Transcription

Online automotiveparts sales:The RISE of aNEW CHANNELMunich, Mai 2014

2Management summary (1/2)Online retail outlook Online retail is growing significantly across all industries, with market share already at 16% –established offline players as well as pure internet newcomers are pushing into this area Following this trend, we expect strong growth in automotive parts online sales with 7-8% CAGR,resulting in 20% online business share by 2025 and EUR 3.6 billion in sales volumeThe strategic fit logic of online parts sales To evaluate the opportunities for online parts sales within the automotive aftermarket universe,we analyzed three dimensions – customers, products and channels – for strategic fit: "Customer product fit" – not every product is attractive for individual customer groups "Customer channel fit" – each customer group has different service expectations "Product channel fit" – standard and simple products dominate online business Various online players already outperform the market via tailored services and innovativebusiness modelsSource: Roland BergerRoland Berger Study Online Automotive Parts Sales Final.pptx

3Management summary (2/2)Success factors and new business opportunities The online parts market follows a simple but crucial rule to excel in the online world, rootedin the proven success factors for online marketing: Awareness Traffic Success requires an aggressive focus on growing the customer base and a perfect alignment in"Customer-Product-Channel Fit" "Automotive service scenario 2025": Completely new business models will appear in the wakeof the market disruption caused by online business, for instance service cooperation networksbased on unbundling and modularizing service offers Every player along the value chain, from OEMs and OESs to wholesalers, workshops andinsurers, is forced to react to the growth in online automotive parts sales and may benefit byputting the right strategies in place – you have to think outside the boxSource: Roland BergerRoland Berger Study Online Automotive Parts Sales Final.pptx

4CROSS-INDUSTRYOnline retail is growing across industries – Faster than generallyexpectedGeneral trends in e-commerceShare of online spending, 2013Online16%84%OfflineSource: Statista; PWC; eCE; press research; Roland BergerGeneral e-commerce trends Internet has become a mass medium –77% of people in Germany have regularinternet access E-commerce shopping is on the rise –number of online shoppers and sales peruser increasing steadily Multi-channel shopping is increasing –86% already shop using two channels, 25%use four or even five different channels M-commerce not yet fully established,but growing – 59% of German mobileusers shop by using their smartphones,with further growth expectedRoland Berger Study Online Automotive Parts Sales Final.pptx Online retail will become adominant sales channel inthe upcoming years The speed with which onlineretail is catching up is oftenunderestimated Having a multi-channeloffering is key, but it has tobe done right: segmentspecific needs need to beaddressed

5AUTOMOTIVE PARTSOnline sales of automotive parts in Germany set for strong growth –We expect online business to have 20% share in 2025Market volume, aftersales parts, Germany1) – Online sales share [EUR bn]Share of online (3.6)2025 The automotive aftermarketin Germany amounted toEUR 30 billion in 2013,including labor and parts The parts market (excludingcrash repair parts) amountedto EUR 14.9 billion in 2013– Here, online sales alreadymake up 11% and volume isgoing to grow further by 7-8%yearly We expect online sales toaccount for 20% ofautomotive parts sales in2025Online1) Crash repair parts, MOT, inspection, labor and VAT excluded; passenger cars onlySource: Roland Berger market modelRoland Berger Study Online Automotive Parts Sales Final.pptx The aftermarket onlinechannel is being developedby new entrants, such aspure online players, as wellas incumbent aftermarketcompanies OEMs are starting torespond to the disruption bydeveloping online solutionsfor selling parts andaccessories, often incooperation with onlineplayers Some parts wholesalershave also developed onlineconcepts, based on theirown online shops as well asofferings via third partyproviders

