Transcription

How to Maximize yourMedigap Market Sharewww.usascn.com

How to Maximize your Medigap Market ShareA refreshed look at Medigap revenue, the opportunity that exists to increase marketshare and the financial impact it has on healthcare organizations.The number of Medicare enrollees willincrease by approximately 15 million over thenext eight years, bringing the total numberto 76 million individuals by 20291. Differentiate Medigap patients versusMedicare Advantage patients as it relatesto demographics, outcome scores andrisk of bad debtWhat does that mean for healthcarefinance leaders when it comes to maximizingrevenue with this population? Presentedhere are three considerations for healthcarefinance leaders as they look to expandrevenue streams and tap into a growingpopulation of insured Medigap patients. Explore a strategic approach tomaximizing Medigap market share whilealso helping seniors maintain Medigapinsurance coverage Realize direct financial impact Medigappatients have on hospital revenue andother ancillary benefits2

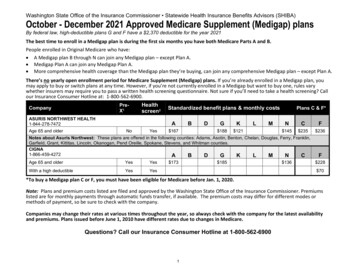

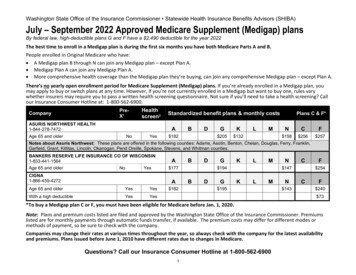

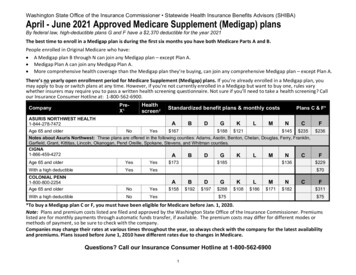

Medigap versus Medicare AdvantageWith its many plans, insurance categories, eligibility andthe like, it’s important to have a full understanding of thisdiverse Medicare population.1.2.3.Fee-for-service planMedigapMedicare ReplacementOriginal Medicare is a fee-forservice health plan managedby the federal government.It has two parts: Part A(Hospital insurance) andPart B (Medical insurance).After the patient pays thedeductible, Medicare paysits share of the Medicareapproved amount, and thepatient pays their share(coinsurance). Generally,an individual can go to anydoctor, health care provider,hospital or facility that isenrolled in Medicare andaccepting newMedicare patients.Medigap is MedicareSupplemental insurancethat helps fill in the “gaps” inOriginal Medicare. Medigapplans are governmentstandardized and are sold byprivate insurance companies.Although Original Medicarepays for much of the costfor covered health services,a Medigap policy helps paythe remaining costs likecopayments, coinsurance anddeductibles. Medigap seniorspay a monthly premium forthis coverage.Medicare Replacement,also known as MedicareAdvantage, is another way toget Medicare Part A and PartB coverage. These plans areoffered by Medicare-approvedprivate companies that mustfollow rules set by Medicare.In many cases, the patientwill need to use health careproviders who participate inthe plan’s network and servicearea for the lowest costs.3

