Transcription

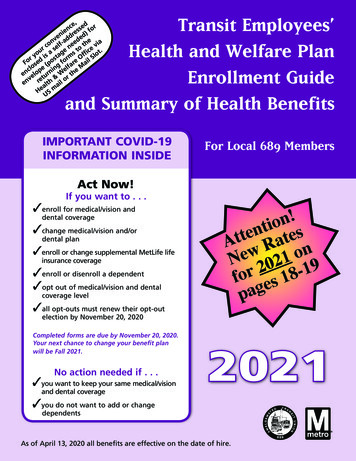

Transit Employees’Health and Welfare PlanEnrollment Guideand Summary of Health Benefits,ce sed ornsfeni dre ed)edvn -a ed e aco elf ne o th e virstou s a age s ffic lot.yi st rm O l SrFo sed (po g fo are aiclo pe in elf e Men elo turn W r th& ov een r alth ailHe S mUIMPORTANT COVID-19INFORMATION INSIDEFor Local 689 MembersAct Now!If you want to . . . enroll for medical/vision anddental coverage change medical/vision and/ordental plan enroll or change supplemental MetLife lifeinsurance coverage enroll or disenroll a dependent opt out of medical/vision and etailse1N2 1902for es 18pagcoverage level all opt-outs must renew their opt-outelection by November 20, 2020Completed forms are due by November 20, 2020.Your next chance to change your benefit planwill be Fall 2021.No action needed if . . . you want to keep your same medical/visionand dental coverage2021 you do not want to add or changedependentsAs of April 13, 2020 all benefits are effective on the date of hire.

Message from the Board of TrusteesFall Open Enrollment: Begins: Monday, October 26, 2020Ends: Friday, November 20, 2020 BEFORE ThanksgivingThe members of Local 689 have the opportunity to review their benefit options and to make changesbefore the premium rates change on January 1st.COVID-19To ensure our members' safety, the Transit Employees’ Health & Welfare staff are working remotely.They can be reached by phone at (301) 568-2294, by email and info@tehw.org or by fax at(301) 568-7302. Enrollment forms can be mailed to the office using the self-addressed envelope(postage needed) enclosed in the open enrollment guide, or you can drop off your forms using themail slot at 2701 Whitney Place, Suite 100, Forestville, MD 20747.Preprinted FormsWe are enclosing a customized preprinted open enrollment form in the booklet due to the positivefeedback from previous open enrollments. It will help us process your changes accurately. Please use itto make any plan changes for you or your dependents.RatesYour Benefits Summary Statement is provided with the details of your current benefits and premiumrates. You can compare this information with the new 2021 rates on pages 18 and 19.Supplemental Life Insurance ProgramYou can enroll in or increase your current supplemental life benefits. MetLife also offers the followingservices at no cost to you for participating in the program: Funeral Discounts & Planning Services,Will Preparation, Digital Legacy, Retirement Planning, Transition Solutions Employee AssistanceProgram, Grief Counseling, Funeral Assistance, Estate Resolution Services, and Life SettlementAccount.WellnessJoin the wellness program to earn up to 800/yearly off your health insurance!You can also earn up to 210/yearly for obtaining preventive services, suchas an annual physical or enlisting a health coach. To learn more, email689wellness@tehw.org or visit www.tehw.org.Please review your current benefits carefully. If you make any changes, your choices will be effectiveon January 1, 2021. If you opt-out of benefits, you must complete a new opt-out form and provideproof of other coverage. If you are satisfied with your current benefit choices, no action is required onyour part.Sincerely,Board of TrusteesWMATAATU LOCAL 689Michael Duncan, ChairmanWinston EllisCraig GrossRaymond Jackson, SecretaryKeith BullockEsker Bilger

