Transcription

Connection and collaboration:powering UK tech and driving the economy

PRIME MINISTERRt Hon Theresa May MPOver the last year, the performance of the United Kingdom’sdigital tech sector has been world-leading, with British firmsattracting more capital than any other European country.Our great strength in technology and innovation, built on theUK’s excellence in R&D and creative thinking, is demonstratedby the breadth of tech activity right across the country, andthe powerful networks being forged by the next generationof entrepreneurs.As this 2018 Tech Nation Report makes clear, the digital techsector makes an essential contribution to local economiesin our towns and cities. Clusters built around AI, machinelearning, cyber security and big data industries are supportinggrowth, jobs and productivity in communities large and small.Ambitious people are brought together by a passion for newtechnologies and together become pioneers.As Prime Minister, I am proud of the strengths of the UK techsector and ambitious for what it can achieve in the future.That is why the government has made tech a core componentof our modern industrial strategy, and we will continue to investin the best innovations and ideas, in the brightest and besttalent, and in revolutionary digital infrastructure.For years, our tech sector has been concentrated in Londonand the South East. In line with the wider aspirations of theindustrial strategy to promote economic growth and prosperityacross the whole UK, I want to see our tech sector realise itshuge potential to boost communities and economies acrossthe entire nation.Every entrepreneur, every innovator and every employer in thetech sector and beyond can help make this happen. Together,we can build a stronger and fairer country — a Tech Nation whichsets the UK apart, and brings us all closer together.The Tech Nation team that worked on this report includesFrancesca Cahill, George Windsor, Henri Egle Sorotos,Lucy Cousins, Safa Boga and Sahra Bashir Mohamed.This report benefited greatly by feedback from Caroline Rae,Gerard Grech, Nadia Kelly, Paul Abbott, Tia McPhee, Vicki Shiel,and support from all colleagues at Tech Nation.This work contains statistical data from the Office for National Statistics (ONS)which is Crown Copyright. The use of the ONS statistical data in this work doesnot imply the endorsement of the ONS in relation to the interpretation or analysisof the statistical data. This work uses research datasets which may not exactlyreproduce National Statistics aggregates.Design: PHILPOTT DesignFind out more at technation.io/report2018Find out more at technation.io/report20183

This report would not have come to fruitionwithout the support and significant resourcesdedicated by our data partners and sponsors.Special thanks to data partners Adzuna,Beauhurst, the Office for National Statistics,Pitchbook, Startup Genome, Streetbees, andour 2018 report sponsors Barclays, EY, and JLL.The Tech Nation Report 2018 lives online.This booklet summarises our key insights.Explore new findings and more detail includinginteractive data visualisations, communityinsights and founder views online.FOREWORDGerard Grech, Chief Executive, Tech NationEileen Burbidge, Chair, Tech Nation and Partner,Passion CapitalWelcome to the 2018 Tech Nation Report — the mostcomprehensive guide to the UK’s digital tech ecosystem to date.Using a rich mix of official, open and web data, the Tech NationReport 2018 dives deep inside the themes that are essentialto the success of the UK’s tech entrepreneurs. This year, theTech Nation Report lives online. This booklet summarises thekey insights. Interactive data visualisations, community insightsand founder views all await at technation.io/report2018.From international competitiveness to jobs and skills, we areproud to provide cutting-edge data and information that helpsmove the UK’s digital economy narrative forward. Indeed, theUK’s digital economy has seen astonishing growth over recentyears. But it has also experienced challenges, some sharedby the economy more broadly. Amongst these, of course, is theUK’s changing relationship with the EU. Like the Tech Nationteam itself, however, the tech communities we surveyed thisyear remain resolutely optimistic about the resilience of the UK’sdigital ecosystem.So as we power into that future, we must support founders,investors, international talent and our homegrown digitalworkforce. Helping them to connect, learn and share, to ensurethe UK remains the best place to start and scale world-classdigital businesses. This is what Tech Nation is about; it’s not aboutcreating tech hubs but connecting the most ambitious techentrepreneurs across the UK, so they are successful in their owncities, inspiring the next generation of local tech entrepreneursthrough programmes, event and insights.This year’s Tech Nation survey received the largest responseyet from members of the UK tech community. In more than3,400 submissions, they told us about achievements they arecelebrating and the challenges they face. The report alsofeatures over 70 business case studies — all online.We would like to thank our Tech Nation community partners, ourboard, the UK Government, the Department for Digital, Culture,Media and Sport and of course, the awesome Tech Nation team —a team we are incredibly proud to be part of.4Find out more at technation.io/report2018Find out more at technation.io/report20185

