Transcription

LOAN COUNSELING&STUDENTLOANS.GOVWood MasonU.S Department of EducationFederal Student AidAtlanta, GA770.383.9662wood.mason@ed.gov

AGENDA Counseling Overview The regulations StudentLoans.gov What’s new? Logging in Counseling “Landing Page” Common features School functionality Options set on the Common Origination & Disbursement(COD) website “Options” screen Searching for counseling results Reports Contact information2

Entrance and exit counseling are required byregulations, 34 CFR 685.304, “CounselingBorrowers” Who must undergo entrance and/or exit counselingand when Required topics to address The new “Limit on eligibility for Direct SubsidizedLoan(s) and responsibility for paying accrued intereston Direct Subsidized Loan(s)” regulations are coveredunder 34 CFR 685.200, “Student Eligibility”3

Entrance and Exit Counseling can be deliveredonline via an interactive electronic vehicle (e.g.,StudentLoans.gov), in person, or on a signed andreturned written form Entrance counseling must be completed prior to thefirst disbursement of the proceeds of a loan unlessthat student has received a Direct Subsidized/DirectUnsubsidized, Direct Graduate/Professional StudentPLUS Loan, or Federal Stafford Loan previously Exit counseling must be conducted shortly before thestudent ceases at least half-time study at your school4

StudentLoans.gov provides ALL* Federal Student Aidelectronic loan counseling tools at one location and inpretty much the same “format” Entrance Counseling Sub/Unsub/Grad & Professional Student PLUS Financial Awareness Counseling NOT a regulatory or statutory requirement Exit Counseling NSLDS will continue to provide detailed Exit Counselingreports* TEACH Grant annual counseling via the TEACH Grantwebsite5

Financial Awareness Counseling was developed andimplemented to provide a centralized, online sourceof financial literacy information for students Voluntary NOT mandatory Does NOT replace entrance counseling Assists borrowers in making informed postsecondaryfunding decisions by educating them about their currentindebtedness and managing their student loans6

StudentLoans.gov notifies your school if a studentselects your school as the recipient of a completedEntrance or Financial Awareness counseling sessionor if you’re the attending school when it comes timeto complete Exit counseling Transmits a common record (CR) acknowledgement Document (DOC) type “EC” Displays the type of counseling completed7

Without logging in, students, borrowers, and otherusers can complete a “demo session” on any of thethree counseling options No information from NSLDS will be “pulled” No schools notified No documentation of completionOnce logged in, users can complete a counselingsession with their current loan data provided, viewcompleted counseling sessions, or send entrance orfinancial awareness counseling results to anadditional school(s)8

What’s new? Sign-in is more secure Data is now “masked” upon entry More emphasis on Federal loans before private loans Additional, and more clear, information on interest Capitalized interest Added 150% subsidized loan limit text and hyperlink “Confirm Your E-mail Address” fields added when userasked for email address “Notify School” vs. “Add School”9

What’s new? “Projected Loan Balance Calculator” “Understand Your Loans” “Additional Loans” The “Estimate School Expenses” dropdown Pre-populated with schools “associated” with theborrower Schools from “Notify Schools” selection Pulled from NSLDS Can enter own expenses or choose from 2 and 4 yearpublic/private school “estimated expenses”10

11

12

Initial logonprovides theopportunity to setindividual userpreferences all users will berequired toconfirm againe-correspondencepreferences oninitial logon withCOD Release 13.0on April 14th13

14

Users cannotify anadditionalschool(s) sessions15

16

ononselectingthe type ofcounselingthey wishtocomplete17

18

19

FinancialAwarenessCounselingallows theuser toforegoschoolselection20

“Understand Your Loans” Detailed list of loans pulled from NSLDS, loan basics,i.e., principal amount, interest, capitalized interest Things You Should Know about the MPN, accrual ofinterest, half-time enrollment, loan acceleration Free money should be sought first Types of loans and loan limits Dependent/Independent Grade level Hyperlink to 150% Subsidized interest eligibilityinformation21

“Manage Your Spending” (not in Exit Counseling) Develop a budget while still enrolled Load the “College Navigator” cost data for yourselected institution Data pulled from IPEDS Benefits of controlling your expenses and incurringminimal debt Learn how paying accruing interest may lessenborrowing costs Tips to help you manage your debt22

“Plan To Repay” topic Estimate your payment in different repayment plans Do you qualify you for an income-driven plan? Evaluate your student loan debt “burden” vs.estimated future income, i.e., high, medium, or low? Savings realized with extra payments, EFT, or payinginterest during deferment or forbearance Repayment facts Grace period First payment Contacting your loan Servicer23