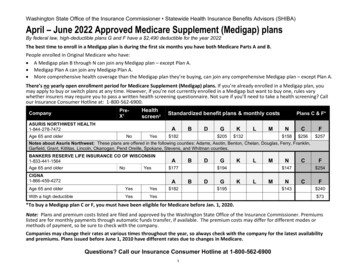

According to CSG Actuarial, LLC research,Medicare Supplement will continue to expandat a higher rate than Medicare enrollmentgrowth through 2029, creating ampleopportunities for entities relying on Medicarefor revenue. Hospitals undoubtedly fall intothis category.In their 10th Annual Market Projection(2020), CSG Actuarial used the followingdemographic factors in evaluating the currentMedicare population and comparing MedicareSupplement insureds to those with MedicareAdvantage Plans1. Plan Type Eligibility Status Age, Gender Income Level Area of Residence Health Status Living ArrangementThrough CSG’s research, they found thatthe Medicare Supplement market still hada higher percentage of healthier individualscompared to the Medicare Advantage market,with 20.8% of Medicare Supplement insuredsexhibiting Excellent health status and 17.3% ofMedicare Advantage having Excellent status.In addition, CSG Actuarial found that MedicareSupplement plans tended to appeal to seniorswith higher income on average – nearly 76%of Medicare Supplement insureds had annualincomes of 25,000 or more whereas 57%of Medicare Advantage enrollees reportedthat level of income. A healthier Medigappopulation with higher incomes could helplessen readmissions for hospitals sincefactors like good nutrition, physical activityand affordability of transportation all playinto it. With fewer readmissions, Medicarereimbursement for hospitals could be higheras well as improve outcome scores.Medicare Advantage beneficiariesencounter more healthcare spendingrelated problems compared to theirMedigap counterparts, according to theKaiser Family Foundation issue brief, “CostRelated Problems Are Less Common AmongBeneficiaries in Traditional Medicare Thanin Medicare Advantage, Mainly Due toSupplemental Coverage.” KFF reported onthese problems which included difficultyaccessing quality care, delays in care dueto affordability and problems paying theirmedical bills2.The results of the study showed thatMedicare Supplement beneficiaries had thehighest level of stability with their healthcarespending, indicating that Medigap coverageis a key component when it comes toaffordable healthcare. The brief explains,“Medicare Advantage plans, like traditionalMedicare, generally impose cost-sharingrequirements for covered services, subject tocertain limits, such as daily copayments forinpatient hospital stays or coinsurance forphysician administered drugs, which meansthat Medicare Advantage enrollees may incurthousands of dollars in out-of-pocket costsfor covered benefits before reaching theirplan’s maximum out-of-pocket limit3. Froma hospital finance perspective, with regard toMedigap, there is no burden to the revenuecycle side in chasing money. The hospitalsimply bills CMS, which will automatically billMedigap for the overage, and the bill is paid.The process is seamless and easy, creating noadditional administrative burden on hospitals.According to AHIP’s most recent MedicareSupplemental Survey, the top three reasonsMedigap policyholders chose Medicaresupplemental insurance over MedicareAdvantage were (1) greater choice of healthcare providers, (2) lower out-of-pocket costsand (3) it makes more frequent care moreaffordable4.4

Maximizing Medigap Market Share while helping SeniorsMore important now than ever, hospitalsin highly competitive markets are looking forways to differentiate themselves and gainmarket share. Healthcare systems are ableto maximize their Medigap market sharethrough a partnership with USA Senior CareNetwork (USA SCN).Through USA SCN’s one-of-a kind Medigapnetwork, their Medigap carrier clientschannel patients to contracted facilitiesall across the country, from rural areas tomajor metropolitan cities. The only thingparticipating hospitals are asked to do iswaive the Part A deductible when one ofUSA SCN’s clients’ policyholders is admitted.There are no Part B waivers or discounts.Contracted hospitals are seeing an increase inthe volume of fully-insured Medigap patientsand the incremental revenue generatedby those patients. A successful exampleincludes a three-hospital system with anincrease of 64.5% of Medigap policyholdersin one year after contracting with USA SCN,which translated to 7.1 million in additionalinpatient revenue and 5.2 million inoutpatient revenue.In addition to increased revenue,participating hospitals are helping to reducecost-related issues for seniors. USA SCN hasa patented process to help keep premiumsaffordable for patients with MedicareSupplemental Insurance. Savings from thePart A deductible waiver are applied to their130 insurance carrier clients toward keeping alid on future rate increases for more than 10.5million seniors nationwide.According to AHIP’s 2021 MedicareSupplement Survey, 90% of MedicareSupplement policyholders are satisfied withtheir coverage, with 37% Extremely Satisfied4.Seniors were also asked how valuable theythought their Medicare supplement policywas considering the monthly premium theyhad to pay. An overwhelming 79% of thosesurveyed indicated the value was excellent/good which indicates a desire to maintainthis level of coverage indefinitely. Seniorswho purchase a Medigap policy within USASCN network are aware that the Part Adeductible savings to the insurer help keeppolicy premiums affordable, which is a hugeenticement to move to an in-network facility.5