KEY FINDINGSCollaboration and global connectivityhelps the UK tech sector grow 2.6 times fasterthan the rest of the economyThis booklet summarisesour key insights. Explorenew findings and moredetail with interactivedata visualisations,community insights andfounder views online.Pages 8 – 10Pages 11 – 13Pages 14 – 18Pages 19 – 21Pages 22 – 231 INTERNATIONALCOMPETITIVENESS2 DIGITAL TECHBUSINESS3 COMMUNITYPERCEPTIONS4 COLLABORATION,CONNECTIVITY ANDCULTURE5 JOBS AND SKILLS The UK cements its positionas a global tech leader T he UK has digital suburbs,not just cities UK software developersare highly collaborative Jobs in digital tech areon the riseThis is the fourth in an annualseries of groundbreakingreports that give deep insightinto the UK tech ecosystemto further the understandingof the sector’s key challenges,opportunities and trends forthe year ahead and beyond. Its digital tech sector isa shining light not only inEurope but also on a globalscale. In London 33% oftech company customersare based outside the UK,compared to 30% in SiliconValley and 7% in Beijing. London’s digital density isbelow the UK average at0.92, while Newbury at 15.5is the most tech specialisedlocal economy in the UK. Access to talent andinvestment continue tochallenge tech communitiesacross the UK Data on 52,000 UK Githubusers reveals important,often hidden, ways thatdevelopers collaborate.Languages associatedwith web development areprevalent, the top threeare JavaScript, Pythonand PHP. From 2014 to 2017 digitaltech sector employmentrose 13.2%. Its workersare more productive, onaverage, by 10,000 perworker. Jobs requiringdigital tech skills commandhigher salaries, at 42,578compared to 32,477 forthose that do not.It highlights the uniquestrengths of clusters andconsiders how to supporttheir growth in an evolvingpolitical climate.Here is what you need to knowabout the ecosystem in 2018.6 Global connections arekey to domestic success 25% of the world’sentrepreneurs report asignificant relationship withtwo or more others basedin London, a figure beatenonly by Silicon Valley. Healthy mix of growthstages across the UK The highest proportion ofclusters (36%) emerged asbalanced ecosystems, 26%are scaleup dominant, and12% startup dominant.Find out more at technation.io/report2018/keyfindings In 83% of clusters, thetech community citedaccess to talent as theirbiggest challenge. U K tech communities valuequality of life and senseof place Communities identifiedthe top ecosystemstrengths as: 1) appealingarea; 2) a helpful techcommunity; 3) proximity toa university. The UK tech communityis highly connected We found 3,527 tech meetupgroups, with over 1.6 millionmembers across 283locations. Their interactionsindicate a vibrant grassrootstech scene and highlightemerging trends such as AI.Find out more at report2018 Diversity remains a keychallenge for digital tech Only 19% of the digitaltech workforce is female.Despite the stereotype thatdigital tech jobs are formillennials, 72% of workersare aged over 35.7