Enrollment Guide and Summary of Health BenefitsTable of ContentsCovid-192Health & Welfare Plan Choices3Eligibility for Yourself and Your Dependents4Timing: When You Can Make Changes6How do I Pay for My Benefits7 2021 Cost of Medical/Vision and Dental Benefits Payment of Health and Welfare Premiums Waive Medical Coverage Opt-out RequirementsCOBRA Continuation Coverage8 Spousal Credit Available Applied Behavioral Analysis About Privacy and DocumentationMedical/Vision Plan Choices9 Pharmacy BenefitsKaiser Medicare Advantage12 Retired Employees Living Out of the Area Eligible for Medicare Parts A and BDental Plan Options13Wellness Incentive Programs14 BurnAlong 2020 Wellness ProgramsVoluntary Benefits16 Supplemental Life Insurance and Perks Universal Life Insurance Flexible Spending AccountsShort and Long Term Disability FAQs17 Prescription GlassesActive Contribution Rates, Effective 01/01/202118 MetLife Term Life Insurance RatesRetiree Contribution Rates, Effective 01/01/202119Key Contacts for Claims and Service Information20Open Enrollment FormsInserts1

CORONOVIRUS(COVID-19) PREVENTION TIPSFollow the tips below to help you & your family stay healthy & safe!Be sure to wear a mask & practice social distancing in public!Wash your handsoften with soap &water for at least20 seconds. Usehand sanitizerfrequently!Cover your cough orsneeze with a tissue.Or, cough & sneezeinto your elbow orsleeve.Avoid touchingyour eyes,nose, andmouth.Clean & disinfectfrequentlytouched objects &surfaces.Stay homewhen you aresick except toget medicalcare.2Avoid closecontact withpeople who aresick.Source: CDC, 2020 www.cdc.gov

Health & Welfare Plan Choices For ActivesMEDICAL/VISION AND DENTAL VDo You Have a Summary Plan Booklet? Medical/Vision– KaiserHMO Choicesmedical andForNVAActivesvisionHealth& PermanenteWelfare Plan– BlueChoice HMO medical and Davis VisionMEDICAL/VISIONAND(POS)DENTALV Vision– CareFirst BC Advantageand DavisDo YouMedicalHave a Summary Plan Booklet?alntDeVision Dental(if you elect medical/vision)Medical/VisionCareFirst– KaiserPermanente HMO medical and NVA vision– BlueChoiceCIGNA DMOHMO medical and Davis Vision– CareFirst BC Advantage (POS) and Davis VisionAUTOMATIC BENEFITS VilityMedicalsabsabngsa -Tebi rmlitDiyLife andAccidentAll activefull-timeandInsurancepart-time employees receivethese rmilityDialntDeeencncraralsusualttaInInneeen cefenc ifemm nLile ra Lle rapp nsupp nsuSu fe ISu fe ILiLiVision Dental (if you elect medical/vision)All– activefull-time and part-time employees receiveCareFirstthese benefits:– CIGNA DMO Short Term DisabilityAUTOMATICBENEFITS V Long Term DisabilityWELLNESS INCENTIVE PROGRAM Short Term Disability LongTermupDisabilityYoucan signanytime to join the Moving Metro689Wellnessincentiveprogram. Earn up to 800 Life and Accident Insuranceper year in premium reductions/incentive payments.Seepage 15 fordetails. Watchfor notices ofWELLNESSINCENTIVEPROGRAMprogram improvements.You can sign up anytime to join the Moving MetroVOLUNTARYBENEFITS689Wellness incentiveprogram. Earn up to 800per year in premium reductions/incentive payments.You pagemay purchasecoverageby forenrollingtheseSee15 for details.Watchnoticesinofplans andimprovements.paying the full cost:program Supplemental Life Insurance (See page 16 fornew features)BENEFITSVOLUNTARY Supplemental Dental/Orthodontic coverageYou may purchase coverage by enrolling in these(CareFirst)plans and paying the full cost:1 SupplementalING Universal LifeLife InsuranceInsurance (See page 16 fornew features)1The Health & Welfare office is not responsible for enrollment in this plan.IF YOU HAVE QUESTIONS. The Health and Welfare Office is openremotely during open enrollment.After reading this booklet, if you havequestions, please contact us by phone at(301) 568-2294, by email at info@tehw.orgor by fax at (301) 568-7302. Supplemental Dental/Orthodontic coverage(CareFirst)1 ING&UniversalLifePlanInsuranceHealthWelfareChoices For RetireesMEDICAL/VISIONANDDENTAL1TheHealth & Welfare office is notresponsiblefor enrollment in this plan. Medical/Vision– Kaiser Permanente HMO medical and NVA visionHealth & Welfare Plan Choices For Retirees– BlueChoice HMO medical and Davis Vision– CareFirst BC Advantageand Davis VisionMEDICAL/VISIONAND(POS)DENTAL Dental: Single coverage under Delta Dental is Medical/Visionautomatic. You may opt out of single coverage or– KaiserPermanenteHMO andmedicaland NVA visionelectto coveryour spousedependents.– BlueChoice HMO medical and Davis Vision3– CareFirst BC Advantage (POS) and Davis Vision Dental: Single coverage under Delta Dental isautomatic. You may opt out of single coverage orelect to cover your spouse and dependents.3