6AUTOMOTIVE PARTSAs a leading online player, Delticom has continuously achievedprofitable, higher-than-market growthCase study: DelticomFacts and figures1)Historical developmentCAGR 6.2%11.2% 10.9%4.4%71292000200542048020102011EBIT 15ERevenue [EUR m]9/2013Acquisition of Tirendo(EUR 50 m)12/2008SDAX listing10/2006Initial public offering (IPO)7/1999Founded in HannoverProduct offeringCustomer structure A broad portfolio of replacement tires covering 100 tire brandsand 25,000 types (e.g. PC, CV, motorbike, bicycle, mountedwheels) Delticom expanded its portfolio with selected spare parts andaccessories, lubricants, workshop equipment, etc. Delticom also offers own, variously positioned brands: "StarPerformer" (PC tires) and "High Performer" (lubricants) Customer base of 6.5 million; 1 millionnew customers in 2013 Compared with 3 years ago, these figuresrepresent a 50-60% increase in newcustomers, 40-50% in repeat customers Repeat customers had higher growthrates compared to new customers1) Does not consider current acquisition of TirendoSource: Company information; Hauck & Aufhäuser; Roland BergerRoland Berger Study Online Automotive Parts Sales Final.pptxDelticomBrühlstraße 11DE-30169 Hannoverhttp://www.delti.com

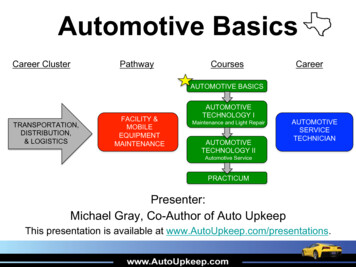

7To compete successfully, firms need to understand online customerdemand and tailor their product and channel strategy accordinglyDetermining dimensions for online automotive parts sales strategy11CUSTOMER groupsStrongly differing capabilities andneeds of online customers –customers expect specific offers toreflect their individual needs2PRODUCT specificationsNot all products are suitable foronline sales – product type (e.g. fastmovers), vehicle age and ease ofrepair are decisive3CHANNEL characteristicsCompared to stationary sales withdedicated logistics (of wholesaler),the online channel by definition facesrestrictionsCUSTOMERPRODUCTCHANNEL23Source: Roland BergerRoland Berger Study Online Automotive Parts Sales Final.pptx

8End customers represent the largest customer segment in the onlineautomotive aftersales market – Strong price sensitivityOverview of customer segments and their reasons for purchasing onlineDimensionsAddressed customer segments1)Main reasons to shop for auto parts onlineHighRelevance Low0 20 40 60 80 ailabilityProduct portfolioEnd customers61%Delivery & return optionsTransparency, usabilityAdvice e.g. via customer hotline No matter if B2B or B2C –online customers' keypurchasing criteria is costWorkshops Most online shops address B2C customers in theonline automotive aftersales market (61% share) Workshop segment is addressed by only 1/3 ofonline traders1) Scope: Germany, UK, France, Sweden2) Gas stations, dealerships, etc.Source: VREI; 2hm; Roland BergerEnd customers Price, convenience, parts availability and a widerange of products are the most critical reasons forcustomers to shop online All other factors are perceived as "nice to have" Evaluations by workshops and end customers differonly slightly – convenience usually more important forend customersRoland Berger Study Online Automotive Parts Sales Final.pptx

9Both B2B and B2C customers are buying automotive parts onlineDistribution chain and customers of online parts salesDimensionsTraditionaldistributionFirst wave of online shops1 Workshops (B2B)OESOESPARTSWHOLESALERSPARTSWHOLESALERS Workshops have technical know-how tobuy online as well as the requiredequipment (tools, lift, diagnostic systems)to assemble even complex partsCUSTOMER2 DIFM (B2B2C and B2C2C) The first wave of onlinechallenges has cut out thetraditional distribution stage ofparts wholesalers in the case oftech-savvy customersWORKSHOPS1Independent onlineparts shopsWORKSHOPS "Do-it-for-me" customers, who purchaseparts online but have them installed: B2B2C: at a professional workshop withcommercial purpose B2C2C: by an acquaintance outsideworking hours/without commercialpurpose (gray market)3 DIY (B2C) "Do-it-yourself" customers, who have thetechnical knowledge and interest tomaintain and upgrade cars themselvesEND CUSTOMERS1) Do-it-for-me2DIFM1)3DIY2)4STANDARDEND CUSTOMERS4 Standard end customers (B2C) Standard end customers without technicalknow-how, who buy simple parts that donot require complex installation2) Do-it-yourselfSource: Roland BergerRoland Berger Study Online Automotive Parts Sales Final.pptx