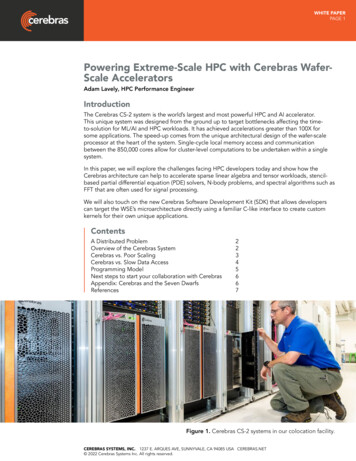

1. INTERNATIONAL COMPETITIVENESSSponsored by: EYThe UK cements its position asa global tech leaderWith the digital sector growing twice as fast as the economyas a whole, it is clear that technology is a critical component ofUK growth, both now and for the future.The UK tech sector is ashining light in Europe, butBrexit is forcing the nation tothink bigger. It is thereforecritical that the UK looksbeyond its borders and judgesits performance on a trulyinternational scale.However, EY’s recent Regional Economic Forecast also foundthat digital tech growth was fastest in the south of the country.Today, we have a once-in-a-generation opportunity to repositionthe country. Against a backdrop of changing trade dynamicsand technology-led disruption, we believe that the UK regionshave a critically important role in strengthening the country’sposition on a global stage.The tech sector hasexperienced rapid growthover recent years, both acrossthe UK and beyond. At eachstage of growth, ecosystemsexperience shared challengesand find shared strengths.The success that London’s tech sector is currently enjoyinginternationally is a positive story, and one that other regions canlearn from. 33% of its tech company customers are based outsideof the UK, making it the second most connected tech ecosystemin the world, following only Silicon Valley. But all of the UK’stech ecosystems now have a vital role to play in driving thecountry’s international connections and ensuring our continuedcompetitiveness.So, as we find ourselves faced with a real opportunity to placethe UK at front and centre of the international digital techeconomy, now is the time for a renewed focus on the digitallandscape across the country. Tech Nation provides a platformfor the UK’s regions to learn from successful and establishedecosystems. It helps forge connections, joins the dots andsupports local networks to flourish. We are proud to be partof that journey’s start.Data from Startup Genomeallows us to create a detailedpicture of the dynamicsdriving global tech startupecosystems. It helps us toanswer important questionsfrom founders and CEOs, suchas: where should I form mytech startup to maximise mychances of success? Whereshould I open a second office?Or, how can I help address myecosystem’s challenges?LONDON SECURES ITS POSITION AS 3RD GLOBALTECH STARTUP ECOSYSTEMMark GregoryEY Chief Economist, UKDebbie O’HanlonEY Managing Partner, UK RegionsPerformanceof the top12 globaltech startupecosystemsSource: StartupGenome, 20178Find out more at technation.io/report2018/internationalFind out more at technation.io/report2018/international9

2. DIGITAL TECH BUSINESSESSponsored by: BarclaysGlobal connections are keyto domestic success“Having contactsacross the world hashelped Deliveroo’sgrowth go fromstrength to strength,expanding to 12markets since 2015in Europe, Australiaand the Middle East.”London is second only toSilicon Valley for inboundglobal connections. 25% ofentrepreneurs acrossthe world report havinga significant relationshipwith two or more entrepreneursin London, compared to33% for Silicon Valley.Will ShuCo-founder & CEODeliverooThese connections extend theUK’s market reach and driveinnovation in a process thatis inherently collaborative.Physical proximity often aidscollaboration, so we mustnot underestimate theimportance of domesticnetworks. But it is increasinglyimportant that UK tech clustersare seen as local nodes withinan international web.Since the success of firms inthe knowledge based economyis increasingly dependent ontheir ability to innovate, theimportance of these globalnetworks to the performanceof the UK tech sector cannotbe overstated.LONDON IS THE SECOND MOST CONNECTED ECOSYSTEM IN THE WORLDWe can learn a huge amount about the UK’s tech ecosystemby better understanding the innovative businesses across thenation that are driving economic growth. Barclays is delightedto support Tech Nation’s vision of galvanising tech ecosystemsright across the UK.The impact of high-growth, digital tech companies is hugelypositive. They create employment, generate new opportunitiesfor investors and grow the economy in all corners of the UK. In fact,the tech sector is an important part of a much wider range of localeconomies than we previously realised — we see tech hotspotsthroughout a range of digital suburbs like Stevenage and WelwynGarden City, as well as cities such as Bristol.We know that tech companies are powered by relationships.By helping to forge meaningful connections, Barclays lookto support the ecosystem — connecting businesses to peersand experts, and offering innovative and bespoke support toaccelerate growth.Digital disruption is impacting all industries — we only have tolook at the way technology is becoming an enabling force insectors like healthcare and transport to see this. But this typeof disruption inevitably has a wide range of implications — andconsensus will need to be built around the way we manage theglobal changes tech is already bringing about, and the UK’s placein this new world.High-growth small businesses and large corporates must be unitedin this journey. Barclays are excited to support Tech Nation’smission to bring these businesses together, catalysing a nationalnetwork of ambitious entrepreneurs, and to help the UK’s digitaltech economy thrive.Tom EasterbyHead of Venture Capital CoverageBarclaysInboundconnectionsfor the top 20global techecosystemsSource: StartupGenome, 201710Inbound ConnectionsNote: Inbound connections refers to the percentage of entrepreneurs from internationalecosystems (in another country) who report a significant relationship with two or moreentrepreneurs in a given ecosystem. The size of the bubble on the map corresponds tothe percentage of entrepreneurs in a given ecosystem.Find out more at technation.io/report2018/internationalFind out more at technation.io/report2018/business11