Eligibility for Yourself and Your DependentsYour Eligibility for BenefitsDependent EligibilityEligibility for benefits under the Transit Employees’Health and Welfare Plan is determined by the CollectiveBargaining Agreement between ATU Local 689and WMATA. Medical/vision and dental coverage ismandatory for full-time employees unless you havemedical coverage from another source. The followinggroups are eligible for coverage under the Plan: Full-time employees Part-time employees Employees working under the NewService Agreement Retired employees hired before Jan. 1, 2010 Surviving dependents of active andretired employeesEmployees on Military Leave and their dependentswill continue in the Plan until the last day of themonth after the month you worked when you werecalled to duty. COBRA continuation benefits will beavailable to you and your family afterwards.You may cover eligible dependents under yourmedical/vision and dental coverage provided therequired documentation is submitted and updated asnecessary.You cannot make changes directly with yourmedical/vision or dental provider. To add or removedependents you must notify the Health and WelfareFund office. Forms can be downloaded px.A spouse can only be removed prior to the nextannual enrollment period if the couple divorces, thespouse dies, or with evidence of other coverage.A child can normally only be removed prior to thenext annual enrollment period with evidence ofother coverage.Effective Date of Coverage for New DependentsTO ENROLL YOUR REQUIREDDOCUMENTS COVERAGE EFFECTIVE . . .SpouseMarriage certificate if not yourfirst spouse, then also divorce decreeor death certificate. If married morethan two years, you must also providea copy of your most recent tax returnFirst of the month following themarriage and the Plan’s receipt of allrequired documentation.Natural childrenBirth certificate and social securitynumber your name must appearon the birth certificateCovered from date of birth if the Plan isnotified within 30 days. Otherwise, firstof the month following date originaldocumentation is received by the Health& Welfare office (within 90 days).StepchildrenBirth certificate and social securitynumber the name of your currentspouse must appear on the birthcertificateSame as spouse.Adopted children, children inplacement for adoption andchildren for whom you areappointed legal guardianOriginal birth certificate, adoptionand legal guardianship paperssatisfactory to the TrusteesCovered from the date of adoption orplacement for adoption.Domestic PartnerAffidavit of Domestic Partnershipalong with documentation offinancial interdependenceJanuary 1st following Open Enrollmentor the first of the next month after allnecessary documention is provided.Registration of Domesticpartnership if applicableTaxation will begin at the same time.This benefit is fully taxable to theemployee4