10In-depth understanding of customer group demand is key to effectivelysetting the right business model and support processesReasons for customer segmentationDimensionsTypical return rates of online purchased products [%]1 Workshops2 DIFM3 DIY4 Standardend customersCUSTOMER50 Low return rate of eBay motors indicates A high share of experienced DIFM and DIYcustomers Scrapping of low value parts instead ofreturning them40 15-20 To successfully run a business,you need to know yourcustomers! Online shops have to customize their processes,(e.g. logistics, warehouses, return incentives) inorder to minimize return costs5-7Automotive eBay motorswholesale Managing return rates is critical in determiningprofitability across industries: Each return costs EUR 15-20 on average Returned parts most often lead to a loss in valueof 20%Fashionindustry(average)Source: Expert interviews; press research; Roland BergerZalando First initiatives have been already launched byZalando and Amazon (e.g. better productdescriptions, shutting down accounts withexcessive return behavior)Roland Berger Study Online Automotive Parts Sales Final.pptx

11PRODUCTFast-moving products are typically suitable for workshops' onlinebusiness"Fit-for-online" decision criteria – Fast-moving partsDimensionsFast-moving partsExamples To offer prompt service to the customer,workshops tend to have fast-moving productgroups in stock, e.g. wiper blades, brake pads,lubricants, bulbs etc.PRODUCT "Fit-for-online" decision criteria:fast-moving productsparticularly in scope ofworkshops' online purchasing In particular, fast fitters (e.g. A.T.U inGermany) and OEM workshops offer serviceswithout an appointment – high levels of productavailability essential Modern warehouse/inventory managementsystems enable efficient and earlypurchasing processes – price advantage ofonline purchasing can be leveraged Thus, professional workshop processesincluding frontloading and capacity planning areenablers for online purchasingSource: Roland BergerRoland Berger Study Online Automotive Parts Sales Final.pptx

12Parts and labor costs are key in determining online fit for a particularaftermarket product – Scope of products offered online is increasing"Fit-for-online" decision criteria – Share of parts and labor costDimensionsHigh-margin partsLabor-intensive parts High-margin products become more important foronline purchasing, e.g. lubricants Low-value products that require expensiveinstallation are increasingly being bought online, e.g.air filters, brake discs Products requiring no/little installation effort andno/less equipment to install reflect a higher share ofonline business, e.g. wiper bladesPRODUCTComponentLubricantsWindscreenwiper blades "Fit-for-online" decision criteria:different patterns based onparts cost profileTiresCAGR all channels2013-'161)CAGR onlinechannel 2013-'161)ComponentPartscostLaborcostCAGR allchannels2013-'161)CAGR onlinechannels2013-'161) 2.5% 10%Air filters 25% 75% 1.5% 9% 2% 9.5%Brake disc 50% 50% 1.5% 9% 1.5% 9%Starter/alternators 50% 50% 4% 12%As online customers' key purchasing criteria is cost, high-margin and labor-intensive parts getting more important foronline sales to leverage online price advantages (high-margin parts) and DIY/DIFM services (labor-intensive parts)1) Based on parts value only (excl. labor and VAT)Source: Roland BergerRoland Berger Study Online Automotive Parts Sales Final.pptx

