jsf 1.pdf.As one can see from reviewing the results of Figure 2, recyclingcollection and reclamation quantities for all resins needs toincrease over current levels for CPG companies to meet their goals.While our survey encompasses demand across all resins, we notethat the portfolio approach of most company goals indicates thatmost of these companies will try to reach their commitmentsthrough increasing PCR usage for the most available resinstypes – PET and HDPE – until such time domestic capacity forreprocessing the other resin types can be increased. At the currenttime, we lack significant opportunity for recycling LDPE, (PS), andother resins back into packaging in the U.S., particularly for foodcontact packaging.789Use of PCR in food packaging is regulated by the U.S. Food andDrug Administration (FDA) and requires the receipt of a Letter ofNo Objection (LNO) to ensure safe use in certain food contactpackaging. It’s estimated that only 70 percent of PET reclamationplant locations in the U.S. have LNOs to be able to sell PET PCRfor use in food and beverage packaging. This is further restrictedwhen we consider that only a few HDPE reclaimers have LNOs.Considering that several CPGs with PCR goals sell food andbeverages, the U.S. would need to add additional equipmentto produce sufficient LNO resin for those CPGs to meet theirpackaging recycled content goals.It should be noted that LNOs for other resins including LDPE, PPand PS are also required and there are also limited facilities toprovide availability of these materials for food contact packaging.One promising technology offers the ability to purify PP to removecolorants and other contaminants, but at the current time the firstcommercial operation for this technology will not be ready untillater in 2021.9 Access to LNOs for PP PCR will be limited until thistechnology begins operations and scales up.Data on current usage taken from 2019 for PET and 2018 for the other resins. Capacity data is from 2020.Current usage refers to PCR use in packaging - not total supply. There may be additional supply that could work for packaging but is not used due to demand for aspecific viscosity, LNO for food contact etc.PureCycle TechnologiesWWW.AMERIPEN.ORG7

U.S. COMPANY RECYCLED PLASTIC CONTENT GOALS ANALYSIS –SUPPLY & DEMANDQUALITY CONSIDERATIONSCOLLECTION CONSIDERATIONSCPG companies build their brand identity using certain colors andscents. These can have a significant impact on PCR quality andtheir ability for reuse. At the current time, very few bottle reclaimershave installed the equipment needed to reduce odors in PCR.Additionally, there is currently no domestic purification capacitythat can remove pigments from a mixed color stream.Approximately 1.8 billion pounds of PET bottles and 0.1 billionpounds of thermoforms were collected in the U.S. for recycling in2018 out of more than 6.3 billion pounds of PET bottles sold.10 If thetotal domestic PET reclamation capacity were to be increased to3.8 billion pounds of capacity and that capacity were to be utilized,collection would need to increase to nearly double currentlevels (i.e., the PET bottle recycling rate would need to increasefrom 29 to approximately 56 percent).Based upon current infrastructure, more sorting or reprocessingequipment investment is needed by, or on behalf of, reclaimersto address the limited capacity to produce color-sorted, color freeand/or fragrance-free PCR that would be acceptable for consumerpackaging use.FURTHER TECHNICAL CONSIDERATIONSTo ensure a package performs properly, it is essential to have thecorrect melt index of viscosity. Additionally, each resin or packagingformat will have different mechanical properties needed to ensurethe package’s integrity. Achieving these targeted specificationsthrough PCR can be more challenging than from virgin resinswhich have been manufactured with targeted specifications inmind. This “fit for use” challenge further restricts available plasticsupply for use in plastic packaging.All three of these design constraints indicate that even withincreased supply and capacity for packaging specific needs,packaging producers may still face barriers with integratingincreased PCR content into packaging formats.SUPPLY CONSIDERATIONS: ACCESS TO SCRAPMATERIALWhen we consider the availability of PCR and the brands whoare making commitments on its use, PET appears to be the resinwith the greatest amount of packaging demand. Approximately70 percent of the brand commitments for U.S. PCR included inthis study is for the beverage category, including bottled water,carbonated soft drink, juice, and other PET beverage bottles. Yetsupply of and capacity to reclaim this material, as seen in Figure2: U.S. Production Capacity, Current Usage and Future Committed Use(Goals) for Consumer Packaging PCR, is lacking.1011REPROCESSING CAPACITY CONSIDERATIONSThe U.S. capacity as of the end of 2020 to recycle PET bottles andpost-consumer PET thermoforms to produce PCR for all uses,including non-packaging uses such as fiber, is over 2.6 billionpounds of incoming material per year. To meet the future demandfor PCR, the PET reclamation capacity would need to increase toat least 3.8 billion pounds per year, accounting for yield loss fromincoming purchased bottles.11 In other words, PET reclamationcapacity in the U.S. would, at a minimum, need to increase by50 percent from current capacity to meet CPG company brandcommitments for their PET packaging, assuming that there is nochange in demand from other end markets for this material.This data indicates that we will need significantly more captureand reprocessing of PET if we want to achieve company goals, andthe collection and capacity figures presented above could be evenhigher if CPGs plan to meet their company-wide recycled contentaverages for all resins by increasing their usage of PET PCR. Whilewe recognize goals could be achieved by targeting other resins,the overall message is the same. With most resins other than HDPEand PET lacking sufficient reprocessing capability for packagingrecycling, we still lack sufficient domestic supply and capacity toachieve success. We will need to do more to capture and reprocessexisting recyclables to increase plastic PCR supply.ACCESS TO REPROCESSING TECHNOLOGIESCONSIDERATIONSWith PET and HDPE the most likely resins to utilize to meetcompany goals, evaluating capacity and access for those canhelp us understand the opportunity and role regional marketdevelopment could play in helping increase PCR access to meetthose goals.This underestimates since the amount of PET packaging sold since it excludes PET thermoform quantities for which industry data does not publicly exist. Data weredrawn from aks-reverse-falling-pet-recycling-rate.This assumes that the U.S. reclaimer PCR yield from incoming material continues to be approximately 70 percent, with yield loss due to caps, labels, contamination,residual contents, and loss of PET resin in the reclamation process, as reported by NAPCOR.WWW.AMERIPEN.ORG8