Healthy mix of growth stagesacross the UKThe UK has digital suburbs,not just citiesDigital tech is powering localeconomies across the UK. But asthe map below shows, it is far fromuniformly distributed.Nor is it the sole preserve of large,metropolitan cities. In digitalsuburbs like Guildford andAldershot, Slough and Heathrow,digital tech density is significantlyhigher than the UK average,while employment and turnoverare amongst the highest of allUK clusters.The value generated by a digitaltech worker varies considerably.Clusters where we see a high digitaldensity also tend towards higherproductivity per worker.In fact, there is a ‘productivity powerpath’ from London to the mouthof the River Severn, travelling alongthe M4 corridor and spreading toSouthampton and Portsmouth.Turnover by employee rangesfrom 27,650 in Campbeltown to 320,000 in Bristol. The UK’sstrength as a Tech Nation rests oncomprehending, and valuing, thisdiversity of economic activity.DIGITAL SUBURBS UNCOVEREDACROSS THE UK“As an ambitious andearly stage SME, thatis tackling a globallydefined problem,collaboration is keyfor us. We look forthe support ofgovernment andhealth departments,as well as industrygiants to find waysthat we can innovate,and grow together.”Devika WoodCo-founderVidaThe number of digital techcompanies born in the UK hasboomed, with a staggering78% increase between2009–2010 and high growthwas sustained until 2015–2016when the business birthratefell by 17%.The highest proportion ofclusters (36%) emerged asbalanced ecosystems,26% are scaleup dominant,and just 12% startup dominant.This analysis paves the wayfor more targeted supportfor each.To look at the age of techcompanies we segmented50 Travel to Work Areas intofour groups:1 BALANCED An evendistribution of businesses ofdifferent ages, from startupsto mature companies2 MATURE A higher thanaverage proportion ofcompanies aged 10–18 yearsand 19 or over3 SCALEUP A higher proportionof companies aged 5–9 years4 STARTUP A higherproportion of companiesaged four or under.A HIGH PROPORTION OFCLUSTERS WITH A BALANCEOF COMPANY GROWTHSTAGES SUGGESTS A HEALTHYUK ECOSYSTEM 2Digital techdensity inTravel to WorkAreas acrossthe UKSource: TechNation, 2018;ONS, BusinessStructureDatabase, 2017121.510.50Note: Digital density measures digital tech specialisation in clusters compared to densityin the UK. A figure above 1 indicates relative specialisation, and below 1 indicates relativelack of specialisation in digital tech.Find out more at technation.io/report2018/businessGrowth Stagedistributionof companies inTravel to WorkAreas acrossthe UKSource: TechNation, 2018; ONS,Business alancedNote: Data on 50 Travel to Work Areas are presented due to low sample sizes in therest of the UK.Find out more at technation.io/report2018/business13