YOUR ELIGIBLEDEPENDENTSINCLUDE YOUR: SpouseDomestic PartnerChildren under age 26Children over age26 who meet therequirements as adisabled dependent Unmarried childrenfor whom you arethe court appointedguardian and whomeet the additionalrequirements of theplanTHE CHILDRENCOVERED ARE YOUR: Natural children Stepchildren Legally adoptedchildren and childrenbeing placed foradoption Children for whomyou are appointedlegal guardianTo Enroll A Dependent You must provide an original birth certificate ororiginal certificate of live birth to enroll children.The document must name the member or eligiblespouse or eligible domestic partner as a parent. You must provide the social security number andcopy of card for each of your eligible dependents.If your dependent cannot obtain a social securitynumber, he or she can apply to the InternalRevenue Service for an individual taxpayeridentification number. You have a maxiumum of 90 days from the date ofmarriage, birth, adoption, placement for adoptionor appointment as legal guardian to add yournew dependent. If you miss the 90-day window,you must wait until the next scheduled Novemberannual enrollment period to make the change. The Plan will also provide dependent coverageto a child if it is required to do so by a QualifiedMedical Child Support Order (QMCSO) that meetsthe national standards or the requirementsestablished by the Trustees. A copy of the samplelanguage for “Medical Child Support Order” maybe obtained from the Health & Welfare office.To Enroll A Spouse You need an original state-issued marriagecertificate and copy of social security card to enrolla spouse. If your former spouse was previouslyenrolled in the Plan, you will also need an originaldivorce decree or death certificate if marriedmore than two years, you must provide a copy ofyour most recent tax return. Legally married samesex couples may enroll within 90 days of theirmarriage.To Enroll A Domestic Partner Obtain the “Affidavit of Domestic Partnership”from the Health & Welfare Office. Complete and return the form with all relateddocumentation to the Health & Welfare Office byNovember 20, 2020. The domestic partner benefit is a taxable benefit tothe employee. In addition to any additional premium,you will also pay additional taxes each paycheck.SPOUSAL CREDIT NOW AVAILABLE If your spouse has other insuranceyou may be eligible for a spousalcreditSee page 8 for detailsMarried Local 689 Members withDual CoverageIf two Local 689 members of the same family areeligible for separate coverage, they must consolidatecoverage with one member electing family coverage.This saves money and keeps all members’ costs down.The members decide which spouse will carry thefamily plan and which will waive coverage. If thefamily member is a child under age 26, the child ORparent may elect separate coverage at any time.If an active member is married to a retired member,the retired member should be named as a dependenton the active member’s plan unless the retiredmember is on Medicare.Each Local 689 member remains entitled to theirindividual life insurance, short term disability, longterm disability and other voluntary benefits.Members of Local 689 with a spouse with otherAuthority coverage should contact the Health &Welfare office.5

Timing: When You Can Make ChangesThe Health & Welfare Plan offers several coverage options for you and your family. If you would like to change yourbenefit plan, or enroll in the Plan, you may do so this October with an effective date of January 1, 2021.You may always enroll new dependents during the 30- or 90-day period when they are first eligible. If not,you can only enroll them during the annual enrollment. When you have a new dependent as a result of birth,adoption or placement for adoption, you may be able to enroll your dependent(s) in the Plan, even if you do nothave family coverage at the time of the event. You must contact the Health & Welfare office immediately.OCTOBER 2020NOVEMBER 20, 2020Enrollment periodif you want tochange yourbenefit plan orenroll dependentsin the PlanEnrollment forms dueOpt-Outs must renewtheir opt-out electionby Nov. 20, 2020Changes to Benefits Outside ofOpen EnrollmentGenerally, the enrollment decisions you make thisyear will remain in place through the next OpenEnrollment in Fall 2021. However, if you have afamily status or work status change such as thoselisted below, and you wish to change your benefitelection, notify the Health & Welfare officeimmediately. Generally, you have 30 or 90 days,depending on circumstances, in which to make achange to your benefits after the date of the statusevent.QUALIFIED LIFE EVENTS MarriageBirth or adoptionDivorce or annulmentDeath of your spouse or eligible dependent childChange in your full- or part-time status (see “YourEligibility for Benefits” on page 4) Change in your spouse’s employer healthinsurance coverage Change in Qualifying status of a dependent Issuance of a qualified Medical Child Support Orderrequiring coverage of a dependent child6JANUARY 1, 2021FALL 2021Next chance tochange yourbenefit plan orenroll in the PlanEffective date ofenrollment andbenefit plan changesDo I Have 30 Days or 90 Days to Make Changes?Depending on the type of change you need to maketo your coverage, you have 30 or 90 days in which tomake a change as follows:30 DAYS TO MAKEA CHANGEÿ To enroll for Plancoverage if you or adependent lose otherhealth care coverage To enroll a newborn,to be effective fromthe date of birth, or toenroll a child adoptedor placed for adoption,to be effective fromthe date of adoption orplacement for adoption. Change from part-timeto full-time or fromfull-time to part-time orattaining 36 months ofservice beyond probation90 DAYS TO MAKEA CHANGE V. To add a new dependent,to be effective the firstday of the calendarmonth after youprovide the necessarydocumentationIf you and your spouse divorce, you must notify thisPlan immediately. If you fail to remove your divorcedspouse from your Plan, you may be liable for anyclaims expense incurred by your spouse after thedate of the divorce.