13The demand for automotive spare part categories also varies withincreasing car age"Fit-for-online" decision criteria – Vehicle ageDimensionsPRODUCT "Fit-for-online" decision-makingcriteria: vehicle age determineswhich parts are purchasedonlineVehicle age relevanceMaintenance and wear & tear behavior "Fit-for-online" for automotive spare partsvaries by car age segment – even withinsame product categoriesCar agesegment While some accessories (e.g. roof bars androof boxes) are typically purchased for newand "young" used cars, others (e.g.entertainment systems) are mainly bought forolder vehiclesShare of DIYcustomers Tires, lubricants and selected wear & tearparts (e.g. wiper blades) reflect an abruptvolume rise as the first-time changebecomes necessary after 2-3 years Most parts (wear & tear, crash repair andservice parts) are typically purchased onlinefor segment II and III vehicles, as the OEMwarranty expires and drivers migrate towardsthe independent aftermarket – increasingshare of DIFM/DIY customersIII0%0%III6%Maintenance/wear & tearfrequency andspending316791.276%6%5795821.681.746-8 yrs8-10 yrs15%6383691.482.000.50 2 yrs2-4 yrs4-6 yrs 10 yrsFrequency [no. of repair jobs per vehicle and year]Spending [EUR per vehicle and year]1) GermanySource: DAT report; Roland BergerRoland Berger Study Online Automotive Parts Sales Final.pptx

14The ability of customers to identify errors and parts and to conduct theinstallation is a key determinant in their readiness to purchase onlineThree challenges of the repair process – The "EASY³ logic"DimensionsPRODUCT Online sales have to overcomethree main challenges tobecome a valid counterpart forcustomers who are used tooffline salesEASY error recognitionEASY parts identification EASY installation First, the root cause of thefailure needs to be identified inany case of a defective system For modern cars with highlycomplex electric/electroniccomponents, the defect might notonly be a defect in a mechanicalcomponent, but also a defect in anelectronic part that might not bevisible to the naked eye In a growing number of cases,fully fledged diagnostic systemsare required to identify failurescomprehensively When the defect has been taggedcorrectly, the right part(s) needto be identified The corresponding partsmanufacturer, part number andother detailed information need tobe known Correct identification becomesincreasingly complex if thedefective part is a component ofa system or involves anelectronic defect Online shops already collaboratewith parts catalog providers toensure simple and correctidentificationSource: Roland Berger Last but not least the receivedpart(s) must be installed, whichis a masterstroke consideringmodern vehicles with EURO-5/-6norm Depending on the part, specialtools and equipment (e.g. lift)are required to conduct theinstallation properly Furthermore, legal requirementsmight hinder installation withoutprofessional service, e.g.environmental regulation in caseof oil changes, expiring parts andcar warranty issues in the case ofnon-professional repairRoland Berger Study Online Automotive Parts Sales Final.pptx

15The online channel is currently less suitable for certain purchasingneeds due to its underlying parts delivery modelDelivery time – Fit with online salesDimensionsICHANNEL Time is money! The right partmust be delivered the sameday or next day – but only if it isnot a foreseeable requirementNext servicein 1,000 kmOnline@IIDHLIIIWholesalerIVWholesaler Typical delivery time of24-72 h Suitable for foreseeableand/or scheduled repair jobsOffline Delivery up to 6 times a day In urgent cases, promptdelivery is essential, e.g. Missing parts during therepair job Breakdown of a carDelivery time as knockout argumentWith the current business models of online shops, online sales do not provide a solution to satisfyprompt delivery needsSource: Roland BergerRoland Berger Study Online Automotive Parts Sales Final.pptx

16We have developed a framework for selecting the right online businessmodelDetermining online parts sales fitInnovative strategies as enabler to enforceproduct (groups) to the next type of customer,e.g. offering fitting partners for tiresTiresConsumables &accessoriesCUSTOMERWear & tear partsPRODUCTMechanical partsFast-moving partsHigh-margin partsLabor-intensive partsVehicle age relevance"EASY³ logic"Customer groupsTypical productsExamples ofplayersProducts onlySource: Roland BergerB2BB2B2C/B2C2CB2CWorkshop mechanics,parts managers Brake discs/pads Clutches Shock absorbers TiresDIFMDIY Additional service offeringsBrake discs/padsTiming beltsFilterTiresHigh relevanceStandard end customersBatteryFiltersSpark plugTires AccessoriesLubricantsFloor matsTiresNo relevanceRoland Berger Study Online Automotive Parts Sales Final.pptxCHANNEL Customer, product andchannel specifics need to beconsidered in establishing theright business model However, special initiativeswould enable online players toexpand their target group toDIFM/DIY and even to standardend customers