3. COMMUNITY PERCEPTIONSSponsored by: JLLAt JLL, we understand just how important the place you workcan be. But, as this report confirms, places are nothing withoutdedicated communities supporting them. 57% of clusters acrossthe nation flagged the tech community as a top local strength.We are here to make sure you choose the right location foryour business, to help create inspiring workplaces, and to showyou how the buildings you occupy can make your talent moreproductive. More than this, though, at JLL we share the sameambition as Tech Nation — to help digital tech communitiesflourish across the UK. What better way to engage with thepressing issues experienced in tech, than to hear from thoseambitious entrepreneurs driving the sector forward?Many of the challenges that tech businesses in the UK faceare not exclusive to where they are based. Although they varyfrom place to place, broadband speeds, living costs, transport,affordable workspace and even access to the best talent, areneeds shared across the country. That is why we are supportingTech Nation’s work on community perceptions this year — toshare insights, and facilitate connections.The UK is at an inflection point. We have the opportunity to unitea rich and diverse range of communities across the country tocome together on key issues defining your ecosystem. We hopethat you will use these insights to make informed businessdecisions, and accelerate your success at this incredibly excitingtime for UK tech.Michael DavisTech and Media Sector LeadJLLUK tech communities sharekey experiencesTo develop a deep understanding of the UK digitaltech ecosystem, it is essentialto explore a mix of official,web and open data, as wellas probe the experiencesand perceptions of ambitiousentrepreneurs, supportorganisations and employeesin the sector.This year’s Tech Nation surveyreceived the largest responseyet from these members of theUK tech community. In a totalof 3,428 submissions, theytold us about the opportunitiesand challenges their localecosystems face, andthe digital tech leadersthey admire.The majority of respondents(33%) were founders and CEOs,followed by workers in techcompanies (31%).Access to talent and investmentcontinue to challenge techcommunities across the UKThe challenges experiencedby people living and workingin UK tech clusters areseldom exclusive to theirown environment.The maps overleaf showtop challenges andstrengths perceived in theclusters we surveyed.The top challenges identifiedin survey areas were:1 Access to talent2 Access to funding3 Bad transport links14Find out more at technation.io/report2018/communityFind out more at technation.io/report2018/community15

Community perceptionsof local tech ecosystemsExplore your region online attechnation.io/report2018/communityKEY CHALLENGESPERCEIVED BYTHE LOCAL TECHCOMMUNITYKEY STRENGTHSPERCEIVED BYTHE LOCAL TECHCOMMUNITYStrengthsof local techecosystemsSource: TechNation andStreetbees,201816Access toresourcesProximity ofa universityAppealingareaGood qualityof lifeCreativity/innovationGood transportlinksHelpful techcommunityAccess toworkspaceAccess totalentProximity oflarge techcompaniesDigitalinfrastructureDiversity oftalentFind out more at technation.io/report2018/communityChallengesof local techecosystemsSource: TechNation andStreetbees,2018LimitedinfrastructureAccess to talentCost of livingLack of supportfrom widertech communityBad transportlinksRemote areaRetaining talentAvailabilityof workspaceLack of supportfrom governmentFew nearbytech companiesFind out more at technation.io/report2018/communityAccess tofundingLack ofawarenessof local techcommunityLack of techtraining17