How do I pay for my benefits?2021 Cost of Medical/Vision andDental BenefitsCosts for the various coverage options and levels for2021 can be found on pages 18 and 19 of this booklet.Your premium contribution for medical/vision anddental coverage depends on which option you select,and whether you enroll for single or family coverage.The Authority pays most of the premiums for theoptions offered. Your total out-of-pocket cost forcare depends on which option you select as well asthe services and treatments you and your family needduring the year.Payment of Health and Welfare PremiumsIf you are currently working, your portion of theHealth & Welfare contributions will normally bededucted from your paycheck. Unless you electmonthly deductions, deductions from your paycheckwill occur four times per month in advance of thecoverage month. If you are not currently working andare eligible for benefits under the Collective BargainingAgreement, you may continue your coverage duringperiods of approved leave by making timely monthlypayments directly to the Health & Welfare Fund.You will not receive a bill. Failure to pay your Health& Welfare contributions by the first of the coveragemonth will result in termination of your coverage.If you are not receiving a pension checkor a paycheck from WMATA you must paythe Health & Welfare Fund directly.If You Waive Medical Coverage Because ofOther Medical Insurance Coverage . . .You may waive medical coverage for yourself and yourdependents (including your spouse) if you have othermedical insurance coverage.According to the Collective Bargaining Agreement,Full-time Active employees are eligible to receivean annual payment of 1,500 from the PremiumConversion Plan if they elect other non-Metrocoverage instead of medical/vision and dentalcoverage under the Plan.Part-time Active employees who choose not toparticipate in the Health & Welfare Plan do not receivea payment from the Premium Conversion Plan.New employees and late enrollees, who elect theopt-out option effective for the first of a month otherthan January 1, will receive a prorated share of therespective annual payment. Retired employees can terminate their coverage at anytime; however, once a retired employee cancels coverage,he or she can only return under certain circumstances.Call the health and welfare office with questions.I Opted Out Last Year.Do I Need To Do Anything?All Opt-Outs must renew theiropt-out election by Nov. 20, 2020In the event you and/or your dependents lose theother health care coverage, you or your dependentsmay be able to enroll in this plan. You must requestenrollment within 30 days after the previous coverageends. In addition to the supporting documentationnormally needed (described in the Eligibility forYourself and Your Dependents section on page 4),you must also provide a “Health Insurance CoverageCertificate” from your former healthcare provider asproof of previous health coverage. Coverage will beeffective the first of the month following completionof the enrollment request.Call the Health & Welfare office immediately if you haveany questions to avoid any gap in coverage.7