17Customers are buying products online based on their specifications –Level of fit varies by product and customer type"Customer product fit"B2BB2B2C/B2C2CB2CWorkshop mechanics,parts managersWorkshop employeeslooking for standardreplenishmentDIFMDIYCustomers order onlineand have parts installed inworkshops (B2B2C) or byan acquaintance (B2C2C)Well-informed customerswith advanced technicalknowledgeStandardend customersGenerally less techsavvy customerssegmentCUSTOMERPRODUCTFast-moving partsHigh-margin partsLabor-intensive partsVehicle age relevance"EASY ³ logic"1) Workshops focus theironline purchasing onfast-moving parts –based on intelligentworkshop process(frontloading) Online priceadvantage to beleveragedHighly relevantNot relevantSource: Roland Berger High repair cost andhigh-margin partsare the main driversfor DIFM – either thecustomers bring theparts purchasedonline to a professional workshop orhave them installed onthe gray market Cost is the key driverfor DIY – expensiverepair services boostthe "do-it-yourselfphilosophy" DIY customers mainlydominate the olderage segments For the standard endcustomer, the mostimportant criteriaremains the ability todiagnose the error,identify the correctpart(s) and chose theright partner forinstallation (if required)1) Same assessment for each repair process step error recognition, parts identification and installationRoland Berger Study Online Automotive Parts Sales Final.pptx As an online player, you needto know your customers inorder to choose the rightproduct portfolio for your onlineshop

18Expected scope of services varies by customer group – Deliveryperformance remains the key hurdle for online sales to B2B clients"Customer channel fit" see p. 2B2BTypical customertypeCustomerprofileExpectedserviceCurrent online channelofferWorkshopmechanics,parts managersWorkshop employeeslooking for standardreplenishmentSame day deliveryCertainty of delivery dateCheap deliveryCertainty of parts availabilityAdvanced aftersales serviceLow pricesEmployed payment periodProduct portfolioDelivery in 24-72 hLimited certaintyModerate delivery feesModerate own stockComplex return policyUnbeatable pricesImmediate paymentLarge portfolioCustomer using onlineshops to order items to beinstalled in workshops(B2B2C) or by aacquaintance (B2C2C)Certainty of delivery dateCheap deliveryLow pricesProduct portfolioLimited certaintyModerate delivery feesUnbeatable pricesLarge portfolioDIYWell-informed customerwith a lot of technicalknowledgeStandardend customersGenerally less techsavvy customerssegmentApproximate deliveryLimited certaintyCheap deliveryModerate delivery feesUnbeatable pricesUnbeatable pricesProduct portfolioLarge portfolioOnly attracted to online shops if parts are less complex or sales areaugmented with easy-to-use services (e.g. for tires)B2B2C DIFMB2C2CB2CSource: Roland BergerRoland Berger Study Online Automotive Parts Sales Final.pptxCUSTOMERCHANNEL Each customer type hasdifferent expectations regardingonline sales – standard endcustomers currently onlyshopping online for tires andsimple products

19Online penetration also varies by product – Standard productsdominate due to ease of purchase and installation"Product channel fit"Main spare part categoriessold online% on total aftermarket value1)Windscreen wiper bladeFilter (oil, air, diesel, cabin)BulbTireBrake padBrake discSpark plugBatteryTiming beltHeadlightLubricantsShock absorberAccessory belt, rollerAlternatorBody partExhaust partClutchStarterWater pumpOthersTop spare part categories sold onlineSource: Expert interviews; Roland 3% 1%n.a.24%% online buyers having already bought one spare part ofthis category on the 16%15%12%11%10%Fast-movingand/or easy-toidentify andinstall (at leastfor DIFM/DIY) Currentinternetpenetrationrate of 11%amongautomotiveaftermarketparts Expectedshare ofonlinebusinesswill be 20% in20251) Excluding crash repair parts, MOT, inspection, labor and VAT; passenger cars onlyRoland Berger Study Online Automotive Parts Sales Final.pptxPRODUCTCHANNEL Online business primarilycentered around fast-movingand simple parts today – sellingadditional products (orproduction groups) will requirespecial service offerings