Financial Impact of Medigap PatientsAllen Bailey & Associates, Inc., an actuarialfirm based in Austin, TX, analyzed fiveyears of claims data, claims paid from 2015through June 2019, related to a population ofpolicyholders for one of the nation’s leadingMedicare supplement insurance carriers. Thisparticular carrier participates in USA SeniorCare Network’s Part A deductible waiverprogram in which they experience a Part Adeductible savings when their policyholdershave an inpatient admission at a USA SCNcontracted facility. The purpose of the analysiswas to assess the amount of claim dollarspaid by the carrier to providers and facilities.Additionally, this claim data was utilizedto calculate an estimate of claims paid byMedicare and the total amount of revenuegenerated for hospitals by a large populationof nearly 2 million Medigap policyholders.The findings were significant: Patients who experienced a hospitaladmission during the analysis time frame,generated additional Part A revenue(within 12 months of initial admission)approximately 8 times higher than theamount of the Part A deductible - 1,484in 2021. Patients who experienced a hospitaladmission during the analysis time frame,generated additional Part B revenue(within 12 months of initial admission) ofover 11,264. Patients who did not experience a hospitaladmission during the analysis time frameaveraged approximately 1,300 of Part Brevenue on an annual basis.6

Over 59% of the approximate 2 millionpolicyholders included in the analysisreceived a household discount on theirMedicare supplement insurance premium.Depending on state and product, thehousehold discount is available toindividuals that either live with anotheradult or live with an individual that also hasa Medicare supplement policy from thecarrier. Therefore, at a minimum, 1.2 millionof these policyholders live with at leastone other adult. Therefore, this increasesexposure to the hospital facilities’ totalhealthcare system to approximately 2.4million potential utilizers of the system.Medigap beneficiaries are provided withsignificant incentive to utilize contractedfacilities which helps to keep their Medigapcoverage affordable for the future while alsooffering hospitals significant opportunityto generate Part A and Part B revenue wellbeyond the amount of the waived Part Adeductible. USA Senior Care Network’sinnovative network, benefits everyone bymanaging costs, keeping Medigap premiumsaffordable for a growing senior populationand channeling Medigap patients toparticipating hospitals.Contracted hospitals are seeingan increase in the volume of fullyinsured Medigap patients and theincremental revenue generatedby those patients. A successfulexample includes a three-hospitalsystem with an increase of 64.5%of Medigap policyholders in oneyear after contracting with USASCN, which translated to 7.1million in additional inpatientrevenue and 5.2 million inoutpatient revenue.References:1 CSG Actuarial, LLC. (2020). The Future of Medicare Supplement, 10thAnnual Market Projection. Omaha: CSG Actuarial, LLC.2 Fuglesten Biniek, J., Ochieng, N., Cubanski, J., & Neuman, T. (2021, June25). Cost Related Problems Are Less Common Among Beneficiariesin Traditional Medicare Than in Medicare Advantage, mainly Due toSupplemental Coverage. Retrieved from Kaiser Family f3. Bailey, V. (2021, July 1). Private Payer News. Retrieved from HealthpayerIntelligence: http:healthpayerintelligence.com4.Global Strategy Group. (2021). AHIP Medicare Supplemental Survey.Global Strategy Group.www.usascn.com7

According to CSG Actuarial, LLC research, Medicare Supplement will continue to expand at a higher rate than Medicare enrollment growth through 2029, creating ample opportunities for entities relying on Medicare for revenue. Hospitals undoubtedly fall into this category. In their 10th Annual Market Projection (2020), CSG Actuarial used the following