COBRA Continuation CoverageThe Consolidated Omnibus Reconciliation Act of 1985 (“COBRA”) allows active employees, their spouses anddependents who lose coverage under the Plan under certain circumstances called “qualifying events” to continuecoverage on a self-pay basis for up to 18 months (36 months in certain situations).The Health & Welfare office will notify you of the right to elect COBRA continuation coverage and how much thecoverage will cost, which may change annually. You must notify the Health & Welfare office within 60 days of thenotice or 60 days after you lose coverage (whichever is later) if you want to elect COBRA continuation coverage. Acomplete description of your COBRA Rights & Responsibilities is available in the Summary Plan Booklet.SPOUSAL CREDIT AVAILABLEThe collective bargaining agreement permits employees to receive a credit of up to 1,200 ( 100 per month) if theyhave a spouse but do not enroll the spouse in the Transit Employees’ Health & Welfare Plan’s health insurance program.It can only be used as a credit against medical and dental benefit expenses incurred as a Participant in the Plan. Youmust elect the spousal credit option each year. If you elect spousal credit, the premium credit will be for January 2021.Applied Behavior AnalysisEffective January 1, 2020, both CareFirst and Kaiser Permanente plans will offer Applied Behavior Analysis (ABA) forour members and dependents which consists of Habilitative services for members diagnosed with Autism or AutismSpectrum Disorder (ASD). Habilitative services are health care services and devices that help a child keep, learn orimprove skills and functioning for daily living. Benefits include occupational therapy, physical therapy and speechtherapy.About Privacy and DocumentationThe Fund has a Notice of Privacy Practices (the “Privacy Notice”) describing how health information about you may beused and disclosed by the Fund and other parties, and how you can get access to this information. You may request acopy of the Privacy Notice by submitting a written request to the Fund’s HIPAA Privacy Officer, Mary A. Marsten, at theHealth & Welfare office address.Premium Assistance Under Medicaid and the Children's Health insurance Program (CHIP)If you or your children are eligible for Medicaid or CHIP and you’re eligible for health coverage from your employer, your state may havea premium assistance program that can help pay for coverage, using funds from their Medicaid or CHIP programs. If you or your childrenaren’t eligible for Medicaid or CHIP, you won’t be eligible for these premium assistance programs but you may be able to buy individualinsurance coverage through the Health Insurance Marketplace. For more information, visit www.healthcare.gov.If you or your dependents are already enrolled in Medicaid or CHIP and you live in a State listed below, contact your State Medicaid orCHIP office to find out if premium assistance is available.If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligiblefor either of these programs, contact your State Medicaid or CHIP office or dial 1- 877-KIDS NOW or www.insurekidsnow.gov to find outhow to apply. If you qualify, ask your state if it has a program that might help you pay the premiums for an employer-sponsored plan.If you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligible under your employer plan, youremployer must allow you to enroll in your employer plan if you aren’t already enrolled. This is called a “special enrollment” opportunity,and you must request coverage within 60 days of being determined eligible for premium assistance. If you have questions about enrolling inyour employer plan, contact the Department of Labor at www.askebsa.dol.gov or call 1-866-444-EBSA (3272).VIRGINIA – Medicaid and CHIPMedicaid Website: http://www.coverva.org/programs premium assistance. cfmCHIP Website: http://www.coverva.org/programs premium assistance. cfmMedicaid Phone: 1-800-432-5924CHIP Phone: 1-855-242-8282To see if any other states have added a premium assistance program since July 31, 2019, or for more information on special enrollment rights, contact either:U.S. Department of LaborEmployee Benefits Security BSA (3272)8U.S. Department of Health and Human ServicesCenters for Medicare & Medicaid Serviceswww.cms.hhs.gov1-877-267-2323, Menu Option 4, Ext. 61565

Your Medical/VisionBenefit Plan ChoicesThe Plan offers both active and retired employees thefollowing options for medical (including prescriptiondrugs) and vision coverage, including an “opt-out”option for Active Employees: Kaiser Permanente HMO medical and NVA vision BlueChoice HMO medical Optum Rx, and DavisVision CareFirst BC Advantage (POS) medical, Optum Rx,and Davis VisionPharmacy BenefitsIf your medical plan is:Kaiser Permanente HMOSummary Comparison of YourMedical/Vision OptionsThis chart summarizes some key features of yourmedical/vision plan options, so you can compareoptions and select the best one for your needs. Amore complete description of benefits can be foundin materials provided by the individual providers.The Plan will also send you a Health & Welfare PlanSummary Plan Booklet, which will further detaileligibility rules and benefits. You will receive aSummary of Benefits and Coverage for each of thethree plans offered by the Plan as required by theAffordable Care Act (health care reform). It uses astandardized report to allow you to compare yourbenefit options.Your prescription drugprogram is:Kaiser PermanenteYour Co-Payment is:GenericRetail Network(30-day supply)Retail Non-Network(30-day supply)Mail Order(90-day supply) 10 Kaiser PharmacyFull cost of drug 20Full cost of drug 50Full cost of drug 80 10 OtherParticipatingNetwork PharmacyFormulary brand 25 Kaiser Pharmacy 25 OtherParticipatingNetwork PharmacyNon-Formulary 40 Kaiser Pharmacy 40 OtherParticipatingNetwork PharmacyCareFirst BC Advantage (POS)BlueChoice HMOCareFirst BC Advantage (POS)BlueChoice HMOOPTUMRXActive ParticpantsPre-Medicare RetireesUnited Health CareMedicare RetireesGeneric 10Full cost of drug 20Formulary brand 25 *Full cost of drug 50Non-Formulary 40Full cost of drug 80Generic 10Full cost of drug 20Formulary brand 25 *Full cost of drug 50Non-Formulary 40Full cost of drug 80For Medicare Eligible Retirees with high out-of-pocket expenses, copayments may be lower than the ones noted above.* May be responsible for the difference between the generic price and the brand price. Please see bottom of page 10.Have Fun! Schedule regular adult fun time to experience more joy andfun in your life! Take a free online cooking class or enjoy a nature walk.9