20CASE STUDYSet up in 2002, Tyre24 has grown into the largest B2B online platformfor tires in Europe – Yearly growth rate of approx. 44% p.a.Tyre24Facts and figuresTyre24GroupGewerbegebiet SauerwiesenTechnologie-Park I & IIDE-67661 al developmentRevenue growth of Tyre24 [group level, EUR m]16.0CAGR 8.0200920072005200220102011Expansion of portfolio(tuning, wear & tear)Acquisition of rimmanufacturer AZEVStart of B2C businessStart of European expansionFoundation of Tyre24 GmbHand launch of tyre24.de asB2B market placeProduct offeringCustomer structure B2B online platform with more than 400 wholesalers and 10 mtires and rims available www.reifen-vor-ort.de: online community for end customers withmore than 8,000 dealers offering tires/installation services TopM retail software solution, tire information system (RIS) andshop system "Tyre Shopping PRO" for retail industry Tire industry magazine "reifenwelt" B2B: tire manufacturer, wholesaler andretailer/dealer using www.tyre24.deplatform and additional product offerings B2C: DIFM, DIY and standard endcustomers using www.reifen-vor-ort.de tobuy tires and installation services fromretailerSource: Company information; press research; Roland BergerRoland Berger Study Online Automotive Parts Sales Final.pptx

21CASE STUDYFrom a pure B2B market place to a B2C community and workshopportal cooperation – Currently expanding product portfolioTyre241 B2B platformTyre24GroupGewerbegebiet SauerwiesenTechnologie-Park I & IIDE-67661 Kaiserslauternhttp://www.tyre24-group.com/ Tyre24 started as B2B online platform for tires and is currentlythe largest player in Europe with 80% market penetrationFullrange2 End customer portal Tyre24 established a match-making portal for end customersto buy tires and services from retailers Customers can find retailers and their offers (parts andservices) in the neighborhood Customers are able to compare prices, service offers anddistances from their place431) Tyre24 and drivelog started collaborating in April 2013 Workshops listed on drivelog can start to act as tire retailers The end customer can compare product offerings ofworkshops and buy best-price offers via an integrated onlineshop; additional access to a professional tire managementsystem provided2Specialist1B2B3 Collaboration with drivelog1)B2C1) Drivelog is one of the current leaders in vehicle servicing portals.For further information please see Roland Berger study "Repair shopportals in Germany – Who will be the 'Google' of repair shop services?"Source: Company information; press research; Roland Berger4 Wear & tear parts In parallel with the launch of the new website, Tyre24 expandedits B2B product portfolio from tires, rims and workshopequipment to wear & tear partsRoland Berger Study Online Automotive Parts Sales Final.pptx

22CASE STUDYEurope's leading online player for tires – Success due to high numberof online shops and early collaboration with installation partnersDelticomDelticomBrühlstraße 11DE-30169 Hannoverhttp://www.delti.comBusiness modelUnique selling proposition Delticom focuses on both end customers (B2C)and business customers (B2B); Delticom acts aswholesaler and as an e-commerce player Overall, Delticom comprises 130 shops in 42countries Tires will be delivered to the customers' home ordirectly to one of 35,000 service partnersworldwide ( 8,600 in Germany) Delticom operates the independent test portalreifentest.com; the portal includes links toDelticom online shops Several central warehouses in Germany plussmall satellite ones in other European markets Acquisition of Tirendo with benefits for both: Delticom benefits from Tirendo brand andmarketing expertise Tirendo benefits from logistics and processes Delticom is Europe's leading online player fortires with vast geographical coverage and broadportfolio First mover advantage enabled Delticom toestablish required relationships to differentbusiness partners Value add for customers: Broad range of low-priced quality productsincluding pre- and aftersales services ( 2025% below stationary tire market level) Fast delivery times ( 2 working days) and highavailability Large network of service partners Value add for service partners: Cross-/upselling opportunity New/additional customers Service partner network enables Delticom toaddress standard end customers who needprofessional installation supportSource: Company information; press research; Roland BergerRoland Berger Study Online Automotive Parts Sales Final.pptx