4. COLLABORATIONCONNECTIVITY AND CULTUREUK tech communities value qualityof life and sense of place“Norwich businessesvalue workingtogether, both locallyand as part of themuch bigger techcommunity in the UK.”The top strengths identified insurvey areas were:1 Appealing area2 A helpful tech community3 Proximity to a universityJames DuezInvestor, Co-founder& Executive ChairmanRainbird TechnologiesUK software developers are highly collaborativeSoftware innovation is criticalto the success of the UK digitaltech sector, yet how developerscollaborate is seldom captured.We have done so using datafrom leading softwaredevelopment platform, Github.Strengths as well as challengesare shared — suggesting thatbenefits could come frombetter connections that enablefounders and CEOs to learnfrom one another andopen up new opportunitiesthrough collaboration.Productive connections requirecollaborators to communicateeffectively. In the case ofdevelopment, this does notnecessarily mean speaking thesame language, but coding thesame language.The UK’s strength as a technation lies in the diversity oflocal clusters and culturesthat come together to form adynamic, national ecosystem.Diversity among UK tech leadersremains a challengeWe asked members of the techcommunity who they saw asthe most influential tech figuresin their local area. Unsungheroes emerged alongsidebetter known figures, but only11% were women.This is concerning. A diversityof role models is important ifpeople are to identify not onlywith leaders in the field, butwith tech itself.18Tech leaders do, however,inhabit a spectrum of roles.48% of those identifiedare members of the widerecosystem and 51%are heads of, or workingin, tech companies. Some areindustry veterans, such asHermann Hauser at AmadeusCapital. Others are disruptorslike Demis Hassabis atDeepMind, Lawrence Jonesat UKFast and Paul Smithat Hyperloop One.Find out more at technation.io/report2018/communityData on 52,000 UK Githubusers shows that thelanguages associated withweb development are mostprevalent, the top three areJavaScript, Python and PHP.The connections that usersmake on Github are bestillustrated through the networksthey create. As a project isdeveloped, Github storesand manages revisions madeby its users. It also enablesthem to ‘fork’ projects — copyanother user’s work from anopen source code repository.This extensive, and ostensiblyhidden, network of digitalcollaboration is evidence ofthe depth of the national techecosystem.GITHUB SHOWS HOW UK TECH DEVELOPERSSHARE CODING vaTopprogramminglanguagesused on Github,by numberof usersSource: TechNation, 2018;Github, 2018C#2,272Ruby2,2452,118HTMLCSSC C1,6441,5051,105Find out more at technation.io/report2018/collaboration19

The UK tech communityis highly connected“Calling in favours,asking for adviceand sparring withfellow entrepreneurshas helped me builda big business (andkeep my sanity!)over the last 5 years.”Andrew HunterCo-founderAdzunaTOP 400 MEETUPS HIGHLIGHTEMERGING TRENDS, WATCH OUTFOR AI AND BLOCKCHAINAS THEY TAKE CENTRE STAGEIN THE CONVERSATIONThe UK’s tech communityis highly connected.Meetup.com data reveals: 3,527 UK tech groups 1.6 million members 283 locationsTech meetups are inclusiveand collaborative — 91% ofUK groups are open for allto attend. 9% require approvaland only 0.03% are closed.They highlight emerging trends,for instance, in Manchestera mass of groups arediscussing new technologieslike Blockchain, and a strongdata science community ismaking itself felt in London.The network diagram hereshows the top 400 meetupsin the UK, by size ofmembership. Meetups areclustered not by geography,but by specialisation — themore similar the tags usedto describe them, the closerthey appear on the diagram.Software development isa core part of this network,and an integral componentof UK tech, both now andfor the future.Top 400 techmeetup groupsby membershipin the UKSource: TechNation, 2018;Meetup.com,20182023.75%Pink cluster:20.75%Green cluster:17.25%Blue cluster:16.25%Black cluster:15.75%Orange cluster:3.75%Purple cluster:Main theme:Open sourceLinuxSystem administrationMain theme:Software developmentScrumAgileProject managementMain theme:Web designCSSUX designProduct designMain theme:Emerging technologyVirtual currencyMobile technologyReg techMain theme:Artificial intelligenceBig dataPythonHadoopRoboticsMain theme:Java.NETPHPRubyFind out more at technation.io/report2018/collaborationFind out more at technation.io/report2018/collaboration21