Medical/Vision Plan OptionsCOVERED SERVICESKAISER PERMANENTEHMO*BLUECHOICEHMOCAREFIRST BCADVANTAGE (POS)IN-NETWORKCAREFIRST BCADVANTAGE (POS)OUT-OF-NETWORK**Annual DeductibleNoneNoneNone 300 individual 600 FamilyOffice Visits 15 co-pay per visit 15 co-pay per visit 15 co-pay per visitPlan pays 75% of allowance after deductibleHospital StaysNo chargeNo chargeNo chargePlan pays 75% of allowance after deductibleOutpatientHospital Visits 15 co-pay per visit 15 co-pay per visit 15 co-pay per visitPlan pays 75% of allowance after deductibleSurgeryNo chargeNo chargeNo chargePlan pays 75% of allowance after deductibleX-Rays and LabsNo chargeNo chargeNo chargePlan pays 75% of allowance after deductibleEmergency Room Care 50, waived if admitted 50, waived if admitted 50, waived if admitted 50, waived if admittedPlan pays 75% of allowance after deductiblePreventive ServicesNo chargeNo charge 15 co-pay per visitPlan pays 75% of allowance after deductible(birth to age 17)Urgent Care 15 co-pay per visitNo charge 15 co-pay per visit 50 co-pay(participating facilities only)Mammograms andAnnual Pap TestsNo chargeNo chargeNo chargeNo chargeMental HealthInpatient CareNo chargeNo chargeNo chargePlan pays 75% of allowance after deductible upto 45 days per calendaryearMental HealthOutpatient CareNo chargeNo chargeNo chargePlan pays 75% of allowance after deductible upto 40 visits, 60% afterthatSubstance AbuseInpatient CareNo chargeNo chargeNo chargePlan pays 75% of allowance after deductibleSubstance AbuseOutpatient CareNo chargeNo chargeNo chargePlan pays 75% of allowance after deductibleHospice CareNo chargeNo chargeNo chargePlan pays 75% of allowance after deductibleChiropractic Care 15 co-pay per visit,up to 20 visits 15 co-pay per visit, up to20 visits per calendar year 15 co-pay per visitPlan pays 75% of allowance after deductiblePhysical Therapy 15 co-pay per visit,up to 90 visits 15, co-pay per visit up to30 visits per calendar year 15 co-pay per visitPlan pays 75% of allowance after deductibleWeight Loss(including surgery)Limited coverageLimited coverage***Limited coverage***Not Covered* Benefits for Kaiser enrollees who are retired and Medicare-eligible differ in some respects from the benefits for active employees and pre-Medicare retirees.** Remember, when you see an out-of-network provider for care, the provider may charge more than the CareFirst allowance. If this is the case, you areresponsible for paying the balance in addition to your coinsurance.10*** Surgical benefits only available at Centers of Blue Distinction.

Medical/Vision Plan OptionsVISION PLANCOVERAGEVision Coverage(Active Employees)NVA (INCLUDED WITHKAISER)DAVIS VISION(INCLUDED WITHBLUECHOICE)DAVIS VISION(INCLUDED WITHCAREFIRST BCADVANTAGE (POS))Exams through HMO – 15– discounted lenses andframes through National VisionAdmin

- Kaiser Permanente HMO medical and NVA vision - BlueChoice HMO medical and Davis Vision - CareFirst BC Advantage (POS) and Davis Vision Dental: Single coverage under Delta Dental is automatic. You may opt out of single coverage or elect to cover your spouse and dependents. Health & Welfare Plan Choices For Retirees MEDICAL/VISION AND .