23CASE STUDYeBay motors offers a wide product portfolio – Special service offeringsenable the company to address standard end customerseBay motorseBay motorseBay GermanyAlbert-Einstein-Ring 2-6DE-14532 Berlinhttp://www.ebay.de/motors(Corporate headquarter in SanJose, CA)Business modelUnique selling proposition eBay is an open, online marketplace thatmatches demand (customer) and supply (dealer)across the world eBay motors offers not only automotive spareparts, but also used car trading, which leads toa broader customer base and cross-sellingFacts and figures Above all, well-informed DIFM and DIYcustomers use eBay for parts purchasing,resulting in low return rates and reinforcing lowprices eBay had EUR 54 bn GMV1) and EUR 11 bnnet sales in 2012 worldwide 116 m active users worldwide; 50% penetrationamong German internet users eBay motors 8 m unique users per month inGermany 70% of offerings from professional dealersProducts sold ['000 per month]17043TiresExhaustsystem292522Lamps Floor mats Brakepads18Air filters1) Gross merchandise volumeSource: Company information; press research; Roland Berger Standard end customers addressed by specialservice offerings: In combination with parts (installation) Stand-alone service offerings, such assummer/winter checks, inspections or overallOEM services Both vendor and customer can choose betweenbidding offers/auctions and fixed price offers( 30% auction to 70% fixed price offers) eBay has started to push delivery excellence:customers in big cities should receive their goodswithin 90 minutes or at a certain, required timeRoland Berger Study Online Automotive Parts Sales Final.pptx

24CASE STUDYAmazon is clear market leader in online retail – Current initiatives forsame-day delivery to overcome the online sales knockdown argumentAmazon Business modelUnique selling propositionAmazon EU S.a.r.l.Amazon Services EuropeS.a.r.l5, Rue PlaetisL-2338 Luxembourghttp://www.amazon.de Amazon's business model combines an onlineshop with a market place for 3rd party shops Coupling its well-known brand1) with a vastproduct portfolio besides automotive parts,amazon generates enormous traffic(24.75 m users in Germany in November 2013)(Corporate headquarter inSeattle, WA) Amazon.de launched in 1998; automotive storelaunched in 2008 Both Amazon and 3rd parties offer products for theB2C and B2B marketFacts and figuresMarket share[Germany, %]Revenue[Germany,EUR bn]# of offers['000, selectivesnap shot]16.620.521.923.6CAGR 25.8%3.95.46.57.820102011201220132761066658Floor Brake Brake Airmats pads discs filter4834Tires Wiperblades Customers trust Amazon based on its robust andreliable processes and quality checks of marketplace supplier – easy and efficient handling ofcustomer claims Value added for customers: Personalized and convenient shoppingexperience including wish list, advertising,customer reviews, 1-Click shopping, etc. Value added for 3rd party retailer: Retailer can use Amazon's technical service,merchandising, customer service and logistics Amazon is currently developing same-daydelivery strategies by setting up its own fleet1) Amazon is the #1 retail brand in Germany based on brandutility and brand presenceSource: Company information; Statista; Batten & Company; press research; RolandBergerRoland Berger Study Online Automotive Parts Sales Final.pptx

25There is a "golden rule" for becoming a successful online player –Traffic and brand are prerequisites to surviving in the online businessKey succ

Final.pptx Management summary (2/2) Success factors and new business opportunities The online parts market follows a simple but crucial rule to excel in the online world, rooted in the proven success factors for online marketing: Awareness Traffic Success requires an aggressive focus on growing the customer base and a perfect .