5. JOBS AND SKILLSJobs in digital tech are on the riseBetween 2014 and 2017employment in the digital techsector increased by 13.2%.Workers in digital tech are alsomore productive than thosein non-digital sectors, by anaverage of 10,000 per personper annum.Jobs requiring digital tech skillscommand higher salaries, onaverage, 42,578 compared to 32,477 per year, while digitallyenabled jobs — those requiringonly some engagement withdigital tech – bring in 35,227.Overall, digital tech jobs aregood for workers, and goodfor the UK.Diversity remains a keychallenge for digital techEmployer demand is increasingtoo. Non-digital tech companiesare becoming more relianton digital tech workers, as techpervades every business andnew forms of work evolve.However, tech does notcurrently offer equalopportunities for all. There is agrowing movement to promotediversity, with a number ofinitiatives aiming to addressthe gulf between men andwomen’s employment in thesector. Other inequalities alsodeserve attention.“With almost halfof our exec andmanagement teambeing female,diversity is the gluethat holds our businesstogether, and thefuel that allows usto keep innovating.”Norm JohnstonCEOUnrulyDigitally enabledNon- digitalAverage annualsalary of jobsSource: Adzuna,201822WOMEN IN TECH AREOUTNUMBERED 4:1 42,578 35,277 32,477Note: Jobs are categorised based on their digital skill level according to theDCMS definition of technology literacy.Find out more at technation.io/report2018/jobsOn average 72% of UK digitaltech workers are over 35,challenging the stereotypethat jobs in this sector arethe preserve of millennials.East London, the site of SiliconRoundabout, is the only regionwhere the majority of digitaltech workers (51%) are under 35.15% of those in digital techjobs are of black, Asianand ethnic minority (BAME)background. This is significantlyhigher than the 10% acrossall UK jobs. Ethnic diversityis above UK average, yetgender diversity is significantlylower — this reminds us of theimportance of taking a nuancedapproach to understandingworkforce composition.THE MORE DIGITALLY SKILLED A UK JOB IS,THE HIGHER ITS AVERAGE ANNUAL SALARYDigital nativeOnly 19% of the digital techworkforce is female, comparedto 49% across all UK jobs.The diversity of the digitaltech workforce can be probedfurther using the ONS’ AnnualPopulation Survey. This findingflags a diversity dilemma intech, reinforcing a groundswellof industry activity to addressinclusion and equality in digitalcompanies.Genderdiversity ofpeople workingin digitaltech jobs, 2017Source: TechNation, 2018;ONS, AnnualPopulation Survey,Wave 3 2017Find out more at technation.io/report2018/jobs23

24568%429%1. Leicester6. Newcastle418%526%8. Dunfermline & Kirkcaldy11. Glasgow3. Edinburgh397%422%7. Wolverhampton & WalsallDigital startupbirths within Travelto Work Areas,percentage change indigital startup births2006 vs 2016Source: ONSBusiness StructureDatabase, 2006, 2016Find out more at technation.io/report2018Find out more at technation.io/report2018514%4. London562%536%10. Medway12. Milton KeynesProductivity( per person),turnover byemployee for thetop 15 UK Travelto Work AreasSource: ONSBusiness StructureDatabase, 20172. Slough & HeathrowGuildford & AldershotWolverhampton & Walsall562%YorkStoke-on-Trent5. NewburySouthampton381%Stevenage & Welwyn Garden CityLEICESTER HASEXPERIENCEDTHE LARGESTINCREASE INDIGITAL STARTUPBIRTHS2006 VS 201613. High Wycombe & AylesburyTelfordLondon412%Reading9. Stevenage & Welwyn Garden CityPortsmouth369%Basingstoke15. CheltenhamSwindonSlough and 2K188K186K168K165K14. DudleyBristolNewbury385% per personBRISTOL TOPSPRODUCTIVITYOF LOCAL TECHECOSYSTEMS380%DIGITAL PERFORMANCEINDICATORSNote: A minimum threshold of 10 companies per Travel toWork Area has been applied to the underlying data.25

RECOMMENDATIONS FORAMBITIOUS ENTREPRENEURSLondon has powerfulglobal connections, buttech clusters across theUK are going global, andall must elevate theirambitions to perform onan international stage.Analysing the agedistribution of companieswithin each of the UK’stech ecosystems pavesthe way for more targetedand appropriate supportfor each.Begin expandingyours by learning fromfounders and CEOs withinternational experience.Engage with UK networkslike International Techfor Good. Tech Nation’sFuture Fifty and Upscaleprogrammes, for lateand mid-stage scaleups,run tailored sessions ongoing global.26% of clusters arecategor

Debbie O'Hanlon EY Managing Partner, UK Regions The UK cements its position as a global tech leader The UK tech sector is a shining light in Europe, but Brexit is forcing the nation to think bigger. It is therefore critical that the UK looks beyond its borders and judges its performance on a truly international scale. The tech sector has