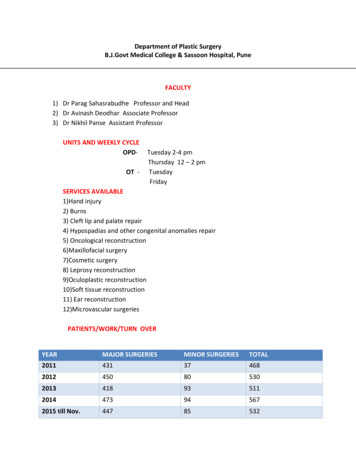

U.S. COMPANY RECYCLED PLASTIC CONTENT GOALS ANALYSIS –SUPPLY & DEMANDFIGURE 3: PET and HDPE Bottle Reclamation PlantsFIGURE 4: EPA Region State GroupingsSOURCE: Circular Matters, NAPCOR (PET Reclaimers) More Recycling (Plastics Markets)SOURCE: U.S. EPATABLE 1: PET Bottle and Thermoform Reclamation Capacity Analysis by EPA Region State GroupingsREGION12345678910EXISTING PETPLANTS0218520071EXISTING PET BOTTLE RECLAMATION CAPACITY(million pounds, all uses)01501009854801000062830PET BOTTLE RECLAIM CAPACITY ALLOCATION TO MEETPCR PACKAGING COMMITMENTS (million pounds)174335361770616494165141597165SOURCE: Circular MattersFigure 3: PET and HDPE Bottle Reclamation Plants indicates thatthe regional access to PET and HDPE reclamation plants remainslimited. The majority of reprocessing capacity for packagingspecific needs is focused predominately in the Eastern UnitedStates. There are large portions of the country that need totransport their curbside materials significant distances forreclamation and remanufacturing.Since earlier data demonstrated that PET reclamation capacitywould need to be expanded to help meet goals, CircularMatters also compared regional PET reclaimer capacities tothe populations in those regions to evaluate where expandedreclamation capacity could be supported through recyclingmarket development efforts to better align recycling quantitieswith reclamation. For this comparison state groupings by U.SEnvironmental Protection Agency (EPA) regions were used(Figure 4) and the results are shown in Table 1.Basing demand upon stated company goals and little to noexpected change in alternative end markets, then all regionscould use more PET reclamation capacity and/or at least onemore PET reclaimer than is shown in Table 1 to meet potentialfuture demand for PCR content in PET bottles and thermoforms.When further assessing recycling market developmentopportunities, an efficient commercial-scale plant is typicallysized at 100 million pounds per year of incoming bottle recyclingcapacity.Technical reprocessing capacity for LDPE, PP, PS, and otherplastic resin types remains limited, suggesting a need for moreinvestment in both research and development and the abilityto scale for market for emerging technologies in this area, whichcould remove some tension on PET as the key resin to realizecompany goals.APPROACHES AND ACTIONS TO ACHIEVINGCOMPANY PLASTIC PCR GOALSOur current data indicates the domestic U.S. supply and capacityfor plastic reprocessing is not sufficient to meet the demandoutlined through company goals for packaging PCR use. Welack sufficient technologies to leverage some PCR resins forpackaging-specific needs, requiring increased emphasis on PETand HDPE as the two resins with the greatest supply potentialfor packaging quality PCR. Yet these two resins, despite theirmore robust markets, also lack sufficient supply and domesticcapacity to meet the stated demand. With HDP

media scan, AMERIPEN compiled a list of 57 companies with U.S. sales and recycled content goals for their packaging. Packaging was defined as primary, secondary, or tertiary packaging that would appear in a consumer's home through the purchase of fast-moving consumer goods. We did not examine foodservice packaging or busines-to-business .