“Avoid Default” topic Borrow only what you needComplete your program and graduatePay on timeTrouble making payments Deferment / Forbearance Change repayment plan Consequences of delinquency and/or default Forgiveness, cancellation, and discharge Retaining loan records and resolving a dispute Loan consolidation24

“Make Finances a Priority” topic Plan for the future Plan, save, and spend wisely Your income and taxes Gross to net income comparison graph Education tax incentives, i.e., deductions and credits Your credit and identity Establish, maintain, and protect your good credit andidentity Credit cards and other borrowing25

“Repayment Information” topic (Exit Counseling only) Borrower Information Includes demographic, employer, and next-of-kin data Reference Information Different addresses and telephone numbers Known borrower 3 years or more Select a preferred Repayment Plan Compares your indebtedness and repayment acrosseligible repayment plans Preference sent to Servicer26

“Check YourKnowledge,”“Did youKnow?” and“Remember”appearthroughouteach topicexcept forDemoscreens27

Entrance,Exit, andFinancialAwarenessCounselingpull loandata fromNSLDS andassociatedschool(s) forExitCounseling28

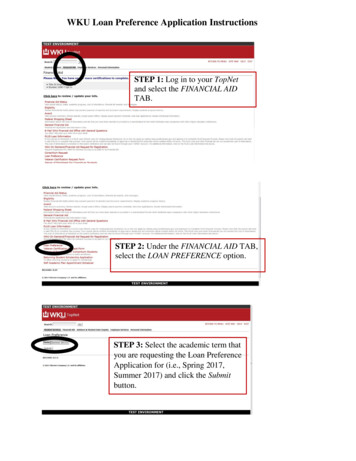

Step 1 & Step2 MUST becompleted tocontinueIPEDS datapulled viathe“CollegeNavigator”and appliedto “ManageYourSpending”screen29

Step 2 allowsentry ofexpectedassistance forthe upcomingaward year30

EntranceCounselingSummaryscreenSummary Toolsallow e-mailing,posting to socialmedia, exportingto MS Excel, orprinting31

ExitCounselingSummaryconcludeswith currentindebtednessand otherinformation32

The conclusionof ExitCounselingrequiresselection of a“preferred”repaymentplan” that canbe changed ata later date ifdesired33

Schools are provided various controls and tools inCOD to manage their participation in, andcommunication with, Entrance, Financial Awareness,and Exit Counseling School Options Page On-demand or daily acknowledgements Counseling Search Functions Counseling Response Requests COD Counseling Report34

State University35

COD SchoolOptionsPage As you want it to appear36

Upon completion of Counseling selected schools arenotified electronically System generated acknowledgement Common Record (CR) response CRECMYOP DOC Type “EC” Schools can obtain and view completed Counseling COD Batch Search COD Counseling Response Request COD Reports: Counseling Reports (CSV)37

38

Theresponseidentifiesthe type ofcounselingcompletedShane Williamsxxxxxxxxx12/12/1970Specter University000000000S14G00000001‘13-’1439

Person TabCounselingSearch “AwardYear” willdefault tothe currentaward yearand “DateRange” canbe up toone week40

Batch Tabsearch by daterange, aparticularDocument ID, ora unique SSNDate Rangewindow up to60 days41

Counseling“OnDemand”ResponseRequestDate Rangeup to 7days42

ReturnedCounselingRequestSteven TylerJerry GarciaSteven Stills43

The Counseling Report displays completed Entrance,Financial Awareness and Exit Counseling sessions Delivered weekly to the School’s Newsbox on the CODReporting Website Saturday through Friday data window CSV with headers format REMEMBER: COD does NOT generate nor providedetailed Exit Counseling reports. Exit Counseling reportsremain available from NSLDS and you should continue toretrieve those reports from NSLDS as you do currently44

New counseling type indicators 45

COD School Relations Center – # 1,800.557.7394 CODSupport@ed.gov StudentLoans.govNSLDS Customer Support Center - # 1.800.999.8219 nslds@ed.gov Direct Loan Exit Counseling ReportsCPS/SAIG Technical Support - # 1.800.330.5947 CPSSAIG@ed.gov SAIG/TG Mailbox and EdExpress for Windows software46

Wood MasonPhone: 770.383.9662E-mail: wood.mason@ed.govFederal Loan School Support TeamE-mail: DLOps@ed.gov47

48

NSLDS Customer Support Center - # 1.800.999.8219 nslds@ed.gov Direct Loan Exit Counseling Reports CPS/SAIG Technical Support - # 1.800.330.5947 CPSSAIG@ed.gov SAIG/TG Mailbox and EdExpress for Windows software 46